Key Insights

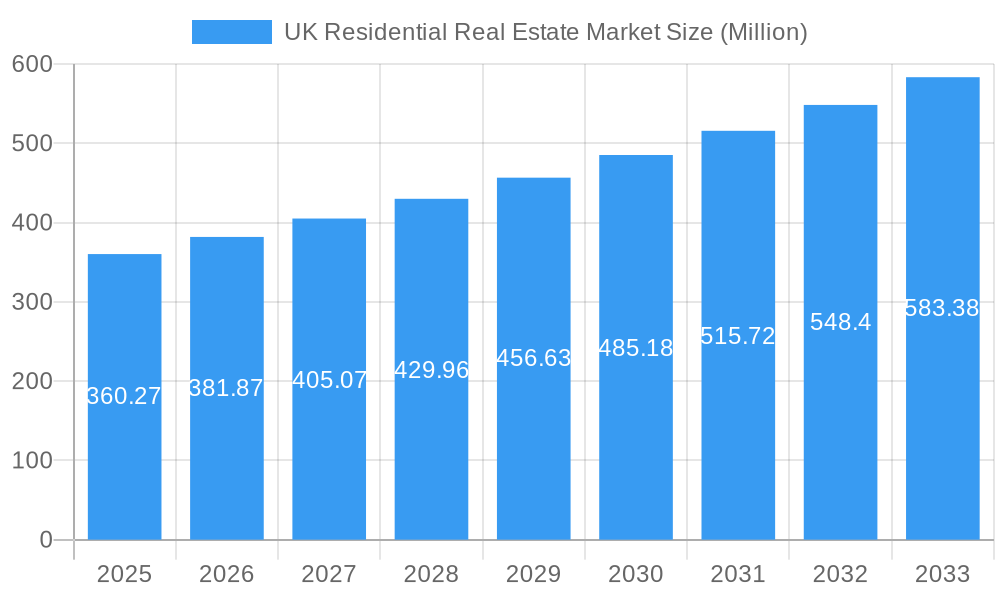

The UK residential real estate market, valued at £360.27 million in 2025, is projected to experience robust growth, driven by factors such as increasing urbanization, a growing population, and government initiatives aimed at boosting homeownership. The compound annual growth rate (CAGR) of 5.75% over the forecast period (2025-2033) indicates a significant expansion in market size. Demand is particularly strong in England, especially London, fueled by economic activity and job creation. However, constraints such as limited land availability, stringent planning regulations, and affordability challenges, particularly for first-time buyers, pose significant hurdles. The market is segmented by property type (apartments/condominiums and landed houses/villas) and region (England, Wales, Scotland, Northern Ireland, and other regions). Major players like Berkeley Group, London & Quadrant Housing Trust, Barratt Developments, and others compete in this dynamic landscape. The increase in remote work opportunities also contributed to shifting regional demand, increasing property values in areas outside traditional city centers. Furthermore, the fluctuating interest rates and overall economic climate play a crucial role in shaping investor confidence and purchasing decisions within the market.

UK Residential Real Estate Market Market Size (In Million)

The forecast period will likely see a continued growth trajectory, albeit potentially moderated by economic fluctuations. While the apartment and condominium segment is expected to remain popular in urban centers, the demand for landed houses and villas in suburban and rural areas is also projected to increase, reflecting changing lifestyle preferences. Analyzing regional variations in growth rates will be key to understanding market dynamics. The success of individual developers and housing trusts will depend on their ability to adapt to evolving consumer preferences, navigate regulatory challenges, and maintain a competitive edge in a market characterized by both opportunity and constraint. The ongoing impact of Brexit, inflation, and the cost of living crisis will play an important role in shaping the long-term outlook for the market.

UK Residential Real Estate Market Company Market Share

UK Residential Real Estate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK residential real estate market, covering historical performance (2019-2024), current status (2025), and future projections (2025-2033). It offers invaluable insights for investors, developers, policymakers, and industry professionals seeking to navigate this dynamic market. The report segments the market by key regions (England, Wales, Scotland, Northern Ireland, and Other Regions) and property types (Apartments & Condominiums, Landed Houses & Villas), providing granular data and analysis. The total market value in 2025 is estimated at £xx Million.

UK Residential Real Estate Market Market Structure & Competitive Dynamics

The UK residential real estate market is characterized by a moderately concentrated structure with a mix of large national players and smaller regional firms. Key players like Berkeley Group, Barratt Developments PLC, Redrow, and Bellway PLC command significant market share, while numerous smaller developers and independent agents contribute to market activity. Market concentration is further shaped by the presence of large housing associations like London and Quadrant Housing Trust. The market exhibits a robust innovation ecosystem, with technological advancements impacting property search, management, and construction techniques.

Regulatory frameworks, including planning permissions and building regulations, significantly influence development activity and pricing. Product substitutes, such as Build-to-Rent (BTR) developments, are gaining traction, especially in urban areas. End-user trends indicate a growing demand for sustainable, energy-efficient housing and smart home technologies. Mergers and acquisitions (M&A) activity remains significant, with deal values fluctuating based on market conditions. In recent years, M&A activity has averaged approximately £xx Million annually, although this figure fluctuates based on market conditions and investor confidence. For example, the recent acquisition of Capital Value Surveyors by ValuStrat highlights ongoing foreign investment interest in the UK real estate market.

UK Residential Real Estate Market Industry Trends & Insights

The UK residential real estate market is experiencing dynamic shifts. Market growth is driven by several factors, including increasing urbanization, population growth, and ongoing demand for housing in key regions. Technological disruptions, such as the adoption of PropTech solutions and the growth of online property portals, are transforming how properties are marketed, managed, and transacted. Consumer preferences are evolving, with increased focus on energy efficiency, sustainable materials, and smart home integration. The market exhibits strong competitive dynamics, with intense competition among developers, estate agents, and property management companies. This competition drives innovation and pushes for better services. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). Market penetration of sustainable building materials is estimated at xx% in 2025, expected to increase to xx% by 2033.

Dominant Markets & Segments in UK Residential Real Estate Market

Leading Region: England remains the dominant region, driven by strong economic activity, infrastructure development, and high population density, particularly in London and the South East.

Leading Segment: Apartments and Condominiums represent a significant segment, especially in urban areas, catering to the growing demand for compact, accessible, and often more affordable living spaces.

England's Dominance: England's dominance is fueled by multiple factors. Robust economic performance attracts both domestic and international investors, driving up demand. Significant infrastructure investments, including transportation upgrades and improved connectivity, enhance property values and attractiveness. Government policies, while subject to change, influence the supply of new homes. London, as a global hub, sees especially strong demand, although affordability remains a significant challenge. Wales, Scotland, and Northern Ireland exhibit distinct market characteristics, driven by regional economic activity and demographic trends.

UK Residential Real Estate Market Product Innovations

The UK residential real estate market is witnessing significant product innovation, driven by technological advancements and evolving consumer preferences. Smart home technology integration, energy-efficient designs utilizing sustainable materials, and modular construction techniques are gaining traction. These innovations offer enhanced living experiences, reduced environmental impact, and improved construction efficiency. The increasing adoption of virtual reality (VR) and augmented reality (AR) technologies for property viewing and design visualization is further reshaping the market landscape. The market is quickly adapting to the increased focus on environmentally sustainable practices.

Report Segmentation & Scope

This report segments the UK residential real estate market in two key ways:

By Key Regions: England, Wales, Scotland, Northern Ireland, and Other Regions. Each region presents unique characteristics in terms of market size, growth rates, and competitive dynamics. England's market size is projected to represent the majority of the overall market in 2025 at £xx Million, driven by higher population density and economic activity, while other regions are anticipated to have comparatively smaller market sizes, although growth rates may vary.

By Type: Apartments and Condominiums and Landed Houses and Villas. The report analyzes the distinct dynamics within each segment, including pricing trends, demand drivers, and competitive landscapes. Apartments and Condominiums are expected to witness continued high demand, particularly in urban centres, while Landed Houses and Villas remain popular in suburban and rural areas.

Key Drivers of UK Residential Real Estate Market Growth

Several factors are driving growth in the UK residential real estate market: increasing urbanization leading to higher demand for housing in urban centers; population growth pushing up housing demand; government initiatives aimed at increasing housing supply; and robust economic conditions attracting investment. Technological advancements in construction and property management are also increasing efficiency and driving growth. Furthermore, the increasing preference for sustainable and energy-efficient housing is influencing design and construction.

Challenges in the UK Residential Real Estate Market Sector

The UK residential real estate market faces significant challenges, including stringent planning regulations that can hinder development, supply chain disruptions affecting construction costs and timelines, and affordability issues impacting accessibility for a large section of the population. The sector also faces ongoing challenges related to Brexit's impact on foreign investment and skilled labor shortages impacting construction. These factors together contribute to a complex and ever-evolving environment. These challenges, if not addressed effectively, could impact the overall market growth.

Leading Players in the UK Residential Real Estate Market Market

- Berkeley Group

- London and Quadrant Housing Trust

- Foxtons Ltd

- Redrow

- Places for People

- Mears Group

- Kier Group

- Countrywide PLC

- Countryside Properties PLC

- Barratt Developments PLC

- Galliard Homes Limited

- Native Land Limited

- Bellway PLC

- Crest Nicholson PLC

- Miller Homes

Key Developments in UK Residential Real Estate Market Sector

May 2023: Rasmala Investment Bank launched a USD 2bn (€1.8bn) UK multifamily strategy, targeting serviced apartments (SAP) and BTR within and around London. This significant investment signals confidence in the UK multifamily sector.

November 2022: ValuStrat's acquisition of a stake in Capital Value Surveyors strengthens its presence in the UK market, highlighting continued foreign investment interest.

Strategic UK Residential Real Estate Market Outlook

The UK residential real estate market is poised for continued growth, driven by sustained population growth, urbanization, and ongoing demand for quality housing. Opportunities exist within the Build-to-Rent (BTR) sector, sustainable housing developments, and technological advancements within the property management space. Strategic partnerships, acquisitions, and investments in innovative construction methods will be crucial for players seeking to thrive in this evolving market. The long-term outlook remains positive, with potential for significant returns, particularly for those who adapt to changing market conditions and capitalize on emerging trends.

UK Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

UK Residential Real Estate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Residential Real Estate Market Regional Market Share

Geographic Coverage of UK Residential Real Estate Market

UK Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Increasing in the United Kingdom House Prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Berkeley Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 London and Quadrant Housing Trust**List Not Exhaustive 7 3 Other Companies (Foxtons Ltd Redrow Places for People Mears Kier Group Countrywide PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Countryside Properties PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Barratt Developments PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Galliard Homes Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Native Land Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bellway PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crest Nicholson PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Miler homes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Berkeley Group

List of Figures

- Figure 1: Global UK Residential Real Estate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 7: South America UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Residential Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific UK Residential Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific UK Residential Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Residential Real Estate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Residential Real Estate Market?

The projected CAGR is approximately 5.75%.

2. Which companies are prominent players in the UK Residential Real Estate Market?

Key companies in the market include Berkeley Group, London and Quadrant Housing Trust**List Not Exhaustive 7 3 Other Companies (Foxtons Ltd Redrow Places for People Mears Kier Group Countrywide PLC, Countryside Properties PLC, Barratt Developments PLC, Galliard Homes Limited, Native Land Limited, Bellway PLC, Crest Nicholson PLC, Miler homes.

3. What are the main segments of the UK Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 360.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Increasing in the United Kingdom House Prices.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

May 2023: A UAE-based investment manager, Rasmala Investment Bank, has launched a USD 2bn ( €1.8bn) UK multifamily strategy for a five-year period to build a USD 2bn portfolio of UK residential properties. The strategy is focused on the UK market for multifamily properties through a Shariah-compliant investment vehicle, initially targeting the serviced apartment (SAP) and BTR (build-to-rent) subsectors within and around London. Seeded by Rasmala Group, the strategy is backed by an active investment pipeline for the next 12 – 18 months.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the UK Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence