Key Insights

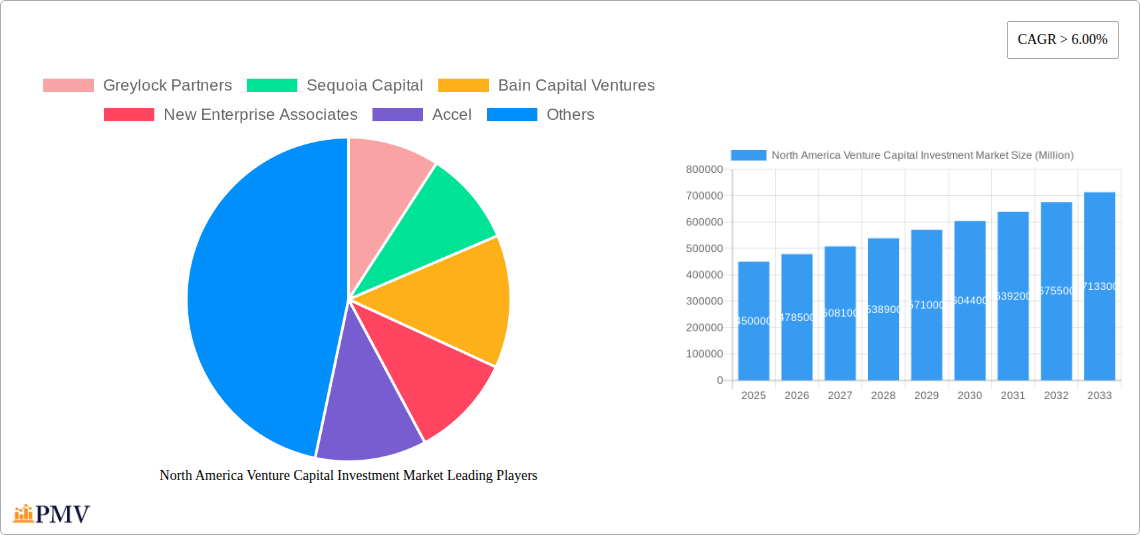

The North America Venture Capital Investment Market is poised for significant expansion, projected to reach an estimated USD 450,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This dynamic growth is fueled by a confluence of innovative drivers, including the accelerating digital transformation across industries, the burgeoning demand for sustainable solutions, and the continuous emergence of groundbreaking technologies in sectors like Artificial Intelligence, biotechnology, and clean energy. Venture capital firms are strategically channeling investments into early-stage startups and established growth-stage companies, recognizing the immense potential for high returns. The industry landscape is characterized by intense competition among leading firms such as Sequoia Capital, Greylock Partners, and Accel, who are actively seeking out disruptive business models and scalable technologies to gain a competitive edge. Emerging trends like the increasing focus on Environmental, Social, and Governance (ESG) investing, the rise of impact investing, and the growing significance of SaaS-based business models are further shaping investment strategies and driving market evolution.

North America Venture Capital Investment Market Market Size (In Billion)

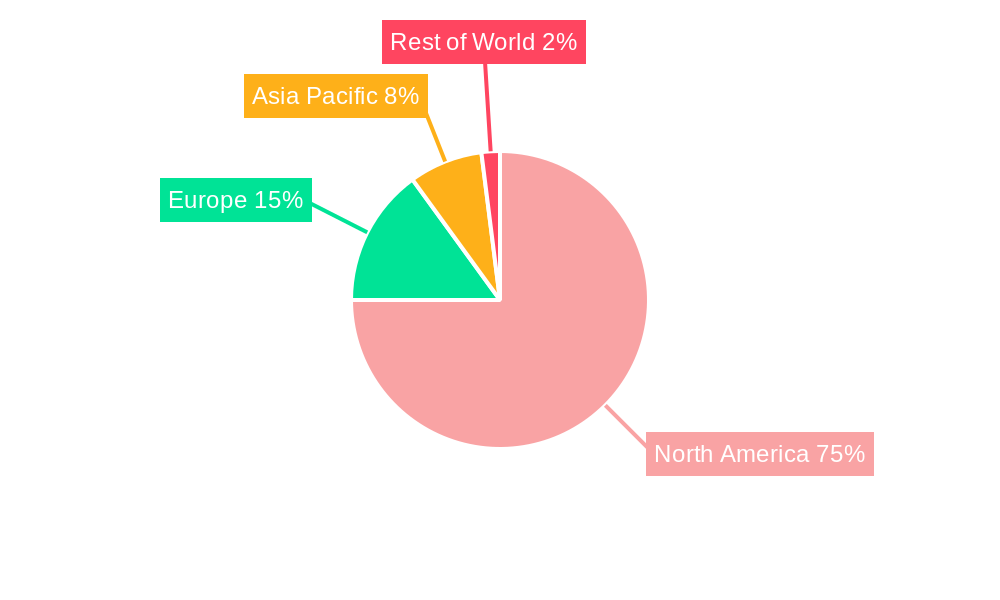

Despite the optimistic outlook, the market faces certain restraints that could temper growth. These include increasing regulatory scrutiny on tech giants and venture capital activities, potential economic slowdowns impacting investor confidence and funding availability, and a tightening of exit opportunities due to market volatility. Geographically, North America, particularly the United States, continues to dominate the venture capital landscape, attracting the lion's share of investments due to its mature innovation ecosystem, access to talent, and well-established venture capital infrastructure. However, regions like Canada and Mexico are also witnessing increasing investor interest, driven by their growing startup ecosystems and favorable investment climates. The market segmentation reveals a strong emphasis on Fintech, Pharma and Biotech, and IT Hardware and Services, reflecting the areas with the highest perceived potential for innovation and substantial returns. The ongoing evolution of investment stages, from early-stage seed funding to substantial later-stage investments, underscores the market's maturity and its capacity to support companies throughout their growth trajectory.

North America Venture Capital Investment Market Company Market Share

This comprehensive report delves into the dynamic North America Venture Capital Investment Market, providing an in-depth analysis of its current state and future trajectory. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this research is built on a robust historical analysis (2019–2024). It offers critical insights for investors, startups, and industry stakeholders seeking to navigate the evolving venture capital landscape in the United States and Canada. Leveraging high-ranking keywords such as venture capital deals, startup funding, early-stage investment, late-stage funding, Fintech ventures, biotech startups, and technology investment, this report is optimized for maximum search visibility and audience engagement.

North America Venture Capital Investment Market Market Structure & Competitive Dynamics

The North America venture capital investment market is characterized by a moderately concentrated structure, with a few dominant firms wielding significant influence, alongside a vibrant ecosystem of smaller, specialized funds. Innovation ecosystems are primarily concentrated in hubs like Silicon Valley, Boston, and Toronto, fostering intense competition and collaboration. Regulatory frameworks, while generally supportive of innovation, can present varying challenges across different jurisdictions within North America. Product substitutes for traditional venture capital funding, such as private equity and crowdfunding, are increasingly prevalent, forcing VC firms to adapt their strategies. End-user trends are heavily influenced by the rapid adoption of disruptive technologies and shifting consumer preferences, particularly in the digital and sustainability sectors. Mergers and acquisition (M&A) activities are a critical component of market dynamics, with deal values in the billions of dollars, often involving strategic consolidations and the acquisition of innovative startups by larger entities. For instance, the venture capital deal value in the last historical year reached an estimated $180 Billion, reflecting a steady upward trend. Key players like Sequoia Capital and New Enterprise Associates consistently lead in M&A volume and value, driving market consolidation and shaping the competitive landscape.

North America Venture Capital Investment Market Industry Trends & Insights

The North America venture capital investment market is witnessing unprecedented growth, driven by a confluence of factors including robust economic conditions, a surge in technological innovation, and an increasing appetite for high-risk, high-reward investments. The CAGR (Compound Annual Growth Rate) is projected to be approximately 12.5% over the forecast period. Technological disruptions, particularly in AI, quantum computing, and biotechnology, are creating new investment frontiers and fueling the emergence of disruptive startups. Consumer preferences are rapidly evolving towards personalized experiences, sustainable solutions, and digital-first offerings, directly impacting investment flows into sectors like e-commerce, health tech, and clean energy. The competitive dynamics are intensifying, with both established VC firms and new entrants vying for deal flow and promising ventures. The market penetration of venture capital funding continues to expand beyond traditional tech hubs, reaching emerging innovation centers across the continent. A key trend observed is the increasing allocation of capital towards impact investing and ESG-focused ventures, reflecting a growing awareness of societal and environmental concerns among limited partners and venture capitalists alike. Furthermore, the rise of corporate venture capital arms signifies a strategic move by large corporations to stay ahead of innovation curves and secure access to groundbreaking technologies. The ongoing digital transformation across all industries is a perpetual catalyst for venture capital activity, with significant investments channeled into software-as-a-service (SaaS), cybersecurity, and cloud computing solutions.

Dominant Markets & Segments in North America Venture Capital Investment Market

Within the North America Venture Capital Investment Market, Early-stage Investing consistently emerges as a dominant segment, characterized by a high volume of deals and a significant influx of capital allocated to promising startups at their nascent stages. The United States, particularly California, Massachusetts, and New York, remains the leading region for venture capital activity, driven by its well-established innovation ecosystems, access to skilled talent, and supportive economic policies. Canada, with its burgeoning tech hubs in Toronto, Vancouver, and Montreal, is rapidly gaining prominence.

Key drivers for dominance in the Angel/Seed Investing and Early-stage Investing segments include the availability of substantial seed capital from angel investors and early-stage venture funds, coupled with a robust pipeline of entrepreneurial talent. Economic policies promoting entrepreneurship and research & development further bolster these segments.

In terms of industry, Fintech and Pharma and Biotech are spearheading investment trends. The Fintech sector benefits from widespread digital adoption, the demand for innovative financial solutions, and regulatory advancements. Pharma and Biotech are experiencing a renaissance fueled by breakthroughs in genomics, personalized medicine, and the ongoing need for novel healthcare solutions, especially post-pandemic. The IT Hardware and Services sector also maintains strong investor interest, driven by the continuous evolution of cloud computing, AI infrastructure, and the Internet of Things (IoT).

- Angel/Seed Investing: Driven by a high number of individual investors and early-stage funds actively seeking disruptive ideas and strong founding teams. Economic policies that incentivize early-stage investment, such as tax credits, play a crucial role.

- Early-stage Investing: Characterized by significant capital deployment into startups with proven traction and a clear path to scalability. The availability of experienced mentors and accelerators further nurtures this stage.

- Later-stage Investing: Dominated by growth equity and buyouts, focusing on companies with established revenue streams and proven business models seeking capital for expansion and market dominance.

The dominance of these segments is further amplified by the presence of leading venture capital firms that specialize in these areas, such as Greylock Partners and Accel, consistently deploying capital and supporting portfolio companies through their growth journeys.

North America Venture Capital Investment Market Product Innovations

Product innovations within the North America Venture Capital Investment Market are primarily driven by advancements in AI, machine learning, and data analytics, leading to the development of novel platforms and solutions across various sectors. These innovations aim to enhance efficiency, personalize user experiences, and address complex societal challenges. For instance, AI-powered diagnostic tools in Pharma and Biotech are revolutionizing drug discovery and patient care, offering significant competitive advantages. Similarly, blockchain-based solutions in Fintech are enhancing security and transparency in financial transactions. The rapid evolution of cloud-native applications and cybersecurity solutions within IT Hardware and Services also reflects a strong emphasis on agility and resilience in the face of evolving threats.

Report Segmentation & Scope

This report meticulously segments the North America Venture Capital Investment Market across key dimensions to provide a granular understanding of its dynamics. The segmentation includes:

Stage of Investment:

- Angel/Seed Investing: This segment focuses on the initial funding rounds for nascent startups, typically involving smaller investment amounts and a higher degree of risk. Growth projections indicate a steady expansion driven by increased entrepreneurial activity.

- Early-stage Investing: This encompasses Series A and B funding rounds, where startups have demonstrated initial traction and are seeking capital for product development, market expansion, and team building. This segment is projected to witness robust growth due to increasing investor confidence in scalable business models.

- Later-stage Investing: This includes Series C and beyond, involving significant capital injections into more mature companies for global expansion, acquisitions, or market consolidation. This segment is anticipated to maintain strong investment flows, especially in high-growth sectors.

Industry:

- Fintech: Projections indicate sustained high growth, driven by digital transformation and the demand for innovative financial services.

- Pharma and Biotech: Expected to see significant growth fueled by R&D breakthroughs and an aging global population.

- Consumer Goods: Moderate growth anticipated, with a focus on innovative and sustainable product offerings.

- Industrial/Energy: Growth influenced by the green energy transition and advancements in automation.

- IT Hardware and Services: Continuous robust growth driven by cloud computing, AI, and cybersecurity needs.

- Other Industries: A broad category encompassing emerging sectors and niche markets, with varied growth potentials.

The scope of this report is confined to the venture capital investment activities within the United States and Canada, covering the stipulated study and forecast periods.

Key Drivers of North America Venture Capital Investment Market Growth

Several key drivers are propelling the growth of the North America Venture Capital Investment Market. Technological advancements, particularly in Artificial Intelligence, Machine Learning, and Biotechnology, are creating new avenues for disruptive innovation and attracting significant investment. A supportive economic environment, characterized by low interest rates and strong consumer spending, fosters investor confidence and capital availability. Government initiatives and policies promoting entrepreneurship, research and development, and the establishment of innovation hubs further stimulate investment. The increasing global demand for scalable technology solutions and the rapid digital transformation across industries are also critical growth accelerators. Furthermore, the growing trend of impact investing, where capital is deployed with the intention to generate positive, measurable social and environmental impact alongside a financial return, is opening up new investment frontiers.

Challenges in the North America Venture Capital Investment Market Sector

Despite its robust growth, the North America Venture Capital Investment Market faces several challenges. Intense competition for promising deal flow among a growing number of venture capital firms can lead to inflated valuations and higher acquisition costs. Regulatory hurdles, though generally favorable, can still pose complexities, particularly concerning cross-border investments and evolving data privacy laws. Talent acquisition and retention remain a significant challenge, as startups vie for skilled professionals in a competitive labor market. Economic uncertainties, such as inflation and potential recessions, can impact investor sentiment and the availability of capital. Supply chain disruptions, particularly for hardware-intensive industries, can affect the operational efficiency and scalability of portfolio companies. Furthermore, the increasing focus on profitability and sustainable growth by LPs (Limited Partners) is pressuring VC funds to demonstrate clear paths to exit and long-term value creation, adding another layer of complexity to investment strategies.

Leading Players in the North America Venture Capital Investment Market Market

- Greylock Partners

- Sequoia Capital

- Bain Capital Ventures

- New Enterprise Associates

- Accel

- Khosla Ventures

- Real Ventures

- Tiger Global Management

- Matrix Partners

- Index Ventures

Key Developments in North America Venture Capital Investment Market Sector

- June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3. This new fund targets venture companies in high-growth sectors, including ICT services such as health tech and fintech, as a limited partner. The fund aims to support business growth and investment in startups in the United States, Canada, and other countries. This development signifies increased international investment interest in North American technology ventures.

- May 2023: AXA Venture Partners, a global venture capital firm, launched a new strategy focused on late-stage tech companies with a EUR 1.5 Billion fund. The firm plans to expand its team in North America to efficiently execute this strategy, indicating a growing appetite for substantial investments in established, high-growth technology companies and a commitment to strengthening its presence in the region.

Strategic North America Venture Capital Investment Market Market Outlook

The strategic outlook for the North America Venture Capital Investment Market remains highly positive, driven by continued innovation, global demand for technology solutions, and a resilient entrepreneurial spirit. Future growth accelerators include the increasing digitalization of traditional industries, the ongoing advancements in AI and biotechnology, and the growing emphasis on sustainability and ESG principles. Opportunities lie in emerging markets, specialized technology niches, and impact-driven ventures. The market is expected to witness a continued trend of strategic partnerships between venture capital firms and established corporations, fostering synergistic growth and accelerating market penetration. The increasing sophistication of investment vehicles and a greater focus on data-driven decision-making will further shape the landscape, ensuring sustained dynamism and attractive returns for investors and entrepreneurs alike.

North America Venture Capital Investment Market Segmentation

-

1. Stage of Investment

- 1.1. Angel/Seed Investing

- 1.2. Early-stage Investing

- 1.3. Later-stage Investing

-

2. Industry

- 2.1. Fintech

- 2.2. Pharma and Biotech

- 2.3. Consumer Goods

- 2.4. Industrial/Energy

- 2.5. IT Hardware and Services

- 2.6. Other Industries

North America Venture Capital Investment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Venture Capital Investment Market Regional Market Share

Geographic Coverage of North America Venture Capital Investment Market

North America Venture Capital Investment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America

- 3.3. Market Restrains

- 3.3.1. Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment

- 3.4. Market Trends

- 3.4.1. Canada Increasing Venture Capital Scenario is Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Venture Capital Investment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 5.1.1. Angel/Seed Investing

- 5.1.2. Early-stage Investing

- 5.1.3. Later-stage Investing

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Fintech

- 5.2.2. Pharma and Biotech

- 5.2.3. Consumer Goods

- 5.2.4. Industrial/Energy

- 5.2.5. IT Hardware and Services

- 5.2.6. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Greylock Partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sequoia Capital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bain Capital Ventures

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 New Enterprise Associates

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Khosla Ventures

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Real Ventures

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tiger Global Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Matrix Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Index Ventures

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Greylock Partners

List of Figures

- Figure 1: North America Venture Capital Investment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Venture Capital Investment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 2: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 3: North America Venture Capital Investment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 5: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 6: North America Venture Capital Investment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Venture Capital Investment Market?

The projected CAGR is approximately 20.3%.

2. Which companies are prominent players in the North America Venture Capital Investment Market?

Key companies in the market include Greylock Partners, Sequoia Capital, Bain Capital Ventures, New Enterprise Associates, Accel, Khosla Ventures, Real Ventures, Tiger Global Management, Matrix Partners, Index Ventures.

3. What are the main segments of the North America Venture Capital Investment Market?

The market segments include Stage of Investment, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America.

6. What are the notable trends driving market growth?

Canada Increasing Venture Capital Scenario is Fueling the Market.

7. Are there any restraints impacting market growth?

Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment.

8. Can you provide examples of recent developments in the market?

June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3, which was a new investment fund targeting venture companies in industry sectors with high growth potential, including ICT services such as health tech and fintech, as a limited partner. This fund was expected to support business growth and Investment in Startups in the United States, Canada, and other countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Venture Capital Investment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Venture Capital Investment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Venture Capital Investment Market?

To stay informed about further developments, trends, and reports in the North America Venture Capital Investment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence