Key Insights

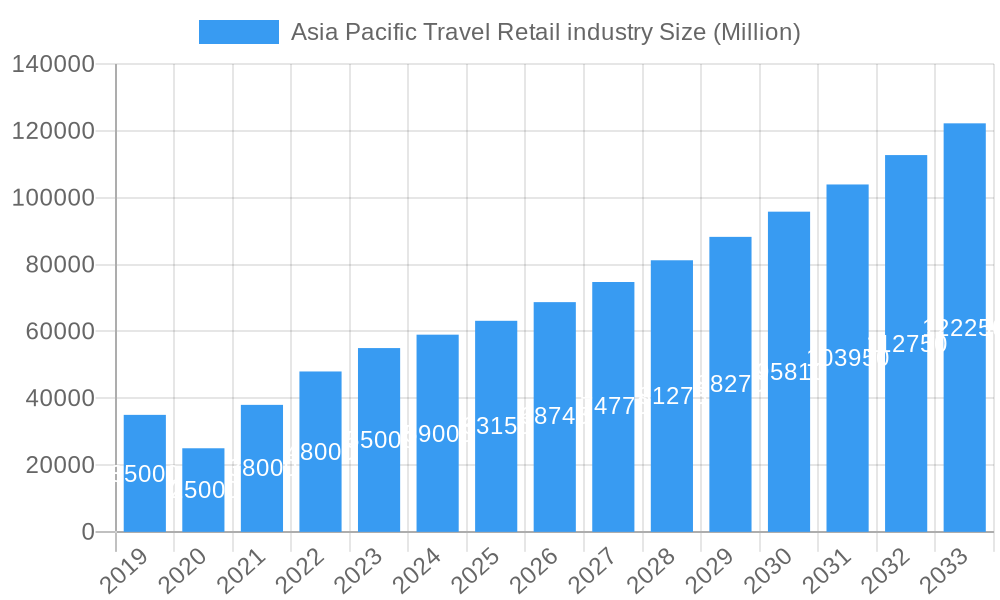

The Asia Pacific Travel Retail market is poised for significant expansion, projected to reach approximately USD 63.15 billion in value. Driven by a robust Compound Annual Growth Rate (CAGR) of 9.21%, this growth is fueled by a burgeoning middle class with increasing disposable income, a surge in international tourist arrivals, and the evolving shopping habits of travelers seeking unique and premium products. The sector is experiencing a dynamic shift with key drivers including the expanding aviation infrastructure, particularly in emerging economies, and the growing demand for luxury goods, fashion, and cosmetics among Asian travelers. The integration of digital technologies for a seamless omnichannel experience, along with the personalization of offers and services, are also pivotal in capturing the attention of today's discerning global shopper.

Asia Pacific Travel Retail industry Market Size (In Billion)

The market's expansion is further supported by strategic expansions by major duty-free operators, who are investing heavily in enhancing store aesthetics, product assortments, and customer engagement strategies within key travel hubs like airports, airlines, and ferries. While the market is vibrant, it also faces certain restraints, such as evolving travel regulations, currency fluctuations, and increasing competition from local e-commerce platforms. However, the overarching trend is one of optimistic growth, particularly in segments like Fashion & Accessories, Jewellery & Watches, and Fragrances & Cosmetics. Geographically, China, Japan, and South Korea are expected to remain dominant markets, with significant growth potential also observed in India and Southeast Asia, indicating a dynamic and opportunity-rich landscape for travel retail in the APAC region.

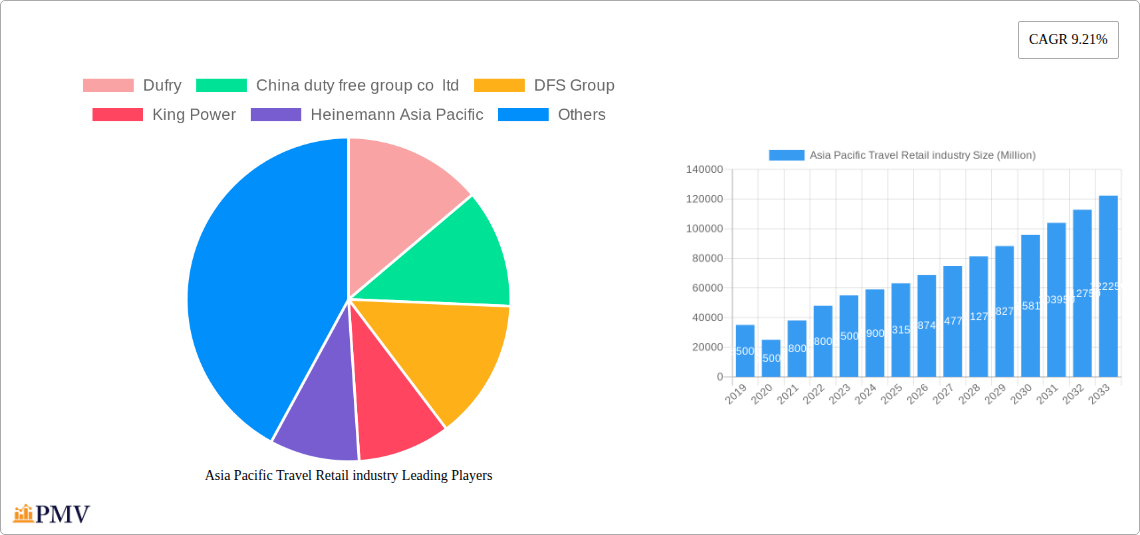

Asia Pacific Travel Retail industry Company Market Share

This comprehensive report dives deep into the dynamic Asia Pacific travel retail market, providing an in-depth analysis of its structure, competitive landscape, and future outlook. Covering the study period of 2019–2033, with 2025 as the base year and estimated year, and a forecast period from 2025–2033, this report offers actionable insights for stakeholders in the burgeoning APAC travel retail sector. We meticulously examine market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and M&A activities. Discover key growth drivers, technological disruptions, evolving consumer preferences, and the competitive strategies of leading players, including Dufry, China Duty Free Group Co Ltd, DFS Group, King Power, Heinemann Asia Pacific, Lotte Duty Free, The Shilla Duty Free, Flemingo International, James Richardson Group, and The Nuance Group. Understand the dominant markets and segments, from Fashion and Accessories to Fragrances and Cosmetics, and explore the impact of airports, airlines, and the rapidly growing China and Southeast Asia markets. This report is an essential resource for anyone seeking to navigate and capitalize on the immense opportunities within the Asia Pacific travel retail industry.

Asia Pacific Travel Retail Industry Market Structure & Competitive Dynamics

The Asia Pacific travel retail market exhibits a complex and evolving structure characterized by a mix of global giants and strong regional players. Market concentration is moderately high, with a few key companies dominating a significant portion of the market share. For instance, China Duty Free Group Co Ltd and Dufry have been instrumental in shaping the competitive landscape through strategic acquisitions and expansions. Innovation is a critical differentiator, with companies investing heavily in enhancing the customer experience through digital integration and unique retail formats. The regulatory framework across APAC countries presents both opportunities and challenges, with varying duty-free regulations influencing operational strategies. Product substitutes exist, particularly in categories like confectionery and cosmetics, but premium and exclusive offerings in jewelry and watches and wine & spirits often command higher loyalty. End-user trends are shifting towards experiential retail and personalized offers, driven by an increasingly affluent and digitally connected traveler base. Mergers and acquisitions (M&A) are a constant feature, aimed at consolidating market presence, gaining access to new geographies, or acquiring new technologies. For example, M&A deal values in the APAC travel retail sector have reached several Million in recent years, reflecting the strategic importance of consolidation. Companies are actively pursuing strategic partnerships to expand their reach and diversify their product portfolios.

- Market Share: Leading companies hold significant market share, with top players often exceeding 30% in specific sub-segments or geographies.

- M&A Activities: Recent M&A deals have focused on consolidating market share, acquiring specialized retail capabilities, and expanding into high-growth regions. Deal values for significant transactions have been reported in the hundreds of Million.

- Innovation Ecosystems: Companies are fostering innovation through technology adoption, loyalty programs, and exclusive product collaborations.

- Regulatory Frameworks: Navigating diverse customs and duty-free regulations across China, Japan, Korea, and Southeast Asia is crucial.

- Product Substitutes: While price is a factor, product exclusivity and brand heritage in categories like luxury fashion and fine wines mitigate substitute impact.

- End-User Trends: Growing demand for sustainable products, personalized shopping experiences, and omnichannel integration.

Asia Pacific Travel Retail Industry Industry Trends & Insights

The Asia Pacific travel retail industry is experiencing robust growth, driven by a confluence of factors including rising disposable incomes, increasing intra-regional travel, and the expansion of aviation infrastructure. The Compound Annual Growth Rate (CAGR) for the APAC travel retail market is projected to be significant, estimated at xx% over the forecast period. Technological disruptions are reshaping the retail landscape, with a surge in e-commerce and omnichannel strategies. For instance, the integration of digital platforms allows travelers to browse and purchase goods online before their journey, thereby broadening digital sales channels and creating multiple customer touchpoints. This pre-travel browsing and purchasing capability, as seen with partnerships like Lagardère Travel Retail and Inflyter, is becoming increasingly vital for capturing consumer attention. Consumer preferences are evolving rapidly; travelers are seeking unique and authentic experiences, demanding premiumization, and showing a growing interest in sustainable and ethically sourced products. The demand for fragrances and cosmetics, wine & spirits, and fashion and accessories remains strong, while tobacco sales are subject to fluctuating regulations and changing consumer habits. Competitive dynamics are intensifying, with established players and new entrants vying for market share. Market penetration is deepening, particularly in emerging economies within Southeast Asia and India. The recovery of international travel post-pandemic has further fueled this expansion, with airports continuing to be the dominant distribution channel. However, the rise of online travel agencies and the potential for direct-to-consumer models by brands present new competitive pressures. Companies are investing in data analytics to understand traveler behavior and personalize their offerings, aiming to increase conversion rates and average transaction values. The development of integrated entertainment and shopping complexes, such as DFS Group's venture on Hainan Island, signifies a strategic shift towards creating destination retail experiences that attract visitors even during economic uncertainties. This trend highlights a move beyond transactional sales towards building holistic travel and leisure hubs. Furthermore, the growing influence of Gen Z and Millennial travelers, who are more digitally savvy and value-driven, is prompting retailers to adapt their product assortments and marketing approaches. The focus on experiential retail, including pop-up stores, personalized consultations, and immersive brand activations, is becoming a key differentiator in this competitive market.

Dominant Markets & Segments in Asia Pacific Travel Retail Industry

The Asia Pacific travel retail industry is characterized by distinct dominant markets and segments, each offering unique growth opportunities. China stands out as the undisputed leader, driven by a massive domestic outbound travel market and a growing appetite for luxury goods. The China Duty Free Group (CDFG) has been a pivotal force in solidifying this dominance, particularly with its strategic developments on Hainan Island. Southeast Asia is emerging as a significant growth engine, fueled by increasing tourism arrivals and a burgeoning middle class.

Dominant Geography: China:

- Economic Policies: Government initiatives supporting duty-free shopping and tourism development significantly boost the sector.

- Infrastructure: Expansion of airports and development of large-scale shopping complexes like those on Hainan Island enhance accessibility and attractiveness.

- Consumer Spending: High disposable incomes and a strong preference for international brands drive substantial spending in travel retail.

- Market Size: China's travel retail market is valued in the tens of Billions of US Dollars.

Dominant Geography: Southeast Asia:

- Tourism Growth: A steady influx of international and intra-regional tourists fuels demand.

- Emerging Economies: Rising middle class with increasing purchasing power.

- Airport Development: Significant investment in airport infrastructure across countries like Thailand, Vietnam, and Singapore.

- Market Size: The Southeast Asian travel retail market is projected to reach several Billions of US Dollars by the forecast period.

Dominant Product Type: Fragrances and Cosmetics:

- High Margins & Demand: This segment consistently performs well due to perceived value and gifting potential.

- Brand Power: Strong brand loyalty and continuous product innovation from major cosmetic houses.

- Market Share: Fragrances and Cosmetics often account for over 25% of the total travel retail market value.

Dominant Product Type: Wine & Spirits:

- Premiumization Trend: Growing demand for premium and exclusive spirits and wines.

- Gifting Culture: A popular category for gifts among travelers.

- Market Size: This segment contributes a substantial 20-25% to the overall market value.

Dominant Distribution Channel: Airports:

- High Footfall: Airports offer unparalleled access to a captive audience of travelers.

- Strategic Location: Prime retail space within international hubs.

- Ancillary Revenue: Airports are a significant source of non-aeronautical revenue for airport authorities.

- Market Share: Airports typically account for over 70% of travel retail sales.

Emerging Segments: Fashion and Accessories, and Jewellery and Watches are experiencing robust growth, driven by aspirational consumer spending and the increasing presence of luxury brands in travel retail environments. The shift towards online pre-ordering and click-and-collect services is also impacting how these segments are accessed and purchased.

Asia Pacific Travel Retail Industry Product Innovations

Product innovations in the Asia Pacific travel retail industry are increasingly focused on delivering unique, localized, and digitally-enhanced experiences. Companies are prioritizing exclusive product launches and limited-edition collections that cater to the specific tastes of APAC consumers. This includes the development of travel-exclusive formulations in fragrances and cosmetics, curated selections of premium wine & spirits, and bespoke fashion and accessories. Technological integration is also a key innovation driver, with advancements in augmented reality (AR) for virtual try-ons of jewelry and watches, and personalized recommendation engines powered by AI. The competitive advantage lies in offering products that are not readily available in domestic markets, thereby creating a strong incentive for purchase. Furthermore, there is a growing emphasis on sustainable and ethically sourced products, aligning with evolving consumer values and driving market fit for eco-conscious travelers.

Report Segmentation & Scope

This report comprehensively segments the Asia Pacific travel retail industry to provide granular insights. The market is analyzed across key Product Types: Fashion and Accessories, Jewellery and Watches, Wine & Spirits, Food & Confectionary, Fragrances and Cosmetics, and Tobacco. The Distribution Channels examined include Airports, Airlines, and Ferries. Geographically, the report covers major regions and countries such as China, Japan, Korea, India, Australia, Southeast Asia, and Rest of APAC. Each segment is assessed for its current market size, projected growth rates, and competitive dynamics, with a particular focus on the dominant players and emerging trends within each category.

- Product Type Segmentation: Analysis of growth projections and market sizes for each category, including Fashion and Accessories and Fragrances and Cosmetics, which are expected to see strong growth.

- Distribution Channel Segmentation: Evaluation of market share and competitive dynamics for Airports, Airlines, and Ferries, with airports maintaining their dominant position.

- Geographical Segmentation: Detailed market analysis for China, Japan, Korea, India, Australia, Southeast Asia, and Rest of APAC, highlighting regional growth drivers and market potential.

Key Drivers of Asia Pacific Travel Retail Industry Growth

The Asia Pacific travel retail industry is propelled by several key drivers. The resurgence of international travel post-pandemic is a primary catalyst, significantly increasing passenger traffic and, consequently, consumer spending. Economic growth across the region, particularly in emerging markets like Southeast Asia and India, is leading to a rise in disposable incomes and a growing middle class with the capacity for discretionary spending on premium travel retail goods. Technological advancements, including the widespread adoption of e-commerce and the implementation of omnichannel retail strategies, are enhancing accessibility and convenience for consumers. Furthermore, significant investments in airport infrastructure and the expansion of flight routes are facilitating greater travel accessibility. The strategic development of large-scale entertainment and shopping complexes, as seen in Hainan, China, also acts as a powerful growth accelerator, attracting both domestic and international tourists.

Challenges in the Asia Pacific Travel Retail Industry Sector

Despite its strong growth trajectory, the Asia Pacific travel retail industry faces several challenges. Evolving regulatory landscapes across different countries can create operational complexities and impact product availability. Supply chain disruptions, exacerbated by geopolitical events and global logistics challenges, can affect inventory management and product delivery. Intense competition from both established global players and agile local retailers necessitates continuous innovation and cost management. The fluctuating economic conditions and potential global recessions can impact consumer discretionary spending, affecting sales volumes. Furthermore, the increasing trend of online shopping and direct-to-consumer sales by brands poses a threat to traditional travel retail channels. The environmental impact of travel and increasing consumer awareness around sustainability also present a challenge that retailers must address through responsible sourcing and operational practices.

Leading Players in the Asia Pacific Travel Retail Industry Market

The Asia Pacific travel retail industry is shaped by a constellation of leading global and regional players. These companies are at the forefront of innovation, market expansion, and customer engagement within this dynamic sector.

- Dufry

- China Duty Free Group Co Ltd

- DFS Group

- King Power

- Heinemann Asia Pacific

- Lotte Duty Free

- The Shilla Duty Free

- Flemingo International

- James Richardson Group

- The Nuance Group

Key Developments in Asia Pacific Travel Retail Industry Sector

Recent developments underscore the dynamic nature of the Asia Pacific travel retail industry, highlighting strategic initiatives and evolving business models.

- October 2023: DFS Group, the travel retail company, developed an entertainment and shopping complex on the duty-free Hainan Island of China. This development aimed to enhance the tourism market, even during economic downturns.

- July 2023: Lagardère Travel Retail, in partnership with Inflyter, expanded its business by offering an online Duty-Free shopping experience for a broader audience of travelers. This partnership offers customers pre-travel browsing and purchasing to broaden the digital sales channels and create multiple customer touchpoints throughout their journey.

Strategic Asia Pacific Travel Retail Industry Market Outlook

The Asia Pacific travel retail industry presents a strategically bright outlook, driven by sustained economic growth and the recovery of global travel. Future market potential is immense, particularly in emerging economies within Southeast Asia and India, which are poised for significant expansion. Strategic opportunities lie in further leveraging digital transformation to create seamless omnichannel experiences, from pre-travel browsing to post-travel engagement. The increasing demand for experiential retail will encourage the development of integrated shopping and entertainment hubs, offering unique brand collaborations and personalized services. Investments in sustainable retail practices and the curated offering of ethically sourced products will be crucial for capturing the attention of environmentally conscious travelers. Furthermore, strategic partnerships and potential consolidation will continue to shape the competitive landscape, enabling players to expand their geographical footprint and product portfolios, thereby maximizing growth accelerators in this vibrant market.

Asia Pacific Travel Retail industry Segmentation

-

1. Product Type

- 1.1. Fashion and Accessories

- 1.2. Jewellery and Watches

- 1.3. Wine & Spirits

- 1.4. Food & Confectionary

- 1.5. Fragnances and Cosmetics

- 1.6. Tobacco

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. Korea

- 3.4. India

- 3.5. Australia

- 3.6. Southeast Asia

- 3.7. Rest Of APAC

Asia Pacific Travel Retail industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. Korea

- 4. India

- 5. Australia

- 6. Southeast Asia

- 7. Rest Of APAC

Asia Pacific Travel Retail industry Regional Market Share

Geographic Coverage of Asia Pacific Travel Retail industry

Asia Pacific Travel Retail industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Customer Base In Travel Duty-Free Shops Drives The Market; Exemption From Taxes When Goods Are Taken Out Of The Country Of Purchase Drives The Market

- 3.3. Market Restrains

- 3.3.1. Guaranteed Customer Base In Travel Duty-Free Shops Drives The Market; Exemption From Taxes When Goods Are Taken Out Of The Country Of Purchase Drives The Market

- 3.4. Market Trends

- 3.4.1. High Revenue Generation From Airport Retailing Drives The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia Pacific Travel Retail industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Jewellery and Watches

- 5.1.3. Wine & Spirits

- 5.1.4. Food & Confectionary

- 5.1.5. Fragnances and Cosmetics

- 5.1.6. Tobacco

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. Korea

- 5.3.4. India

- 5.3.5. Australia

- 5.3.6. Southeast Asia

- 5.3.7. Rest Of APAC

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. Korea

- 5.4.4. India

- 5.4.5. Australia

- 5.4.6. Southeast Asia

- 5.4.7. Rest Of APAC

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Travel Retail industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fashion and Accessories

- 6.1.2. Jewellery and Watches

- 6.1.3. Wine & Spirits

- 6.1.4. Food & Confectionary

- 6.1.5. Fragnances and Cosmetics

- 6.1.6. Tobacco

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Airports

- 6.2.2. Airlines

- 6.2.3. Ferries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. Korea

- 6.3.4. India

- 6.3.5. Australia

- 6.3.6. Southeast Asia

- 6.3.7. Rest Of APAC

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia Pacific Travel Retail industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fashion and Accessories

- 7.1.2. Jewellery and Watches

- 7.1.3. Wine & Spirits

- 7.1.4. Food & Confectionary

- 7.1.5. Fragnances and Cosmetics

- 7.1.6. Tobacco

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Airports

- 7.2.2. Airlines

- 7.2.3. Ferries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. Korea

- 7.3.4. India

- 7.3.5. Australia

- 7.3.6. Southeast Asia

- 7.3.7. Rest Of APAC

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Korea Asia Pacific Travel Retail industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fashion and Accessories

- 8.1.2. Jewellery and Watches

- 8.1.3. Wine & Spirits

- 8.1.4. Food & Confectionary

- 8.1.5. Fragnances and Cosmetics

- 8.1.6. Tobacco

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Airports

- 8.2.2. Airlines

- 8.2.3. Ferries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. Korea

- 8.3.4. India

- 8.3.5. Australia

- 8.3.6. Southeast Asia

- 8.3.7. Rest Of APAC

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. India Asia Pacific Travel Retail industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fashion and Accessories

- 9.1.2. Jewellery and Watches

- 9.1.3. Wine & Spirits

- 9.1.4. Food & Confectionary

- 9.1.5. Fragnances and Cosmetics

- 9.1.6. Tobacco

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Airports

- 9.2.2. Airlines

- 9.2.3. Ferries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. Korea

- 9.3.4. India

- 9.3.5. Australia

- 9.3.6. Southeast Asia

- 9.3.7. Rest Of APAC

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Australia Asia Pacific Travel Retail industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Fashion and Accessories

- 10.1.2. Jewellery and Watches

- 10.1.3. Wine & Spirits

- 10.1.4. Food & Confectionary

- 10.1.5. Fragnances and Cosmetics

- 10.1.6. Tobacco

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Airports

- 10.2.2. Airlines

- 10.2.3. Ferries

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. Korea

- 10.3.4. India

- 10.3.5. Australia

- 10.3.6. Southeast Asia

- 10.3.7. Rest Of APAC

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Southeast Asia Asia Pacific Travel Retail industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Fashion and Accessories

- 11.1.2. Jewellery and Watches

- 11.1.3. Wine & Spirits

- 11.1.4. Food & Confectionary

- 11.1.5. Fragnances and Cosmetics

- 11.1.6. Tobacco

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Airports

- 11.2.2. Airlines

- 11.2.3. Ferries

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Japan

- 11.3.3. Korea

- 11.3.4. India

- 11.3.5. Australia

- 11.3.6. Southeast Asia

- 11.3.7. Rest Of APAC

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest Of APAC Asia Pacific Travel Retail industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Fashion and Accessories

- 12.1.2. Jewellery and Watches

- 12.1.3. Wine & Spirits

- 12.1.4. Food & Confectionary

- 12.1.5. Fragnances and Cosmetics

- 12.1.6. Tobacco

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Airports

- 12.2.2. Airlines

- 12.2.3. Ferries

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. Japan

- 12.3.3. Korea

- 12.3.4. India

- 12.3.5. Australia

- 12.3.6. Southeast Asia

- 12.3.7. Rest Of APAC

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dufry

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 China duty free group co ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 DFS Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 King Power

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Heinemann Asia Pacific

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lotte Duty Free

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The shilla duty free

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Flemingo International

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 James Richardson Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 The Nuance Group**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Dufry

List of Figures

- Figure 1: Global Asia Pacific Travel Retail industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia Pacific Travel Retail industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: China Asia Pacific Travel Retail industry Revenue (Million), by Product Type 2025 & 2033

- Figure 4: China Asia Pacific Travel Retail industry Volume (Billion), by Product Type 2025 & 2033

- Figure 5: China Asia Pacific Travel Retail industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: China Asia Pacific Travel Retail industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: China Asia Pacific Travel Retail industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: China Asia Pacific Travel Retail industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 9: China Asia Pacific Travel Retail industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: China Asia Pacific Travel Retail industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: China Asia Pacific Travel Retail industry Revenue (Million), by Geography 2025 & 2033

- Figure 12: China Asia Pacific Travel Retail industry Volume (Billion), by Geography 2025 & 2033

- Figure 13: China Asia Pacific Travel Retail industry Revenue Share (%), by Geography 2025 & 2033

- Figure 14: China Asia Pacific Travel Retail industry Volume Share (%), by Geography 2025 & 2033

- Figure 15: China Asia Pacific Travel Retail industry Revenue (Million), by Country 2025 & 2033

- Figure 16: China Asia Pacific Travel Retail industry Volume (Billion), by Country 2025 & 2033

- Figure 17: China Asia Pacific Travel Retail industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: China Asia Pacific Travel Retail industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Asia Pacific Travel Retail industry Revenue (Million), by Product Type 2025 & 2033

- Figure 20: Japan Asia Pacific Travel Retail industry Volume (Billion), by Product Type 2025 & 2033

- Figure 21: Japan Asia Pacific Travel Retail industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Japan Asia Pacific Travel Retail industry Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Japan Asia Pacific Travel Retail industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 24: Japan Asia Pacific Travel Retail industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 25: Japan Asia Pacific Travel Retail industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Japan Asia Pacific Travel Retail industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: Japan Asia Pacific Travel Retail industry Revenue (Million), by Geography 2025 & 2033

- Figure 28: Japan Asia Pacific Travel Retail industry Volume (Billion), by Geography 2025 & 2033

- Figure 29: Japan Asia Pacific Travel Retail industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Japan Asia Pacific Travel Retail industry Volume Share (%), by Geography 2025 & 2033

- Figure 31: Japan Asia Pacific Travel Retail industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Japan Asia Pacific Travel Retail industry Volume (Billion), by Country 2025 & 2033

- Figure 33: Japan Asia Pacific Travel Retail industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Japan Asia Pacific Travel Retail industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Korea Asia Pacific Travel Retail industry Revenue (Million), by Product Type 2025 & 2033

- Figure 36: Korea Asia Pacific Travel Retail industry Volume (Billion), by Product Type 2025 & 2033

- Figure 37: Korea Asia Pacific Travel Retail industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Korea Asia Pacific Travel Retail industry Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Korea Asia Pacific Travel Retail industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 40: Korea Asia Pacific Travel Retail industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 41: Korea Asia Pacific Travel Retail industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Korea Asia Pacific Travel Retail industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Korea Asia Pacific Travel Retail industry Revenue (Million), by Geography 2025 & 2033

- Figure 44: Korea Asia Pacific Travel Retail industry Volume (Billion), by Geography 2025 & 2033

- Figure 45: Korea Asia Pacific Travel Retail industry Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Korea Asia Pacific Travel Retail industry Volume Share (%), by Geography 2025 & 2033

- Figure 47: Korea Asia Pacific Travel Retail industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Korea Asia Pacific Travel Retail industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Korea Asia Pacific Travel Retail industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Korea Asia Pacific Travel Retail industry Volume Share (%), by Country 2025 & 2033

- Figure 51: India Asia Pacific Travel Retail industry Revenue (Million), by Product Type 2025 & 2033

- Figure 52: India Asia Pacific Travel Retail industry Volume (Billion), by Product Type 2025 & 2033

- Figure 53: India Asia Pacific Travel Retail industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: India Asia Pacific Travel Retail industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: India Asia Pacific Travel Retail industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: India Asia Pacific Travel Retail industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 57: India Asia Pacific Travel Retail industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: India Asia Pacific Travel Retail industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: India Asia Pacific Travel Retail industry Revenue (Million), by Geography 2025 & 2033

- Figure 60: India Asia Pacific Travel Retail industry Volume (Billion), by Geography 2025 & 2033

- Figure 61: India Asia Pacific Travel Retail industry Revenue Share (%), by Geography 2025 & 2033

- Figure 62: India Asia Pacific Travel Retail industry Volume Share (%), by Geography 2025 & 2033

- Figure 63: India Asia Pacific Travel Retail industry Revenue (Million), by Country 2025 & 2033

- Figure 64: India Asia Pacific Travel Retail industry Volume (Billion), by Country 2025 & 2033

- Figure 65: India Asia Pacific Travel Retail industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: India Asia Pacific Travel Retail industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Australia Asia Pacific Travel Retail industry Revenue (Million), by Product Type 2025 & 2033

- Figure 68: Australia Asia Pacific Travel Retail industry Volume (Billion), by Product Type 2025 & 2033

- Figure 69: Australia Asia Pacific Travel Retail industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Australia Asia Pacific Travel Retail industry Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Australia Asia Pacific Travel Retail industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 72: Australia Asia Pacific Travel Retail industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 73: Australia Asia Pacific Travel Retail industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Australia Asia Pacific Travel Retail industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Australia Asia Pacific Travel Retail industry Revenue (Million), by Geography 2025 & 2033

- Figure 76: Australia Asia Pacific Travel Retail industry Volume (Billion), by Geography 2025 & 2033

- Figure 77: Australia Asia Pacific Travel Retail industry Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Australia Asia Pacific Travel Retail industry Volume Share (%), by Geography 2025 & 2033

- Figure 79: Australia Asia Pacific Travel Retail industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Australia Asia Pacific Travel Retail industry Volume (Billion), by Country 2025 & 2033

- Figure 81: Australia Asia Pacific Travel Retail industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Australia Asia Pacific Travel Retail industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Southeast Asia Asia Pacific Travel Retail industry Revenue (Million), by Product Type 2025 & 2033

- Figure 84: Southeast Asia Asia Pacific Travel Retail industry Volume (Billion), by Product Type 2025 & 2033

- Figure 85: Southeast Asia Asia Pacific Travel Retail industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 86: Southeast Asia Asia Pacific Travel Retail industry Volume Share (%), by Product Type 2025 & 2033

- Figure 87: Southeast Asia Asia Pacific Travel Retail industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 88: Southeast Asia Asia Pacific Travel Retail industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 89: Southeast Asia Asia Pacific Travel Retail industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 90: Southeast Asia Asia Pacific Travel Retail industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 91: Southeast Asia Asia Pacific Travel Retail industry Revenue (Million), by Geography 2025 & 2033

- Figure 92: Southeast Asia Asia Pacific Travel Retail industry Volume (Billion), by Geography 2025 & 2033

- Figure 93: Southeast Asia Asia Pacific Travel Retail industry Revenue Share (%), by Geography 2025 & 2033

- Figure 94: Southeast Asia Asia Pacific Travel Retail industry Volume Share (%), by Geography 2025 & 2033

- Figure 95: Southeast Asia Asia Pacific Travel Retail industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Southeast Asia Asia Pacific Travel Retail industry Volume (Billion), by Country 2025 & 2033

- Figure 97: Southeast Asia Asia Pacific Travel Retail industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Southeast Asia Asia Pacific Travel Retail industry Volume Share (%), by Country 2025 & 2033

- Figure 99: Rest Of APAC Asia Pacific Travel Retail industry Revenue (Million), by Product Type 2025 & 2033

- Figure 100: Rest Of APAC Asia Pacific Travel Retail industry Volume (Billion), by Product Type 2025 & 2033

- Figure 101: Rest Of APAC Asia Pacific Travel Retail industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 102: Rest Of APAC Asia Pacific Travel Retail industry Volume Share (%), by Product Type 2025 & 2033

- Figure 103: Rest Of APAC Asia Pacific Travel Retail industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 104: Rest Of APAC Asia Pacific Travel Retail industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 105: Rest Of APAC Asia Pacific Travel Retail industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 106: Rest Of APAC Asia Pacific Travel Retail industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 107: Rest Of APAC Asia Pacific Travel Retail industry Revenue (Million), by Geography 2025 & 2033

- Figure 108: Rest Of APAC Asia Pacific Travel Retail industry Volume (Billion), by Geography 2025 & 2033

- Figure 109: Rest Of APAC Asia Pacific Travel Retail industry Revenue Share (%), by Geography 2025 & 2033

- Figure 110: Rest Of APAC Asia Pacific Travel Retail industry Volume Share (%), by Geography 2025 & 2033

- Figure 111: Rest Of APAC Asia Pacific Travel Retail industry Revenue (Million), by Country 2025 & 2033

- Figure 112: Rest Of APAC Asia Pacific Travel Retail industry Volume (Billion), by Country 2025 & 2033

- Figure 113: Rest Of APAC Asia Pacific Travel Retail industry Revenue Share (%), by Country 2025 & 2033

- Figure 114: Rest Of APAC Asia Pacific Travel Retail industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 19: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 27: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 43: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 51: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 52: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 53: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 55: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Country 2020 & 2033

- Table 57: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 58: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 59: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 60: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 61: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 62: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 63: Global Asia Pacific Travel Retail industry Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Asia Pacific Travel Retail industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Travel Retail industry?

The projected CAGR is approximately 9.21%.

2. Which companies are prominent players in the Asia Pacific Travel Retail industry?

Key companies in the market include Dufry, China duty free group co ltd, DFS Group, King Power, Heinemann Asia Pacific, Lotte Duty Free, The shilla duty free, Flemingo International, James Richardson Group, The Nuance Group**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Travel Retail industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Customer Base In Travel Duty-Free Shops Drives The Market; Exemption From Taxes When Goods Are Taken Out Of The Country Of Purchase Drives The Market.

6. What are the notable trends driving market growth?

High Revenue Generation From Airport Retailing Drives The Market.

7. Are there any restraints impacting market growth?

Guaranteed Customer Base In Travel Duty-Free Shops Drives The Market; Exemption From Taxes When Goods Are Taken Out Of The Country Of Purchase Drives The Market.

8. Can you provide examples of recent developments in the market?

October 2023: DFS Group, the travel retail company, developed an entertainment and shopping complex on the duty-free Hainan Island of China. This development aimed to enhance the tourism market, even during economic downturns.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Travel Retail industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Travel Retail industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Travel Retail industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Travel Retail industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence