Key Insights

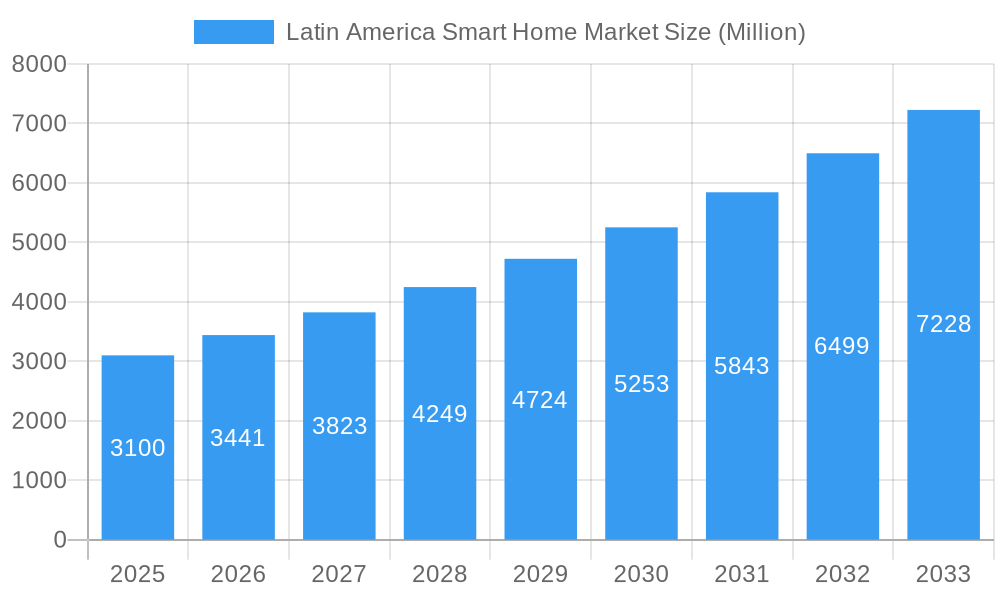

The Latin American smart home market is experiencing robust growth, projected to reach a market size of $3.10 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization and rising disposable incomes are fueling consumer demand for enhanced convenience, security, and energy efficiency. Furthermore, advancements in technology, such as the Internet of Things (IoT) and improved affordability of smart devices, are making smart home solutions more accessible to a wider segment of the population. The growing adoption of smart assistants like Amazon Alexa and Google Home, alongside the increasing availability of high-speed internet, is further accelerating market penetration. Government initiatives promoting digitalization and infrastructure development are also contributing positively to the market's trajectory.

Latin America Smart Home Market Market Size (In Billion)

However, market growth faces some challenges. Significant disparities in income levels across Latin American countries create uneven market penetration. Concerns about data privacy and cybersecurity, along with the need for robust technical support and reliable internet connectivity in certain regions, pose obstacles to widespread adoption. Despite these restraints, the long-term outlook remains positive, fueled by continuous technological innovation, improved infrastructure, and increasing consumer awareness of the benefits of smart home technology. Key players like Schneider Electric, Emerson Electric, ABB, and Honeywell are actively shaping the market landscape through strategic partnerships, product development, and investments in expanding market reach. The market is segmented by device type (lighting, security, appliances, etc.), technology (Wi-Fi, Zigbee, Z-Wave), and price point, reflecting varying consumer needs and preferences.

Latin America Smart Home Market Company Market Share

Latin America Smart Home Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America smart home market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, competitive landscape, growth drivers, challenges, and future outlook. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Latin America Smart Home Market Market Structure & Competitive Dynamics

The Latin American smart home market exhibits a moderately concentrated structure, with key players like Schneider Electric SE, Emerson Electric Co, ABB Ltd, Honeywell International Inc, Siemens AG, and Signify Holding vying for market share. The market is characterized by a dynamic innovation ecosystem, with continuous advancements in IoT technologies, AI integration, and cloud-based solutions. Regulatory frameworks, while evolving, play a significant role in shaping market growth, particularly concerning data privacy and security. Product substitution is limited, primarily driven by technological advancements rather than completely replacing existing solutions. End-user trends show a growing preference for integrated, user-friendly systems and energy-efficient solutions.

Mergers and acquisitions (M&A) have been significant in consolidating market power and expanding product portfolios. For example, in 2023, the value of M&A deals in this sector reached an estimated xx Million. Key M&A activities have focused on expanding geographical reach, enhancing technological capabilities, and diversifying product offerings. Larger players are strategically acquiring smaller companies with specialized technologies or strong regional presence to gain a competitive edge. Market share data reveals that xx% is held by the top five players, signifying an oligopolistic structure, though numerous smaller players and startups contribute to market dynamism.

Latin America Smart Home Market Industry Trends & Insights

The Latin American smart home market is experiencing robust growth, fueled by several factors. Rising disposable incomes, increasing urbanization, and growing awareness of energy efficiency are driving adoption. The market penetration rate is projected to reach xx% by 2033, up from xx% in 2024. Technological disruptions, including advancements in artificial intelligence (AI), 5G connectivity, and edge computing, are transforming the landscape. Consumers are increasingly drawn to smart home solutions that offer enhanced convenience, security, and energy management capabilities. Competition is intensifying, with companies investing heavily in research and development (R&D) to offer innovative, user-friendly products and services. The market is witnessing a shift towards integrated ecosystems that seamlessly connect various smart home devices, creating a unified and intuitive user experience. This trend, along with the increasing adoption of smart assistants and voice control, are shaping consumer preferences and driving market growth.

Dominant Markets & Segments in Latin America Smart Home Market

Brazil and Mexico currently dominate the Latin American smart home market, owing to their larger economies, higher consumer spending, and better infrastructure compared to other countries in the region.

- Brazil: Strong economic growth, expanding middle class, and government initiatives promoting technological advancements fuel the market's growth.

- Mexico: A significant base of tech-savvy consumers, coupled with growing investments in smart city infrastructure, drive market expansion.

Other key segments showing significant growth include smart lighting, smart security systems, and smart appliances. These segments are driven by increasing demand for enhanced home security, energy efficiency, and convenient home automation.

The dominance of Brazil and Mexico is primarily attributed to:

- Stronger consumer spending: A larger middle class with more disposable income to invest in smart home technologies.

- Developed infrastructure: Better internet penetration and electricity grids support the seamless operation of smart home devices.

- Government support: Initiatives promoting technological innovation and digital transformation in the region.

Latin America Smart Home Market Product Innovations

The Latin American smart home market witnesses continuous product innovation, marked by the integration of AI, advanced analytics, and enhanced connectivity features. New products offer improved energy management capabilities, intuitive user interfaces, and enhanced security features. This focuses on addressing the specific needs and preferences of the Latin American consumer, tailoring solutions to accommodate diverse household structures and budgets. This includes integration with local payment systems and language support in the smart home interfaces to increase product adoption.

Report Segmentation & Scope

This report segments the Latin American smart home market based on:

- Product Type: Smart lighting, smart security systems, smart appliances, smart thermostats, and other smart home devices. Each segment's growth projection and competitive dynamics are analyzed in detail.

- Technology: Wi-Fi, Zigbee, Z-Wave, and other connectivity protocols, assessing their market share and impact on overall growth.

- End-User: Residential, commercial, and industrial sectors, highlighting segment-specific trends and growth drivers.

- Country: Brazil, Mexico, Argentina, Colombia, Chile, and other Latin American countries, providing detailed market size and growth projections for each nation.

Key Drivers of Latin America Smart Home Market Growth

Several factors drive the growth of the Latin American smart home market:

- Technological advancements: Continued innovation in IoT, AI, and cloud computing enhances the capabilities and appeal of smart home devices.

- Rising disposable incomes: A growing middle class with increased spending power fuels demand for smart home solutions.

- Government initiatives: Policies supporting digital transformation and smart city projects enhance market adoption.

Challenges in the Latin America Smart Home Market Sector

Despite strong growth potential, challenges hinder the market’s expansion:

- High initial investment costs: The price of smart home technologies can be a barrier for many consumers.

- Cybersecurity concerns: Data privacy and security risks can deter adoption, demanding robust security protocols.

- Uneven internet penetration: In certain regions, limited internet access restricts the functionality of many smart home devices. This uneven access reduces the market's overall potential.

Leading Players in the Latin America Smart Home Market Market

- Schneider Electric SE

- Emerson Electric Co

- ABB Ltd

- Honeywell International Inc

- Siemens AG

- Signify Holding

- Microsoft Corporation

- Google Inc

- Cisco Systems Inc

- General Electric Company

- Dahua Technology

- D-Link Electronics Co Ltd

Key Developments in Latin America Smart Home Market Sector

- January 2024: Universal Electronics Inc. launched UEI Butler Smart Home Control Hubs, enhancing interoperability and smart home control.

- April 2024: Samsung Electronics Co., Ltd. unveiled its 'BESPOKE AI' home appliances, integrating AI and advanced connectivity features.

Strategic Latin America Smart Home Market Market Outlook

The Latin American smart home market holds significant growth potential. Strategic investments in R&D, focusing on cost-effective solutions, addressing cybersecurity concerns, and expanding internet access will be crucial for unlocking its full potential. Targeted marketing campaigns that highlight the benefits of smart home technologies and address consumer concerns will be necessary to drive wider adoption. Partnerships with local installers and service providers will facilitate the market's growth by ensuring smooth installation and maintenance.

Latin America Smart Home Market Segmentation

-

1. Product Type

- 1.1. Comfort and Lighting

- 1.2. Control and Connectivity

- 1.3. Energy Management

- 1.4. Home Entertainment

- 1.5. Security

- 1.6. Smart Appliances

- 1.7. HVAC Control

-

2. Technology

- 2.1. Wi-Fi

- 2.2. Bluetooth

- 2.3. Other Technologies

Latin America Smart Home Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Smart Home Market Regional Market Share

Geographic Coverage of Latin America Smart Home Market

Latin America Smart Home Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Concerns about Home Security and Safety; Advances in Technology

- 3.2.2 such as IoT

- 3.2.3 Artificial Intelligence

- 3.2.4 and Voice Controlled Assistants

- 3.3. Market Restrains

- 3.3.1 Rising Concerns about Home Security and Safety; Advances in Technology

- 3.3.2 such as IoT

- 3.3.3 Artificial Intelligence

- 3.3.4 and Voice Controlled Assistants

- 3.4. Market Trends

- 3.4.1. Brazil is Experiencing Significant Demand for Smart Homes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Smart Home Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Comfort and Lighting

- 5.1.2. Control and Connectivity

- 5.1.3. Energy Management

- 5.1.4. Home Entertainment

- 5.1.5. Security

- 5.1.6. Smart Appliances

- 5.1.7. HVAC Control

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Wi-Fi

- 5.2.2. Bluetooth

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Schneider Electric SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emerson Electric Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Seimens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Signify Holding

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Google Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cisco Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 General Electric Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 D-Link Electronics Co Ltd*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Schneider Electric SE

List of Figures

- Figure 1: Latin America Smart Home Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Smart Home Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Smart Home Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Smart Home Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Latin America Smart Home Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Latin America Smart Home Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 5: Latin America Smart Home Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Smart Home Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Latin America Smart Home Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Latin America Smart Home Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Latin America Smart Home Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Latin America Smart Home Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 11: Latin America Smart Home Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Smart Home Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Argentina Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Chile Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Colombia Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Peru Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Peru Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Venezuela Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Venezuela Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Ecuador Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Ecuador Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Bolivia Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Bolivia Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Paraguay Latin America Smart Home Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Paraguay Latin America Smart Home Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Smart Home Market?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Latin America Smart Home Market?

Key companies in the market include Schneider Electric SE, Emerson Electric Co, ABB Ltd, Honeywell International Inc, Seimens AG, Signify Holding, Microsoft Corporation, Google Inc, Cisco Systems Inc, General Electric Company, Dahua Technology, D-Link Electronics Co Ltd*List Not Exhaustive.

3. What are the main segments of the Latin America Smart Home Market?

The market segments include Product Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Concerns about Home Security and Safety; Advances in Technology. such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

6. What are the notable trends driving market growth?

Brazil is Experiencing Significant Demand for Smart Homes.

7. Are there any restraints impacting market growth?

Rising Concerns about Home Security and Safety; Advances in Technology. such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

8. Can you provide examples of recent developments in the market?

April 2024: Samsung Electronics Co., Ltd unveiled its latest lineup of home appliances, 'BESPOKE AI.' These appliances, equipped with built-in Wi-Fi, internal cameras, and AI chips, enhance connectivity and performance. The AI Home, featuring a 7-inch LCD display, offers intuitive control over the connected ecosystem, including a 3D Map View for easy appliance management.January 2024: Universal Electronics Inc. introduced the UEI Butler Smart Home Control Hubs. These hubs offer seamless integration with QuickSet Cloud, facilitating Discovery, Control, and Interaction across various connected devices for smarter living. With pre-integrated Zigbee sensors, Wi-Fi or Ethernet configurations, and matter-bridging capability, they enable tailored experiences for energy management, climate control, and smart lighting.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Smart Home Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Smart Home Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Smart Home Market?

To stay informed about further developments, trends, and reports in the Latin America Smart Home Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence