Key Insights

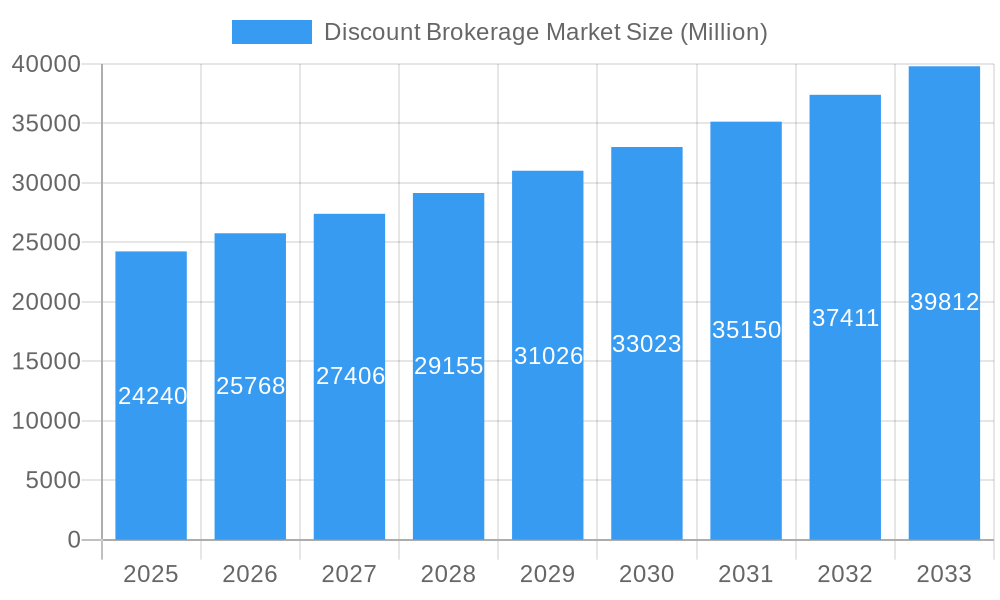

The discount brokerage market, valued at $24.24 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of online trading platforms, fueled by technological advancements and the rise of mobile investing apps, is a primary catalyst. Younger generations, particularly millennials and Gen Z, are increasingly embracing self-directed investing, further boosting market demand. Furthermore, the growing accessibility of financial information and educational resources online empowers individuals to manage their investments independently, reducing reliance on traditional, fee-heavy brokerage services. Competition among established players like Interactive Brokers, TD Ameritrade, Charles Schwab, and newer entrants such as Robinhood, continues to intensify, driving innovation and pushing down fees, ultimately benefiting consumers. Regulatory changes aimed at increasing transparency and protecting investors also play a significant role in shaping the market landscape.

Discount Brokerage Market Market Size (In Billion)

Looking ahead, the market's Compound Annual Growth Rate (CAGR) of 6.29% from 2025 to 2033 signifies sustained expansion. However, several challenges exist. Increasing regulatory scrutiny and compliance costs could impact profitability for some firms. Fluctuations in the overall stock market and economic downturns can affect investor sentiment and trading activity, potentially impacting revenue streams. The ongoing evolution of financial technology necessitates continuous adaptation and investment in innovation to stay competitive. While the market offers substantial opportunities, players must navigate these complexities effectively to capitalize on the long-term growth potential. Geographic expansion into emerging markets also presents significant opportunities for growth, albeit with associated challenges.

Discount Brokerage Market Company Market Share

Discount Brokerage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Discount Brokerage Market, covering the period from 2019 to 2033. It offers valuable insights into market structure, competitive dynamics, industry trends, and future growth prospects, enabling businesses to make informed strategic decisions. The report features detailed analysis of key players like Interactive Brokers, TD Ameritrade, Charles Schwab, ETrade, Fidelity Investments, Robinhood, Vanguard, Ally Invest, Firstrade, and DEGIRO (list not exhaustive), and includes data-driven projections for market size and growth. With a focus on recent developments like HDFC Securities’ launch of Sky and Ujjivan SFB’s partnership with SMC Global Securities, this report is an essential resource for industry professionals, investors, and anyone interested in the evolving landscape of discount brokerage. The Base Year is 2025, the Estimated Year is 2025, and the Forecast Period is 2025-2033.

Discount Brokerage Market Structure & Competitive Dynamics

The discount brokerage market is characterized by a dynamic interplay of established giants and emerging fintech players. Market concentration is relatively high, with a few dominant players controlling a significant portion of the market share. However, the landscape is becoming increasingly competitive, driven by technological innovation and changing consumer preferences. The market is witnessing a significant rise in the adoption of mobile trading platforms and algorithmic trading strategies. Regulatory frameworks, varying across jurisdictions, influence the operational dynamics and compliance requirements of brokerage firms. Product substitutes, such as robo-advisors and direct investing platforms, are impacting market share, especially amongst younger demographics. Mergers and acquisitions (M&A) are frequent, with deal values reaching into the billions. For example, in 2022, xx Million in M&A deals were recorded, indicating considerable consolidation within the sector.

- Market Concentration: High, with top 5 players controlling approximately xx% of market share in 2024.

- Innovation Ecosystems: Strong, with emphasis on mobile trading, AI-driven algorithms, and personalized investment solutions.

- Regulatory Frameworks: Diverse across geographies, influencing operational costs and compliance.

- Product Substitutes: Robo-advisors and direct investing platforms are gaining traction, particularly amongst younger investors.

- End-User Trends: Increasing demand for mobile trading, personalized financial advice, and commission-free trades.

- M&A Activities: Frequent consolidation, with significant deal values observed in recent years (e.g., xx Million in 2022).

Discount Brokerage Market Industry Trends & Insights

The Discount Brokerage Market is currently experiencing a robust expansion, propelled by a confluence of powerful catalysts. The widespread adoption of mobile-first investment platforms and the increasing ease of access to online trading services have fundamentally democratized investment opportunities, making them accessible to a broader demographic. This trend has been further amplified by the significant reduction in commission fees, a strategic move that has successfully attracted a burgeoning segment of retail investors. The market is also undergoing a period of profound technological transformation, marked by the integration of Artificial Intelligence (AI) and machine learning for sophisticated portfolio management and precise risk assessment. Consumer preferences are demonstrably shifting towards platforms that not only offer user-friendly interfaces but also provide tailored financial advice. The competitive arena is defined by fierce competition among established industry giants and the dynamic emergence of innovative fintech enterprises. Projections indicate the market will witness a Compound Annual Growth Rate (CAGR) of approximately **12-15%** during the forecast period (2025-2033), with market penetration expected to reach **60-70%** by 2033. This significant growth trajectory is underpinned by factors such as rising disposable incomes, a marked increase in financial literacy, and the pervasive adoption of digital technologies across all age groups.

Dominant Markets & Segments in Discount Brokerage Market

The North American market currently holds the largest share of the global discount brokerage market, driven by strong economic growth, advanced technological infrastructure, and a high level of financial literacy among the population. Europe and Asia-Pacific are also significant markets experiencing robust growth. Within the North American market, the United States accounts for the lion's share, with a high concentration of major players and a large base of active investors.

- Key Drivers in North America:

- Robust economic growth and high disposable incomes.

- Advanced technological infrastructure and high internet penetration.

- High financial literacy rates and a strong culture of investing.

- Presence of major established players and a strong competitive landscape.

- Dominance Analysis: The United States' dominance stems from a combination of strong economic conditions, favorable regulatory environment, and the concentration of major discount brokerages within its borders. This dominance is expected to continue throughout the forecast period, though other regions are expected to exhibit strong growth.

Discount Brokerage Market Product Innovations

Recent innovations in the discount brokerage market are focused on enhancing user experience, expanding product offerings, and leveraging advanced technologies. The integration of AI-powered robo-advisors, advanced charting tools, and fractional share trading are significantly improving the accessibility and ease of use of trading platforms. The increasing availability of commission-free trading and the introduction of innovative investment products are attracting new customers and strengthening the competitive landscape. Furthermore, the development of sophisticated risk management tools and personalized investment recommendations are enhancing the appeal of discount brokerage services.

Report Segmentation & Scope

This report segments the discount brokerage market based on several key factors including geographical location (North America, Europe, Asia-Pacific, etc.), customer segment (retail investors, institutional investors), and service offering (online trading, mobile trading, financial advisory). Each segment’s growth projections, market size estimates, and competitive dynamics are comprehensively analyzed. For example, the retail investor segment is expected to experience significant growth driven by increased accessibility to online trading platforms. The geographical segment analysis will include country-level assessments to provide granular insights.

Key Drivers of Discount Brokerage Market Growth

The expansion of the discount brokerage market is primarily fueled by the following significant drivers:

- Technological Advancements: The proliferation of intuitive mobile trading applications, sophisticated AI-powered investment tools, and continuously evolving online platforms are significantly enhancing accessibility, user experience, and overall engagement within the investment ecosystem.

- Economic Growth and Stability: A sustained period of economic growth, characterized by rising disposable incomes and increasing savings rates among the population, directly translates to higher levels of investment activity and capital deployment.

- Favorable Regulatory Environments: In numerous regions, the implementation of supportive and forward-thinking regulatory frameworks is actively encouraging greater participation and investment in the financial markets.

- Heightened Financial Literacy and Awareness: A growing public awareness of diverse investment opportunities, coupled with enhanced financial education initiatives, is significantly contributing to a surging demand for accessible investment services.

- Shift Towards Passive Investing: The increasing popularity of index funds and ETFs, which are inherently low-cost and easy to manage, aligns perfectly with the offerings of discount brokerages, driving demand for their services.

Challenges in the Discount Brokerage Market Sector

The discount brokerage sector faces several challenges including:

- Regulatory Hurdles: Evolving regulatory landscapes pose compliance challenges and increase operational costs.

- Cybersecurity Risks: The reliance on digital platforms increases vulnerability to cyberattacks and data breaches. This leads to significant financial and reputational losses estimated to cost the industry xx Million annually.

- Competitive Pressure: Intense competition from both established players and emerging fintech companies is squeezing margins.

Leading Players in the Discount Brokerage Market Market

- Interactive Brokers

- TD Ameritrade (now part of Charles Schwab)

- Charles Schwab

- ETrade (now part of Morgan Stanley)

- Fidelity Investments

- Robinhood

- Vanguard

- Ally Invest

- Firstrade

- DEGIRO (now part of flatexDEGIRO)

- Webull

- SoFi Invest

Key Developments in Discount Brokerage Market Sector

- September 2023: HDFC Securities launched its integrated discount brokerage platform, 'Sky', aimed at providing a comprehensive suite of trading and investment options. This strategic move significantly broadens HDFC Securities' market presence and intensifies competition within the Indian discount brokerage sector.

- September 2023: Ujjivan Small Finance Bank (SFB) announced a strategic partnership with SMC Global Securities, enabling its customers to access online trading services. This collaboration expands the financial service offerings for Ujjivan SFB's customer base, reflecting a broader trend of banking institutions leveraging strategic alliances to provide diversified financial products.

- Early 2024: Several platforms have been actively enhancing their educational resources and community forums to empower novice investors and foster greater financial literacy, recognizing its importance for long-term market growth.

- Late 2023: An increasing number of discount brokerages are integrating ESG (Environmental, Social, and Governance) investing options into their platforms, catering to the growing investor demand for sustainable and socially responsible investment choices.

Strategic Discount Brokerage Market Market Outlook

The trajectory of the discount brokerage market is exceptionally bright, fueled by the relentless pace of technological innovation, a concerted push towards greater financial inclusion, and a discernible rise in the demand for highly personalized investment solutions. Strategic opportunities abound for firms that can adeptly harness the power of AI and machine learning to deliver bespoke financial guidance, effectively cater to the diverse and evolving needs of various investor segments, and adeptly navigate the dynamic and often complex regulatory landscape. The market is anticipated to witness further consolidation through strategic mergers and acquisitions as companies endeavor to amplify their market share and enhance their value propositions. Moreover, a persistent emphasis on fortifying cybersecurity measures and consistently developing intuitive, user-centric platforms will be paramount for sustained success and competitive advantage in the ensuing years.

Discount Brokerage Market Segmentation

-

1. Mode

- 1.1. Online Discount Brokerage Service

- 1.2. Offline Discount Brokerage Service

-

2. Application

- 2.1. Individual

- 2.2. Enterprise

- 2.3. Government Agencies

-

3. Services

- 3.1. Order Execution and Advisory

- 3.2. Discretionary

- 3.3. Online Trading Platforms

- 3.4. Education and Investor Resources

-

4. Commission

- 4.1. Commission-free Brokers

- 4.2. Fixed Commission Brokers

Discount Brokerage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Discount Brokerage Market Regional Market Share

Geographic Coverage of Discount Brokerage Market

Discount Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low-cost Trading Fee is Driving the Market; Increasing Popularity of Self-directed Investing

- 3.3. Market Restrains

- 3.3.1. Low-cost Trading Fee is Driving the Market; Increasing Popularity of Self-directed Investing

- 3.4. Market Trends

- 3.4.1. Increase in Enterprise Market is Fuelling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Discount Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Online Discount Brokerage Service

- 5.1.2. Offline Discount Brokerage Service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Individual

- 5.2.2. Enterprise

- 5.2.3. Government Agencies

- 5.3. Market Analysis, Insights and Forecast - by Services

- 5.3.1. Order Execution and Advisory

- 5.3.2. Discretionary

- 5.3.3. Online Trading Platforms

- 5.3.4. Education and Investor Resources

- 5.4. Market Analysis, Insights and Forecast - by Commission

- 5.4.1. Commission-free Brokers

- 5.4.2. Fixed Commission Brokers

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. North America Discount Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode

- 6.1.1. Online Discount Brokerage Service

- 6.1.2. Offline Discount Brokerage Service

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Individual

- 6.2.2. Enterprise

- 6.2.3. Government Agencies

- 6.3. Market Analysis, Insights and Forecast - by Services

- 6.3.1. Order Execution and Advisory

- 6.3.2. Discretionary

- 6.3.3. Online Trading Platforms

- 6.3.4. Education and Investor Resources

- 6.4. Market Analysis, Insights and Forecast - by Commission

- 6.4.1. Commission-free Brokers

- 6.4.2. Fixed Commission Brokers

- 6.1. Market Analysis, Insights and Forecast - by Mode

- 7. Europe Discount Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode

- 7.1.1. Online Discount Brokerage Service

- 7.1.2. Offline Discount Brokerage Service

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Individual

- 7.2.2. Enterprise

- 7.2.3. Government Agencies

- 7.3. Market Analysis, Insights and Forecast - by Services

- 7.3.1. Order Execution and Advisory

- 7.3.2. Discretionary

- 7.3.3. Online Trading Platforms

- 7.3.4. Education and Investor Resources

- 7.4. Market Analysis, Insights and Forecast - by Commission

- 7.4.1. Commission-free Brokers

- 7.4.2. Fixed Commission Brokers

- 7.1. Market Analysis, Insights and Forecast - by Mode

- 8. Asia Pacific Discount Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode

- 8.1.1. Online Discount Brokerage Service

- 8.1.2. Offline Discount Brokerage Service

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Individual

- 8.2.2. Enterprise

- 8.2.3. Government Agencies

- 8.3. Market Analysis, Insights and Forecast - by Services

- 8.3.1. Order Execution and Advisory

- 8.3.2. Discretionary

- 8.3.3. Online Trading Platforms

- 8.3.4. Education and Investor Resources

- 8.4. Market Analysis, Insights and Forecast - by Commission

- 8.4.1. Commission-free Brokers

- 8.4.2. Fixed Commission Brokers

- 8.1. Market Analysis, Insights and Forecast - by Mode

- 9. South America Discount Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode

- 9.1.1. Online Discount Brokerage Service

- 9.1.2. Offline Discount Brokerage Service

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Individual

- 9.2.2. Enterprise

- 9.2.3. Government Agencies

- 9.3. Market Analysis, Insights and Forecast - by Services

- 9.3.1. Order Execution and Advisory

- 9.3.2. Discretionary

- 9.3.3. Online Trading Platforms

- 9.3.4. Education and Investor Resources

- 9.4. Market Analysis, Insights and Forecast - by Commission

- 9.4.1. Commission-free Brokers

- 9.4.2. Fixed Commission Brokers

- 9.1. Market Analysis, Insights and Forecast - by Mode

- 10. Middle East Discount Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode

- 10.1.1. Online Discount Brokerage Service

- 10.1.2. Offline Discount Brokerage Service

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Individual

- 10.2.2. Enterprise

- 10.2.3. Government Agencies

- 10.3. Market Analysis, Insights and Forecast - by Services

- 10.3.1. Order Execution and Advisory

- 10.3.2. Discretionary

- 10.3.3. Online Trading Platforms

- 10.3.4. Education and Investor Resources

- 10.4. Market Analysis, Insights and Forecast - by Commission

- 10.4.1. Commission-free Brokers

- 10.4.2. Fixed Commission Brokers

- 10.1. Market Analysis, Insights and Forecast - by Mode

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Interactive Brokers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TD Ameritrade

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Charles Schwab

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ETrade

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fidelity Investments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Robinhood

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vanguard

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ally Invest

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Firstrade

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DEGIRO**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Interactive Brokers

List of Figures

- Figure 1: Global Discount Brokerage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Discount Brokerage Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Discount Brokerage Market Revenue (Million), by Mode 2025 & 2033

- Figure 4: North America Discount Brokerage Market Volume (Billion), by Mode 2025 & 2033

- Figure 5: North America Discount Brokerage Market Revenue Share (%), by Mode 2025 & 2033

- Figure 6: North America Discount Brokerage Market Volume Share (%), by Mode 2025 & 2033

- Figure 7: North America Discount Brokerage Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Discount Brokerage Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America Discount Brokerage Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Discount Brokerage Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Discount Brokerage Market Revenue (Million), by Services 2025 & 2033

- Figure 12: North America Discount Brokerage Market Volume (Billion), by Services 2025 & 2033

- Figure 13: North America Discount Brokerage Market Revenue Share (%), by Services 2025 & 2033

- Figure 14: North America Discount Brokerage Market Volume Share (%), by Services 2025 & 2033

- Figure 15: North America Discount Brokerage Market Revenue (Million), by Commission 2025 & 2033

- Figure 16: North America Discount Brokerage Market Volume (Billion), by Commission 2025 & 2033

- Figure 17: North America Discount Brokerage Market Revenue Share (%), by Commission 2025 & 2033

- Figure 18: North America Discount Brokerage Market Volume Share (%), by Commission 2025 & 2033

- Figure 19: North America Discount Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Discount Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 21: North America Discount Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Discount Brokerage Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Discount Brokerage Market Revenue (Million), by Mode 2025 & 2033

- Figure 24: Europe Discount Brokerage Market Volume (Billion), by Mode 2025 & 2033

- Figure 25: Europe Discount Brokerage Market Revenue Share (%), by Mode 2025 & 2033

- Figure 26: Europe Discount Brokerage Market Volume Share (%), by Mode 2025 & 2033

- Figure 27: Europe Discount Brokerage Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Europe Discount Brokerage Market Volume (Billion), by Application 2025 & 2033

- Figure 29: Europe Discount Brokerage Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Discount Brokerage Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Discount Brokerage Market Revenue (Million), by Services 2025 & 2033

- Figure 32: Europe Discount Brokerage Market Volume (Billion), by Services 2025 & 2033

- Figure 33: Europe Discount Brokerage Market Revenue Share (%), by Services 2025 & 2033

- Figure 34: Europe Discount Brokerage Market Volume Share (%), by Services 2025 & 2033

- Figure 35: Europe Discount Brokerage Market Revenue (Million), by Commission 2025 & 2033

- Figure 36: Europe Discount Brokerage Market Volume (Billion), by Commission 2025 & 2033

- Figure 37: Europe Discount Brokerage Market Revenue Share (%), by Commission 2025 & 2033

- Figure 38: Europe Discount Brokerage Market Volume Share (%), by Commission 2025 & 2033

- Figure 39: Europe Discount Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Discount Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Europe Discount Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Discount Brokerage Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Discount Brokerage Market Revenue (Million), by Mode 2025 & 2033

- Figure 44: Asia Pacific Discount Brokerage Market Volume (Billion), by Mode 2025 & 2033

- Figure 45: Asia Pacific Discount Brokerage Market Revenue Share (%), by Mode 2025 & 2033

- Figure 46: Asia Pacific Discount Brokerage Market Volume Share (%), by Mode 2025 & 2033

- Figure 47: Asia Pacific Discount Brokerage Market Revenue (Million), by Application 2025 & 2033

- Figure 48: Asia Pacific Discount Brokerage Market Volume (Billion), by Application 2025 & 2033

- Figure 49: Asia Pacific Discount Brokerage Market Revenue Share (%), by Application 2025 & 2033

- Figure 50: Asia Pacific Discount Brokerage Market Volume Share (%), by Application 2025 & 2033

- Figure 51: Asia Pacific Discount Brokerage Market Revenue (Million), by Services 2025 & 2033

- Figure 52: Asia Pacific Discount Brokerage Market Volume (Billion), by Services 2025 & 2033

- Figure 53: Asia Pacific Discount Brokerage Market Revenue Share (%), by Services 2025 & 2033

- Figure 54: Asia Pacific Discount Brokerage Market Volume Share (%), by Services 2025 & 2033

- Figure 55: Asia Pacific Discount Brokerage Market Revenue (Million), by Commission 2025 & 2033

- Figure 56: Asia Pacific Discount Brokerage Market Volume (Billion), by Commission 2025 & 2033

- Figure 57: Asia Pacific Discount Brokerage Market Revenue Share (%), by Commission 2025 & 2033

- Figure 58: Asia Pacific Discount Brokerage Market Volume Share (%), by Commission 2025 & 2033

- Figure 59: Asia Pacific Discount Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Discount Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Discount Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Discount Brokerage Market Volume Share (%), by Country 2025 & 2033

- Figure 63: South America Discount Brokerage Market Revenue (Million), by Mode 2025 & 2033

- Figure 64: South America Discount Brokerage Market Volume (Billion), by Mode 2025 & 2033

- Figure 65: South America Discount Brokerage Market Revenue Share (%), by Mode 2025 & 2033

- Figure 66: South America Discount Brokerage Market Volume Share (%), by Mode 2025 & 2033

- Figure 67: South America Discount Brokerage Market Revenue (Million), by Application 2025 & 2033

- Figure 68: South America Discount Brokerage Market Volume (Billion), by Application 2025 & 2033

- Figure 69: South America Discount Brokerage Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: South America Discount Brokerage Market Volume Share (%), by Application 2025 & 2033

- Figure 71: South America Discount Brokerage Market Revenue (Million), by Services 2025 & 2033

- Figure 72: South America Discount Brokerage Market Volume (Billion), by Services 2025 & 2033

- Figure 73: South America Discount Brokerage Market Revenue Share (%), by Services 2025 & 2033

- Figure 74: South America Discount Brokerage Market Volume Share (%), by Services 2025 & 2033

- Figure 75: South America Discount Brokerage Market Revenue (Million), by Commission 2025 & 2033

- Figure 76: South America Discount Brokerage Market Volume (Billion), by Commission 2025 & 2033

- Figure 77: South America Discount Brokerage Market Revenue Share (%), by Commission 2025 & 2033

- Figure 78: South America Discount Brokerage Market Volume Share (%), by Commission 2025 & 2033

- Figure 79: South America Discount Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Discount Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 81: South America Discount Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Discount Brokerage Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East Discount Brokerage Market Revenue (Million), by Mode 2025 & 2033

- Figure 84: Middle East Discount Brokerage Market Volume (Billion), by Mode 2025 & 2033

- Figure 85: Middle East Discount Brokerage Market Revenue Share (%), by Mode 2025 & 2033

- Figure 86: Middle East Discount Brokerage Market Volume Share (%), by Mode 2025 & 2033

- Figure 87: Middle East Discount Brokerage Market Revenue (Million), by Application 2025 & 2033

- Figure 88: Middle East Discount Brokerage Market Volume (Billion), by Application 2025 & 2033

- Figure 89: Middle East Discount Brokerage Market Revenue Share (%), by Application 2025 & 2033

- Figure 90: Middle East Discount Brokerage Market Volume Share (%), by Application 2025 & 2033

- Figure 91: Middle East Discount Brokerage Market Revenue (Million), by Services 2025 & 2033

- Figure 92: Middle East Discount Brokerage Market Volume (Billion), by Services 2025 & 2033

- Figure 93: Middle East Discount Brokerage Market Revenue Share (%), by Services 2025 & 2033

- Figure 94: Middle East Discount Brokerage Market Volume Share (%), by Services 2025 & 2033

- Figure 95: Middle East Discount Brokerage Market Revenue (Million), by Commission 2025 & 2033

- Figure 96: Middle East Discount Brokerage Market Volume (Billion), by Commission 2025 & 2033

- Figure 97: Middle East Discount Brokerage Market Revenue Share (%), by Commission 2025 & 2033

- Figure 98: Middle East Discount Brokerage Market Volume Share (%), by Commission 2025 & 2033

- Figure 99: Middle East Discount Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 100: Middle East Discount Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 101: Middle East Discount Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: Middle East Discount Brokerage Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Discount Brokerage Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Global Discount Brokerage Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 3: Global Discount Brokerage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Discount Brokerage Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Discount Brokerage Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Global Discount Brokerage Market Volume Billion Forecast, by Services 2020 & 2033

- Table 7: Global Discount Brokerage Market Revenue Million Forecast, by Commission 2020 & 2033

- Table 8: Global Discount Brokerage Market Volume Billion Forecast, by Commission 2020 & 2033

- Table 9: Global Discount Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Discount Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Discount Brokerage Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 12: Global Discount Brokerage Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 13: Global Discount Brokerage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Discount Brokerage Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Global Discount Brokerage Market Revenue Million Forecast, by Services 2020 & 2033

- Table 16: Global Discount Brokerage Market Volume Billion Forecast, by Services 2020 & 2033

- Table 17: Global Discount Brokerage Market Revenue Million Forecast, by Commission 2020 & 2033

- Table 18: Global Discount Brokerage Market Volume Billion Forecast, by Commission 2020 & 2033

- Table 19: Global Discount Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Discount Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United States Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Canada Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Mexico Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of North America Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of North America Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Global Discount Brokerage Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 30: Global Discount Brokerage Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 31: Global Discount Brokerage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Discount Brokerage Market Volume Billion Forecast, by Application 2020 & 2033

- Table 33: Global Discount Brokerage Market Revenue Million Forecast, by Services 2020 & 2033

- Table 34: Global Discount Brokerage Market Volume Billion Forecast, by Services 2020 & 2033

- Table 35: Global Discount Brokerage Market Revenue Million Forecast, by Commission 2020 & 2033

- Table 36: Global Discount Brokerage Market Volume Billion Forecast, by Commission 2020 & 2033

- Table 37: Global Discount Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Discount Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: Germany Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: United Kingdom Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: United Kingdom Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: France Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: France Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Russia Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Russia Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Spain Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Spain Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Global Discount Brokerage Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 52: Global Discount Brokerage Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 53: Global Discount Brokerage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Discount Brokerage Market Volume Billion Forecast, by Application 2020 & 2033

- Table 55: Global Discount Brokerage Market Revenue Million Forecast, by Services 2020 & 2033

- Table 56: Global Discount Brokerage Market Volume Billion Forecast, by Services 2020 & 2033

- Table 57: Global Discount Brokerage Market Revenue Million Forecast, by Commission 2020 & 2033

- Table 58: Global Discount Brokerage Market Volume Billion Forecast, by Commission 2020 & 2033

- Table 59: Global Discount Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Discount Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 61: India Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: India Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: China Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: China Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Japan Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Japan Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Rest of Asia Pacific Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Asia Pacific Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Global Discount Brokerage Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 70: Global Discount Brokerage Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 71: Global Discount Brokerage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 72: Global Discount Brokerage Market Volume Billion Forecast, by Application 2020 & 2033

- Table 73: Global Discount Brokerage Market Revenue Million Forecast, by Services 2020 & 2033

- Table 74: Global Discount Brokerage Market Volume Billion Forecast, by Services 2020 & 2033

- Table 75: Global Discount Brokerage Market Revenue Million Forecast, by Commission 2020 & 2033

- Table 76: Global Discount Brokerage Market Volume Billion Forecast, by Commission 2020 & 2033

- Table 77: Global Discount Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Discount Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 79: Brazil Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Brazil Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Argentina Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Argentina Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Rest of South America Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Rest of South America Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: Global Discount Brokerage Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 86: Global Discount Brokerage Market Volume Billion Forecast, by Mode 2020 & 2033

- Table 87: Global Discount Brokerage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 88: Global Discount Brokerage Market Volume Billion Forecast, by Application 2020 & 2033

- Table 89: Global Discount Brokerage Market Revenue Million Forecast, by Services 2020 & 2033

- Table 90: Global Discount Brokerage Market Volume Billion Forecast, by Services 2020 & 2033

- Table 91: Global Discount Brokerage Market Revenue Million Forecast, by Commission 2020 & 2033

- Table 92: Global Discount Brokerage Market Volume Billion Forecast, by Commission 2020 & 2033

- Table 93: Global Discount Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 94: Global Discount Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 95: United Arab Emirates Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: United Arab Emirates Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: Saudi Arabia Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: Saudi Arabia Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: Rest of Middle East Discount Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: Rest of Middle East Discount Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Discount Brokerage Market?

The projected CAGR is approximately 6.29%.

2. Which companies are prominent players in the Discount Brokerage Market?

Key companies in the market include Interactive Brokers, TD Ameritrade, Charles Schwab, ETrade, Fidelity Investments, Robinhood, Vanguard, Ally Invest, Firstrade, DEGIRO**List Not Exhaustive.

3. What are the main segments of the Discount Brokerage Market?

The market segments include Mode, Application, Services , Commission.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Low-cost Trading Fee is Driving the Market; Increasing Popularity of Self-directed Investing.

6. What are the notable trends driving market growth?

Increase in Enterprise Market is Fuelling the Market.

7. Are there any restraints impacting market growth?

Low-cost Trading Fee is Driving the Market; Increasing Popularity of Self-directed Investing.

8. Can you provide examples of recent developments in the market?

September 2023: HDFC Securities launched the discount brokerage platform Sky. Through a single fintech platform, the app provides users with a wide range of trading and investment possibilities, including global equities, IPOs, Indian stocks, ETFs, mutual funds, futures and options, currencies, and commodities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Discount Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Discount Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Discount Brokerage Market?

To stay informed about further developments, trends, and reports in the Discount Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence