Key Insights

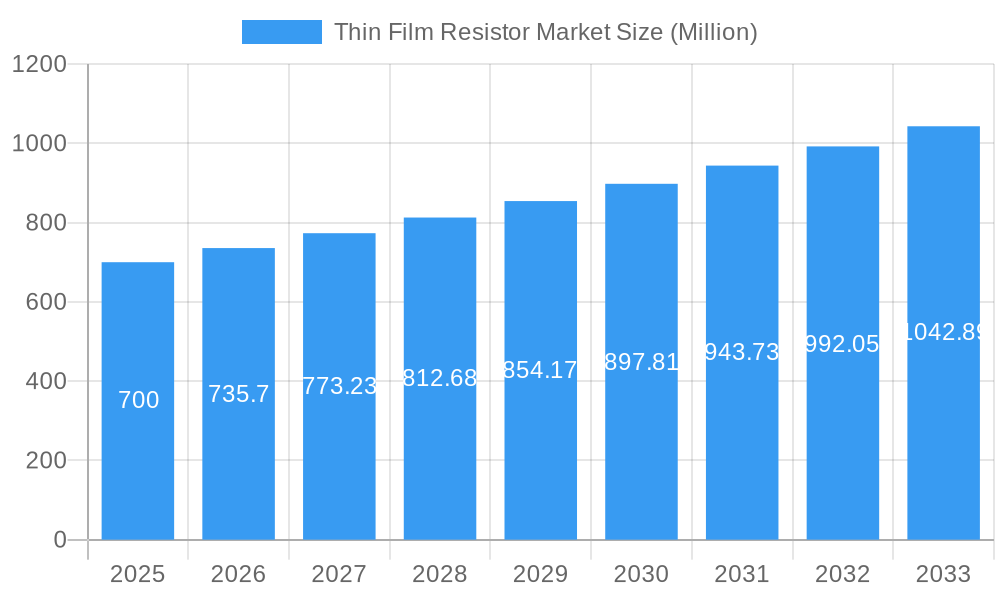

The global Thin Film Resistor market is poised for robust expansion, currently valued at approximately $700 million and projected to grow at a Compound Annual Growth Rate (CAGR) of 5.04% through 2033. This sustained growth is primarily fueled by the escalating demand for miniaturized and high-performance electronic components across a wide array of industries. The consumer electronics sector, driven by the relentless innovation in smartphones, wearables, and IoT devices, represents a significant demand generator. Similarly, the automotive industry's rapid electrification and the increasing integration of advanced driver-assistance systems (ADAS) are creating substantial opportunities for thin film resistors due to their superior precision and reliability in critical applications. The industrial equipment sector also contributes significantly, with the adoption of smart manufacturing and automation technologies requiring sophisticated electronic controls.

Thin Film Resistor Market Market Size (In Million)

While the market is experiencing healthy growth, certain challenges may temper its full potential. High manufacturing costs associated with the precise deposition processes required for thin film resistors can be a restraint. Furthermore, the emergence of alternative resistive technologies and the increasing commoditization of some resistor types could exert price pressures. Nonetheless, the inherent advantages of thin film resistors, such as their excellent stability, low temperature coefficients, and high accuracy, ensure their continued relevance and demand in high-end and performance-critical applications. Key players like Samsung Electro-Mechanics, Panasonic Corporation, and Walsin Technology Corporation are investing in research and development to enhance performance and explore new material innovations, positioning them to capitalize on the evolving market landscape.

Thin Film Resistor Market Company Market Share

Thin Film Resistor Market: Comprehensive Analysis & Future Outlook (2019-2033)

Uncover critical insights into the global thin film resistor market, a vital component in advanced electronics. This in-depth report provides detailed analysis of market dynamics, technological advancements, competitive landscape, and future growth opportunities. With a study period spanning from 2019 to 2033, featuring a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to navigate this rapidly evolving industry. Explore market segmentation by End-User Industry, including Industrial Equipment, Consumer Electronics, and Automotive, to identify high-potential growth avenues. Leverage actionable intelligence derived from historical trends (2019-2024) and estimated market values in the millions.

Thin Film Resistor Market Market Structure & Competitive Dynamics

The global thin film resistor market exhibits a moderately concentrated structure, with a mix of established multinational corporations and specialized niche players. Innovation ecosystems are driven by continuous R&D in miniaturization, enhanced performance characteristics like low TCR (Temperature Coefficient of Resistance), and improved power handling capabilities. Regulatory frameworks primarily revolve around environmental compliance and safety standards, impacting manufacturing processes and material sourcing. Key competitive advantages are gained through superior precision, reliability, and specialized applications. Product substitutes, such as thick film resistors, are available for less demanding applications, but thin film resistors maintain dominance in high-precision and high-frequency scenarios. End-user trends increasingly favor miniaturized, high-performance components for advanced devices across all sectors. Mergers and acquisitions (M&A) are strategic for market expansion and technology acquisition. For instance, recent M&A activities in the broader passive components market have seen deal values in the hundreds of millions, indicating consolidation and a drive for market share. Market share distribution reveals that key players hold significant portions, with a few dominant companies accounting for over 60% of the global market value.

Thin Film Resistor Market Industry Trends & Insights

The thin film resistor market is experiencing robust growth, propelled by escalating demand for sophisticated electronic devices and the relentless pursuit of higher performance and miniaturization. The compound annual growth rate (CAGR) is projected to be a healthy xx% over the forecast period, driven by key technological disruptions. Advancements in semiconductor manufacturing, particularly in the fabrication of integrated circuits, directly influence the demand for high-precision thin film resistors. Consumer preferences are shifting towards smaller, more powerful, and energy-efficient gadgets, necessitating components that offer superior performance in minimal space. The automotive sector, with its increasing integration of advanced driver-assistance systems (ADAS) and electric vehicle (EV) technology, presents a significant growth avenue. These applications require resistors with exceptional reliability, tight tolerances, and extended temperature ranges. Furthermore, the industrial equipment segment, encompassing automation, medical devices, and telecommunications, also contributes substantially to market expansion. The competitive dynamics are characterized by fierce price competition at the lower end of the market, while differentiation is achieved through specialized product offerings and technological innovation at the premium segment. Market penetration is deep across developed economies and is rapidly expanding in emerging markets due to increasing digitalization and industrialization. The overall trend indicates a sustained upward trajectory for the thin film resistor market, underpinned by pervasive technological adoption and evolving consumer and industrial demands.

Dominant Markets & Segments in Thin Film Resistor Market

The Automotive end-user industry is emerging as a dominant market segment for thin film resistors. This dominance is propelled by several key drivers, including the accelerating adoption of electric vehicles (EVs) and the proliferation of advanced driver-assistance systems (ADAS). Economic policies globally are increasingly incentivizing EV production and adoption, further bolstering demand for specialized electronic components like high-performance thin film resistors for battery management systems, power inverters, and control units. Infrastructure development related to smart automotive technologies and charging stations also indirectly fuels this growth.

- Key Drivers for Automotive Dominance:

- Electric Vehicle (EV) Revolution: The transition to EVs necessitates sophisticated power electronics, where thin film resistors offer the precision and reliability required for efficient energy management.

- ADAS and Autonomous Driving: The increasing complexity of sensors, processors, and control systems in ADAS requires high-tolerance, stable, and robust passive components.

- Stringent Performance Standards: Automotive applications demand components that can withstand extreme temperature variations, vibration, and harsh environmental conditions, areas where thin film resistors excel.

- Government Regulations and Incentives: Global push towards emission reduction and safety standards drives innovation and adoption of advanced automotive electronics.

In addition to Automotive, Industrial Equipment remains a cornerstone of the thin film resistor market. This segment benefits from ongoing industrial automation, the expansion of the Internet of Things (IoT) in manufacturing, and the demand for precision instrumentation. Growth is further supported by investments in smart grid technologies and renewable energy infrastructure.

- Key Drivers for Industrial Equipment Dominance:

- Industrial Automation and IIoT: The integration of smart sensors and control systems in factories requires highly reliable and precise resistors.

- Precision Instrumentation: Scientific and medical equipment often demands the exceptional accuracy and stability offered by thin film resistors.

- Telecommunications Infrastructure: The build-out of 5G networks and data centers relies on high-frequency and low-noise electronic components.

Consumer Electronics continues to be a substantial market, driven by the ongoing innovation in smartphones, wearables, and home entertainment systems. Miniaturization and power efficiency are paramount in this sector, making thin film resistors indispensable.

- Key Drivers for Consumer Electronics Dominance:

- Miniaturization Trends: The demand for sleeker and smaller electronic devices necessitates tiny, high-performance components.

- Increasing Device Complexity: Smart devices with advanced features require more sophisticated and precise electronic circuitry.

- Global Demand for Consumer Gadgets: A large and growing global consumer base fuels continuous demand for new and upgraded electronic products.

While these three segments represent the primary markets, Other End-User Industries, including aerospace, defense, and medical devices, also contribute significantly to the overall market size due to their stringent quality and performance requirements.

Thin Film Resistor Market Product Innovations

Product innovations in the thin film resistor market are centered on enhancing precision, power handling, and environmental resistance. Companies are developing resistors with ultra-low tolerances (e.g., ±0.01%), exceptionally low TCR values (e.g., 5ppm/°C), and increased power dissipation capabilities. Innovations also focus on specialized materials and structures to improve resistance to moisture, sulfur, and high temperatures, making them ideal for demanding applications like automotive powertrain systems and industrial automation. The trend towards miniaturization continues with the development of smaller package sizes without compromising performance, catering to the ever-shrinking footprint requirements of modern electronic devices. These advancements offer competitive advantages by enabling the design of more reliable, efficient, and compact electronic systems.

Report Segmentation & Scope

This report meticulously segments the global thin film resistor market by End-User Industry, providing detailed analysis for each category. The primary segments covered are:

- Industrial Equipment: This segment encompasses applications in automation, instrumentation, test and measurement, power supplies, and telecommunications infrastructure. Market size is projected to reach xx Million by 2033, with a CAGR of xx%.

- Consumer Electronics: This segment includes smartphones, tablets, laptops, wearables, gaming consoles, and home appliances. The market is expected to grow to xx Million by 2033, with a CAGR of xx%.

- Automotive: This segment focuses on resistors used in EVs, ADAS, infotainment systems, and engine control units. It is anticipated to reach xx Million by 2033, exhibiting a CAGR of xx%.

- Other End-User Industries: This broad category includes aerospace, defense, medical devices, and energy sectors, characterized by high-reliability requirements. Market size is estimated at xx Million by 2033, with a CAGR of xx%.

The scope of this report covers the global market from 2019 to 2033, with a detailed analysis of the base year 2025 and the forecast period 2025-2033.

Key Drivers of Thin Film Resistor Market Growth

The growth of the thin film resistor market is propelled by several interconnected factors. Technological advancements in semiconductor manufacturing, leading to the development of more complex and integrated electronic circuits, necessitate the use of high-precision passive components like thin film resistors. The burgeoning demand for advanced electronics across consumer, industrial, and automotive sectors, driven by digitalization and the proliferation of smart devices, is a significant growth accelerator. Government initiatives promoting electrification, automation, and digitalization further stimulate market expansion. For instance, global policies supporting the transition to electric vehicles directly translate into increased demand for automotive-grade thin film resistors. The increasing sophistication of applications requiring tight tolerances and stable performance, such as 5G infrastructure and medical devices, also acts as a powerful growth driver.

Challenges in the Thin Film Resistor Market Sector

Despite strong growth, the thin film resistor market faces several challenges. Intense price competition, particularly from manufacturers in low-cost regions, can put pressure on profit margins, especially for standard product offerings. Supply chain disruptions, exacerbated by geopolitical events and raw material availability fluctuations, can lead to increased lead times and costs. Regulatory hurdles related to environmental compliance and material sourcing can impact manufacturing processes and necessitate significant investment in compliance. Furthermore, the rapid pace of technological change requires continuous R&D investment to keep pace with evolving performance demands, posing a challenge for smaller players to remain competitive. Overcoming these obstacles requires strategic sourcing, robust R&D, and a focus on niche, high-value applications.

Leading Players in the Thin Film Resistor Market Market

- Elektronische Bauelemente GmbH (EBG)

- Ever Ohms Technology Co Ltd

- Rohm Co Ltd

- Walsin Technology Corporation

- Ta-I Technology Co Ltd

- Tateyama Kagaku Industry Co Ltd

- Samsung Electro-Mechanics

- Ralec Electronics Corporation

- Uniohm Corporation

- Panasonic Corporation

Key Developments in Thin Film Resistor Market Sector

- June 2024: Stackpole introduced its RNWA thin film chip resistor, featuring wide terminations for enhanced solder joint reliability, tolerances as tight as 0.1%, and an impressively low TCR of 25ppm. Designed for automotive applications, it offers superior long-term stability and resistance to sulfur, significantly bolstering durability.

- June 2024: ROHM unveiled three new additions to its PMR100 series, each rated for 5W power. These new products are available with resistance values of 0.5mΩ, 1.0mΩ, and 1.5mΩ, targeting motor control and power circuits in automotive, consumer, and industrial equipment applications. They are offered in the 2512-size (0.25inch × 0.12inch) and 6432-size (6.4mm × 3.2mm) formats.

Strategic Thin Film Resistor Market Market Outlook

The strategic outlook for the thin film resistor market is exceptionally promising, driven by persistent demand from high-growth sectors. The increasing electrification of transportation, coupled with advancements in autonomous driving technologies, will continue to fuel demand for automotive-grade thin film resistors. The expansion of 5G infrastructure and the growing adoption of IoT devices in industrial and consumer applications will further accelerate market penetration. Strategic opportunities lie in developing specialized, high-performance resistors for niche applications, such as medical imaging, aerospace, and defense, where precision and reliability are paramount. Companies that focus on sustainable manufacturing practices and innovative solutions addressing miniaturization and power efficiency will be well-positioned for sustained growth and market leadership in the coming years. The estimated market size is projected to reach xx Million by 2033.

Thin Film Resistor Market Segmentation

-

1. End-User Industry

- 1.1. Industrial Equipment

- 1.2. Consumer Electronics

- 1.3. Automotive

- 1.4. Other End-User Industries

Thin Film Resistor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Thin Film Resistor Market Regional Market Share

Geographic Coverage of Thin Film Resistor Market

Thin Film Resistor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for High-Performance Electronic and Electrical Systems; Rising Demand for ADAS in Vehicles; Increasing Adoption of 5G Networks

- 3.3. Market Restrains

- 3.3.1. Rising Prices of Raw Materials

- 3.4. Market Trends

- 3.4.1. Consumer Electronics is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thin Film Resistor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Industrial Equipment

- 5.1.2. Consumer Electronics

- 5.1.3. Automotive

- 5.1.4. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. North America Thin Film Resistor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Industrial Equipment

- 6.1.2. Consumer Electronics

- 6.1.3. Automotive

- 6.1.4. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. Europe Thin Film Resistor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Industrial Equipment

- 7.1.2. Consumer Electronics

- 7.1.3. Automotive

- 7.1.4. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Asia Thin Film Resistor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Industrial Equipment

- 8.1.2. Consumer Electronics

- 8.1.3. Automotive

- 8.1.4. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. Australia and New Zealand Thin Film Resistor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9.1.1. Industrial Equipment

- 9.1.2. Consumer Electronics

- 9.1.3. Automotive

- 9.1.4. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10. Latin America Thin Film Resistor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10.1.1. Industrial Equipment

- 10.1.2. Consumer Electronics

- 10.1.3. Automotive

- 10.1.4. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by End-User Industry

- 11. Middle East and Africa Thin Film Resistor Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-User Industry

- 11.1.1. Industrial Equipment

- 11.1.2. Consumer Electronics

- 11.1.3. Automotive

- 11.1.4. Other End-User Industries

- 11.1. Market Analysis, Insights and Forecast - by End-User Industry

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Elektronische Bauelemente GmbH (EBG)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ever Ohms Technology Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Rohm Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Walsin Technology Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Ta-I Technology Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Tateyama Kagaku Industry Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Samsung Electro-Mechanics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Ralec Electronics Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Uniohm Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Panasonic Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Elektronische Bauelemente GmbH (EBG)

List of Figures

- Figure 1: Global Thin Film Resistor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Thin Film Resistor Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Thin Film Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 4: North America Thin Film Resistor Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 5: North America Thin Film Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Thin Film Resistor Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 7: North America Thin Film Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Thin Film Resistor Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Thin Film Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Thin Film Resistor Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Thin Film Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 12: Europe Thin Film Resistor Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 13: Europe Thin Film Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 14: Europe Thin Film Resistor Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 15: Europe Thin Film Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Thin Film Resistor Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Thin Film Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Thin Film Resistor Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Thin Film Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 20: Asia Thin Film Resistor Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 21: Asia Thin Film Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 22: Asia Thin Film Resistor Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 23: Asia Thin Film Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Thin Film Resistor Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Thin Film Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Thin Film Resistor Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Australia and New Zealand Thin Film Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 28: Australia and New Zealand Thin Film Resistor Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 29: Australia and New Zealand Thin Film Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Australia and New Zealand Thin Film Resistor Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 31: Australia and New Zealand Thin Film Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Thin Film Resistor Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Thin Film Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Australia and New Zealand Thin Film Resistor Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Latin America Thin Film Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 36: Latin America Thin Film Resistor Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 37: Latin America Thin Film Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 38: Latin America Thin Film Resistor Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 39: Latin America Thin Film Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Latin America Thin Film Resistor Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Latin America Thin Film Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Thin Film Resistor Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Middle East and Africa Thin Film Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 44: Middle East and Africa Thin Film Resistor Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 45: Middle East and Africa Thin Film Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 46: Middle East and Africa Thin Film Resistor Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 47: Middle East and Africa Thin Film Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Thin Film Resistor Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Thin Film Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Thin Film Resistor Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thin Film Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: Global Thin Film Resistor Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Thin Film Resistor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Thin Film Resistor Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Thin Film Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Thin Film Resistor Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 7: Global Thin Film Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Thin Film Resistor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global Thin Film Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Global Thin Film Resistor Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: Global Thin Film Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Thin Film Resistor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Thin Film Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Global Thin Film Resistor Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Thin Film Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Thin Film Resistor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Thin Film Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global Thin Film Resistor Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 19: Global Thin Film Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Thin Film Resistor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Thin Film Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 22: Global Thin Film Resistor Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 23: Global Thin Film Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Thin Film Resistor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Thin Film Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 26: Global Thin Film Resistor Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 27: Global Thin Film Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Thin Film Resistor Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thin Film Resistor Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Thin Film Resistor Market?

Key companies in the market include Elektronische Bauelemente GmbH (EBG), Ever Ohms Technology Co Ltd, Rohm Co Ltd, Walsin Technology Corporation, Ta-I Technology Co Ltd, Tateyama Kagaku Industry Co Ltd, Samsung Electro-Mechanics, Ralec Electronics Corporation, Uniohm Corporation, Panasonic Corporation.

3. What are the main segments of the Thin Film Resistor Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.7 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for High-Performance Electronic and Electrical Systems; Rising Demand for ADAS in Vehicles; Increasing Adoption of 5G Networks.

6. What are the notable trends driving market growth?

Consumer Electronics is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Rising Prices of Raw Materials.

8. Can you provide examples of recent developments in the market?

June 2024: Stackpole's RNWA, a thin film chip resistor, boasts wide terminations, offers tolerances as tight as 0.1%, and features an impressively low TCR of 25ppm. It is designed for automotive applications, enhances long-term stability and reliability and also exhibits resistance to sulfur, bolstering its durability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thin Film Resistor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thin Film Resistor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thin Film Resistor Market?

To stay informed about further developments, trends, and reports in the Thin Film Resistor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence