Key Insights

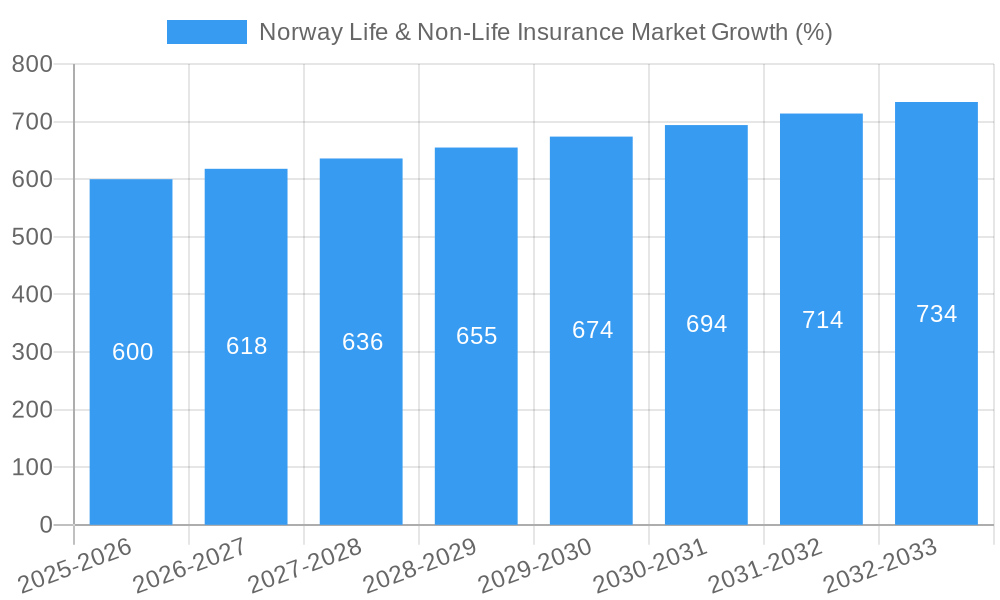

The Norwegian life and non-life insurance market exhibits robust growth, driven by a combination of factors. A rising elderly population necessitates increased demand for life insurance products, particularly annuities and long-term care coverage. Simultaneously, growing awareness of the need for comprehensive risk protection, coupled with increasing disposable incomes, fuels demand within the non-life insurance sector, encompassing areas like property, motor, and health insurance. Government regulations promoting financial inclusion and insurance penetration further contribute to market expansion. However, challenges persist, including intense competition among established players like KLP, Storebrand Livsforsikring, Nordea Liv, and DNB Livsforsikring, as well as emerging digital insurers. Economic fluctuations and evolving consumer preferences also present ongoing considerations for market players. The market is segmented by product type (life, non-life, health, etc.), distribution channels (online, agents, brokers), and customer demographics. Given a CAGR exceeding 3%, and assuming a 2025 market size of (for example) 20 billion NOK (this value is an illustrative example; the actual value needs to be provided in the original data, or a reasonable estimate based on available data), we project continued steady growth throughout the forecast period (2025-2033). This growth will likely be influenced by technological advancements such as Insurtech solutions enhancing customer experience and operational efficiency.

The competitive landscape remains dynamic, with established players facing pressure to innovate and adapt to changing consumer expectations. Strategic partnerships and mergers & acquisitions are anticipated to reshape the market structure. Furthermore, the increasing adoption of digital technologies and data analytics will play a crucial role in optimizing risk assessment, claims processing, and customer service, impacting both profitability and market share. The market’s regional variations warrant further examination, as certain geographical areas might exhibit stronger growth than others due to factors like population density and economic activity. Successful navigation of the challenges and effective capitalisation of opportunities will be key for continued success within the Norwegian insurance industry.

Norway Life & Non-Life Insurance Market: 2019-2033 Forecast Report

This comprehensive report provides a detailed analysis of the Norway Life & Non-Life Insurance Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The study period spans 2019–2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025–2033, encompassing the historical period of 2019–2024.

Norway Life & Non-Life Insurance Market Market Structure & Competitive Dynamics

The Norwegian life and non-life insurance market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Key players such as KLP, Storebrand Livsforsikring, Nordea Liv, and DNB Livsforsikring hold substantial positions. The market displays a robust innovation ecosystem driven by technological advancements and regulatory changes. The regulatory framework, largely shaped by the Financial Supervisory Authority of Norway (Finanstilsynet), ensures market stability and consumer protection. Product substitution, primarily from alternative risk management strategies, presents a moderate competitive threat. End-user trends demonstrate a rising demand for digital insurance solutions and personalized products. M&A activity in the sector has been relatively moderate in recent years, with deal values averaging around xx Million in the past five years, reflecting a strategic consolidation phase within the industry. Market share fluctuations have been observed, with some incumbents consolidating their positions through organic growth and selective acquisitions. This competitive environment fosters innovation and efficiency, ultimately benefiting consumers with wider product choices and more competitive pricing.

Norway Life & Non-Life Insurance Market Industry Trends & Insights

The Norway Life & Non-Life Insurance Market is experiencing steady growth, driven by several key factors. The aging population and rising life expectancy contribute significantly to the increasing demand for life insurance products. Moreover, growing awareness of financial security needs and the rise of personalized insurance solutions fuel market expansion. Technological disruptions, particularly the adoption of Insurtech solutions and the utilization of Big Data analytics, are reshaping the industry landscape, enhancing efficiency and improving customer experience. Consumer preferences are shifting towards digital channels, personalized products, and value-added services. The competitive dynamics are characterized by innovation, strategic partnerships, and the emergence of Insurtech players. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, indicating sustained market expansion. Market penetration for digital insurance channels is estimated to reach xx% by 2033, driven by increasing internet and smartphone adoption.

Dominant Markets & Segments in Norway Life & Non-Life Insurance Market

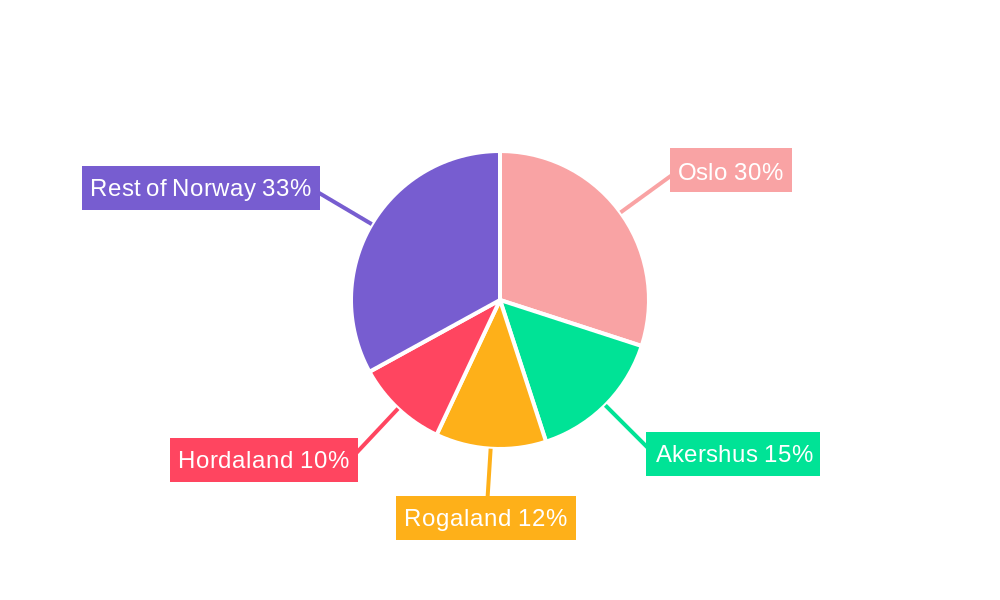

The Norwegian Life & Non-Life insurance market is dominated by the urban areas, reflecting higher disposable incomes and greater awareness of insurance products. Key drivers of this dominance include:

- Robust economic activity: Strong economic performance in urban centers fuels demand for various insurance products, from life insurance to property and casualty coverage.

- Developed infrastructure: Advanced infrastructure facilitates efficient insurance operations and wider access to insurance services for urban residents.

- Higher disposable incomes: Higher income levels in urban areas translate into greater affordability and willingness to purchase insurance policies.

Detailed dominance analysis reveals that the urban centers have consistently shown higher market penetration rates and premium volumes compared to rural areas. This dominance is expected to continue over the forecast period due to the sustained economic growth in these regions and the continued focus on urban development initiatives.

Norway Life & Non-Life Insurance Market Product Innovations

Recent product innovations in the Norwegian insurance market revolve around digitalization and personalization. Insurers are increasingly leveraging technology to offer customized policies, online portals for claims processing, and telematics-based solutions for auto insurance. The integration of AI and machine learning enhances risk assessment and fraud detection, improving efficiency and pricing accuracy. These innovations enhance customer experiences and cater to evolving preferences, building competitive advantages.

Report Segmentation & Scope

The report segments the Norway Life & Non-Life Insurance market based on several key criteria:

Life Insurance: This segment encompasses various life insurance products, such as term life, whole life, and endowment plans, driven by increasing awareness of financial security needs. Growth projections show a steady expansion in this area.

Non-Life Insurance: This segment includes auto, property, and liability insurance, with market size and competitive dynamics affected by factors such as economic conditions and regulatory changes. Growth is expected to be driven by increasing vehicle ownership and the rising value of properties.

Key Drivers of Norway Life & Non-Life Insurance Market Growth

Several factors contribute to the growth of the Norway Life & Non-Life Insurance market. The aging population coupled with increasing awareness of financial security drives demand for life insurance products. Technological advancements, such as AI-powered risk assessment and digital distribution channels, enhance efficiency and customer experience. Furthermore, supportive regulatory frameworks encourage market stability and promote consumer protection, ensuring continued market growth.

Challenges in the Norway Life & Non-Life Insurance Market Sector

The Norwegian insurance market faces challenges such as increasing regulatory scrutiny, cybersecurity threats, and the need to adapt to evolving consumer preferences. Intense competition from both established players and new Insurtech entrants puts pressure on profitability. The need for continuous innovation and investment in technology are crucial for maintaining competitiveness. These challenges require proactive strategies to mitigate risks and capitalize on growth opportunities.

Leading Players in the Norway Life & Non-Life Insurance Market Market

- KLP

- Storebrand Livsforsikring

- Nordea Liv

- DNB Livsforsikring

- SpareBank

- Oslo Pensjonsforsikring

- Gjensidige Forsikring ASA

- Fremtind Forsikring AS

- Protector Forsikring ASA

- Eika Forsikring AS

- DNB Forsikring AS

- Frende Skadeforsikring AS (List Not Exhaustive)

Key Developments in Norway Life & Non-Life Insurance Market Sector

- February 2022: The Norwegian Agency for Development Cooperation (NORAD) provides a NOK 500 million (approximately USD 56 million) grant to the African Trade Insurance Agency (ATI) to support renewable energy initiatives. This reflects a broader trend toward sustainable investment and potentially influences the development of specialized insurance products in Norway’s market.

- February 2022: KLP collaborates with Nordic financial institutions and the Norwegian government to establish guidelines for the shipping industry's transition to climate-friendly fuels. This highlights the increasing focus on ESG (Environmental, Social, and Governance) factors within the industry and may lead to new insurance products or risk management strategies.

Strategic Norway Life & Non-Life Insurance Market Market Outlook

The future of the Norwegian Life & Non-Life Insurance market is promising, with significant growth potential driven by demographic shifts, technological advancements, and increased focus on sustainable development. Strategic opportunities exist in developing innovative digital products, leveraging data analytics for improved risk management, and expanding into new market segments. Companies that successfully adapt to changing consumer preferences and embrace technological innovation will be best positioned to capture market share and drive future growth.

Norway Life & Non-Life Insurance Market Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Channels of Distribution

Norway Life & Non-Life Insurance Market Segmentation By Geography

- 1. Norway

Norway Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Online Sale of Insurance Policy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Channels of Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 KLP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Storebrand Livsforsikring

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nordea Liv

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DNB Livsforsikring

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SpareBank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oslo Pensjonsforsikring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gjensidige Forsikring ASA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fremtind Forsikring AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Protector Forsikring ASA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eika Forsikring AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DNB Forsikring AS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Frende Skadeforsikring AS**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 KLP

List of Figures

- Figure 1: Norway Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Life & Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: Norway Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 4: Norway Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Norway Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Norway Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 7: Norway Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Life & Non-Life Insurance Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Norway Life & Non-Life Insurance Market?

Key companies in the market include KLP, Storebrand Livsforsikring, Nordea Liv, DNB Livsforsikring, SpareBank, Oslo Pensjonsforsikring, Gjensidige Forsikring ASA, Fremtind Forsikring AS, Protector Forsikring ASA, Eika Forsikring AS, DNB Forsikring AS, Frende Skadeforsikring AS**List Not Exhaustive.

3. What are the main segments of the Norway Life & Non-Life Insurance Market?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Online Sale of Insurance Policy.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022- The Norwegian Agency for Development Cooperation (NORAD) Partners with and Commits Funding toward African Trade Insurance Agency's (ATI) Renewable Energy Sector Initiatives.The grant of NOK 500 million (approximately USD 56 million) is geared towards the continued implementation of ATI's Regional Liquidity Support Facility (RLSF) and the development of additional insurance or guarantee products in support of small and medium sized renewable energy sector initiatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Norway Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence