Key Insights

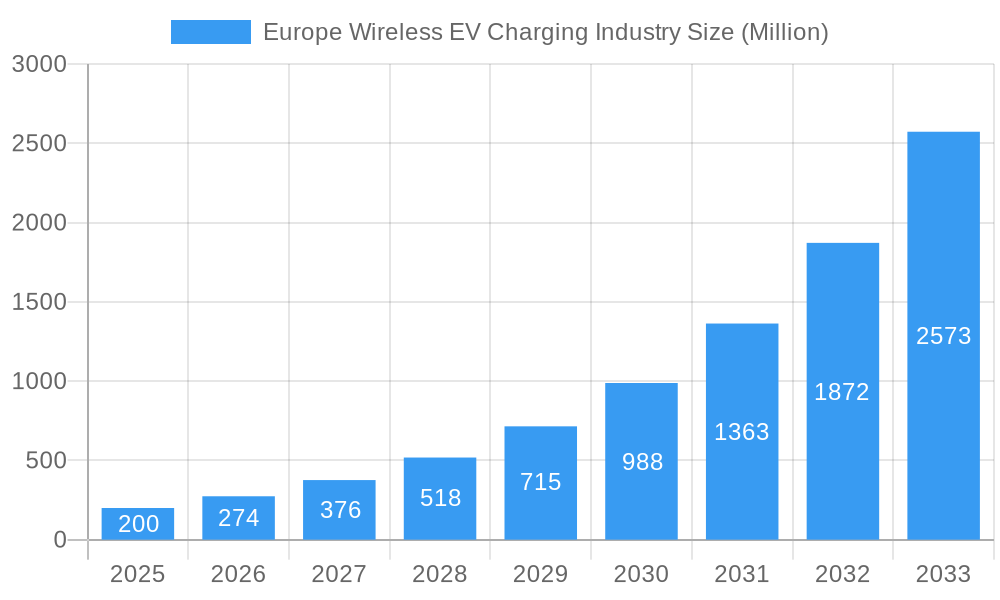

The European Wireless Electric Vehicle (EV) Charging Market is poised for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of 18.3%. This growth is projected from a market size of 1.87 billion in the base year of 2024, extending through 2033. Key catalysts for this surge include escalating EV adoption across prominent European nations, robust government incentives promoting sustainable transport, and stringent emission regulations. Advancements in wireless charging technology, enhancing efficiency and reliability, further bolster market penetration. The market is segmented by vehicle type (Battery Electric Vehicles and Plug-in Hybrid Vehicles) and geography, with Germany, the UK, and France leading current market share. Despite initial infrastructure investment and potential interoperability challenges, the inherent convenience and superior user experience of wireless charging are expected to drive widespread adoption.

Europe Wireless EV Charging Industry Market Size (In Billion)

The competitive landscape features established automotive giants and innovative technology firms, fostering continuous development. Future growth will be sustained by ongoing R&D, increasing EV uptake, and supportive governmental frameworks. Standardization will be critical for seamless interoperability. Addressing consumer perceptions regarding charging speed and efficiency relative to wired solutions is also paramount. Anticipated market developments include intensified competition, emerging subscription-based services, and integrated charging solutions, with a strategic focus on expanding public and residential charging infrastructure to elevate the overall user experience and accelerate the adoption of wireless EV charging technology.

Europe Wireless EV Charging Industry Company Market Share

Europe Wireless EV Charging Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Europe wireless EV charging industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a detailed understanding of the market's historical performance, current state, and future trajectory. The report meticulously analyzes market segments by country (Germany, United Kingdom, Italy, France, Spain, and Rest of Europe) and vehicle type (Battery Electric Vehicle and Plug-in Hybrid Vehicle), incorporating key performance indicators and growth projections.

Europe Wireless EV Charging Industry Market Structure & Competitive Dynamics

The European wireless EV charging market exhibits a moderately concentrated structure, with a handful of major players dominating alongside several emerging innovators. The market is characterized by intense competition driven by technological advancements and increasing demand for convenient EV charging solutions. Market share is currently dominated by established automotive manufacturers like Tesla Motors, Daimler, and BMW AG, leveraging their existing infrastructure and brand recognition. However, specialized wireless charging technology providers such as WiTricity, HEVO Power, and OLEV Technologies are actively expanding their market presence through strategic partnerships and technological innovation. Regulatory frameworks vary across European nations, influencing the speed of market adoption. The industry witnesses frequent M&A activities, with deal values exceeding xx Million in recent years, reflecting the strategic importance of securing technological capabilities and expanding market reach. Innovation ecosystems are thriving, fostered by government incentives, research initiatives, and collaborative efforts among industry players, research institutions, and startups. Product substitutes, mainly wired charging stations, remain competitive, but the convenience and potential for dynamic charging offered by wireless technology are significant differentiators. End-user trends show a clear preference for faster, more convenient charging options, boosting the demand for wireless technologies.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Innovation Ecosystems: Strong, supported by government initiatives and collaborative efforts.

- Regulatory Frameworks: Vary across countries, impacting market growth.

- M&A Activity: Significant, with deal values exceeding xx Million in recent years.

- End-User Trends: Favor wireless solutions for convenience and speed.

Europe Wireless EV Charging Industry Industry Trends & Insights

The Europe wireless EV charging market is experiencing robust growth, driven by the escalating adoption of electric vehicles, supportive government policies, and continuous technological advancements. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration is increasing gradually, with higher adoption rates observed in countries with robust EV infrastructure development and favorable incentives. Technological disruptions, such as the development of higher-power wireless charging systems and dynamic charging technologies, are further accelerating market expansion. Consumer preferences are shifting towards convenient and seamless charging experiences, making wireless charging an attractive option. However, competitive dynamics remain intense, with established automotive players and specialized technology companies vying for market share. The cost of wireless charging infrastructure remains a barrier to widespread adoption, but economies of scale and technological advancements are expected to reduce costs over time.

Dominant Markets & Segments in Europe Wireless EV Charging Industry

Germany currently holds the leading position in the European wireless EV charging market, driven by strong government support for EV adoption, a well-established automotive industry, and a relatively advanced infrastructure. The UK and France follow closely, showcasing significant growth potential.

By Country:

- Germany: Strong government support, established automotive industry, advanced infrastructure.

- United Kingdom: Growing EV adoption, supportive policies.

- France: Increasing EV sales, government incentives.

- Italy, Spain, Rest of Europe: Growing market potential, but slower adoption than leading countries.

By Vehicle Type:

- Battery Electric Vehicles (BEVs): Dominant segment due to higher power requirements and suitability for wireless charging.

- Plug-in Hybrid Vehicles (PHEVs): Growing segment, with wireless charging offering convenience benefits.

The dominance of Germany stems from its proactive EV policies, substantial investments in charging infrastructure, and the presence of major automotive manufacturers.

Europe Wireless EV Charging Industry Product Innovations

Recent advancements in wireless charging technology focus on increasing power transfer efficiency, range, and compatibility across different vehicle models. The development of dynamic wireless charging systems, enabling charging while driving, is a significant breakthrough. This technology offers considerable advantages over traditional wired charging, eliminating range anxiety and enabling extended driving ranges for electric vehicles. The market is witnessing innovation in both resonant and magnetic induction technologies, each with unique advantages and limitations, influencing the choice of technology for specific applications.

Report Segmentation & Scope

This report segments the Europe wireless EV charging market by country (Germany, United Kingdom, Italy, France, Spain, and Rest of Europe) and vehicle type (Battery Electric Vehicle and Plug-in Hybrid Vehicle). Each segment provides a detailed analysis of market size, growth projections, and competitive dynamics. Growth projections vary across segments, reflecting differing levels of EV adoption and government support. Competitive intensity varies regionally, influenced by the concentration of key players and the level of innovation.

Key Drivers of Europe Wireless EV Charging Industry Growth

Several key factors contribute to the growth of the Europe wireless EV charging market. Firstly, the increasing adoption of electric vehicles across the continent is a major driver. Secondly, supportive government policies, including financial incentives and infrastructure development initiatives, are accelerating market growth. Thirdly, technological advancements in wireless charging efficiency and power transfer capabilities are making wireless charging a more viable and attractive option. Finally, growing consumer awareness of environmental concerns and the benefits of electric mobility is significantly influencing purchase decisions and demand for convenient charging infrastructure.

Challenges in the Europe Wireless EV Charging Industry Sector

Despite significant growth potential, several challenges impede the widespread adoption of wireless EV charging. High initial investment costs for infrastructure development remain a significant barrier. Standardization challenges and interoperability issues across different wireless charging systems could hinder seamless integration and widespread adoption. Furthermore, the reliability and efficiency of wireless charging technology, particularly in adverse weather conditions, remain areas of ongoing improvement. Competition from wired charging infrastructure and varying regulatory landscapes across different European countries also pose challenges. These issues, if not adequately addressed, could impact market growth and widespread adoption.

Leading Players in the Europe Wireless EV Charging Industry Market

- Tesla Motors

- OLEV Technologies

- Daimler

- BMW AG

- Plugless

- Bombardier

- Nissan

- HEVO Power

- WiTricity

- Qualcomm

- Hella Aglaia Mobile Vision

- Toyota

Key Developments in Europe Wireless EV Charging Industry Sector

- June 2020: Jaguar partnered with NorgesTaxi AS and the City of Oslo to build a wireless charging infrastructure for electric taxis in Oslo, Norway. This demonstrates the growing interest in wireless charging for fleet operations.

- May 2020: HEVO Power announced plans to launch US manufacturing for wireless EV chargers by 2024, indicating an expansion in production capacity and global reach.

- March 2020: Electreon successfully tested dynamic wireless charging of a 40-ton electric truck in Sweden, marking a significant milestone in heavy-duty EV charging technology.

Strategic Europe Wireless EV Charging Industry Market Outlook

The future of the Europe wireless EV charging market looks promising, fueled by continuous technological innovations, supportive government regulations, and the ever-increasing adoption of electric vehicles. Strategic opportunities abound for companies focused on developing high-efficiency, cost-effective wireless charging systems and expanding charging infrastructure. The growing demand for dynamic wireless charging solutions presents a particularly attractive area for investment and innovation, promising to significantly reduce range anxiety and accelerate EV adoption across Europe. The market is poised for substantial growth, driven by a confluence of technological, economic, and regulatory factors.

Europe Wireless EV Charging Industry Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric Vehicle

- 1.2. Plug-in Hybrid Vehicle

Europe Wireless EV Charging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Wireless EV Charging Industry Regional Market Share

Geographic Coverage of Europe Wireless EV Charging Industry

Europe Wireless EV Charging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Electric Vehicles Aiding Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Wireless Chargers

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric Vehicle

- 5.1.2. Plug-in Hybrid Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tesla Motors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OLEV Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daimler

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BMW AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plugless

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bombardier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nissan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HEVO Powe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WiTricity

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qualcomm

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hella Aglaia Mobile Vision

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Toyota

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Tesla Motors

List of Figures

- Figure 1: Europe Wireless EV Charging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Wireless EV Charging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Wireless EV Charging Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Wireless EV Charging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Wireless EV Charging Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Wireless EV Charging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wireless EV Charging Industry?

The projected CAGR is approximately 18.3%.

2. Which companies are prominent players in the Europe Wireless EV Charging Industry?

Key companies in the market include Tesla Motors, OLEV Technologies, Daimler, BMW AG, Plugless, Bombardier, Nissan, HEVO Powe, WiTricity, Qualcomm, Hella Aglaia Mobile Vision, Toyota.

3. What are the main segments of the Europe Wireless EV Charging Industry?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Electric Vehicles Aiding Market Growth.

6. What are the notable trends driving market growth?

Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand.

7. Are there any restraints impacting market growth?

High Cost of Installing Wireless Chargers.

8. Can you provide examples of recent developments in the market?

In June 2020, Jaguar announced a collaboration with NorgesTaxi AS and the City of Oslo to build a wireless, high-powered charging infrastructure for electric taxis in the Norwegian capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wireless EV Charging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wireless EV Charging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wireless EV Charging Industry?

To stay informed about further developments, trends, and reports in the Europe Wireless EV Charging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence