Key Insights

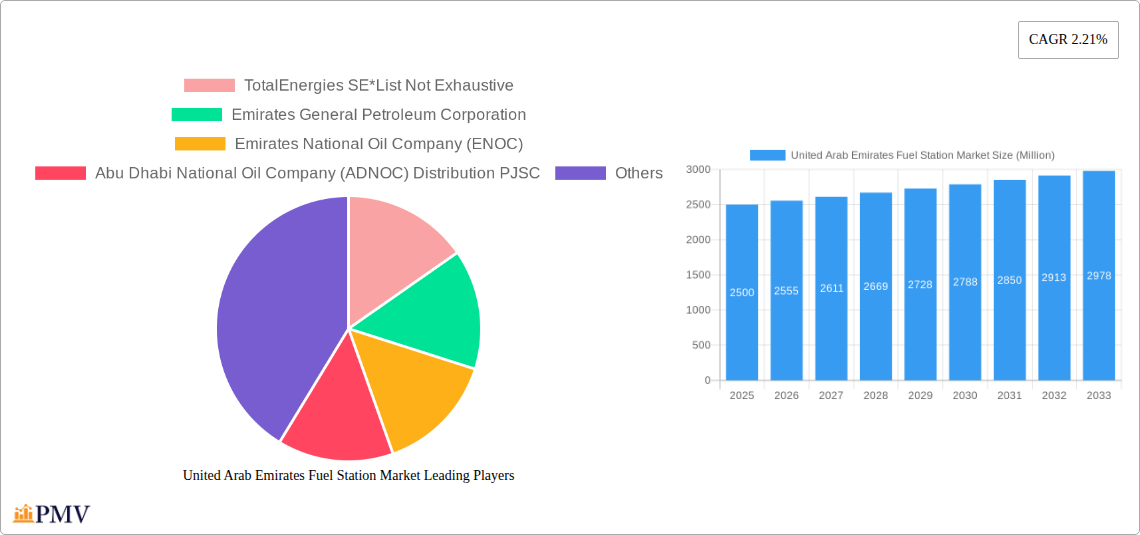

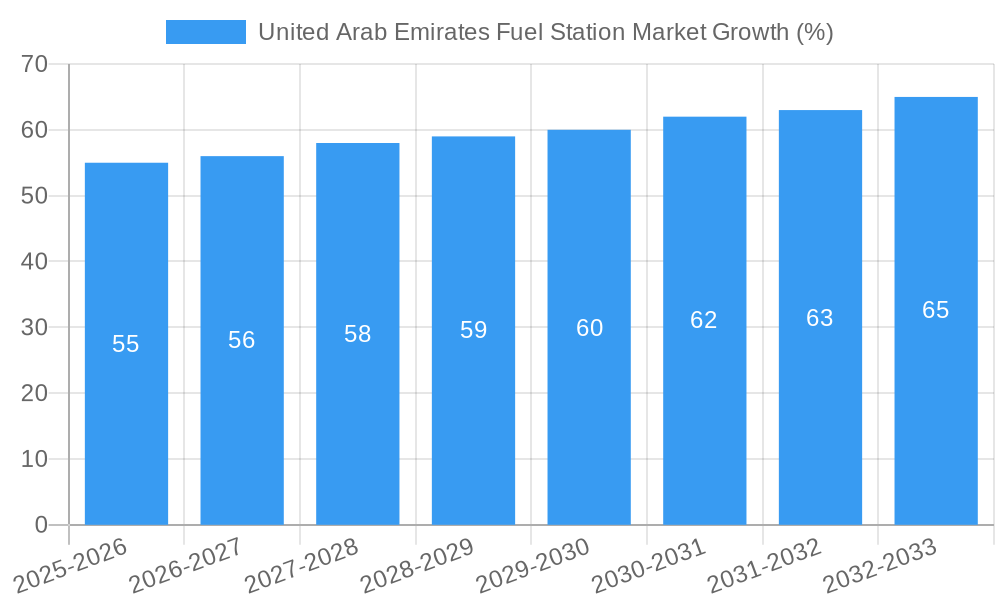

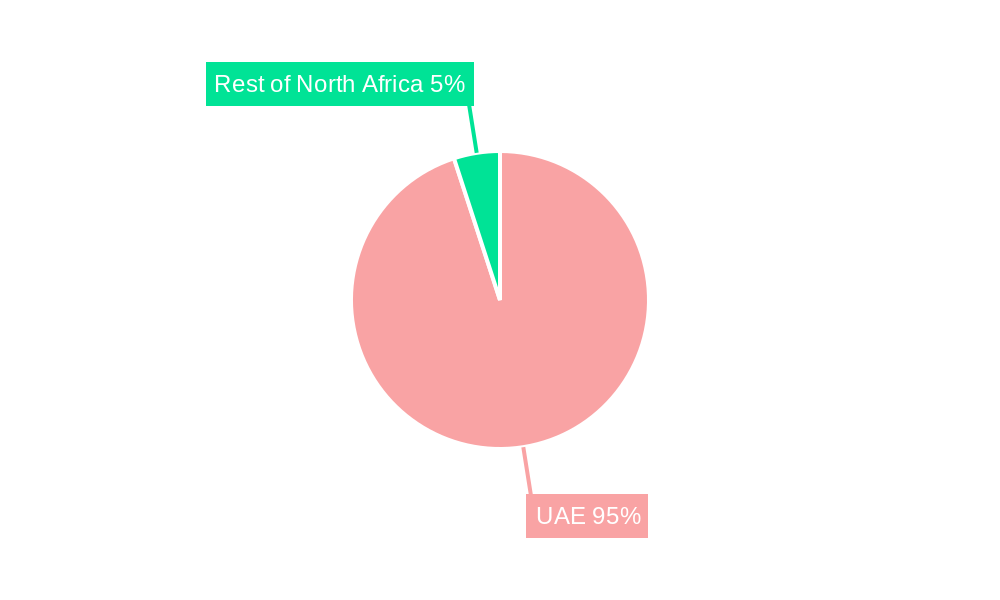

The United Arab Emirates (UAE) fuel station market, while lacking precise figures for market size in the provided data, exhibits robust growth potential. Considering the UAE's strong economy, reliance on vehicles, and burgeoning tourism sector, the market is driven by consistently high fuel demand. The presence of major players like TotalEnergies SE, Emirates General Petroleum Corporation, Emirates National Oil Company (ENOC), and Abu Dhabi National Oil Company (ADNOC) Distribution PJSC signifies a competitive landscape characterized by established brands and significant investment in infrastructure. Future growth will likely be influenced by factors such as government policies promoting fuel efficiency and the adoption of alternative fuels, as well as the expansion of the country's transportation networks and economic development projects. While challenges like fluctuating global oil prices and environmental concerns related to carbon emissions exist, the overall outlook remains positive, with the market expected to experience a moderate Compound Annual Growth Rate (CAGR) exceeding the global average, potentially reaching several billion dollars in market value over the forecast period (2025-2033). This growth is projected to be sustained by consistent population growth, increased tourism, and ongoing infrastructure development within the UAE. The segment breakdown (light, middle, and heavy distillates) reflects the diverse fuel needs of the transportation sector, ranging from passenger vehicles to heavy-duty equipment, and the geographical segmentation emphasizes the market's concentration within the UAE, with potential for growth in other North African regions.

The competitive landscape within the UAE fuel station market is characterized by a blend of established multinational corporations and domestically prominent players. This robust competition fosters innovation and investment in modernizing infrastructure, upgrading services, and improving customer experiences. Strategies likely include aggressive marketing campaigns, loyalty programs, and integration of technology for enhanced payment and customer service. To maintain market share, companies will likely need to balance profitability with environmental responsibility and increasingly stringent emission regulations. Diversification into alternative fuels and electric vehicle charging infrastructure presents a crucial growth opportunity for companies aiming to secure a long-term competitive edge. The emphasis on convenience and customer experience, including initiatives like 24/7 service and integrated convenience stores, will also play a vital role in market competitiveness.

United Arab Emirates Fuel Station Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United Arab Emirates (UAE) fuel station market, offering invaluable insights for stakeholders across the energy sector. Covering the period 2019-2033, with a base year of 2025, this study delves into market structure, competitive dynamics, growth drivers, challenges, and future prospects. The report projects a xx Million market value by 2033, showcasing significant growth opportunities. This in-depth analysis covers key segments including light, middle, and heavy distillates, across geographic regions including Morocco, Algeria, Egypt, and the Rest of North Africa.

United Arab Emirates Fuel Station Market Market Structure & Competitive Dynamics

This section analyzes the UAE fuel station market's competitive landscape, including market concentration, innovation, regulations, substitutes, end-user trends, and mergers & acquisitions (M&A). The market is characterized by a moderately concentrated structure, with key players like TotalEnergies SE, Emirates General Petroleum Corporation, Emirates National Oil Company (ENOC), and Abu Dhabi National Oil Company (ADNOC) Distribution PJSC holding significant market share. Market share data for 2024 reveals ADNOC holds approximately 40%, ENOC 35%, and TotalEnergies 15%, with the remaining 10% distributed among other players. Innovation is driven by technological advancements such as AI-powered fueling solutions and the exploration of alternative fuels like hydrogen. Regulatory frameworks, including environmental regulations and pricing policies, significantly influence market dynamics. The observed M&A activity is relatively low, with deal values estimated at xx Million in the past five years. Future growth will likely depend on further consolidation and technological adoption.

United Arab Emirates Fuel Station Market Industry Trends & Insights

The UAE fuel station market exhibits a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as rising vehicle ownership, increasing urbanization, and robust economic growth. Technological disruptions, including the integration of AI and digital technologies, are transforming the customer experience, enhancing efficiency, and optimizing operations. Consumer preferences are shifting towards convenient, technologically advanced fuel stations offering additional services like convenience stores and quick-service restaurants. Intense competition among major players is further stimulating market growth through strategic investments, service enhancements, and expansion initiatives. Market penetration of AI-powered solutions is projected to reach xx% by 2033. The increasing focus on sustainability and the government's initiatives promoting alternative fuels will shape future market trends.

Dominant Markets & Segments in United Arab Emirates Fuel Station Market

The UAE dominates the regional market, followed by other North African countries. Within the UAE, the major urban centers experience the highest demand.

Key Drivers for UAE Dominance:

- Robust economic growth and high disposable incomes.

- Extensive road infrastructure network.

- High vehicle ownership rates.

- Government support for infrastructure development.

In terms of fuel types, light distillates (gasoline) represent the largest segment, accounting for approximately 60% of the market, followed by middle distillates (diesel) at 30%, and heavy distillates at 10%. This market share is expected to remain consistent until 2033, although the adoption of alternative fuels may slowly alter this projection.

United Arab Emirates Fuel Station Market Product Innovations

Recent innovations focus on enhancing customer experience and operational efficiency. The introduction of AI-powered fuel dispensing systems, offering personalized services and optimized fuel delivery, represents a significant advancement. Furthermore, the exploration of alternative fuel options like hydrogen highlights a shift towards sustainable practices within the industry. These innovations aim to improve convenience, reduce operational costs, and cater to evolving consumer demands and environmental concerns.

Report Segmentation & Scope

This report segments the UAE fuel station market by geography (UAE, Morocco, Algeria, Egypt, Rest of North Africa) and fuel type (Light Distillates, Middle Distillates, Heavy Distillates). Each segment's analysis includes growth projections, market sizes, and competitive dynamics. For instance, the UAE market exhibits the highest growth rate due to the factors mentioned above. The light distillates segment dominates in terms of volume and revenue, while the heavy distillates segment shows modest growth potential. The North African region's segment size is expected to grow at a CAGR of xx%, but remains relatively small compared to the UAE market.

Key Drivers of United Arab Emirates Fuel Station Market Growth

The UAE fuel station market's growth is propelled by several key factors: the nation's robust economic growth fuels higher vehicle ownership and fuel consumption. Government investments in infrastructure development, particularly road networks, expand accessibility and usage of fuel stations. Moreover, increasing urbanization contributes to heightened demand, while ongoing technological advancements, such as AI-powered systems, improve efficiency and customer experience.

Challenges in the United Arab Emirates Fuel Station Market Sector

The UAE fuel station market faces challenges including fluctuating global crude oil prices impacting fuel costs and profitability. Stringent environmental regulations regarding emissions and fuel quality necessitate significant investments in upgrading infrastructure and adopting cleaner technologies. Intense competition and the emergence of new market entrants may further intensify pricing pressures. Supply chain disruptions can also create operational inefficiencies. The combined effect of these factors might negatively affect market profitability by xx% by 2033.

Leading Players in the United Arab Emirates Fuel Station Market Market

- TotalEnergies SE

- Emirates General Petroleum Corporation

- Emirates National Oil Company (ENOC)

- Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

Key Developments in United Arab Emirates Fuel Station Market Sector

- February 2023: DEWA and ENOC announced a joint feasibility study to develop a hydrogen fueling station, signifying a move towards sustainable fuels.

- February 2023: ADNOC Fill & Go launched AI technology at its stations, enhancing customer experience and operational efficiency. This represents a significant technological advancement in the sector.

Strategic United Arab Emirates Fuel Station Market Market Outlook

The UAE fuel station market presents significant growth potential, driven by continued economic expansion, infrastructure development, and technological innovations. Strategic opportunities exist in expanding into new geographical areas, investing in sustainable fuel infrastructure, and leveraging technological advancements to enhance customer experience and operational efficiency. Focus on diversification through alternative fuel offerings and strategic partnerships will be crucial for future success.

United Arab Emirates Fuel Station Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United Arab Emirates Fuel Station Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Fuel Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Vehicles4.; Increasing Adoption of Compact Fuel Station Concept

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand for Electric Vehicles in the Country

- 3.4. Market Trends

- 3.4.1. Increasing Number of Vehicles to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United Kingdom United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Norway United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Rest of North Sea United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 TotalEnergies SE*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Emirates General Petroleum Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Emirates National Oil Company (ENOC)

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.1 TotalEnergies SE*List Not Exhaustive

List of Figures

- Figure 1: United Arab Emirates Fuel Station Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Fuel Station Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Fuel Station Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: United Arab Emirates Fuel Station Market Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 5: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: United Arab Emirates Fuel Station Market Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 7: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: United Arab Emirates Fuel Station Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: United Arab Emirates Fuel Station Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: United Arab Emirates Fuel Station Market Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: United Arab Emirates Fuel Station Market Volume Million Forecast, by Region 2019 & 2032

- Table 15: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2019 & 2032

- Table 17: United Arab Emirates Fuel Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Fuel Station Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2019 & 2032

- Table 21: United Arab Emirates Fuel Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Arab Emirates Fuel Station Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2019 & 2032

- Table 25: United Arab Emirates Fuel Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Arab Emirates Fuel Station Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 28: United Arab Emirates Fuel Station Market Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 29: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 30: United Arab Emirates Fuel Station Market Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 31: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 32: United Arab Emirates Fuel Station Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 33: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 34: United Arab Emirates Fuel Station Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 35: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 36: United Arab Emirates Fuel Station Market Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 37: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Fuel Station Market?

The projected CAGR is approximately 2.21%.

2. Which companies are prominent players in the United Arab Emirates Fuel Station Market?

Key companies in the market include TotalEnergies SE*List Not Exhaustive, Emirates General Petroleum Corporation, Emirates National Oil Company (ENOC), Abu Dhabi National Oil Company (ADNOC) Distribution PJSC.

3. What are the main segments of the United Arab Emirates Fuel Station Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Vehicles4.; Increasing Adoption of Compact Fuel Station Concept.

6. What are the notable trends driving market growth?

Increasing Number of Vehicles to Drive the Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Demand for Electric Vehicles in the Country.

8. Can you provide examples of recent developments in the market?

February 2023: DEWA and ENOC announced joining hands to develop a hydrogen fuelling station for vehicles in the United Arab Emirates. Both firms will conduct a joint feasibility study for establishing, developing, and operating pilot projects which will be utilized to provide hydrogen for vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Fuel Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Fuel Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Fuel Station Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Fuel Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence