Key Insights

The Finland Life and Non-Life Insurance Industry is poised for robust expansion, projected to reach an impressive market size of USD 4.83 billion by 2025, growing at a compound annual growth rate (CAGR) of 4.36% through 2033. This growth is underpinned by a confluence of significant market drivers. An aging population and increasing awareness regarding financial security are fueling demand for life insurance products, particularly individual policies that offer long-term savings and protection. Simultaneously, a growing emphasis on asset protection and mitigating financial risks associated with unforeseen events like natural disasters, accidents, and property damage are driving the non-life insurance segment. Within non-life, motor insurance remains a cornerstone due to consistently high vehicle ownership, while home insurance is experiencing a surge driven by increased property ownership and a greater understanding of the need for comprehensive coverage against various risks.

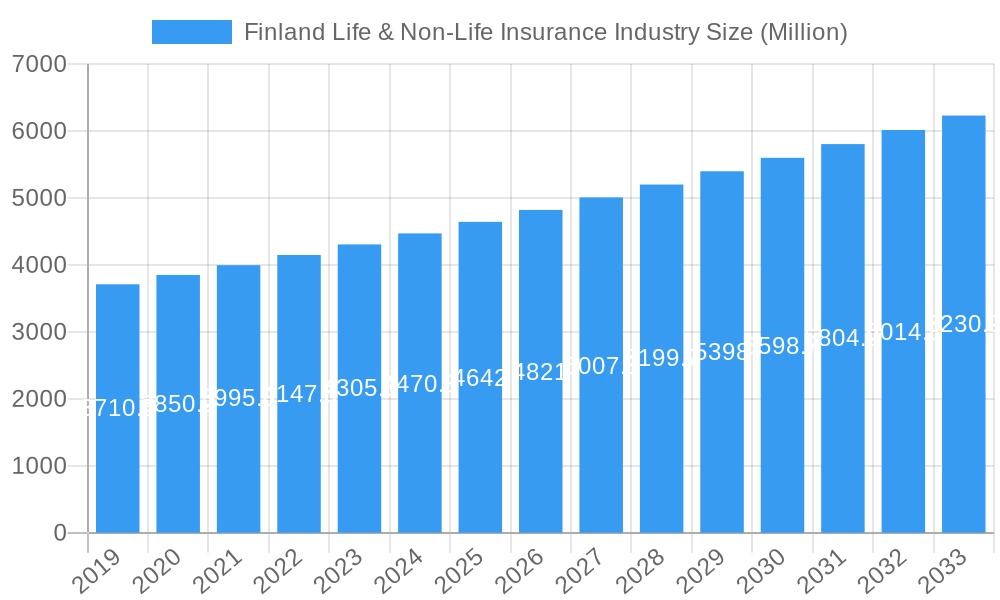

Finland Life & Non-Life Insurance Industry Market Size (In Billion)

Emerging trends are further shaping the landscape, with digitalization playing a pivotal role. Insurers are increasingly leveraging online channels for sales, policy management, and claims processing, enhancing customer convenience and operational efficiency. The rise of InsurTech startups is also introducing innovative solutions and business models, pushing traditional players to adapt. Furthermore, a shift towards personalized insurance products, tailored to individual needs and risk profiles, is gaining traction. Despite these positive growth catalysts, certain restraints could temper the pace of expansion. Economic slowdowns, inflation impacting disposable incomes, and stringent regulatory frameworks can present challenges. Nevertheless, the industry's inherent resilience, coupled with continuous innovation in product offerings and distribution strategies, is expected to navigate these hurdles effectively, ensuring sustained growth in the Finnish insurance market.

Finland Life & Non-Life Insurance Industry Company Market Share

This detailed report provides an in-depth analysis of the Finland Life & Non-Life Insurance Industry, offering strategic insights and actionable intelligence for stakeholders. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study delves into market structure, competitive dynamics, emerging trends, dominant segments, product innovations, and key growth drivers and challenges. Leverage robust data and expert analysis to understand the evolving Finnish insurance landscape, identify lucrative opportunities, and navigate market complexities. This report is essential for insurers, reinsurers, brokers, investors, regulators, and technology providers seeking to capitalize on the dynamic Finnish insurance market.

Finland Life & Non-Life Insurance Industry Market Structure & Competitive Dynamics

The Finland Life & Non-Life Insurance Industry is characterized by a moderately concentrated market structure, with a few dominant players holding significant market share. Key companies like OP Insurance and LocalTapiola Group lead the charge, offering a comprehensive suite of life and non-life insurance products. Innovation ecosystems are rapidly evolving, driven by a strong focus on digitalization and customer-centric solutions. Regulatory frameworks, overseen by bodies like the Finnish Financial Supervisory Authority (FIN-FSA), are robust, emphasizing solvency, consumer protection, and fair market practices. Product substitutes, while present, are primarily evolving within the insurance sector itself, such as the increasing adoption of parametric insurance for specific risks. End-user trends highlight a growing demand for personalized insurance products, flexible coverage options, and seamless digital customer journeys. Mergers and acquisitions (M&A) activities, while not as frequent as in larger markets, play a crucial role in market consolidation and strategic expansion. Notable M&A deals in recent years have seen established players acquiring smaller entities to expand their product portfolios or geographic reach.

- Market Concentration: Dominated by a few key players, with significant market share held by leading insurance groups.

- Innovation Ecosystems: Driven by InsurTech adoption, AI-powered underwriting, and digital distribution channels.

- Regulatory Frameworks: Strong emphasis on solvency, consumer protection, and cybersecurity.

- Product Substitutes: Evolving to include embedded insurance solutions and on-demand coverage.

- End-User Trends: Growing preference for digital self-service, personalized policies, and proactive risk management.

- M&A Activities: Focus on strategic acquisitions for market expansion, technology integration, and portfolio diversification.

Finland Life & Non-Life Insurance Industry Industry Trends & Insights

The Finland Life & Non-Life Insurance Industry is poised for steady growth, fueled by a confluence of technological advancements, evolving consumer preferences, and supportive economic policies. The Compound Annual Growth Rate (CAGR) for the overall market is projected to be approximately XX%, demonstrating a healthy expansion trajectory over the forecast period. Market penetration, currently at XX% for life insurance and XX% for non-life insurance, is expected to increase as awareness and accessibility of insurance products grow. Technological disruptions are at the forefront of this evolution. The widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing underwriting, claims processing, and personalized product development. Telematics in motor insurance, for instance, is enabling dynamic pricing and risk assessment based on actual driving behavior. Furthermore, the increasing digitalization of public services, as evidenced by the DigiFinland and Tietoevry partnership announced in October 2023, creates opportunities for embedded insurance solutions within these platforms. Consumer preferences are shifting towards greater transparency, ease of access, and tailored coverage. Digital-first insurance providers and InsurTech startups are challenging traditional players by offering agile and customer-centric solutions through online channels. The demand for health and wellness-focused life insurance products is also rising, aligning with a broader societal emphasis on well-being. Competitive dynamics are intensifying, with both incumbent insurers and new entrants vying for market share. Companies are investing heavily in digital transformation, customer experience enhancement, and strategic partnerships to maintain their competitive edge. The modernization of payment capabilities, as seen with Aktia’s selection of Temenos to adopt Temenos Payments Hub, indicates a broader industry trend towards streamlining financial operations and enhancing payment processing efficiency, which directly benefits insurance customers through faster claims settlements and policy adjustments. This push for efficiency and seamless integration underscores the broader trend of leveraging technology to improve the overall customer journey and operational effectiveness within the Finnish insurance sector.

Dominant Markets & Segments in Finland Life & Non-Life Insurance Industry

The Finland Life & Non-Life Insurance Industry exhibits dominance across several key segments and distribution channels, driven by distinct market dynamics and consumer behaviors.

Insurance Type Dominance:

Non-life Insurance: This segment currently holds a larger market share and is expected to continue its strong performance.

- Motor Insurance: Remains a compulsory and significant segment, driven by vehicle ownership rates and regulatory requirements. Economic policies that support private car ownership and infrastructure development are key drivers. The adoption of advanced driver-assistance systems (ADAS) is leading to a demand for specialized motor insurance products.

- Home Insurance: Crucial for property owners, this segment is influenced by real estate market trends and the prevalence of homeownership. Economic stability and consumer confidence in property investments are vital. Demand for coverage against extreme weather events is also increasing.

- Others: This broad category, encompassing travel, cyber, and specialized commercial insurance, is experiencing rapid growth. The increasing reliance on digital infrastructure fuels demand for cyber insurance, while global travel trends and increased awareness of niche risks contribute to the expansion of other non-life segments.

Life Insurance: While currently smaller in market size, this segment is showing robust growth potential, particularly in individual life policies.

- Individual Life Insurance: Driven by increasing awareness of financial planning, retirement needs, and the desire for financial security for families. Demographic trends, such as an aging population and evolving family structures, are key influences. Product innovations offering flexible benefits and investment-linked options are gaining traction.

- Group Life Insurance: Primarily linked to employer benefits, this segment's growth is tied to employment rates and corporate policy offerings. Companies are increasingly offering comprehensive employee benefits, including life insurance, as a competitive advantage.

Channel of Distribution Dominance:

- Direct Channel: This channel is experiencing significant growth, propelled by digitalization and a demand for direct customer engagement. Online platforms and mobile applications allow for seamless policy purchase, management, and claims submission. Technological advancements enabling direct-to-consumer (D2C) sales are a major driver.

- Agency Channel: Still a vital distribution network, especially for complex products and personalized advice, particularly in life insurance and for older demographics. The trusted relationship between agents and clients remains a key strength.

- Banks: Bancassurance models continue to be influential, leveraging existing customer relationships to cross-sell insurance products. The integration of financial services and insurance offerings provides convenience for consumers.

- Online Channel: Integral to the direct channel, the online segment encompasses company websites, comparison portals, and InsurTech platforms. Its dominance is fueled by customer preference for convenience, transparency, and competitive pricing.

- Other Channels of Distribution: This can include partnerships with retailers, affinity groups, and aggregators, which are growing as insurers seek to broaden their reach and cater to niche markets.

Finland Life & Non-Life Insurance Industry Product Innovations

Product innovation in the Finland Life & Non-Life Insurance Industry is increasingly focused on leveraging technology to offer personalized, flexible, and value-added solutions. Companies are developing usage-based insurance (UBI) for motor and home, utilizing IoT devices to collect data and tailor premiums based on individual risk profiles. In life insurance, innovations include hybrid products combining life cover with long-term care benefits or investment components, catering to evolving demographic needs and financial planning aspirations. Parametric insurance, triggered by specific predefined events rather than traditional loss assessment, is emerging for niche risks, offering faster payouts. Cybersecurity insurance is also rapidly evolving to address the increasing threat landscape for businesses and individuals, providing coverage for data breaches, cyber-attacks, and associated recovery costs. These innovations enhance competitive advantage by meeting specific consumer demands, improving risk management, and creating new revenue streams.

Report Segmentation & Scope

This report segments the Finland Life & Non-Life Insurance Industry comprehensively, providing detailed analysis across critical dimensions.

Insurance Type:

- Life Insurance: Further divided into Individual Life Insurance and Group Life Insurance. Individual life insurance is projected to see a CAGR of XX% due to growing financial literacy and retirement planning needs, while group life insurance is expected to grow at XX% driven by employer benefit trends.

- Non-life Insurance: Encompasses Home Insurance, Motor Insurance, and Others. Motor insurance, a mature segment, is projected to grow at XX%, while Home Insurance is expected at XX%. The 'Others' category, including cyber and travel insurance, is anticipated to exhibit the highest growth rate at XX% due to increasing awareness and demand for specialized coverage.

Channel of Distribution:

- Direct: This channel is expected to grow at a significant CAGR of XX%, driven by digital transformation and customer preference for self-service.

- Agency: This traditional channel is projected to grow at a steady XX%, retaining its importance for advisory services.

- Banks: Bancassurance is anticipated to grow at XX%, leveraging existing customer bases for cross-selling.

- Online: Closely linked to the direct channel, the online segment is expected to surge at XX%, reflecting the increasing preference for digital interactions.

- Other Channels of Distribution: This segment, including partnerships and aggregators, is projected to grow at XX%, as companies seek to expand their market reach.

Key Drivers of Finland Life & Non-Life Insurance Industry Growth

The growth of the Finland Life & Non-Life Insurance Industry is propelled by several key factors. Digitalization is paramount, with InsurTech innovations enhancing customer experience, streamlining operations, and enabling personalized product offerings. A robust economic outlook and stable employment rates contribute to increased disposable income, fostering demand for both life and non-life insurance products. Evolving consumer preferences for convenience, transparency, and tailored solutions are driving the adoption of online channels and customized policies. Furthermore, regulatory initiatives aimed at consumer protection and market stability create a conducive environment for growth. The increasing awareness of emerging risks, such as cyber threats and climate change-related events, also fuels demand for specialized insurance coverage.

Challenges in the Finland Life & Non-Life Insurance Industry Sector

Despite its growth potential, the Finland Life & Non-Life Insurance Industry faces several challenges. Intense competition from both incumbent players and agile InsurTech startups exerts pressure on pricing and margins. Navigating complex regulatory landscapes and ensuring compliance with evolving data privacy laws (e.g., GDPR) requires continuous investment and adaptation. Rising customer expectations for seamless digital experiences and instant service necessitate ongoing technological upgrades and customer service enhancements. Economic uncertainties, such as inflation and potential recessions, can impact consumer spending power and investment returns, affecting premium volumes and profitability. The talent gap in specialized areas like data science and cybersecurity also poses a challenge for insurers seeking to innovate and adapt.

Leading Players in the Finland Life & Non-Life Insurance Industry Market

- OP Insurance

- LocalTapiola Group

- If P&C Insurance

- Fennia Mutual

- Pohjantahti

- Turva

- Alandia Group

- Suomen Vahinkovakuutus

- Nordea Insurance Finland

- Suomen Keskinainen Laakevahinkovakuutusyhtio

- POP Insurance

- Patient Insurance Company

- Garantia

- Nordea Insurance

Key Developments in Finland Life & Non-Life Insurance Industry Sector

- October 2023: DigiFinland enhanced digital public services with a USD 22.72 million Tietoevry partnership. This collaboration spans a robust seven-year contract period and aspires to develop and sustain digital solutions that will streamline Finland’s social and health care, emergency services, and other pivotal public sector services.

- October 2023: Temenos announced that Finland’s wealth manager bank Aktia selected Temenos to modernize its payments capabilities, adopting Temenos Payments Hub to support the introduction of pan-European instant payments and consolidate all payment rail processing onto a single platform.

Strategic Finland Life & Non-Life Insurance Industry Market Outlook

The strategic outlook for the Finland Life & Non-Life Insurance Industry is one of continued digital transformation and customer-centric evolution. Growth accelerators include the increasing adoption of AI and IoT for personalized risk assessment and product development, alongside the expansion of embedded insurance solutions within non-financial ecosystems. The focus on sustainability and ESG (Environmental, Social, and Governance) factors will also shape product offerings and investment strategies. Opportunities lie in catering to the growing needs of an aging population with specialized health and retirement products, and in providing comprehensive cyber insurance solutions to businesses of all sizes. Strategic partnerships, particularly with FinTech and InsurTech companies, will be crucial for enhancing capabilities and expanding market reach. The industry is expected to witness a sustained drive towards greater efficiency, transparency, and proactive risk management, ultimately benefiting both insurers and policyholders.

Finland Life & Non-Life Insurance Industry Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other Channels of Distribution

Finland Life & Non-Life Insurance Industry Segmentation By Geography

- 1. Finland

Finland Life & Non-Life Insurance Industry Regional Market Share

Geographic Coverage of Finland Life & Non-Life Insurance Industry

Finland Life & Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Insurtech Partnerships

- 3.3. Market Restrains

- 3.3.1. Growth of Insurtech Partnerships

- 3.4. Market Trends

- 3.4.1. Online Channel will witness New growth avenue in Coming Future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Finland Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Channels of Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Finland

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OP Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LocalTapiola Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 If P&C Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fennia mutual

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pohjantahti

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Turva

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alandia Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Suomen Vahinkovakuutus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nordea Insurance Finland

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Suomen Keskinainen Laakevahinkovakuutusyhtio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 POP Insurance

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Patient Insurance Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Garantia

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Nordea Insurance**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 OP Insurance

List of Figures

- Figure 1: Finland Life & Non-Life Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Finland Life & Non-Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Finland Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Finland Life & Non-Life Insurance Industry Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: Finland Life & Non-Life Insurance Industry Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 4: Finland Life & Non-Life Insurance Industry Volume Billion Forecast, by Channel of Distribution 2020 & 2033

- Table 5: Finland Life & Non-Life Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Finland Life & Non-Life Insurance Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Finland Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 8: Finland Life & Non-Life Insurance Industry Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 9: Finland Life & Non-Life Insurance Industry Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 10: Finland Life & Non-Life Insurance Industry Volume Billion Forecast, by Channel of Distribution 2020 & 2033

- Table 11: Finland Life & Non-Life Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Finland Life & Non-Life Insurance Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Finland Life & Non-Life Insurance Industry?

The projected CAGR is approximately 4.36%.

2. Which companies are prominent players in the Finland Life & Non-Life Insurance Industry?

Key companies in the market include OP Insurance, LocalTapiola Group, If P&C Insurance, Fennia mutual, Pohjantahti, Turva, Alandia Group, Suomen Vahinkovakuutus, Nordea Insurance Finland, Suomen Keskinainen Laakevahinkovakuutusyhtio, POP Insurance, Patient Insurance Company, Garantia, Nordea Insurance**List Not Exhaustive.

3. What are the main segments of the Finland Life & Non-Life Insurance Industry?

The market segments include Insurance Type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Insurtech Partnerships.

6. What are the notable trends driving market growth?

Online Channel will witness New growth avenue in Coming Future.

7. Are there any restraints impacting market growth?

Growth of Insurtech Partnerships.

8. Can you provide examples of recent developments in the market?

October 2023: DigiFinland enhanced digital public services with a USD 22.72 million Tietoevry partnership. This collaboration spans a robust seven-year contract period and aspires to develop and sustain digital solutions that will streamline Finland’s social and health care, emergency services, and other pivotal public sector services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Finland Life & Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Finland Life & Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Finland Life & Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Finland Life & Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence