Key Insights

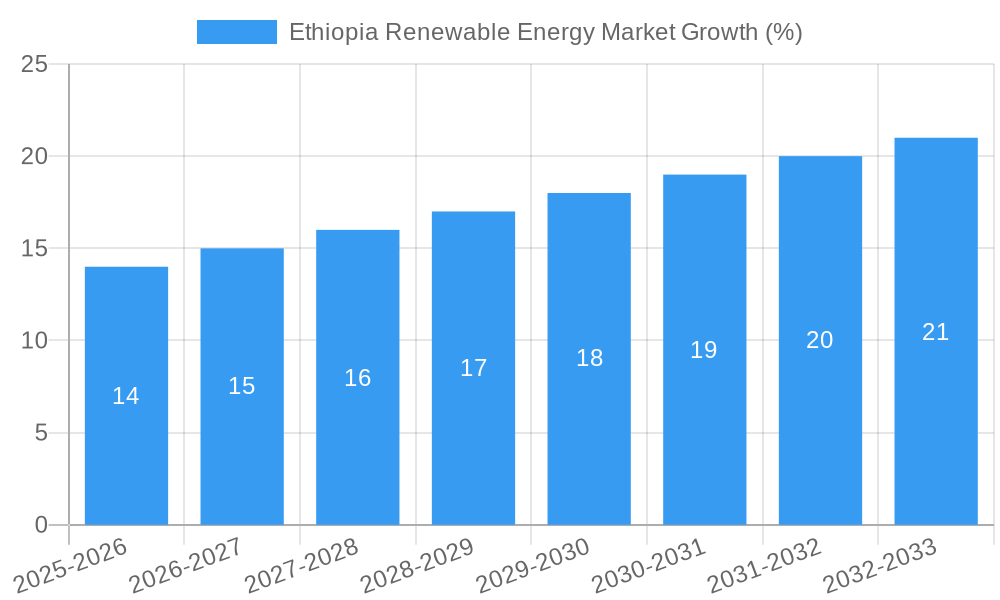

The Ethiopian renewable energy market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 7% compound annual growth rate (CAGR) through 2033. This expansion is driven by several key factors. Ethiopia's significant hydropower potential, coupled with increasing investments in solar and wind energy, forms the foundation of this growth. Government initiatives promoting renewable energy adoption, aimed at reducing reliance on fossil fuels and boosting energy access across the country, are further accelerating market expansion. Furthermore, the rising demand for electricity fueled by economic development and population growth is creating a substantial market for renewable energy solutions. While challenges such as grid infrastructure limitations and the need for consistent policy implementation exist, the overall market outlook remains positive.

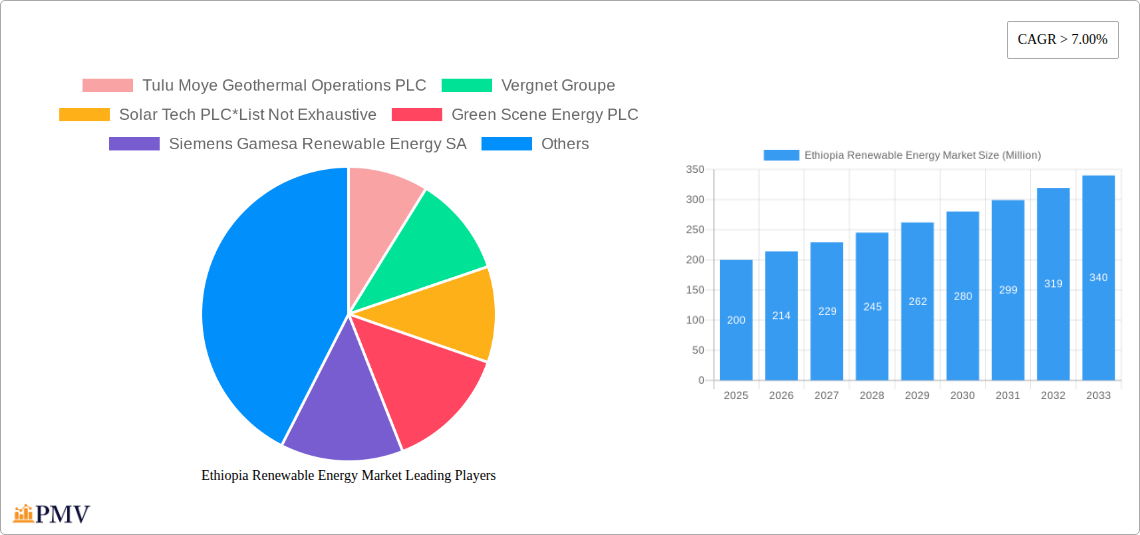

The market is segmented primarily into hydropower, wind, geothermal, solar, and others. Hydropower currently holds a dominant position, owing to Ethiopia's abundant water resources and existing infrastructure. However, solar and wind energy are witnessing rapid growth, fueled by decreasing technology costs and supportive government policies. Geothermal energy, though currently less prominent, possesses significant untapped potential and is expected to see increased investment in the coming years. Key players such as Tulu Moye Geothermal Operations PLC, Vergnet Groupe, Solar Tech PLC, Green Scene Energy PLC, Siemens Gamesa Renewable Energy SA, and ANDRITZ AG are actively involved in developing and deploying renewable energy projects, contributing to the market's dynamic landscape. The forecast period of 2025-2033 anticipates substantial market expansion driven by the factors outlined above and further technological advancements in the renewable energy sector.

Ethiopia Renewable Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Ethiopian renewable energy market, offering valuable insights for investors, industry stakeholders, and policymakers. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data analysis to provide actionable intelligence and strategic recommendations for navigating this rapidly evolving sector.

Ethiopia Renewable Energy Market Structure & Competitive Dynamics

This section analyzes the market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the Ethiopian renewable energy market. The market is characterized by a mix of both large multinational corporations and smaller domestic players. Market share data reveals a fragmented landscape, with no single company dominating. However, significant mergers and acquisitions (M&A) activity is expected to reshape the market in the coming years. The total value of M&A deals in the sector between 2019 and 2024 was approximately USD xx Million, with an anticipated increase to USD xx Million by 2033. Innovation is driven by a combination of government incentives, technological advancements, and growing consumer demand for sustainable energy. The regulatory framework, while evolving, presents both opportunities and challenges for market participants. Product substitution is likely to be driven by advancements in solar and wind technologies, potentially impacting the market share of established players. Finally, end-user trends show a clear preference for cost-effective and reliable renewable energy solutions, impacting investment decisions and technological adoption.

Ethiopia Renewable Energy Market Industry Trends & Insights

This section delves into the key drivers and disruptors shaping the Ethiopian renewable energy market. The market is experiencing substantial growth, driven by government support, increasing energy demand, and the abundant renewable resources available in the country. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, significantly higher than the global average. Market penetration of renewable energy sources is expected to increase from xx% in 2025 to xx% by 2033. Technological disruptions are primarily driven by advancements in solar PV technology, improved wind turbine designs, and innovative geothermal exploration techniques. Consumer preferences are increasingly focused on affordability, reliability, and environmental sustainability. Competitive dynamics are intensifying as both domestic and international companies vie for market share. This dynamic interplay of factors presents both opportunities and challenges for those operating within this market.

Dominant Markets & Segments in Ethiopia Renewable Energy Market

This section identifies the leading segments within the Ethiopian renewable energy market.

- Hydropower: Remains the dominant segment, accounting for xx% of the market in 2025 due to Ethiopia's significant hydropower potential. Key drivers include existing infrastructure and ongoing government investment in large-scale hydroelectric projects.

- Geothermal: Experiencing rapid growth, projected to reach xx% market share by 2033, fueled by substantial government investment in geothermal projects in the Rift Valley (e.g., Tulu Moye).

- Solar: Showing strong growth potential, projected at xx% market share in 2033, driven by declining costs of solar PV technology and supportive government policies, as evidenced by the Masdar agreement.

- Wind: Represents a smaller but growing segment, projected at xx% market share in 2033. Growth is constrained by suitable wind resource locations and grid infrastructure limitations.

- Others: Includes biomass and other renewable sources, representing a relatively small share (xx%) of the total market.

The dominance of hydropower is expected to gradually decrease as other segments, particularly geothermal and solar, witness substantial growth in the coming years.

Ethiopia Renewable Energy Market Product Innovations

The Ethiopian renewable energy market is witnessing significant product innovation, particularly in solar PV technology, with a focus on efficiency improvements and cost reductions. Advances in wind turbine design are also enhancing energy capture and reducing operational costs. These innovations are improving the market fit of renewable energy solutions, driving adoption and enhancing competitiveness.

Report Segmentation & Scope

The report segments the market by source: Hydropower, Wind, Geothermal, Solar, and Others. Each segment is analyzed based on its size, growth projections, and competitive dynamics. For example, the Hydropower segment showcases considerable growth due to ongoing large-scale projects. The Geothermal segment demonstrates strong expansion prospects with numerous planned projects. The Solar segment is characterized by competitive pricing and increasing accessibility. Detailed analysis for each segment offers a comprehensive understanding of the market's composition.

Key Drivers of Ethiopia Renewable Energy Market Growth

The Ethiopian renewable energy market is propelled by several factors. Governmental commitment, exemplified by the USD 40 billion investment plan, provides significant impetus. Ethiopia's abundant renewable resources offer a sustainable and cost-effective energy solution. Furthermore, the increasing energy demand necessitates a shift towards renewable sources. Technological advancements in renewable energy technologies make them increasingly competitive with traditional energy sources.

Challenges in the Ethiopia Renewable Energy Market Sector

Despite significant opportunities, the Ethiopian renewable energy market faces challenges. Grid infrastructure limitations pose a major obstacle, particularly in remote areas. Financing remains a hurdle for some projects, despite government support. Supply chain issues and the availability of skilled labor also present significant constraints, impacting project timelines and costs.

Leading Players in the Ethiopia Renewable Energy Market Market

- Tulu Moye Geothermal Operations PLC

- Vergnet Groupe

- Solar Tech PLC

- Green Scene Energy PLC

- Siemens Gamesa Renewable Energy SA

- ANDRITZ AG

List Not Exhaustive

Key Developments in Ethiopia Renewable Energy Market Sector

- September 2021: USD 40 Billion investment announced for renewable energy infrastructure over ten years.

- March 2021: Agreement between the Government of Ethiopia and Masdar for 500 MW of solar power projects.

These developments highlight the government's commitment to renewable energy and are expected to significantly shape the market's future growth trajectory.

Strategic Ethiopia Renewable Energy Market Outlook

The Ethiopian renewable energy market presents a significant growth opportunity. Abundant resources, supportive government policies, and increasing energy demand create a favorable environment for investment. Strategic opportunities exist in developing grid infrastructure, enhancing project financing mechanisms, and fostering local capacity building to effectively leverage the country's vast renewable energy potential. The forecast period promises substantial growth, making it an attractive sector for both domestic and international players.

Ethiopia Renewable Energy Market Segmentation

-

1. Source

- 1.1. Hydropower

- 1.2. Wind

- 1.3. Geothermal

- 1.4. Solar

- 1.5. Others

Ethiopia Renewable Energy Market Segmentation By Geography

- 1. Ethiopia

Ethiopia Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Cleaner Energy4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Underdeveloped Power Grid

- 3.4. Market Trends

- 3.4.1. Wind Energy to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ethiopia Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Hydropower

- 5.1.2. Wind

- 5.1.3. Geothermal

- 5.1.4. Solar

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ethiopia

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tulu Moye Geothermal Operations PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vergnet Groupe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solar Tech PLC*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Green Scene Energy PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa Renewable Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ANDRITZ AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Tulu Moye Geothermal Operations PLC

List of Figures

- Figure 1: Ethiopia Renewable Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ethiopia Renewable Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Ethiopia Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ethiopia Renewable Energy Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Ethiopia Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Ethiopia Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Ethiopia Renewable Energy Market Revenue Million Forecast, by Source 2019 & 2032

- Table 6: Ethiopia Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethiopia Renewable Energy Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Ethiopia Renewable Energy Market?

Key companies in the market include Tulu Moye Geothermal Operations PLC, Vergnet Groupe, Solar Tech PLC*List Not Exhaustive, Green Scene Energy PLC, Siemens Gamesa Renewable Energy SA, ANDRITZ AG.

3. What are the main segments of the Ethiopia Renewable Energy Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Cleaner Energy4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Wind Energy to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Underdeveloped Power Grid.

8. Can you provide examples of recent developments in the market?

In September 2021, Ethiopia has announced plans to invest USD 40 billion in constructing new renewable energy infrastructure over the next ten years. Ethiopia has already begun to tap into the Rift Valley's geothermal potential with projects at Tulu Moye, Aluto Langano, and Corbetti. In the subsequent years, the country plans to build 17 geothermal projects and plans to have 35,000 MW of installed capacity by 2037.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethiopia Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethiopia Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethiopia Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Ethiopia Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence