Key Insights

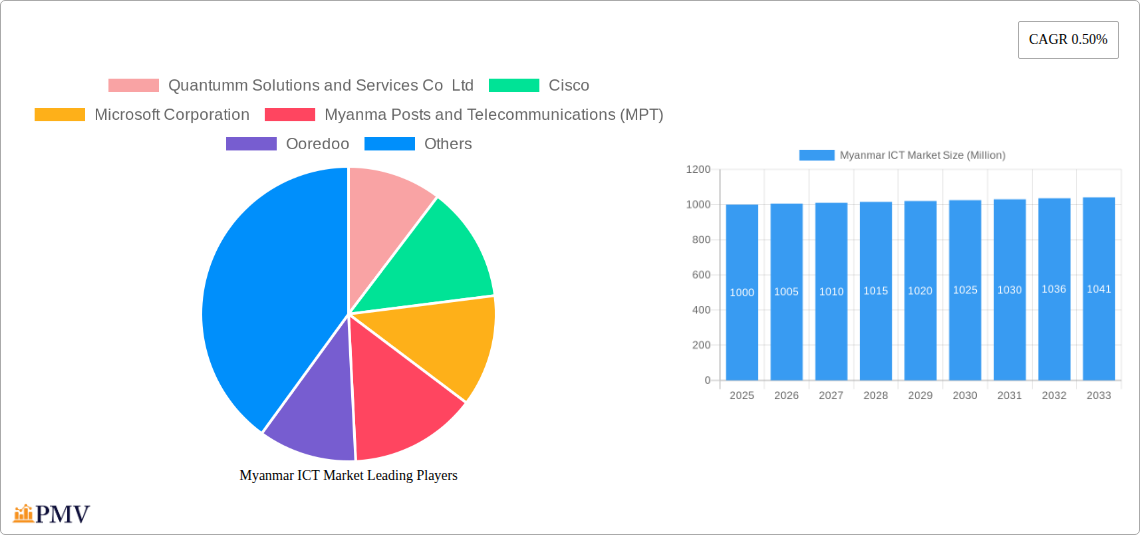

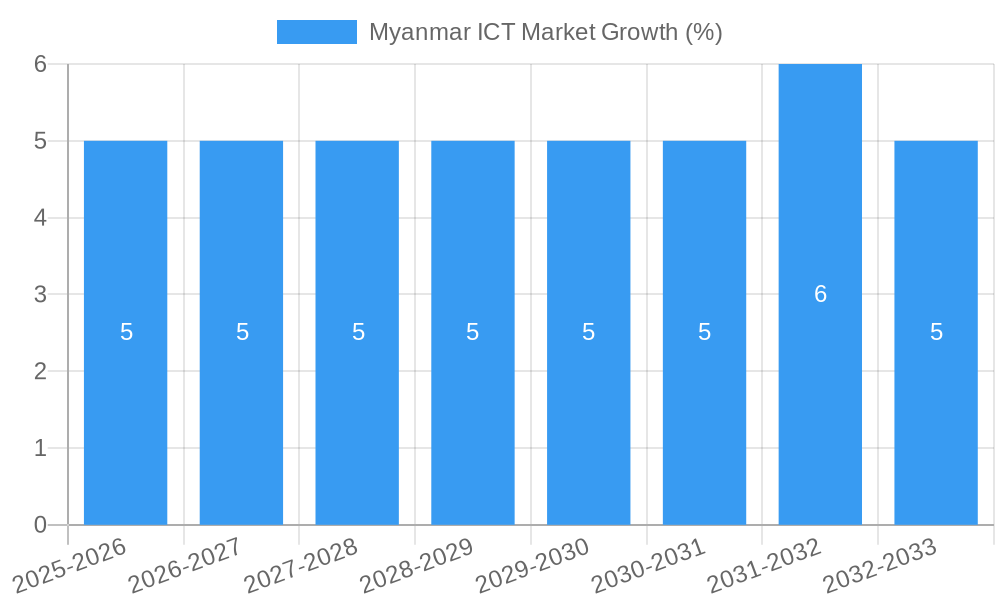

The Myanmar ICT market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR and market size), is projected to experience steady growth with a compound annual growth rate (CAGR) of 0.50% from 2025 to 2033. This moderate growth reflects the country's ongoing efforts to improve digital infrastructure and expand internet access, coupled with increasing mobile phone penetration and the adoption of digital technologies across various sectors. Key drivers include government initiatives promoting digital transformation, rising demand for cloud computing and cybersecurity solutions, and the burgeoning e-commerce sector. The market is segmented by type (hardware, software, IT services, telecommunication services), enterprise size (SMEs and large enterprises), and industry vertical (BFSI, IT & Telecom, Government, Retail & E-commerce, Manufacturing, Energy & Utilities, and Others). The presence of established international players like Cisco, Microsoft, and Huawei, alongside local companies such as Quantumm Solutions and Services, signifies a dynamic market landscape.

However, growth is constrained by factors such as limited internet penetration in rural areas, challenges in establishing reliable infrastructure, and the need for further investment in digital literacy programs. The BFSI and IT & Telecom sectors are currently leading market adoption, yet the potential for expansion exists across all verticals as Myanmar increasingly embraces digital technologies for economic and social development. The forecast period will witness an evolution towards greater cloud adoption, strengthened cybersecurity measures, and continued investment in 5G and broadband infrastructure, shaping the future trajectory of the Myanmar ICT market. Further analysis would benefit from granular data on specific market segments to provide more precise projections and growth opportunities within the sector.

This detailed report provides a comprehensive analysis of the Myanmar ICT market, offering invaluable insights for businesses, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report examines the market's structure, competitive dynamics, key trends, and future outlook. The report segments the market by type (Hardware, Software, IT Services, Telecommunication Services), enterprise size (Small and Medium Enterprises, Large Enterprises), and industry vertical (BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, Other Industry Verticals). The market size is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period.

Myanmar ICT Market Market Structure & Competitive Dynamics

The Myanmar ICT market exhibits a moderately concentrated structure, with a few dominant players alongside a large number of smaller, niche players. Key players like Cisco, Microsoft Corporation, Huawei, Wipro, Infosys, and Oracle compete intensely, driving innovation and shaping market dynamics. Myanma Posts and Telecommunications (MPT) and Ooredoo hold significant market share in telecommunication services. Quantumm Solutions and Services Co Ltd, ATG Systems, and Frontiir represent notable local players. The regulatory framework, while evolving, influences market entry and competition. The market is witnessing increased M&A activity, with deal values estimated at xx Million USD in 2024. Innovation ecosystems are nascent but growing, spurred by government initiatives and foreign investment. Product substitution is a significant factor, particularly in the hardware segment, where cost-effective alternatives continuously emerge. End-user trends reveal a growing preference for cloud-based solutions and mobile technologies.

Myanmar ICT Market Industry Trends & Insights

The Myanmar ICT market is experiencing significant growth, driven by rising internet and smartphone penetration, increasing government investments in digital infrastructure, and the expanding adoption of digital technologies across various sectors. The market's CAGR is projected at xx%, exceeding the global average. Technological disruptions, such as the advent of 5G and the increasing adoption of AI and IoT, are reshaping the competitive landscape. Consumer preferences are shifting towards user-friendly, cost-effective, and secure ICT solutions. The market is characterized by increasing competition, with both local and international players vying for market share. Market penetration of cloud services is rapidly increasing, with predictions of xx% by 2033. This growth is fueled by government initiatives promoting digital transformation and the increasing need for secure and scalable IT infrastructure among businesses.

Dominant Markets & Segments in Myanmar ICT Market

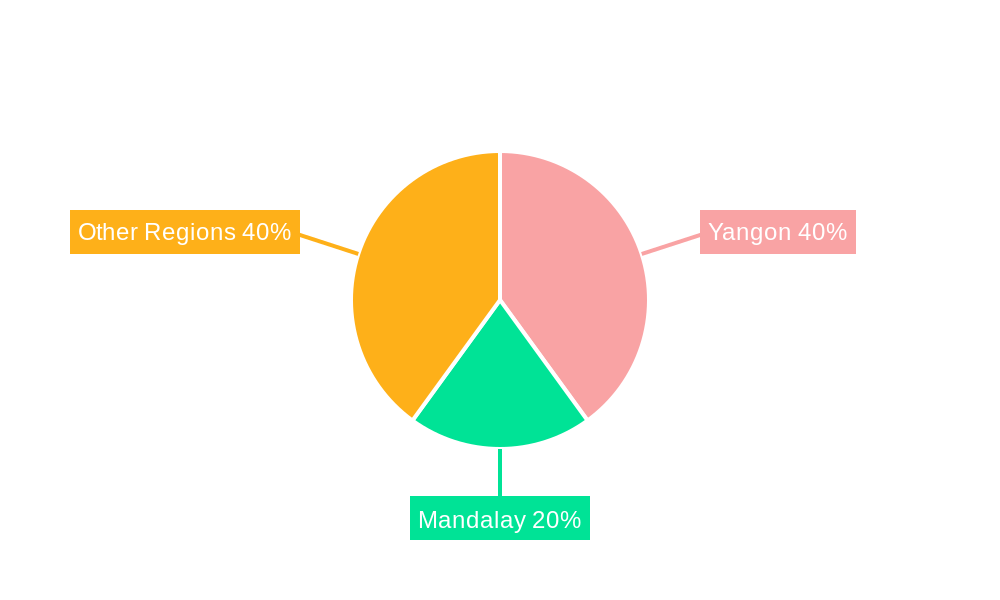

Leading Region/Segment: Yangon and Mandalay regions are the most dominant in the market, due to higher internet penetration and economic activity. The Telecommunication Services segment currently holds the largest market share, followed by IT Services. Large Enterprises drive a significant portion of the overall market spending. The BFSI and IT and Telecom verticals are the fastest-growing segments.

Key Drivers:

- Economic Policies: Government initiatives to promote digitalization and investments in infrastructure are key catalysts.

- Infrastructure Development: Expansion of internet and mobile network coverage is crucial for market growth.

- Rising Smartphone Penetration: Increasing smartphone adoption fuels demand for mobile data and applications.

- Government Initiatives: Government focus on digital inclusion and development of the digital economy is crucial.

The dominance of Telecommunication Services is attributable to the widespread adoption of mobile phones and increasing internet usage. The rapid growth of the BFSI and IT & Telecom verticals reflects the increasing digitization of these sectors. Large enterprises’ higher investment capacity compared to SMEs also contributes to the market's dynamics.

Myanmar ICT Market Product Innovations

Recent product innovations include the launch of cloud-based services tailored to local market needs, advancements in mobile money applications, and development of localized software solutions. These innovations reflect technological trends towards cloud computing, mobile-first strategies, and localized solutions that address the specific challenges and opportunities of the Myanmar market. The competitive advantage lies in offering cost-effective, user-friendly solutions catering to the diverse needs of various segments.

Report Segmentation & Scope

This report segments the Myanmar ICT market comprehensively:

By Type: Hardware (xx Million USD in 2025, projected to reach xx Million USD by 2033), Software (xx Million USD in 2025, projected to reach xx Million USD by 2033), IT Services (xx Million USD in 2025, projected to reach xx Million USD by 2033), and Telecommunication Services (xx Million USD in 2025, projected to reach xx Million USD by 2033). Competition is intense in each segment, with a mix of global and local players.

By Enterprise Size: Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs represent a significant but fragmented market, while large enterprises drive higher spending and innovation.

By Industry Vertical: BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, and Other Industry Verticals. Each vertical presents unique opportunities and challenges, requiring tailored ICT solutions.

Key Drivers of Myanmar ICT Market Growth

Several factors drive the Myanmar ICT market's growth: increased government investment in digital infrastructure, rising internet and mobile penetration, burgeoning demand for cloud-based services, increasing adoption of digital technologies across various sectors, and supportive government policies promoting digital transformation. Furthermore, the growing adoption of mobile banking and financial technology (fintech) solutions significantly contributes to the market's expansion.

Challenges in the Myanmar ICT Market Sector

Challenges include limited digital literacy, inadequate infrastructure in some regions, political and economic instability affecting investment and growth, regulatory hurdles in licensing and data privacy, cybersecurity concerns, and supply chain disruptions impacting the availability of hardware and software. These factors can collectively constrain market growth and require strategic mitigation efforts. The impact of these challenges on the market is estimated to result in a xx% reduction in potential market growth annually.

Leading Players in the Myanmar ICT Market Market

- Quantumm Solutions and Services Co Ltd

- Cisco

- Microsoft Corporation

- Myanma Posts and Telecommunications (MPT)

- Ooredoo

- Huawei

- Wipro

- Infosys

- ATG Systems

- Frontiir

- Oracle

- IBM

Key Developments in Myanmar ICT Market Sector

- August 2022: MPT Launches Myanmar's First One-Stop Cloud Service, enhancing business operations and data security.

- September 2022: Alibaba Cloud announces a USD 1 billion investment in its global partner ecosystem, signaling increased commitment to the Asian market, including potential expansion in Myanmar.

Strategic Myanmar ICT Market Market Outlook

The Myanmar ICT market presents significant long-term growth potential. Continued government investment in infrastructure, increasing digital literacy, and the expanding adoption of digital technologies across various sectors will drive market expansion. Strategic opportunities exist for players focused on delivering cost-effective, user-friendly, and secure ICT solutions tailored to the specific needs of the Myanmar market. Focusing on localized solutions and building strong partnerships will be crucial for success.

Myanmar ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Myanmar ICT Market Segmentation By Geography

- 1. Myanmar

Myanmar ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Digital Transformation Initiatives; Robust Telecommunication Network

- 3.3. Market Restrains

- 3.3.1. Infrastructural Constraints

- 3.4. Market Trends

- 3.4.1. Growing demand for Cloud Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Quantumm Solutions and Services Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cisco

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microsoft Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Myanma Posts and Telecommunications (MPT)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ooredoo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wipro

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Infosys

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ATG Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Frontiir*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Oracle

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 IBM

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Quantumm Solutions and Services Co Ltd

List of Figures

- Figure 1: Myanmar ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Myanmar ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Myanmar ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Myanmar ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Myanmar ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Myanmar ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Myanmar ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Myanmar ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Myanmar ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Myanmar ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: Myanmar ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: Myanmar ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar ICT Market?

The projected CAGR is approximately 0.50%.

2. Which companies are prominent players in the Myanmar ICT Market?

Key companies in the market include Quantumm Solutions and Services Co Ltd, Cisco, Microsoft Corporation, Myanma Posts and Telecommunications (MPT), Ooredoo, Huawei, Wipro, Infosys, ATG Systems, Frontiir*List Not Exhaustive, Oracle, IBM.

3. What are the main segments of the Myanmar ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consistent Digital Transformation Initiatives; Robust Telecommunication Network.

6. What are the notable trends driving market growth?

Growing demand for Cloud Technology.

7. Are there any restraints impacting market growth?

Infrastructural Constraints.

8. Can you provide examples of recent developments in the market?

September 2022: At the 2022 Alibaba Cloud Summit, Alibaba Cloud, Alibaba Group's digital technology and intelligence backbone, revealed its newest worldwide strategic plan. During the three-day summit, the trusted cloud provider announced new products to support enterprise technology innovation, a USD 1 billion investment to upgrade the global partner ecosystem, and enhanced customer services to provide comprehensive support throughout a customer's digitalization journey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar ICT Market?

To stay informed about further developments, trends, and reports in the Myanmar ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence