Key Insights

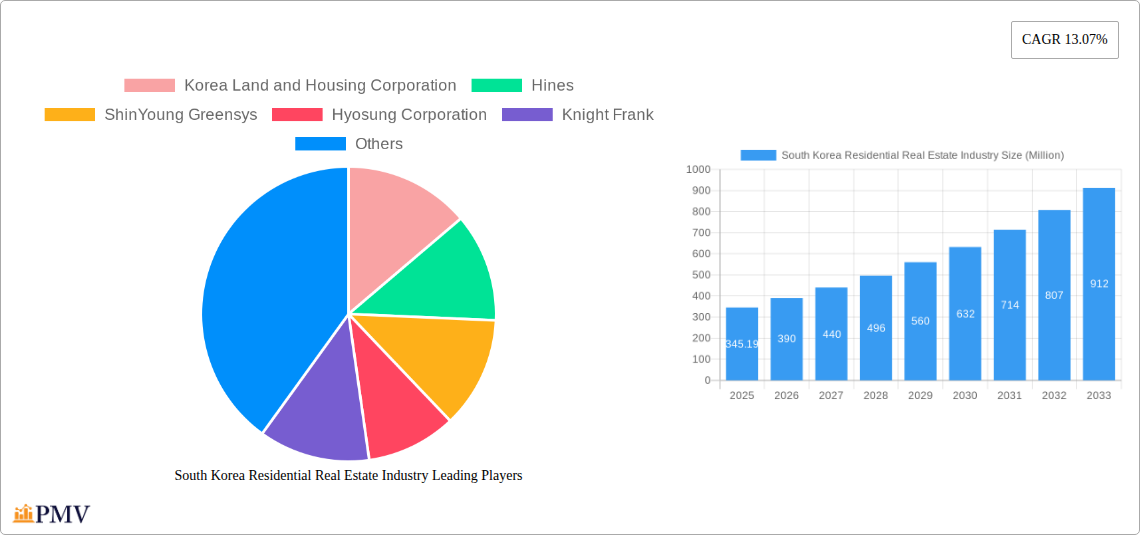

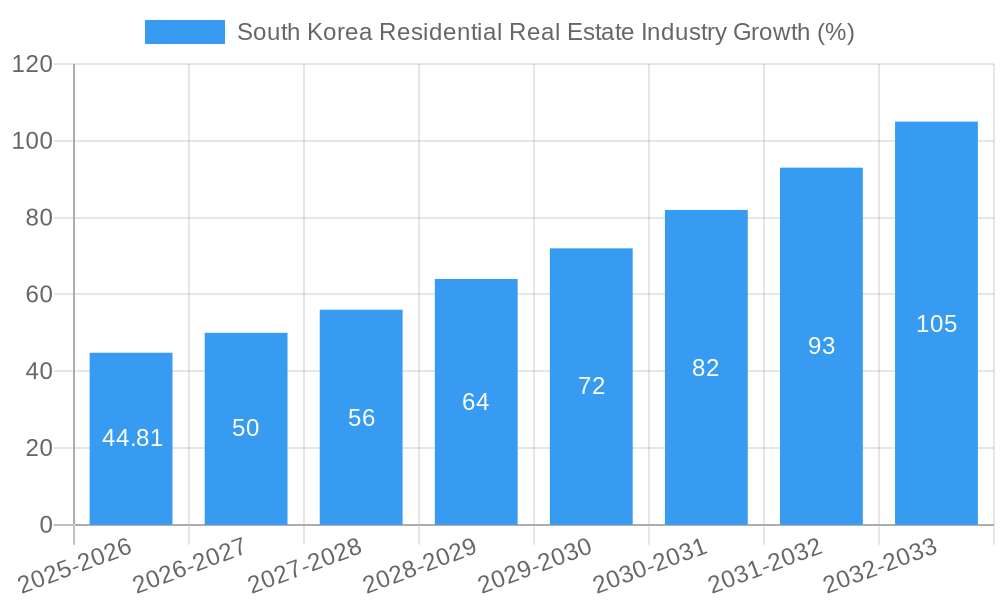

The South Korean residential real estate market, valued at $345.19 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 13.07% from 2025 to 2033. This expansion is fueled by several key drivers. A growing population, particularly in urban centers like Seoul, coupled with increasing disposable incomes and a preference for modern, comfortable housing are significant factors. Government initiatives aimed at stimulating the construction sector and improving infrastructure further contribute to market dynamism. However, challenges remain. Rising construction costs and land scarcity, especially in prime locations, pose constraints on market expansion. Furthermore, fluctuating interest rates and potential economic slowdowns could impact buyer sentiment and investment levels. The market is segmented primarily by property type, with apartments and condominiums dominating the landscape, followed by landed houses and villas. Key players in the market include large developers like Korea Land and Housing Corporation, Hines, and Hyundai Development Company, alongside smaller firms catering to niche segments. Competition is intensifying, leading to innovation in design, technology integration within properties and a greater focus on sustainable building practices.

The forecast period (2025-2033) anticipates a steady increase in market value, driven by sustained economic growth and population shifts. Strategic land acquisitions by developers and the increasing popularity of eco-friendly and technologically advanced housing units are expected to shape market trends. While regulatory changes and macroeconomic factors could introduce uncertainty, the overall outlook remains positive, suggesting significant investment opportunities in the South Korean residential real estate sector. The ongoing urbanization trend and government support for affordable housing will continue to be pivotal factors in shaping market trajectories over the coming years. The dominance of apartments and condominiums is likely to persist, given their accessibility and suitability for urban living. Nevertheless, the demand for landed houses and villas, especially amongst higher-income groups, is also anticipated to experience growth.

South Korea Residential Real Estate Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Korea residential real estate industry, offering invaluable insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report forecasts market trends, identifies key players, and examines the driving forces shaping this dynamic sector. The report leverages a robust data-driven methodology encompassing historical data (2019-2024), current market estimations (2025), and future projections (2025-2033). Expect detailed breakdowns by segment (Apartments and Condominiums, Landed Houses and Villas), a thorough competitive landscape analysis, and a deep dive into recent industry developments. The total market size is estimated at xx Million in 2025.

South Korea Residential Real Estate Industry Market Structure & Competitive Dynamics

The South Korean residential real estate market exhibits a moderately concentrated structure, with several large players dominating the landscape. Key players like Korea Land and Housing Corporation, Hines, ShinYoung Greensys, Hyosung Corporation, and Knight Frank hold significant market share, though the exact figures are proprietary information and cannot be revealed here. The industry's innovation ecosystem is evolving rapidly, driven by technological advancements in construction, design, and property management. Regulatory frameworks, including zoning laws and building codes, significantly impact market dynamics. Substitutes, such as renting or co-living spaces, present competitive pressures. End-user trends lean toward sustainable and technologically advanced housing options. M&A activity has been moderate in recent years, with deal values averaging xx Million per transaction.

- Market Concentration: Moderately concentrated, with top players controlling xx% of market share.

- Innovation Ecosystem: Rapid evolution, driven by technological advancements.

- Regulatory Framework: Significant influence on market dynamics, via zoning laws and building codes.

- Product Substitutes: Increasing competition from renting and co-living options.

- End-User Trends: Demand for sustainable and technologically advanced housing solutions.

- M&A Activity: Moderate activity with an average deal value of xx Million.

South Korea Residential Real Estate Industry Industry Trends & Insights

The South Korean residential real estate market is characterized by a complex interplay of factors driving growth and posing challenges. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025-2033, driven primarily by urbanization, population growth, and rising disposable incomes. Technological disruptions such as modular construction (as showcased by GS E&C's XiGEIST initiative) are improving efficiency and reducing construction timelines. Consumer preferences are shifting towards energy-efficient, smart homes, and improved amenities. Intense competition among developers necessitates innovative product offerings and superior customer service. Market penetration of smart home technology is projected to reach xx% by 2033.

Dominant Markets & Segments in South Korea Residential Real Estate Industry

The South Korean residential real estate market is geographically diverse, but the Seoul metropolitan area consistently dominates in terms of both transaction volume and value. Apartments and Condominiums comprise the largest segment by far, driven by high population density and a preference for urban living.

Key Drivers for Apartments and Condominiums:

- High population density in urban areas.

- Preference for convenient location and amenities.

- Government policies supporting urban development.

- Strong investor interest in multi-unit properties.

Detailed Dominance Analysis: The Seoul metropolitan area's dominance is attributed to factors such as high employment opportunities, excellent infrastructure, and access to education and healthcare. While Landed Houses and Villas hold a smaller market share, there is growing interest in these segments driven by increasing affluence and a demand for larger living spaces in more exclusive locations, often outside of major urban centers.

South Korea Residential Real Estate Industry Product Innovations

The South Korean residential real estate sector is witnessing significant product innovation, particularly in the areas of sustainable design, smart home technology, and modular construction. Recent developments like GS E&C's XiGEIST modular homes, aim to reduce construction time and costs, while initiatives focusing on incorporating green building materials and energy-efficient technologies are becoming increasingly prevalent. These innovations improve market fit by catering to the growing consumer demand for environmentally friendly and technologically advanced housing solutions.

Report Segmentation & Scope

This report segments the South Korean residential real estate market by property type:

Apartments and Condominiums: This segment represents the largest portion of the market and is expected to experience robust growth throughout the forecast period, driven by urbanization and rising demand for modern living spaces. The market size is projected at xx Million in 2025, experiencing a CAGR of xx%. Competition is fierce, with numerous developers vying for market share.

Landed Houses and Villas: This segment caters to a more affluent clientele seeking larger living spaces and greater privacy. The market size is projected to be xx Million in 2025, with a lower CAGR of xx% than the apartments and condominiums segment. Competition is less intense than in the apartment segment.

Key Drivers of South Korea Residential Real Estate Industry Growth

Several factors are driving growth in the South Korean residential real estate sector:

- Economic Growth: Rising disposable incomes and increasing urbanization fuel demand for housing.

- Government Policies: Initiatives supporting urban development and affordable housing contribute to market expansion.

- Technological Advancements: Innovations in construction and design enhance efficiency and sustainability.

- Improved Infrastructure: Enhanced transportation and utilities improve quality of life in residential areas.

Challenges in the South Korea Residential Real Estate Industry Sector

Despite positive growth trends, the South Korean residential real estate sector faces several challenges:

- High Land Prices: Limited land availability in urban areas leads to high costs and potentially limits market expansion.

- Regulatory Hurdles: Complex bureaucratic processes and zoning regulations can hinder new construction.

- Supply Chain Issues: Disruptions in the supply chain can impact project timelines and affordability.

- Competition: Intense competition amongst developers can lead to price wars and reduced profitability.

Leading Players in the South Korea Residential Real Estate Industry Market

- Korea Land and Housing Corporation

- Hines

- ShinYoung Greensys

- Hyosung Corporation

- Knight Frank

- Booyoung Group

- Dongbu Corporation

- Daelim Corporation

- Hyundai Development Company

Key Developments in South Korea Residential Real Estate Industry Sector

- January 2023: KPF unveils the design for Parkside Seoul, a large mixed-use development incorporating residential, office, retail, and hospitality spaces, signaling a trend towards integrated and amenity-rich developments.

- April 2023: GS E&C launches XiGEIST, its premium modular housing division, indicating an increased focus on technological advancements and efficiency in the construction sector. This initiative could significantly impact construction times and overall costs.

Strategic South Korea Residential Real Estate Industry Market Outlook

The South Korean residential real estate market is poised for continued growth, driven by strong economic fundamentals and technological innovation. Strategic opportunities lie in focusing on sustainable and technologically advanced housing solutions, catering to the changing preferences of consumers, and capitalizing on growth in secondary urban centers. Investors and developers who can navigate the regulatory landscape and adapt to evolving consumer demands are likely to secure a significant advantage in this dynamic market.

South Korea Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Geography

- 2.1. Seoul

- 2.2. Other Locations

South Korea Residential Real Estate Industry Segmentation By Geography

- 1. Seoul

- 2. Other Locations

South Korea Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government's Plans to Supply New Homes

- 3.3. Market Restrains

- 3.3.1. Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Urbanization in the Country is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Seoul

- 5.2.2. Other Locations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Seoul

- 5.3.2. Other Locations

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Seoul South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Seoul

- 6.2.2. Other Locations

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Other Locations South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Seoul

- 7.2.2. Other Locations

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 Korea Land and Housing Corporation

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Hines

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 ShinYoung Greensys

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Hyosung Corporation

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Knight Frank

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Booyoung Group

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Dongbu Corporation

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Daelim Corporation

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Hyundai Development Company

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.1 Korea Land and Housing Corporation

List of Figures

- Figure 1: South Korea Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South Korea Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Residential Real Estate Industry?

The projected CAGR is approximately 13.07%.

2. Which companies are prominent players in the South Korea Residential Real Estate Industry?

Key companies in the market include Korea Land and Housing Corporation, Hines, ShinYoung Greensys, Hyosung Corporation, Knight Frank, Booyoung Group, Dongbu Corporation, Daelim Corporation, Hyundai Development Company.

3. What are the main segments of the South Korea Residential Real Estate Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 345.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Government's Plans to Supply New Homes.

6. What are the notable trends driving market growth?

Urbanization in the Country is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

January 2023: International architecture office KPF has unveiled the design for Parkside Seoul, a new mixed-use neighborhood planned for the South Korean capital to complement the surrounding natural elements and pay homage to Yongsan Park. The 482,600 square meter development is composed of a layered exterior envelope encompassing various programs and public amenities to enhance the residents’ experience of space. Besides the residential units, the complex includes office and retail spaces, hospitality facilities, and public and green spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the South Korea Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence