Key Insights

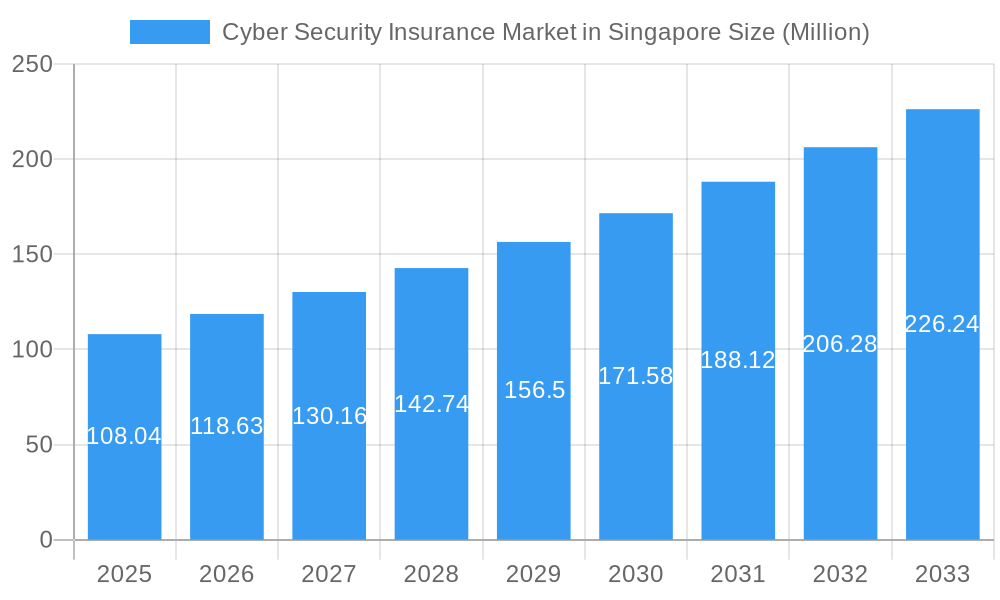

The Singapore Cyber Security Insurance market is poised for significant expansion, currently valued at an estimated USD 108.04 million. This robust growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 9.85% over the forecast period of 2025-2033. This dynamic trajectory is fueled by a confluence of escalating cyber threats and a heightened awareness among businesses of all sizes regarding the critical need for robust cyber risk mitigation strategies. As digital transformation accelerates across industries, so too does the attack surface, making comprehensive cyber insurance an indispensable component of a sound business continuity plan. The increasing sophistication of cyber-attacks, including ransomware, data breaches, and denial-of-service attacks, necessitates proactive financial protection against the potentially devastating consequences of such incidents, including recovery costs, regulatory fines, and reputational damage.

Cyber Security Insurance Market in Singapore Market Size (In Million)

The market's expansion is driven by several key factors, including the increasing frequency and severity of cyber incidents globally, coupled with growing regulatory pressure on organizations to enhance their data protection measures. The rising adoption of cloud computing and the Internet of Things (IoT) further expands the digital footprint and creates new vulnerabilities, amplifying the demand for specialized cyber insurance policies. While the market experiences strong growth, certain restraints, such as the complexity of underwriting cyber risks and the evolving threat landscape, require continuous innovation in insurance products and services. Key segments experiencing substantial demand include SMEs and Corporates across vital industries like Financial Services, Healthcare, and Professional Services, reflecting the high-value data and critical operations these sectors manage. Major insurance providers like Howden Group, MSIG Insurance, Delta Insurance, CHUBB Insurance, AIG Insurance, AXA, TIQ, Tokio Marine Insurance Group, QBE Singapore, and Sompo International are actively participating in this burgeoning market, offering a range of solutions tailored to diverse business needs.

Cyber Security Insurance Market in Singapore Company Market Share

This comprehensive report delivers an in-depth analysis of the Singapore cybersecurity insurance market, a rapidly evolving sector critical for protecting businesses and individuals from escalating digital threats. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study provides unparalleled insights into market dynamics, segmentation, competitive landscape, and future growth trajectories. We explore key drivers, challenges, and emerging trends shaping the Singapore cyber insurance landscape, offering actionable intelligence for stakeholders. Dive into detailed market structures, industry trends, dominant segments, product innovations, and leading players to understand the strategic opportunities within the Singapore digital risk insurance market.

Cyber Security Insurance Market in Singapore Market Structure & Competitive Dynamics

The Singapore cybersecurity insurance market exhibits a moderately concentrated structure, characterized by the presence of established global insurers and a growing number of specialized providers. Innovation ecosystems are actively developing, driven by increasing cyber threats and evolving regulatory landscapes. The Monetary Authority of Singapore (MAS) plays a pivotal role in shaping the Singapore cyber insurance framework, emphasizing robust risk management and consumer protection. Product substitutes, such as robust internal cybersecurity measures and data recovery services, exist but often fall short of providing comprehensive financial protection against the full spectrum of cyber incidents. End-user trends reveal a growing demand across all segments, from individuals to large corporations, as the perceived value of cyber liability insurance Singapore intensifies. Mergers and acquisitions (M&A) activities are strategically shaping the market, with recent deals like Chubb's acquisition of DUAL Asia's Financial Lines portfolios in Singapore demonstrating a clear intent to consolidate market share and enhance underwriting capabilities. While specific M&A deal values are proprietary, the strategic importance of these transactions underscores the competitive fervor in the Singapore digital security insurance sector. Market share is distributed among key players, with continuous efforts to capture a larger portion through innovative product offerings and aggressive marketing.

- Market Concentration: Moderately concentrated with a mix of global and regional players.

- Innovation Ecosystems: Flourishing, driven by increasing cyber threats and regulatory oversight.

- Regulatory Frameworks: Influenced by the Monetary Authority of Singapore (MAS), promoting robust cyber risk management.

- Product Substitutes: Internal cybersecurity measures, data recovery services.

- End-User Trends: Growing demand across Personal, SMEs, and Corporates segments.

- M&A Activities: Strategic consolidation to enhance capabilities and market reach.

Cyber Security Insurance Market in Singapore Industry Trends & Insights

The Singapore cybersecurity insurance market is experiencing robust growth, propelled by an escalating frequency and sophistication of cyberattacks, alongside increasing regulatory scrutiny and growing awareness among businesses of all sizes. The CAGR for the Singapore cyber insurance market is projected to be significant, reflecting a fundamental shift in risk management priorities. As the digital economy in Singapore continues to expand, so does the attack surface, making cyber insurance Singapore an indispensable tool for business continuity and financial resilience. Technological disruptions, including the pervasive adoption of cloud computing, the Internet of Things (IoT), and artificial intelligence (AI), while offering operational efficiencies, simultaneously introduce new vulnerabilities that drive the demand for comprehensive cyber incident response insurance. Consumer preferences are evolving from basic data breach coverage to broader policies that encompass business interruption, ransomware payments, reputational damage, and cyber extortion. The competitive dynamics are intensifying, with insurers differentiating themselves through tailored product features, enhanced risk assessment capabilities, and proactive risk mitigation services. The market penetration of cyber liability insurance Singapore is steadily increasing, particularly within sectors like Financial Services and Healthcare, which are prime targets for cybercriminals. This trend is further bolstered by government initiatives promoting digital transformation and cybersecurity awareness. The perceived financial implications of a successful cyberattack, including significant fines, legal costs, and loss of customer trust, are powerful catalysts for market expansion. The Singapore digital risk insurance sector is thus poised for sustained expansion as organizations proactively seek to safeguard their digital assets and operational integrity.

Dominant Markets & Segments in Cyber Security Insurance Market in Singapore

The Singapore cybersecurity insurance market is characterized by dominant segments that reflect the nation's economic structure and digital adoption.

End-User Dominance:

- Corporates: This segment holds the largest market share due to their extensive digital footprint, higher volume of sensitive data, and greater susceptibility to sophisticated cyber threats. Large corporations, particularly in regulated industries, face significant financial and reputational risks from cyber incidents, making comprehensive cyber insurance Singapore a necessity.

- SMEs: While historically lagging, SMEs are increasingly recognizing the critical need for cyber liability insurance Singapore. Their often-limited IT resources and perceived lower risk profile have historically made them less attractive targets, but recent trends indicate a shift, with a growing understanding of their vulnerability and the affordability of digital security insurance solutions tailored for them.

- Personal: The personal segment is emerging, driven by increased online transactions, social media usage, and the proliferation of smart devices. While currently smaller, the potential for growth in protecting individuals from identity theft, online fraud, and cyberbullying is substantial.

Industry Dominance:

- Financial Services: This sector remains a dominant force in the Singapore cyber insurance market. Financial institutions handle vast amounts of sensitive financial data and are high-value targets for cybercriminals. Stringent regulatory requirements and the critical nature of their operations necessitate comprehensive cyber incident response insurance.

- Professional Services: Firms in this sector, including legal, accounting, and consulting services, handle confidential client information and intellectual property. The risk of data breaches and the associated reputational damage make cyber insurance Singapore a vital component of their risk management strategy.

- Healthcare: The digitization of patient records and the sensitive nature of health information make the healthcare industry a prime target. Data privacy regulations and the potential for disruption of critical healthcare services drive strong demand for Singapore digital risk insurance.

- Government Bodies/Agencies: As governments increasingly rely on digital infrastructure for public services, protecting sensitive citizen data and critical national infrastructure from cyber threats is paramount, leading to significant uptake of cybersecurity insurance.

- Other Industries: This broad category includes manufacturing, retail, and technology. These industries are also increasingly embracing digital technologies, expanding their attack surfaces and driving demand for cyber insurance Singapore.

The dominance of these segments is underpinned by factors such as the volume of sensitive data handled, the financial impact of cyber incidents, regulatory mandates, and the overall maturity of their digital transformation efforts.

Cyber Security Insurance Market in Singapore Product Innovations

Product innovations in the Singapore cybersecurity insurance market are focused on expanding coverage and providing proactive risk mitigation. Insurers are moving beyond traditional data breach response to include coverage for ransomware payments, business interruption losses, reputational damage, and cyber extortion. Advanced underwriting tools leveraging AI and machine learning are enabling more accurate risk assessments and personalized policy terms. The integration of cybersecurity services, such as threat intelligence and incident response retainers, into insurance policies is a significant trend, offering clients a more holistic approach to cyber risk management. These innovations are crucial in addressing the evolving threat landscape and the specific needs of the Singaporean market, enhancing the value proposition of cyber insurance Singapore and driving competitive advantage.

Report Segmentation & Scope

This report segments the Singapore cybersecurity insurance market based on key parameters to provide granular insights. The scope encompasses detailed analysis of:

- End-User Segments:

- Personal: Focuses on individuals and their protection against cyber threats. Projections indicate steady growth driven by increasing online activity.

- SMEs: Analyzes the market for small and medium-sized enterprises, a rapidly growing segment with increasing awareness of cyber risks.

- Corporates: Examines the demand from large enterprises, driven by regulatory compliance and the high stakes of cyber incidents.

- Industry Segments:

- Financial Services: Covers the leading sector in demand for comprehensive cyber insurance.

- Government Bodies/Agencies: Highlights the critical need for protection of public sector digital assets.

- Healthcare: Addresses the specific risks and regulatory landscape for this vital industry.

- Professional Services: Analyzes the demand from law firms, accounting firms, and other service providers.

- Other Industries: Encompasses manufacturing, retail, technology, and emerging sectors.

The report provides market size estimations, growth projections, and competitive dynamics for each of these segments.

Key Drivers of Cyber Security Insurance Market in Singapore Growth

The Singapore cybersecurity insurance market is propelled by several key drivers. The increasing frequency, sophistication, and evolving nature of cyber threats, including ransomware, phishing, and data breaches, necessitate robust financial protection. Heightened regulatory scrutiny from bodies like the Monetary Authority of Singapore (MAS), which mandates stronger data protection and incident reporting, incentivizes organizations to secure cyber insurance Singapore. The accelerating digital transformation across all industries in Singapore expands the attack surface, making digital risk a paramount concern. Growing awareness among businesses and individuals about the severe financial and reputational consequences of cyber incidents further fuels demand for cyber liability insurance.

Challenges in the Cyber Security Insurance Market in Singapore Sector

Despite strong growth prospects, the Singapore cybersecurity insurance market faces several challenges. The underwriting of cyber risk remains complex due to its evolving and unpredictable nature, leading to potential pricing challenges and coverage limitations. A shortage of skilled cybersecurity professionals to manage and mitigate risks can hinder effective risk management for policyholders, impacting insurability. The cost of comprehensive cyber insurance Singapore can be a barrier for some SMEs, limiting market penetration. Furthermore, the increasing prevalence of large-scale, state-sponsored attacks presents systemic risks that are difficult for insurers to fully quantify and cover.

Leading Players in the Cyber Security Insurance Market in Singapore Market

- Howden Group

- MSIG Insurance

- Delta Insurance

- CHUBB Insurance

- AIG Insurance

- AXA

- TIQ ( Etiga Insurance)

- Tokio Marine Insurance Group

- QBE Singapore

- Sompo International

Key Developments in Cyber Security Insurance Market in Singapore Sector

- April 2023: Asian insurance company FWD Singapore announced the expansion of its home insurance coverage by protecting homeowners from cyber fraud through its complimentary FWD cyber insurance. FWD Cyber insurance provides coverage for some of the most common scams, up to USD 3739.50 in coverage for financial loss arising directly from an online marketplace fraud, and up to USD 3739.50 in coverage for financial loss to customers' bank accounts or digital wallets arising directly from a cyber event. This development highlights a growing trend towards integrating cyber protection into broader insurance offerings.

- March 2022: Chubb acquired renewal rights of DUAL Asia's Financial Lines portfolios in Hong Kong SAR and Singapore. Chubb purchased the business assets, including the intellectual property and underwriting models. The parties took over DUAL's client portfolio renewal rights, effective from 18 June 2022. This strategic move by Chubb signifies market consolidation and an effort to strengthen its position in the Singapore cyber insurance landscape by acquiring established portfolios and expertise.

Strategic Cyber Security Insurance Market in Singapore Market Outlook

The strategic outlook for the Singapore cybersecurity insurance market is highly positive, driven by a confluence of factors including sustained digital economic growth, escalating cyber threats, and robust regulatory support. The increasing sophistication of cyberattacks necessitates more comprehensive and specialized insurance solutions, presenting significant opportunities for innovation in product development and service delivery. Strategic initiatives focusing on enhancing risk assessment capabilities, integrating advanced cybersecurity services with insurance policies, and expanding reach into underserved segments like SMEs will be crucial for market leadership. The growing emphasis on proactive risk management and resilience by both the government and private sector will continue to accelerate the adoption of cyber liability insurance Singapore, solidifying its position as an indispensable component of any organization's risk management framework.

Cyber Security Insurance Market in Singapore Segmentation

-

1. End-User

- 1.1. Personal

- 1.2. SMEs

- 1.3. Corporates

-

2. Industry

- 2.1. Financial Services

- 2.2. Government Bodies/Agencies

- 2.3. Healthcare

- 2.4. Professional Services

- 2.5. Other Industries

Cyber Security Insurance Market in Singapore Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cyber Security Insurance Market in Singapore Regional Market Share

Geographic Coverage of Cyber Security Insurance Market in Singapore

Cyber Security Insurance Market in Singapore REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Embedded Insurance is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Inflation is Restraining the Property and Casualty Insurance Market of Singapore

- 3.4. Market Trends

- 3.4.1. Data Breaches and Loss of Confidential Information is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Personal

- 5.1.2. SMEs

- 5.1.3. Corporates

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Financial Services

- 5.2.2. Government Bodies/Agencies

- 5.2.3. Healthcare

- 5.2.4. Professional Services

- 5.2.5. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Personal

- 6.1.2. SMEs

- 6.1.3. Corporates

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Financial Services

- 6.2.2. Government Bodies/Agencies

- 6.2.3. Healthcare

- 6.2.4. Professional Services

- 6.2.5. Other Industries

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. South America Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Personal

- 7.1.2. SMEs

- 7.1.3. Corporates

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Financial Services

- 7.2.2. Government Bodies/Agencies

- 7.2.3. Healthcare

- 7.2.4. Professional Services

- 7.2.5. Other Industries

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Europe Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Personal

- 8.1.2. SMEs

- 8.1.3. Corporates

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Financial Services

- 8.2.2. Government Bodies/Agencies

- 8.2.3. Healthcare

- 8.2.4. Professional Services

- 8.2.5. Other Industries

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Middle East & Africa Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Personal

- 9.1.2. SMEs

- 9.1.3. Corporates

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Financial Services

- 9.2.2. Government Bodies/Agencies

- 9.2.3. Healthcare

- 9.2.4. Professional Services

- 9.2.5. Other Industries

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Asia Pacific Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Personal

- 10.1.2. SMEs

- 10.1.3. Corporates

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Financial Services

- 10.2.2. Government Bodies/Agencies

- 10.2.3. Healthcare

- 10.2.4. Professional Services

- 10.2.5. Other Industries

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Howden Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MSIG Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delta Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CHUBB Insurance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AIG Insurance

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TIQ ( Etiga Insurance)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tokio Marine Insurance Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 QBE Singapore**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sompo International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Howden Group

List of Figures

- Figure 1: Global Cyber Security Insurance Market in Singapore Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 3: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 4: North America Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 5: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 9: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 10: South America Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 11: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 12: South America Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 17: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 18: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 21: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 22: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 23: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 24: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 27: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 28: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 29: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 2: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 11: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 12: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 17: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 18: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 29: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 30: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 38: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 39: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Security Insurance Market in Singapore?

The projected CAGR is approximately 9.85%.

2. Which companies are prominent players in the Cyber Security Insurance Market in Singapore?

Key companies in the market include Howden Group, MSIG Insurance, Delta Insurance, CHUBB Insurance, AIG Insurance, AXA, TIQ ( Etiga Insurance), Tokio Marine Insurance Group, QBE Singapore**List Not Exhaustive, Sompo International.

3. What are the main segments of the Cyber Security Insurance Market in Singapore?

The market segments include End-User, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 108.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Embedded Insurance is Driving the Market.

6. What are the notable trends driving market growth?

Data Breaches and Loss of Confidential Information is Driving the Market.

7. Are there any restraints impacting market growth?

Inflation is Restraining the Property and Casualty Insurance Market of Singapore.

8. Can you provide examples of recent developments in the market?

April 2023: Asian insurance company FWD Singapore announced the expansion of its home insurance coverage by protecting homeowners from cyber fraud through its complimentary FWD cyber insurance. FWD Cyber insurance provides coverage for some of the most common scams, up to USD 3739.50 in coverage for financial loss arising directly from an online marketplace fraud, and up to USD 3739.50 in coverage for financial loss to customers' bank accounts or digital wallets arising directly from a cyber event.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyber Security Insurance Market in Singapore," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyber Security Insurance Market in Singapore report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyber Security Insurance Market in Singapore?

To stay informed about further developments, trends, and reports in the Cyber Security Insurance Market in Singapore, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence