Key Insights

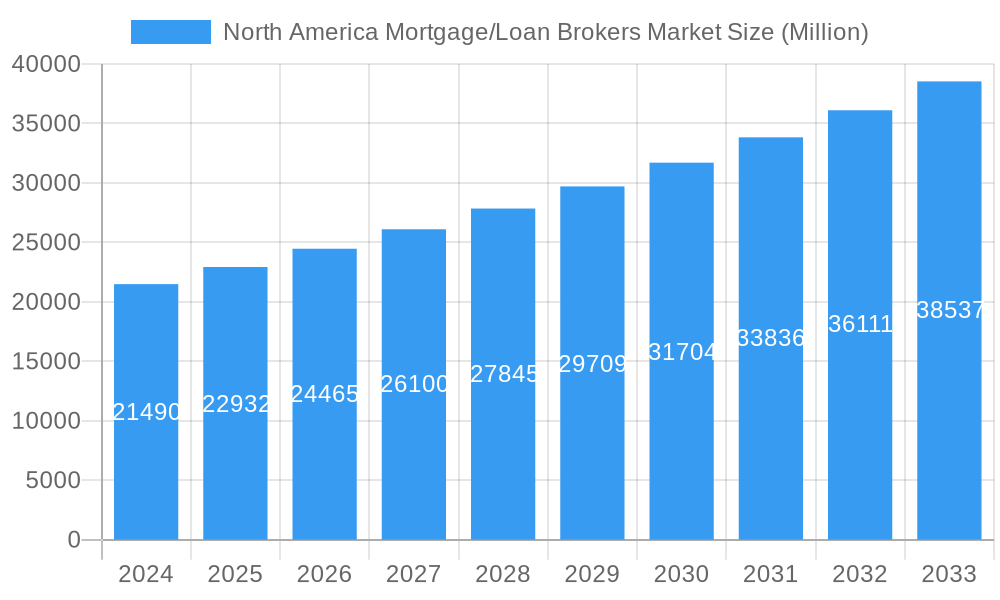

The North America mortgage and loan broker market is poised for robust growth, projected to reach a significant $21.49 billion in 2024. This expansion is fueled by a CAGR of 6.6% over the forecast period, indicating a dynamic and expanding landscape for mortgage and loan brokerage services. The market's strength is underpinned by several key drivers, including increasing demand for homeownership, particularly among millennials and Gen Z entering the housing market, and the ongoing need for financing for commercial and industrial ventures. Government initiatives aimed at stimulating economic activity and supporting small businesses also contribute to the demand for loan brokerage services. Furthermore, the complexity of mortgage and loan products, coupled with evolving regulatory environments, necessitates the expertise and guidance that loan brokers provide, making their services indispensable for both individuals and businesses navigating these financial processes.

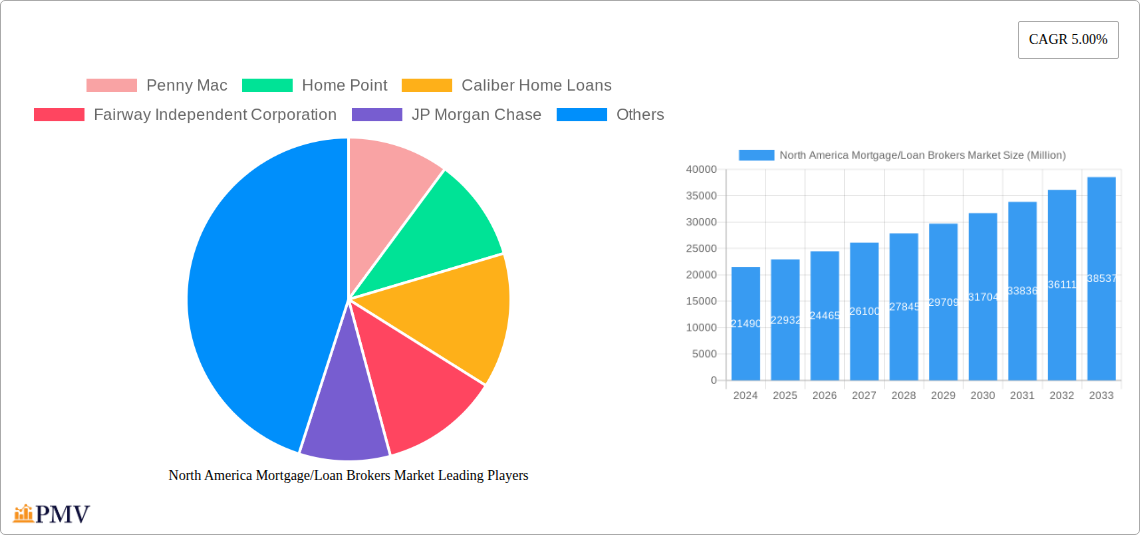

North America Mortgage/Loan Brokers Market Market Size (In Billion)

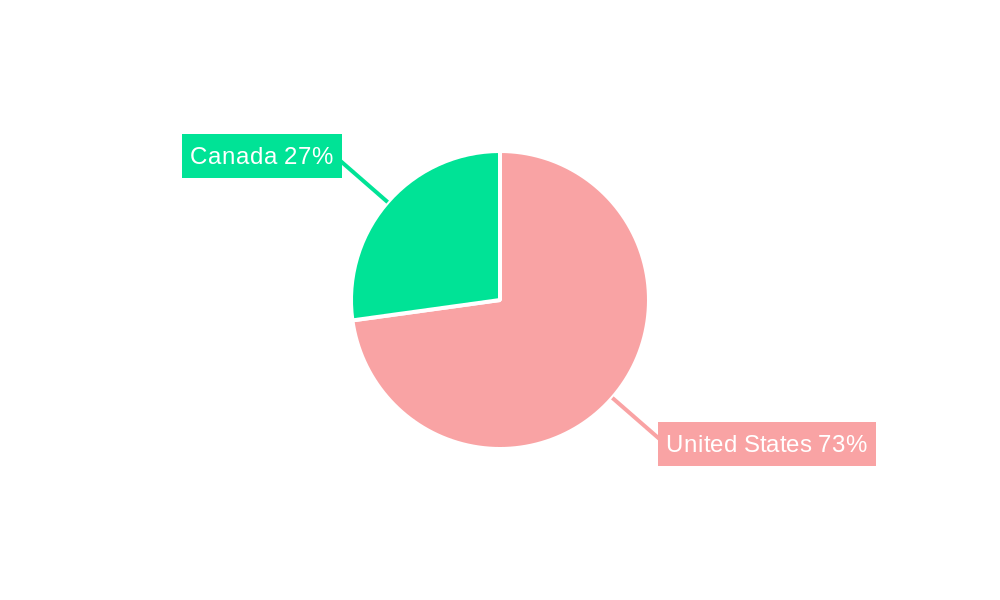

The market is segmented to reflect the diverse needs of its clientele. In terms of enterprise size, large enterprises, alongside a growing number of small and medium-sized businesses, are actively seeking loan brokerage services. The application landscape is dominated by demand for home loans, commercial and industrial loans, and vehicle loans, with loans to governments and other miscellaneous loan types also forming significant segments. The end-user base comprises a substantial number of businesses and individuals. Geographically, the United States commands the largest market share, with Canada also representing a key region. Emerging trends include a greater adoption of digital platforms for loan origination and client management, enhancing efficiency and customer experience. However, the market faces restraints such as tightening credit conditions, rising interest rates, and stringent regulatory compliance, which can impact loan volumes and broker profitability. Nevertheless, the overall outlook remains positive, driven by the fundamental need for accessible and tailored financing solutions.

North America Mortgage/Loan Brokers Market Company Market Share

North America Mortgage/Loan Brokers Market: Comprehensive Market Analysis & Forecast (2019–2033)

This in-depth report provides a definitive analysis of the North America Mortgage/Loan Brokers Market, offering critical insights into its structure, trends, and future trajectory. Spanning the historical period of 2019–2024 and forecasting through 2033, with 2025 as the base and estimated year, this study is an indispensable resource for stakeholders seeking to understand the competitive landscape, growth drivers, and strategic opportunities within this dynamic sector. The report delves into detailed segmentation across enterprise size, loan application types, end-user demographics, and key geographical markets, providing actionable intelligence for strategic decision-making.

North America Mortgage/Loan Brokers Market Market Structure & Competitive Dynamics

The North America mortgage and loan broker market is characterized by a moderate level of concentration, with a significant presence of both large, established financial institutions and a growing number of agile, specialized firms. The market share distribution reflects this dynamic, with leading entities like JP Morgan Chase and Royal Bank of Canada holding substantial portions, alongside key mortgage originators such as Penny Mac and Home Point. Innovation is a critical differentiator, driven by technological advancements in digital lending platforms, e-signature solutions, and data analytics, fostering an ecosystem where efficiency and customer experience are paramount. Regulatory frameworks, including those overseen by the Consumer Financial Protection Bureau (CFPB) in the U.S. and the Office of the Superintendent of Financial Institutions (OSFI) in Canada, significantly influence market operations and product offerings, ensuring compliance and consumer protection. While direct product substitutes are limited, the efficiency and accessibility of online lenders and in-house lending departments at major banks present indirect competitive pressures. End-user preferences are shifting towards faster, more transparent, and digital-first loan application processes. Mergers and acquisitions (M&A) activity remains a key strategy for consolidation and market expansion, with recent deal values often in the hundreds of millions of dollars, as companies aim to acquire technology, market share, or specialized expertise.

North America Mortgage/Loan Brokers Market Industry Trends & Insights

The North America mortgage and loan broker market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This expansion is fueled by a confluence of factors, including sustained demand for housing, evolving consumer preferences for convenient and digitalized financial services, and supportive economic policies in both the United States and Canada. Technological disruptions are at the forefront, with the increasing adoption of artificial intelligence (AI) for loan underwriting, blockchain for enhanced security and transparency in transactions, and advanced data analytics for personalized product offerings. The integration of e-signature and eVault technologies is streamlining the mortgage closing process, significantly reducing turnaround times and improving operational efficiency. Consumer preferences are leaning heavily towards digital channels for research, application, and communication, demanding a seamless, intuitive user experience. Competitive dynamics are intensifying, with established players and emerging fintech companies vying for market share through competitive pricing, innovative product development, and superior customer service. The market penetration of digital mortgage solutions is steadily increasing, indicating a fundamental shift in how consumers and businesses access financing. Furthermore, regulatory changes, while sometimes presenting challenges, often spur innovation by creating a more standardized and secure lending environment. The focus on personalized loan products, catering to diverse individual and business needs, is also a significant trend shaping the industry's evolution, moving beyond one-size-fits-all solutions to meet the specific financial goals of a broad customer base.

Dominant Markets & Segments in North America Mortgage/Loan Brokers Market

The United States stands as the dominant geographical market within the North America Mortgage/Loan Brokers Market, driven by its larger population, robust housing market, and a more complex and varied financial ecosystem. Its market size is estimated to be in the trillions of dollars, significantly outweighing Canada. Within the U.S., Home Loans represent the largest application segment, accounting for a substantial portion of the market share, driven by consistent homeownership aspirations and a well-established real estate sector.

- Enterprise Size: The Large enterprise segment, encompassing major financial institutions and national mortgage lenders, commands a significant market share due to their extensive resources, brand recognition, and broad product portfolios. However, Small and Medium-sized enterprises are increasingly gaining traction by offering specialized services, niche market focus, and agile customer service, often leveraging technology to compete effectively.

- Application: Home Loans are the primary revenue generators, encompassing purchase mortgages, refinances, and home equity loans. The Commercial and Industrial Loans segment is also substantial, serving the financing needs of businesses. Vehicle Loans represent a significant but distinct market. Loans to Governments are a smaller but stable segment. Others, including personal loans and specialized financing, contribute to the market's diversity.

- End-User: Individuals are the largest end-user group, primarily through home loans and vehicle financing. Businesses constitute a significant segment, utilizing commercial and industrial loans for expansion, operations, and investment.

- Geography: The United States dominates due to its economic scale and housing market activity. Canada represents a substantial secondary market, with its own unique regulatory environment and economic drivers influencing mortgage and loan broker activities.

Key drivers for U.S. dominance include its substantial GDP, diversified economy, and strong culture of homeownership. Favorable economic policies, such as fluctuating interest rates that can stimulate refinancing, and infrastructure developments that support real estate growth, further bolster the market. In Canada, economic stability, government housing initiatives, and a consistent demand for residential mortgages are key growth factors.

North America Mortgage/Loan Brokers Market Product Innovations

Product innovations in the North America mortgage and loan brokers market are primarily driven by technological advancements and the pursuit of enhanced customer convenience and efficiency. Key developments include the widespread adoption of digital mortgage platforms that streamline the entire loan application, underwriting, and closing process. The increasing use of eNotes and eVaults, facilitated by companies like Snapdocs, is revolutionizing mortgage transactions by enabling secure, digital record-keeping and faster closings. AI-powered underwriting tools are enhancing accuracy and speed, while personalized loan product offerings, tailored to individual borrower profiles and needs, are becoming more prevalent. These innovations provide competitive advantages by reducing costs, improving turnaround times, and offering a superior customer experience.

Report Segmentation & Scope

This report segments the North America Mortgage/Loan Brokers Market comprehensively.

Enterprise: The market is analyzed across Large, Small, and Medium-sized enterprises, each with distinct operational strategies, market shares, and growth potentials.

Application: Key application segments include Home Loans, Commercial and Industrial Loans, Vehicle Loans, Loans to Governments, and Others. Each segment exhibits unique market dynamics, demand drivers, and competitive landscapes, with projected market sizes and growth rates detailed.

End-User: The analysis covers Businesses and Individuals, reflecting their diverse financing needs and the specialized products and services offered to each.

Geography: The report provides in-depth analysis for the United States and Canada, detailing their respective market sizes, growth projections, and competitive dynamics within the broader North American context.

Key Drivers of North America Mortgage/Loan Brokers Market Growth

Several key drivers are propelling the North America Mortgage/Loan Brokers Market. Technological advancements, particularly in digital lending platforms, AI for underwriting, and e-signature solutions, are enhancing efficiency and customer experience. Economic factors, including fluctuating interest rates that influence refinancing activity and overall housing demand, play a crucial role. Government initiatives and regulatory frameworks that promote fair lending practices and streamline the mortgage process also contribute to growth. The sustained demand for homeownership in both the U.S. and Canada, coupled with evolving consumer preferences for accessible and digital financial services, further fuels market expansion.

Challenges in the North America Mortgage/Loan Brokers Market Sector

Despite strong growth, the North America Mortgage/Loan Brokers Market faces several challenges. Regulatory hurdles and evolving compliance requirements can increase operational costs and complexity. Interest rate volatility can impact loan demand and profitability. Intense competitive pressures from both traditional lenders and fintech disruptors necessitate continuous innovation and cost-efficiency. Cybersecurity threats and data privacy concerns are paramount, requiring significant investment in security measures. Economic downturns or recessions can lead to reduced borrowing and increased default rates, posing a significant risk to the market.

Leading Players in the North America Mortgage/Loan Brokers Market Market

- Penny Mac

- Home Point

- Caliber Home Loans

- Fairway Independent Corporation

- JP Morgan Chase

- Royal Bank of Canada

- Flagstar Bank

- PNC Bank

- Ally

- New American Funding

Key Developments in North America Mortgage/Loan Brokers Market Sector

- November 2022: Primary Residential Mortgage Inc. (PRMI) employed the eVault and digital closing platform from Snapdocs to expand the use of eNotes across 250 locations in 49 states, enhancing digital transaction capabilities and operational efficiency.

- August 2022: Due to the slowdown in home sales caused by rising interest rates, two of the largest mortgage originators in the U.S., Rocket Mortgage and United Wholesale Mortgage, are increasing pressure on their smaller rivals by providing discounts and other incentives, pursuing aggressive strategies at a time when many lenders are leaving the market or going out of business.

Strategic North America Mortgage/Loan Brokers Market Market Outlook

The strategic outlook for the North America Mortgage/Loan Brokers Market is one of continued innovation and expansion, driven by digitalization and evolving consumer demands. Companies that can successfully integrate cutting-edge technology, offer personalized financial solutions, and navigate the complex regulatory landscape will be best positioned for growth. Opportunities lie in expanding digital offerings, focusing on niche markets, and leveraging data analytics to enhance customer engagement and risk management. Strategic partnerships and potential M&A activities will continue to shape the competitive environment, leading to a more consolidated yet dynamic market. The emphasis on seamless digital experiences and efficient loan processing will remain a critical growth accelerator.

North America Mortgage/Loan Brokers Market Segmentation

-

1. Enterprise

- 1.1. Large

- 1.2. Small

- 1.3. Medium- sized

-

2. Application

- 2.1. Home Loans

- 2.2. Commercial and Industrial Loans

- 2.3. Vehicle Loans

- 2.4. Loans to Governments

- 2.5. Others

-

3. End - User

- 3.1. Businesses

- 3.2. Individuals

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Mortgage/Loan Brokers Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Mortgage/Loan Brokers Market Regional Market Share

Geographic Coverage of North America Mortgage/Loan Brokers Market

North America Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Digitization in Lending and Blockchain Technology is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 5.1.1. Large

- 5.1.2. Small

- 5.1.3. Medium- sized

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Loans

- 5.2.2. Commercial and Industrial Loans

- 5.2.3. Vehicle Loans

- 5.2.4. Loans to Governments

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End - User

- 5.3.1. Businesses

- 5.3.2. Individuals

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 6. United States North America Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Enterprise

- 6.1.1. Large

- 6.1.2. Small

- 6.1.3. Medium- sized

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Home Loans

- 6.2.2. Commercial and Industrial Loans

- 6.2.3. Vehicle Loans

- 6.2.4. Loans to Governments

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End - User

- 6.3.1. Businesses

- 6.3.2. Individuals

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Enterprise

- 7. Canada North America Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Enterprise

- 7.1.1. Large

- 7.1.2. Small

- 7.1.3. Medium- sized

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Home Loans

- 7.2.2. Commercial and Industrial Loans

- 7.2.3. Vehicle Loans

- 7.2.4. Loans to Governments

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End - User

- 7.3.1. Businesses

- 7.3.2. Individuals

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Enterprise

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Penny Mac

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Home Point

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Caliber Home Loans

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Fairway Independent Corporation

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 JP Morgan Chase

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Royal Bank of Canada

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Flagstar Bank

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 PNC Bank

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Ally

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 New American Funding**List Not Exhaustive

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Penny Mac

List of Figures

- Figure 1: Global North America Mortgage/Loan Brokers Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: United States North America Mortgage/Loan Brokers Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 3: United States North America Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 4: United States North America Mortgage/Loan Brokers Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: United States North America Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: United States North America Mortgage/Loan Brokers Market Revenue (undefined), by End - User 2025 & 2033

- Figure 7: United States North America Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 8: United States North America Mortgage/Loan Brokers Market Revenue (undefined), by Geography 2025 & 2033

- Figure 9: United States North America Mortgage/Loan Brokers Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: United States North America Mortgage/Loan Brokers Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: United States North America Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Canada North America Mortgage/Loan Brokers Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 13: Canada North America Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 14: Canada North America Mortgage/Loan Brokers Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Canada North America Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Canada North America Mortgage/Loan Brokers Market Revenue (undefined), by End - User 2025 & 2033

- Figure 17: Canada North America Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 18: Canada North America Mortgage/Loan Brokers Market Revenue (undefined), by Geography 2025 & 2033

- Figure 19: Canada North America Mortgage/Loan Brokers Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Canada North America Mortgage/Loan Brokers Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Canada North America Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 2: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by End - User 2020 & 2033

- Table 4: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 7: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by End - User 2020 & 2033

- Table 9: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 12: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by End - User 2020 & 2033

- Table 14: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Global North America Mortgage/Loan Brokers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mortgage/Loan Brokers Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the North America Mortgage/Loan Brokers Market?

Key companies in the market include Penny Mac, Home Point, Caliber Home Loans, Fairway Independent Corporation, JP Morgan Chase, Royal Bank of Canada, Flagstar Bank, PNC Bank, Ally, New American Funding**List Not Exhaustive.

3. What are the main segments of the North America Mortgage/Loan Brokers Market?

The market segments include Enterprise, Application, End - User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Digitization in Lending and Blockchain Technology is driving the market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2022, To expand the use of eNotes across 250 locations in 49 states, Primary Residential Mortgage Inc. (PRMI) employed the eVault and digital closing platform from Snapdocs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the North America Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence