Key Insights

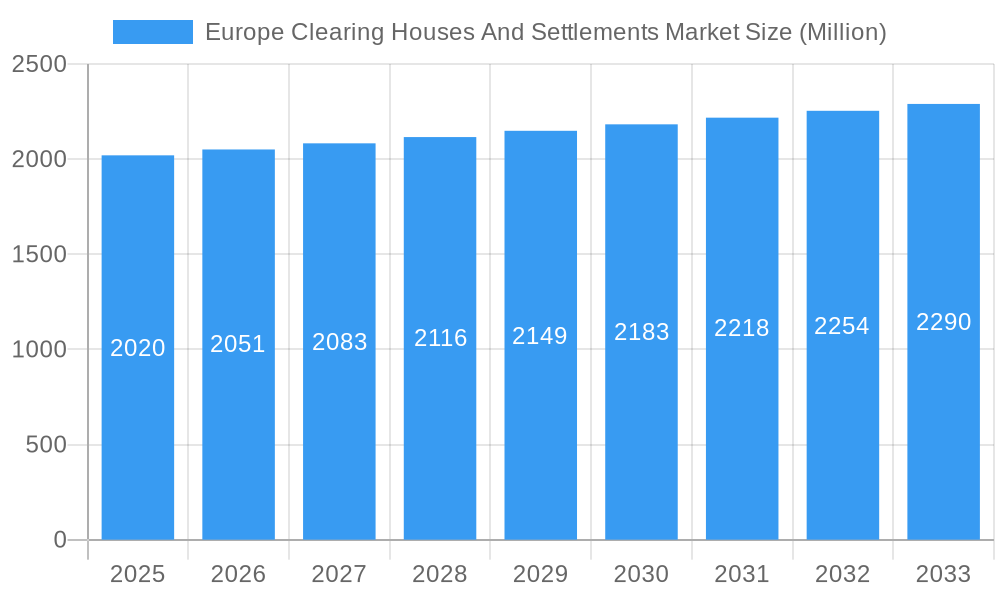

The Europe Clearing Houses and Settlements market, valued at €2.02 billion in 2025, is projected to experience steady growth, driven by increasing regulatory scrutiny demanding robust and transparent financial infrastructures. The market's Compound Annual Growth Rate (CAGR) of 1.59% from 2019-2033 suggests a moderate but consistent expansion. This growth is fueled by several factors, including the rising adoption of digital technologies within the financial sector, the increasing volume of securities trading in Europe, and a growing focus on operational efficiency and risk mitigation by clearing houses. Key players like Euroclear, Clearstream Banking, and LCH Clearnet are at the forefront of these advancements, constantly investing in infrastructure upgrades and innovative solutions. While the market faces some restraints, such as potential cybersecurity threats and evolving regulatory landscapes, these are likely to be offset by ongoing investments and the inherent need for secure and efficient clearing and settlement systems within the European Union's financial ecosystem.

Europe Clearing Houses And Settlements Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a continued, albeit modest, expansion. This growth is expected to be largely driven by increased cross-border transactions, the expanding digitalization of financial services within Europe, and a sustained demand for greater transparency and risk management tools. Competition amongst established players is expected to remain intense, leading to further innovation and efficiency improvements. However, the emergence of new technologies and potential disruptions from fintech companies could present both opportunities and challenges in the coming years. The market's segmentation is expected to remain relatively stable, with a focus on the provision of robust and reliable clearing and settlement services for various asset classes, including equities, bonds, and derivatives.

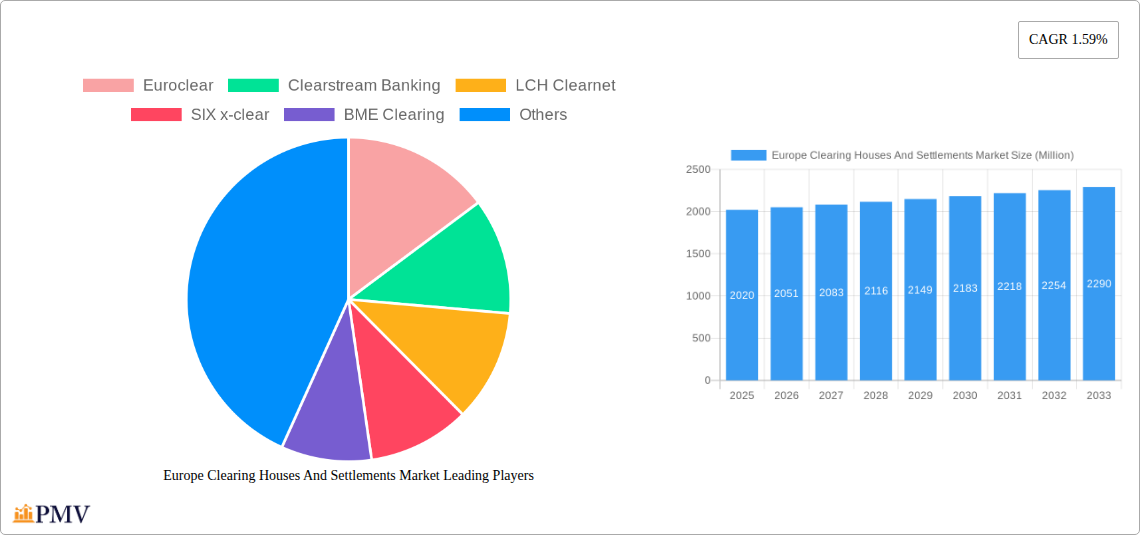

Europe Clearing Houses And Settlements Market Company Market Share

Europe Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Clearing Houses and Settlements Market, covering the period from 2019 to 2033. It offers actionable insights into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future growth prospects. The report utilizes data from the historical period (2019-2024), with the base year set at 2025 and forecasts extending to 2033. The estimated market size in 2025 is valued at xx Million.

Europe Clearing Houses and Settlements Market Market Structure & Competitive Dynamics

The European clearing houses and settlements market exhibits a moderately concentrated structure, dominated by established players like Euroclear, Clearstream Banking, and LCH Clearnet. These firms hold significant market share, estimated at a combined xx% in 2025, benefiting from economies of scale and extensive network effects. However, the emergence of innovative fintech companies like Bitbond and Fnality, along with established players exploring DLT solutions like Euroclear's MVP, is increasing competitive intensity. The regulatory landscape, heavily influenced by bodies such as ESMA, plays a crucial role, shaping market entry barriers and operational standards. Recent M&A activity has been relatively subdued, with deal values totaling approximately xx Million in the past five years. This reflects the capital-intensive nature of the sector and existing regulatory scrutiny. End-user trends indicate a growing demand for efficient, transparent, and secure settlement solutions, fueled by increasing volumes of securities trading.

- Market Concentration: Highly concentrated with top three players holding xx% market share.

- Innovation Ecosystems: Growing presence of fintech companies and DLT-based solutions.

- Regulatory Frameworks: Stringent regulations by ESMA and other European bodies.

- M&A Activity: Relatively low in recent years, with total deal values around xx Million.

- Product Substitutes: Limited direct substitutes, but alternative settlement mechanisms are emerging.

- End-User Trends: Increasing demand for efficient, transparent, and secure solutions.

Europe Clearing Houses and Settlements Market Industry Trends & Insights

The European clearing houses and settlements market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven primarily by the increasing volume of securities trading, particularly in the burgeoning digital asset space. Technological disruptions, such as the adoption of distributed ledger technology (DLT) and blockchain, are fundamentally altering settlement processes, promising improved efficiency and reduced costs. Consumer preferences are shifting towards faster and more transparent settlement solutions. The competitive dynamics are becoming more intense due to new entrants and the innovative offerings of established players. Market penetration of DLT-based solutions is expected to reach xx% by 2033, driven by regulatory support and industry initiatives. Increased regulatory scrutiny and the need for robust cybersecurity measures remain significant challenges.

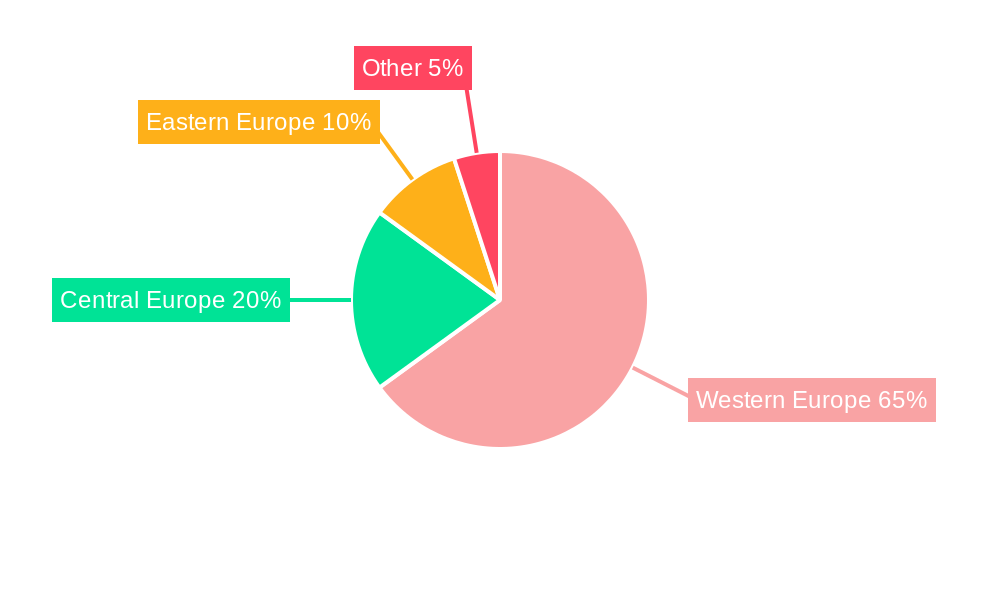

Dominant Markets & Segments in Europe Clearing Houses and Settlements Market

The United Kingdom remains the dominant market within Europe, accounting for approximately xx% of the total market value in 2025. This dominance is attributed to several factors:

- Strong Financial Infrastructure: London's established financial infrastructure provides a robust ecosystem for clearing and settlement activities.

- Large Trading Volumes: The UK's significant trading volumes in various asset classes fuel the demand for clearing and settlement services.

- Pro-Business Regulatory Environment: While evolving, the UK's regulatory environment generally fosters innovation and investment.

- Skilled Workforce: London boasts a deep pool of skilled professionals in the finance sector.

Other key markets include Germany, France, and the Netherlands, each contributing significantly to the overall market. The growth of these markets is driven by increasing domestic trading activity and supportive regulatory frameworks. However, Brexit has influenced the dynamics of the UK's role in the wider European clearing market.

Europe Clearing Houses and Settlements Market Product Innovations

Recent innovations center on integrating distributed ledger technology (DLT) and blockchain to streamline settlement processes and enhance security. Euroclear's DLT platform for digital bonds demonstrates this trend. These innovations offer improved speed, transparency, and cost efficiency compared to traditional systems, driving greater market adoption. The ability to handle large volumes of transactions while maintaining high levels of security is a key competitive advantage.

Report Segmentation & Scope

This report segments the European clearing houses and settlements market based on several factors:

By Service Type: This includes clearing, settlement, custody, and other related services, each projected to have different growth rates and competitive dynamics. For example, the clearing segment is anticipated to grow at xx% CAGR during the forecast period, primarily due to rising trading volumes.

By Asset Class: This includes equities, bonds, derivatives, and other asset classes, each with its unique characteristics and regulatory requirements. The derivatives segment is predicted to expand at a xx% CAGR due to increasing complexity and volatility in financial markets.

By Geography: This includes a regional breakdown of the market across Europe's key financial centers, reflecting differences in regulatory environments and trading volumes.

Key Drivers of Europe Clearing Houses and Settlements Market Growth

Several key factors fuel the market's expansion:

- Increasing Trading Volumes: Growth in securities trading across different asset classes fuels demand for clearing and settlement services.

- Technological Advancements: The adoption of DLT and blockchain offers substantial efficiency gains.

- Regulatory Changes: Ongoing regulatory reforms and initiatives encourage market modernization and standardization.

- Demand for Transparency and Security: Increased focus on mitigating risks and improving market transparency drives adoption of advanced solutions.

Challenges in the Europe Clearing Houses and Settlements Market Sector

The market faces several challenges:

- Regulatory Complexity: Navigating evolving regulatory landscapes is a continuous hurdle for market participants.

- Cybersecurity Threats: The industry faces increasing risks of cyberattacks, necessitating robust security measures.

- Competition: The emergence of fintech firms and the innovation of existing players creates a competitive landscape.

- Integration Challenges: Integrating new technologies and adapting to evolving industry standards can be complex.

Leading Players in the Europe Clearing Houses and Settlements Market Market

- Euroclear

- Clearstream Banking

- LCH Clearnet

- SIX x-clear

- BME Clearing

- National Settlements Depository (NSD)

- Monte Titoli

- Nasdaq CSD

- Bitbond

- Fnality

- Clearmatics

Key Developments in Europe Clearing Houses and Settlements Market Sector

- June 2023: Cboe Clear Europe plans to launch a CCP clearing service for securities financing transactions (SFTs).

- March 2023: Euroclear announces the potential release of a new DLT platform for trading securities.

Strategic Europe Clearing Houses and Settlements Market Market Outlook

The future of the European clearing houses and settlements market is bright, driven by continued technological advancements, regulatory changes, and the expansion of digital assets. Opportunities exist for firms to leverage DLT and AI to further enhance efficiency, security, and transparency. Strategic partnerships and acquisitions will play a crucial role in shaping market leadership. The market's growth is expected to continue, fueled by the increasing complexity and volume of financial transactions.

Europe Clearing Houses And Settlements Market Segmentation

-

1. Type

- 1.1. Outward House Clearing

- 1.2. Inward House Clearing

-

2. Type of System

- 2.1. TARGET2

- 2.2. SEPA

- 2.3. EBICS

- 2.4. Other Systems

Europe Clearing Houses And Settlements Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Clearing Houses And Settlements Market Regional Market Share

Geographic Coverage of Europe Clearing Houses And Settlements Market

Europe Clearing Houses And Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Requirements; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Regulatory Requirements; Technological Advancements

- 3.4. Market Trends

- 3.4.1. SEPA Schemes are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Clearing Houses And Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Outward House Clearing

- 5.1.2. Inward House Clearing

- 5.2. Market Analysis, Insights and Forecast - by Type of System

- 5.2.1. TARGET2

- 5.2.2. SEPA

- 5.2.3. EBICS

- 5.2.4. Other Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Euroclear

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clearstream Banking

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LCH Clearnet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SIX x-clear

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BME Clearing

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Settlements Depository (NSD)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Monte Titoli

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nasdaq CSD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bitbond

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fnality

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Clearmatics**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Euroclear

List of Figures

- Figure 1: Europe Clearing Houses And Settlements Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Clearing Houses And Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type 2020 & 2033

- Table 3: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 4: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type of System 2020 & 2033

- Table 5: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Region 2020 & 2033

- Table 7: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type 2020 & 2033

- Table 9: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 10: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type of System 2020 & 2033

- Table 11: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Clearing Houses And Settlements Market?

The projected CAGR is approximately 1.59%.

2. Which companies are prominent players in the Europe Clearing Houses And Settlements Market?

Key companies in the market include Euroclear, Clearstream Banking, LCH Clearnet, SIX x-clear, BME Clearing, National Settlements Depository (NSD), Monte Titoli, Nasdaq CSD, Bitbond, Fnality, Clearmatics**List Not Exhaustive.

3. What are the main segments of the Europe Clearing Houses And Settlements Market?

The market segments include Type, Type of System.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Requirements; Technological Advancements.

6. What are the notable trends driving market growth?

SEPA Schemes are Driving the Market.

7. Are there any restraints impacting market growth?

Regulatory Requirements; Technological Advancements.

8. Can you provide examples of recent developments in the market?

On June 2023, Cboe Clear Europe's plan to launch a central counterparty (CCP) clearing service for securities financing transactions (SFTs). Cboe Clear Europe is a wholly-owned subsidiary of derivatives and securities exchange network Cboe Clear Markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Quadrillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Clearing Houses And Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Clearing Houses And Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Clearing Houses And Settlements Market?

To stay informed about further developments, trends, and reports in the Europe Clearing Houses And Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence