Key Insights

The China home mortgage finance market is poised for continued expansion, driven by sustained housing demand from a rapidly urbanizing population. In 2025, the market size is projected at $1.6 billion, with a Compound Annual Growth Rate (CAGR) of 6% anticipated between 2025 and 2033. While recent growth has been robust, a period of moderated expansion is expected from 2025 onwards due to government regulations designed to curb excessive leverage and speculative investment in the property sector. These measures, alongside potential economic headwinds, may influence the market's trajectory. Nevertheless, underlying drivers such as increasing household incomes, ongoing urbanization, and the strong cultural preference for homeownership will continue to support market growth, albeit at a more measured pace.

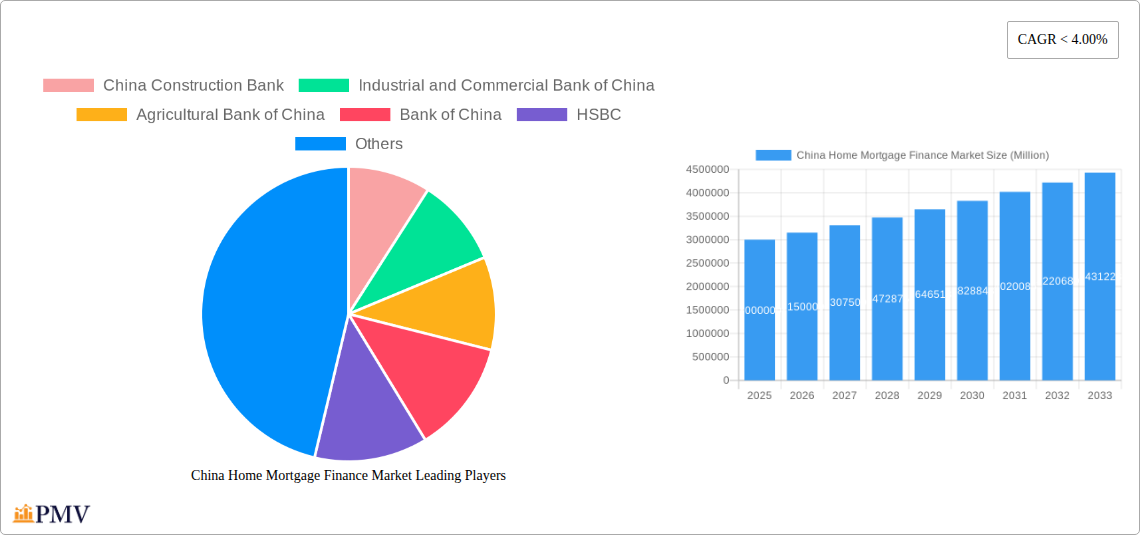

China Home Mortgage Finance Market Market Size (In Billion)

The long-term outlook for the China home mortgage finance market remains positive, with anticipated fluctuations influenced by macroeconomic conditions and evolving government policies. The projected CAGR of 6% for the 2025-2033 forecast period reflects a balance between persistent demand and regulatory efforts to maintain financial stability. The market is expected to witness a shift towards more sustainable and responsible lending practices, focusing on affordability and risk mitigation. This will shape the strategies of financial institutions, leading to innovative products and services for a more discerning borrower base.

China Home Mortgage Finance Market Company Market Share

Deep Dive into the China Home Mortgage Finance Market: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the China Home Mortgage Finance Market, offering invaluable insights for investors, lenders, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential. The study period spans the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering a holistic view of this dynamic market. Expected market size values are provided throughout the report, even where precise figures are unavailable (indicated by “xx Million”).

China Home Mortgage Finance Market Market Structure & Competitive Dynamics

The China Home Mortgage Finance Market exhibits a highly concentrated structure dominated by a few major players. State-owned banks, including China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, and Bank of China, command significant market share, leveraging their extensive branch networks and established customer bases. Other key players include HSBC, Bank of Communications, and Postal Savings Bank of China. However, the market is not without competitive pressures, with smaller banks and fintech companies increasingly vying for market share.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Innovation Ecosystems: While innovation is present, it’s largely driven by technological advancements in risk assessment and digital lending platforms, rather than radical product disruption.

- Regulatory Frameworks: Stringent regulations imposed by the Chinese government significantly impact lending practices and risk management. These regulations influence market entry, lending rates, and loan-to-value ratios.

- Product Substitutes: The primary substitute for home mortgages is personal savings, impacting market growth particularly in periods of economic uncertainty.

- End-User Trends: Increasing urbanization and a growing middle class fuel demand for housing and mortgages. However, fluctuating property prices and government policies influence demand.

- M&A Activities: The value of M&A activity in the sector in 2024 was estimated at xx Million. Consolidation among smaller players is anticipated, driven by the need for scale and enhanced technological capabilities.

China Home Mortgage Finance Market Industry Trends & Insights

The China Home Mortgage Finance Market is characterized by a complex interplay of factors influencing its growth trajectory. From 2019 to 2024, the market experienced a CAGR of xx%, driven primarily by robust housing demand and government initiatives. However, the market faced significant headwinds in 2022 and 2023, triggered by a slowdown in the real estate sector and stricter regulatory measures aimed at curbing excessive risk-taking. These challenges are anticipated to temper growth in the near term, though the long-term outlook remains positive, with a projected CAGR of xx% from 2025 to 2033. Consumer preferences are shifting towards digital mortgage applications and more flexible repayment options. Technological disruptions such as AI-powered credit scoring and blockchain-based transaction systems are gradually changing market dynamics. Competitive dynamics are shaping the landscape, pushing banks to innovate and offer more competitive products and services. Market penetration of digital mortgage platforms is expected to reach xx% by 2033.

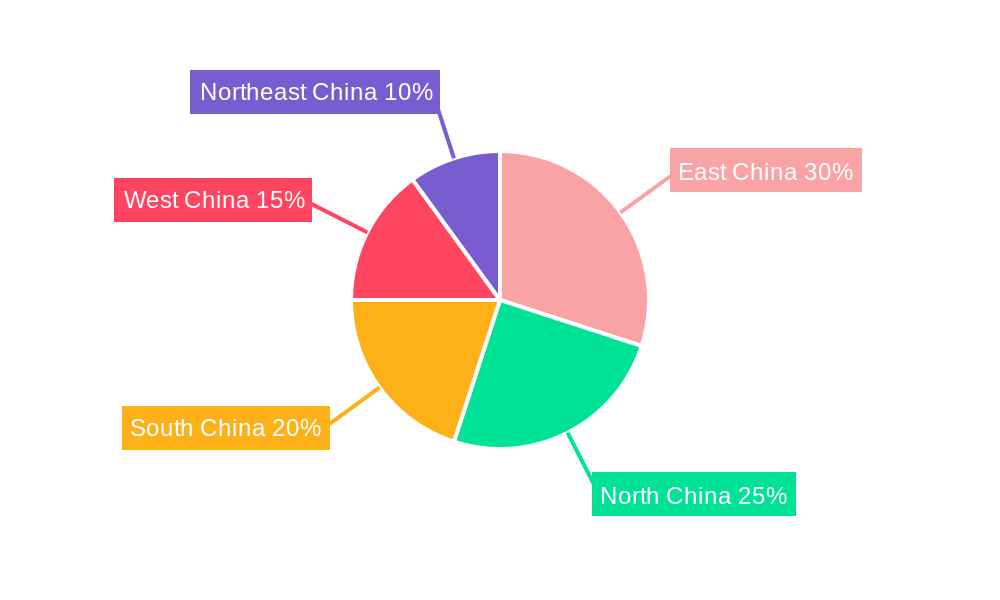

Dominant Markets & Segments in China Home Mortgage Finance Market

Tier 1 and Tier 2 cities in coastal regions like Guangdong, Jiangsu, and Zhejiang provinces represent the dominant markets within China’s home mortgage finance sector.

- Key Drivers:

- Rapid Urbanization: Massive internal migration fuels demand for housing in these economically vibrant regions.

- Robust Economic Growth (historically): Strong economic growth in these areas historically supported higher disposable incomes and increased purchasing power.

- Government Infrastructure Investment: Extensive infrastructure development in these cities has attracted investments and fueled property development.

- Favorable Government Policies (Historically): Past government policies have generally supported homeownership, including tax incentives and subsidized mortgages.

The dominance of these regions is attributed to a confluence of factors: higher disposable incomes, robust economic activity, substantial infrastructure investments, and government policies that historically supported homeownership. However, recent government measures aimed at cooling the real estate market have tempered growth in these regions.

China Home Mortgage Finance Market Product Innovations

Recent innovations in the China home mortgage finance market focus on improving efficiency and access. Digital mortgage applications, AI-powered credit scoring, and streamlined loan processing are becoming increasingly prevalent, enhancing speed and convenience for borrowers. Furthermore, the integration of fintech solutions is allowing for more flexible repayment options, catering to the diverse needs of borrowers. These innovations are aimed at improving customer experience and driving greater market penetration.

Report Segmentation & Scope

This report segments the China home mortgage finance market across several key parameters:

By Loan Type: This includes conventional mortgages, government-backed loans, and other specialized loan products. Growth projections vary significantly depending on the type of loan, with government-backed loans maintaining a relatively stable growth rate. Competitive dynamics are influenced by government regulations and the availability of capital.

By Geographic Location: Segmentation considers regional variations in demand, economic activity, and regulatory environments, as discussed above.

By Borrower Type: This encompasses individual borrowers and corporate entities. Each segment exhibits distinct characteristics impacting lending strategies and risk profiles.

Key Drivers of China Home Mortgage Finance Market Growth

The growth of the China home mortgage finance market is driven by several key factors:

- Increasing Urbanization: A continuous influx of population into urban centers fuels strong demand for housing and mortgages.

- Rising Disposable Incomes: A growing middle class with higher disposable incomes significantly contributes to increased mortgage applications.

- Government Support (Historically): Historically favorable government policies towards homeownership have played a crucial role in driving market growth.

- Technological Advancements: Innovations in digital lending and risk assessment enhance efficiency and affordability.

Challenges in the China Home Mortgage Finance Market Sector

The China home mortgage finance market faces several significant challenges:

- Real Estate Market Volatility: Fluctuations in property prices and government regulations impacting the real estate sector pose risks to lending institutions.

- Regulatory Uncertainty: Changes in government policies and regulations regarding mortgage lending can introduce uncertainty and impact market stability.

- Non-Performing Loans: The risk of non-performing loans remains a concern, especially during periods of economic slowdown.

- Competition: Increased competition among financial institutions intensifies pressure on profit margins.

Leading Players in the China Home Mortgage Finance Market Market

- China Construction Bank

- Industrial and Commercial Bank of China

- Agricultural Bank of China

- Bank of China

- HSBC

- Bank of Communications

- Postal Savings Bank of China

- List Not Exhaustive

Key Developments in China Home Mortgage Finance Market Sector

September 2022: China Construction Bank Corp. announces a 30-billion-yuan (USD 4.2 billion) fund to purchase properties from developers, attempting to stabilize the real estate market amidst a crisis. This move significantly impacted market sentiment and investor confidence.

October 2022: HSBC expands its private banking network in China, launching in two new cities. This expansion indicates growing confidence in the long-term prospects of the Chinese market, despite short-term challenges.

Strategic China Home Mortgage Finance Market Market Outlook

The long-term outlook for the China Home Mortgage Finance Market remains positive, despite short-term challenges. Continued urbanization, growth of the middle class, and technological advancements will drive growth. Opportunities lie in leveraging technology to improve efficiency, expanding into underserved markets, and developing innovative financial products. Strategic partnerships with fintech companies and a focus on risk management will be critical for success in this evolving market.

China Home Mortgage Finance Market Segmentation

-

1. Types of Lenders

- 1.1. Banks

- 1.2. House Provident Fund (HPF)

-

2. Financing Options

- 2.1. Personal New Housing Loan

- 2.2. Personal Second-hand Housing Loan

- 2.3. Personal Housing Provident Fund (Portfolio) Loan

-

3. Types of Mortgage

- 3.1. Fixed

- 3.2. Variable

China Home Mortgage Finance Market Segmentation By Geography

- 1. China

China Home Mortgage Finance Market Regional Market Share

Geographic Coverage of China Home Mortgage Finance Market

China Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Favorable Mortgage Rates is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Home Mortgage Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types of Lenders

- 5.1.1. Banks

- 5.1.2. House Provident Fund (HPF)

- 5.2. Market Analysis, Insights and Forecast - by Financing Options

- 5.2.1. Personal New Housing Loan

- 5.2.2. Personal Second-hand Housing Loan

- 5.2.3. Personal Housing Provident Fund (Portfolio) Loan

- 5.3. Market Analysis, Insights and Forecast - by Types of Mortgage

- 5.3.1. Fixed

- 5.3.2. Variable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Types of Lenders

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Construction Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Industrial and Commercial Bank of China

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agricultural Bank of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bank of China

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HSBC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bank of Communications

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Postal Savings Bank of China**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 China Construction Bank

List of Figures

- Figure 1: China Home Mortgage Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Home Mortgage Finance Market Share (%) by Company 2025

List of Tables

- Table 1: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Lenders 2020 & 2033

- Table 2: China Home Mortgage Finance Market Revenue billion Forecast, by Financing Options 2020 & 2033

- Table 3: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Mortgage 2020 & 2033

- Table 4: China Home Mortgage Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Lenders 2020 & 2033

- Table 6: China Home Mortgage Finance Market Revenue billion Forecast, by Financing Options 2020 & 2033

- Table 7: China Home Mortgage Finance Market Revenue billion Forecast, by Types of Mortgage 2020 & 2033

- Table 8: China Home Mortgage Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Home Mortgage Finance Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the China Home Mortgage Finance Market?

Key companies in the market include China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, HSBC, Bank of Communications, Postal Savings Bank of China**List Not Exhaustive.

3. What are the main segments of the China Home Mortgage Finance Market?

The market segments include Types of Lenders, Financing Options, Types of Mortgage.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Favorable Mortgage Rates is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: HSBC expands China's private banking network and launches in two new cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the China Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence