Key Insights

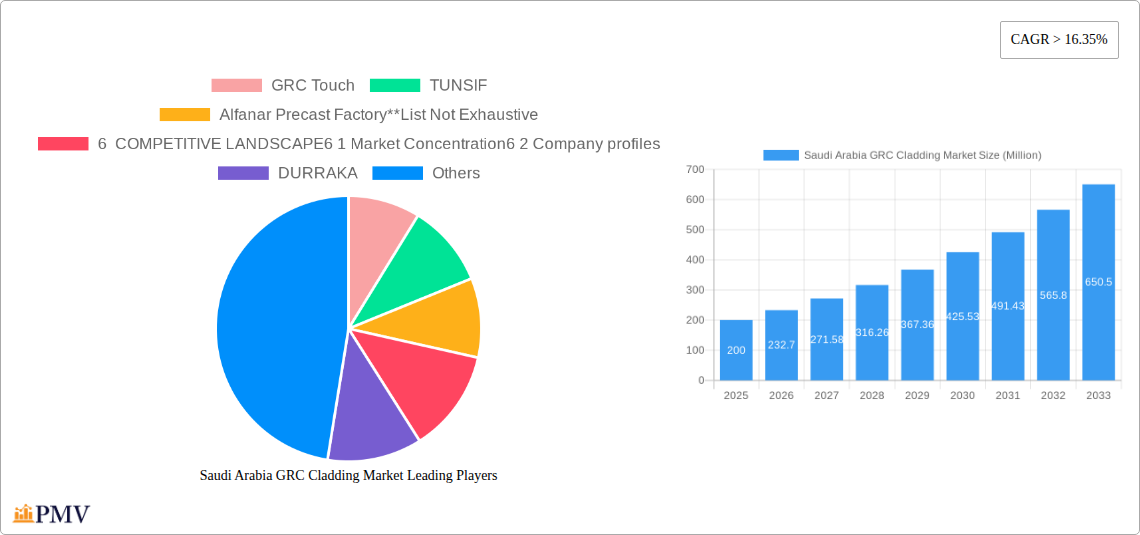

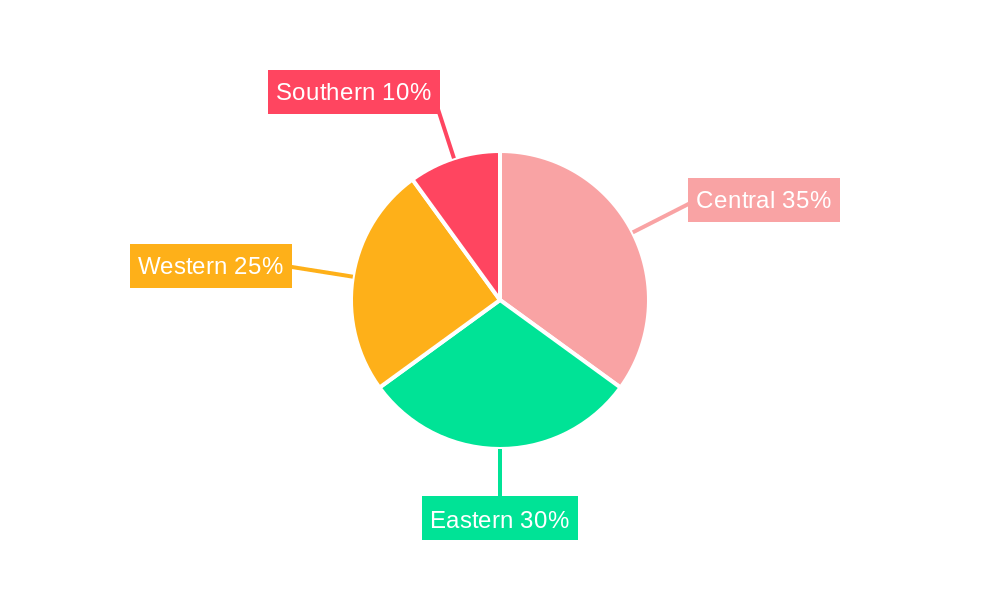

The Saudi Arabian GRC cladding market is experiencing substantial expansion, driven by a flourishing construction sector and a growing preference for aesthetically appealing and durable building materials. With an estimated market size of $148.71 million in the base year 2025 and a projected Compound Annual Growth Rate (CAGR) of 12.32%, the market is set for significant growth through 2033. Major catalysts include extensive infrastructure projects, rising disposable incomes boosting residential construction, and government support for sustainable building practices. The inherent advantages of GRC cladding—its lightweight, versatility, and cost-effectiveness—further propel market adoption over traditional alternatives. Market segmentation indicates a prevalence of spray and premix GRC production methods, with commercial and residential construction sectors being the primary application areas. The competitive environment is moderately consolidated, featuring key stakeholders such as GRC Touch, TUNSIF, and Alfanar Precast Factory influencing market trends. Regional demand is expected to be particularly strong in the rapidly developing urban centers of Saudi Arabia's Central and Eastern regions.

Saudi Arabia GRC Cladding Market Market Size (In Million)

The forecast period (2025-2033) indicates sustained robust growth, supported by ongoing infrastructure development and consistent investment in the construction industry. While factors like material costs and the availability of skilled labor may present challenges, the long-term market trajectory remains highly positive. Market participants will likely prioritize innovation, product portfolio expansion, and strategic collaborations to leverage emerging opportunities. The adoption of advanced manufacturing techniques and the development of eco-friendly GRC solutions will be vital for maintaining competitive advantage. The hybrid application method is anticipated to gain momentum, offering combined benefits of spray and premix processes. In-depth regional analysis within Saudi Arabia will facilitate precise market penetration strategies.

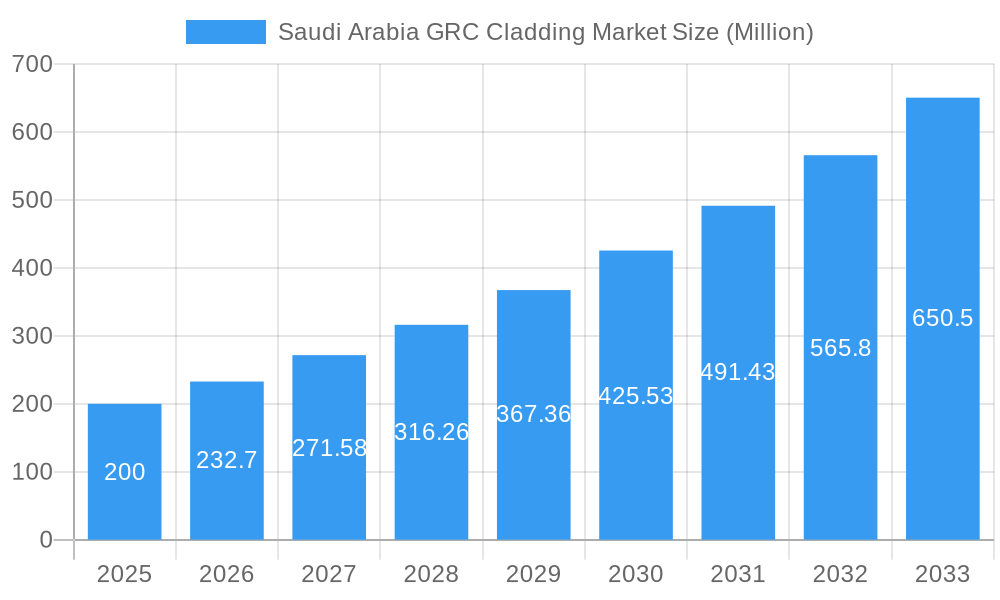

Saudi Arabia GRC Cladding Market Company Market Share

Saudi Arabia GRC Cladding Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia GRC cladding market, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence for informed decision-making. The report utilizes rigorous research methodologies and data to provide a clear picture of market size, segmentation, growth drivers, challenges, and competitive landscape. The market is segmented by process (Spray, Premix, Hybrid) and application (Commercial Construction, Residential Construction, Civil and Other Infrastructure Construction).

Saudi Arabia GRC Cladding Market Market Structure & Competitive Dynamics

This section analyzes the Saudi Arabia GRC cladding market's structure and competitive dynamics. The market exhibits a moderately concentrated landscape, with a few key players holding significant market share, estimated at xx% in 2025. However, the market also includes numerous smaller players, driving competition. Innovation within the GRC cladding sector is primarily focused on enhancing material properties, improving installation methods, and developing sustainable solutions. The regulatory framework governing construction materials in Saudi Arabia influences both product standards and market access. Product substitutes, such as metal composite materials and other facade solutions, exert some competitive pressure. End-user trends towards aesthetically pleasing and sustainable building designs are driving demand for high-quality GRC cladding. M&A activity in the sector has been relatively limited in recent years with an estimated total deal value of xx Million USD in the historical period (2019-2024), signaling a potential for future consolidation.

- Market Concentration: xx% held by top 3 players in 2025.

- Key M&A Activities (2019-2024): xx number of deals with an estimated total value of xx Million USD.

- Innovation Focus: Improved material properties, sustainable solutions, efficient installation.

- Regulatory Landscape: Compliance with Saudi building codes and standards is critical.

Saudi Arabia GRC Cladding Market Industry Trends & Insights

The Saudi Arabia GRC cladding market is projected to witness significant growth during the forecast period (2025-2033), driven by robust construction activity, particularly in the residential and commercial sectors. The Compound Annual Growth Rate (CAGR) is estimated at xx% during this period. Government initiatives to diversify the economy and promote infrastructure development are key growth catalysts. Technological advancements, such as the adoption of advanced manufacturing techniques, are enhancing product quality and efficiency. Consumer preferences are shifting towards aesthetically appealing and sustainable building solutions, favoring GRC cladding due to its versatility and design flexibility. Market penetration of GRC cladding in the construction sector is increasing, driven by a rising preference for modern and sustainable construction materials. The competitive landscape is characterized by both established players and emerging entrants, leading to intensified competition and innovation.

Dominant Markets & Segments in Saudi Arabia GRC Cladding Market

The dominant segments within the Saudi Arabia GRC cladding market are analyzed in detail. Considering the extensive construction projects underway across the Kingdom, Commercial Construction currently holds the largest market share, followed by the Residential Construction segment, which is expected to witness substantial growth due to urbanization and population expansion. Within the process segment, Premix currently dominates owing to its cost-effectiveness and ease of application. However, the Spray method is gaining traction due to its versatility and ability to create intricate designs.

- Key Drivers for Commercial Construction Segment:

- Extensive infrastructure projects across major cities.

- Increased private sector investment in commercial buildings.

- Government initiatives promoting sustainable building practices.

- Key Drivers for Residential Construction Segment:

- Rapid urbanization and population growth.

- Government support for affordable housing initiatives.

- Rising disposable incomes and improved living standards.

- Premix Process Dominance: Cost-effective, ease of application, established market presence.

- Spray Process Growth: Versatility, intricate design capabilities, increasing adoption.

Saudi Arabia GRC Cladding Market Product Innovations

Recent innovations in GRC cladding include the development of high-performance materials with improved durability, fire resistance, and weather resistance. New manufacturing techniques are leading to more efficient and cost-effective production processes. The integration of advanced technologies, such as 3D printing, is also making customized designs more feasible. This results in a wider range of aesthetically pleasing and functionally superior GRC cladding options tailored to specific project needs. The market is witnessing increased adoption of lighter-weight GRC cladding solutions, lowering transportation costs and simplifying installations.

Report Segmentation & Scope

The Saudi Arabia GRC cladding market is segmented by process and application.

- By Process: Spray, Premix, and Hybrid processes each represent a distinct market segment with differing growth projections and competitive dynamics. Spray processes are projected to grow at xx% CAGR, driven by complex design demands. The Premix segment maintains a large share, reflecting established market penetration and cost-effectiveness. The Hybrid method is experiencing a steady growth rate of xx% driven by its ability to combine the benefits of both spray and premix techniques.

- By Application: Commercial Construction, Residential Construction, and Civil and Other Infrastructure Construction segments show varying growth rates, market sizes, and competitive landscapes. Commercial construction dominates the market share due to large-scale projects. Residential construction is seeing rapid growth due to population increases, with a projected CAGR of xx%. The Civil and Other Infrastructure Construction segment represents a smaller but steadily growing market segment owing to expanding public infrastructure projects.

Key Drivers of Saudi Arabia GRC Cladding Market Growth

Several factors drive the growth of the Saudi Arabia GRC cladding market. The ongoing expansion of the construction sector, fueled by government investments in infrastructure projects like the Neom project and Vision 2030 initiatives, is a major catalyst. Increasing urbanization and population growth are driving demand for new residential and commercial buildings. Furthermore, favorable government policies promoting sustainable building practices, like the Saudi Green Initiative, are boosting the adoption of eco-friendly materials like GRC cladding. Finally, advancements in GRC technology are enhancing the material's performance and aesthetics, making it a more attractive option for construction projects.

Challenges in the Saudi Arabia GRC Cladding Market Sector

The Saudi Arabia GRC cladding market faces certain challenges. Fluctuations in raw material prices can impact production costs and profitability. Competition from alternative cladding materials necessitates continuous innovation and differentiation. Strict building codes and regulations can create compliance hurdles, while potential supply chain disruptions can impact project timelines and costs. The market is also subject to the impact of general economic conditions, making it susceptible to both growth and contraction based on macroeconomic factors. These issues combined contribute to xx% of total market risk in 2025.

Leading Players in the Saudi Arabia GRC Cladding Market Market

- GRC Touch

- TUNSIF

- Alfanar Precast Factory

- DURRAKA

- PETRACO

- Station Contracting Co Ltd

- Arabian Tile Company

- ARTIC

- Albitar Factory Co

- Acementiat Factory

Key Developments in Saudi Arabia GRC Cladding Market Sector

- December 2022: Short-term repairs undertaken on the Makkah Gate (Qur'an Gate), highlighting the need for durable cladding solutions in high-profile projects.

- February 2022: Fibrex Construction Group's contract win for villa development at Aldar's Noya demonstrates significant activity in the residential sector within the wider GCC market and illustrates GRC's use in high-end projects.

Strategic Saudi Arabia GRC Cladding Market Market Outlook

The Saudi Arabia GRC cladding market presents significant growth opportunities for both established and emerging players. Continued investment in infrastructure projects, coupled with the government's focus on sustainable development, will drive market expansion. Focusing on innovation, offering customized solutions, and building strong supply chain relationships will be crucial for success. The market presents potential for both organic growth through market share expansion and inorganic growth through mergers and acquisitions. Companies with a focus on sustainable and technologically advanced GRC cladding solutions are well-positioned to capitalize on the long-term growth prospects of this market.

Saudi Arabia GRC Cladding Market Segmentation

-

1. Process

- 1.1. Spray

- 1.2. Premix

- 1.3. Hybrid

-

2. Application

- 2.1. Commercial Construction

- 2.2. Residential Construction

- 2.3. Civil and Other Infrastructure Construction

Saudi Arabia GRC Cladding Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia GRC Cladding Market Regional Market Share

Geographic Coverage of Saudi Arabia GRC Cladding Market

Saudi Arabia GRC Cladding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Increasing Construction Spending in Saudi

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia GRC Cladding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Spray

- 5.1.2. Premix

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Construction

- 5.2.2. Residential Construction

- 5.2.3. Civil and Other Infrastructure Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GRC Touch

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TUNSIF

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alfanar Precast Factory**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DURRAKA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PETRACO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Station Contracting Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arabian Tile Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ARTIC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Albitar Factory Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Acementiat Factory

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 GRC Touch

List of Figures

- Figure 1: Saudi Arabia GRC Cladding Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia GRC Cladding Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Process 2020 & 2033

- Table 2: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Process 2020 & 2033

- Table 5: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Saudi Arabia GRC Cladding Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia GRC Cladding Market?

The projected CAGR is approximately 12.32%.

2. Which companies are prominent players in the Saudi Arabia GRC Cladding Market?

Key companies in the market include GRC Touch, TUNSIF, Alfanar Precast Factory**List Not Exhaustive, 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, DURRAKA, PETRACO, Station Contracting Co Ltd, Arabian Tile Company, ARTIC, Albitar Factory Co, Acementiat Factory.

3. What are the main segments of the Saudi Arabia GRC Cladding Market?

The market segments include Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 148.71 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Increasing Construction Spending in Saudi.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

December 2022: On the imposing-looking Makkah Gate, which is situated on the Makkah-Jeddah Expressway, the Makkah Mayoralty has started performing short-term repairs. The Makkah Gate also referred to as the Qur'an Gate, is a monumental archway at the entry to Makkah from the Jeddah side and is located 27 kilometers from the Grand Mosque within the Haram border.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia GRC Cladding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia GRC Cladding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia GRC Cladding Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia GRC Cladding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence