Key Insights

Denmark's offshore oil and gas decommissioning market presents a significant growth opportunity, driven by aging infrastructure and evolving environmental regulations. The market is projected to reach $11.1 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. Key growth factors include stringent environmental mandates for platform removal and the increasing number of offshore installations reaching end-of-life. The market is segmented by water depth (shallow, deep, ultra-deepwater) and operation type (plug and abandonment, topside/substructure/subsea infrastructure removal, and others). Innovations in technology are crucial for cost reduction and efficiency enhancement. While initial investments are substantial, the long-term benefits of environmental protection and resource recovery are fueling market expansion. Leading companies like Aker Solutions ASA, Saipem S.p.A., and Halliburton Company are contributing to a competitive landscape and driving technological advancements.

Denmark Offshore Oil And Gas Decommissioning Market Market Size (In Billion)

The market's positive growth trajectory is supported by government incentives, technological progress, and a heightened emphasis on sustainability in the energy sector. Challenges include volatile oil prices and the complexity of offshore decommissioning. Nevertheless, the Denmark offshore oil and gas decommissioning market offers substantial prospects for specialized service and technology providers. The trend towards environmentally responsible decommissioning methods, including material recycling and reuse, is expected to further stimulate market growth.

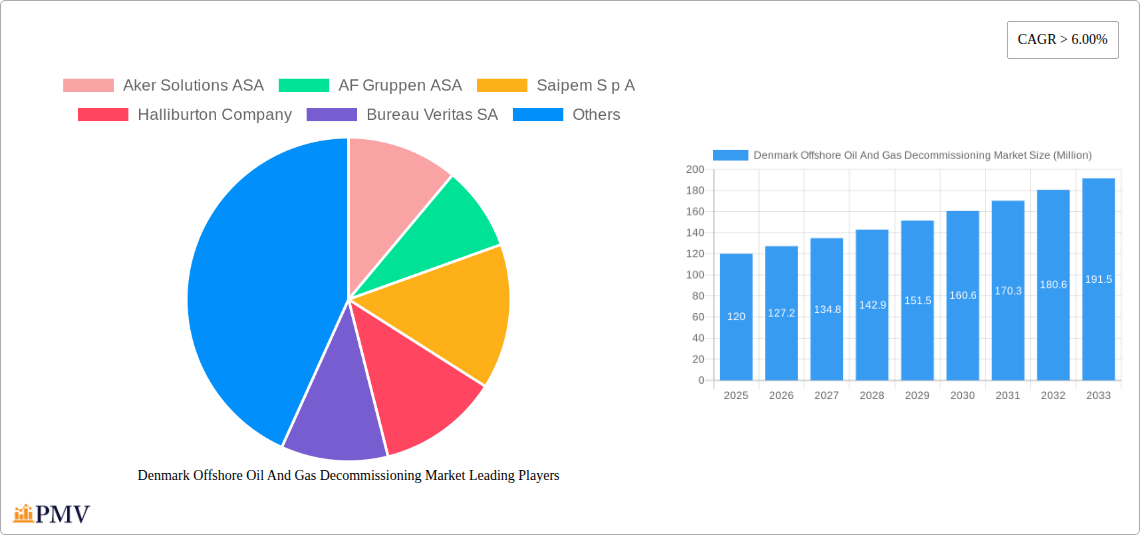

Denmark Offshore Oil And Gas Decommissioning Market Company Market Share

Denmark Offshore Oil and Gas Decommissioning Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Denmark offshore oil and gas decommissioning market, offering invaluable insights for stakeholders across the energy sector. Covering the period from 2019 to 2033, with 2025 as the base year, this study meticulously examines market structure, competitive dynamics, industry trends, and future growth prospects. The report is crucial for businesses involved in plug and abandonment, topside/substructure removal, subsea infrastructure decommissioning, and other related operations, helping them navigate the complexities of this evolving market. The total market size in 2025 is estimated at xx Million.

Denmark Offshore Oil And Gas Decommissioning Market Structure & Competitive Dynamics

The Denmark offshore oil and gas decommissioning market exhibits a moderately concentrated structure, with several multinational players holding significant market share. The market is characterized by a dynamic interplay of established operators and specialized service providers. Key players such as Aker Solutions ASA, AF Gruppen ASA, Saipem S p A, Halliburton Company, Bureau Veritas SA, A P Moller - Maersk B A/S, and Schlumberger Limited compete fiercely, driving innovation and shaping market dynamics. Innovation ecosystems are growing, fueled by advancements in technologies like remotely operated vehicles (ROVs) and automated dismantling techniques. The regulatory framework, largely governed by the Danish Energy Agency, plays a vital role in influencing decommissioning practices and safety standards. While substitutes for decommissioning services are limited, cost-effective and environmentally friendly solutions are driving competition. End-user trends are shifting toward sustainable decommissioning practices, emphasizing environmental protection and minimizing the carbon footprint. Recent M&A activities, while not extensive, have focused on consolidating expertise and expanding operational capabilities. Deal values have ranged from xx Million to xx Million in recent years, reflecting the considerable investment needed in specialized equipment and expertise.

- Market Concentration: Moderately concentrated, with several major players dominating.

- Innovation Ecosystems: Growing, with a focus on technological advancements for efficient and environmentally friendly decommissioning.

- Regulatory Framework: Stringent safety and environmental regulations driven by the Danish Energy Agency.

- Product Substitutes: Limited, but a push for environmentally friendly alternatives.

- End-User Trends: Increasing focus on sustainability and minimizing environmental impact.

- M&A Activities: Moderate activity, focused on consolidating expertise and expanding operational capabilities.

Denmark Offshore Oil And Gas Decommissioning Market Industry Trends & Insights

The Denmark offshore oil and gas decommissioning market is projected to experience significant growth throughout the forecast period (2025-2033), driven by several key factors. The aging offshore oil and gas infrastructure in the Danish North Sea necessitates extensive decommissioning activities. This is further propelled by stringent environmental regulations promoting responsible dismantling and waste management. Technological advancements, such as improved robotics and automation, enhance efficiency and safety, making decommissioning projects more economically viable. The rising costs of maintaining aging platforms and the potential for environmental liabilities also incentivize decommissioning. The market is witnessing increased collaboration between operators, contractors, and technology providers. Competitive dynamics are intensifying as companies strive to offer more efficient and sustainable decommissioning solutions. The Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period, with market penetration steadily increasing.

Dominant Markets & Segments in Denmark Offshore Oil And Gas Decommissioning Market

The Danish North Sea remains the dominant region for offshore oil and gas decommissioning activities. Within the operational segments, Plug and Abandonment (P&A) constitutes the largest share of the market, driven by the significant number of aging wells requiring safe and secure closure. Deepwater decommissioning projects are also increasing in prominence due to the presence of older platforms in deeper water areas. However, shallow water decommissioning continues to account for a significant portion of activity due to the maturity of installations in shallower waters.

- Key Drivers for Deepwater Segment:

- Complex infrastructure requiring specialized expertise.

- High decommissioning costs necessitating advanced technologies.

- Key Drivers for Plug and Abandonment:

- Significant number of aging wells requiring closure.

- Stringent regulations on well integrity and environmental protection.

- Key Drivers for Topside/Substructure Removal:

- Need to dismantle aging platforms, creating opportunities for specialized contractors.

- Economic incentives to reclaim valuable materials from decommissioned assets.

- Dominance Analysis: Deepwater and Plug and Abandonment segments demonstrate the highest growth potential. The large volume of shallow water facilities nearing the end of their operational life contributes to the sustained significance of shallow water decommissioning.

Denmark Offshore Oil And Gas Decommissioning Market Product Innovations

Recent technological advancements have significantly improved decommissioning efficiency and safety. This includes advanced robotics, remotely operated vehicles (ROVs), and improved cutting and separation techniques for dismantling structures. These innovations enhance operational efficiency, minimize downtime, and reduce environmental impact. Furthermore, the focus on sustainable decommissioning methods, including material recycling and waste management strategies, is gaining traction, driving innovation in this space. The market increasingly favors solutions that minimize environmental impact and optimize resource utilization.

Report Segmentation & Scope

This report segments the Denmark offshore oil and gas decommissioning market based on Water Depth (Shallow Water, Deepwater, Ultra-Deepwater) and Operation type (Plug and Abandonment, Topside/Substructure Removal, Subsea Infrastructure Removal, Other Operations). Each segment is analyzed to estimate its market size, growth projections, and competitive dynamics. Deepwater is projected to see the highest growth due to complexities requiring specialized expertise. Plug and Abandonment and Subsea infrastructure removal are expected to have a large market share. The "Other Operations" segment encompasses smaller projects and activities.

Key Drivers of Denmark Offshore Oil And Gas Decommissioning Market Growth

Several factors drive the growth of the Denmark offshore oil and gas decommissioning market. These include stringent government regulations, ensuring environmental protection during decommissioning, a rising number of aging offshore platforms that require decommissioning, and the continuous technological advancements in decommissioning methods, improving efficiency and safety. Economic incentives for responsible decommissioning, as well as the growing awareness of environmental responsibility and corporate social responsibility, play significant roles.

Challenges in the Denmark Offshore Oil And Gas Decommissioning Market Sector

Challenges include high decommissioning costs and the need for specialized equipment and expertise, resulting in potential project delays and budget overruns. Supply chain disruptions can impact project timelines. Intense competition among service providers, often leading to price wars and reduced profit margins, is another hurdle. Furthermore, securing permits and approvals from regulatory bodies can lead to significant delays.

Leading Players in the Denmark Offshore Oil And Gas Decommissioning Market Market

Key Developments in Denmark Offshore Oil And Gas Decommissioning Market Sector

- April 2023: ABL Group secures a decommissioning contract in the Danish North Sea from TotalEnergies SE. This highlights the growing demand for specialized decommissioning services in the region and the competition among service providers.

Strategic Denmark Offshore Oil And Gas Decommissioning Market Outlook

The Denmark offshore oil and gas decommissioning market presents significant opportunities for companies with expertise in specialized decommissioning technologies and sustainable practices. The increasing number of aging platforms and stringent environmental regulations will continue to drive demand for efficient and environmentally friendly decommissioning solutions. Companies that invest in advanced technologies, foster strategic partnerships, and prioritize sustainable decommissioning practices are well-positioned to capture a larger share of this expanding market. The long-term outlook remains positive, with consistent growth projected throughout the forecast period.

Denmark Offshore Oil And Gas Decommissioning Market Segmentation

-

1. Water Depth

- 1.1. Shallow Water

- 1.2. Deepwater and Ultra-Deepwater

-

2. Operation

- 2.1. Plug and Abandonment

- 2.2. Topside

- 2.3. Other Operations

Denmark Offshore Oil And Gas Decommissioning Market Segmentation By Geography

- 1. Denmark

Denmark Offshore Oil And Gas Decommissioning Market Regional Market Share

Geographic Coverage of Denmark Offshore Oil And Gas Decommissioning Market

Denmark Offshore Oil And Gas Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Shallow Water Projects to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Water Depth

- 5.1.1. Shallow Water

- 5.1.2. Deepwater and Ultra-Deepwater

- 5.2. Market Analysis, Insights and Forecast - by Operation

- 5.2.1. Plug and Abandonment

- 5.2.2. Topside

- 5.2.3. Other Operations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Water Depth

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aker Solutions ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AF Gruppen ASA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saipem S p A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Halliburton Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bureau Veritas SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A P Moller - Maersk B A/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schlumberger Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Denmark Offshore Oil And Gas Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Denmark Offshore Oil And Gas Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 2: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 3: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 5: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 6: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Offshore Oil And Gas Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Denmark Offshore Oil And Gas Decommissioning Market?

Key companies in the market include Aker Solutions ASA, AF Gruppen ASA, Saipem S p A, Halliburton Company, Bureau Veritas SA, A P Moller - Maersk B A/S, Schlumberger Limited.

3. What are the main segments of the Denmark Offshore Oil And Gas Decommissioning Market?

The market segments include Water Depth, Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Shallow Water Projects to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

April 2023: ABL Group announced that the company won a decommissioning contract in the Danish North Sea from TotalEnergies SE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Offshore Oil And Gas Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Offshore Oil And Gas Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Offshore Oil And Gas Decommissioning Market?

To stay informed about further developments, trends, and reports in the Denmark Offshore Oil And Gas Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence