Key Insights

The Egypt Manufactured Homes Market is projected for robust expansion, driven by strategic economic development, increasing demand for affordable housing, and the growing adoption of sustainable prefab construction. Favorable government initiatives in infrastructure and urban development are significantly boosting the demand for both residential and multi-family manufactured homes. Advancements in manufacturing technologies are enhancing quality, design flexibility, and construction speed. Furthermore, heightened environmental awareness surrounding modular construction's reduced waste and energy efficiency benefits supports its positive market trajectory. A competitive landscape is emerging with participation from established construction firms and specialized prefab technology providers.

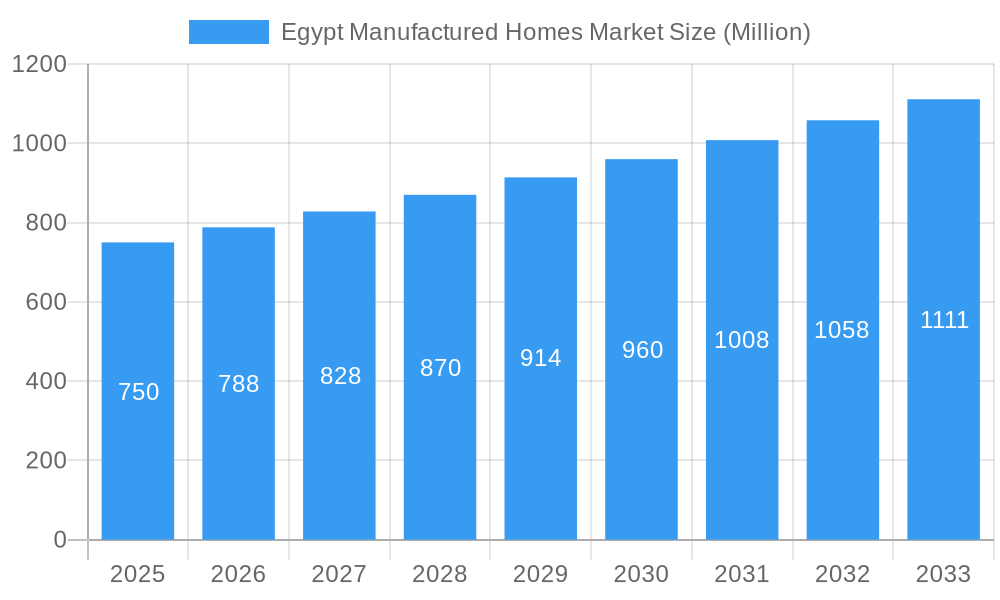

Egypt Manufactured Homes Market Market Size (In Billion)

Key trends shaping the market include the integration of smart manufacturing techniques and sustainable materials, enhancing the appeal and efficiency of manufactured homes. The imperative for rapid housing deployment due to population growth and urbanization acts as a significant catalyst. Potential restraints involve initial perceptions regarding durability and aesthetics, financing challenges, and evolving regulatory frameworks for prefabricated construction. However, the inherent advantages of cost-effectiveness, rapid delivery, and scalability are expected to drive sustained market growth. Egypt's focus on industrialization, exemplified by key players such as Shewekar Design Studio and Karmod Prefabricated Building Technologies, highlights the strategic importance and future potential of the manufactured homes sector.

Egypt Manufactured Homes Market Company Market Share

This comprehensive report offers deep insights into the Egypt manufactured homes market, detailing market structure, competitive dynamics, industry trends, dominant segments, product innovations, growth drivers, challenges, key players, and future outlook. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast from 2025 to 2033, this analysis is crucial for stakeholders seeking to capitalize on the burgeoning modular construction Egypt and prefab housing Egypt sectors. We examine the offsite construction Egypt landscape, including prefabricated homes Egypt and modular buildings Egypt, providing actionable intelligence for investors, manufacturers, and policymakers.

Egypt Manufactured Homes Market Market Structure & Competitive Dynamics

The Egypt manufactured homes market is characterized by a moderately concentrated structure, with a blend of established local players and emerging international participants. Innovation ecosystems are rapidly developing, driven by a growing demand for affordable and sustainable housing solutions. Regulatory frameworks are evolving to support the expansion of modular construction Egypt, with initiatives focused on streamlining building permits and quality standards for prefab homes Egypt. Product substitutes, while present in traditional construction methods, are increasingly being outcompeted by the cost-effectiveness and speed of manufactured homes. End-user trends are shifting towards customization and smart home integration within prefabricated homes Egypt. Merger and acquisition (M&A) activities are anticipated to intensify as larger companies seek to consolidate market share and gain access to advanced manufacturing capabilities. Current market share estimations suggest significant growth potential for leading firms, with projected M&A deal values to rise as the market matures and economies of scale become more pronounced.

- Market Concentration: Moderate, with increasing fragmentation and consolidation potential.

- Innovation Ecosystems: Driven by demand for speed, affordability, and sustainability.

- Regulatory Frameworks: Evolving to support modular construction Egypt.

- Product Substitutes: Traditional construction, but facing competition from efficiency of prefab housing Egypt.

- End-User Trends: Demand for customization, smart features, and sustainable living in modular buildings Egypt.

- M&A Activities: Expected to increase as the market consolidates.

Egypt Manufactured Homes Market Industry Trends & Insights

The Egypt manufactured homes market is experiencing robust growth, propelled by several key industry trends and insights. A significant CAGR is projected over the forecast period, driven by increasing urbanization, a growing middle class, and government initiatives aimed at addressing the housing deficit. Technological disruptions, particularly in advanced manufacturing techniques and materials science, are revolutionizing the production of prefab homes Egypt, enabling greater design flexibility, enhanced durability, and improved energy efficiency. Consumer preferences are leaning towards faster project completion times, reduced construction costs, and sustainable building practices, all of which are core advantages of modular construction Egypt. The competitive landscape is intensifying, with companies vying for market share through product differentiation, pricing strategies, and strategic partnerships. The market penetration of manufactured homes is expected to rise significantly as awareness and acceptance grow among consumers and developers.

- Market Growth Drivers: Urbanization, housing deficit, government support.

- Technological Disruptions: Advanced manufacturing, sustainable materials, digital design.

- Consumer Preferences: Speed, affordability, sustainability, customization.

- Competitive Dynamics: Increasing competition, focus on differentiation.

- Market Penetration: Expected to rise substantially.

Dominant Markets & Segments in Egypt Manufactured Homes Market

Within the Egypt manufactured homes market, the Single Family segment is currently the dominant force, driven by escalating demand for individual housing units in rapidly expanding urban and peri-urban areas. This dominance is underpinned by several key drivers including favorable government policies promoting homeownership, increasing disposable incomes of the burgeoning middle class, and significant investments in infrastructure development that facilitate the accessibility and placement of prefab homes Egypt. The Multi-Family segment, however, is poised for substantial growth, fueled by large-scale urban development projects, the need for affordable housing solutions in densely populated cities, and the increasing adoption of modular construction Egypt for residential complexes and affordable housing initiatives. Leading regions are experiencing accelerated adoption due to concentrated population centers and proactive local government support for innovative housing solutions.

- Dominant Segment (Current): Single Family Homes

- Key Drivers:

- Government policies promoting homeownership.

- Rising disposable incomes.

- Infrastructure development.

- Demand for individual housing.

- Key Drivers:

- High-Growth Segment (Future): Multi-Family Homes

- Key Drivers:

- Urban development projects.

- Affordable housing initiatives.

- Scalability of modular construction Egypt.

- Demand for efficient land use.

- Key Drivers:

- Leading Regions: Major urban centers and developing new cities.

Egypt Manufactured Homes Market Product Innovations

Product innovations in the Egypt manufactured homes market are revolutionizing the sector, focusing on enhanced sustainability, energy efficiency, and smart home integration. Manufacturers are increasingly adopting advanced materials like recycled composites and energy-efficient insulation to reduce the environmental footprint of prefab homes Egypt. Technological advancements in digital design and 3D printing are enabling greater customization and complexity in modular buildings Egypt, catering to diverse architectural preferences. Competitive advantages are being realized through faster on-site assembly, superior quality control in factory settings, and reduced waste generation. The market fit for these innovations is strong, aligning with Egypt's national agenda for sustainable development and its growing demand for modern, cost-effective housing solutions.

Report Segmentation & Scope

The Egypt manufactured homes market is segmented into the following key categories:

- Type:

- Single Family: This segment encompasses individual dwelling units designed for one family. It is expected to maintain significant market share due to sustained demand for independent housing. Growth projections indicate steady expansion driven by individual homebuyer demand.

- Multi Family: This segment includes apartment buildings, townhouses, and other multi-unit residential structures. It is projected to experience rapid growth as large-scale residential projects increasingly adopt modular solutions for efficiency and affordability. Competitive dynamics are shaping this segment towards larger contract wins.

Key Drivers of Egypt Manufactured Homes Market Growth

The Egypt manufactured homes market is propelled by several interconnected factors. Economically, growing disposable incomes and government incentives for homeownership are boosting demand. Technologically, advancements in prefab construction Egypt methods and materials are making manufactured homes more attractive in terms of quality, durability, and aesthetics. Regulatory frameworks are increasingly supportive, with streamlined approval processes and a growing recognition of the efficiency and sustainability benefits of modular construction Egypt. Furthermore, a significant housing deficit in urban areas creates a persistent need for rapid and affordable housing solutions, making manufactured homes an ideal answer.

Challenges in the Egypt Manufactured Homes Market Sector

Despite its growth trajectory, the Egypt manufactured homes market faces certain challenges. Regulatory hurdles, though decreasing, can still pose delays in project approvals and adherence to diverse local building codes. Supply chain issues, particularly concerning the availability and timely delivery of specialized materials for prefab homes Egypt, can impact production timelines. Competitive pressures from traditional construction methods, while diminishing, remain a factor. Public perception and a historical preference for traditional construction can also present a barrier to widespread adoption. Quantifiable impacts include potential cost escalations and extended project timelines if these challenges are not effectively managed.

Leading Players in the Egypt Manufactured Homes Market Market

- Shewekar Design Studio

- Cretematic Prefabricated Concrete & Steel Structures - S A E

- Middle East Caravan

- Rush Projects Egypt "RPE"

- Arabian Construction House Group

- Karmod Prefabricated Building Technologies

- Al Quds Steel

- DTH PREFAB

- Dalal Steel Industries

- Ideal Prefab

- Industrial Engineering Company for Construction and Development (ICON)

Key Developments in Egypt Manufactured Homes Market Sector

- October 2022: Madinet Nasr for Housing and Development (MNHD) announced the signing of a partnership agreement with DMC, one of Egypt's leading general contracting and project construction companies, to build 13 buildings in Taj City's Lake Park project. The project's total investment is EGP 350 million (USD 11.82 Million), and it is expected to be completed in 18 months, showcasing large-scale adoption of modern construction methods.

- October 2022: Seqoon received a pre-seed round of USD 500,000 from one of Egypt's Banque Misr as part of the bank's pilot program to support innovative startups in Egypt. The program aims to assist financial technology (FinTech) startups by providing subject matter sponsors from Banque Misr, as well as international subject matter experts for guidance and mentorship in upcoming accelerated ventures. By 2023, Seqoon intends to expand into other Red Sea destinations such as Dahab and the Mediterranean North Coast, indicating a growing interest in financing and supporting innovative solutions within the broader construction and real estate technology sectors, which can indirectly benefit the manufactured homes market.

Strategic Egypt Manufactured Homes Market Market Outlook

The strategic outlook for the Egypt manufactured homes market is highly promising, driven by a confluence of favorable demographic trends, governmental support for housing solutions, and technological advancements in prefab construction Egypt. The market is poised to become a cornerstone of Egypt's affordable housing strategy and sustainable development goals. Growth accelerators include further integration of smart home technologies, the development of eco-friendly building materials, and an increasing embrace of large-scale modular buildings Egypt for commercial and residential developments. Strategic opportunities lie in expanding manufacturing capacity, fostering skilled labor development, and strengthening partnerships across the construction value chain to capitalize on the burgeoning demand for efficient, cost-effective, and sustainable housing solutions.

Egypt Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Egypt Manufactured Homes Market Segmentation By Geography

- 1. Egypt

Egypt Manufactured Homes Market Regional Market Share

Geographic Coverage of Egypt Manufactured Homes Market

Egypt Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization and Changing Lifestyle4.; Improved Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Construction Cost

- 3.4. Market Trends

- 3.4.1. Increasing residential real estate prices demanding more manufactured homes construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shewekar Design Studio

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cretematic Prefabricated Concrete & Steel Structures - S A E

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Middle East Caravan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rush Projects Egypt "RPE"

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arabian Construction House Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Karmod Prefabricated Building Technologies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al Quds Steel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DTH PREFAB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dalal Steel Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ideal Prefab**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Industrial Engineering Company for Construction and Development (ICON)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Shewekar Design Studio

List of Figures

- Figure 1: Egypt Manufactured Homes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Egypt Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Egypt Manufactured Homes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Egypt Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Egypt Manufactured Homes Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Manufactured Homes Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Egypt Manufactured Homes Market?

Key companies in the market include Shewekar Design Studio, Cretematic Prefabricated Concrete & Steel Structures - S A E, Middle East Caravan, Rush Projects Egypt "RPE", Arabian Construction House Group, Karmod Prefabricated Building Technologies, Al Quds Steel, DTH PREFAB, Dalal Steel Industries, Ideal Prefab**List Not Exhaustive, Industrial Engineering Company for Construction and Development (ICON).

3. What are the main segments of the Egypt Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.72 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization and Changing Lifestyle4.; Improved Infrastructure.

6. What are the notable trends driving market growth?

Increasing residential real estate prices demanding more manufactured homes construction.

7. Are there any restraints impacting market growth?

4.; Rising Construction Cost.

8. Can you provide examples of recent developments in the market?

October 2022: Madinet Nasr for Housing and Development (MNHD) announced the signing of a partnership agreement with DMC, one of Egypt's leading general contracting and project construction companies, to build 13 buildings in Taj City's Lake Park project. The project's total investment is EGP 350 million (USD 11.82 million), and it is expected to be completed in 18 months.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Egypt Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence