Key Insights

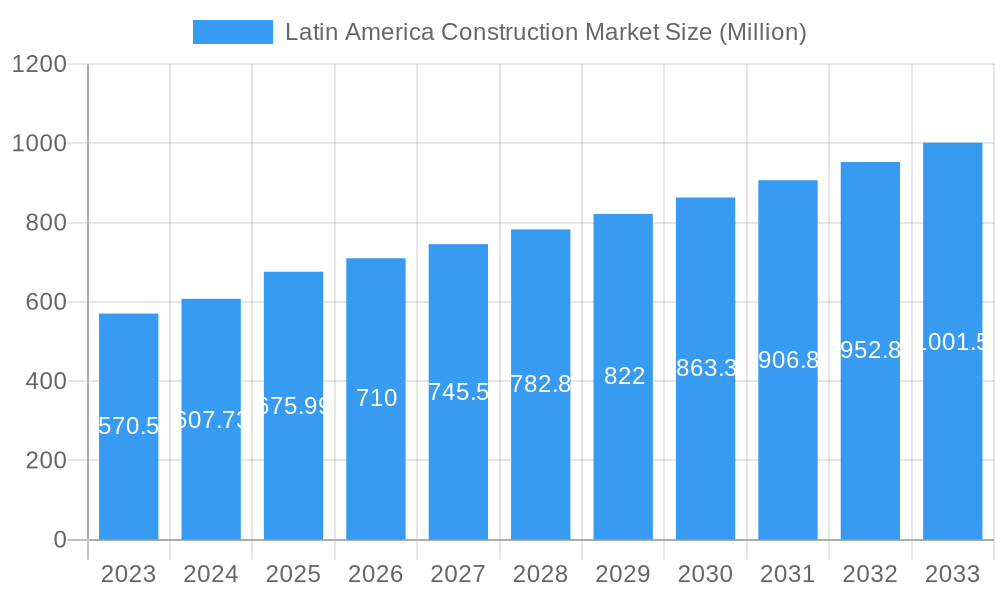

The Latin America construction market is poised for significant expansion, projected to reach USD 675.99 million by 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.00% throughout the forecast period. This growth is underpinned by a surge in infrastructure development across the region, driven by government initiatives aimed at modernizing transportation networks, improving public utilities, and enhancing energy generation capabilities. Increased investment in residential and commercial projects, fueled by urbanization and a growing middle class, further contributes to market buoyancy. Key players like Sigdo Koppers, Mota-Engil, and Techint Ingeniería y construcción are actively participating in this dynamic landscape, undertaking large-scale projects that will shape the region's built environment for years to come.

Latin America Construction Market Market Size (In Million)

The competitive landscape is characterized by a blend of established regional leaders and international conglomerates, all vying for a share in the burgeoning construction opportunities. While economic volatility and political uncertainties in some nations present potential restraints, the overarching trend towards increased public and private sector investment in construction is expected to outweigh these challenges. The market segments of Residential, Commercial, Industrial, Infrastructure, and Energy & Utilities are all expected to witness healthy growth, with Infrastructure and Energy & Utilities likely to be the primary growth engines. The study period of 2019-2033, with a base year of 2025 and a forecast period from 2025-2033, indicates a long-term positive outlook for the Latin American construction industry, reflecting its critical role in the region's economic development and modernization.

Latin America Construction Market Company Market Share

This in-depth report provides a detailed analysis of the Latin America construction market, covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. It offers critical insights into market structure, competitive dynamics, emerging trends, dominant segments, product innovations, key growth drivers, challenges, leading players, recent developments, and a strategic future outlook. Essential for stakeholders seeking to capitalize on the evolving Latin American construction industry, this report focuses on residential construction, commercial construction, industrial construction, infrastructure development, and the energy and utilities sector. Leverage actionable intelligence to navigate this dynamic and rapidly growing market.

Latin America Construction Market Market Structure & Competitive Dynamics

The Latin America construction market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, alongside a robust ecosystem of mid-sized and smaller enterprises. Innovation within the sector is driven by increasing demand for sustainable building materials, smart construction technologies, and efficient project management. Regulatory frameworks vary across countries, influencing project approvals, environmental standards, and labor laws. The report analyzes the impact of these regulations on market entry and operational efficiency. Product substitutes are evolving, with advancements in pre-fabricated components and modular construction offering alternatives to traditional building methods. End-user trends are shifting towards eco-friendly, energy-efficient, and technologically integrated structures, particularly in urban centers. Mergers and acquisitions (M&A) activities are on the rise as companies seek to expand their regional footprint, acquire new technologies, and consolidate market positions. Key M&A deals are scrutinized for their strategic implications and impact on market concentration.

- Market Concentration: Moderate, with top players holding significant share.

- Innovation Ecosystem: Driven by sustainability, smart tech, and efficiency.

- Regulatory Frameworks: Varied across countries, impacting market operations.

- Product Substitutes: Growing adoption of pre-fab and modular solutions.

- End-User Trends: Demand for sustainable, energy-efficient, and smart buildings.

- M&A Activities: Increasing to expand reach and acquire technologies.

Latin America Construction Market Industry Trends & Insights

The Latin America construction market is experiencing robust growth, propelled by increasing urbanization, significant government investments in infrastructure, and a burgeoning middle class driving demand for residential and commercial properties. Technological disruptions, such as the adoption of Building Information Modeling (BIM), Artificial Intelligence (AI) in project management, and the use of drones for site surveying, are enhancing efficiency, reducing costs, and improving project timelines. Consumer preferences are increasingly leaning towards sustainable and green building practices, influencing the demand for eco-friendly materials and energy-efficient designs. The competitive landscape is dynamic, characterized by both local players and international firms vying for market share. The report quantifies market penetration of new technologies and sustainable practices, alongside projected CAGR for various segments. Infrastructure development remains a cornerstone of growth, with significant projects in transportation, energy, and telecommunications underway. The energy and utilities sector is also a key contributor, with ongoing investments in renewable energy sources and power grid modernization. The residential construction segment benefits from housing deficit and a growing demand for affordable and modern housing solutions. Commercial construction is fueled by retail expansion, office space development, and hospitality projects. The industrial construction segment is supported by manufacturing sector growth and foreign direct investment.

Dominant Markets & Segments in Latin America Construction Market

The Latin America construction market is characterized by distinct regional strengths and dominant segments. Infrastructure development consistently emerges as a leading sector, driven by governmental initiatives to improve connectivity, logistics, and public services across the region. Countries like Brazil, Mexico, and Colombia are at the forefront of large-scale infrastructure projects, including highways, airports, and public transportation systems, supported by favorable economic policies and substantial public-private partnerships.

Infrastructure Dominance

- Key Drivers: Government spending on transportation networks, energy grid upgrades, and urban development projects. Economic stimulus packages aimed at job creation and economic recovery often prioritize infrastructure.

- Detailed Analysis: Significant investments in renewable energy infrastructure are also boosting this segment. For instance, the development of solar and wind farms across Chile and Argentina, alongside investments in hydroelectric power in Brazil, demonstrates the sector's broad reach. The need for modernized ports and logistics hubs to facilitate trade further underpins its dominance.

Residential Construction Growth

- Key Drivers: Growing population, increasing urbanization rates, and a rising middle class with enhanced purchasing power. Housing affordability initiatives and access to mortgages are crucial.

- Detailed Analysis: This segment is experiencing steady growth, particularly in metropolitan areas. Demand for both affordable and mid-to-high-end housing remains strong, driven by demographic shifts and a desire for improved living standards. Developer activity is high in countries with expanding economies and supportive housing policies.

Commercial Sector Expansion

- Key Drivers: Retail sector growth, demand for modern office spaces in business hubs, and expansion of the tourism and hospitality industries. Foreign direct investment plays a vital role.

- Detailed Analysis: Major cities are witnessing significant commercial construction, including shopping malls, corporate offices, and hotels. The e-commerce boom is also influencing the design and construction of logistics and distribution centers.

Industrial Sector Activity

- Key Drivers: Manufacturing sector expansion, growth in agribusiness, and the development of industrial parks to attract foreign investment.

- Detailed Analysis: Industrial construction is closely tied to economic diversification and foreign direct investment. Countries focusing on manufacturing exports and developing specialized industrial zones are seeing increased activity.

Energy and Utilities Demand

- Key Drivers: Investment in renewable energy projects (solar, wind, hydro), modernization of power grids, and expansion of water and wastewater treatment facilities.

- Detailed Analysis: This segment is crucial for economic development and sustainability. Governments and private entities are investing heavily in ensuring reliable and clean energy access, driving demand for construction services in this area.

Latin America Construction Market Product Innovations

The Latin America construction market is witnessing a wave of product innovations focused on enhancing sustainability, efficiency, and durability. Advanced concrete admixtures that reduce water content and improve strength, as well as pre-fabricated building components made from recycled materials, are gaining traction. Smart building technologies, including IoT sensors for monitoring structural health and energy consumption, are becoming more prevalent, particularly in commercial and industrial projects. Developments in sustainable roofing and waterproofing solutions, like those introduced by PASA®, are expanding the market for energy-efficient buildings. The integration of digital design tools and advanced materials allows for faster construction times and reduced waste, offering significant competitive advantages.

Report Segmentation & Scope

This report segments the Latin America construction market into key categories for comprehensive analysis. The Residential construction segment is expected to see continued growth driven by housing demand and urbanization. Commercial construction will be influenced by retail expansion and the need for modern office spaces. Industrial construction is linked to manufacturing growth and foreign investment. Infrastructure development, including transportation and utilities, remains a critical growth area, with substantial government backing. The Energy and Utilities sector is experiencing significant investment in renewable energy and grid modernization, presenting unique construction opportunities. Each segment's growth projections, market sizes, and competitive dynamics are detailed within the report.

Key Drivers of Latin America Construction Market Growth

Several key factors are propelling the Latin America construction market. Economic growth and stability across the region are fundamental, leading to increased private investment and consumer spending on housing and commercial properties. Government initiatives and public spending on infrastructure development, including transportation networks, energy projects, and urban renewal, are significant growth accelerators. Technological advancements, such as the adoption of BIM, prefabrication, and sustainable building materials, are improving efficiency and reducing costs, making projects more viable. Favorable demographics, including a growing young population and increasing urbanization, are creating sustained demand for residential and commercial spaces. Foreign direct investment in sectors like manufacturing and tourism also stimulates industrial and commercial construction.

Challenges in the Latin America Construction Market Sector

The Latin America construction market faces several hurdles. Political and economic instability in some countries can deter investment and lead to project delays. Regulatory complexities and bureaucratic processes often lead to extended approval times and increased project costs. Supply chain disruptions and the volatility of raw material prices, such as steel and cement, can impact project budgets and timelines. Shortages of skilled labor in certain specialized areas pose a challenge to project execution and quality. Furthermore, limited access to financing and high interest rates can hinder smaller developers and impact project feasibility. Environmental regulations and the need for sustainable practices require significant investment and adaptation from market participants.

Leading Players in the Latin America Construction Market Market

- Sigdo Koppers

- Echeverria Izquierdo

- Mota-Engil

- Carso Infraestructura y Construcción

- Besalco

- Techint Ingeniería y construcción

- MRV Engenharia

- Aenza (Graña y Montero)

- Sacyr

- SalfaCorp

Key Developments in Latin America Construction Market Sector

- May 2023: Holcim acquires PASA®, a leading roofing and waterproofing solutions producer in Mexico and Central America, with pro forma net sales of USD 38 million. This strategic move strengthens Holcim's regional presence and expands its offering in innovative and sustainable building solutions.

- May 2023: Sika has acquired the MBCC Group, a leading global supplier of construction chemicals. This landmark acquisition creates a combined entity with 33,000 experts and net sales exceeding USD 13.21 billion, significantly enhancing Sika's portfolio and global reach in the construction chemicals sector, with a strong emphasis on innovation and sustainability.

Strategic Latin America Construction Market Market Outlook

The Latin America construction market is poised for continued expansion, driven by a confluence of factors including ongoing urbanization, a strong pipeline of infrastructure projects, and increasing adoption of sustainable building practices. The report identifies growth accelerators such as smart city initiatives, the development of affordable housing, and investments in renewable energy infrastructure. Opportunities lie in leveraging digital transformation to enhance project management and efficiency, and in developing green building solutions to meet evolving environmental standards and consumer preferences. Strategic alliances and technological integration will be crucial for companies seeking to solidify their market position and capitalize on the region's vast development potential. The forecast indicates a robust outlook, with significant opportunities for both domestic and international stakeholders.

Latin America Construction Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Latin America Construction Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Construction Market Regional Market Share

Geographic Coverage of Latin America Construction Market

Latin America Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in residential construction driving the market; Development of hospitality infrastructure driving the market

- 3.3. Market Restrains

- 3.3.1. Limited access to financing; Shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increase in residential construction driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sigdo Koppers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Echeverria Izquierdo*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mota-Engil

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Carso Infraestructura y Construcci�n

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Besalco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Techint Ingenier�a y construcci�n

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MRV Engenharia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aenza (Gra�a y Montero)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sacyr

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SalfaCorp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sigdo Koppers

List of Figures

- Figure 1: Latin America Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Latin America Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Latin America Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Latin America Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Brazil Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Argentina Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Chile Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Colombia Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Peru Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Venezuela Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Ecuador Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bolivia Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Paraguay Latin America Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Construction Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Latin America Construction Market?

Key companies in the market include Sigdo Koppers, Echeverria Izquierdo*List Not Exhaustive, Mota-Engil, Carso Infraestructura y Construcci�n, Besalco, Techint Ingenier�a y construcci�n, MRV Engenharia, Aenza (Gra�a y Montero), Sacyr, SalfaCorp.

3. What are the main segments of the Latin America Construction Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 675.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in residential construction driving the market; Development of hospitality infrastructure driving the market.

6. What are the notable trends driving market growth?

Increase in residential construction driving the market.

7. Are there any restraints impacting market growth?

Limited access to financing; Shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

May 2023: Holcim acquires PASA®, a leading roofing and waterproofing solutions producer in Mexico and Central America, with pro forma net sales of USD 38 million. As a leader in innovation, sustainability, and quality, PASA® expands Holcim’s roofing and waterproofing offer and strengthens its regional business footprint. By integrating the existing PASA® distribution network with waterproofing solutions from its GacoFlex product range, Holcim will deliver more customer value with an enhanced supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Construction Market?

To stay informed about further developments, trends, and reports in the Latin America Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence