Key Insights

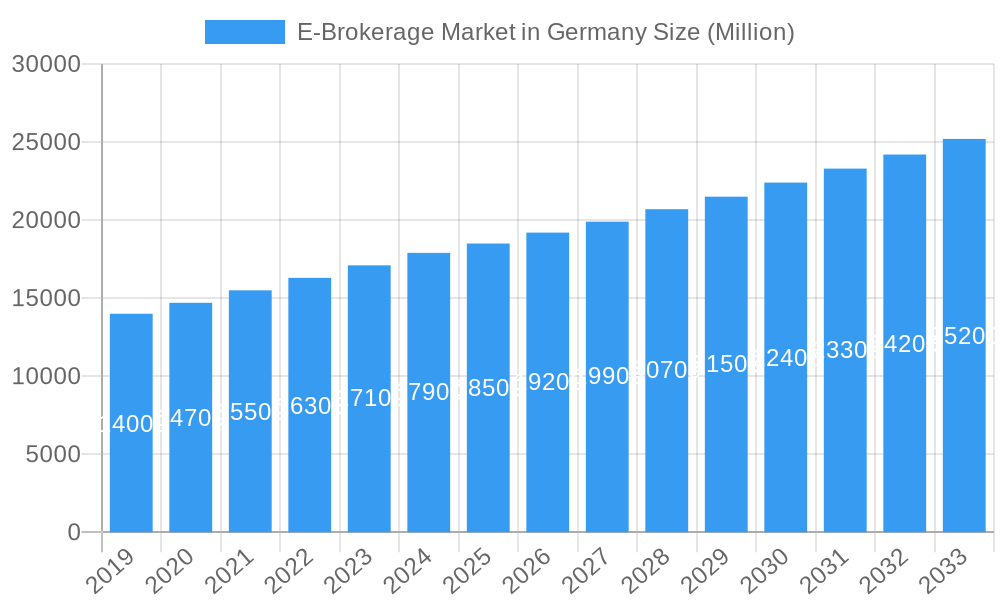

The German E-Brokerage market is projected to reach an estimated market size of €18.5 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 6.4% through 2033. Key growth catalysts include the increasing adoption of digital financial services, enhanced platform accessibility, and rising retail investor interest. The market is dynamic, featuring competition between established players like Interactive Brokers and Trade Republic, and emerging platforms. This competitive landscape drives innovation in product offerings and trading functionalities, further stimulating market expansion. The sustained shift towards online trading, favored for its convenience and reduced fees compared to traditional services, continues to attract both new and experienced investors.

E-Brokerage Market in Germany Market Size (In Billion)

Evolving investment preferences and technological advancements further solidify this growth. The proliferation of commission-free trading, fractional shares, and integrated analytical tools and educational resources empowers investors, making the market more accessible. While underlying demand is strong, increasing regulatory scrutiny and the necessity for robust cybersecurity measures may influence growth pacing. Nevertheless, a substantial investor base, encompassing both retail and institutional investors, and the presence of domestic and international brokerage firms, indicate a robust market. The ongoing digitalization of financial services in Germany is expected to sustain this upward trend, positioning the e-brokerage sector as a vital component of the nation's financial ecosystem.

E-Brokerage Market in Germany Company Market Share

This comprehensive report offers an in-depth analysis of the German E-Brokerage Market, a rapidly evolving segment within the European financial landscape. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this study provides critical insights for stakeholders aiming to capitalize on opportunities in Online Trading Germany, Digital Brokerage Germany, and Fintech Germany. The report examines market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key growth drivers, equipping businesses with actionable intelligence for strategic decision-making.

E-Brokerage Market in Germany Market Structure & Competitive Dynamics

The German e-brokerage market is characterized by a dynamic interplay of established financial institutions and agile fintech startups. Market concentration is moderate, with a few key players holding significant share, yet innovation continues to disrupt established models. The regulatory framework in Germany, overseen by the BaFin (Federal Financial Supervisory Authority), plays a crucial role in shaping market entry and operational standards for online brokers Germany. Product substitutes, such as traditional bank investment services and direct investment platforms, exert competitive pressure. End-user trends indicate a growing preference for user-friendly interfaces, low fees, and a broad range of investment products, including ETFs Germany and cryptocurrency trading Germany. Mergers and acquisitions (M&A) activities are on the rise as companies seek to expand their market reach and consolidate offerings. For instance, recent consolidation efforts aim to achieve economies of scale and enhance technological capabilities. The estimated market share of leading players is continuously shifting, driven by strategic partnerships and evolving consumer behavior. M&A deal values are expected to increase as larger entities acquire innovative startups to integrate cutting-edge technology and gain access to new customer segments. The e-brokerage Germany market size is projected for significant expansion.

E-Brokerage Market in Germany Industry Trends & Insights

The German e-brokerage market is experiencing robust growth, fueled by several key trends. A primary driver is the increasing adoption of digital financial services among both retail investors Germany and institutional clients. The market penetration of online trading platforms Germany has seen a substantial increase, with a projected Compound Annual Growth Rate (CAGR) of XX% between the forecast period. Technological disruptions, particularly in artificial intelligence (AI) and blockchain, are reshaping the investment experience. AI-powered robo-advisors are gaining traction, offering personalized investment strategies and automated portfolio management, thus enhancing accessibility for novice investors. Blockchain technology is paving the way for innovative financial products and potentially more efficient transaction processing. Consumer preferences are strongly leaning towards platforms offering commission-free trading, intuitive mobile applications, and comprehensive educational resources to empower investors. The competitive landscape is intensifying, with traditional banks enhancing their digital offerings and new entrants rapidly capturing market share. This competitive pressure is driving innovation in product development and customer service. The focus on sustainability and ethical investing is also emerging as a significant trend, with a growing demand for ESG investing Germany options. The German online brokerage market is also benefiting from a favorable economic climate and increasing disposable income, encouraging more individuals to engage in investment activities. The accessibility of these platforms has democratized investing, allowing a wider demographic to participate in capital markets. This has led to an expansion of the digital brokerage Germany sector.

Dominant Markets & Segments in E-Brokerage Market in Germany

The German e-brokerage market exhibits a clear dominance within specific segments, driven by distinct economic and demographic factors. The Retail Investor segment is overwhelmingly dominant, accounting for an estimated XX% of the total market volume. This is attributed to increasing financial literacy, a growing desire for wealth creation, and the widespread availability of user-friendly online trading platforms Germany. Key drivers for retail investor dominance include the accessibility of low-cost investment options, the proliferation of mobile trading apps, and educational initiatives by brokers to onboard new investors. The Institutional Investor segment, while smaller, represents significant transaction volumes and is characterized by a demand for sophisticated trading tools and advanced analytics. Economic policies supporting capital market participation and robust financial infrastructure in Germany are foundational to the growth of both segments.

Regarding broker ownership, Local brokers hold a significant, though not exclusive, position. These players often possess deep understanding of the German regulatory landscape and customer preferences. However, Foreign brokers are increasingly making inroads, leveraging their global technological expertise and competitive pricing strategies to capture market share. The influx of international players has spurred innovation and intensified competition, ultimately benefiting end-users through enhanced service offerings and lower costs. The e-brokerage Germany market size is heavily influenced by the retail segment's growth.

Key Drivers for Segment Dominance:

Retail Investor Segment:

- Growing financial awareness and wealth accumulation among the German population.

- User-friendly interfaces and mobile-first strategies of online brokers Germany.

- Availability of low-cost and commission-free trading options.

- Expansion of investment education and resources for novice investors.

- Interest in diversified investment products like ETFs and individual stocks.

Institutional Investor Segment:

- Sophisticated trading needs and demand for advanced analytical tools.

- High-value transactions and complex investment strategies.

- Regulatory compliance and risk management requirements.

- Access to institutional-grade research and market data.

Local Broker Ownership:

- Established trust and brand recognition within Germany.

- Deep understanding of the German regulatory environment and consumer nuances.

- Strong customer support and localized service offerings.

Foreign Broker Ownership:

- Technological innovation and cutting-edge platform development.

- Competitive fee structures and attractive product portfolios.

- Global market access and diversified investment opportunities.

- Aggressive market entry strategies and marketing campaigns.

E-Brokerage Market in Germany Product Innovations

The German e-brokerage market is witnessing a wave of product innovations aimed at enhancing user experience and expanding investment horizons. Key developments include the integration of AI-driven robo-advisors Germany offering personalized investment recommendations and automated portfolio rebalancing. Mobile trading applications are becoming increasingly sophisticated, providing real-time market data, advanced charting tools, and seamless execution capabilities for stock trading Germany. The introduction of fractional share trading is democratizing access to high-priced stocks, enabling retail investors Germany to invest with smaller capital. Furthermore, the expansion of cryptocurrency trading Germany offerings by prominent brokers signifies a growing acceptance of digital assets within the mainstream investment landscape. These innovations are fostering greater market participation and providing investors with more flexible and accessible avenues for wealth creation, driving the digital brokerage Germany sector forward.

Report Segmentation & Scope

This report segmentations cover the e-brokerage market in Germany across critical dimensions:

- Investor Type: The market is segmented into Retail and Institutional investors. The Retail segment is projected to show a CAGR of XX% during the forecast period, driven by increasing individual investment activity and accessible platforms. The Institutional segment, while smaller in number of accounts, represents a larger market size due to higher transaction values.

- Broker Ownership Type: This segmentation analyzes the market based on Local and Foreign broker ownership. Local brokers are expected to maintain a strong presence due to established trust, while foreign brokers are anticipated to grow significantly by leveraging technological advancements and competitive pricing, contributing to the overall digital brokerage Germany growth.

Key Drivers of E-Brokerage Market in Germany Growth

Several factors are propelling the e-brokerage market in Germany forward:

- Technological Advancements: The proliferation of user-friendly mobile applications, AI-powered trading tools, and robust digital infrastructure is enhancing accessibility and the trading experience for online brokers Germany.

- Growing Investor Base: An increasing number of German citizens, particularly millennials and Gen Z, are engaging in investment activities, seeking to build wealth and secure their financial future.

- Favorable Regulatory Environment: While stringent, Germany's regulatory framework provides a stable and secure environment for online trading Germany, fostering investor confidence.

- Low-Interest Rate Environment: Historically low interest rates on traditional savings accounts have incentivized individuals to explore alternative investment avenues for higher returns, boosting demand for digital brokerage Germany.

- Expansion of Investment Products: The growing availability of diverse investment products, including ETFs, ESG funds, and increasingly, cryptocurrencies, caters to a wider range of investor preferences and risk appetites.

Challenges in the E-Brokerage Market in Germany Sector

Despite its growth, the e-brokerage market in Germany faces several challenges:

- Regulatory Compliance: Navigating the complex and evolving regulatory landscape in Germany can be challenging and costly for both new entrants and established players.

- Intense Competition: The market is highly competitive, with numerous players vying for market share, leading to pressure on fees and margins.

- Cybersecurity Threats: As digital platforms become more prevalent, protecting sensitive customer data from cyberattacks is a paramount concern, requiring continuous investment in robust security measures.

- Investor Education and Trust: While growing, financial literacy varies across the population, and building and maintaining investor trust in digital platforms remains crucial for sustained growth.

- Technological Obsolescence: The rapid pace of technological change necessitates continuous investment in platform upgrades and innovation to remain competitive. The estimated impact of these challenges on market growth is a potential deceleration of XX% in market expansion if not addressed proactively.

Leading Players in the E-Brokerage Market in Germany Market

The e-brokerage market in Germany is comprised of a diverse range of companies, including:

Interactive Brokers TradeStation eToro Comdirect Bank ING Diba Flatex Trade Republic Lynx Onvista Consors Bank Geno Broker

Key Developments in E-Brokerage Market in Germany Sector

- July 2022: Flatex, Europe's leading online broker for retail investors, became the Exclusive Online Brokerage Partner of the Police Union ('Gewerkschaft der Polizei, GdP') of North Rhine-Westphalia. This strategic partnership expands Flatex's reach within a significant demographic.

- January 2022: Comdirect Bank partnered with ETC Group to provide savings plans based on crypto exchange-traded products (ETPs) to its German retail investor clients. This move signifies the growing integration of digital assets into mainstream investment offerings and caters to the increasing interest in cryptocurrency trading Germany.

Strategic E-Brokerage Market in Germany Market Outlook

The e-brokerage market in Germany is poised for sustained growth, driven by ongoing digital transformation and increasing investor participation. Strategic opportunities lie in expanding offerings to cater to the growing demand for ESG-compliant investments, further leveraging AI for personalized investment advice, and enhancing the mobile trading experience. Partnerships with financial advisory firms and continued focus on cybersecurity will be crucial for building long-term trust and ensuring market resilience. The market is expected to benefit from demographic shifts, with younger generations actively seeking accessible and cost-effective investment solutions. The digital brokerage Germany sector is anticipated to mature, with consolidation and further technological integration shaping its future. The estimated e-brokerage market Germany size is projected to reach €XX Billion by 2033, with a significant CAGR of XX%.

E-Brokerage Market in Germany Segmentation

-

1. Investor Type

- 1.1. Retail

- 1.2. Institutional

-

2. Broker Ownership Type

- 2.1. Local

- 2.2. Foreign

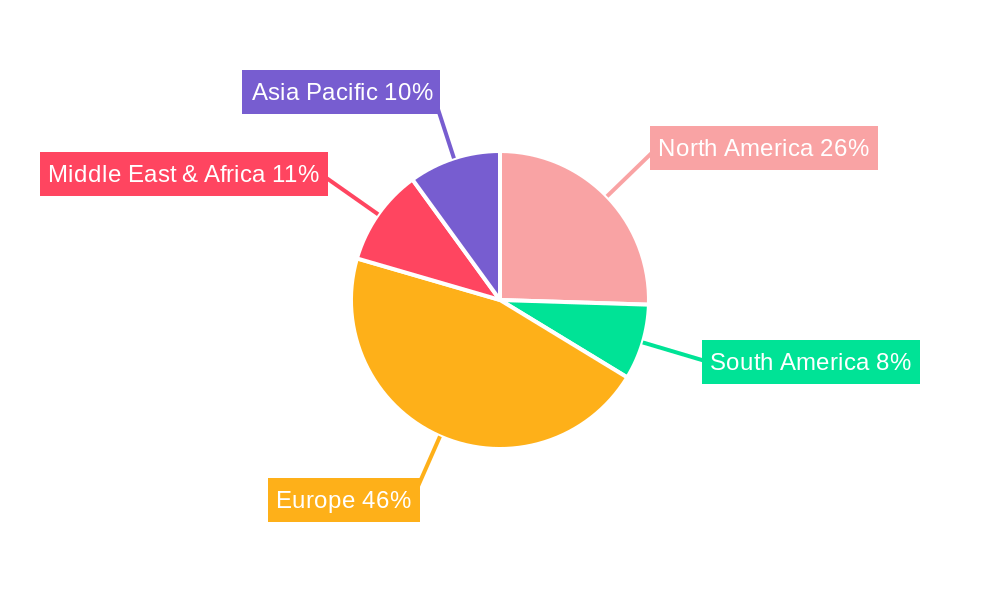

E-Brokerage Market in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-Brokerage Market in Germany Regional Market Share

Geographic Coverage of E-Brokerage Market in Germany

E-Brokerage Market in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Culture is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Investment Culture is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Internet and Mobile Penetration in Germany is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investor Type

- 5.1.1. Retail

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 5.2.1. Local

- 5.2.2. Foreign

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investor Type

- 6. North America E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investor Type

- 6.1.1. Retail

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 6.2.1. Local

- 6.2.2. Foreign

- 6.1. Market Analysis, Insights and Forecast - by Investor Type

- 7. South America E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investor Type

- 7.1.1. Retail

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 7.2.1. Local

- 7.2.2. Foreign

- 7.1. Market Analysis, Insights and Forecast - by Investor Type

- 8. Europe E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investor Type

- 8.1.1. Retail

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 8.2.1. Local

- 8.2.2. Foreign

- 8.1. Market Analysis, Insights and Forecast - by Investor Type

- 9. Middle East & Africa E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investor Type

- 9.1.1. Retail

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 9.2.1. Local

- 9.2.2. Foreign

- 9.1. Market Analysis, Insights and Forecast - by Investor Type

- 10. Asia Pacific E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investor Type

- 10.1.1. Retail

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 10.2.1. Local

- 10.2.2. Foreign

- 10.1. Market Analysis, Insights and Forecast - by Investor Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Interactive Bokers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TradeStation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 eToro

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Comdirect Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ING Diba

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Flatex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trade Republic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lynx

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Onvista

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Consors Bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Geno Broker**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Interactive Bokers

List of Figures

- Figure 1: Global E-Brokerage Market in Germany Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 3: North America E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 4: North America E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 5: North America E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 6: North America E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 7: North America E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 9: South America E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 10: South America E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 11: South America E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 12: South America E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 13: South America E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 15: Europe E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 16: Europe E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 17: Europe E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 18: Europe E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 21: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 22: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 23: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 24: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 27: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 28: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 29: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 30: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 2: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 3: Global E-Brokerage Market in Germany Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 5: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 6: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 11: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 12: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 17: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 18: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 29: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 30: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 38: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 39: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Brokerage Market in Germany?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the E-Brokerage Market in Germany?

Key companies in the market include Interactive Bokers, TradeStation, eToro, Comdirect Bank, ING Diba, Flatex, Trade Republic, Lynx, Onvista, Consors Bank, Geno Broker**List Not Exhaustive.

3. What are the main segments of the E-Brokerage Market in Germany?

The market segments include Investor Type, Broker Ownership Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1 billion as of 2022.

5. What are some drivers contributing to market growth?

Investment Culture is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Internet and Mobile Penetration in Germany is Driving the Market.

7. Are there any restraints impacting market growth?

Investment Culture is Driving the Market.

8. Can you provide examples of recent developments in the market?

July 2022: Flatex, Europe's leading online broker for retail investors, became the Exclusive Online Brokerage Partner of the Police Union ('Gewerkschaft der Polizei, GdP') of North Rhine-Westphalia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Brokerage Market in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Brokerage Market in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Brokerage Market in Germany?

To stay informed about further developments, trends, and reports in the E-Brokerage Market in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence