Key Insights

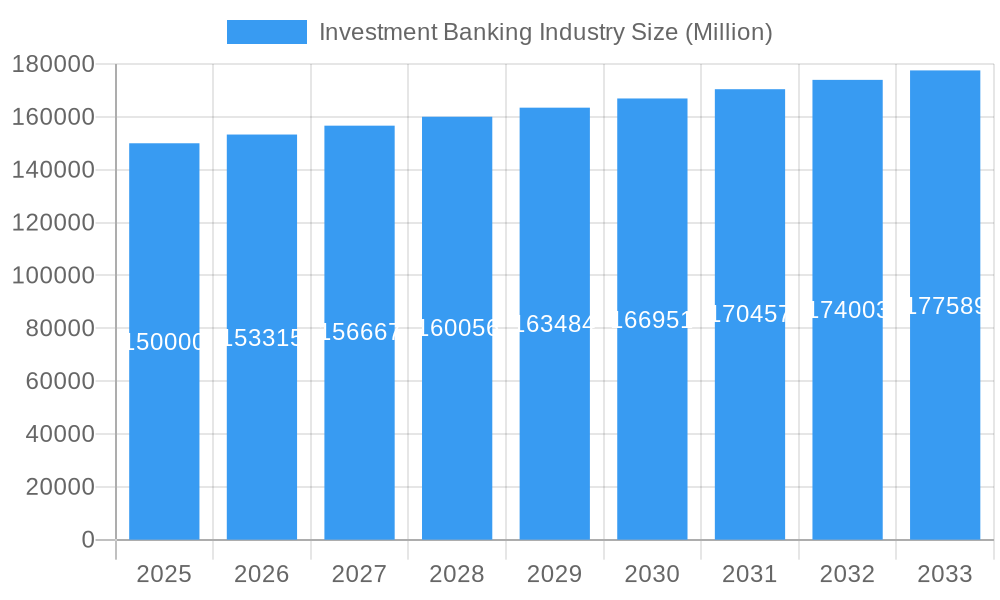

The global investment banking market, projected to reach $150.49 billion by 2025, is poised for robust expansion at a compound annual growth rate (CAGR) of 7.6% through 2033. This growth trajectory is propelled by escalating merger and acquisition (M&A) activities, particularly within the technology and healthcare sectors, a heightened demand for capital raising solutions from both established enterprises and burgeoning startups, and the continuous requirement for expert financial advisory services across diverse industries. While traditional underwriting and advisory services remain foundational, the sector is undergoing a significant digital transformation, with fintech innovators increasingly disrupting established market dynamics. The proliferation of alternative investment strategies and the growing complexity of international regulatory frameworks present both significant opportunities and challenges for market participants.

Investment Banking Industry Market Size (In Billion)

The competitive landscape is characterized by the dominance of global financial giants such as JPMorgan Chase & Co., Goldman Sachs Group Inc., and Morgan Stanley, who leverage their extensive networks and deep expertise to secure substantial market share. Nevertheless, specialized firms and boutique investment banks continue to carve out success by focusing on niche sectors or offering bespoke services.

Investment Banking Industry Company Market Share

The forecast period (2025-2033) anticipates intensified competition driven by rapid technological advancements, evolving regulatory landscapes necessitating strategic adaptation and increased compliance investments, and dynamic global economic conditions. The industry's inherent resilience is expected to be sustained by the fundamental and ongoing need for sophisticated financial intermediation. While precise regional growth data is not provided, North America and Europe are expected to remain leading markets, with emerging economies in Asia and Latin America exhibiting higher growth potential due to ongoing economic expansion and increasing financial sector development. Sustained long-term success will be contingent upon adaptability, effective technological integration, and the capacity to address evolving client demands within a dynamic regulatory and economic milieu.

Investment Banking Industry: Market Analysis, Trends & Forecasts (2019-2033)

This comprehensive report provides a detailed analysis of the global investment banking industry, offering in-depth insights into market structure, competitive dynamics, key trends, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an essential resource for investors, industry professionals, and strategic decision-makers. The report analyzes a market valued at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Key Companies Analyzed: J P Morgan Chase & Co (JPMorgan Chase & Co), Goldman Sachs Group Inc (Goldman Sachs Group Inc), Morgan Stanley (Morgan Stanley), BofA Securities Inc (BofA Securities Inc), Citi Group Inc (Citigroup Inc), Barclays Investment Bank (Barclays Investment Bank), Credit Suisse Group AG (Credit Suisse Group AG), Deutsche Bank AG (Deutsche Bank AG), Wells Fargo & Company (Wells Fargo & Company), RBC Capital Markets (RBC Capital Markets), Jefferies Group LLC (Jefferies Group LLC), The Blackstone Group Inc (The Blackstone Group Inc), Cowen Inc (Cowen Inc). List Not Exhaustive

Investment Banking Industry Market Structure & Competitive Dynamics

The investment banking industry is characterized by a highly concentrated market structure, with a few major players dominating the landscape. The top 10 firms control approximately xx% of the global market share in 2025. This concentration is driven by significant barriers to entry, including substantial capital requirements, stringent regulatory frameworks, and the need for experienced professionals. Innovation ecosystems are vibrant, with fintech companies disrupting traditional models, particularly in areas like algorithmic trading and digital asset management. Regulatory frameworks, such as Dodd-Frank and MiFID II, continue to evolve, impacting operational costs and strategies. Product substitutes are limited, primarily alternative financing options, but these often lack the scale and sophistication of investment banking services. End-user trends reflect a growing demand for advisory services, particularly in areas such as mergers and acquisitions (M&A), restructuring, and capital markets transactions. M&A activity in the investment banking sector itself has remained relatively subdued in recent years, with total deal values around xx Million in 2024.

- Market Share: Top 5 players hold approximately xx% of the global market share.

- M&A Deal Values (2024): Approximately xx Million.

- Regulatory Landscape: Increasingly stringent regulations impacting operational costs and strategies.

Investment Banking Industry Industry Trends & Insights

The investment banking industry is experiencing significant transformation driven by several key trends. Market growth is propelled by increased global M&A activity, robust capital markets, and the rising need for sophisticated financial advisory services across various sectors. Technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), are disrupting traditional operations, leading to improved efficiency, automation of tasks, and enhanced risk management. Changing client preferences are driving the demand for customized solutions and greater transparency. Increased competition from fintech companies and traditional banks is forcing established firms to adapt and innovate to maintain market share. The industry's CAGR is projected to be xx% from 2025-2033, with market penetration growing in emerging markets. This growth is influenced by factors such as increasing global interconnectedness and expanding cross-border investments.

Dominant Markets & Segments in Investment Banking Industry

The United States remains the dominant market for investment banking services, followed by the United Kingdom and other major European economies. This dominance is driven by a robust financial infrastructure, a large and sophisticated pool of investors, and a vibrant ecosystem of companies actively seeking capital and advisory support. Key drivers include favorable economic policies promoting foreign direct investment, well-developed capital markets, and a strong regulatory framework that fosters confidence in market operations.

- Key Drivers in the US Market:

- Favorable economic policies

- Deep capital markets

- Large and sophisticated investor base

- Strong regulatory framework fostering confidence

Investment Banking Industry Product Innovations

Recent product innovations in investment banking include the development of sophisticated algorithmic trading platforms, enhanced risk management tools utilizing AI, and blockchain-based solutions for improved transaction efficiency and security. These innovations are enhancing the speed and efficiency of transactions, reducing operational costs, and improving risk management capabilities, leading to a greater competitive advantage for firms able to leverage these advancements effectively.

Report Segmentation & Scope

This report segments the investment banking industry based on service type (e.g., M&A advisory, underwriting, sales & trading), client type (e.g., corporations, governments, institutions), and geography (e.g., North America, Europe, Asia-Pacific). Each segment presents unique growth dynamics and competitive landscapes. For example, the M&A advisory segment is expected to experience strong growth driven by increasing consolidation in various industries, while the underwriting segment will be influenced by fluctuating market conditions. The Asia-Pacific region is projected to show significant growth due to economic expansion and increasing capital needs in emerging markets.

Key Drivers of Investment Banking Industry Growth

The growth of the investment banking industry is driven by a confluence of factors, including increasing global M&A activity, economic expansion in emerging markets, technological advancements enabling automation and enhanced risk management, and evolving regulatory frameworks stimulating the need for sophisticated financial solutions. The development of new financial instruments and increasing demand for cross-border investment further fuels industry growth.

Challenges in the Investment Banking Industry Sector

The investment banking industry faces various challenges including increasing regulatory scrutiny leading to higher compliance costs, geopolitical uncertainties affecting market volatility and investor sentiment, and intense competition from both established players and emerging fintech disrupting traditional business models. These challenges are estimated to impact profitability by approximately xx% in 2025 if not mitigated effectively.

Leading Players in the Investment Banking Industry Market

- J P Morgan Chase & Co

- Goldman Sachs Group Inc

- Morgan Stanley

- BofA Securities Inc

- Citi Group Inc

- Barclays Investment Bank

- Credit Suisse Group AG

- Deutsche Bank AG

- Wells Fargo & Company

- RBC Capital Markets

- Jefferies Group LLC

- The Blackstone Group Inc

- Cowen Inc

- List Not Exhaustive

Key Developments in Investment Banking Industry Sector

- 2023 Q4: Increased regulatory scrutiny on ESG (Environmental, Social, and Governance) investing.

- 2024 Q1: Several large M&A deals finalized, impacting market consolidation.

- 2024 Q3: Launch of new AI-powered trading platforms by multiple firms.

- 2025 Q1: Implementation of new regulatory changes impacting transaction costs.

Strategic Investment Banking Industry Market Outlook

The future of the investment banking industry is bright, driven by sustained global economic growth, the increasing complexity of financial transactions, and the ongoing digital transformation. Strategic opportunities lie in adapting to technological disruptions, focusing on ESG investments, expanding into new markets, and enhancing client relationships through personalized advisory services. This necessitates significant investments in technology, talent acquisition, and strategic partnerships to maintain a competitive edge in this rapidly evolving landscape.

Investment Banking Industry Segmentation

-

1. Product Types

- 1.1. Mergers & Acquisitions

- 1.2. Debt Capital Markets

- 1.3. Equity Capital Markets

- 1.4. Syndicated Loans and Others

Investment Banking Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Latin America

-

2. EMEA

- 2.1. Europe

- 2.2. Russia

- 2.3. United Kingdom

- 2.4. Middle East

-

3. Asia

- 3.1. Japan

- 3.2. China

- 3.3. Others

-

4. Australasia

- 4.1. Australia

- 4.2. New Zealand

Investment Banking Industry Regional Market Share

Geographic Coverage of Investment Banking Industry

Investment Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. 2019 - The Year of Mega Deals yet with Lesser M&A Volume

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 5.1.1. Mergers & Acquisitions

- 5.1.2. Debt Capital Markets

- 5.1.3. Equity Capital Markets

- 5.1.4. Syndicated Loans and Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.2.2. EMEA

- 5.2.3. Asia

- 5.2.4. Australasia

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 6. Americas Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 6.1.1. Mergers & Acquisitions

- 6.1.2. Debt Capital Markets

- 6.1.3. Equity Capital Markets

- 6.1.4. Syndicated Loans and Others

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 7. EMEA Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 7.1.1. Mergers & Acquisitions

- 7.1.2. Debt Capital Markets

- 7.1.3. Equity Capital Markets

- 7.1.4. Syndicated Loans and Others

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 8. Asia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 8.1.1. Mergers & Acquisitions

- 8.1.2. Debt Capital Markets

- 8.1.3. Equity Capital Markets

- 8.1.4. Syndicated Loans and Others

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 9. Australasia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 9.1.1. Mergers & Acquisitions

- 9.1.2. Debt Capital Markets

- 9.1.3. Equity Capital Markets

- 9.1.4. Syndicated Loans and Others

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 J P Morgan Chase & Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Goldman Sachs Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Morgan Stanley

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BofA Securities Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Citi Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Barclays Investment Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Credit Suisse Group AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deutsche Bank AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wells Fargo & Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 RBC Capital Markets

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Jefferies Group LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Blackstone Group Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Cowen Inc**List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 J P Morgan Chase & Co

List of Figures

- Figure 1: Global Investment Banking Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Americas Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 3: Americas Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 4: Americas Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Americas Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: EMEA Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 7: EMEA Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 8: EMEA Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: EMEA Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 11: Asia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 12: Asia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australasia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 15: Australasia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 16: Australasia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Australasia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 2: Global Investment Banking Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 4: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Latin America Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 9: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Russia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Middle East Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 15: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Japan Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: China Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Others Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 20: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Australia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: New Zealand Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Investment Banking Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Investment Banking Industry?

Key companies in the market include J P Morgan Chase & Co, Goldman Sachs Group Inc, Morgan Stanley, BofA Securities Inc, Citi Group Inc, Barclays Investment Bank, Credit Suisse Group AG, Deutsche Bank AG, Wells Fargo & Company, RBC Capital Markets, Jefferies Group LLC, The Blackstone Group Inc, Cowen Inc**List Not Exhaustive.

3. What are the main segments of the Investment Banking Industry?

The market segments include Product Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.49 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

2019 - The Year of Mega Deals yet with Lesser M&A Volume.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Investment Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Investment Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Investment Banking Industry?

To stay informed about further developments, trends, and reports in the Investment Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence