Key Insights

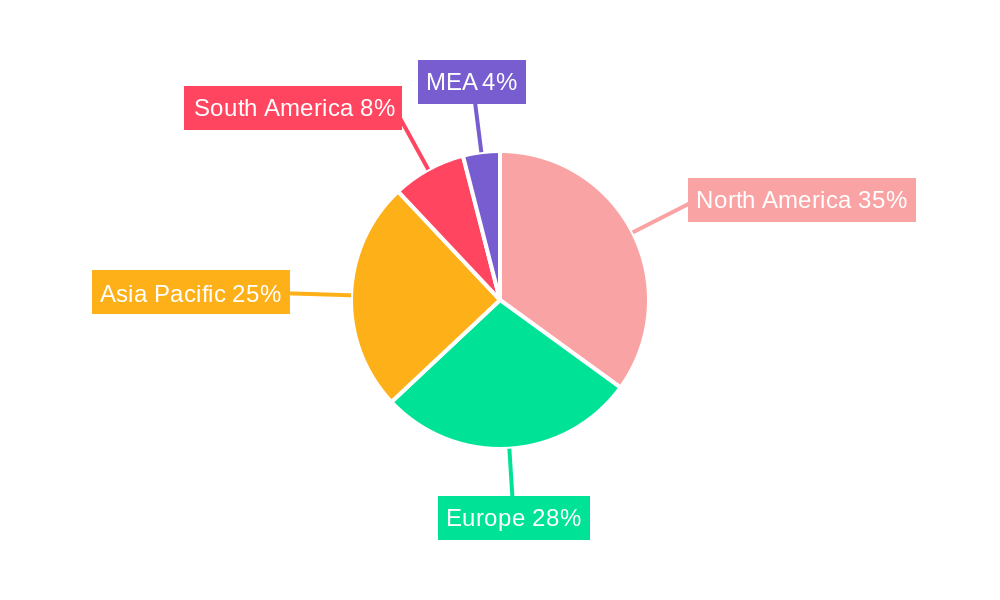

The Bluetooth Low Energy (BLE) beacon market is projected for substantial growth, with a CAGR of 20.55%. This expansion is fueled by the increasing demand for advanced location-based services across numerous industries. Key growth drivers include enhanced customer engagement in retail, optimized operational efficiency in logistics and transportation, and expanded applications in asset tracking and healthcare. The market is segmented by standard type (iBeacon, Eddystone, others), connectivity (Bluetooth Low Energy, Wi-Fi, others), and end-user segments such as retail, sports, transportation & logistics, construction, aviation, healthcare, and automotive. Widespread smartphone adoption with Bluetooth capabilities facilitates seamless interaction for proximity marketing, indoor navigation, and real-time asset monitoring. Continuous technological advancements, including improved battery life and enhanced security, are further accelerating market penetration. The competitive landscape features both established leaders and innovative new entrants offering specialized solutions. North America and Europe currently dominate the market, with Asia-Pacific demonstrating rapid growth due to increasing smartphone penetration and digitalization efforts.

BLE Beacon Industry Market Size (In Billion)

Future market expansion will be driven by technological innovations leading to more compact, energy-efficient, and cost-effective beacons. The integration of BLE beacon technology with the Internet of Things (IoT) and artificial intelligence (AI) presents significant opportunities for novel applications and market penetration. While security concerns and infrastructure requirements may pose minor challenges, the overall market outlook remains exceptionally positive. The market is anticipated to reach a size of 24.4 billion by 2025, with a base year of 2025. The competitive environment is dynamic, characterized by a relentless pursuit of innovation and market share.

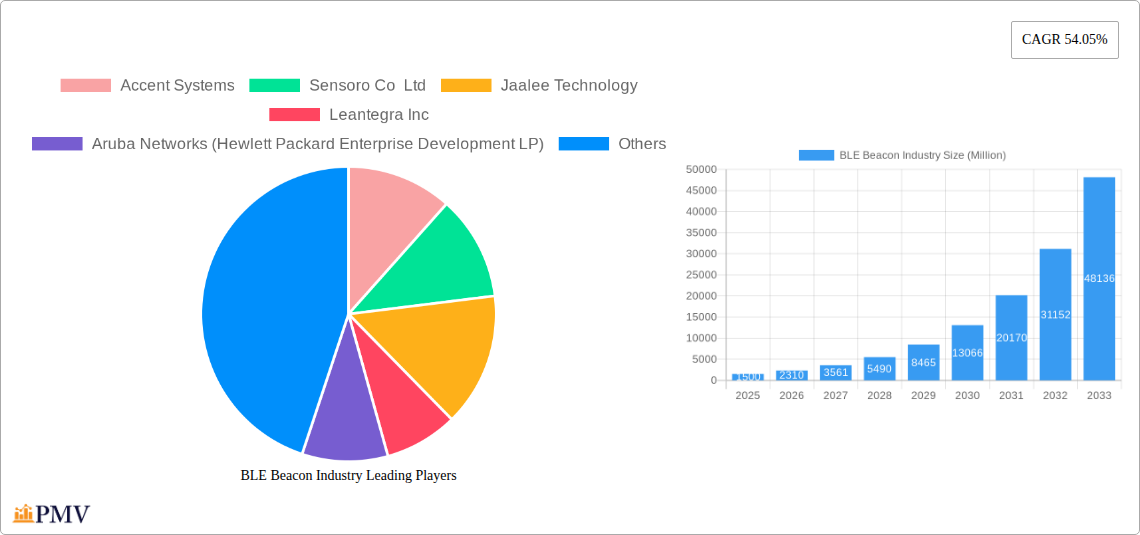

BLE Beacon Industry Company Market Share

BLE Beacon Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the BLE Beacon industry, covering market size, growth projections, competitive landscape, and key trends from 2019 to 2033. With a focus on actionable insights and a projected market value exceeding $XX Million by 2033, this report is essential for industry professionals, investors, and anyone seeking to understand this rapidly evolving technology sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033 and the historical period is 2019-2024.

BLE Beacon Industry Market Structure & Competitive Dynamics

The BLE Beacon market exhibits a moderately concentrated structure, with several key players holding significant market share. The competitive landscape is dynamic, characterized by ongoing innovation, strategic partnerships, and mergers & acquisitions (M&A) activities. Market concentration is influenced by factors such as technological advancements, regulatory changes, and evolving end-user demands. Key players are constantly striving to differentiate their offerings through enhanced functionalities, improved battery life, and advanced analytics capabilities. The total M&A deal value in the period 2019-2024 is estimated at $XX Million.

- Market Share: While precise market share data for individual companies is proprietary, leading players such as Accent Systems, Sensoro Co Ltd, Jaalee Technology, Leantegra Inc, Aruba Networks (Hewlett Packard Enterprise Development LP), Cisco Systems Inc, HID Global Corporation, Gimbal Inc, Fujitsu Components Asia Pte Ltd, and Kontakt io Inc. collectively account for a substantial portion of the global market.

- Innovation Ecosystems: Collaboration between beacon manufacturers, software developers, and system integrators drives innovation. Open standards like iBeacon and Eddystone foster interoperability and ecosystem growth.

- Regulatory Frameworks: Government regulations concerning data privacy and security are increasingly influential, shaping product development and deployment strategies.

- Product Substitutes: Technologies like Ultra-Wideband (UWB) and RFID pose competitive challenges, offering alternative solutions for location tracking and proximity detection.

- End-User Trends: The growing adoption of BLE beacons across various sectors, fueled by the demand for enhanced customer engagement and operational efficiency, is a primary growth driver.

- M&A Activities: Consolidation within the industry through strategic acquisitions continues to reshape the competitive landscape, leading to increased scale and expanded product portfolios.

BLE Beacon Industry Industry Trends & Insights

The BLE Beacon industry is experiencing significant growth, driven by increasing demand across diverse sectors. The market is witnessing a compound annual growth rate (CAGR) of XX% during the forecast period (2025-2033). This growth is fueled by several key factors. Technological advancements, such as improved power efficiency and enhanced data analytics capabilities, continue to broaden the applications of BLE beacons. Consumer preference for personalized and location-based services is another significant driver. The market penetration rate is expected to reach XX% by 2033. The competitive dynamics remain intense, with established players focusing on innovation and expansion into new markets, while emerging companies introduce disruptive technologies and business models. The overall market trend signifies a positive outlook for sustained growth, with further expansion expected in emerging economies.

Dominant Markets & Segments in BLE Beacon Industry

The retail sector remains the dominant end-user segment globally, followed by the transportation and logistics industry. North America and Europe currently represent the largest regional markets, owing to higher adoption rates and robust technological infrastructure.

- By Standard Type: iBeacon holds a significant market share due to its wide adoption and established ecosystem. Eddystone is gaining traction due to its flexibility and features. Other standard types comprise a niche segment.

- By Connectivity: Bluetooth Low Energy (BLE) remains the dominant connectivity technology due to its low power consumption and cost-effectiveness. Wi-Fi based solutions are used in specific applications requiring higher bandwidth. Other connectivity technologies remain a smaller segment.

- By End-User:

- Retail: High adoption for customer engagement, loyalty programs, and inventory management. Key drivers include the need for improved customer experience and optimized operational efficiency.

- Sports: Used for audience engagement, real-time analytics, and personalized experiences. Key drivers include enhancing fan engagement and gathering valuable data for marketing and operations.

- Transportation and Logistics: Facilitates asset tracking, real-time location monitoring, and improved logistics efficiency. Key drivers include the need for increased efficiency and improved transparency in supply chain management.

- Construction: Used for worker safety, equipment tracking, and project monitoring. Key drivers include improving worker safety and streamlining project management.

- Aviation: Applications in passenger tracking, baggage handling, and airport operations. Key drivers include optimizing airport operations and enhancing passenger experience.

- Healthcare: Used for patient tracking, asset management, and real-time location services. Key drivers include improved patient care and efficient resource management.

- Automotive: Applications in vehicle tracking, proximity sensing, and driver assistance systems. Key drivers include enhancing vehicle safety and improving driver experience.

BLE Beacon Industry Product Innovations

Recent product innovations focus on enhancing functionalities, improving power efficiency, and integrating advanced analytics capabilities. Miniaturization and improved battery life are key features, enabling wider deployment scenarios. The integration of BLE with other technologies, such as UWB, is expanding the potential applications of BLE beacons, offering more precise and reliable location tracking. The market is seeing a trend towards smart beacons with embedded sensors for environmental monitoring and data collection, creating new opportunities for data-driven applications. These innovations are tailored to address the specific needs of various end-user industries.

Report Segmentation & Scope

This report segments the BLE Beacon market based on standard type (iBeacon, Eddystone, Other Standard Types), connectivity (Bluetooth Low Energy, Wi-Fi, Other Connectivity), and end-user (Retail, Sports, Transportation and Logistics, Construction, Aviation, Healthcare, Automotive, Other End-Users). Each segment includes growth projections, market size estimations, and competitive landscape analyses.

Key Drivers of BLE Beacon Industry Growth

The BLE Beacon industry's growth is driven by several key factors. Technological advancements like improved power efficiency and smaller form factors are broadening applications. The increasing demand for personalized and location-based services across various industries fuels market expansion. Government initiatives promoting smart city development and digital transformation are also creating opportunities. Favorable economic conditions and increased investments in infrastructure further accelerate adoption.

Challenges in the BLE Beacon Industry Sector

Challenges include maintaining data security and privacy concerns, ensuring interoperability across different platforms, and addressing the complexities of integrating BLE technology with existing infrastructure. Competition from alternative location technologies, such as UWB and RFID, poses a threat. Supply chain disruptions and the rising cost of components can affect profitability. Strict regulatory frameworks and compliance requirements also represent obstacles. These challenges impact market growth and require strategic solutions from industry players.

Leading Players in the BLE Beacon Industry Market

- Accent Systems

- Sensoro Co Ltd

- Jaalee Technology

- Leantegra Inc

- Aruba Networks (Hewlett Packard Enterprise Development LP)

- Cisco Systems Inc

- HID Global Corporation

- Gimbal Inc

- Fujitsu Components Asia Pte Ltd

- Kontakt io Inc

Key Developments in BLE Beacon Industry Sector

- November 2022: infsoft launched a new Locator Beacon combining BLE and UWB, enhancing location tracking accuracy for various applications.

- October 2022: ZPE Systems introduced Nodegrid MiniSR, a smartphone-sized cloud gateway for IoT, OT, and IoMD applications, facilitating secure and centralized management of connected devices, including alert beacons.

Strategic BLE Beacon Industry Market Outlook

The BLE Beacon market exhibits strong growth potential, driven by ongoing technological advancements and expanding applications across numerous sectors. Future opportunities lie in the integration of BLE beacons with emerging technologies, such as AI and IoT, to create more intelligent and data-driven solutions. Strategic partnerships and collaborations will be crucial for companies to expand their market reach and capture new growth opportunities. The focus on developing robust security measures and addressing privacy concerns will be vital for building consumer trust and fostering wider adoption. The market is poised for continued expansion, offering significant opportunities for innovation and investment.

BLE Beacon Industry Segmentation

-

1. Standard Type

- 1.1. iBeacon

- 1.2. Eddystone

- 1.3. Other Standard Types

-

2. Connectivity

- 2.1. Bluetooth Low Energy

- 2.2. Wi-Fi

- 2.3. Other Connectivity

-

3. End-User

- 3.1. Retail

- 3.2. Sports

- 3.3. Transportation and Logistics

- 3.4. Construction

- 3.5. Aviation

- 3.6. Healthcare

- 3.7. Automotive

- 3.8. Other End-Users

BLE Beacon Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

BLE Beacon Industry Regional Market Share

Geographic Coverage of BLE Beacon Industry

BLE Beacon Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Spatial Data to Analyze Demographic Trend; Rising Adoption of Smart Beacons in Logistics and Transportation

- 3.3. Market Restrains

- 3.3.1. Requirement of High Skill for the Creation of Beacon Solution; Increasing Trend toward Offline Stores for Opting Online Platforms in Retail Sector

- 3.4. Market Trends

- 3.4.1. Retail End-User Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global BLE Beacon Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Standard Type

- 5.1.1. iBeacon

- 5.1.2. Eddystone

- 5.1.3. Other Standard Types

- 5.2. Market Analysis, Insights and Forecast - by Connectivity

- 5.2.1. Bluetooth Low Energy

- 5.2.2. Wi-Fi

- 5.2.3. Other Connectivity

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Retail

- 5.3.2. Sports

- 5.3.3. Transportation and Logistics

- 5.3.4. Construction

- 5.3.5. Aviation

- 5.3.6. Healthcare

- 5.3.7. Automotive

- 5.3.8. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Standard Type

- 6. North America BLE Beacon Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Standard Type

- 6.1.1. iBeacon

- 6.1.2. Eddystone

- 6.1.3. Other Standard Types

- 6.2. Market Analysis, Insights and Forecast - by Connectivity

- 6.2.1. Bluetooth Low Energy

- 6.2.2. Wi-Fi

- 6.2.3. Other Connectivity

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Retail

- 6.3.2. Sports

- 6.3.3. Transportation and Logistics

- 6.3.4. Construction

- 6.3.5. Aviation

- 6.3.6. Healthcare

- 6.3.7. Automotive

- 6.3.8. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Standard Type

- 7. Europe BLE Beacon Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Standard Type

- 7.1.1. iBeacon

- 7.1.2. Eddystone

- 7.1.3. Other Standard Types

- 7.2. Market Analysis, Insights and Forecast - by Connectivity

- 7.2.1. Bluetooth Low Energy

- 7.2.2. Wi-Fi

- 7.2.3. Other Connectivity

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Retail

- 7.3.2. Sports

- 7.3.3. Transportation and Logistics

- 7.3.4. Construction

- 7.3.5. Aviation

- 7.3.6. Healthcare

- 7.3.7. Automotive

- 7.3.8. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Standard Type

- 8. Asia Pacific BLE Beacon Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Standard Type

- 8.1.1. iBeacon

- 8.1.2. Eddystone

- 8.1.3. Other Standard Types

- 8.2. Market Analysis, Insights and Forecast - by Connectivity

- 8.2.1. Bluetooth Low Energy

- 8.2.2. Wi-Fi

- 8.2.3. Other Connectivity

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Retail

- 8.3.2. Sports

- 8.3.3. Transportation and Logistics

- 8.3.4. Construction

- 8.3.5. Aviation

- 8.3.6. Healthcare

- 8.3.7. Automotive

- 8.3.8. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Standard Type

- 9. Rest of the World BLE Beacon Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Standard Type

- 9.1.1. iBeacon

- 9.1.2. Eddystone

- 9.1.3. Other Standard Types

- 9.2. Market Analysis, Insights and Forecast - by Connectivity

- 9.2.1. Bluetooth Low Energy

- 9.2.2. Wi-Fi

- 9.2.3. Other Connectivity

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Retail

- 9.3.2. Sports

- 9.3.3. Transportation and Logistics

- 9.3.4. Construction

- 9.3.5. Aviation

- 9.3.6. Healthcare

- 9.3.7. Automotive

- 9.3.8. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Standard Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Accent Systems

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sensoro Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jaalee Technology

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Leantegra Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Aruba Networks (Hewlett Packard Enterprise Development LP)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cisco Systems Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 HID Global Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Gimbal Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fujitsu Components Asia Pte Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kontakt io Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Accent Systems

List of Figures

- Figure 1: Global BLE Beacon Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global BLE Beacon Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America BLE Beacon Industry Revenue (billion), by Standard Type 2025 & 2033

- Figure 4: North America BLE Beacon Industry Volume (K Unit), by Standard Type 2025 & 2033

- Figure 5: North America BLE Beacon Industry Revenue Share (%), by Standard Type 2025 & 2033

- Figure 6: North America BLE Beacon Industry Volume Share (%), by Standard Type 2025 & 2033

- Figure 7: North America BLE Beacon Industry Revenue (billion), by Connectivity 2025 & 2033

- Figure 8: North America BLE Beacon Industry Volume (K Unit), by Connectivity 2025 & 2033

- Figure 9: North America BLE Beacon Industry Revenue Share (%), by Connectivity 2025 & 2033

- Figure 10: North America BLE Beacon Industry Volume Share (%), by Connectivity 2025 & 2033

- Figure 11: North America BLE Beacon Industry Revenue (billion), by End-User 2025 & 2033

- Figure 12: North America BLE Beacon Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 13: North America BLE Beacon Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America BLE Beacon Industry Volume Share (%), by End-User 2025 & 2033

- Figure 15: North America BLE Beacon Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America BLE Beacon Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America BLE Beacon Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America BLE Beacon Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe BLE Beacon Industry Revenue (billion), by Standard Type 2025 & 2033

- Figure 20: Europe BLE Beacon Industry Volume (K Unit), by Standard Type 2025 & 2033

- Figure 21: Europe BLE Beacon Industry Revenue Share (%), by Standard Type 2025 & 2033

- Figure 22: Europe BLE Beacon Industry Volume Share (%), by Standard Type 2025 & 2033

- Figure 23: Europe BLE Beacon Industry Revenue (billion), by Connectivity 2025 & 2033

- Figure 24: Europe BLE Beacon Industry Volume (K Unit), by Connectivity 2025 & 2033

- Figure 25: Europe BLE Beacon Industry Revenue Share (%), by Connectivity 2025 & 2033

- Figure 26: Europe BLE Beacon Industry Volume Share (%), by Connectivity 2025 & 2033

- Figure 27: Europe BLE Beacon Industry Revenue (billion), by End-User 2025 & 2033

- Figure 28: Europe BLE Beacon Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 29: Europe BLE Beacon Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe BLE Beacon Industry Volume Share (%), by End-User 2025 & 2033

- Figure 31: Europe BLE Beacon Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe BLE Beacon Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe BLE Beacon Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe BLE Beacon Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific BLE Beacon Industry Revenue (billion), by Standard Type 2025 & 2033

- Figure 36: Asia Pacific BLE Beacon Industry Volume (K Unit), by Standard Type 2025 & 2033

- Figure 37: Asia Pacific BLE Beacon Industry Revenue Share (%), by Standard Type 2025 & 2033

- Figure 38: Asia Pacific BLE Beacon Industry Volume Share (%), by Standard Type 2025 & 2033

- Figure 39: Asia Pacific BLE Beacon Industry Revenue (billion), by Connectivity 2025 & 2033

- Figure 40: Asia Pacific BLE Beacon Industry Volume (K Unit), by Connectivity 2025 & 2033

- Figure 41: Asia Pacific BLE Beacon Industry Revenue Share (%), by Connectivity 2025 & 2033

- Figure 42: Asia Pacific BLE Beacon Industry Volume Share (%), by Connectivity 2025 & 2033

- Figure 43: Asia Pacific BLE Beacon Industry Revenue (billion), by End-User 2025 & 2033

- Figure 44: Asia Pacific BLE Beacon Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 45: Asia Pacific BLE Beacon Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Asia Pacific BLE Beacon Industry Volume Share (%), by End-User 2025 & 2033

- Figure 47: Asia Pacific BLE Beacon Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific BLE Beacon Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific BLE Beacon Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific BLE Beacon Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World BLE Beacon Industry Revenue (billion), by Standard Type 2025 & 2033

- Figure 52: Rest of the World BLE Beacon Industry Volume (K Unit), by Standard Type 2025 & 2033

- Figure 53: Rest of the World BLE Beacon Industry Revenue Share (%), by Standard Type 2025 & 2033

- Figure 54: Rest of the World BLE Beacon Industry Volume Share (%), by Standard Type 2025 & 2033

- Figure 55: Rest of the World BLE Beacon Industry Revenue (billion), by Connectivity 2025 & 2033

- Figure 56: Rest of the World BLE Beacon Industry Volume (K Unit), by Connectivity 2025 & 2033

- Figure 57: Rest of the World BLE Beacon Industry Revenue Share (%), by Connectivity 2025 & 2033

- Figure 58: Rest of the World BLE Beacon Industry Volume Share (%), by Connectivity 2025 & 2033

- Figure 59: Rest of the World BLE Beacon Industry Revenue (billion), by End-User 2025 & 2033

- Figure 60: Rest of the World BLE Beacon Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 61: Rest of the World BLE Beacon Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 62: Rest of the World BLE Beacon Industry Volume Share (%), by End-User 2025 & 2033

- Figure 63: Rest of the World BLE Beacon Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Rest of the World BLE Beacon Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World BLE Beacon Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World BLE Beacon Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global BLE Beacon Industry Revenue billion Forecast, by Standard Type 2020 & 2033

- Table 2: Global BLE Beacon Industry Volume K Unit Forecast, by Standard Type 2020 & 2033

- Table 3: Global BLE Beacon Industry Revenue billion Forecast, by Connectivity 2020 & 2033

- Table 4: Global BLE Beacon Industry Volume K Unit Forecast, by Connectivity 2020 & 2033

- Table 5: Global BLE Beacon Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global BLE Beacon Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Global BLE Beacon Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global BLE Beacon Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global BLE Beacon Industry Revenue billion Forecast, by Standard Type 2020 & 2033

- Table 10: Global BLE Beacon Industry Volume K Unit Forecast, by Standard Type 2020 & 2033

- Table 11: Global BLE Beacon Industry Revenue billion Forecast, by Connectivity 2020 & 2033

- Table 12: Global BLE Beacon Industry Volume K Unit Forecast, by Connectivity 2020 & 2033

- Table 13: Global BLE Beacon Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Global BLE Beacon Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: Global BLE Beacon Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global BLE Beacon Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global BLE Beacon Industry Revenue billion Forecast, by Standard Type 2020 & 2033

- Table 22: Global BLE Beacon Industry Volume K Unit Forecast, by Standard Type 2020 & 2033

- Table 23: Global BLE Beacon Industry Revenue billion Forecast, by Connectivity 2020 & 2033

- Table 24: Global BLE Beacon Industry Volume K Unit Forecast, by Connectivity 2020 & 2033

- Table 25: Global BLE Beacon Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global BLE Beacon Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: Global BLE Beacon Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global BLE Beacon Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: Germany BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Germany BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: United Kingdom BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global BLE Beacon Industry Revenue billion Forecast, by Standard Type 2020 & 2033

- Table 38: Global BLE Beacon Industry Volume K Unit Forecast, by Standard Type 2020 & 2033

- Table 39: Global BLE Beacon Industry Revenue billion Forecast, by Connectivity 2020 & 2033

- Table 40: Global BLE Beacon Industry Volume K Unit Forecast, by Connectivity 2020 & 2033

- Table 41: Global BLE Beacon Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 42: Global BLE Beacon Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 43: Global BLE Beacon Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global BLE Beacon Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: China BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: China BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Japan BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific BLE Beacon Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific BLE Beacon Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global BLE Beacon Industry Revenue billion Forecast, by Standard Type 2020 & 2033

- Table 56: Global BLE Beacon Industry Volume K Unit Forecast, by Standard Type 2020 & 2033

- Table 57: Global BLE Beacon Industry Revenue billion Forecast, by Connectivity 2020 & 2033

- Table 58: Global BLE Beacon Industry Volume K Unit Forecast, by Connectivity 2020 & 2033

- Table 59: Global BLE Beacon Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 60: Global BLE Beacon Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 61: Global BLE Beacon Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 62: Global BLE Beacon Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the BLE Beacon Industry?

The projected CAGR is approximately 20.55%.

2. Which companies are prominent players in the BLE Beacon Industry?

Key companies in the market include Accent Systems, Sensoro Co Ltd, Jaalee Technology, Leantegra Inc, Aruba Networks (Hewlett Packard Enterprise Development LP), Cisco Systems Inc, HID Global Corporation, Gimbal Inc, Fujitsu Components Asia Pte Ltd, Kontakt io Inc.

3. What are the main segments of the BLE Beacon Industry?

The market segments include Standard Type, Connectivity, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Spatial Data to Analyze Demographic Trend; Rising Adoption of Smart Beacons in Logistics and Transportation.

6. What are the notable trends driving market growth?

Retail End-User Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Requirement of High Skill for the Creation of Beacon Solution; Increasing Trend toward Offline Stores for Opting Online Platforms in Retail Sector.

8. Can you provide examples of recent developments in the market?

November 2022 - infsoft introduced a new Locator Beacon that combines BLE and UWB. The updated infsoft Locator Beacon combines Bluetooth Low Energy and Ultra-wideband tracking technology for client and server tracking. With the new hardware from the Ingolstadt-based full-service provider, large companies may achieve many use cases based on the locator infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "BLE Beacon Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the BLE Beacon Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the BLE Beacon Industry?

To stay informed about further developments, trends, and reports in the BLE Beacon Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence