Key Insights

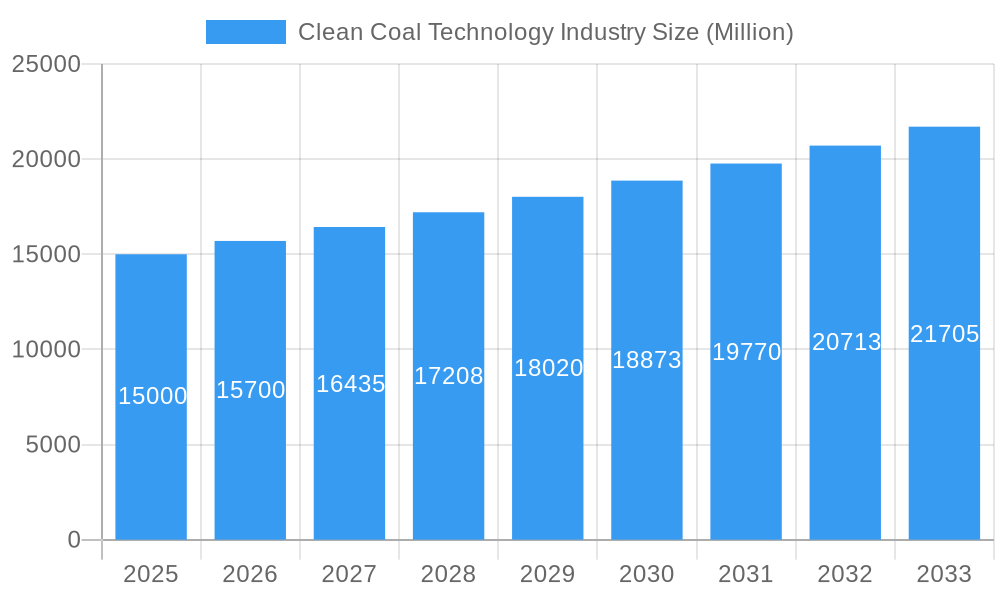

The global Clean Coal Technology market is poised for significant expansion, driven by escalating energy needs and stringent environmental mandates to curb greenhouse gas emissions. The market, valued at $4.57 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 6.39% through 2033. This robust growth is underpinned by advancements in technologies such as Carbon Capture and Storage (CCS), enhanced combustion techniques, and Flue Gas Desulfurization (FGD), which improve the environmental performance of coal-fired power plants. Increased R&D investment is fostering innovation and economic viability in clean coal solutions. Stringent global emission standards are also a key growth driver, compelling power generators to adopt cleaner alternatives. The industrial sector, a major coal consumer, is increasingly integrating these technologies to reduce its environmental impact.

Clean Coal Technology Industry Market Size (In Billion)

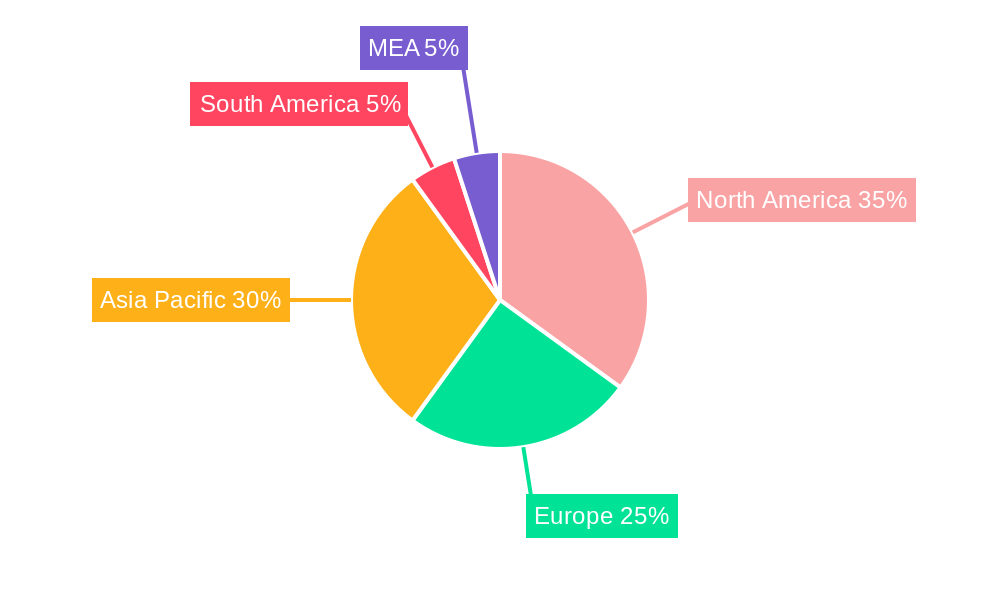

Carbon Capture and Storage (CCS) commands a substantial market share due to its efficacy in CO2 sequestration. Advanced combustion and FGD technologies are also gaining traction, especially in regions with existing coal power infrastructure. North America and Asia Pacific lead the market, influenced by high coal utilization and investments. Europe's adoption is accelerating due to stricter environmental policies. Prominent industry players like Shell PLC, KBR Inc., Siemens Energy AG, General Electric Company, and Alstom SA are instrumental in driving innovation and competition through the development and deployment of advanced clean coal solutions. Despite challenges related to initial investment and technical complexities, the market's outlook remains optimistic, supported by the persistent demand for reliable, affordable energy and a global commitment to environmental sustainability.

Clean Coal Technology Industry Company Market Share

Clean Coal Technology Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Clean Coal Technology (CCT) industry, offering valuable insights for investors, industry professionals, and policymakers. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period and a base year of 2025. The report projects a market size of xx Million by 2033, driven by factors detailed within.

Clean Coal Technology Industry Market Structure & Competitive Dynamics

The Clean Coal Technology market exhibits a moderately concentrated structure, with key players like Shell PLC, KBR Inc, Siemens Energy AG, General Electric Company, and Alstom SA holding significant market share. However, the presence of numerous smaller players, particularly in niche technologies like advanced combustion and FGD, contributes to a competitive landscape. Innovation ecosystems are largely concentrated around research institutions and government-funded initiatives, with varying levels of collaboration between academia and industry. Regulatory frameworks, particularly concerning emissions standards and carbon pricing mechanisms, significantly influence technological adoption and investment decisions. The market faces competition from renewable energy sources, which represent a strong substitute for coal-fired power generation. End-user trends, driven by environmental concerns and stricter regulations, are pushing demand towards cleaner coal technologies. M&A activity in the sector has been relatively modest in recent years, with deal values totaling approximately xx Million in the past five years. This relatively low level of M&A activity might indicate a period of consolidation and strategic positioning before more substantial mergers and acquisitions take place.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share.

- M&A Activity (2019-2024): Total deal value approximately xx Million.

- Key Regulatory Drivers: Stringent emission standards and carbon pricing policies.

- Competitive Pressures: Growing competition from renewable energy technologies.

Clean Coal Technology Industry Industry Trends & Insights

The Clean Coal Technology market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Increased demand for electricity in developing economies, particularly in Asia, is driving the construction of new coal-fired power plants, even as stricter environmental regulations are implemented. This creates a significant market opportunity for clean coal technologies that enable compliance with emission limits while maintaining cost-effectiveness. Technological advancements in carbon capture, utilization, and storage (CCUS) are also playing a vital role. Furthermore, continuous improvements in existing technologies, such as advanced combustion and FGD, are leading to increased efficiency and reduced emissions. Consumer preferences are increasingly focused on environmentally friendly energy sources, further motivating the adoption of clean coal technologies as a transitional solution. However, the market also faces challenges from the increasing competitiveness of renewable energy sources like solar and wind, alongside considerable investment in these sectors.

Dominant Markets & Segments in Clean Coal Technology Industry

The power generation segment dominates the Clean Coal Technology market, accounting for approximately xx% of the total market value. China and India are the leading markets, driven by their large coal-fired power capacities and ambitious plans for cleaner energy.

By Technology:

- CCS (Carbon Capture and Storage): This segment is experiencing the fastest growth, driven by government incentives and advancements in capture technologies.

- Advanced Combustion Technologies: This segment offers cost-effective solutions for improved efficiency and reduced emissions.

- Flue Gas Desulfurization (FGD): A mature technology with widespread adoption, primarily for sulfur dioxide removal.

- Selective Catalytic Reduction (SCR): This technology is crucial for reducing nitrogen oxide emissions from coal-fired power plants.

By Application:

- Power Generation: Largest segment driven by increasing electricity demand globally.

- Industrial Processes: Significant growth potential driven by the need to reduce emissions across different industries.

- Residential and Commercial Heating: This segment is still relatively niche but is expected to expand with advancements in clean coal technologies for heating applications.

Key Drivers:

- Strong government support through policies and subsidies.

- Increasing stringency of environmental regulations.

- Expanding coal-fired power capacity in developing nations.

Clean Coal Technology Industry Product Innovations

Recent innovations focus on improving the efficiency and cost-effectiveness of existing technologies and developing novel solutions for carbon capture and utilization. Advances in materials science, process optimization, and integration with renewable energy sources are key trends. The market is witnessing the development of more compact, modular CCS systems, which offer greater flexibility and reduced installation costs. These innovations are leading to a better market fit for clean coal technologies by making them more economically viable and technologically feasible.

Report Segmentation & Scope

This report segments the Clean Coal Technology market by technology (CCS, Advanced Combustion, FGD, SCR) and application (Power Generation, Industrial Processes, Residential & Commercial Heating). Each segment's growth projection, market size, and competitive dynamics are comprehensively analyzed within this report. For instance, the CCS segment is expected to witness significant growth driven by carbon pricing policies and technological advancements, while the Power Generation application holds the largest market share and is expected to remain dominant due to its scale.

Key Drivers of Clean Coal Technology Industry Growth

The growth of the Clean Coal Technology industry is primarily driven by stringent environmental regulations aimed at reducing greenhouse gas emissions, particularly from coal-fired power plants. Government incentives and subsidies for clean coal technologies are also significant drivers. Furthermore, technological advancements leading to improved efficiency and reduced emissions are contributing to increased market adoption. The increasing demand for electricity globally, especially in developing nations, continues to drive the need for cleaner and more efficient coal-fired power generation.

Challenges in the Clean Coal Technology Industry Sector

Challenges to the industry include high capital costs associated with implementing clean coal technologies, particularly CCS. Supply chain complexities and potential disruptions can also impact project timelines and costs. Intense competition from renewable energy sources and potentially fluctuating energy policies create additional hurdles. These challenges collectively represent a drag on market expansion and influence investment decisions. For example, the high cost of CCS deployment can limit its widespread adoption, especially in smaller-scale power plants.

Leading Players in the Clean Coal Technology Industry Market

- Shell PLC

- KBR Inc

- Siemens Energy AG

- General Electric Company

- Alstom SA

- List Not Exhaustive

Key Developments in Clean Coal Technology Industry Sector

- October 2021: Adani Power Limited announced plans to commission the Godda Ultra Super Critical coal thermal power project (1600 MW capacity). This highlights the continued investment in coal-fired power generation, despite environmental concerns, and the opportunity for CCT adoption.

- February 2022: The Indian Institute of Chemical Technology (IICT) announced a collaborative project with Northern Coalfields Limits (NCL) for research and development in sustainable mining and clean coal technologies. This signifies government and institutional support for innovation in the CCT sector.

Strategic Clean Coal Technology Industry Market Outlook

The Clean Coal Technology market presents significant growth potential, especially in developing economies with substantial coal-fired power capacities. Strategic opportunities exist in developing cost-effective and scalable CCS technologies, enhancing the efficiency of existing clean coal technologies, and exploring potential synergies between clean coal and renewable energy sources. The future of the market will depend on navigating the challenges of high capital costs, stringent regulations, and competition from renewable energy while capitalizing on the continued need for reliable and affordable energy. Focused research and development in CCS and advanced combustion technologies could unlock significant market growth in the coming years.

Clean Coal Technology Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Clean Coal Technology Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Clean Coal Technology Industry Regional Market Share

Geographic Coverage of Clean Coal Technology Industry

Clean Coal Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets

- 3.3. Market Restrains

- 3.3.1. 4.; Shift Toward Unmanned Aircraft

- 3.4. Market Trends

- 3.4.1. Growth in Power Consumption is Likely to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Middle East and Africa

- 5.6.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East and Africa Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. South America Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shell PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KBR Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens Energy AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Electric Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alstom SA*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Shell PLC

List of Figures

- Figure 1: Global Clean Coal Technology Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 3: North America Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 5: North America Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 15: Europe Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 39: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 51: South America Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: South America Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 53: South America Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: South America Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: South America Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: South America Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: South America Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: South America Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 59: South America Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: South America Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 61: South America Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Clean Coal Technology Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 20: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 32: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clean Coal Technology Industry?

The projected CAGR is approximately 6.39%.

2. Which companies are prominent players in the Clean Coal Technology Industry?

Key companies in the market include Shell PLC, KBR Inc, Siemens Energy AG, General Electric Company, Alstom SA*List Not Exhaustive.

3. What are the main segments of the Clean Coal Technology Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.57 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets.

6. What are the notable trends driving market growth?

Growth in Power Consumption is Likely to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Shift Toward Unmanned Aircraft.

8. Can you provide examples of recent developments in the market?

In February 2022, the Indian Institute of Chemical Technology (IICT) announced a collaborative project of approximately INR 7.31 core with Northern Coalfields Limits (NCL), Madhya Pradesh (MP), to take up research and development in the field of sustainable mining and clean coal technologies (CCT).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clean Coal Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clean Coal Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clean Coal Technology Industry?

To stay informed about further developments, trends, and reports in the Clean Coal Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence