Key Insights

The Canada Asset Management Market is projected for substantial expansion, forecasting a Compound Annual Growth Rate (CAGR) of 12.6%. The market is expected to reach $489.4 billion by 2025, propelled by escalating demand for expert financial stewardship and heightened investment awareness across Canada. Key growth catalysts include the imperative for diversified portfolios, regulatory frameworks fostering transparency and investor security, and the accumulating wealth of the Canadian middle class. Leading entities such as RBC Group, TD Asset Management Inc, and BlackRock Asset Management Canada Ltd are intensifying competition through innovative investment offerings and digital platforms designed to align with contemporary investor expectations.

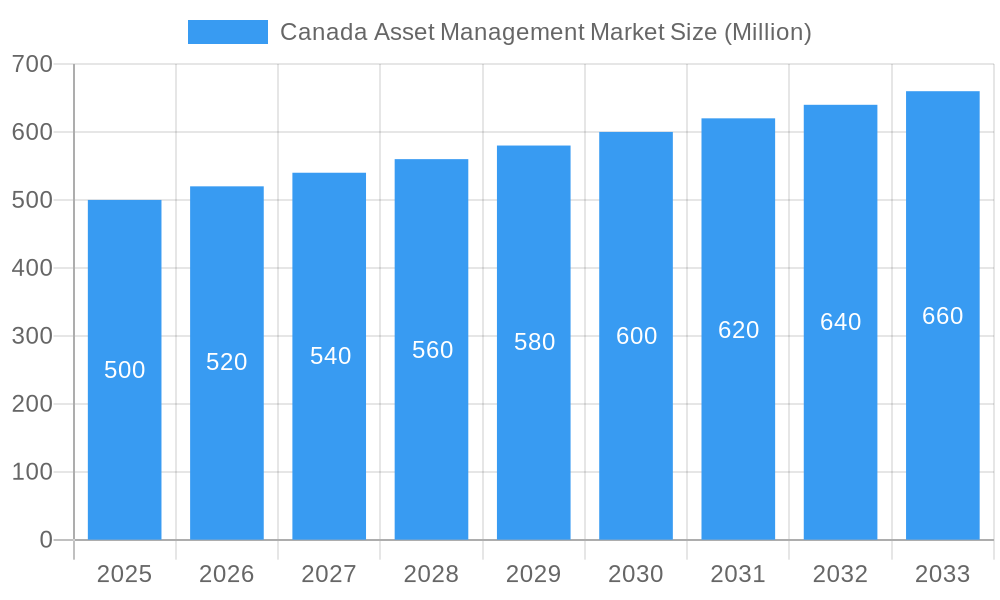

Canada Asset Management Market Market Size (In Billion)

Emerging trends highlight a significant movement towards Sustainable and Socially Responsible Investing (SRI), with asset managers increasingly embedding Environmental, Social, and Governance (ESG) principles into their investment methodologies. Technological innovation, including the proliferation of robo-advisors and artificial intelligence, is also revolutionizing investment decision-making processes. While robust growth opportunities exist, the market navigates challenges such as market volatility and the continuous need for innovation to satisfy client demands. The competitive arena, populated by both domestic and international firms, necessitates strategic collaborations and consolidations for sustained market presence. In summation, the Canada Asset Management Market is on track for vigorous growth, underpinned by a supportive economic climate and dynamic investor requirements.

Canada Asset Management Market Company Market Share

Canada Asset Management Market Market Structure & Competitive Dynamics

The Canada Asset Management Market is characterized by a robust competitive landscape, with a mix of domestic and international players striving for market share. The market concentration is moderate, with the top ten companies, including RBC Group, TD Asset Management Inc, and BlackRock Asset Management Canada Ltd, holding a significant portion of the market. The innovation ecosystem in Canada's asset management sector is vibrant, driven by technological advancements and a focus on sustainable investing. Regulatory frameworks such as those from the Canadian Securities Administrators (CSA) and the Office of the Superintendent of Financial Institutions (OSFI) play a crucial role in shaping market dynamics. Product substitutes like robo-advisors and direct indexing are gaining traction, challenging traditional asset management models. End-user trends are shifting towards personalized and digital-first investment solutions. Mergers and acquisitions (M&A) are frequent, with deal values ranging from 100 Million to 500 Million in recent years, reflecting strategic consolidations and market expansion efforts. These dynamics collectively influence the competitive positioning and growth trajectories of firms within the sector.

- Market Share: Top 10 firms control approximately 60% of the market.

- M&A Deal Values: Average deal value in the sector over the past five years is around 300 Million.

- Regulatory Influence: CSA and OSFI regulations drive transparency and investor protection, impacting market practices.

- Innovation: Increased adoption of AI and machine learning for portfolio management.

- End-User Trends: Growing demand for ESG (Environmental, Social, and Governance) investing.

Canada Asset Management Market Industry Trends & Insights

The Canada Asset Management Market is poised for significant growth, driven by a compound annual growth rate (CAGR) of 5.5% from 2025 to 2033. Key growth drivers include increasing wealth among Canadians, a rising awareness of investment opportunities, and the need for retirement planning. Technological disruptions such as the integration of artificial intelligence and blockchain in asset management are reshaping the industry. Consumer preferences are shifting towards sustainable and impact investing, which has led to the development of new financial products tailored to these demands. The competitive dynamics within the market are intense, with firms like RBC Group and TD Asset Management Inc leveraging their extensive networks and innovative solutions to maintain market leadership. Market penetration rates for digital asset management platforms are expected to reach 30% by 2033, reflecting a strong shift towards digital-first solutions. The market's evolution is also influenced by regulatory changes that promote transparency and investor protection, further driving the adoption of advanced technologies and investment strategies.

Dominant Markets & Segments in Canada Asset Management Market

The Canadian asset management market is a dynamic landscape shaped by regional strengths and evolving investor preferences. Ontario remains the dominant market, fueled by its robust financial infrastructure, concentration of wealth, and supportive government policies like investment tax incentives. Toronto, as a major global financial hub, further solidifies Ontario's leading position. This concentration of expertise and capital attracts both domestic and international investment.

- Key Drivers in Ontario:

- Strategic economic policies fostering investment and growth.

- A sophisticated financial infrastructure supporting complex asset management activities.

- High concentration of wealth management firms and experienced investment professionals.

- Presence of major global financial institutions.

Within the market, the institutional segment, encompassing pension funds, endowments, insurance companies, and sovereign wealth funds, commands a substantial share. These institutions manage vast portfolios, demanding sophisticated asset management strategies emphasizing diversification, risk management, and long-term performance. This segment drives demand for specialized expertise and tailored solutions.

- Key Drivers in the Institutional Segment:

- Large-scale investments demanding specialized expertise and risk management.

- Growing demand for ESG (Environmental, Social, and Governance) integrated investment strategies.

- Increasing regulatory scrutiny emphasizing transparency, accountability, and responsible investing.

The retail segment, while smaller in overall AUM, exhibits significant growth potential driven by increased financial literacy, the proliferation of user-friendly digital investment platforms, and the rise of robo-advisors. This democratization of access to investment opportunities is empowering individual investors to actively participate in the market.

- Key Drivers in the Retail Segment:

- Rising financial literacy and increased investor awareness.

- The accessibility and convenience offered by digital investment platforms and robo-advisors.

- Demand for personalized and transparent investment solutions.

Canada Asset Management Market Product Innovations

Product innovations in the Canada Asset Management Market are largely driven by technological advancements, with a focus on enhancing user experience and investment outcomes. Key developments include the integration of AI and machine learning for predictive analytics and portfolio optimization, as well as the introduction of blockchain technology for secure and transparent transactions. These innovations provide competitive advantages by offering personalized investment solutions and improving operational efficiency, aligning well with market demands for digital-first and sustainable investment options.

Report Segmentation & Scope

The Canada Asset Management Market is segmented by type, application, and region. The type segment includes mutual funds, ETFs, hedge funds, and others, with mutual funds projected to grow at a CAGR of 4.8% from 2025 to 2033, driven by their accessibility and diversification benefits. The application segment covers institutional and retail investors, with the institutional segment expected to maintain its dominance due to large-scale investments and complex needs. Regionally, Ontario is anticipated to continue leading the market, supported by its financial infrastructure and economic policies. Each segment experiences unique competitive dynamics, influenced by regulatory frameworks and market trends.

Key Drivers of Canada Asset Management Market Growth

Several key drivers are propelling the growth of the Canada Asset Management Market. Technologically, the integration of AI and blockchain enhances investment strategies and operational efficiencies. Economically, rising wealth and an aging population increase the demand for retirement planning and wealth management services. Regulatory factors, such as those from the CSA and OSFI, promote transparency and investor protection, driving the adoption of advanced technologies and sustainable investment practices. These drivers collectively contribute to the market's robust growth trajectory.

Challenges in the Canada Asset Management Market Sector

The Canada Asset Management Market faces several challenges that could impede growth. Regulatory hurdles, such as stringent compliance requirements, increase operational costs and complexity for firms. Supply chain issues, particularly in the context of digital platforms, can disrupt service delivery and client engagement. Competitive pressures are intense, with new entrants like robo-advisors and fintech companies challenging traditional business models. These challenges have quantifiable impacts, with regulatory compliance costs estimated at around 10 Million annually per firm, and supply chain disruptions potentially reducing market penetration by up to 5%.

Leading Players in the Canada Asset Management Market Market

- RBC Group

- TD Asset Management Inc

- BlackRock Asset Management Canada Ltd

- CIBC Asset Management Inc

- Fidelity Canada Institutional

- CI Investments Inc (including CI Institutional Asset Management)

- Mackenzie Investments

- 1832 Asset Management LP (Scotiabank)

- Manulife Asset Management Ltd

- Brookfield Asset Management Inc

Key Developments in Canada Asset Management Market Sector

- June 2023: Ninepoint Partners LP announced the expansion of its partnership with Monroe Capital LLC, enhancing its private credit offerings and strengthening its position in middle-market lending. This development is expected to increase Ninepoint's assets under management by approximately 200 Million over the next two years.

- April 2023: CapIntel entered into a strategic partnership with SEI, aiming to streamline sales and marketing processes for SEI's investment solutions. This collaboration is projected to boost SEI's market penetration by 10% within the next year through enhanced communication and sales efficiency.

Strategic Canada Asset Management Market Market Outlook

The strategic outlook for the Canada Asset Management Market is optimistic, with significant growth accelerators on the horizon. The market's future potential lies in the increasing adoption of digital and sustainable investment solutions, driven by technological advancements and shifting consumer preferences. Opportunities for strategic expansion include targeting underserved segments like millennials and Gen Z, leveraging AI for personalized investment strategies, and exploring new markets in sustainable and impact investing. These trends position the market for robust growth through 2033, offering ample opportunities for established players and new entrants alike.

Canada Asset Management Market Segmentation

-

1. Asset Class

- 1.1. Equity

- 1.2. Fixed Income

- 1.3. Alternative Investment

- 1.4. Hybrid

- 1.5. Cash Management

-

2. Source of Funds

- 2.1. Pension Funds and Insurance Companies

- 2.2. Individu

- 2.3. Corporate Investors

- 2.4. Other So

-

3. Type of Asset Management Firms

- 3.1. Large Financial Institutions/Bulge Brackets Banks

- 3.2. Mutual Funds and ETFs

- 3.3. Private Equity and Venture Capital

- 3.4. Fixed Income Funds

- 3.5. Hedge Funds

- 3.6. Other Types of Asset Management Firms

Canada Asset Management Market Segmentation By Geography

- 1. Canada

Canada Asset Management Market Regional Market Share

Geographic Coverage of Canada Asset Management Market

Canada Asset Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Data-Driven Approaches

- 3.3. Market Restrains

- 3.3.1. Increasing Use of Data-Driven Approaches

- 3.4. Market Trends

- 3.4.1. Responsible Investment Funds are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Asset Class

- 5.1.1. Equity

- 5.1.2. Fixed Income

- 5.1.3. Alternative Investment

- 5.1.4. Hybrid

- 5.1.5. Cash Management

- 5.2. Market Analysis, Insights and Forecast - by Source of Funds

- 5.2.1. Pension Funds and Insurance Companies

- 5.2.2. Individu

- 5.2.3. Corporate Investors

- 5.2.4. Other So

- 5.3. Market Analysis, Insights and Forecast - by Type of Asset Management Firms

- 5.3.1. Large Financial Institutions/Bulge Brackets Banks

- 5.3.2. Mutual Funds and ETFs

- 5.3.3. Private Equity and Venture Capital

- 5.3.4. Fixed Income Funds

- 5.3.5. Hedge Funds

- 5.3.6. Other Types of Asset Management Firms

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Asset Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 RBC Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TD Asset Management Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BlackRock Asset Management Canada Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CIBC Asset Management Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fidelity Canada Institutional

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CI Investments Inc (including CI Institutional Asset Management)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mackenzie Investments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1832 Asset Management LP (Scotiabank)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Manulife Asset Management Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brookfield Asset Management Inc **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 RBC Group

List of Figures

- Figure 1: Canada Asset Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Asset Management Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Asset Management Market Revenue billion Forecast, by Asset Class 2020 & 2033

- Table 2: Canada Asset Management Market Revenue billion Forecast, by Source of Funds 2020 & 2033

- Table 3: Canada Asset Management Market Revenue billion Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 4: Canada Asset Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Asset Management Market Revenue billion Forecast, by Asset Class 2020 & 2033

- Table 6: Canada Asset Management Market Revenue billion Forecast, by Source of Funds 2020 & 2033

- Table 7: Canada Asset Management Market Revenue billion Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 8: Canada Asset Management Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Asset Management Market?

The projected CAGR is approximately 12.6%.

2. Which companies are prominent players in the Canada Asset Management Market?

Key companies in the market include RBC Group, TD Asset Management Inc, BlackRock Asset Management Canada Ltd, CIBC Asset Management Inc, Fidelity Canada Institutional, CI Investments Inc (including CI Institutional Asset Management), Mackenzie Investments, 1832 Asset Management LP (Scotiabank), Manulife Asset Management Ltd, Brookfield Asset Management Inc **List Not Exhaustive.

3. What are the main segments of the Canada Asset Management Market?

The market segments include Asset Class, Source of Funds, Type of Asset Management Firms.

4. Can you provide details about the market size?

The market size is estimated to be USD 489.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Data-Driven Approaches.

6. What are the notable trends driving market growth?

Responsible Investment Funds are Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Use of Data-Driven Approaches.

8. Can you provide examples of recent developments in the market?

June 2023: Ninepoint Partners LP, one of Canada’s investment management firms, has announced the expansion of its partnership with Chicago-based private credit asset management firm Monroe Capital LLC, a leader in middle-market private lending with approximately USD 16 billion in assets under management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Asset Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Asset Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Asset Management Market?

To stay informed about further developments, trends, and reports in the Canada Asset Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence