Key Insights

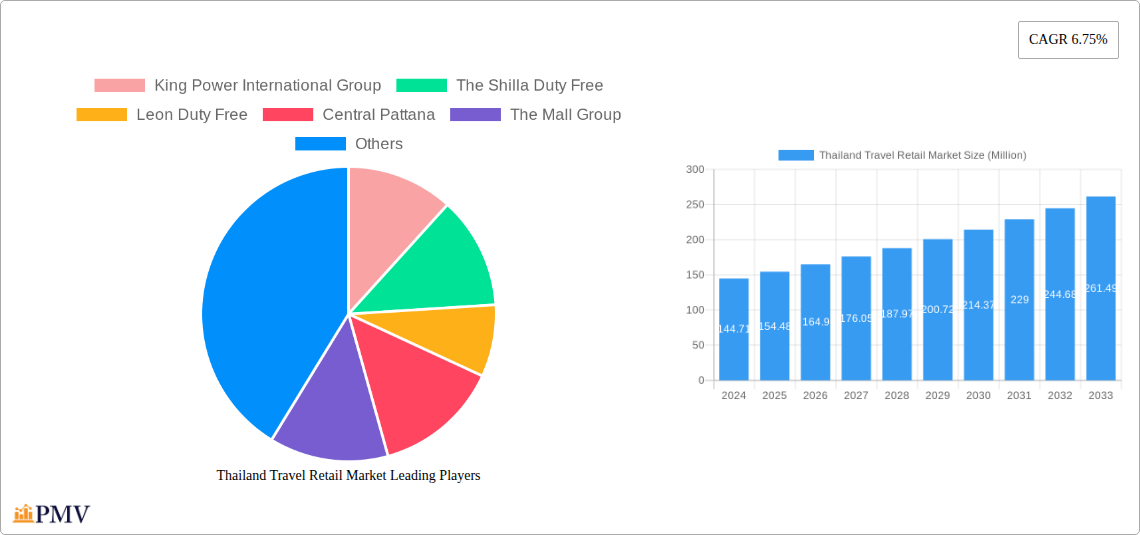

The Thailand Travel Retail Market is poised for robust expansion, with an estimated market size of USD 154.48 million in 2025, projected to grow at a compound annual growth rate (CAGR) of 6.75% through 2033. This sustained growth is fueled by several dynamic drivers, including the burgeoning tourism sector and increasing disposable incomes among both domestic and international travelers. The beauty and personal care segment is expected to lead the market, benefiting from a strong demand for premium and exotic products, alongside a growing trend of travelers seeking to indulge in luxury purchases. The wines and spirits category also presents a significant opportunity, driven by evolving consumer preferences and the appeal of duty-free exclusive offerings. The fashion accessories and hard luxury segment is another key contributor, attracting high-spending tourists with its range of designer goods and unique artisanal creations.

Thailand Travel Retail Market Market Size (In Million)

Distribution channels play a pivotal role in shaping the market landscape. Airports continue to dominate as the primary retail hubs, witnessing continuous upgrades and expansion to accommodate the growing passenger traffic. Airlines are also increasingly focusing on enhancing their in-flight retail offerings, presenting a convenient option for travelers. Emerging trends indicate a strategic shift towards personalized shopping experiences and the integration of digital technologies to enhance customer engagement. This includes the adoption of omnichannel strategies, allowing for seamless online browsing and in-store purchasing. While the market demonstrates strong potential, certain restraints, such as stringent regulatory frameworks and fluctuations in global travel sentiment, warrant careful consideration by market participants. Nevertheless, the overall outlook for the Thailand travel retail market remains highly optimistic, driven by its strategic location, vibrant tourism industry, and the consistent demand for travel retail offerings.

Thailand Travel Retail Market Company Market Share

This comprehensive report delves into the dynamic Thailand travel retail market, offering unparalleled insights into its structure, trends, and future trajectory. With a deep dive into the Thai duty-free market, airport retail Thailand, and travel retail Asia, this analysis provides actionable intelligence for stakeholders seeking to capitalize on this burgeoning sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for understanding the competitive landscape, consumer preferences, and strategic opportunities within Thailand's vibrant travel retail ecosystem.

Thailand Travel Retail Market Market Structure & Competitive Dynamics

The Thailand travel retail market exhibits a moderately concentrated structure, with King Power International Group holding a dominant market share, estimated at over 75% of the airport duty-free channel. Innovation is driven by a blend of international brands seeking Thailand travel retail expansion and local players adapting to evolving consumer demands. Regulatory frameworks, primarily governed by customs regulations and airport authority concessions, play a crucial role in shaping market entry and operational strategies. Product substitutes, while present in general retail, are largely mitigated in travel retail by the unique proposition of duty-free pricing and curated assortments. End-user trends are increasingly focused on premiumization, personalized experiences, and digital integration. Mergers and acquisitions (M&A) activities, though less frequent, are strategic plays for market consolidation and enhanced consumer reach. For instance, significant M&A deals in the broader Asia travel retail market can indirectly influence Thailand's competitive dynamics. The market is characterized by intense competition among key players vying for prime retail space and passenger footfall.

- Market Concentration: Dominated by King Power International Group, with significant influence from other key players.

- Innovation: Driven by brand partnerships, exclusive product launches, and digital integration for enhanced customer experience.

- Regulatory Framework: Influenced by government policies on duty-free operations and international trade agreements.

- M&A Activities: Strategic acquisitions focused on expanding distribution networks and product portfolios.

Thailand Travel Retail Market Industry Trends & Insights

The Thailand travel retail market is poised for substantial growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This expansion is fueled by a confluence of factors, including the robust recovery of international tourism, increased disposable income among travelers, and a growing appetite for luxury and premium goods. The resurgence of inbound tourism to Thailand, particularly from key markets such as China and Southeast Asia, is a primary growth driver, directly correlating with increased passenger traffic through major international airports like Suvarnabhumi and Don Mueang.

Technological disruptions are reshaping the travel retail Thailand landscape. E-commerce integration, contactless payment solutions, and personalized marketing through mobile applications are becoming increasingly prevalent. Brands are leveraging data analytics to understand traveler preferences, offering tailored product recommendations and enhancing the overall shopping journey. The rise of omnichannel retail strategies, where online browsing and purchasing seamlessly integrate with in-store experiences, is also a significant trend.

Consumer preferences in the Thai duty-free market are shifting towards experiential shopping, sustainability, and wellness products. Travelers are seeking unique and authentic local products alongside international luxury brands. There is a growing demand for "buy-before-you-fly" services and click-and-collect options, allowing for greater convenience and time-saving. The Thailand travel retail market is also witnessing a surge in demand for niche categories such as sustainable beauty products and artisanal food items.

Competitive dynamics are characterized by strategic partnerships between brands and retailers, exclusive product launches, and the optimization of retail space within airports. The expansion of downtown duty-free stores by major players like King Power further broadens accessibility and captures a larger share of the consumer wallet. The increasing focus on customer loyalty programs and personalized offers is crucial for retaining customers in this competitive environment. The market penetration of digital technologies is creating new avenues for engagement and sales, making it imperative for all players to adapt to the evolving digital landscape to maintain their competitive edge in the travel retail Asia sector.

Dominant Markets & Segments in Thailand Travel Retail Market

The Thailand travel retail market is heavily influenced by several dominant segments and channels.

Product Type Dominance:

- Beauty and Personal Care: This segment consistently leads the market, driven by the high demand for skincare, cosmetics, and fragrances among international and domestic travelers. The popularity of premium and luxury beauty brands, coupled with aggressive marketing by international cosmetics giants, solidifies its dominance. Key drivers include the influence of social media, celebrity endorsements, and the desire for self-care among a diverse demographic of travelers. The presence of numerous global beauty powerhouses ensures continuous innovation and a wide array of product offerings.

- Wines and Spirits: This remains a strong performer, catering to gifting occasions and personal consumption. The availability of premium and rare vintages, alongside competitive pricing, attracts a significant customer base. Travelers often seek to purchase well-known international spirits and fine wines as souvenirs or gifts. Economic growth and an increasing disposable income among emerging market travelers further bolster this segment's performance.

Distribution Channel Dominance:

- Airports: This is the undisputed dominant distribution channel for travel retail Thailand. Major international airports like Suvarnabhumi (BKK) and Don Mueang (DMK) serve as prime retail hubs, attracting millions of passengers annually. The captive audience and the convenience of purchasing duty-free goods before or after a flight make airports the most lucrative channel. Infrastructure development, expansion of retail space, and strategic placement of outlets by operators like Airports of Thailand are key factors contributing to this dominance. The focus on creating a seamless and enjoyable shopping experience within airports is paramount for capturing traveler spend.

- Other Distribution Channels (Borders, Downtown): While airports hold the largest share, downtown duty-free stores and border retail outlets are gaining traction. Downtown stores, such as those operated by King Power, offer convenience for local residents and tourists outside of airport travel, effectively extending the reach of the Thai duty-free market. Border retail, though smaller in scale, caters to specific cross-border traffic and local consumption patterns.

The overall market dynamics are shaped by Thailand's position as a leading tourist destination in Southeast Asia, drawing a vast number of international visitors. Government initiatives promoting tourism and infrastructure development at airports further amplify the dominance of these channels and segments.

Thailand Travel Retail Market Product Innovations

Product innovation in the Thailand travel retail market is characterized by brand collaborations, exclusive launches, and the growing demand for sustainable and wellness-focused offerings. International brands are increasingly partnering with key retailers like King Power to introduce limited-edition collections and travel-exclusive sets, catering to the specific preferences of the Thai market. There's a noticeable trend towards personalized beauty solutions and advanced skincare technologies, reflecting a more discerning consumer base. The incorporation of natural and organic ingredients is gaining momentum in the beauty and personal care segments. Furthermore, unique edible products and artisanal food items are emerging as popular choices for travelers seeking authentic local flavors. These innovations enhance the shopping experience and drive incremental sales within the travel retail Asia landscape.

Report Segmentation & Scope

This report segment includes a detailed analysis of the Thailand travel retail market across key product types and distribution channels.

- Product Types: The market is segmented into Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, and Other Product Types. Each segment's market size, growth projections, and competitive dynamics are analyzed, highlighting the specific demand drivers and consumer behaviors within each category.

- Distribution Channels: The analysis further segments the market by Airports, Airlines, Ferries, and Other Distribution Channels (Borders, Downtown). The report provides in-depth insights into the market share, revenue generation, and strategic importance of each channel, with a particular focus on the dominant airport retail Thailand segment. Growth projections and competitive strategies for each channel are meticulously examined.

Key Drivers of Thailand Travel Retail Market Growth

The Thailand travel retail market growth is propelled by several interconnected factors. The consistent influx of international tourists, driven by Thailand's appeal as a global tourism hub, directly translates to increased passenger traffic and higher spending potential. Favorable economic conditions, including rising disposable incomes within key source markets, empower travelers to engage more readily with premium and luxury travel retail offerings. Government support for the tourism sector, through visa facilitation and promotional campaigns, further bolsters visitor numbers. Technological advancements in digital retail, such as e-commerce integration and personalized marketing, enhance the consumer shopping experience, driving engagement and sales. Strategic expansions by major players like King Power into downtown retail further broaden accessibility.

Challenges in the Thailand Travel Retail Market Sector

Despite its robust growth, the Thailand travel retail market faces several challenges. Intense competition among retailers for prime airport locations and passenger attention can lead to price wars and margin pressures. Evolving global travel regulations and geopolitical uncertainties can impact international passenger flows, creating volatility in demand. Supply chain disruptions, exacerbated by global events, can affect product availability and lead times. Counterfeit products also pose a threat to brand reputation and consumer trust. Furthermore, the increasing digitalization of retail presents a challenge for traditional brick-and-mortar operations to adapt and integrate seamlessly with online platforms, requiring significant investment in technology and talent.

Leading Players in the Thailand Travel Retail Market Market

- King Power International Group

- The Shilla Duty Free

- Leon Duty Free

- Central Pattana

- The Mall Group

- Jaidee Duty Free

- SIAM Gems Group

- Paradise Duty Free

- Regent Plaza Group

- Bangkok Airways

- The Airways International

- Airports of Thailand

- JR Duty Free

Key Developments in Thailand Travel Retail Market Sector

- October 2023: Foreo broadens its presence in Thailand's travel retail sector with a new outlet at Don Mueang Airport. This expansion, in collaboration with King Power, builds upon Foreo's existing launches at Suvarnabhumi and Phuket airports, along with its presence in King Power Rangnam, King Power Srivaree Complex, and King Power Phuket downtown stores.

- November 2023: Thailand's leading oil and retail company plans to expand into Southeast Asia due to the region's economic growth. PTT Oil and Retail Business is investing $900 million to broaden operations beyond Southeast Asia, operating over 2,500 lifestyle outlets in Asia and supplying petrochemical products globally to over 40 countries.

Strategic Thailand Travel Retail Market Market Outlook

The strategic outlook for the Thailand travel retail market remains highly positive, driven by sustained growth in international tourism and increasing consumer spending power. Key growth accelerators include the continued development of airport infrastructure, enhancing the retail environment and passenger capacity. The integration of advanced digital technologies, offering personalized customer experiences and seamless omnichannel journeys, will be critical for future success. Strategic partnerships between brands and retailers, focusing on exclusive product launches and experiential retail concepts, will further differentiate offerings. The market is expected to witness an increasing focus on sustainability and ethical sourcing, aligning with evolving global consumer values. Capitalizing on emerging travel segments and tailoring offerings to diverse demographic preferences will unlock significant future potential.

Thailand Travel Retail Market Segmentation

-

1. Product Type

- 1.1. Beauty and Personal Care

- 1.2. Wines and Spirits

- 1.3. Tobacco

- 1.4. Eatables

- 1.5. Fashion Accessories and Hard Luxury

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Distribution Channels (Borders, Downtown)

Thailand Travel Retail Market Segmentation By Geography

- 1. Thailand

Thailand Travel Retail Market Regional Market Share

Geographic Coverage of Thailand Travel Retail Market

Thailand Travel Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in Thailand is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beauty and Personal Care

- 5.1.2. Wines and Spirits

- 5.1.3. Tobacco

- 5.1.4. Eatables

- 5.1.5. Fashion Accessories and Hard Luxury

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Distribution Channels (Borders, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 King Power International Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Shilla Duty Free

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leon Duty Free

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Central Pattana

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Mall Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jaidee Duty Free

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIAM Gems Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paradise Duty Free

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Regent Plaza Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bangkok Airways

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Airways International

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Airports of Thailand

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 JR Duty Free**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 King Power International Group

List of Figures

- Figure 1: Thailand Travel Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Travel Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Thailand Travel Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Thailand Travel Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Thailand Travel Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Thailand Travel Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Travel Retail Market?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Thailand Travel Retail Market?

Key companies in the market include King Power International Group, The Shilla Duty Free, Leon Duty Free, Central Pattana, The Mall Group, Jaidee Duty Free, SIAM Gems Group, Paradise Duty Free, Regent Plaza Group, Bangkok Airways, The Airways International, Airports of Thailand, JR Duty Free**List Not Exhaustive.

3. What are the main segments of the Thailand Travel Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.48 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in Thailand is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Foreo broadens its presence in Thailand's travel retail sector with a new outlet at Don Mueang Airport. This expansion, in collaboration with King Power, builds upon Foreo's existing launches at Suvarnabhumi and Phuket airports, along with its presence in King Power Rangnam, King Power Srivaree Complex, and King Power Phuket downtown stores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Travel Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Travel Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Travel Retail Market?

To stay informed about further developments, trends, and reports in the Thailand Travel Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence