Key Insights

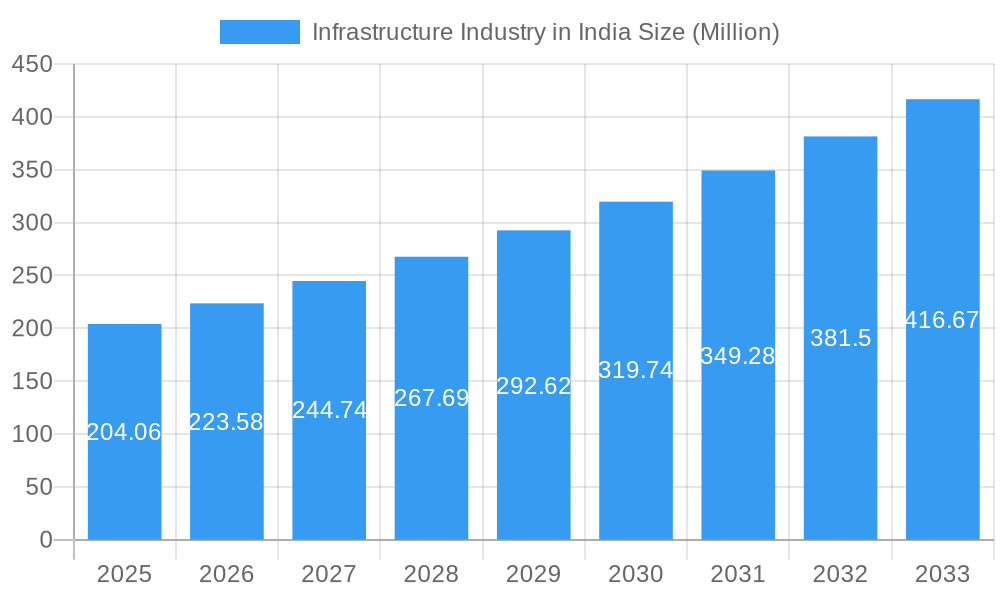

The Indian infrastructure industry is poised for robust expansion, with a projected market size of approximately USD 204.06 million in 2025. This growth is fueled by a significant Compound Annual Growth Rate (CAGR) of 9.57%, indicating a dynamic and expanding market over the forecast period of 2025-2033. Key drivers for this impressive growth trajectory include substantial government initiatives aimed at boosting economic development through infrastructure enhancement, a growing population demanding improved amenities, and increasing private sector investment in large-scale projects. The industry segments expected to witness considerable development are Social Infrastructure, encompassing healthcare and education facilities; Transportation Infrastructure, including roads, railways, and airports; and Utilities Infrastructure, focusing on power, water, and sanitation. These areas are critical for sustainable development and are receiving targeted investment. Furthermore, the "Extraction Infrastructure" segment, crucial for resource development, and "Manufacturing Infrastructure," supporting industrial growth, are also expected to contribute significantly to the overall market expansion.

Infrastructure Industry in India Market Size (In Million)

The Indian infrastructure landscape is characterized by intense competition and a concentration of key players, with companies like Larsen & Toubro Limited, Shapoorji Pallonji & Co. Ltd., and Reliance Infrastructure Limited at the forefront. These established entities are actively involved in developing and executing a wide array of projects across the nation. The market's performance is also significantly influenced by regional developments, with states such as Maharashtra, Karnataka, Delhi, and Telangana emerging as pivotal hubs for infrastructure development due to their economic significance and government focus. While the growth drivers are strong, certain restraints such as land acquisition challenges, regulatory hurdles, and the need for skilled labor require strategic attention and mitigation efforts to ensure sustained progress. The global reach of this market is also evident, with significant presence and opportunities anticipated in regions like Asia Pacific, followed by North America and Europe, reflecting international interest and investment in India's burgeoning infrastructure sector.

Infrastructure Industry in India Company Market Share

This comprehensive report provides an in-depth analysis of the Infrastructure Industry in India, offering crucial insights for stakeholders looking to capitalize on the nation's rapidly expanding development landscape. With a study period spanning 2019-2033, a base and estimated year of 2025, and a forecast period of 2025-2033, this report delves into the historical performance (2019-2024) and future projections of India's vital infrastructure sector. We meticulously examine market structure, competitive dynamics, emerging trends, dominant segments, product innovations, key growth drivers, prevailing challenges, leading players, and significant recent developments.

Infrastructure Industry in India Market Structure & Competitive Dynamics

The Indian infrastructure market exhibits a moderately concentrated structure, with a few large players dominating key segments, while a considerable number of medium and small enterprises compete in specialized niches. Innovation ecosystems are burgeoning, driven by government initiatives promoting digital infrastructure, sustainable construction, and advanced engineering solutions. Regulatory frameworks are continually evolving to streamline project approvals, attract foreign investment, and ensure adherence to environmental standards. Product substitutes are relatively limited in core infrastructure development, though technological advancements are leading to the adoption of modular construction and pre-fabricated components. End-user trends highlight a growing demand for smart cities, green buildings, and resilient infrastructure to withstand climate change. Mergers and acquisitions (M&A) are a significant feature, indicating consolidation and strategic partnerships to enhance capabilities and market reach. For instance, the acquisition of 12 road projects by Highway Infrastructure Trust (HIT) at an enterprise value of INR 90.06 billion (USD 1.08 billion) exemplifies this trend. Market share is dynamic, with leading companies like Larsen & Toubro Limited, Tata Projects Ltd, and Shapoorji Pallonji & Co Ltd consistently holding substantial positions across various infrastructure verticals.

Infrastructure Industry in India Industry Trends & Insights

The Infrastructure Industry in India is poised for robust growth, propelled by a confluence of factors including increasing urbanization, a burgeoning middle class, and sustained government focus on capital expenditure. The Compound Annual Growth Rate (CAGR) is projected to be strong, reflecting the nation's ambitious development agenda. Market penetration is expanding across all segments, driven by a fundamental need for improved connectivity, enhanced social services, and efficient resource extraction. Technological disruptions, such as the adoption of Building Information Modeling (BIM), artificial intelligence (AI) for project planning, and the use of advanced materials, are revolutionizing construction methodologies, leading to increased efficiency and cost-effectiveness. Consumer preferences are shifting towards sustainable and eco-friendly infrastructure, with a growing emphasis on green building practices, renewable energy integration, and resilient designs that can withstand extreme weather events. Competitive dynamics are intensifying, with both domestic and international players vying for lucrative projects, leading to a focus on innovation, project execution excellence, and cost optimization. The push towards digital infrastructure, including 5G rollout and data center development, is creating new avenues for growth and investment. Furthermore, the increasing emphasis on multimodal transportation networks, including high-speed rail and logistics corridors, is a significant trend shaping the industry.

Dominant Markets & Segments in Infrastructure Industry in India

Transportation Infrastructure stands out as a dominant segment within the Infrastructure Industry in India, driven by the government's massive investments in highways, expressways, and railways. This segment is crucial for facilitating economic activity and connecting hinterlands to major consumption centers. Maharashtra consistently emerges as a leading state in terms of infrastructure development, owing to its strong industrial base, high urbanization, and significant investments in urban infrastructure, transportation networks, and utilities. Karnataka, with Bengaluru as its technology hub, also shows substantial growth in IT parks, residential infrastructure, and transportation upgrades. Delhi, the national capital region, continues to see significant development in metro expansion, road networks, and social infrastructure. Telangana is rapidly developing its urban infrastructure, especially in Hyderabad, focusing on smart city initiatives and transportation solutions.

Key drivers for the dominance of these segments and states include:

- Economic Policies: Pro-growth policies, Make in India initiatives, and increased FDI inflows.

- Infrastructure Gaps: A persistent need to bridge the infrastructure deficit across various sectors.

- Urbanization: Rapid migration to cities necessitates continuous development of urban amenities and services.

- Government Spending: Sustained allocation of funds by the central and state governments for infrastructure projects.

- Technological Adoption: Implementation of advanced technologies for more efficient and sustainable project delivery.

The Utilities Infrastructure segment, encompassing power generation, transmission, distribution, and water management, is also witnessing significant expansion, crucial for supporting industrial and residential growth. Social Infrastructure, including healthcare facilities, educational institutions, and affordable housing, is gaining momentum due to increasing population and government focus on human development.

Infrastructure Industry in India Product Innovations

Product innovations in the Indian infrastructure sector are increasingly focused on sustainability, efficiency, and technological integration. Advanced construction materials, such as high-performance concrete, recycled aggregates, and low-carbon cement, are gaining traction. Modular construction techniques and pre-fabricated components are being adopted to accelerate project timelines and reduce on-site waste. Digital twins and IoT-enabled sensors are enhancing asset management and predictive maintenance for existing infrastructure. The application of drones for site surveying and monitoring, alongside AI-powered project management software, is streamlining operations and improving safety. These innovations offer competitive advantages by reducing project costs, minimizing environmental impact, and improving the longevity and performance of infrastructure assets.

Report Segmentation & Scope

The Infrastructure Industry in India is segmented across several key verticals. Transportation Infrastructure includes roads, railways, airports, and ports, with projected market sizes and competitive dynamics reflecting ongoing large-scale government projects and private sector participation. Social Infrastructure encompasses healthcare, education, and housing, showing steady growth driven by demographic shifts and government welfare programs. Extraction Infrastructure, vital for mining and energy resources, is influenced by commodity prices and national energy policies. Manufacturing Infrastructure supports industrial growth with factories, logistics hubs, and special economic zones. Utilities Infrastructure, covering power, water, and sanitation, is a foundational segment with consistent demand. Key states like Maharashtra, Karnataka, Delhi, and Telangana are analyzed for their specific development trajectories and market potential within these segments, alongside the broader outlook for Other States. Growth projections and market sizes are estimated for each segment across the forecast period.

Key Drivers of Infrastructure Industry in India Growth

The growth of the Infrastructure Industry in India is primarily driven by several interconnected factors. Firstly, government initiatives like the National Infrastructure Pipeline (NIP) and Gati Shakti aim to accelerate project execution and investment. Secondly, economic liberalization and increased FDI inflows are providing crucial capital for large-scale projects. Thirdly, urbanization and a growing middle class are fueling demand for enhanced transportation, housing, and utility services. Fourthly, technological advancements in construction materials and methodologies are improving efficiency and sustainability. Lastly, the increasing focus on renewable energy infrastructure and climate resilience presents significant opportunities for innovation and investment.

Challenges in the Infrastructure Industry in India Sector

Despite strong growth prospects, the Infrastructure Industry in India faces several challenges. Regulatory hurdles and complex land acquisition processes often lead to project delays and cost overruns. Supply chain disruptions, particularly for critical raw materials and specialized equipment, can impact project timelines. Financing challenges, including access to long-term capital and the financial health of some developers, remain a concern. Skilled labor shortages can affect project quality and execution speed. Furthermore, environmental clearances and community resistance can pose significant obstacles. Competitive pressures can also lead to lower profit margins for contractors.

Leading Players in the Infrastructure Industry in India Market

- Larsen & Toubro Limited

- Tata Projects Ltd

- Shapoorji Pallonji & Co Ltd

- Reliance Infrastructure Limited

- Hindustan Construction Co Ltd

- Gammon India Ltd

- Nagarjuna Construction Company Limited (NCC Ltd)

- Jaiprakash Associates Ltd

- Simplex Infrastructures Ltd

- Lanco Infratech Limited

- 6 3 Other Companies

Key Developments in Infrastructure Industry in India Sector

- February 2024: Tata Steel partnered with South Eastern Railway (SER) to foster sustainable rail infrastructure by leveraging slag-based aggregates.

- January 2024: Highway Infrastructure Trust (HIT) acquired 12 road projects at an enterprise value of INR 90.06 billion (USD 1.08 billion) from PNC Infratech Ltd and PNC Infra Holdings Ltd. This portfolio includes 11 Hybrid Annuity (HAM) concessions from NHAI and 1 toll road concession from UPSHA, spanning Rajasthan, Uttar Pradesh, Madhya Pradesh, and Karnataka, covering approximately 3,800 lane kilometers.

Strategic Infrastructure Industry in India Market Outlook

The strategic outlook for the Infrastructure Industry in India is highly positive, driven by the nation's commitment to becoming a developed economy. Growth accelerators include the sustained focus on smart cities, the expansion of renewable energy infrastructure, and the development of logistics and connectivity corridors. The increasing adoption of digital technologies in project management and execution will further enhance efficiency. Opportunities abound in public-private partnerships (PPPs), which are expected to play a crucial role in funding and delivering large-scale projects. The government's emphasis on ease of doing business and streamlined approvals will continue to attract domestic and international investment, creating a robust environment for sustained infrastructure development and economic progress.

Infrastructure Industry in India Segmentation

-

1. Infrastructure segment

- 1.1. Social Infrastructure

- 1.2. Transportation Infrastructure

- 1.3. Extraction Infrastructure

- 1.4. Manufacturing Infrastructure

- 1.5. Utilities Infrastructure

-

2. Key States

- 2.1. Maharashtra

- 2.2. Karnataka

- 2.3. Delhi

- 2.4. Telangana

- 2.5. Other States

Infrastructure Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Infrastructure Industry in India Regional Market Share

Geographic Coverage of Infrastructure Industry in India

Infrastructure Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization is Driving the Market; Surge in Foreign Direct Investments is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Bureaucratic Processes are Affecting the Market; Environmental Concerns and Regulatory Hurdles are Affecting the Market

- 3.4. Market Trends

- 3.4.1. Increase in Road Infrastructure Investment is Expected to Propel the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 5.1.1. Social Infrastructure

- 5.1.2. Transportation Infrastructure

- 5.1.3. Extraction Infrastructure

- 5.1.4. Manufacturing Infrastructure

- 5.1.5. Utilities Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Key States

- 5.2.1. Maharashtra

- 5.2.2. Karnataka

- 5.2.3. Delhi

- 5.2.4. Telangana

- 5.2.5. Other States

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6. North America Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6.1.1. Social Infrastructure

- 6.1.2. Transportation Infrastructure

- 6.1.3. Extraction Infrastructure

- 6.1.4. Manufacturing Infrastructure

- 6.1.5. Utilities Infrastructure

- 6.2. Market Analysis, Insights and Forecast - by Key States

- 6.2.1. Maharashtra

- 6.2.2. Karnataka

- 6.2.3. Delhi

- 6.2.4. Telangana

- 6.2.5. Other States

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 7. South America Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 7.1.1. Social Infrastructure

- 7.1.2. Transportation Infrastructure

- 7.1.3. Extraction Infrastructure

- 7.1.4. Manufacturing Infrastructure

- 7.1.5. Utilities Infrastructure

- 7.2. Market Analysis, Insights and Forecast - by Key States

- 7.2.1. Maharashtra

- 7.2.2. Karnataka

- 7.2.3. Delhi

- 7.2.4. Telangana

- 7.2.5. Other States

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 8. Europe Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 8.1.1. Social Infrastructure

- 8.1.2. Transportation Infrastructure

- 8.1.3. Extraction Infrastructure

- 8.1.4. Manufacturing Infrastructure

- 8.1.5. Utilities Infrastructure

- 8.2. Market Analysis, Insights and Forecast - by Key States

- 8.2.1. Maharashtra

- 8.2.2. Karnataka

- 8.2.3. Delhi

- 8.2.4. Telangana

- 8.2.5. Other States

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 9. Middle East & Africa Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 9.1.1. Social Infrastructure

- 9.1.2. Transportation Infrastructure

- 9.1.3. Extraction Infrastructure

- 9.1.4. Manufacturing Infrastructure

- 9.1.5. Utilities Infrastructure

- 9.2. Market Analysis, Insights and Forecast - by Key States

- 9.2.1. Maharashtra

- 9.2.2. Karnataka

- 9.2.3. Delhi

- 9.2.4. Telangana

- 9.2.5. Other States

- 9.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 10. Asia Pacific Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 10.1.1. Social Infrastructure

- 10.1.2. Transportation Infrastructure

- 10.1.3. Extraction Infrastructure

- 10.1.4. Manufacturing Infrastructure

- 10.1.5. Utilities Infrastructure

- 10.2. Market Analysis, Insights and Forecast - by Key States

- 10.2.1. Maharashtra

- 10.2.2. Karnataka

- 10.2.3. Delhi

- 10.2.4. Telangana

- 10.2.5. Other States

- 10.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shapoorji Pallonji & Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lanco Infratech Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hindustan Construction Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Reliance Infrastructure Limited**List Not Exhaustive 6 3 Other Companie

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Larsen & Toubro Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gammon India Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tata Projects Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nagarjuna Construction Company Limited (NCC Ltd)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jaiprakash Associates Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Simplex Infrastructures Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Shapoorji Pallonji & Co Ltd

List of Figures

- Figure 1: Global Infrastructure Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 3: North America Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 4: North America Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 5: North America Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 6: North America Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 9: South America Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 10: South America Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 11: South America Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 12: South America Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 15: Europe Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 16: Europe Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 17: Europe Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 18: Europe Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 21: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 22: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 23: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 24: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 27: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 28: Asia Pacific Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 29: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 30: Asia Pacific Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 2: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 3: Global Infrastructure Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 5: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 6: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 11: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 12: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 17: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 18: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 29: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 30: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 38: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 39: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrastructure Industry in India?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Infrastructure Industry in India?

Key companies in the market include Shapoorji Pallonji & Co Ltd, Lanco Infratech Limited, Hindustan Construction Co Ltd, Reliance Infrastructure Limited**List Not Exhaustive 6 3 Other Companie, Larsen & Toubro Limited, Gammon India Ltd, Tata Projects Ltd, Nagarjuna Construction Company Limited (NCC Ltd), Jaiprakash Associates Ltd, Simplex Infrastructures Ltd.

3. What are the main segments of the Infrastructure Industry in India?

The market segments include Infrastructure segment, Key States.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization is Driving the Market; Surge in Foreign Direct Investments is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Road Infrastructure Investment is Expected to Propel the Market Growth.

7. Are there any restraints impacting market growth?

Bureaucratic Processes are Affecting the Market; Environmental Concerns and Regulatory Hurdles are Affecting the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Tata Steel, a prominent private steel firm, unveiled its partnership with South Eastern Railway (SER). The collaboration aims to foster sustainable rail infrastructure by leveraging slag-based aggregates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infrastructure Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infrastructure Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infrastructure Industry in India?

To stay informed about further developments, trends, and reports in the Infrastructure Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence