Key Insights

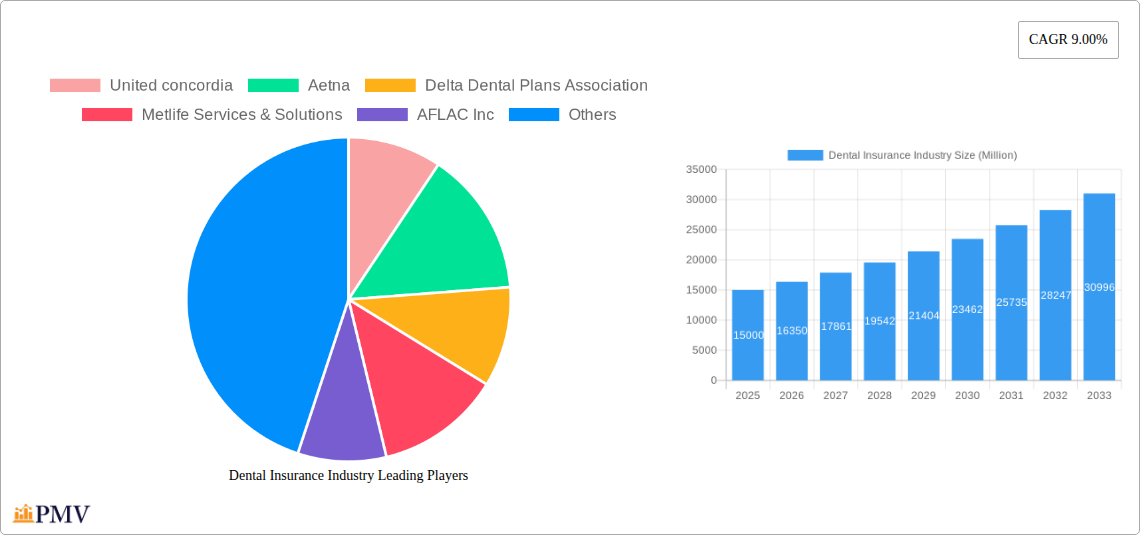

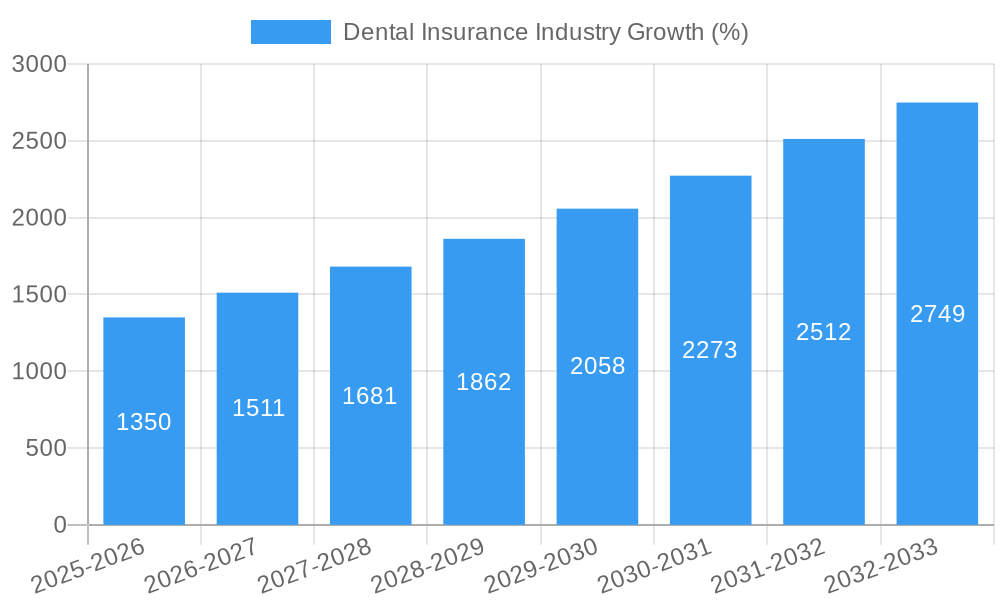

The global dental insurance market, currently valued at approximately $XX million (estimated based on available CAGR and market trends), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 9% from 2025 to 2033. Several factors contribute to this expansion. The aging global population, particularly the increasing number of senior citizens, fuels demand for comprehensive dental coverage. Simultaneously, rising awareness of oral health and the preventative benefits of regular dental checkups are driving adoption across all age groups. The market is segmented by coverage type (DHMO, DPPO, DIP, DEPO, DPS), procedure (preventive, major, basic), demographics (senior citizens, adults, minors), and end-users (individuals, corporates). Growth is further fueled by increasing disposable incomes in developing economies and the expansion of dental insurance coverage through corporate health plans. Technological advancements in dental procedures and a greater emphasis on preventative care also play a significant role.

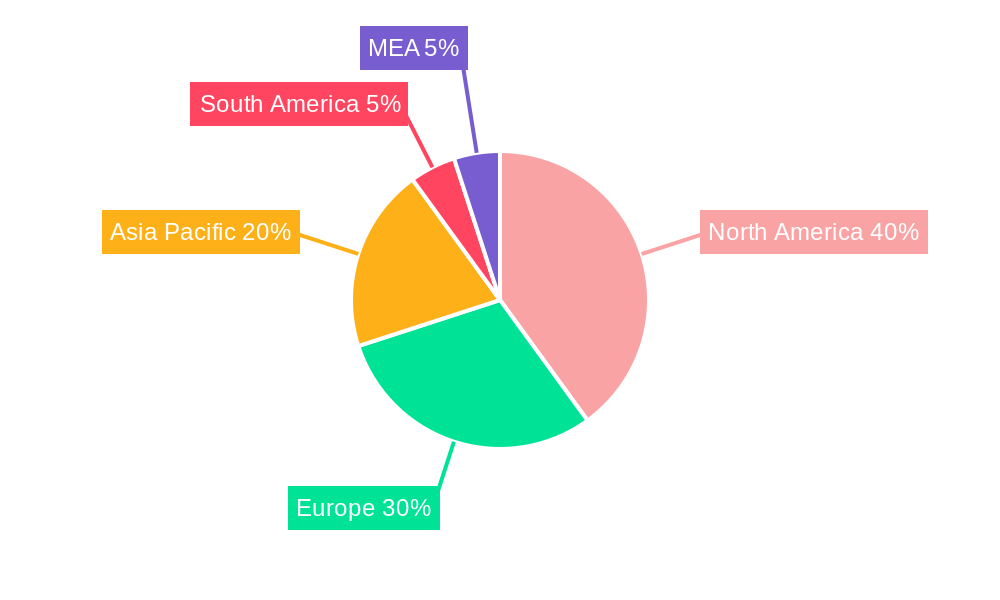

However, challenges remain. The high cost of dental procedures, particularly major treatments, can create barriers to access, even with insurance coverage. Furthermore, variations in regulatory frameworks across different regions impact market penetration and pricing structures. Competition among established players like United Concordia, Aetna, Delta Dental, MetLife, AFLAC, Allianz, UnitedHealthCare, AXA, HDFC Ergo, Cigna, and Ameritas, along with emerging players, is intense, leading to pricing pressures and the necessity for continuous innovation in product offerings and service delivery. Market growth will be uneven across regions, with North America and Europe likely maintaining a significant market share due to established healthcare infrastructure and higher per capita income. However, the Asia-Pacific region is expected to show rapid growth fueled by a burgeoning middle class and increasing healthcare spending. Understanding these dynamics is crucial for effective market participation and strategic planning in the dental insurance industry.

Dental Insurance Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global dental insurance industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report projects a xx Million market size by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The report segments the market by demographics (senior citizens, adults, minors), coverage type (DHMO, DPPO, DIP, DEPO, DPS), procedure (preventive, major, basic), and end-user (individuals, corporates). Leading players like Aetna, Delta Dental, and MetLife are analyzed for their market share and strategic moves.

Dental Insurance Industry Market Structure & Competitive Dynamics

The global dental insurance market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market's competitive landscape is dynamic, driven by factors such as technological advancements, regulatory changes, and evolving consumer preferences. The market share of the top 5 players is estimated at xx%, indicating a relatively competitive environment. Innovation is a key differentiator, with companies investing heavily in developing new products and services, including digital platforms and tele-dentistry integration.

Regulatory frameworks vary across regions, impacting market access and pricing strategies. Substitutes, such as out-of-pocket payments, pose a challenge, particularly in regions with limited insurance penetration. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from xx Million to xx Million in recent years. Examples include:

- Aetna's expansion into new counties, adding 1 Million Medicare beneficiaries.

- Bajaj Allianz's launch of Global Health Care, expanding its reach internationally.

End-user trends reveal a growing demand for comprehensive dental coverage, driven by rising awareness of oral health and increased disposable incomes.

Dental Insurance Industry Industry Trends & Insights

The dental insurance industry is experiencing robust growth, driven by several key factors. The aging global population and increasing prevalence of dental diseases are fueling demand for dental insurance. Technological disruptions, such as the adoption of telehealth and AI-powered diagnostic tools, are transforming the industry, improving access to care and reducing costs. Consumer preferences are shifting towards more comprehensive and affordable plans, with a growing preference for digital platforms and personalized services. The competitive dynamics are characterized by increasing consolidation, with major players expanding their geographical reach and product offerings. This expansion is expected to continue, leading to further market concentration. The market’s CAGR is projected to be xx%, with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Dental Insurance Industry

The United States dominates the global dental insurance market, driven by high healthcare expenditure and extensive insurance coverage. However, other developed nations and emerging economies are showing significant growth potential.

By Demographics: The adult segment holds the largest market share, followed by senior citizens and minors. This is driven by factors like higher disposable income amongst adults and the growing awareness of the importance of oral health throughout life stages.

By Coverage: DPPOs are the most prevalent type of dental insurance, offering a balance between cost and choice of providers. DHMOs and DIPs also hold significant market share, catering to different consumer needs and preferences. DEPO and DPS plans represent smaller yet steadily growing segments.

By Procedure: Preventive procedures contribute the largest portion of the market, followed by basic and major procedures. This highlights a trend towards preventive care and early intervention.

By End-users: Corporates hold the largest market share, driven by employee benefit programs, while the individual segment is also growing rapidly.

Key drivers include favorable government policies that encourage dental insurance adoption, well-established healthcare infrastructure, and a rising middle-class population in developing countries.

Dental Insurance Industry Product Innovations

Recent product innovations in the dental insurance industry focus on enhancing accessibility, affordability, and convenience. Digital platforms are becoming increasingly prevalent, enabling online enrollment, claims processing, and provider searches. Tele-dentistry is gaining traction, providing remote consultations and reducing barriers to access. Value-added services, such as wellness programs and preventative care incentives, are being incorporated to improve customer engagement and outcomes. The market is also witnessing the emergence of AI-powered diagnostic tools and personalized treatment plans. These innovations enhance efficiency and improve the overall customer experience.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the dental insurance market.

By Demographics: Senior citizens, adults, and minors are analyzed separately, considering their unique healthcare needs and purchasing power. Each segment's growth trajectory is assessed based on demographics and healthcare trends.

By Coverage: The report examines the distinct features and market dynamics of DHMO, DPPO, DIP, DEPO, and DPS plans. The analysis includes coverage limitations, provider networks, and cost implications.

By Procedure: Preventive, basic, and major procedures are analyzed, revealing treatment preferences, coverage patterns, and market share distribution.

By End-users: Individual and corporate clients have separate analyses, focusing on their insurance needs, buying behavior, and the size of the market share they hold. Growth projections and competitive dynamics are included for each segment.

Key Drivers of Dental Insurance Industry Growth

Several factors are driving the growth of the dental insurance industry. The aging global population, with its associated increased need for dental care, is a significant factor. Technological advancements, including telehealth and AI-powered diagnostics, are making dental care more accessible and efficient. Government regulations promoting dental health and insurance coverage also play a critical role. Finally, rising disposable incomes in developing economies are fueling demand for higher-quality healthcare, including dental insurance.

Challenges in the Dental Insurance Industry Sector

The dental insurance industry faces several challenges. High administrative costs and complexities in claim processing remain significant hurdles. Varying regulatory frameworks across regions create complexities in market entry and operation. Competition from other healthcare providers and the increasing prevalence of cost-containment measures also contribute to challenges, impacting profitability and expansion plans.

Leading Players in the Dental Insurance Industry Market

- Aetna

- Delta Dental Plans Association

- Metlife Services & Solutions

- AFLAC Inc

- Allianz SE

- United HealthCare Services Inc

- AXA

- HDFC Ergo Health Insurance Ltd

- Cigna

- Ameritas Life Insurance Corp

- United Concordia

Key Developments in Dental Insurance Industry Sector

- June 2022: Bajaj Allianz launched Global Health Care in collaboration with Allianz Partners, offering international and domestic health coverage with sum insured ranging from USD 100,000 to USD 1,000,000.

- January 2022: Aetna expanded its Medicare Advantage Prescription Drug (MAPD) plans to 1,875 counties, increasing access for 53.2 Million Medicare beneficiaries.

Strategic Dental Insurance Industry Market Outlook

The dental insurance industry presents significant growth opportunities. Further expansion into emerging markets, leveraging technological advancements to improve efficiency and customer experience, and developing innovative insurance products tailored to diverse consumer needs are key strategies. The market's future hinges on the industry's ability to address challenges related to affordability, access, and regulatory complexities while embracing technological innovations and data-driven decision-making.

Dental Insurance Industry Segmentation

-

1. Coverage

- 1.1. Dental health maintenance organizations (DHMO)

- 1.2. Dental preferred provider organizations (DPPO)

- 1.3. Dental Indemnity plans (DIP)

- 1.4. Dental exclusive provider organizations (DEPO)

- 1.5. Dental point of service (DPS)

-

2. Procedure

- 2.1. Preventive

- 2.2. Major

- 2.3. Basic

-

3. End-users

- 3.1. Individuals

- 3.2. Corporates

-

4. Demographics

- 4.1. Senior citizens

- 4.2. Adults

- 4.3. Minors

Dental Insurance Industry Segmentation By Geography

- 1. North America

- 2. South America

- 3. Asia Pacific

- 4. Europe

- 5. Middle East and Africa

Dental Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Efficient and Cost-Effective Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Scrutiny and Compliance Requirements

- 3.4. Market Trends

- 3.4.1. Rising Awareness about Oral Health is Expected to boost growth of Dental Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Dental health maintenance organizations (DHMO)

- 5.1.2. Dental preferred provider organizations (DPPO)

- 5.1.3. Dental Indemnity plans (DIP)

- 5.1.4. Dental exclusive provider organizations (DEPO)

- 5.1.5. Dental point of service (DPS)

- 5.2. Market Analysis, Insights and Forecast - by Procedure

- 5.2.1. Preventive

- 5.2.2. Major

- 5.2.3. Basic

- 5.3. Market Analysis, Insights and Forecast - by End-users

- 5.3.1. Individuals

- 5.3.2. Corporates

- 5.4. Market Analysis, Insights and Forecast - by Demographics

- 5.4.1. Senior citizens

- 5.4.2. Adults

- 5.4.3. Minors

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Asia Pacific

- 5.5.4. Europe

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. North America Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 6.1.1. Dental health maintenance organizations (DHMO)

- 6.1.2. Dental preferred provider organizations (DPPO)

- 6.1.3. Dental Indemnity plans (DIP)

- 6.1.4. Dental exclusive provider organizations (DEPO)

- 6.1.5. Dental point of service (DPS)

- 6.2. Market Analysis, Insights and Forecast - by Procedure

- 6.2.1. Preventive

- 6.2.2. Major

- 6.2.3. Basic

- 6.3. Market Analysis, Insights and Forecast - by End-users

- 6.3.1. Individuals

- 6.3.2. Corporates

- 6.4. Market Analysis, Insights and Forecast - by Demographics

- 6.4.1. Senior citizens

- 6.4.2. Adults

- 6.4.3. Minors

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 7. South America Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 7.1.1. Dental health maintenance organizations (DHMO)

- 7.1.2. Dental preferred provider organizations (DPPO)

- 7.1.3. Dental Indemnity plans (DIP)

- 7.1.4. Dental exclusive provider organizations (DEPO)

- 7.1.5. Dental point of service (DPS)

- 7.2. Market Analysis, Insights and Forecast - by Procedure

- 7.2.1. Preventive

- 7.2.2. Major

- 7.2.3. Basic

- 7.3. Market Analysis, Insights and Forecast - by End-users

- 7.3.1. Individuals

- 7.3.2. Corporates

- 7.4. Market Analysis, Insights and Forecast - by Demographics

- 7.4.1. Senior citizens

- 7.4.2. Adults

- 7.4.3. Minors

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 8. Asia Pacific Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 8.1.1. Dental health maintenance organizations (DHMO)

- 8.1.2. Dental preferred provider organizations (DPPO)

- 8.1.3. Dental Indemnity plans (DIP)

- 8.1.4. Dental exclusive provider organizations (DEPO)

- 8.1.5. Dental point of service (DPS)

- 8.2. Market Analysis, Insights and Forecast - by Procedure

- 8.2.1. Preventive

- 8.2.2. Major

- 8.2.3. Basic

- 8.3. Market Analysis, Insights and Forecast - by End-users

- 8.3.1. Individuals

- 8.3.2. Corporates

- 8.4. Market Analysis, Insights and Forecast - by Demographics

- 8.4.1. Senior citizens

- 8.4.2. Adults

- 8.4.3. Minors

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 9. Europe Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 9.1.1. Dental health maintenance organizations (DHMO)

- 9.1.2. Dental preferred provider organizations (DPPO)

- 9.1.3. Dental Indemnity plans (DIP)

- 9.1.4. Dental exclusive provider organizations (DEPO)

- 9.1.5. Dental point of service (DPS)

- 9.2. Market Analysis, Insights and Forecast - by Procedure

- 9.2.1. Preventive

- 9.2.2. Major

- 9.2.3. Basic

- 9.3. Market Analysis, Insights and Forecast - by End-users

- 9.3.1. Individuals

- 9.3.2. Corporates

- 9.4. Market Analysis, Insights and Forecast - by Demographics

- 9.4.1. Senior citizens

- 9.4.2. Adults

- 9.4.3. Minors

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 10. Middle East and Africa Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 10.1.1. Dental health maintenance organizations (DHMO)

- 10.1.2. Dental preferred provider organizations (DPPO)

- 10.1.3. Dental Indemnity plans (DIP)

- 10.1.4. Dental exclusive provider organizations (DEPO)

- 10.1.5. Dental point of service (DPS)

- 10.2. Market Analysis, Insights and Forecast - by Procedure

- 10.2.1. Preventive

- 10.2.2. Major

- 10.2.3. Basic

- 10.3. Market Analysis, Insights and Forecast - by End-users

- 10.3.1. Individuals

- 10.3.2. Corporates

- 10.4. Market Analysis, Insights and Forecast - by Demographics

- 10.4.1. Senior citizens

- 10.4.2. Adults

- 10.4.3. Minors

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 11. North America Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. MEA Dental Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 United concordia

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Aetna

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Delta Dental Plans Association

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Metlife Services & Solutions

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 AFLAC Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Allianz SE

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 United HealthCare Services Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 AXA

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 HDFC Ergo Health Insurance Ltd**List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Cigna

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Ameritas Life Insurance Corp

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 United concordia

List of Figures

- Figure 1: Global Dental Insurance Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Dental Insurance Industry Revenue (Million), by Coverage 2024 & 2032

- Figure 13: North America Dental Insurance Industry Revenue Share (%), by Coverage 2024 & 2032

- Figure 14: North America Dental Insurance Industry Revenue (Million), by Procedure 2024 & 2032

- Figure 15: North America Dental Insurance Industry Revenue Share (%), by Procedure 2024 & 2032

- Figure 16: North America Dental Insurance Industry Revenue (Million), by End-users 2024 & 2032

- Figure 17: North America Dental Insurance Industry Revenue Share (%), by End-users 2024 & 2032

- Figure 18: North America Dental Insurance Industry Revenue (Million), by Demographics 2024 & 2032

- Figure 19: North America Dental Insurance Industry Revenue Share (%), by Demographics 2024 & 2032

- Figure 20: North America Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Dental Insurance Industry Revenue (Million), by Coverage 2024 & 2032

- Figure 23: South America Dental Insurance Industry Revenue Share (%), by Coverage 2024 & 2032

- Figure 24: South America Dental Insurance Industry Revenue (Million), by Procedure 2024 & 2032

- Figure 25: South America Dental Insurance Industry Revenue Share (%), by Procedure 2024 & 2032

- Figure 26: South America Dental Insurance Industry Revenue (Million), by End-users 2024 & 2032

- Figure 27: South America Dental Insurance Industry Revenue Share (%), by End-users 2024 & 2032

- Figure 28: South America Dental Insurance Industry Revenue (Million), by Demographics 2024 & 2032

- Figure 29: South America Dental Insurance Industry Revenue Share (%), by Demographics 2024 & 2032

- Figure 30: South America Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: South America Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Dental Insurance Industry Revenue (Million), by Coverage 2024 & 2032

- Figure 33: Asia Pacific Dental Insurance Industry Revenue Share (%), by Coverage 2024 & 2032

- Figure 34: Asia Pacific Dental Insurance Industry Revenue (Million), by Procedure 2024 & 2032

- Figure 35: Asia Pacific Dental Insurance Industry Revenue Share (%), by Procedure 2024 & 2032

- Figure 36: Asia Pacific Dental Insurance Industry Revenue (Million), by End-users 2024 & 2032

- Figure 37: Asia Pacific Dental Insurance Industry Revenue Share (%), by End-users 2024 & 2032

- Figure 38: Asia Pacific Dental Insurance Industry Revenue (Million), by Demographics 2024 & 2032

- Figure 39: Asia Pacific Dental Insurance Industry Revenue Share (%), by Demographics 2024 & 2032

- Figure 40: Asia Pacific Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Dental Insurance Industry Revenue (Million), by Coverage 2024 & 2032

- Figure 43: Europe Dental Insurance Industry Revenue Share (%), by Coverage 2024 & 2032

- Figure 44: Europe Dental Insurance Industry Revenue (Million), by Procedure 2024 & 2032

- Figure 45: Europe Dental Insurance Industry Revenue Share (%), by Procedure 2024 & 2032

- Figure 46: Europe Dental Insurance Industry Revenue (Million), by End-users 2024 & 2032

- Figure 47: Europe Dental Insurance Industry Revenue Share (%), by End-users 2024 & 2032

- Figure 48: Europe Dental Insurance Industry Revenue (Million), by Demographics 2024 & 2032

- Figure 49: Europe Dental Insurance Industry Revenue Share (%), by Demographics 2024 & 2032

- Figure 50: Europe Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Europe Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Dental Insurance Industry Revenue (Million), by Coverage 2024 & 2032

- Figure 53: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Coverage 2024 & 2032

- Figure 54: Middle East and Africa Dental Insurance Industry Revenue (Million), by Procedure 2024 & 2032

- Figure 55: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Procedure 2024 & 2032

- Figure 56: Middle East and Africa Dental Insurance Industry Revenue (Million), by End-users 2024 & 2032

- Figure 57: Middle East and Africa Dental Insurance Industry Revenue Share (%), by End-users 2024 & 2032

- Figure 58: Middle East and Africa Dental Insurance Industry Revenue (Million), by Demographics 2024 & 2032

- Figure 59: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Demographics 2024 & 2032

- Figure 60: Middle East and Africa Dental Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Insurance Industry Revenue Million Forecast, by Coverage 2019 & 2032

- Table 3: Global Dental Insurance Industry Revenue Million Forecast, by Procedure 2019 & 2032

- Table 4: Global Dental Insurance Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 5: Global Dental Insurance Industry Revenue Million Forecast, by Demographics 2019 & 2032

- Table 6: Global Dental Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Spain Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Belgium Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherland Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Nordics Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: China Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Japan Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Korea Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Southeast Asia Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Indonesia Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Phillipes Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Singapore Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Thailandc Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Asia Pacific Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Brazil Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Peru Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Chile Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Colombia Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Ecuador Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Venezuela Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of South America Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: United Arab Emirates Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Saudi Arabia Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East and Africa Dental Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Dental Insurance Industry Revenue Million Forecast, by Coverage 2019 & 2032

- Table 49: Global Dental Insurance Industry Revenue Million Forecast, by Procedure 2019 & 2032

- Table 50: Global Dental Insurance Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 51: Global Dental Insurance Industry Revenue Million Forecast, by Demographics 2019 & 2032

- Table 52: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Dental Insurance Industry Revenue Million Forecast, by Coverage 2019 & 2032

- Table 54: Global Dental Insurance Industry Revenue Million Forecast, by Procedure 2019 & 2032

- Table 55: Global Dental Insurance Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 56: Global Dental Insurance Industry Revenue Million Forecast, by Demographics 2019 & 2032

- Table 57: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Dental Insurance Industry Revenue Million Forecast, by Coverage 2019 & 2032

- Table 59: Global Dental Insurance Industry Revenue Million Forecast, by Procedure 2019 & 2032

- Table 60: Global Dental Insurance Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 61: Global Dental Insurance Industry Revenue Million Forecast, by Demographics 2019 & 2032

- Table 62: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global Dental Insurance Industry Revenue Million Forecast, by Coverage 2019 & 2032

- Table 64: Global Dental Insurance Industry Revenue Million Forecast, by Procedure 2019 & 2032

- Table 65: Global Dental Insurance Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 66: Global Dental Insurance Industry Revenue Million Forecast, by Demographics 2019 & 2032

- Table 67: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 68: Global Dental Insurance Industry Revenue Million Forecast, by Coverage 2019 & 2032

- Table 69: Global Dental Insurance Industry Revenue Million Forecast, by Procedure 2019 & 2032

- Table 70: Global Dental Insurance Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 71: Global Dental Insurance Industry Revenue Million Forecast, by Demographics 2019 & 2032

- Table 72: Global Dental Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Insurance Industry?

The projected CAGR is approximately 9.00%.

2. Which companies are prominent players in the Dental Insurance Industry?

Key companies in the market include United concordia, Aetna, Delta Dental Plans Association, Metlife Services & Solutions, AFLAC Inc, Allianz SE, United HealthCare Services Inc, AXA, HDFC Ergo Health Insurance Ltd**List Not Exhaustive, Cigna, Ameritas Life Insurance Corp.

3. What are the main segments of the Dental Insurance Industry?

The market segments include Coverage, Procedure, End-users, Demographics.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Efficient and Cost-Effective Healthcare Services.

6. What are the notable trends driving market growth?

Rising Awareness about Oral Health is Expected to boost growth of Dental Insurance Industry.

7. Are there any restraints impacting market growth?

Increasing Regulatory Scrutiny and Compliance Requirements.

8. Can you provide examples of recent developments in the market?

In June 2022, Bajaj Allianz collaborated with Allianz Partners to launch Global Health Care, to provide health coverage across the world. Global Health Care product offers one of the widest Sum Insured ranges available in the Indian market, which starts from USD 100,000 to USD 1,000,000. The product is available with two plans, namely 'Imperial Plan' and 'Imperial Plus Plan', which offer both International and Domestic Covers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Insurance Industry?

To stay informed about further developments, trends, and reports in the Dental Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence