Key Insights

The European Industrial Computed Tomography (ICT) market demonstrates strong growth, propelled by increasing integration across key industries. With a base year of 2025, the market is projected to reach 404.38 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6%. This expansion is primarily driven by the escalating demand for stringent quality control and non-destructive testing (NDT) within manufacturing, particularly in the automotive, aerospace, and energy sectors. Technological advancements in ICT, including enhanced resolution, accelerated scan times, and sophisticated image processing, are key enablers of this market surge. Furthermore, the growing requirement for detailed component analysis and reverse engineering applications fuels the widespread adoption of ICT solutions. The strategic focus on digitalization and Industry 4.0 initiatives within European manufacturing significantly influences the market's upward trajectory.

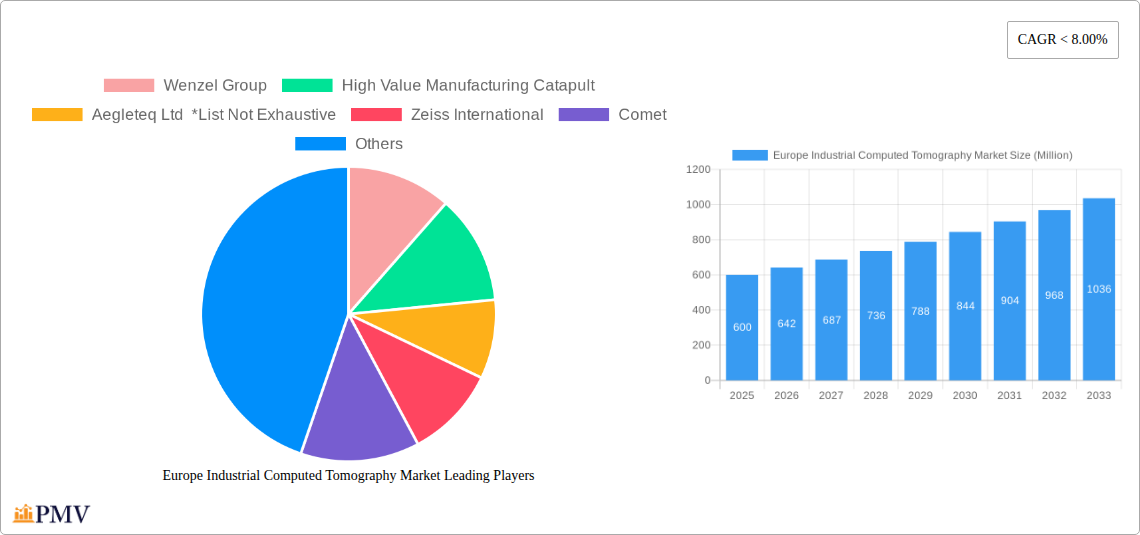

Europe Industrial Computed Tomography Market Market Size (In Million)

The forecast period (2025-2033) is characterized by sustained expansion, driven by continuous innovation and broader ICT solution adoption. This growth trajectory solidifies the projected market size and CAGR. The market's positive outlook is underpinned by the persistent demand for advanced manufacturing solutions and the critical need for comprehensive quality assurance across diverse industrial landscapes.

Europe Industrial Computed Tomography Market Company Market Share

Europe Industrial Computed Tomography Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Industrial Computed Tomography (ICT) market, offering valuable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, dominant segments, and key growth drivers. The report forecasts a substantial expansion of the European ICT market, driven by technological advancements and increasing adoption across diverse industries. This detailed analysis will equip businesses with the strategic intelligence needed to navigate this rapidly evolving landscape.

Europe Industrial Computed Tomography Market Market Structure & Competitive Dynamics

The European Industrial Computed Tomography market exhibits a moderately concentrated structure, with a few major players holding significant market share, alongside numerous smaller, specialized companies. Market share distribution fluctuates depending on specific application segments and geographical regions. The overall market demonstrates a dynamic competitive landscape shaped by ongoing innovation, strategic acquisitions, and evolving regulatory frameworks.

- Market Concentration: The top five players collectively hold an estimated xx% market share in 2025, leaving room for smaller companies to compete through specialization and niche applications.

- Innovation Ecosystems: Collaboration between research institutions, technology providers, and end-users is fostering rapid technological advancements, particularly in software algorithms and system miniaturization.

- Regulatory Frameworks: Stringent safety and quality standards, driven by regulatory bodies across various European countries, impact the market by setting requirements for equipment certification and operational procedures.

- Product Substitutes: While other non-destructive testing (NDT) methods exist (e.g., ultrasonic testing), ICT's superior 3D imaging capabilities provide a significant competitive advantage, especially for complex components.

- End-User Trends: The increasing demand for high-precision inspection and quality control across various industries, including automotive and aerospace, fuels market growth.

- M&A Activities: While exact deal values are confidential in many cases, an increase in M&A activity has been observed, particularly driven by larger players aiming to expand their product portfolios and geographic reach. For example, in xx, a significant acquisition valued at approximately $xx Million was reported.

Europe Industrial Computed Tomography Market Industry Trends & Insights

The Europe Industrial Computed Tomography market is experiencing robust growth, driven by several key factors. Technological advancements, such as improved image resolution and faster scan speeds, are enhancing the capabilities and efficiency of ICT systems. Simultaneously, growing demands for higher product quality, stringent regulatory compliance, and the increasing complexity of manufactured components are driving adoption across various industries. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033). Market penetration within specific end-user industries like aerospace, where high-quality assurance is critical, is already high (xx%), indicating further growth potential in sectors with lower current adoption rates. The competitive landscape is characterized by innovation, with ongoing development of advanced algorithms and hardware improvements enhancing precision and speed. This leads to a continuous improvement in image quality and reduced inspection times, fostering wider market adoption.

Dominant Markets & Segments in Europe Industrial Computed Tomography Market

The European ICT market demonstrates strong regional variations in growth and adoption. Germany and the United Kingdom currently hold the largest market share, driven by robust manufacturing sectors and technological infrastructure. Among applications, Flaw Detection and Inspection dominates, reflecting the critical role ICT plays in ensuring product quality and safety.

- By Application:

- Flaw Detection and Inspection: This segment is the largest, fueled by growing demand for quality control in high-value manufacturing.

- Failure Analysis: Growing importance in understanding product failures and improving designs drives the growth of this segment.

- Assembly Analysis: ICT enables precise analysis of component assembly, enhancing efficiency and reliability.

- Other Applications: This segment encompasses emerging applications like research and development in materials science and medical imaging, showing significant growth potential.

- By End User Industry:

- Aerospace: Stringent quality standards and the need for non-destructive testing drive high adoption rates.

- Automotive: Growing demand for lightweight and high-strength materials requires precise inspection, boosting ICT adoption.

- Electronics: Miniaturization trends and increasing complexity of electronic components necessitate advanced inspection methods.

- Oil and Gas: ICT is used for inspecting pipelines, components, and materials, improving safety and efficiency.

- Other End-user Industries: This segment includes diverse sectors such as medical devices, pharmaceuticals, and consumer goods, with significant, albeit diverse, adoption rates.

- By Country:

- Germany and United Kingdom: These countries benefit from well-established manufacturing sectors and strong technological infrastructure, making them leading markets.

- France and Italy: These countries represent significant markets with considerable growth potential.

- Rest of Europe: This region encompasses various countries with varying levels of industrial development and ICT adoption.

Key Drivers (for Dominant Segments):

- Robust Manufacturing Base: Germany and the UK have a strong foundation of manufacturing industries, which are prime adopters of ICT.

- Government Support: Supportive policies and funding initiatives for technological advancements enhance market growth.

- Advanced Infrastructure: Well-developed technological infrastructure allows for efficient adoption and implementation of advanced imaging technologies.

Europe Industrial Computed Tomography Market Product Innovations

Recent innovations focus on enhancing image resolution, scan speed, and ease of use. Manufacturers are developing more compact and user-friendly systems, broadening accessibility across various industries and company sizes. Advances in algorithms improve image processing and data analysis, providing more insightful results for improved quality control and failure analysis. These innovations are driving market growth by improving the efficiency and effectiveness of industrial computed tomography systems.

Report Segmentation & Scope

This report segments the European Industrial Computed Tomography market by application (Flaw Detection and Inspection, Failure Analysis, Assembly Analysis, Other Applications), end-user industry (Aerospace, Automotive, Electronics, Oil and Gas, Other End-user Industries), and country (United Kingdom, Germany, France, Italy, Rest of Europe). Each segment's market size, growth projections, and competitive dynamics are detailed, providing a granular understanding of the market's diverse landscape.

Key Drivers of Europe Industrial Computed Tomography Market Growth

Several factors propel the European ICT market's expansion. Increasing demand for higher product quality and reliability, stringent regulatory compliance requirements, and the rising complexity of manufactured components are crucial drivers. Technological advancements, including improved image resolution and faster scan speeds, enhance the system's efficiency and capability. Finally, growing investments in research and development by major players and continuous innovation fuel market expansion.

Challenges in the Europe Industrial Computed Tomography Market Sector

The European ICT market faces challenges such as the high initial investment cost of equipment, the need for specialized expertise to operate the systems, and ongoing competition from alternative NDT methods. Supply chain disruptions and the fluctuating price of raw materials also contribute to market uncertainties. Regulatory compliance and obtaining necessary certifications also present hurdles for businesses operating within the sector.

Leading Players in the Europe Industrial Computed Tomography Market Market

- Wenzel Group

- High Value Manufacturing Catapult

- Aegleteq Ltd

- Zeiss International

- Comet

- VJ Group Inc

- Hamamatsu Photonics

- Werth Inc

- Baker Hughes Company

Key Developments in Europe Industrial Computed Tomography Market Sector

- May 2021: Nikon Metrology launched a new offset computed tomography reconstruction algorithm, improving image resolution and scan speed in its industrial microfocus X-ray computed tomography inspection solutions.

- June 2021: Zeiss Company unveiled the Zeiss Metrotom, an entry-level computed tomography product offering non-destructive component inspection.

Strategic Europe Industrial Computed Tomography Market Market Outlook

The European ICT market presents a promising outlook, with significant growth potential fueled by ongoing technological advancements, increasing demand for quality control, and expanding applications across diverse industries. Strategic opportunities exist for companies focusing on innovation, developing user-friendly systems, and expanding their presence in high-growth segments. The market's trajectory is positive, with substantial room for expansion and market penetration across various sectors and geographic regions.

Europe Industrial Computed Tomography Market Segmentation

-

1. Application

- 1.1. Flaw Detection and Inspection

- 1.2. Failure Analysis

- 1.3. Assembly Analysis

- 1.4. Other Applications

-

2. End User Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Electronics

- 2.4. Oil and Gas

- 2.5. Other End-user Industries

Europe Industrial Computed Tomography Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

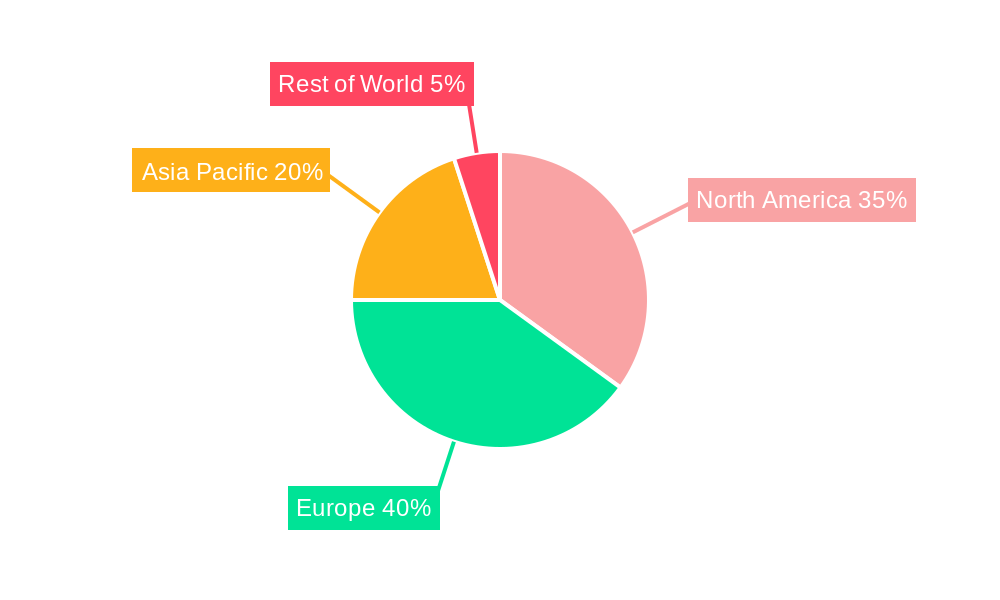

Europe Industrial Computed Tomography Market Regional Market Share

Geographic Coverage of Europe Industrial Computed Tomography Market

Europe Industrial Computed Tomography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Improvements in Resolution and Image Processing; Intensifying Demand for Portable Radiography Equipment

- 3.3. Market Restrains

- 3.3.1. High Product Cost

- 3.4. Market Trends

- 3.4.1. Aerospace to Witness Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Computed Tomography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Flaw Detection and Inspection

- 5.1.2. Failure Analysis

- 5.1.3. Assembly Analysis

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Electronics

- 5.2.4. Oil and Gas

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wenzel Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 High Value Manufacturing Catapult

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aegleteq Ltd *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zeiss International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VJ Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hamamatsu Photonics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Werth Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baker Hughes Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wenzel Group

List of Figures

- Figure 1: Europe Industrial Computed Tomography Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Computed Tomography Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Europe Industrial Computed Tomography Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 3: Europe Industrial Computed Tomography Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: Europe Industrial Computed Tomography Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 6: Europe Industrial Computed Tomography Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Computed Tomography Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Industrial Computed Tomography Market?

Key companies in the market include Wenzel Group, High Value Manufacturing Catapult, Aegleteq Ltd *List Not Exhaustive, Zeiss International, Comet, VJ Group Inc, Hamamatsu Photonics, Werth Inc, Baker Hughes Company.

3. What are the main segments of the Europe Industrial Computed Tomography Market?

The market segments include Application, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 404.38 million as of 2022.

5. What are some drivers contributing to market growth?

Technological Improvements in Resolution and Image Processing; Intensifying Demand for Portable Radiography Equipment.

6. What are the notable trends driving market growth?

Aerospace to Witness Significant Adoption.

7. Are there any restraints impacting market growth?

High Product Cost.

8. Can you provide examples of recent developments in the market?

June 2021 - Zeiss Company unveiled Zeiss Metrotom, its entry-level computed tomography product. The non-destructive inspection of components using this solution is at the entry level. Additionally, this system is a compact computed tomography system that yields precise results and is simple to use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Computed Tomography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Computed Tomography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Computed Tomography Market?

To stay informed about further developments, trends, and reports in the Europe Industrial Computed Tomography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence