Key Insights

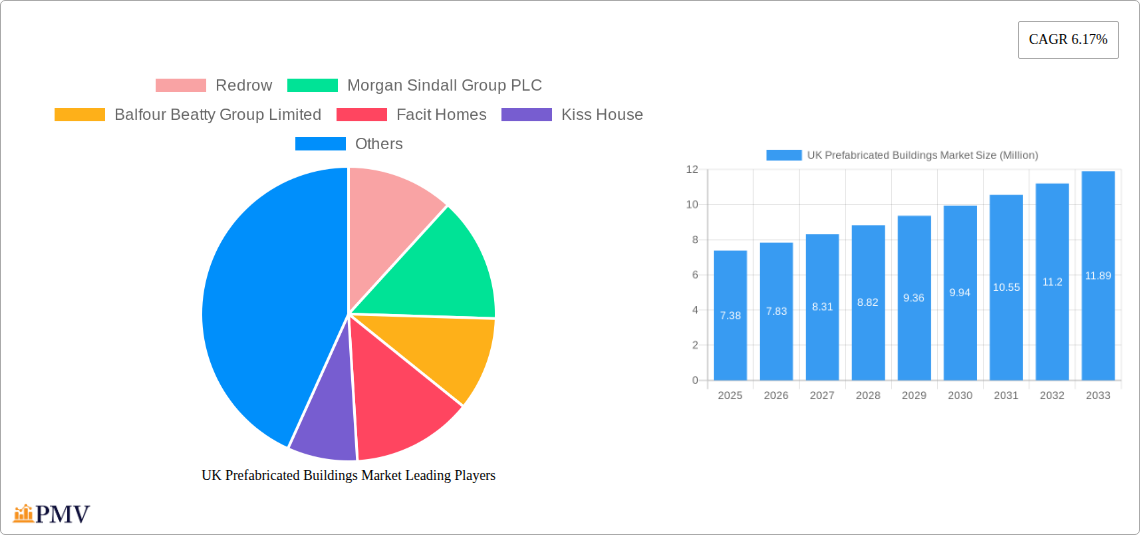

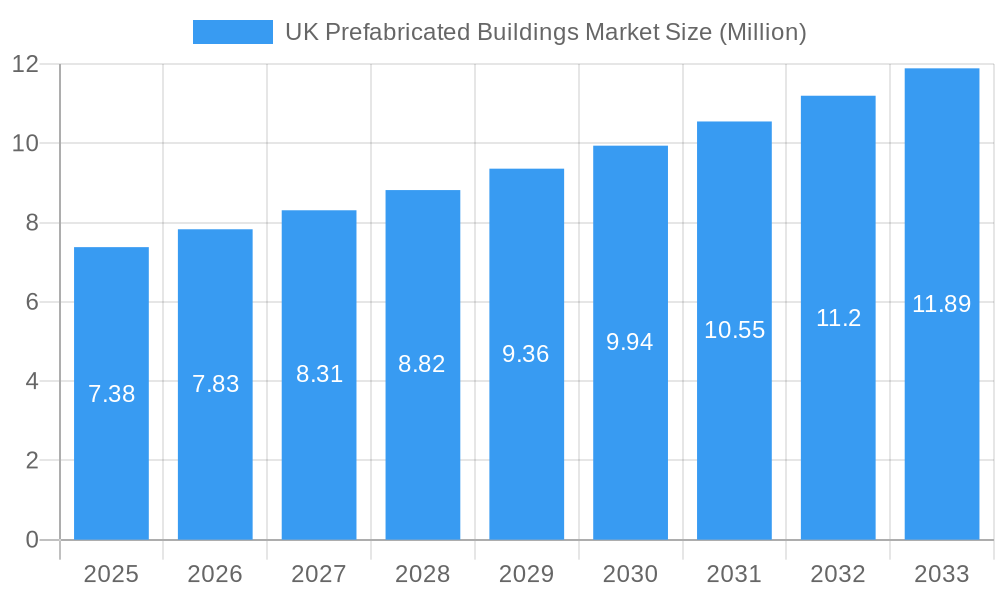

The UK Prefabricated Buildings Market is poised for significant expansion, driven by increasing demand for efficient, sustainable, and cost-effective construction solutions. With a current market size estimated at £7.38 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 6.17% through 2033, the sector is demonstrating robust momentum. Key growth drivers include a national housing shortage necessitating faster build times, a growing emphasis on sustainable construction practices through factory-controlled environments, and government initiatives promoting modern methods of construction. The market is also benefiting from advancements in material science and digital design, enabling greater customization and structural integrity in prefabricated units. This surge in demand is observed across both residential and commercial applications, reflecting the versatility and scalability of off-site construction techniques.

UK Prefabricated Buildings Market Market Size (In Million)

The market's trajectory is further shaped by evolving trends such as the rise of modular construction for its speed and reduced site disruption, and a greater integration of smart technologies within prefabricated structures for enhanced functionality and energy efficiency. While the sector is largely propelled by these positive forces, certain restraints, such as the initial perception of prefabricated buildings as inferior in quality or design, and potential challenges in adapting existing infrastructure for large-scale off-site manufacturing, need to be addressed. However, as more high-profile projects showcase the benefits of prefabrication, these perceptions are rapidly changing. Key industry players like Redrow, Balfour Beatty Group PLC, and Persimmon Homes Limited are actively investing in and expanding their prefabricated offerings, indicating a strong industry commitment to this evolving construction paradigm. The forecast period is expected to witness a sustained upward trend, solidifying prefabricated buildings as a cornerstone of the UK's future construction landscape.

UK Prefabricated Buildings Market Company Market Share

UK Prefabricated Buildings Market Report: In-Depth Analysis & Forecast 2019–2033

Gain unparalleled insights into the burgeoning UK Prefabricated Buildings Market with this comprehensive report. Covering the period 2019–2033, with a base year of 2025, this analysis provides a detailed roadmap of market structure, industry trends, dominant segments, product innovations, growth drivers, challenges, and the competitive landscape. Leveraging high-ranking keywords such as "UK modular construction," "offsite building solutions," "prefabricated housing UK," "timber frame buildings," "concrete modular buildings," and "commercial modular construction," this report is engineered to boost search visibility and engage key stakeholders. We delve into the intricate dynamics of the market, presenting actionable intelligence for strategic decision-making.

UK Prefabricated Buildings Market Market Structure & Competitive Dynamics

The UK Prefabricated Buildings Market is characterized by a moderately concentrated structure, with a mix of large-scale developers and specialized offsite manufacturers. Innovation is a key differentiator, fueled by advancements in digital design, automation, and sustainable materials. Regulatory frameworks, while evolving to support modern methods of construction, can still present hurdles. Product substitutes, such as traditional build methods, remain a competitive factor, though the efficiency and sustainability of prefabricated solutions are increasingly recognized. End-user trends are heavily influenced by the demand for faster project completion, cost predictability, and reduced environmental impact, particularly in the residential and commercial sectors. Mergers and acquisitions (M&A) are becoming more prevalent as larger players seek to integrate offsite capabilities or expand their market reach. For instance, recent investments in companies like Premier Modular underscore this trend. The M&A deal values are projected to see an upward trajectory as the market matures and consolidation opportunities arise. Market share is dynamically shifting, with companies demonstrating strong technological adoption and sustainable practices gaining a competitive edge.

UK Prefabricated Buildings Market Industry Trends & Insights

The UK Prefabricated Buildings Market is experiencing robust growth, driven by a confluence of economic, technological, and societal factors. A significant growth driver is the escalating demand for housing, exacerbated by population growth and a persistent housing shortage. Prefabricated construction offers a solution to accelerate build times and reduce costs, making it an attractive option for developers and homebuyers alike. Technological advancements, including Building Information Modeling (BIM), 3D printing in construction, and advanced robotics in manufacturing, are revolutionizing offsite building, enhancing precision, reducing waste, and enabling more complex designs. The increasing focus on sustainability and environmental regulations is another major catalyst. Prefabricated buildings, often constructed with eco-friendly materials like timber, offer superior energy efficiency and a reduced carbon footprint compared to traditional methods. This resonates strongly with consumers and corporate clients seeking greener building solutions.

The competitive landscape is intensifying, with established construction firms increasingly investing in or acquiring modular manufacturing capabilities. New entrants are also emerging, often leveraging innovative designs and specialized materials. The market is witnessing a significant shift towards smart buildings, integrating IoT technologies for enhanced functionality and user experience. Consumer preferences are evolving, with a growing appreciation for the quality, speed, and customization options offered by prefabricated homes and commercial spaces. The rise of "build-to-rent" schemes and student accommodation projects further bolsters the demand for efficient construction methods. The overall market penetration of prefabricated buildings in the UK is steadily increasing, indicating a broader acceptance and integration into the mainstream construction industry. The Compound Annual Growth Rate (CAGR) for the UK Prefabricated Buildings Market is projected to remain strong throughout the forecast period, supported by ongoing innovation and supportive government policies aimed at boosting construction output and achieving net-zero targets.

Dominant Markets & Segments in UK Prefabricated Buildings Market

The UK Prefabricated Buildings Market exhibits dominance across several key segments, driven by specific economic policies, infrastructure development, and evolving consumer needs.

Residential Application Dominance:

The Residential segment is a primary driver of growth. Factors contributing to its dominance include:

- Housing Shortage: Persistent demand for affordable and quickly deployable housing solutions.

- Government Initiatives: Policies aimed at increasing housing supply and encouraging modern methods of construction.

- Developer Investment: Major housebuilders are increasingly adopting offsite methods to meet volume targets and improve margins.

- Consumer Acceptance: Growing awareness and preference for faster build times, cost certainty, and sustainable home options.

In terms of material types, Timber is a leading segment within residential applications due to its sustainability, natural insulation properties, and speed of assembly. The market is witnessing a surge in timber frame construction for houses, apartments, and student accommodations.

Commercial Application Growth:

The Commercial application segment is also a significant contributor and is poised for substantial growth. Key drivers include:

- Business Efficiency: Companies seeking rapid deployment of new offices, retail spaces, and educational facilities.

- Cost Savings: Predictable costs and reduced project timelines offer significant financial advantages for businesses.

- Flexibility and Adaptability: Modular structures can be easily reconfigured or relocated to meet changing business needs.

- Healthcare Infrastructure: Demand for temporary or permanent healthcare facilities, such as modular clinics and hospital extensions, particularly amplified by recent global health events.

Within commercial applications, Metal and Concrete prefabricated buildings are prominent, especially for larger-scale projects requiring structural integrity and durability, such as industrial units, warehouses, and some retail or office complexes.

Material Type Dynamics:

- Concrete: Dominant in applications requiring high structural strength and durability, such as industrial buildings and larger commercial structures. Its fire resistance and longevity are key advantages.

- Glass: Primarily used for its aesthetic appeal and light-enhancing properties in commercial facades, conservatories, and bespoke residential extensions.

- Metal: Widely adopted for its strength-to-weight ratio, speed of assembly, and durability, prevalent in industrial, commercial, and temporary structures.

- Timber: Experiencing rapid growth, especially in residential and eco-friendly commercial projects, due to its sustainability, excellent insulation, and rapid construction capabilities.

The dominance of these segments is further underscored by ongoing research and development in materials science and manufacturing processes, continuously enhancing the performance and applicability of each material type in the UK prefabricated buildings market.

UK Prefabricated Buildings Market Product Innovations

Product innovations in the UK Prefabricated Buildings Market are centered on enhancing sustainability, increasing design flexibility, and improving construction efficiency. Advances in material science are leading to the development of lighter, stronger, and more eco-friendly prefabricated components. Digital design tools, including AI-powered generative design, are enabling the creation of complex and bespoke architectural solutions. The integration of smart technologies for energy management and building automation is becoming a standard feature. Competitive advantages are derived from reduced embodied carbon, faster on-site assembly, superior thermal performance, and greater design customization, meeting the evolving demands of clients seeking modern, efficient, and sustainable building solutions.

Report Segmentation & Scope

This report segments the UK Prefabricated Buildings Market based on two primary categories: Material Type and Application.

Material Type:

- Concrete: This segment encompasses prefabricated concrete panels, modules, and structural components, valued for their durability and thermal mass. Projections indicate steady growth, driven by infrastructure and commercial projects. Market sizes are significant due to the robust nature of concrete construction.

- Glass: Focuses on prefabricated glass structures and facades, offering aesthetic appeal and natural light. Growth is anticipated in bespoke residential and premium commercial applications, with increasing market share driven by architectural trends.

- Metal: Includes prefabricated steel and other metal structures, known for their strength, speed of assembly, and reusability. This segment is expected to experience strong growth in industrial, logistics, and temporary commercial buildings.

- Timber: This segment covers prefabricated timber frame buildings, including Cross-Laminated Timber (CLT) and Glulam structures. It is projected to see the most significant growth due to its sustainability, thermal efficiency, and alignment with net-zero targets.

- Other Material Types: This category includes emerging materials and composite solutions, offering specialized properties and innovation potential. Growth is expected to be moderate but significant as new technologies mature.

Application:

- Residential: This segment includes prefabricated houses, apartments, student accommodation, and affordable housing projects. It is a dominant segment with substantial market share and high projected growth, fueled by housing demand.

- Commercial: This encompasses prefabricated office buildings, retail spaces, hotels, and healthcare facilities. Growth is strong, driven by business expansion and the need for rapid deployment of commercial infrastructure.

- Other Applications: This includes prefabricated structures for education, industrial, leisure, and temporary event purposes. This segment offers diverse opportunities with moderate to strong growth projections.

Key Drivers of UK Prefabricated Buildings Market Growth

The UK Prefabricated Buildings Market is propelled by several key drivers. Technological advancements in offsite manufacturing, including digital design and automation, are enhancing precision, speed, and efficiency. Economic factors, such as the need for affordable housing and cost-effective construction solutions, are significant. Government initiatives and evolving regulatory frameworks that favor modern methods of construction and sustainability targets, such as net-zero emissions, provide a strong impetus. The increasing demand for speedy project delivery across residential, commercial, and infrastructure sectors, coupled with a focus on sustainability and reduced environmental impact, are fundamental growth accelerators.

Challenges in the UK Prefabricated Buildings Market Sector

Despite its growth potential, the UK Prefabricated Buildings Market faces several challenges. Regulatory hurdles and the need for standardization in offsite construction can slow adoption. Supply chain complexities, particularly for specialized materials and components, can lead to delays and increased costs. Perception and acceptance by some traditionalists in the construction industry and consumers, who may still associate prefabricated with lower quality, needs continuous effort to overcome. Financing challenges can arise due to the non-traditional nature of some projects. Furthermore, transportation logistics for large modular units can be a constraint in certain locations. These challenges, while present, are being addressed through industry collaboration and innovation.

Leading Players in the UK Prefabricated Buildings Market Market

The UK Prefabricated Buildings Market is served by a diverse range of established and emerging companies. Key players contributing to the market's dynamism and innovation include:

- Redrow

- Morgan Sindall Group PLC

- Balfour Beatty Group Limited

- Facit Homes

- Kiss House

- Persimmon Homes Limited

- Barratt Developments PLC

- Phoenix Homes

- Berkley Group

- Bellway Homes Limited

- Galliford Try Limited

- Webrhaus

This list is not exhaustive but represents significant contributors to the market's landscape.

Key Developments in UK Prefabricated Buildings Market Sector

- August 2023: UK offsite company Premier Modular has received new investment from London-headquartered private equity firm MML Capital Partners. This investment is set to fuel expansion and further technological development within the modular construction sector.

- December 2022: Modulaire Group, a European specialist provider of modular services and infrastructure, announced the acquisition of Mobile Mini UK. WillScot Mobile Mini Holdings Corp's subsidiary has 16 locations across the UK and supplies steel storage and accommodation units to a variety of industries, including construction, retail, manufacturing, healthcare, and education. This acquisition strengthens Modulaire Group's presence and service offering in the UK market.

Strategic UK Prefabricated Buildings Market Market Outlook

The strategic outlook for the UK Prefabricated Buildings Market is exceptionally positive, with significant growth accelerators in play. The increasing adoption of offsite construction by major developers and the government's commitment to housing targets and sustainability goals will continue to fuel demand. Innovation in materials, digital design, and automation will enhance the competitiveness and appeal of prefabricated solutions. The market is poised for further consolidation and strategic partnerships as companies seek to expand their capabilities and market share. Future opportunities lie in the development of net-zero certified prefabricated buildings, integration with smart city initiatives, and the application of modular construction in critical infrastructure projects, ensuring a robust and dynamic market trajectory.

UK Prefabricated Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

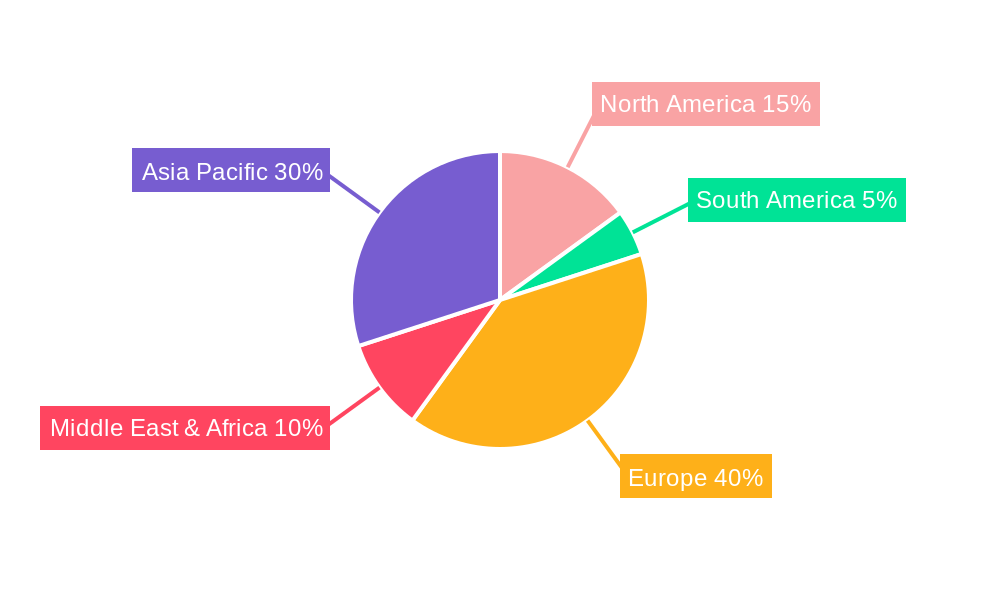

UK Prefabricated Buildings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Prefabricated Buildings Market Regional Market Share

Geographic Coverage of UK Prefabricated Buildings Market

UK Prefabricated Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure Investments; Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry

- 3.3. Market Restrains

- 3.3.1. Limited Adaptability during Construction

- 3.4. Market Trends

- 3.4.1. Need for Precast Concrete Technology Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America UK Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Concrete

- 6.1.2. Glass

- 6.1.3. Metal

- 6.1.4. Timber

- 6.1.5. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. South America UK Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Concrete

- 7.1.2. Glass

- 7.1.3. Metal

- 7.1.4. Timber

- 7.1.5. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe UK Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Concrete

- 8.1.2. Glass

- 8.1.3. Metal

- 8.1.4. Timber

- 8.1.5. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East & Africa UK Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Concrete

- 9.1.2. Glass

- 9.1.3. Metal

- 9.1.4. Timber

- 9.1.5. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Asia Pacific UK Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Concrete

- 10.1.2. Glass

- 10.1.3. Metal

- 10.1.4. Timber

- 10.1.5. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Redrow

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Morgan Sindall Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Balfour Beatty Group Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Facit Homes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kiss House

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Persimmon Homes Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Barratt Developments PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phoenix Homes

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Berkley Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bellway Homes Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Galliford Try Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Webrhaus**List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Redrow

List of Figures

- Figure 1: Global UK Prefabricated Buildings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Prefabricated Buildings Market Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America UK Prefabricated Buildings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America UK Prefabricated Buildings Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America UK Prefabricated Buildings Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America UK Prefabricated Buildings Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UK Prefabricated Buildings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Prefabricated Buildings Market Revenue (Million), by Material Type 2025 & 2033

- Figure 9: South America UK Prefabricated Buildings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: South America UK Prefabricated Buildings Market Revenue (Million), by Application 2025 & 2033

- Figure 11: South America UK Prefabricated Buildings Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America UK Prefabricated Buildings Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UK Prefabricated Buildings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Prefabricated Buildings Market Revenue (Million), by Material Type 2025 & 2033

- Figure 15: Europe UK Prefabricated Buildings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Europe UK Prefabricated Buildings Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe UK Prefabricated Buildings Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe UK Prefabricated Buildings Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UK Prefabricated Buildings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Prefabricated Buildings Market Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Middle East & Africa UK Prefabricated Buildings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Middle East & Africa UK Prefabricated Buildings Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa UK Prefabricated Buildings Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa UK Prefabricated Buildings Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Prefabricated Buildings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Prefabricated Buildings Market Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Asia Pacific UK Prefabricated Buildings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Asia Pacific UK Prefabricated Buildings Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific UK Prefabricated Buildings Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific UK Prefabricated Buildings Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Prefabricated Buildings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 11: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 17: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 29: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 38: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global UK Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Prefabricated Buildings Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the UK Prefabricated Buildings Market?

Key companies in the market include Redrow, Morgan Sindall Group PLC, Balfour Beatty Group Limited, Facit Homes, Kiss House, Persimmon Homes Limited, Barratt Developments PLC, Phoenix Homes, Berkley Group, Bellway Homes Limited, Galliford Try Limited, Webrhaus**List Not Exhaustive.

3. What are the main segments of the UK Prefabricated Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure Investments; Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry.

6. What are the notable trends driving market growth?

Need for Precast Concrete Technology Driving the Market.

7. Are there any restraints impacting market growth?

Limited Adaptability during Construction.

8. Can you provide examples of recent developments in the market?

August 2023: UK offsite company Premier Modular has received new investment from London-headquartered private equity firm MML Capital Partners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Prefabricated Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Prefabricated Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Prefabricated Buildings Market?

To stay informed about further developments, trends, and reports in the UK Prefabricated Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence