Key Insights

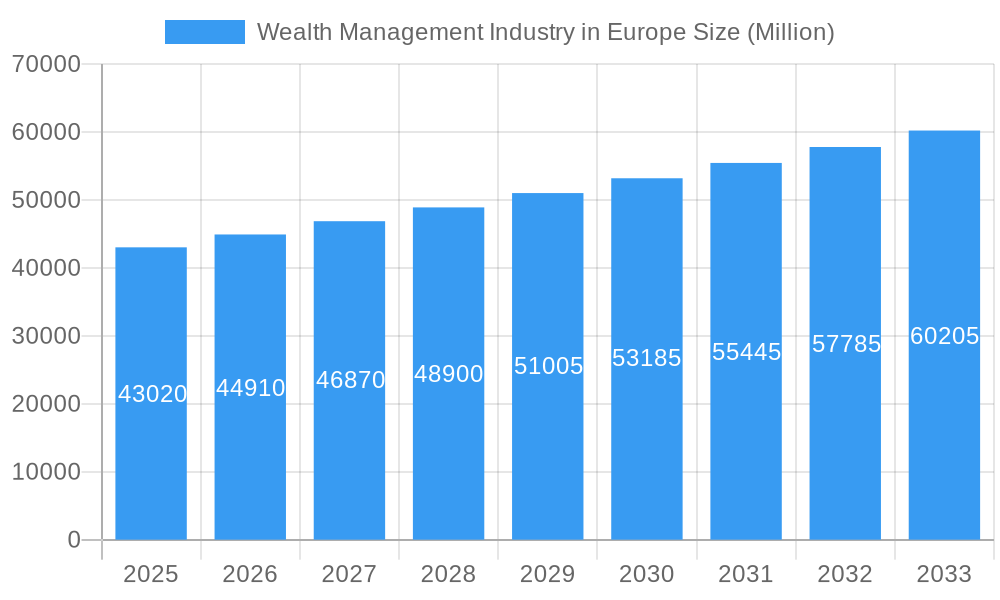

The European Wealth Management industry is poised for significant growth, with a current market size of 43.02 Billion USD and a projected Compound Annual Growth Rate (CAGR) of 4.41% from 2025 to 2033. This robust expansion is fueled by a confluence of factors, including the increasing concentration of wealth among High Net Worth Individuals (HNWIs) and the growing demand for sophisticated financial planning and investment solutions. The region benefits from a well-established financial infrastructure and a growing affluent population seeking to preserve and grow their assets. The trend towards digital wealth management platforms, offering enhanced accessibility and personalized services, is also a key driver. Furthermore, regulatory shifts aimed at increasing transparency and investor protection are fostering greater trust and encouraging more individuals and institutions to engage with wealth management services. The market's resilience is also evident in its ability to navigate economic uncertainties by offering diversified investment strategies and risk management solutions.

Wealth Management Industry in Europe Market Size (In Billion)

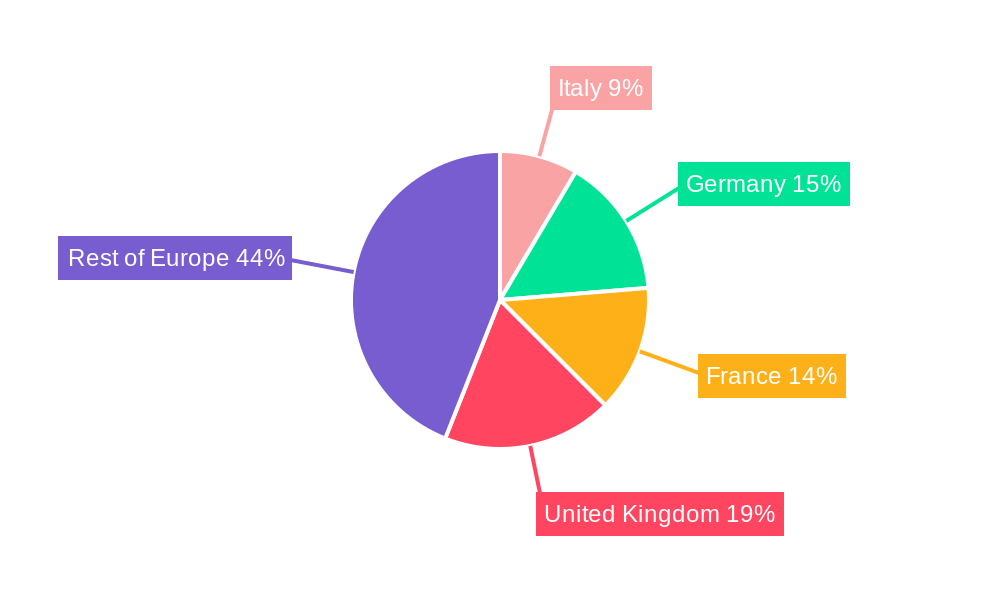

The competitive landscape features a mix of established global players like UBS Group, HSBC Holdings, and Amundi, alongside specialized firms such as Family Offices, indicating a diverse range of service offerings catering to different client segments. While the market is dominated by Private Bankers and Wealth Management Firms serving HNWIs and Mass Affluent individuals, the "Other Client Types" segment is expected to grow as wealth becomes more democratized through digital channels. Geographic regions like the United Kingdom and Germany are anticipated to be significant contributors to this growth, owing to their strong economic foundations and established financial sectors. However, the industry faces certain restraints, including increasing regulatory compliance costs and the ongoing challenge of adapting to rapidly evolving technological advancements and client expectations. The ongoing pursuit of innovation and client-centric strategies will be crucial for firms to maintain a competitive edge in this dynamic European wealth management market.

Wealth Management Industry in Europe Company Market Share

Europe Wealth Management Market: Strategic Outlook & Competitive Landscape 2019-2033

Gain unparalleled insights into the dynamic Europe wealth management market with this comprehensive report. Delving deep into the European financial services sector, we analyze key trends, market structure, and competitive dynamics from 2019 to 2033. This report provides actionable intelligence for HNWIs, retail investors, and mass affluent individuals, as well as private bankers, family offices, and wealth management firms. Discover the impact of digital transformation in wealth management, regulatory changes in European finance, and investment strategies for European wealth.

Wealth Management Industry in Europe Market Structure & Competitive Dynamics

The Europe wealth management market exhibits a diverse and dynamic market structure, characterized by both established global players and agile boutique firms. Market concentration varies by country, with significant shares held by integrated financial institutions and specialized wealth managers. Innovation ecosystems thrive through partnerships between technology providers and financial institutions, fostering advancements in digital wealth solutions and robo-advisory services. Stringent European regulatory frameworks, including MiFID II and GDPR, shape competitive landscapes by emphasizing client protection and data privacy. Product substitutes range from traditional investment vehicles to alternative assets and emerging fintech offerings, constantly challenging existing models. End-user trends reveal a growing demand for personalized financial advice, sustainable investing options (ESG), and seamless digital client experiences. Mergers and acquisitions (M&A) activities are a significant feature, with key deals like the proposed, then withdrawn, acquisition of Wealthfront by UBS Group in September 2022 signaling consolidation and strategic shifts. The total estimated M&A deal value in the historical period reached approximately 15 Billion Euros, with further significant transactions anticipated in the forecast period as firms seek to scale operations and enhance service portfolios. The competitive intensity is high, driven by price sensitivity, service quality, and the ability to adapt to evolving client needs.

Wealth Management Industry in Europe Industry Trends & Insights

The wealth management industry in Europe is on a trajectory of significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% between the Base Year of 2025 and the end of the Forecast Period in 2033. This expansion is propelled by a confluence of powerful market growth drivers, including the sustained accumulation of wealth among High Net Worth Individuals (HNWIs) and a burgeoning mass affluent segment across key European economies. Technological disruptions are fundamentally reshaping the industry. The rapid adoption of AI in wealth management and advanced data analytics is enabling more personalized client experiences, efficient operational processes, and sophisticated risk management. Robo-advisory platforms continue to gain traction, democratizing access to investment advice for retail/individuals and offering cost-effective solutions. Consumer preferences are evolving, with a distinct shift towards sustainable investing (ESG), greater demand for holistic financial planning that extends beyond investment management, and an expectation for hyper-personalized, digitally-enabled services. Competitive dynamics are intensifying, forcing traditional private bankers and family offices to innovate and embrace digital strategies to retain market share. The market penetration of digital wealth solutions is expected to reach xx% by 2033, underscoring the critical role of technology. The ongoing evolution of regulatory landscapes also presents both opportunities and challenges, requiring firms to maintain agility and compliance. The European wealth management market size is projected to reach an impressive XX Trillion Euros by 2033, reflecting the robust growth potential and the increasing importance of effective wealth management strategies.

Dominant Markets & Segments in Wealth Management Industry in Europe

Within the Europe wealth management industry, the United Kingdom stands out as a dominant market, driven by its long-standing financial infrastructure, concentration of HNWIs, and a sophisticated regulatory environment that fosters innovation. Alongside the UK, Switzerland remains a bedrock of the global wealth management sector, particularly for ultra-high-net-worth clients and cross-border asset management. Germany and France also represent significant markets, with growing mass affluent populations and increasing demand for diversified investment products.

Client Type Dominance:

- HNWIs: This segment is characterized by substantial asset pools and a demand for bespoke, often complex, financial solutions including estate planning, philanthropy, and alternative investments. Key drivers include intergenerational wealth transfer and entrepreneurial success. The market size for HNWIs is estimated at XX Trillion Euros.

- Mass Affluent: This rapidly expanding segment seeks accessible yet personalized investment advice and financial planning services. Economic growth and rising disposable incomes are key drivers, with a growing interest in digital tools and simplified investment options. Market size is estimated at XX Trillion Euros.

- Retail/Individuals: This broad segment encompasses a diverse range of financial needs, from basic savings and investment accounts to retirement planning. Accessibility, affordability, and digital convenience are paramount. Market size is estimated at XX Trillion Euros.

Wealth Management Firm Dominance:

- Private Bankers: These firms continue to dominate the high-net-worth and ultra-high-net-worth space, offering a comprehensive suite of services and personal relationships. Their dominance is sustained by trust, discretion, and specialized expertise.

- Family Offices: Both single and multi-family offices are experiencing growth, catering to the complex needs of ultra-wealthy families, including wealth preservation, succession planning, and philanthropic endeavors. Their specialized and holistic approach is a key driver of dominance.

- Other Wealth Management Firms: This category includes independent financial advisors, fintech platforms, and diversified financial institutions. Their dominance is growing, particularly in serving the mass affluent and retail/individuals segments through scalable digital solutions and a wider range of product offerings.

Wealth Management Industry in Europe Product Innovations

The wealth management industry in Europe is witnessing a surge in product innovations driven by technological advancements and evolving client demands. Key developments include the integration of AI-powered financial planning tools, offering hyper-personalized investment recommendations and risk assessments. The proliferation of digital wealth platforms and robo-advisors provides accessible and cost-effective investment solutions for a broader audience. Furthermore, there's a significant trend towards ESG-focused investment products, catering to the growing investor appetite for sustainable and ethical portfolios. These innovations enhance client engagement, streamline advisory processes, and offer competitive advantages in a crowded market.

Report Segmentation & Scope

This report segments the Europe wealth management market across critical dimensions to provide a granular analysis. The segmentation by Client Type includes High Net Worth Individuals (HNWIs), Retail/Individuals, and Mass Affluent, each representing distinct market sizes and growth potentials. The Wealth Management Firm segmentation covers Private Bankers, Family Offices, and Other Wealth Management Firms, detailing their strategic positioning and market reach. The study spans the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The historical period of 2019-2024 provides essential context for understanding past trends and market evolution. The estimated market size for the HNWI segment in Europe is projected to reach XX Trillion Euros by 2033, while the Mass Affluent segment is expected to grow to XX Trillion Euros. The Retail/Individuals segment is estimated to be XX Trillion Euros. The competitive landscape within each segment is dynamic, with ongoing innovation and consolidation.

Key Drivers of Wealth Management Industry in Europe Growth

Several interconnected factors are propelling the Europe wealth management industry forward. Technologically, the widespread adoption of digitalization in financial services, including AI, big data analytics, and blockchain, is enhancing operational efficiency and client experience. Economically, the sustained accumulation of wealth, particularly among HNWIs and a growing mass affluent population, creates a larger asset base for management. Favorable demographic trends, such as intergenerational wealth transfer, also contribute significantly. Regulatory reforms, while presenting compliance challenges, are also driving transparency and client protection, fostering trust. The increasing investor interest in sustainable and ESG investing is opening up new avenues for product development and market expansion. The development of user-friendly investment apps and online brokerage platforms is also making wealth management more accessible.

Challenges in the Wealth Management Industry in Europe Sector

Despite robust growth, the wealth management industry in Europe faces significant challenges. Evolving and complex European financial regulations, such as those pertaining to data privacy (GDPR) and investor protection (MiFID II), necessitate continuous adaptation and compliance investments. Intensifying competition from both established players and agile fintech startups erodes margins and demands constant innovation. Cybersecurity threats pose a constant risk to client data and operational integrity, requiring substantial investments in security infrastructure. Economic uncertainties, including geopolitical instability and inflation, can impact investment performance and client confidence. Supply chain issues, particularly for technology hardware and software, can affect the rollout of new digital services. Adapting to diverse client needs and preferences across different European markets remains a complex undertaking.

Leading Players in the Wealth Management Industry in Europe Market

- Allianz

- Schroders PLC

- UBS Group

- HSBC Holdings

- Amundi

- AXA Group

- BNP Paribas

- Aegon N.V.

- Credit Suisse

- Legal & General

Key Developments in Wealth Management Industry in Europe Sector

- September 2022: UBS Group's proposed acquisition of Millennial and Gen Z-focused wealth management platform Wealthfront was ultimately withdrawn, indicating potential shifts in M&A strategies and market valuations.

- 2021: Legal & General launched its next-generation protection platform for IFAs. Legal & General Group Protection introduced an online quote-and-buy platform, ONIX (Online Insurance Experience), designed to expand access to group income protection and create more digital opportunities for intermediaries. This initiative aimed to provide a more flexible quote experience with enhanced options to capture specific client requirements, supported by new 'Big on small business' SME Group Protection sales materials.

Strategic Wealth Management Industry in Europe Market Outlook

The strategic outlook for the wealth management industry in Europe is one of continued expansion and transformation. Future market potential is significant, driven by ongoing wealth creation and the increasing sophistication of investor needs. Growth accelerators will be centered on embracing digital transformation in wealth management, further integrating AI and big data to deliver hyper-personalized client experiences and operational efficiencies. Strategic opportunities lie in expanding offerings in sustainable and ESG investing, catering to a growing demand for ethical portfolios. The development of accessible and user-friendly platforms will be crucial for capturing the burgeoning mass affluent segment. Mergers and acquisitions will continue to play a role in consolidation and market share expansion, as firms seek to enhance capabilities and broaden their geographic reach. The emphasis on holistic financial planning, encompassing beyond traditional investments, will also define future success.

Wealth Management Industry in Europe Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluent

- 1.4. Other Client Types

-

2. Wealth Management Firm

- 2.1. Private Bankers

- 2.2. Family Offices

- 2.3. Other Wealth Management Firms

Wealth Management Industry in Europe Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. United Kingdom

- 5. Rest of Europe

Wealth Management Industry in Europe Regional Market Share

Geographic Coverage of Wealth Management Industry in Europe

Wealth Management Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluent

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 5.2.1. Private Bankers

- 5.2.2. Family Offices

- 5.2.3. Other Wealth Management Firms

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. United Kingdom

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Italy Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluent

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 6.2.1. Private Bankers

- 6.2.2. Family Offices

- 6.2.3. Other Wealth Management Firms

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Germany Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluent

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 7.2.1. Private Bankers

- 7.2.2. Family Offices

- 7.2.3. Other Wealth Management Firms

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. France Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluent

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 8.2.1. Private Bankers

- 8.2.2. Family Offices

- 8.2.3. Other Wealth Management Firms

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Kingdom Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluent

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 9.2.1. Private Bankers

- 9.2.2. Family Offices

- 9.2.3. Other Wealth Management Firms

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of Europe Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluent

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 10.2.1. Private Bankers

- 10.2.2. Family Offices

- 10.2.3. Other Wealth Management Firms

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allianz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sachroders PLC**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UBS Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HSBC Holdings

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amundi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXA Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BNP Paribas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aegon N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Credit Suisse

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Legal and General

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Allianz

List of Figures

- Figure 1: Wealth Management Industry in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Wealth Management Industry in Europe Share (%) by Company 2025

List of Tables

- Table 1: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 3: Wealth Management Industry in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 5: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 6: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 9: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 11: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 12: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 15: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 17: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 18: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wealth Management Industry in Europe?

The projected CAGR is approximately 4.41%.

2. Which companies are prominent players in the Wealth Management Industry in Europe?

Key companies in the market include Allianz, Sachroders PLC**List Not Exhaustive, UBS Group, HSBC Holdings, Amundi, AXA Group, BNP Paribas, Aegon N V, Credit Suisse, Legal and General.

3. What are the main segments of the Wealth Management Industry in Europe?

The market segments include Client Type, Wealth Management Firm.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

September 2022: UBS was set to acquire the Millennial and Gen Z-focused Wealthfront. UBS and wealth management platform Wealthfront have pulled out of a proposed acquisition deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wealth Management Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wealth Management Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wealth Management Industry in Europe?

To stay informed about further developments, trends, and reports in the Wealth Management Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence