Key Insights

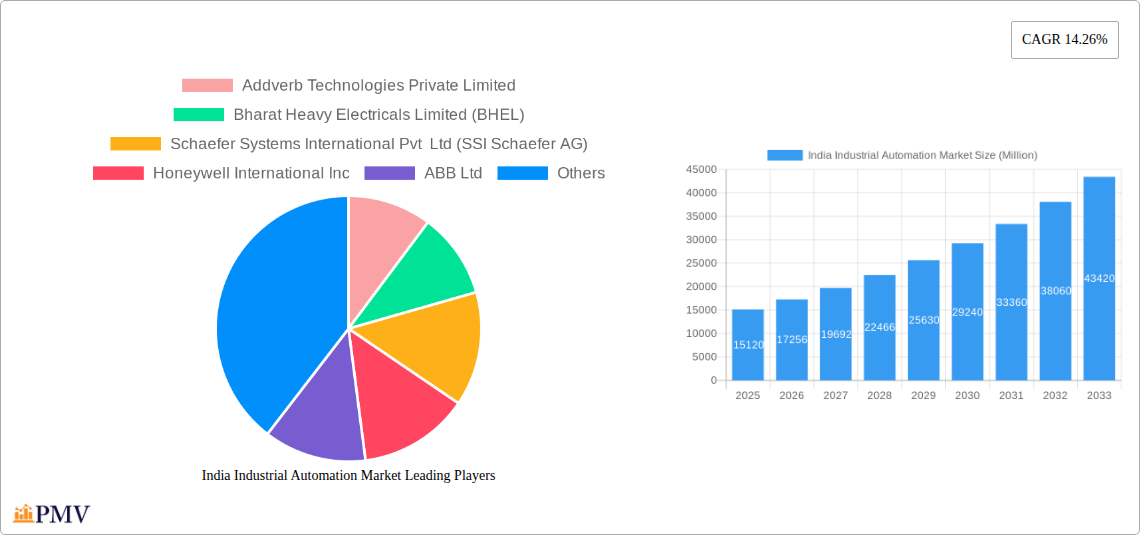

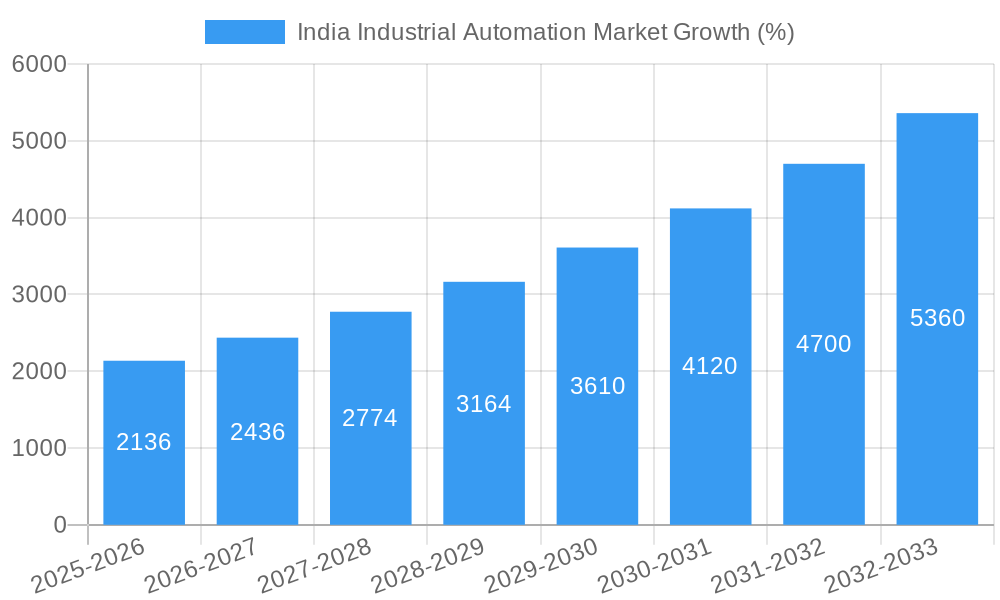

The India Industrial Automation Market is experiencing robust growth, projected to reach \$15.12 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.26% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the "Make in India" initiative and the government's focus on infrastructure development are fueling significant investments in automation across various sectors, including manufacturing, FMCG, and healthcare. Secondly, the increasing adoption of Industry 4.0 technologies, such as AI, machine learning, and IoT, is improving operational efficiency and productivity, leading to higher demand for automation solutions. The rising labor costs and the need to enhance product quality and consistency are further bolstering market growth. Significant segments driving this growth include automated material handling solutions (especially AS/RS and mobile robots), industrial control systems (PLCs and SCADAs), and software solutions like MES and WMS. The market is witnessing a shift towards advanced robotics and collaborative robots, improving flexibility and safety in industrial settings. However, high initial investment costs, the need for skilled workforce, and cybersecurity concerns present some challenges. Nevertheless, the long-term prospects for the India Industrial Automation Market remain extremely positive, underpinned by continuous technological advancements and a supportive government policy environment.

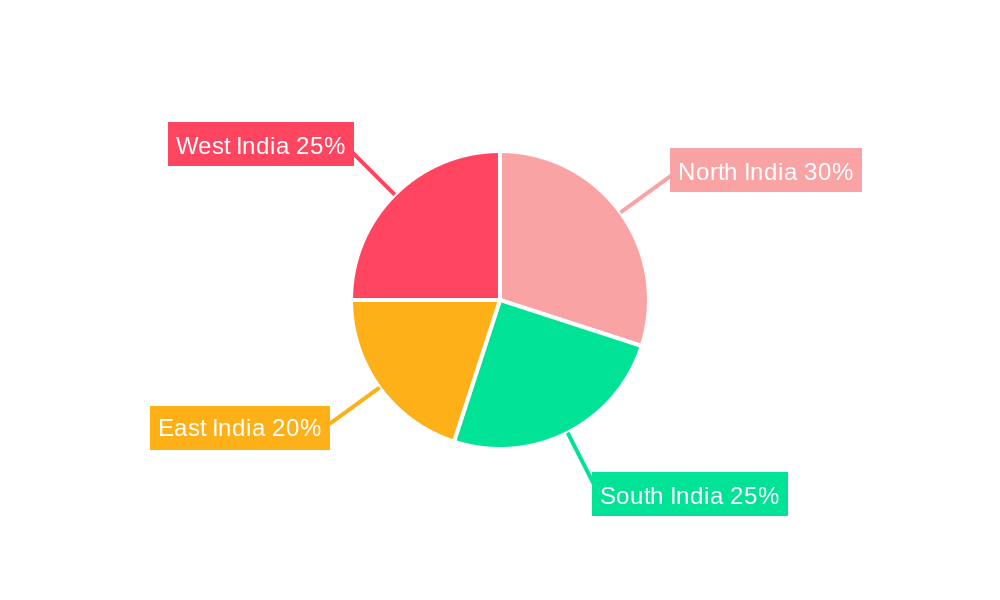

The regional distribution of the market is expected to see substantial growth across all regions, with North and West India potentially leading due to established industrial clusters and robust infrastructure. The competitive landscape features a mix of global giants like ABB, Siemens, and Rockwell Automation, alongside rapidly emerging domestic players like Addverb Technologies and Grey Orange. This competitive environment fosters innovation and ensures that a wide range of solutions are available to cater to diverse industry needs. The market is witnessing strategic partnerships, mergers and acquisitions, and a strong focus on developing tailored solutions for specific industry segments. This trend is likely to continue, driving further growth and consolidation in the years to come. Overall, the India Industrial Automation Market is poised for significant expansion, creating considerable opportunities for both domestic and international companies.

India Industrial Automation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Industrial Automation Market, covering market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future outlook. The report uses data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033) to offer actionable insights for industry stakeholders. The market is segmented by field devices, software, end-user, and type of solution, providing a granular understanding of this rapidly evolving sector. The report's projected market value is xx Million by 2033.

India Industrial Automation Market Market Structure & Competitive Dynamics

The Indian industrial automation market exhibits a moderately concentrated structure, with several multinational corporations and domestic players vying for market share. The market is characterized by a dynamic innovation ecosystem, driven by increasing investments in R&D and strategic partnerships. The regulatory framework, while evolving, supports the adoption of automation technologies, though navigating compliance can pose challenges for some players. Product substitution, particularly in legacy systems, is observed, but overall the market displays robust demand for advanced automation solutions. End-user trends lean towards higher levels of automation and increased digitalization. M&A activity in the sector is moderate, with deals primarily focused on enhancing technological capabilities or expanding market reach. For example, while exact deal values are not publicly available for all transactions, recent mergers and acquisitions have involved sums in the range of xx Million to xx Million. Key metrics such as market share data will be revealed within the complete report.

- Market Concentration: Moderately concentrated, with both domestic and international players.

- Innovation Ecosystem: Active, supported by R&D investments and collaborations.

- Regulatory Framework: Evolving, with both supportive and challenging aspects.

- Product Substitution: Moderate, with ongoing transitions to advanced technologies.

- End-User Trends: Increasing adoption of automation and digitalization.

- M&A Activity: Moderate, focused on technological advancement and market expansion.

India Industrial Automation Market Industry Trends & Insights

The India Industrial Automation Market is experiencing robust growth, driven by a confluence of factors. The government's "Make in India" initiative, coupled with increasing investments in infrastructure and manufacturing, are significant catalysts. The rising adoption of Industry 4.0 technologies, such as IoT, AI, and cloud computing, further accelerates market expansion. Consumer preferences are shifting towards automated and efficient production processes. This is being observed across various sectors, including automotive, pharmaceuticals, and FMCG, creating significant demand. Competitive dynamics involve both intense competition and collaborative efforts among players, leading to product innovation and service improvements. The Compound Annual Growth Rate (CAGR) for the forecast period is projected to be xx%, and market penetration is expected to reach xx% by 2033. Specific details, including detailed CAGR breakdowns by segment, are available in the full report.

Dominant Markets & Segments in India Industrial Automation Market

The industrial automation market in India is witnessing diverse growth across various segments and regions. While comprehensive regional dominance analysis requires detailed regional breakdown data, we can extrapolate some insights. The manufacturing sector dominates the end-user segment, driven by the need for enhanced productivity and efficiency. Within the field devices segment, industrial robots and sensors are experiencing substantial growth due to their critical roles in automated processes. The Factory Automation Market is particularly vibrant, reflecting the increasing demand for integrated solutions to enhance operational efficiency.

Key Drivers:

- Government initiatives (e.g., "Make in India").

- Infrastructure development.

- Rising labor costs.

- Demand for enhanced efficiency.

- Technological advancements (IoT, AI, Cloud Computing).

Dominant Segments:

- Factory Automation Market.

- Industrial Robots (Field Devices).

- Sensors and Transmitters (Field Devices).

- Manufacturing End-user segment.

Detailed dominance analysis including market size and growth projections for each segment and sub-segment is available in the complete report.

India Industrial Automation Market Product Innovations

The Indian industrial automation market is witnessing significant product innovation, with a focus on advanced technologies such as AI-powered robotics, predictive maintenance solutions, and cloud-based industrial control systems. These innovations cater to the growing demand for increased efficiency, reduced downtime, and enhanced data-driven decision-making. Companies are strategically focusing on developing solutions tailored to the specific needs of Indian industries, emphasizing cost-effectiveness and ease of implementation. This fosters greater market adoption and competitiveness.

Report Segmentation & Scope

This report offers a detailed segmentation of the India Industrial Automation Market across several parameters:

By Field Devices: Sensors and Transmitters, Electric AC Drives, Servo Motors, CNC Machines, Inverters, Industrial Robots, Other Factory Automation Solutions. Each segment's growth projection and competitive landscape will be detailed in the full report.

By Software: Manufacturing Execution System (MES), Product Lifecycle Management (PLM), Other Types. Growth rates and market sizes will be specified for each category.

By End-user: Automated Material Handling Market, Non-manufacturing (General Merchandise, Healthcare, FMCG/Non-durable Goods, Other End-Users), Factory Automation Market. The report will analyze the unique characteristics and growth prospects within each end-user category.

By Type of Solution: Automated Material Handling Solutions (Hardware: Conveyor/Sortation Systems, AS/RS, Mobile Robots, AIDC; Software: WMS/WCS), Factory Automation Solutions, Industrial Control Systems (DCS, SCADA, PLC, HMI, Other Control Systems). Each solution type's market share and future potential are analyzed in detail.

Key Drivers of India Industrial Automation Market Growth

The growth of the India Industrial Automation Market is propelled by several key factors. Government initiatives like "Make in India" are driving domestic manufacturing and automation adoption. Rising labor costs and the need for increased productivity incentivize automation investments. Technological advancements in areas such as AI, IoT, and cloud computing are fueling the development of sophisticated automation solutions. The increasing focus on smart manufacturing and Industry 4.0 principles further accelerates market expansion.

Challenges in the India Industrial Automation Market Sector

Despite significant growth potential, the Indian industrial automation market faces challenges. Skill gaps in operating and maintaining advanced automation systems pose a significant hurdle. The high initial investment costs associated with automation technologies can be a barrier for some businesses. Supply chain disruptions and global economic uncertainties can impact the market's trajectory. Regulatory compliance and standardization issues can also create complexities for market participants.

Leading Players in the India Industrial Automation Market Market

- Addverb Technologies Private Limited

- Bharat Heavy Electricals Limited (BHEL)

- Schaefer Systems International Pvt Ltd (SSI Schaefer AG)

- Honeywell International Inc

- ABB Ltd

- Kardex India Storage Solutions Private Limited (Kardex Holding AG)

- Godrej Koerber Supply Chain Limited

- Larsen & Toubro Ltd

- Crompton Greaves Ltd

- Space Magnum Equipment Pvt Ltd

- Fuji Electric Co Ltd

- Hinditron Group

- Armstrong Ltd

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Siemens AG

- Bastian Solution Private Limited (Toyota Industries)

- ATS Conveyors India Pvt Ltd (ATS Group)

- Schneider Electric

- Falcon Autotech Private Limited

- Robert Bosch GmbH

- Bain & Company Inc

- The Hi-Tech Robotic Systemz Limited

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Danfoss A/S

- Daifuku India Private Limited (Daifuku Co Ltd)

- Grey Orange Pte Ltd

- Boston Consulting Grou

- Kuka India Private Limited (Kuka AG)

Key Developments in India Industrial Automation Market Sector

- June 2023: ABB India secures a contract to supply ArcelorMittal Nippon Steel India's cold rolling mill with electrification and automation systems, including the ABB Ability System 800xA DCS.

- March 2023: Bastian Solutions Private Limited showcases its integrated automation technologies at ProMat tradeshow, featuring autonomous vehicles and other advanced solutions.

Strategic India Industrial Automation Market Market Outlook

The future of the India Industrial Automation Market is bright, driven by continued government support, technological innovation, and growing industrialization. Strategic opportunities lie in developing tailored solutions for specific industry needs, focusing on cost-effectiveness, and investing in skilled workforce development. The market is poised for significant expansion, fueled by the increasing adoption of advanced automation technologies across various sectors. The long-term outlook remains positive, with significant potential for growth and market expansion.

India Industrial Automation Market Segmentation

-

1. Type of Solution

-

1.1. Automated Material Handling Solutions

-

1.1.1. Hardware

- 1.1.1.1. Conveyor/Sortation Systems

- 1.1.1.2. Automated Storage and Retrieval System (AS/RS)

- 1.1.1.3. Mobile R

- 1.1.1.4. Automatic Identification and Data Capture (AIDC)

- 1.1.2. Software

-

1.1.1. Hardware

-

1.2. Factory Automation Solutions

-

1.2.1. Industrial Control Systems

- 1.2.1.1. DCS

- 1.2.1.2. SCADA

- 1.2.1.3. PLC

- 1.2.1.4. HMI

- 1.2.1.5. Other Control Systems

-

1.2.2. Field Devices

- 1.2.2.1. Sensors and Transmitters

- 1.2.2.2. Electric AC Drives

- 1.2.2.3. Servo Motors

- 1.2.2.4. Computer Numerical Control (CNC) Machines

- 1.2.2.5. Inverters

- 1.2.2.6. Industrial Robots

- 1.2.2.7. Other Factory Automation Solutions

- 1.2.3. Manufacturing Execution System (MES)

- 1.2.4. Product Lifecycle Management (PLM)

- 1.2.5. Other Types

-

1.2.1. Industrial Control Systems

-

1.1. Automated Material Handling Solutions

-

2. End-user

-

2.1. Automated Material Handling Market

- 2.1.1. Manufacturing

-

2.1.2. Non-manufacturing

- 2.1.2.1. General Merchandise

- 2.1.2.2. Healthcare

- 2.1.2.3. FMCG/Non-durable Goods

- 2.1.2.4. Other End-Users

-

2.2. Factory Automation Market

- 2.2.1. Food and Beverage

- 2.2.2. Pharmaceutical

- 2.2.3. Automotive

- 2.2.4. Textiles

- 2.2.5. Power

- 2.2.6. Oil and Gas

- 2.2.7. Petrochemicals and Fertilizers

-

2.1. Automated Material Handling Market

India Industrial Automation Market Segmentation By Geography

- 1. India

India Industrial Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetic Segment

- 3.3. Market Restrains

- 3.3.1. Lack of Products with the Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. HMI to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Solution

- 5.1.1. Automated Material Handling Solutions

- 5.1.1.1. Hardware

- 5.1.1.1.1. Conveyor/Sortation Systems

- 5.1.1.1.2. Automated Storage and Retrieval System (AS/RS)

- 5.1.1.1.3. Mobile R

- 5.1.1.1.4. Automatic Identification and Data Capture (AIDC)

- 5.1.1.2. Software

- 5.1.1.1. Hardware

- 5.1.2. Factory Automation Solutions

- 5.1.2.1. Industrial Control Systems

- 5.1.2.1.1. DCS

- 5.1.2.1.2. SCADA

- 5.1.2.1.3. PLC

- 5.1.2.1.4. HMI

- 5.1.2.1.5. Other Control Systems

- 5.1.2.2. Field Devices

- 5.1.2.2.1. Sensors and Transmitters

- 5.1.2.2.2. Electric AC Drives

- 5.1.2.2.3. Servo Motors

- 5.1.2.2.4. Computer Numerical Control (CNC) Machines

- 5.1.2.2.5. Inverters

- 5.1.2.2.6. Industrial Robots

- 5.1.2.2.7. Other Factory Automation Solutions

- 5.1.2.3. Manufacturing Execution System (MES)

- 5.1.2.4. Product Lifecycle Management (PLM)

- 5.1.2.5. Other Types

- 5.1.2.1. Industrial Control Systems

- 5.1.1. Automated Material Handling Solutions

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automated Material Handling Market

- 5.2.1.1. Manufacturing

- 5.2.1.2. Non-manufacturing

- 5.2.1.2.1. General Merchandise

- 5.2.1.2.2. Healthcare

- 5.2.1.2.3. FMCG/Non-durable Goods

- 5.2.1.2.4. Other End-Users

- 5.2.2. Factory Automation Market

- 5.2.2.1. Food and Beverage

- 5.2.2.2. Pharmaceutical

- 5.2.2.3. Automotive

- 5.2.2.4. Textiles

- 5.2.2.5. Power

- 5.2.2.6. Oil and Gas

- 5.2.2.7. Petrochemicals and Fertilizers

- 5.2.1. Automated Material Handling Market

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Solution

- 6. North India India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Addverb Technologies Private Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bharat Heavy Electricals Limited (BHEL)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Schaefer Systems International Pvt Ltd (SSI Schaefer AG)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Honeywell International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ABB Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kardex India Storage Solutions Private Limited (Kardex Holding AG)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Godrej Koerber Supply Chain Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Larsen & Toubro Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Crompton Greaves Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Space Magnum Equipment Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Fuji Electric Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hinditron Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Armstrong Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Emerson Electric Co

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Mitsubishi Electric Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Siemens AG

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Bastian Solution Private Limited (Toyota Industries)

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 ATS Conveyors India Pvt Ltd (ATS Group)

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Schneider Electric

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Falcon Autotech Private Limited

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 Robert Bosch GmbH

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.22 Bain & Company Inc

- 10.2.22.1. Overview

- 10.2.22.2. Products

- 10.2.22.3. SWOT Analysis

- 10.2.22.4. Recent Developments

- 10.2.22.5. Financials (Based on Availability)

- 10.2.23 The Hi-Tech Robotic Systemz Limited

- 10.2.23.1. Overview

- 10.2.23.2. Products

- 10.2.23.3. SWOT Analysis

- 10.2.23.4. Recent Developments

- 10.2.23.5. Financials (Based on Availability)

- 10.2.24 Rockwell Automation Inc

- 10.2.24.1. Overview

- 10.2.24.2. Products

- 10.2.24.3. SWOT Analysis

- 10.2.24.4. Recent Developments

- 10.2.24.5. Financials (Based on Availability)

- 10.2.25 Yokogawa Electric Corporation

- 10.2.25.1. Overview

- 10.2.25.2. Products

- 10.2.25.3. SWOT Analysis

- 10.2.25.4. Recent Developments

- 10.2.25.5. Financials (Based on Availability)

- 10.2.26 Danfoss A/S

- 10.2.26.1. Overview

- 10.2.26.2. Products

- 10.2.26.3. SWOT Analysis

- 10.2.26.4. Recent Developments

- 10.2.26.5. Financials (Based on Availability)

- 10.2.27 Daifuku India Private Limited (Daifuku Co Ltd)

- 10.2.27.1. Overview

- 10.2.27.2. Products

- 10.2.27.3. SWOT Analysis

- 10.2.27.4. Recent Developments

- 10.2.27.5. Financials (Based on Availability)

- 10.2.28 Grey Orange Pte Ltd

- 10.2.28.1. Overview

- 10.2.28.2. Products

- 10.2.28.3. SWOT Analysis

- 10.2.28.4. Recent Developments

- 10.2.28.5. Financials (Based on Availability)

- 10.2.29 Boston Consulting Grou

- 10.2.29.1. Overview

- 10.2.29.2. Products

- 10.2.29.3. SWOT Analysis

- 10.2.29.4. Recent Developments

- 10.2.29.5. Financials (Based on Availability)

- 10.2.30 Kuka India Private Limited (Kuka AG)

- 10.2.30.1. Overview

- 10.2.30.2. Products

- 10.2.30.3. SWOT Analysis

- 10.2.30.4. Recent Developments

- 10.2.30.5. Financials (Based on Availability)

- 10.2.1 Addverb Technologies Private Limited

List of Figures

- Figure 1: India Industrial Automation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Industrial Automation Market Share (%) by Company 2024

List of Tables

- Table 1: India Industrial Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Industrial Automation Market Revenue Million Forecast, by Type of Solution 2019 & 2032

- Table 3: India Industrial Automation Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: India Industrial Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Industrial Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Industrial Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Industrial Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Industrial Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Industrial Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Industrial Automation Market Revenue Million Forecast, by Type of Solution 2019 & 2032

- Table 11: India Industrial Automation Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 12: India Industrial Automation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Automation Market?

The projected CAGR is approximately 14.26%.

2. Which companies are prominent players in the India Industrial Automation Market?

Key companies in the market include Addverb Technologies Private Limited, Bharat Heavy Electricals Limited (BHEL), Schaefer Systems International Pvt Ltd (SSI Schaefer AG), Honeywell International Inc, ABB Ltd, Kardex India Storage Solutions Private Limited (Kardex Holding AG), Godrej Koerber Supply Chain Limited, Larsen & Toubro Ltd, Crompton Greaves Ltd, Space Magnum Equipment Pvt Ltd, Fuji Electric Co Ltd, Hinditron Group, Armstrong Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Bastian Solution Private Limited (Toyota Industries), ATS Conveyors India Pvt Ltd (ATS Group), Schneider Electric, Falcon Autotech Private Limited, Robert Bosch GmbH, Bain & Company Inc, The Hi-Tech Robotic Systemz Limited, Rockwell Automation Inc, Yokogawa Electric Corporation, Danfoss A/S, Daifuku India Private Limited (Daifuku Co Ltd), Grey Orange Pte Ltd, Boston Consulting Grou, Kuka India Private Limited (Kuka AG).

3. What are the main segments of the India Industrial Automation Market?

The market segments include Type of Solution, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetic Segment.

6. What are the notable trends driving market growth?

HMI to Witness the Growth.

7. Are there any restraints impacting market growth?

Lack of Products with the Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

June 2023 - ABB India has been contracted to supply ArcelorMittal Nippon Steel India's (AM/NS India) advanced steel cold rolling mill (CRM) in Hazira, Gujarat, with electrification and automation systems, including the ABB Ability System 800xA distributed control system (DCS) and related machinery and supplies. The original equipment manufacturer (OEM) for the project, John Cockerill India Limited (JCIL), is responsible for the contract at the flagship manufacturing facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Automation Market?

To stay informed about further developments, trends, and reports in the India Industrial Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence