Key Insights

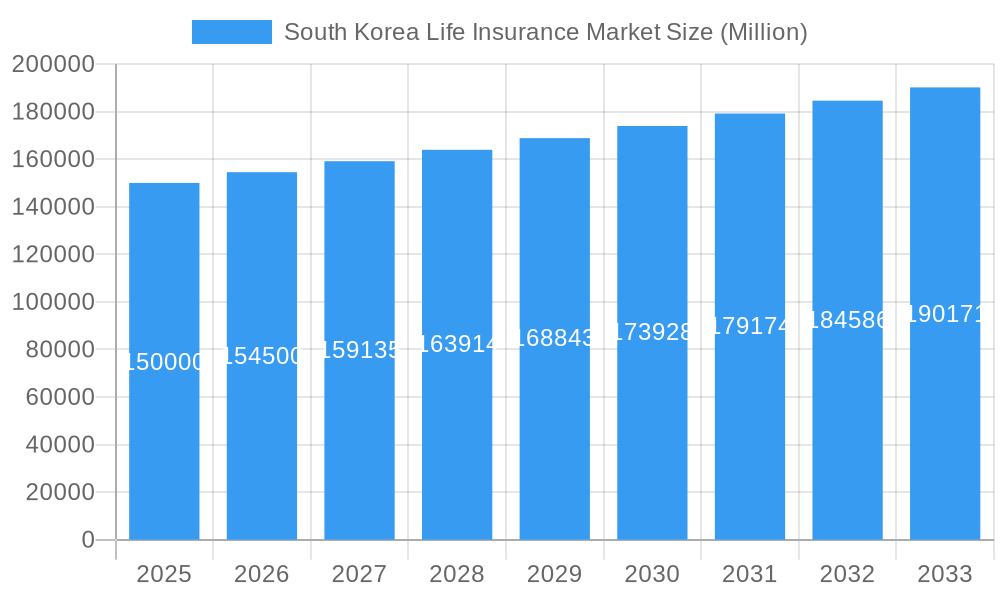

The South Korean life insurance market, while mature, continues to exhibit dynamic growth driven by several key factors. The aging population, coupled with increasing health consciousness and a growing awareness of the need for financial security in retirement, fuels demand for life insurance products. Technological advancements are also significantly impacting the market, with the rise of Insurtech companies offering innovative solutions and digital distribution channels. These innovations are improving customer experience, streamlining processes, and expanding market reach, particularly among younger demographics. Furthermore, regulatory changes aimed at promoting financial inclusion and strengthening consumer protection are shaping the competitive landscape. While precise market sizing data is not fully provided, based on global life insurance market trends and South Korea's economic strength, we can reasonably infer a substantial market size. For instance, assuming a conservative annual growth rate of 3-5% (a reasonable estimate considering market maturity and economic factors), and a 2025 market size of $150 billion USD (this is an estimate based on global market comparables and South Korea's economic standing), we can project significant expansion throughout the forecast period (2025-2033). This growth is likely to be driven primarily by the increasing demand for diversified products, such as unit-linked plans and health insurance add-ons, reflecting changing consumer preferences and a broader understanding of risk management.

South Korea Life Insurance Market Market Size (In Billion)

The competitive dynamics of the South Korean life insurance market are intense, with both established players and new entrants vying for market share. Large, well-established insurers are leveraging their brand recognition and extensive distribution networks to maintain their positions, while newer players are employing innovative strategies and digital technologies to attract customers. The market's profitability is affected by several factors, including the interest rate environment, investment returns, and claims experience. The regulatory environment plays a critical role in influencing insurer strategies and consumer behavior. Overall, the South Korean life insurance market presents a compelling investment opportunity with long-term growth potential, shaped by demographic trends, technological advancements, and evolving regulatory frameworks.

South Korea Life Insurance Market Company Market Share

South Korea Life Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Korea life insurance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The report leverages rigorous data analysis and expert insights to present a clear and actionable understanding of this dynamic market.

South Korea Life Insurance Market Structure & Competitive Dynamics

This section delves into the competitive intensity of the South Korea life insurance market. We analyze market concentration, revealing the market share held by key players such as Samsung Fire & Marine Insurance Co Ltd, Hanwha Life Insurance Co Ltd, Hyundai Marine & Fire Insurance Co Ltd, Kyobo Life Insurance Co Ltd, Nonghyup Life Insurance Co Ltd, KB Insurance Co Ltd, and Mirae Asset Life Insurance Co Ltd, amongst others. The report also examines the National Health Insurance Service's role in shaping the market landscape. We evaluate the impact of mergers and acquisitions (M&A) activities, quantifying deal values (in Million) where possible, and analyzing their influence on market consolidation. Furthermore, the analysis explores the regulatory framework, innovation ecosystems, the presence of product substitutes, prevalent end-user trends, and their collective impact on market structure. The report also assesses the level of market concentration using metrics like the Herfindahl-Hirschman Index (HHI), if data is available. If not, a qualitative assessment will be provided. For example, we will assess whether the market is highly concentrated, moderately concentrated or fragmented, using industry-specific benchmarks. Expected M&A activity for the forecast period will also be predicted (xx Million).

South Korea Life Insurance Market Industry Trends & Insights

This section provides a comprehensive overview of the South Korea life insurance market's growth trajectory. We analyze key growth drivers, including economic expansion, demographic shifts (aging population), increasing health consciousness, and evolving consumer preferences for diverse insurance products. The influence of technological disruptions, such as fintech advancements and digitalization of insurance services, is thoroughly explored. We determine the Compound Annual Growth Rate (CAGR) of the market during the historical period (2019-2024) and forecast the CAGR for the future period (2025-2033). Market penetration rates for different product segments will be calculated where possible. Competitive dynamics, including pricing strategies and product differentiation, are examined to understand their influence on market growth. The impact of government regulations and policies on market expansion will also be assessed.

Dominant Markets & Segments in South Korea Life Insurance Market

This section identifies the leading segments and regions within the South Korea life insurance market. A detailed analysis will reveal the dominant segment, providing insights into its market share and growth drivers. This analysis will also explore regional variations in market performance and identify key factors contributing to the dominance of specific regions or segments.

- Key Drivers for the Dominant Segment:

- Specific economic policies impacting insurance adoption

- Infrastructure development supporting insurance distribution channels

- Demographic trends influencing demand for specific insurance types

- Government regulations favoring specific product offerings

- Consumer preferences within the dominant segment

The analysis will include a thorough examination of the factors contributing to the dominance of the identified segment, including but not limited to the factors listed above. Market size (in Million) for the dominant segment will be provided for historical and forecast periods. Qualitative assessments of competitive intensity within the dominant segment will also be included.

South Korea Life Insurance Market Product Innovations

This section summarizes the latest product developments in the South Korea life insurance market. It will highlight innovative product offerings, their applications, and the competitive advantages they offer. The analysis emphasizes the role of technology in driving product innovation and assesses the market fit of these new products. We will identify key technological trends influencing product development, such as AI-powered risk assessment, personalized insurance plans, and digital distribution channels.

Report Segmentation & Scope

This report segments the South Korea life insurance market based on various factors including product type (e.g., term life, whole life, universal life, endowment, etc.), distribution channel (e.g., online, agents, brokers, banks), and customer demographics (e.g., age, income level). Each segment's market size (in Million) and growth projections for the forecast period will be detailed. Competitive dynamics within each segment will also be analyzed. For each segment, a paragraph describing the market size, growth projections, and competitive landscape will be provided.

Key Drivers of South Korea Life Insurance Market Growth

This section identifies and analyzes the key factors driving the growth of the South Korea life insurance market. These drivers include but are not limited to technological advancements, favorable economic conditions, supportive government regulations, and evolving consumer preferences. Specific examples and quantitative data will be used to illustrate the impact of each driver on market growth.

Challenges in the South Korea Life Insurance Market Sector

This section highlights the challenges and restraints impacting the South Korea life insurance market. These challenges may include regulatory hurdles, supply chain disruptions, intense competition, and economic uncertainties. The impact of these challenges on market growth will be quantified wherever possible.

Leading Players in the South Korea Life Insurance Market Market

- National Health Insurance Service

- Samsung Fire & Marine Insurance Co Ltd

- Hanwha Life Insurance Co Ltd

- Hyundai Marine & Fire Insurance Co Ltd

- Kyobo Life Insurance Co Ltd

- Nonghyup Life Insurance Co Ltd

- KB Insurance Co Ltd

- Korean Reinsurance Company

- Meritz Fire & Marine Insurance Co Ltd

- Mirae Asset Life Insurance Co Ltd *List Not Exhaustive

Key Developments in South Korea Life Insurance Market Sector

- List of key developments with year/month, highlighting impact on market dynamics (e.g., product launches, mergers, regulatory changes) – This section will contain bullet points detailing key developments with their respective dates and an explanation of their impact on the market. Specific examples of the impact (e.g., increase or decrease in market share, changes in competition, impact on consumer behavior) will be provided.

Strategic South Korea Life Insurance Market Market Outlook

This section provides a summary of the key growth accelerators for the South Korea life insurance market. It explores future market potential, highlighting strategic opportunities for market participants. The analysis emphasizes the potential for growth based on the identified trends and the strategic implications for both established players and new entrants.

South Korea Life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-life Insurances

-

1.1. Life Insurance

-

2. Dstribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

South Korea Life Insurance Market Segmentation By Geography

- 1. South Korea

South Korea Life Insurance Market Regional Market Share

Geographic Coverage of South Korea Life Insurance Market

South Korea Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Constant Increase in Vehicle Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-life Insurances

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Dstribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Health Insurance Service

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Fire & Marine Insurance Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Life Insurance Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hyundai Marine & Fire Insurance Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kyobo Life Insurance Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nonghyup Life Insurance Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KB Insurance Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Korean Reinsurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Meritz Fire & Marine Insurance Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mirae Asset Life Insurance Co Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 National Health Insurance Service

List of Figures

- Figure 1: South Korea Life Insurance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South Korea Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Life Insurance Market Revenue undefined Forecast, by Insurance Type 2020 & 2033

- Table 2: South Korea Life Insurance Market Revenue undefined Forecast, by Dstribution Channel 2020 & 2033

- Table 3: South Korea Life Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: South Korea Life Insurance Market Revenue undefined Forecast, by Insurance Type 2020 & 2033

- Table 5: South Korea Life Insurance Market Revenue undefined Forecast, by Dstribution Channel 2020 & 2033

- Table 6: South Korea Life Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Life Insurance Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the South Korea Life Insurance Market?

Key companies in the market include National Health Insurance Service, Samsung Fire & Marine Insurance Co Ltd, Hanwha Life Insurance Co Ltd, Hyundai Marine & Fire Insurance Co Ltd, Kyobo Life Insurance Co Ltd, Nonghyup Life Insurance Co Ltd, KB Insurance Co Ltd, Korean Reinsurance Company, Meritz Fire & Marine Insurance Co Ltd, Mirae Asset Life Insurance Co Ltd*List Not Exhaustive.

3. What are the main segments of the South Korea Life Insurance Market?

The market segments include Insurance Type, Dstribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Constant Increase in Vehicle Sales.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Life Insurance Market?

To stay informed about further developments, trends, and reports in the South Korea Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence