Key Insights

The China residential real estate market is a dynamic sector influenced by economic shifts, government policies, and evolving consumer demands. Post-2024, the market is projected to experience a Compound Annual Growth Rate (CAGR) of 9.8% from 2025 to 2033. The market size was valued at approximately 986.9 billion in the base year of 2025. While historical growth was fueled by rapid urbanization and rising incomes, current market trends are characterized by a shift towards sustainability, smart homes, and infrastructure development in Tier 2 and 3 cities. Government initiatives aimed at affordability and speculation curbing, alongside stricter lending policies, continue to shape market performance. The forecast period anticipates a moderated, yet positive, growth trajectory, with a strategic focus on niche markets and technologically advanced housing solutions.

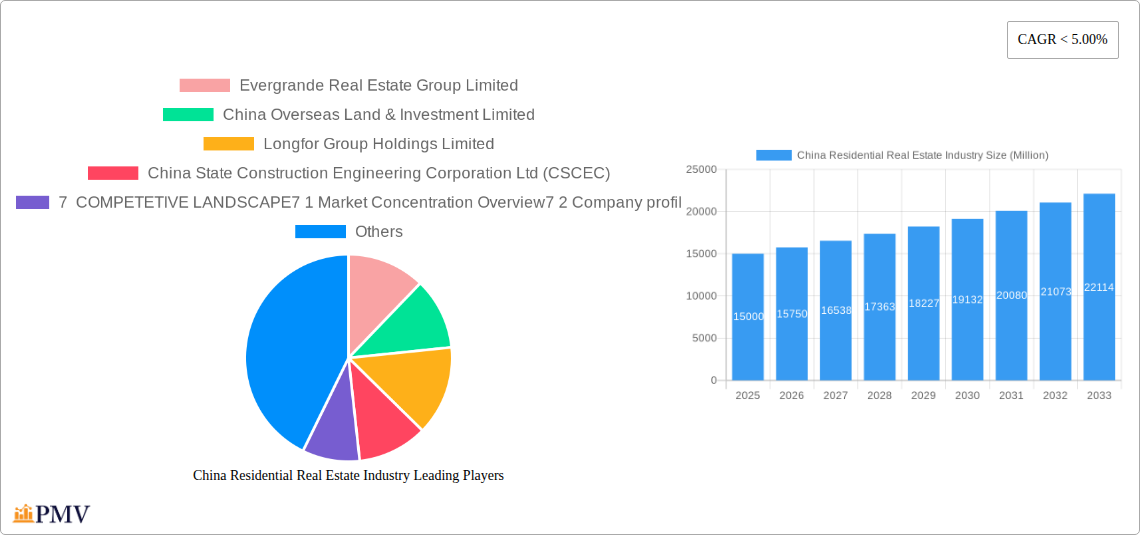

China Residential Real Estate Industry Market Size (In Billion)

The China residential real estate market is forecast to expand between 2025 and 2033, with growth varying regionally. Tier 1 cities may see slower expansion, while Tier 2 and 3 cities are expected to benefit from ongoing urbanization and infrastructure upgrades. The market will likely prioritize affordable housing, sustainable development, and smart home technologies. Government policies on mortgages, land acquisition, and property taxes will remain key drivers of market activity. Overall, the anticipated growth is expected to be more balanced and sustainable than in previous rapid expansion phases.

China Residential Real Estate Industry Company Market Share

China Residential Real Estate Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China residential real estate industry, covering market dynamics, competitive landscapes, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report leverages extensive data and insights to deliver actionable intelligence for industry professionals, investors, and stakeholders seeking to navigate this dynamic market. The report covers a market valued at xx Million USD in 2025, projected to reach xx Million USD by 2033, showcasing a compelling CAGR of xx%.

China Residential Real Estate Industry Market Structure & Competitive Dynamics

This section analyzes the structural components and competitive forces shaping the China residential real estate market. Market concentration is relatively high, with a few dominant players holding significant market share. The industry is characterized by a complex interplay of regulatory frameworks, technological advancements, and evolving consumer preferences. Innovation ecosystems are emerging, driven by PropTech startups and collaborations between traditional developers and tech companies. The presence of product substitutes, such as rental housing and co-living spaces, adds further complexity to the competitive landscape.

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2025, indicating a moderately concentrated market. This concentration is expected to slightly decrease to approximately xx% by 2033 due to increased competition from smaller developers.

- M&A Activity: Significant M&A activity characterized the historical period (2019-2024), with total deal values exceeding xx Million USD. The pace is expected to moderate in the forecast period (2025-2033), with a focus on strategic acquisitions rather than large-scale consolidation.

- Regulatory Framework: Government policies regarding land use, zoning regulations, and financing significantly influence market dynamics. Recent regulations aimed at curbing excessive debt levels have impacted industry players and project development timelines. Changes in these regulations will significantly influence the industry's long-term growth trajectories.

- End-User Trends: Growing urbanization, shifting demographics, and evolving preferences for sustainable and technologically advanced housing are reshaping demand. The preference for smaller, more efficient living spaces in prime locations is increasing, leading to innovative design and construction approaches within the industry.

China Residential Real Estate Industry Industry Trends & Insights

This section delves into the key trends driving the evolution of China's residential real estate industry. Market growth is fueled by persistent urbanization, rising disposable incomes, and government initiatives aimed at boosting housing affordability and access. However, challenges persist, including macroeconomic conditions, regulatory shifts, and evolving consumer preferences.

The industry has experienced significant technological disruptions, with the integration of smart home technology, PropTech platforms for property searches and transactions, and the use of big data analytics becoming increasingly prevalent. Consumer preferences are shifting towards sustainable housing options, high-quality amenities, and convenient locations. The increasing penetration of online real estate platforms is altering the traditional sales and marketing strategies of developers, driving increased competition among industry players for online visibility.

Dominant Markets & Segments in China Residential Real Estate Industry

This section focuses on the leading markets and segments within the industry. Based on market size and growth potential, Tier-1 cities like Shenzhen, Beijing, Shanghai, and Guangzhou are dominant markets, characterized by high demand and premium pricing. Apartments & condominiums constitute the largest segment in terms of both market share and transaction volume.

By Key Cities:

- Shenzhen: High demand fueled by a robust technology sector, resulting in premium pricing and limited housing supply.

- Beijing & Shanghai: Established markets with strong economies, considerable infrastructure development and high competition.

- Hangzhou & Guangzhou: Rapidly developing cities with significant growth potential, attracting both domestic and international investments.

- Other Key Cities: These secondary and tertiary cities offer significant growth potential due to urbanization and government initiatives promoting affordable housing.

By Type:

- Apartments & Condominiums: The largest segment, catering to a broad range of income groups and lifestyles. High demand in urban areas drives significant price appreciation.

- Villas & Landed Houses: A smaller but growing segment, catering to higher-income groups and reflecting a preference for larger, more private living spaces.

Key drivers for these dominant markets include strong economic growth, robust infrastructure development, supportive government policies, and favorable demographic trends. The dominance of these segments and cities is expected to continue throughout the forecast period, although the relative importance of other cities and property types may shift slightly over time.

China Residential Real Estate Industry Product Innovations

The China residential real estate industry is witnessing continuous product innovation. Smart home technologies, incorporating features such as IoT-enabled appliances, automated security systems, and energy-efficient designs, are becoming increasingly common. Prefabricated construction methods and modular designs are gaining traction to reduce construction time and costs. A focus on sustainability and green building practices is reflected in the adoption of environmentally friendly materials and energy-efficient technologies. This innovation improves the efficiency and appeal of the homes to customers, strengthening the competitiveness of the companies.

Report Segmentation & Scope

This report segments the China residential real estate market based on key cities (Shenzhen, Beijing, Shanghai, Hangzhou, Guangzhou, and Other Key Cities) and property types (Apartments & Condominiums, Villas & Landed Houses). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The report provides a granular view of market trends and opportunities within each segment, facilitating informed decision-making and strategic planning. Market size projections consider factors such as population growth, urbanization trends, economic forecasts, and government policies. Competitive dynamics are analyzed by examining the market share of key players, their strategies, and the level of competition within each segment.

Key Drivers of China Residential Real Estate Industry Growth

The growth of the China residential real estate market is driven by several key factors: Rapid urbanization continues to drive demand for housing in major cities. Rising disposable incomes among the burgeoning middle class enhance purchasing power. Government initiatives aimed at improving housing affordability and access, and infrastructure development in both urban and suburban areas are creating favorable conditions for market expansion. Technological advancements in construction and property management are improving efficiency and offering innovative housing solutions.

Challenges in the China Residential Real Estate Industry Sector

The industry faces several challenges including high land costs and construction expenses and stringent government regulations that influence project approvals and financing. The availability of skilled labor and building materials fluctuates and can impact construction timelines and costs. Significant debt burdens for certain developers pose risks to project completions and market stability. The intensifying competition among developers necessitates innovative strategies and efficient cost management. These challenges represent considerable risks to industry players and can dampen growth projections unless they are proactively addressed.

Leading Players in the China Residential Real Estate Industry Market

- Evergrande Real Estate Group Limited

- China Overseas Land & Investment Limited

- Longfor Group Holdings Limited

- China State Construction Engineering Corporation Ltd (CSCEC)

- Shimao Group Holdings Limited

- Sunac China Holdings Limited

- China Resources Land Limited

- China Vanke Co Ltd

- China Merchants Shekou Industrial Zone Holdings Co Ltd

- Country Garden Holdings Company Limited

Key Developments in China Residential Real Estate Industry Sector

- February 2022: Dar Al-Arkan, a Saudi real estate corporation, established an office in Beijing to facilitate joint ventures with Chinese developers and enhance investment opportunities between Saudi Arabia and China. This signals a growing interest in the Chinese real estate market from international players.

- February 2022: China Evergrande Group sold stakes in four developments to state-owned trust firms for CNY 2.13 billion (USD 0.35 billion) to ensure project completion. This highlights the financial challenges faced by some major developers and the government's efforts to maintain stability within the sector.

Strategic China Residential Real Estate Industry Market Outlook

The China residential real estate market is poised for continued growth, driven by long-term urbanization trends and evolving consumer preferences. Strategic opportunities exist for developers who can adapt to changing regulations, embrace technological innovation, and cater to the evolving needs of consumers. Focusing on sustainable development practices and providing technologically advanced, high-quality housing will be critical for success. The market will continue to evolve, presenting both challenges and opportunities for established and emerging players.

China Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Villas & Landed Houses

-

2. Key Cities

- 2.1. Shenzhen

- 2.2. Beijing

- 2.3. Shanghai

- 2.4. Hangzhou

- 2.5. Guangzhou

- 2.6. Other Key Cities

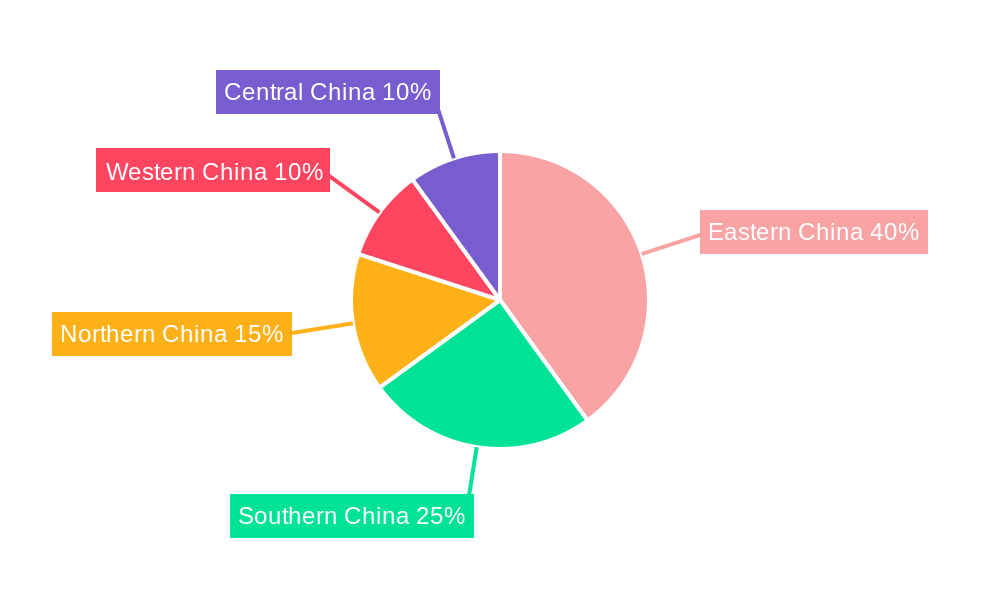

China Residential Real Estate Industry Segmentation By Geography

- 1. China

China Residential Real Estate Industry Regional Market Share

Geographic Coverage of China Residential Real Estate Industry

China Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Urbanization Driving the Residential Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Villas & Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Shenzhen

- 5.2.2. Beijing

- 5.2.3. Shanghai

- 5.2.4. Hangzhou

- 5.2.5. Guangzhou

- 5.2.6. Other Key Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Evergrande Real Estate Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Overseas Land & Investment Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longfor Group Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China State Construction Engineering Corporation Ltd (CSCEC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 7 COMPETETIVE LANDSCAPE7 1 Market Concentration Overview7 2 Company profiles

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shimao Group Holdings Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunac China Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Resources Land Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Vanke Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Merchants Shekou Industrial Zone Holdings Co Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Country Garden Holdings Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Evergrande Real Estate Group Limited

List of Figures

- Figure 1: China Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: China Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Residential Real Estate Industry Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: China Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: China Residential Real Estate Industry Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: China Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Residential Real Estate Industry?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the China Residential Real Estate Industry?

Key companies in the market include Evergrande Real Estate Group Limited, China Overseas Land & Investment Limited, Longfor Group Holdings Limited, China State Construction Engineering Corporation Ltd (CSCEC), 7 COMPETETIVE LANDSCAPE7 1 Market Concentration Overview7 2 Company profiles, Shimao Group Holdings Limited, Sunac China Holdings Limited, China Resources Land Limited, China Vanke Co Ltd, China Merchants Shekou Industrial Zone Holdings Co Ltd **List Not Exhaustive, Country Garden Holdings Company Limited.

3. What are the main segments of the China Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 986.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Urbanization Driving the Residential Real Estate Market.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

February 2022: Dar Al-Arkan, a Saudi real estate corporation, announced the creation of an office in Beijing, China. The move is in accordance with Dar Al-strategic Arkan's expansion ambitions and builds on the company's global brand development efforts. The company's Beijing office is expected to serve a variety of tasks, including establishing joint ventures between Dar Al-Arkan and renowned Chinese real estate developers for both the Chinese and Saudi markets, as well as enhancing investment and knowledge-sharing opportunities between the two countries. Dar Al-office Arkan's will serve as a hub for Chinese enterprises and investors looking to expand, start businesses, or invest in the Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the China Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence