Key Insights

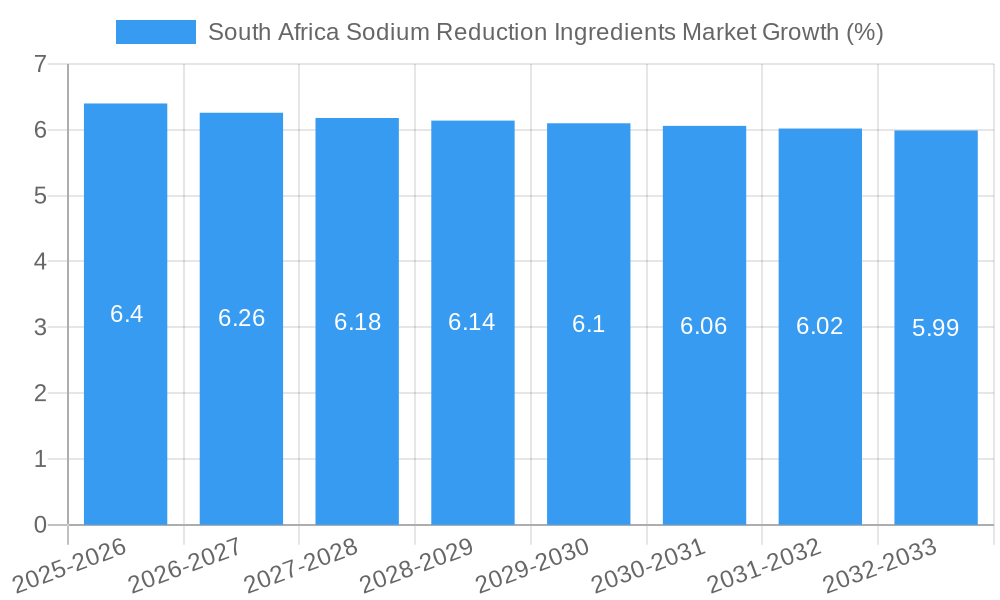

The South African Sodium Reduction Ingredients Market is poised for significant growth, projected to reach a substantial market size by 2033. The market is being propelled by a confluence of strong drivers, including increasing consumer awareness regarding the health implications of high sodium intake, coupled with a growing prevalence of lifestyle-related diseases like hypertension and cardiovascular conditions. This rising health consciousness is directly influencing purchasing decisions, pushing both consumers and food manufacturers towards healthier alternatives. Government initiatives and regulatory pressures aimed at curbing excessive sodium consumption further bolster this trend. Manufacturers are actively reformulating products to meet these demands, creating a robust market for innovative sodium reduction ingredients. The CAGR of 6.40% over the forecast period indicates a dynamic and expanding market.

The market's trajectory is further shaped by evolving consumer preferences and technological advancements. Trends such as the demand for clean-label products and the increasing popularity of savory snacks and processed foods with reduced sodium content are creating new opportunities. Yeast extracts and mineral salts are emerging as key ingredients, offering effective sodium reduction while enhancing flavor profiles. However, certain restraints, such as the potential impact on taste and texture in some applications and the cost-effectiveness of certain alternatives, may present challenges. Despite these hurdles, the application segments like condiments, seasonings, sauces, and meat products are expected to witness considerable expansion due to their high sodium content and consumer demand for healthier options in these categories. Key players like Givaudan SA, Archer Daniels Midland Company, and Kerry Group are actively investing in research and development to offer a wider array of solutions, contributing to the overall market dynamism in South Africa.

This in-depth market research report provides a detailed analysis of the South Africa Sodium Reduction Ingredients Market, offering critical insights for stakeholders aiming to capitalize on the growing demand for healthier food options. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into market dynamics, key trends, segmentation, and competitive landscape, making it an indispensable resource for ingredient suppliers, food manufacturers, policymakers, and investors. The study meticulously examines sodium reduction solutions and salt reduction ingredients impacting the South African food industry, focusing on products designed to lower sodium content without compromising taste or texture.

South Africa Sodium Reduction Ingredients Market Market Structure & Competitive Dynamics

The South Africa Sodium Reduction Ingredients Market exhibits a moderately consolidated structure, with key players like Givaudan SA, Archer Daniels Midland Company, and Tate & Lyle PLC holding significant market share. Innovation ecosystems are flourishing, driven by a confluence of consumer demand for low-sodium foods, stringent government regulations, and advancements in food science. The market is characterized by intense competition, with established ingredient suppliers investing heavily in R&D to develop novel sodium replacers and flavor enhancers. Product substitutes, such as potassium chloride and natural flavor extracts, are also present, but advancements in taste modulation technology are widening the lead of specialized sodium reduction ingredients. End-user trends strongly favor products with transparent ingredient lists and demonstrable health benefits, pushing manufacturers to adopt innovative solutions. While M&A activities are anticipated to increase as larger entities seek to consolidate their position, current deal values are estimated to be in the range of xx Million. The market penetration of advanced sodium reduction technologies is expected to rise, further shaping competitive dynamics.

South Africa Sodium Reduction Ingredients Market Industry Trends & Insights

The South Africa Sodium Reduction Ingredients Market is poised for significant growth, fueled by a rising public health consciousness and proactive government initiatives aimed at curbing sodium intake to combat non-communicable diseases like hypertension. The projected Compound Annual Growth Rate (CAGR) for the forecast period is an impressive xx%. A key driver is the increasing consumer preference for healthier food choices, leading food manufacturers to reformulate their products and incorporate sodium-free salt alternatives and taste modulators. Technological disruptions, particularly in the realm of umami ingredients and fermentation-derived flavor enhancers, are enabling the creation of palatable low-sodium products, thereby expanding market penetration across various food categories. The competitive landscape is evolving with strategic alliances between ingredient developers and prominent food brands, fostering the development and widespread adoption of innovative salt reduction solutions. Furthermore, a growing awareness of the link between high sodium consumption and health issues is compelling regulatory bodies to implement stricter guidelines, thereby creating a more favorable environment for sodium reduction ingredients. The market is also witnessing a surge in investment in research and development, with companies striving to offer cost-effective and efficient salt substitutes that meet diverse sensory requirements. The expansion of the convenience food sector, coupled with the growing disposable income of consumers, further bolsters the demand for processed foods, which in turn necessitates the use of sodium reduction ingredients for healthier formulations. The increasing adoption of clean-label trends also presents opportunities for natural and plant-based sodium reduction ingredients. The overall market penetration of these ingredients is expected to reach xx% by 2033.

Dominant Markets & Segments in South Africa Sodium Reduction Ingredients Market

Within the South Africa Sodium Reduction Ingredients Market, several segments are demonstrating exceptional growth and dominance.

- Dominant Product Type: Amino Acids and Glutamates currently hold the largest market share due to their efficacy in enhancing flavor and providing a savory taste profile, crucial for replacing the perceived loss of saltiness. Yeast Extracts are also experiencing robust growth, driven by their natural origins and complex flavor-enhancing capabilities.

- Key Drivers for Amino Acids and Glutamates: High effectiveness in flavor perception, broad applicability across food types, and established scientific backing for their role in taste modulation.

- Key Drivers for Yeast Extracts: Consumer preference for natural ingredients, versatility in imparting savory notes, and suitability for clean-label formulations.

- Dominant Application: The Condiments, Seasonings, and Sauces segment is a leading application area for sodium reduction ingredients. This is largely due to the high sodium content typically found in these products and the direct impact they have on the overall taste of a meal.

- Key Drivers for Condiments, Seasonings, and Sauces: High sodium content in traditional formulations, consumer desire for healthier condiments, and the ease of reformulation with sodium reduction ingredients without significant impact on texture or mouthfeel.

- Dominant Region/Country: South Africa itself represents the primary market for these ingredients within the region. This dominance is attributed to a combination of factors:

- Economic Policies: Government initiatives promoting public health and encouraging the food industry to adopt healthier practices, including sodium reduction.

- Infrastructure: A well-developed food manufacturing and distribution network that facilitates the uptake and implementation of new ingredient technologies.

- Consumer Awareness: Growing awareness among the South African population regarding the health risks associated with excessive sodium intake.

The Bakery and Confectionery and Meat and Meat Products segments are also showing substantial growth, driven by ongoing product reformulations to meet evolving consumer demands and regulatory pressures. The Snacks segment is another key area where the implementation of low-sodium ingredients is becoming increasingly prevalent as manufacturers strive to offer healthier alternatives.

South Africa Sodium Reduction Ingredients Market Product Innovations

Product innovation in the South Africa Sodium Reduction Ingredients Market is primarily focused on developing salt alternatives that mimic the taste and functional properties of sodium chloride while offering health benefits. Companies are investing in creating ingredients that provide enhanced flavor profiles, improve texture, and extend shelf life in low-sodium food formulations. Key advancements include the development of sophisticated potassium chloride blends, novel yeast extract technologies, and bio-engineered amino acid compounds that deliver a more authentic salty taste. These innovations aim to reduce the reliance on traditional salt, offering competitive advantages through superior taste masking and cost-effectiveness in sodium reduction strategies.

Report Segmentation & Scope

This report meticulously segments the South Africa Sodium Reduction Ingredients Market by Product Type and Application, providing granular insights into each segment's market size, growth projections, and competitive dynamics.

- Product Type Segmentation: The report covers Amino Acids and Glutamates, Mineral Salts, Yeast Extracts, and Other Product Types. Each segment is analyzed for its current market share, anticipated growth rate, and key market drivers within the South African context. For instance, Amino Acids and Glutamates are projected to grow at a CAGR of xx% due to their extensive use in flavor enhancement.

- Application Segmentation: The analysis extends to Bakery and Confectionery, Condiments, Seasonings, and Sauces, Dairy and Frozen Foods, Meat and Meat Products, Snacks, and Other Applications. Detailed market sizes and growth forecasts are provided for each, highlighting the dominant applications and emerging opportunities. Condiments, Seasonings, and Sauces are expected to lead the market, driven by the urgent need for reformulation in these high-sodium categories.

Key Drivers of South Africa Sodium Reduction Ingredients Market Growth

The growth of the South Africa Sodium Reduction Ingredients Market is propelled by several key factors:

- Public Health Initiatives: Government campaigns and regulations aimed at reducing sodium consumption to combat hypertension and other related health issues are a major catalyst.

- Increasing Consumer Health Consciousness: A growing awareness among South African consumers about the detrimental effects of excessive sodium intake is driving demand for low-sodium food products.

- Technological Advancements: Innovations in food science have led to the development of more effective and palatable salt substitutes and flavor enhancers.

- Product Reformulation by Food Manufacturers: To meet consumer demand and regulatory requirements, food companies are actively reformulating their products, increasing the need for sodium reduction ingredients.

- Growth of Processed Food Industry: The expanding processed food sector in South Africa inherently requires strategies for sodium reduction to offer healthier options.

Challenges in the South Africa Sodium Reduction Ingredients Market Sector

Despite the positive growth trajectory, the South Africa Sodium Reduction Ingredients Market faces certain challenges:

- Taste and Palatability Concerns: Achieving a taste profile comparable to traditional salt remains a significant challenge for some sodium reduction ingredients.

- Cost of Ingredients: Certain advanced salt reduction solutions can be more expensive than conventional salt, impacting product pricing.

- Consumer Acceptance: Educating consumers about the benefits and taste equivalence of low-sodium products is crucial for widespread adoption.

- Regulatory Hurdles: Navigating varying and evolving regulatory frameworks for food ingredients can be complex for manufacturers.

- Supply Chain Stability: Ensuring a consistent and reliable supply of specialized sodium reduction ingredients can sometimes be a concern.

Leading Players in the South Africa Sodium Reduction Ingredients Market Market

- Salt of the Earth Ltd

- Givaudan SA

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Kerry Group

- Cargill Inc

Key Developments in South Africa Sodium Reduction Ingredients Market Sector

- 2023 (Ongoing): Launch of new sodium reduction ingredients by key players such as Givaudan SA, focusing on enhanced flavor profiles and cleaner labels.

- 2022: Strategic partnerships between ingredient suppliers like Tate & Lyle PLC and major South African food manufacturers to reformulate popular product lines with reduced sodium content.

- 2024 (Projected): Government investments in research and development of sodium reduction ingredients through national health initiatives and university collaborations.

Strategic South Africa Sodium Reduction Ingredients Market Market Outlook

- 2023 (Ongoing): Launch of new sodium reduction ingredients by key players such as Givaudan SA, focusing on enhanced flavor profiles and cleaner labels.

- 2022: Strategic partnerships between ingredient suppliers like Tate & Lyle PLC and major South African food manufacturers to reformulate popular product lines with reduced sodium content.

- 2024 (Projected): Government investments in research and development of sodium reduction ingredients through national health initiatives and university collaborations.

Strategic South Africa Sodium Reduction Ingredients Market Market Outlook

The strategic outlook for the South Africa Sodium Reduction Ingredients Market is exceptionally positive, driven by a sustained focus on public health and evolving consumer preferences. The market is expected to witness continued growth accelerated by increasing collaborations between ingredient suppliers and food manufacturers, leading to a wider array of palatable low-sodium food options. Government incentives and a growing understanding of the health benefits associated with reduced sodium intake will further fuel market expansion. Innovations in flavor modulation and the development of cost-effective salt substitutes will be critical growth accelerators, enabling greater market penetration across all food categories. The demand for clean-label and natural sodium reduction ingredients presents significant strategic opportunities for ingredient developers and manufacturers in the coming years.

South Africa Sodium Reduction Ingredients Market Segmentation

-

1. Product Type

- 1.1. Amino Acids and Glutamates

- 1.2. Mineral Salts

- 1.3. Yeast Extracts

- 1.4. Other Product Types

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Condiments, Seasonings, and Sauces

- 2.3. Dairy and Frozen Foods

- 2.4. Meat and Meat Products

- 2.5. Snacks

- 2.6. Other Applications

South Africa Sodium Reduction Ingredients Market Segmentation By Geography

- 1. South Africa

South Africa Sodium Reduction Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Government Initiatives to Reduce Sodium Content

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Sodium Reduction Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids and Glutamates

- 5.1.2. Mineral Salts

- 5.1.3. Yeast Extracts

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Condiments, Seasonings, and Sauces

- 5.2.3. Dairy and Frozen Foods

- 5.2.4. Meat and Meat Products

- 5.2.5. Snacks

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa South Africa Sodium Reduction Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Sodium Reduction Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Sodium Reduction Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Sodium Reduction Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Sodium Reduction Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Sodium Reduction Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Salt of the Earth Ltd*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Givaudan SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Archer Daniels Midland Company

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tate & Lyle PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kerry Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Cargill Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.1 Salt of the Earth Ltd*List Not Exhaustive

List of Figures

- Figure 1: South Africa Sodium Reduction Ingredients Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Sodium Reduction Ingredients Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Sodium Reduction Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Sodium Reduction Ingredients Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Africa Sodium Reduction Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South Africa Sodium Reduction Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Sodium Reduction Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa South Africa Sodium Reduction Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan South Africa Sodium Reduction Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda South Africa Sodium Reduction Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania South Africa Sodium Reduction Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya South Africa Sodium Reduction Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa South Africa Sodium Reduction Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Sodium Reduction Ingredients Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: South Africa Sodium Reduction Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: South Africa Sodium Reduction Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Sodium Reduction Ingredients Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the South Africa Sodium Reduction Ingredients Market?

Key companies in the market include Salt of the Earth Ltd*List Not Exhaustive, Givaudan SA, Archer Daniels Midland Company, Tate & Lyle PLC, Kerry Group, Cargill Inc.

3. What are the main segments of the South Africa Sodium Reduction Ingredients Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Government Initiatives to Reduce Sodium Content.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Launch of new sodium reduction ingredients by key players 2. Strategic partnerships between ingredient suppliers and food manufacturers 3. Government investments in research and development of sodium reduction ingredients

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Sodium Reduction Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Sodium Reduction Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Sodium Reduction Ingredients Market?

To stay informed about further developments, trends, and reports in the South Africa Sodium Reduction Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence