Key Insights

The global Cosmetics and Personal Care Stores Market is projected to reach USD 535.18 billion by 2025, exhibiting a CAGR of 5.31%. This expansion is driven by evolving consumer preferences for premium and specialized beauty products, particularly in skincare and haircare, fueled by ingredient consciousness and demand for personalized solutions. The pervasive influence of social media and digital marketing further accelerates awareness and desire for innovative products. Growing disposable incomes, an expanding middle class in emerging economies, and a heightened focus on personal grooming and wellness are significant growth contributors. The market is segmented across Decorative, Skincare, Haircare, Perfume, Oral-Care, and Bath & Shower product categories.

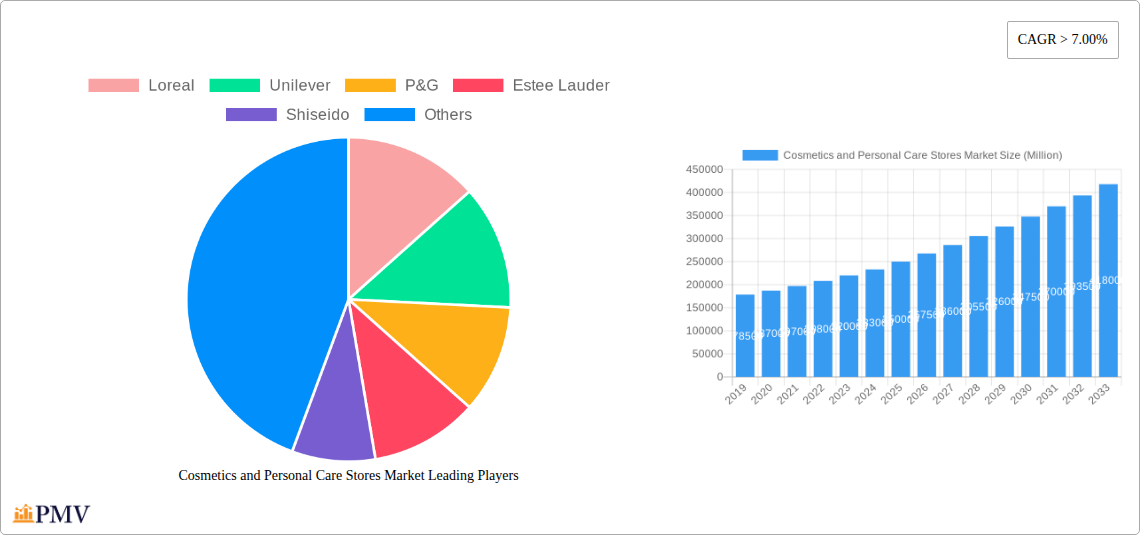

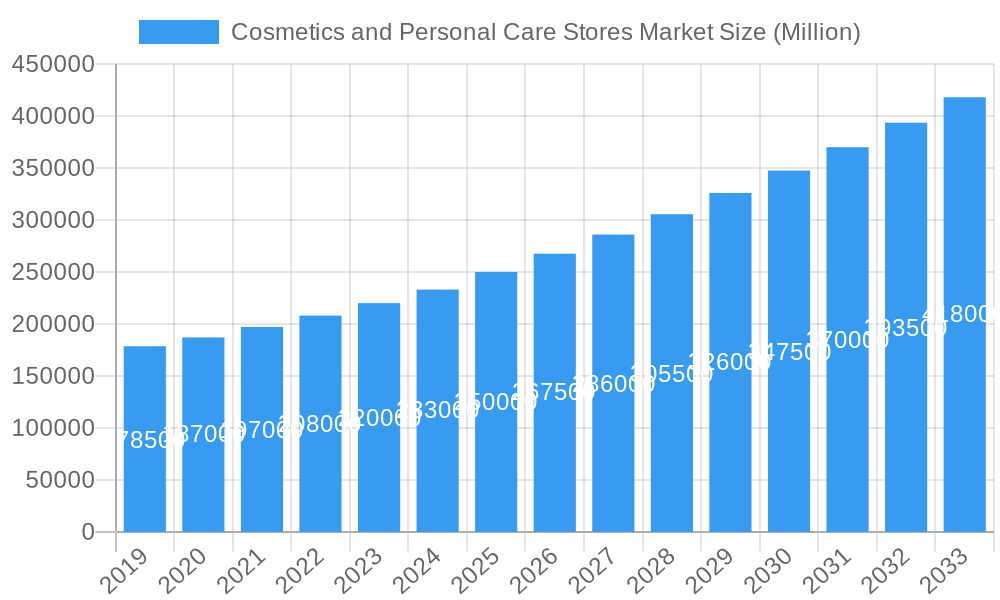

Cosmetics and Personal Care Stores Market Market Size (In Billion)

Distribution strategies are evolving, with specialist retail, supermarkets, and hypermarkets remaining dominant. Pharmacies, drug stores, and online platforms are gaining traction due to convenience and accessibility. Leading players are investing heavily in R&D, product innovation, and strategic acquisitions. Key restraints include intense competition, potential supply chain disruptions, and rising raw material costs. The Asia Pacific region is poised for significant future growth, complementing established markets in North America and Europe. This report offers comprehensive insights into the global beauty and personal care retail landscape.

Cosmetics and Personal Care Stores Market Company Market Share

This comprehensive Cosmetics and Personal Care Stores Market Report analyzes the global beauty and personal care retail market from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. The report details critical market segments, emerging trends, and competitive strategies of leading cosmetic brands and personal care retailers. Analyzing historical data from 2019-2024 and projected figures for 2025, it provides actionable insights for navigating the dynamic beauty retail market. Explore the future of skincare retail, haircare distribution, fragrance sales, oral hygiene products, and bath and shower essentials through extensive segmentation analysis.

Cosmetics and Personal Care Stores Market Market Structure & Competitive Dynamics

The Cosmetics and Personal Care Stores Market exhibits a moderately concentrated structure, dominated by a few global giants. Major players like L'Oréal, Unilever, Procter & Gamble (P&G), The Estée Lauder Companies, Shiseido, Beiersdorf, LVMH, Kao Corporation, Coty Inc., and Johnson & Johnson command significant market share, driven by extensive brand portfolios, robust R&D capabilities, and vast distribution networks. Innovation ecosystems thrive, fueled by substantial investments in new product development, sustainable sourcing, and direct-to-consumer (DTC) strategies. Regulatory frameworks, including stringent ingredient safety standards and labeling requirements across different regions, shape market entry and product compliance. The market faces competition from product substitutes, such as DIY beauty solutions and multi-purpose products, while evolving end-user trends, including a growing demand for clean beauty, personalized routines, and inclusive product offerings, are significant market shapers. Mergers and acquisitions (M&A) remain a key strategy for consolidating market presence and acquiring innovative brands. Recent M&A activities, such as L'Oréal's acquisition of Skinbetter in September 2022, underscore the ongoing consolidation and strategic expansion within the sector. The estimated value of M&A deals in the beauty sector has reached several billion dollars, indicating aggressive strategic maneuvering. Understanding these dynamics is crucial for predicting future market trajectory and competitive advantages.

Cosmetics and Personal Care Stores Market Industry Trends & Insights

The Cosmetics and Personal Care Stores Market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period. This expansion is propelled by several interconnected trends. The increasing disposable income in emerging economies, coupled with a rising global awareness and demand for aesthetic enhancement and self-care, acts as a primary growth driver. Consumers are increasingly educated about ingredients and product efficacy, leading to a preference for premium and specialized products, particularly in the skincare and haircare segments. Technological disruptions are reshaping the retail experience, with the proliferation of e-commerce, social commerce, and AI-powered personalized recommendations significantly influencing purchasing decisions. The integration of augmented reality (AR) for virtual try-ons and personalized diagnostics is becoming mainstream, enhancing customer engagement and reducing return rates.

Furthermore, a significant shift towards sustainability and ethical sourcing is evident. Consumers are actively seeking cruelty-free cosmetics, eco-friendly packaging, and natural and organic personal care products. Brands that prioritize transparency in their supply chains and demonstrate commitment to environmental responsibility are gaining substantial consumer trust and market penetration. The clean beauty movement is no longer a niche but a dominant force, compelling established players and new entrants alike to reformulate products and adopt sustainable practices.

Competitive dynamics are intensifying, with both established giants and agile startups vying for market share. The rise of indie beauty brands, often leveraging social media for rapid customer acquisition and community building, presents a constant challenge to traditional players. This has spurred large corporations to invest in or acquire these nimble entities, as seen with Unilever's acquisition of a majority stake in Nutrafol in May 2022, a move to bolster their presence in the growing hair wellness sector. The omnichannel retail strategy is becoming paramount, with consumers expecting a seamless experience across online platforms, physical stores, and mobile applications. This requires retailers to invest in robust inventory management systems, personalized marketing campaigns, and engaging in-store experiences that complement their digital offerings. The market penetration of specialized retail formats, like concept stores and professional beauty salons, is also increasing, catering to specific consumer needs and providing expert advice.

Dominant Markets & Segments in Cosmetics and Personal Care Stores Market

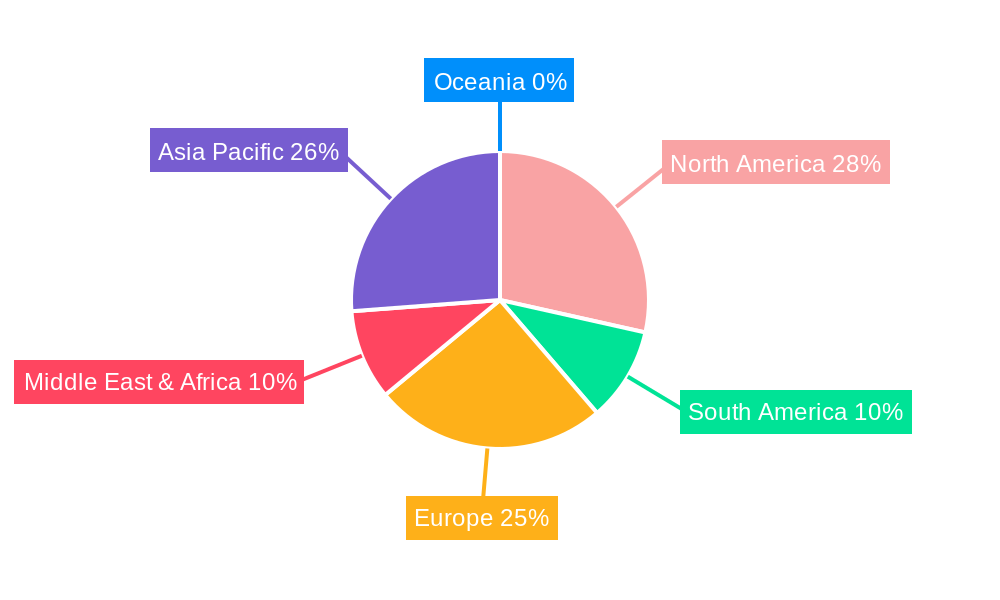

The Cosmetics and Personal Care Stores Market is characterized by significant regional dominance and segment preferences. North America and Europe have historically been leading markets, driven by high consumer spending power, well-established retail infrastructure, and a strong inclination towards premium and innovative beauty products. However, the Asia-Pacific region, particularly China and India, is emerging as the fastest-growing market due to a burgeoning middle class, increasing urbanization, and a rapidly growing awareness of beauty and grooming trends.

Within product segments, Skincare consistently holds the largest market share, accounting for an estimated 35-40% of the total market value. This dominance is attributed to the universal need for skin health and anti-aging solutions, coupled with a growing consumer focus on preventative care and specialized treatments. The Decorative segment, encompassing makeup and color cosmetics, follows closely, driven by evolving fashion trends, social media influence, and a desire for self-expression. Haircare also represents a substantial segment, with increasing demand for specialized treatments for hair loss, damage, and styling. Perfume and Oral-Care segments maintain steady growth, while Bath & Shower products cater to everyday hygiene and relaxation needs.

Distribution channels play a pivotal role in market accessibility and consumer reach. Specialist Retail Stores, including dedicated beauty boutiques and department store beauty counters, continue to be significant, offering curated assortments and personalized customer service. However, Supermarkets/Hypermarkets are gaining traction due to their convenience and wide product availability, attracting a broader consumer base. Pharmacies/Drug Stores are increasingly important for over-the-counter (OTC) dermatological products and a growing range of personal care items. The online channel, encompassing e-commerce websites and mobile applications, is experiencing explosive growth, driven by convenience, wider selection, and competitive pricing.

Key drivers for dominance in specific regions include:

- Economic Policies: Favorable trade agreements and government initiatives promoting retail growth.

- Infrastructure: Advanced logistics and supply chain networks enabling efficient product distribution.

- Consumer Demographics: A young, digitally-savvy population with increasing disposable income.

- Cultural Influence: Growing acceptance and aspiration for beauty and grooming practices.

The dominance analysis reveals a clear trend towards premiumization and personalization within established markets, while emerging markets are characterized by rapid adoption of mass-market products and the growing influence of online retail. The continuous evolution of consumer preferences, from natural ingredients to personalized solutions, necessitates adaptive strategies from players across all segments and distribution channels to maintain and expand their market presence.

Cosmetics and Personal Care Stores Market Product Innovations

Product innovation in the Cosmetics and Personal Care Stores Market is driven by advancements in biotechnology, ingredient science, and sustainable formulation. We are witnessing a surge in personalized skincare solutions, utilizing AI-driven diagnostics and custom-blended formulations to address individual skin concerns. The integration of active ingredients with enhanced delivery systems, such as liposomes and nanocarriers, boosts product efficacy and targets specific skin issues. The clean beauty movement continues to inspire innovation in natural and organic formulations, focusing on biodegradable ingredients and reduced chemical preservatives. Furthermore, the development of multi-functional products, offering benefits across skincare, makeup, and sun protection, caters to the demand for convenience and simplified routines. Technological trends also include the creation of smart beauty devices for at-home use, offering professional-grade treatments. These innovations provide competitive advantages by meeting evolving consumer demands for efficacy, safety, and sustainability, thereby expanding market appeal.

Report Segmentation & Scope

This report segments the Cosmetics and Personal Care Stores Market by Product Type and Distribution Channel. The Product Type segmentation includes Decorative (makeup), Skincare, Haircare, Perfume, Oral-Care, and Bath & Shower products. Each segment's market size and growth projections are analyzed, considering specific consumer preferences and product development trends. For instance, the Skincare segment is projected to maintain its leadership position throughout the forecast period, driven by an aging global population and a growing emphasis on preventative skincare. The Distribution Channel segmentation comprises Specialist Retail Stores, Supermarket/Hypermarket, Convenience Stores, and Pharmacies/Drug Stores. The rapid growth of online retail channels will also be a key consideration, impacting the strategies of brick-and-mortar establishments. This comprehensive segmentation provides a granular understanding of market dynamics, enabling targeted strategic planning.

Key Drivers of Cosmetics and Personal Care Stores Market Growth

The Cosmetics and Personal Care Stores Market growth is propelled by several key factors. Increasing consumer disposable incomes globally, especially in emerging economies, allows for greater expenditure on beauty and personal care products. A pervasive cultural shift towards self-care and grooming, amplified by social media influence, fuels demand across all product categories. Technological advancements, including e-commerce penetration and AI-driven personalization, enhance accessibility and tailor product offerings to individual needs. Furthermore, a growing awareness and demand for ethically sourced, sustainable, and clean beauty products are driving innovation and consumer loyalty towards brands with strong environmental and social governance (ESG) credentials. The continuous introduction of novel products and formulations by leading companies, supported by substantial R&D investments, also plays a crucial role in stimulating market expansion.

Challenges in the Cosmetics and Personal Care Stores Market Sector

Despite robust growth, the Cosmetics and Personal Care Stores Market Sector faces several challenges. Stringent and evolving regulatory landscapes across different countries, particularly concerning ingredient safety, labeling, and advertising claims, can pose compliance hurdles and increase R&D costs. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can impact product availability and manufacturing timelines. Intense competition from a plethora of global brands, agile indie startups, and private-label offerings leads to price pressures and necessitates continuous innovation to maintain market share. Consumer demand for transparency regarding ingredient sourcing and manufacturing processes adds another layer of complexity, requiring significant investment in supply chain visibility and ethical practices. The increasing consumer preference for sustainable packaging and product formulations also presents a challenge, demanding innovative solutions to reduce environmental impact and manage costs.

Leading Players in the Cosmetics and Personal Care Stores Market Market

- Loreal

- Unilever

- P&G

- Estee Lauder

- Shiseido

- Beiersdorf

- LVMH

- Kao

- Coty

- Johnson & Johnson

Key Developments in Cosmetics and Personal Care Stores Market Sector

- April 2023: Reliance Retail entered the beauty space with the launch of Tira, an omnichannel beauty retail platform that will offer a curated assortment of the best global and home-grown brands. This move signifies a major entry into the Indian beauty market, aiming to capture a significant share through a comprehensive retail strategy.

- September 2022: L'Oréal signed an agreement to acquire Skinbetter, which exists as a physician-dispensed American skincare brand. L'Oréal exists among the world's leading beauty players with a portfolio of 35 international brands and more than 85,000 employees globally, this acquisition strengthens its position in the premium and professional skincare segment.

- May 2022: Unilever signed an agreement with Nutrafol to acquire a majority stake in the company from an existing share of 13.2%. Nutrafol is a leading provider of hair wellness products. Nutrafol will be operating as a part of Unilever's health and well-being units with brands like OLLY, Liquid I.V., and Onnnit. This strategic acquisition diversifies Unilever's portfolio and capitalizes on the growing trend of holistic wellness and targeted hair solutions.

Strategic Cosmetics and Personal Care Stores Market Market Outlook

The strategic outlook for the Cosmetics and Personal Care Stores Market is highly promising, driven by continued innovation and evolving consumer behavior. The increasing demand for personalized beauty experiences, fueled by advancements in AI and data analytics, presents significant growth accelerators. Brands that effectively leverage digital platforms for customer engagement, personalized recommendations, and seamless omnichannel shopping will gain a competitive edge. The ongoing shift towards sustainable and ethically produced goods will continue to shape product development and marketing strategies, offering opportunities for brands committed to environmental and social responsibility. Furthermore, the expansion into emerging markets, with their growing middle class and increasing demand for premium beauty products, offers substantial untapped potential. Strategic investments in R&D, particularly in areas like biotechnology and advanced formulations, alongside a focus on building strong brand narratives and community engagement, will be crucial for long-term success and market leadership in the dynamic beauty retail landscape.

Cosmetics and Personal Care Stores Market Segmentation

-

1. Product Type

- 1.1. Decorative

- 1.2. Skincare

- 1.3. Haircare

- 1.4. Perfume

- 1.5. Oral-Care

- 1.6. Bath & Shower

-

2. Distribution Channel

- 2.1. Specialist Retail Stores

- 2.2. Supermarket/Hypermarket

- 2.3. Convenience Stores

- 2.4. Pharmacies/Drug Stores

Cosmetics and Personal Care Stores Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cosmetics and Personal Care Stores Market Regional Market Share

Geographic Coverage of Cosmetics and Personal Care Stores Market

Cosmetics and Personal Care Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Attention Towards Skincare and Beauty Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetics and Personal Care Stores Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Decorative

- 5.1.2. Skincare

- 5.1.3. Haircare

- 5.1.4. Perfume

- 5.1.5. Oral-Care

- 5.1.6. Bath & Shower

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialist Retail Stores

- 5.2.2. Supermarket/Hypermarket

- 5.2.3. Convenience Stores

- 5.2.4. Pharmacies/Drug Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cosmetics and Personal Care Stores Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Decorative

- 6.1.2. Skincare

- 6.1.3. Haircare

- 6.1.4. Perfume

- 6.1.5. Oral-Care

- 6.1.6. Bath & Shower

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Specialist Retail Stores

- 6.2.2. Supermarket/Hypermarket

- 6.2.3. Convenience Stores

- 6.2.4. Pharmacies/Drug Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Cosmetics and Personal Care Stores Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Decorative

- 7.1.2. Skincare

- 7.1.3. Haircare

- 7.1.4. Perfume

- 7.1.5. Oral-Care

- 7.1.6. Bath & Shower

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Specialist Retail Stores

- 7.2.2. Supermarket/Hypermarket

- 7.2.3. Convenience Stores

- 7.2.4. Pharmacies/Drug Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Cosmetics and Personal Care Stores Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Decorative

- 8.1.2. Skincare

- 8.1.3. Haircare

- 8.1.4. Perfume

- 8.1.5. Oral-Care

- 8.1.6. Bath & Shower

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Specialist Retail Stores

- 8.2.2. Supermarket/Hypermarket

- 8.2.3. Convenience Stores

- 8.2.4. Pharmacies/Drug Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Cosmetics and Personal Care Stores Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Decorative

- 9.1.2. Skincare

- 9.1.3. Haircare

- 9.1.4. Perfume

- 9.1.5. Oral-Care

- 9.1.6. Bath & Shower

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Specialist Retail Stores

- 9.2.2. Supermarket/Hypermarket

- 9.2.3. Convenience Stores

- 9.2.4. Pharmacies/Drug Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Cosmetics and Personal Care Stores Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Decorative

- 10.1.2. Skincare

- 10.1.3. Haircare

- 10.1.4. Perfume

- 10.1.5. Oral-Care

- 10.1.6. Bath & Shower

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Specialist Retail Stores

- 10.2.2. Supermarket/Hypermarket

- 10.2.3. Convenience Stores

- 10.2.4. Pharmacies/Drug Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Loreal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unilever

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 P&G

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Estee Lauder

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shiseido

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Beiersdorf

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LVMH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kao

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Coty

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Johnson& Johnson*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Loreal

List of Figures

- Figure 1: Global Cosmetics and Personal Care Stores Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cosmetics and Personal Care Stores Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Cosmetics and Personal Care Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cosmetics and Personal Care Stores Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Cosmetics and Personal Care Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Cosmetics and Personal Care Stores Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cosmetics and Personal Care Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cosmetics and Personal Care Stores Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: South America Cosmetics and Personal Care Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Cosmetics and Personal Care Stores Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Cosmetics and Personal Care Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Cosmetics and Personal Care Stores Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Cosmetics and Personal Care Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cosmetics and Personal Care Stores Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe Cosmetics and Personal Care Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Cosmetics and Personal Care Stores Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Cosmetics and Personal Care Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Cosmetics and Personal Care Stores Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Cosmetics and Personal Care Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cosmetics and Personal Care Stores Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Cosmetics and Personal Care Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Cosmetics and Personal Care Stores Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Cosmetics and Personal Care Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Cosmetics and Personal Care Stores Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cosmetics and Personal Care Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cosmetics and Personal Care Stores Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Cosmetics and Personal Care Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Cosmetics and Personal Care Stores Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Cosmetics and Personal Care Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Cosmetics and Personal Care Stores Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Cosmetics and Personal Care Stores Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Cosmetics and Personal Care Stores Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cosmetics and Personal Care Stores Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetics and Personal Care Stores Market?

The projected CAGR is approximately 5.31%.

2. Which companies are prominent players in the Cosmetics and Personal Care Stores Market?

Key companies in the market include Loreal, Unilever, P&G, Estee Lauder, Shiseido, Beiersdorf, LVMH, Kao, Coty, Johnson& Johnson*List Not Exhaustive.

3. What are the main segments of the Cosmetics and Personal Care Stores Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 535.18 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Attention Towards Skincare and Beauty Care Products.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: Reliance Retail entered the beauty space with the launch of Tira, an omnichannel beauty retail platform that will offer a curated assortment of the best global and home-grown brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetics and Personal Care Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetics and Personal Care Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetics and Personal Care Stores Market?

To stay informed about further developments, trends, and reports in the Cosmetics and Personal Care Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence