Key Insights

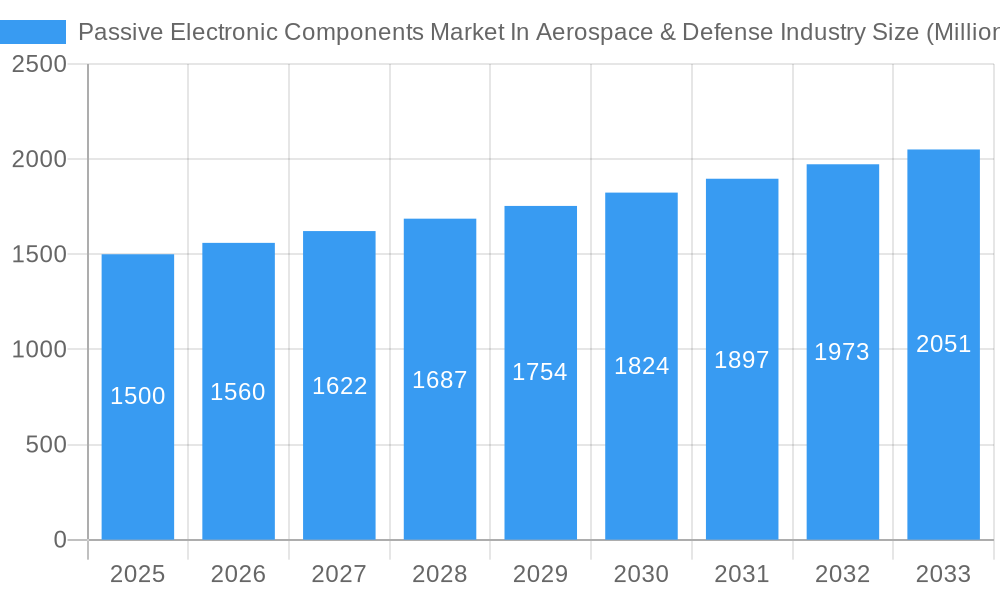

The Passive Electronic Components market in the Aerospace & Defense industry is experiencing steady growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. This expansion is fueled by several key factors. Increasing demand for advanced avionics systems, sophisticated radar technologies, and the growing adoption of unmanned aerial vehicles (UAVs) and other autonomous systems are significant drivers. Furthermore, the ongoing need for enhanced safety and reliability in aerospace and defense applications necessitates the use of high-quality, durable passive components. Technological advancements leading to miniaturization, improved performance, and increased energy efficiency are also contributing to market growth. The market is segmented by component type, with capacitors, inductors, and resistors being the major contributors. Key players such as Vishay Intertechnology, AVX Corporation, KEMET Corporation, and TDK Corporation are actively involved in developing and supplying these components, often tailored to the stringent requirements of the aerospace and defense sector. Competitive landscape is intense, driven by continuous innovation and the need for components that withstand extreme operating conditions. The geographic distribution of the market reflects the concentration of aerospace and defense activities, with North America and Europe holding significant market shares initially, followed by a growing contribution from the Asia-Pacific region due to increasing defense spending and technological advancements in the area.

Passive Electronic Components Market In Aerospace & Defense Industry Market Size (In Billion)

While the market enjoys significant growth drivers, certain restraints exist. High initial investment costs for developing specialized components and rigorous quality control processes can hinder market expansion. Furthermore, the cyclical nature of government defense spending can impact market growth in certain years. Despite these challenges, the long-term outlook for the Passive Electronic Components market in the Aerospace & Defense industry remains positive, driven by continuous technological advancements, rising defense budgets globally, and increased demand for advanced aerospace and defense systems. The market is expected to witness significant expansion across all segments and regions in the forecast period, further solidifying its importance within the broader electronics industry.

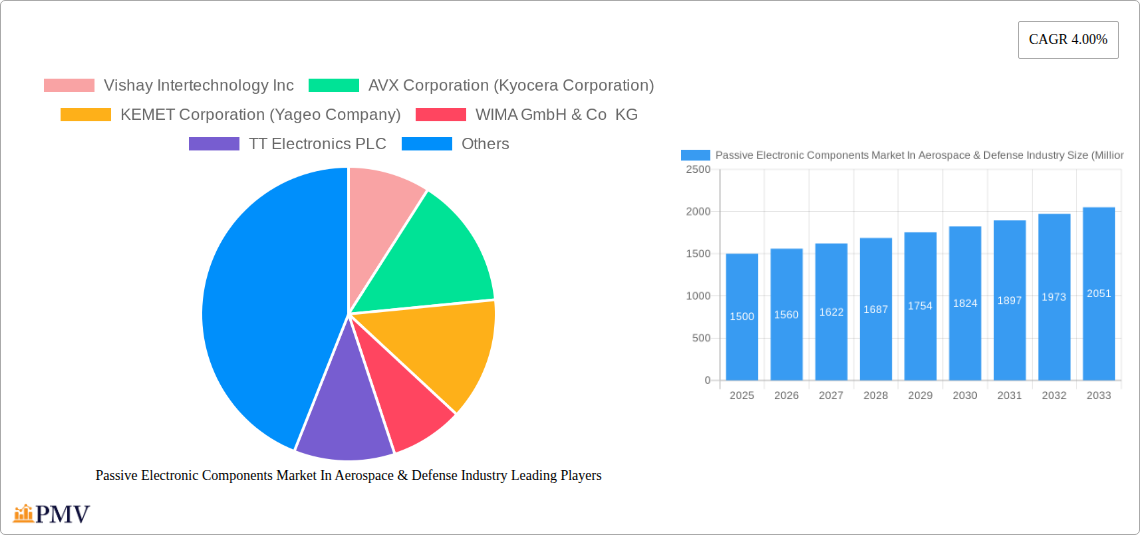

Passive Electronic Components Market In Aerospace & Defense Industry Company Market Share

Passive Electronic Components Market in Aerospace & Defense Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Passive Electronic Components Market in the Aerospace & Defense Industry, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The study covers the period 2019-2033, with 2025 as the base and estimated year. The report utilizes a robust methodology to forecast market trends and growth opportunities, providing crucial data for informed decision-making.

Passive Electronic Components Market In Aerospace & Defense Industry Market Structure & Competitive Dynamics

The Aerospace & Defense Passive Electronic Components market exhibits a moderately consolidated structure, with several major players holding significant market share. The market concentration is influenced by factors such as technological advancements, stringent regulatory frameworks, and the demand for high-reliability components. Innovation ecosystems play a vital role, driving continuous improvement in component performance and miniaturization. The market witnesses significant M&A activity, with larger companies acquiring smaller players to expand their product portfolios and technological capabilities. Key metrics influencing market dynamics include market share, which is currently dominated by a handful of players, and M&A deal values, which have seen fluctuations based on market conditions. Furthermore, the industry is characterized by a relatively high barrier to entry due to stringent quality and safety standards. The availability of substitute components, albeit limited due to the specific requirements of aerospace and defense applications, also impacts the competitive landscape. End-user trends, particularly the shift toward lighter, more efficient aircraft and defense systems, drive demand for smaller, more powerful components. These trends create lucrative opportunities for players offering advanced technologies and high-reliability solutions. Analyzing the competitive dynamics, we find that approximately xx Million in M&A deals occurred in the past five years, primarily driven by the consolidation of component manufacturing. The top five companies hold a combined market share of approximately xx%.

- Market Concentration: Moderately Consolidated

- Innovation Ecosystems: Active, driving miniaturization and performance enhancements.

- Regulatory Frameworks: Stringent, impacting component design and certification.

- Product Substitutes: Limited, due to stringent performance requirements.

- End-User Trends: Shift towards lighter, more efficient systems.

- M&A Activities: Significant, leading to market consolidation.

Passive Electronic Components Market In Aerospace & Defense Industry Industry Trends & Insights

The Aerospace & Defense Passive Electronic Components market is experiencing robust growth, driven by increasing demand for advanced electronic systems in both aerospace and defense applications. The market's CAGR from 2025 to 2033 is projected at xx%, fueled by several key factors. Technological disruptions, such as the increasing adoption of miniaturized components and advanced materials, are transforming the landscape. Consumer preferences are shifting towards higher performance, reliability, and reduced weight, which necessitates the development of innovative passive components. The competitive dynamics are intense, with companies investing heavily in R&D to develop next-generation technologies and gain a competitive edge. The market penetration of advanced components, such as high-frequency capacitors and inductors, is increasing steadily, reflecting a growing adoption of sophisticated electronics in modern aircraft and defense systems. The escalating demand for autonomous systems and smart technologies across both aerospace and defense sectors is further propelling market growth. This is complemented by increasing government investments in defense modernization and an expanding aerospace industry. The market shows significant growth potential with an estimated market size of xx Million by 2033.

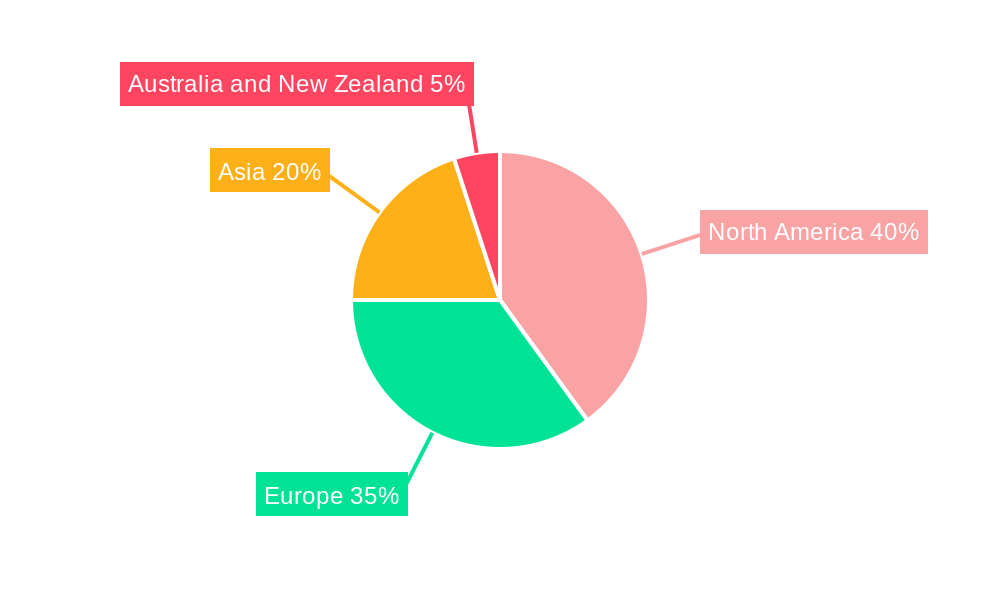

Dominant Markets & Segments in Passive Electronic Components Market In Aerospace & Defense Industry

The North American region currently holds the dominant position in the Aerospace & Defense Passive Electronic Components market, driven by significant investments in defense modernization and a robust aerospace manufacturing base. The United States, in particular, is a key growth driver, fueled by strong government procurement and a thriving private sector. This dominance is attributed to several key factors:

- Economic Policies: Strong government support for defense and aerospace industries.

- Infrastructure: Well-developed manufacturing infrastructure and supply chains.

- Technological Advancements: High level of innovation and technological leadership.

- Strong Domestic Demand: Significant domestic demand for military and civilian aircraft.

Among the product segments, capacitors currently hold the largest market share, driven by their widespread use in various electronic systems. Inductors and resistors are also experiencing significant growth, driven by the increasing adoption of high-frequency applications and sophisticated electronic designs. The market size for capacitors is estimated at xx Million in 2025, while inductors and resistors account for xx Million and xx Million respectively. These numbers are projected to grow substantially by 2033.

Passive Electronic Components Market In Aerospace & Defense Industry Product Innovations

Recent product innovations highlight the focus on miniaturization, higher performance, and improved reliability. The introduction of smaller, lighter, and more efficient passive components is driven by the demand for advanced electronic systems in aerospace and defense applications. Key innovations include advanced material usage, improved packaging technologies, and the development of components with enhanced temperature stability and radiation hardness. These advancements improve the overall performance and reliability of electronic systems in harsh environments. These innovations are crucial for gaining a competitive edge, ensuring market fit, and catering to the evolving demands of the aerospace and defense industries.

Report Segmentation & Scope

The report segments the market by component type:

Capacitors: This segment encompasses various capacitor types used in aerospace and defense applications, including ceramic capacitors, film capacitors, and electrolytic capacitors. The growth of this segment is projected at xx% CAGR during the forecast period, driven by the increasing demand for high-frequency and high-voltage applications. The market size in 2025 is estimated at xx Million. Competitive dynamics are characterized by a mix of established players and emerging companies focusing on specialized capacitor types.

Inductors: This segment includes various inductor types, including chip inductors, power inductors, and RF inductors. This segment exhibits a xx% CAGR during the forecast period, fueled by increasing demand for high-frequency applications and the growth of power electronics in aerospace and defense systems. The market size in 2025 is estimated at xx Million. Competitive intensity is high with several players offering specialized inductor solutions.

Resistors: This segment comprises various resistor types, including thin-film resistors, thick-film resistors, and wire-wound resistors. Growth in this segment is driven by the need for high precision and stability in critical aerospace and defense systems. It is projected to have a xx% CAGR during the forecast period, with a 2025 market size of xx Million. Competitive dynamics are similar to the inductor segment, with several players competing in this area.

Key Drivers of Passive Electronic Components Market In Aerospace & Defense Industry Growth

Several factors fuel the growth of the Passive Electronic Components market in the Aerospace & Defense sector:

- Technological advancements: Miniaturization, higher performance, and improved reliability are driving demand for advanced components.

- Stringent regulatory requirements: Stringent safety and quality standards necessitate the use of high-reliability components.

- Increased defense spending: Government investments in defense modernization are boosting demand for sophisticated electronic systems.

- Growth of the aerospace industry: Expansion of the commercial and military aerospace sectors fuels demand for advanced electronic components.

Challenges in the Passive Electronic Components Market In Aerospace & Defense Industry Sector

The market faces several challenges, including:

- Supply chain disruptions: Global supply chain vulnerabilities can impact the availability and cost of components.

- Stringent quality and certification requirements: Meeting strict industry standards adds to the cost and complexity of component development and manufacturing.

- High-entry barriers: The need for specialized expertise and significant capital investment discourages new entrants.

- Price competition: Intense competition can lead to price pressure, impacting profitability. This has a quantifiable impact, decreasing profit margins by an estimated xx% in recent years.

Leading Players in the Passive Electronic Components Market In Aerospace & Defense Industry Market

- Vishay Intertechnology Inc

- AVX Corporation (Kyocera Corporation)

- KEMET Corporation (Yageo Company)

- WIMA GmbH & Co KG

- TT Electronics PLC

- TE Connectivity

- Cornell Dubilier Electronics Inc

- API Delevan (Fortive Corporation)

- Taiyo Yuden Co Ltd

- Bourns Inc

- TDK Corporation

- Ohmite Manufacturing Company

- Panasonic Corporation

- Honeywell International Inc

- Eaton Corporation

Key Developments in Passive Electronic Components Market In Aerospace & Defense Industry Sector

April 2023: Cornell Dubilier Electronics Inc. announced a new line of standard supercapacitor modules (DSM series), offering higher voltage capabilities than individual devices. This expands the applicability of supercapacitors in aerospace and defense systems requiring high energy storage.

March 2023: API Delevan released its S0603 and S0402 space SMD inductors, designed for space, downhole, medical, and other harsh environment applications. These inductors offer improved temperature stability, low outgassing, and high Q values, addressing key challenges in aerospace and defense electronics.

Strategic Passive Electronic Components Market In Aerospace & Defense Industry Market Outlook

The future of the Passive Electronic Components market in the Aerospace & Defense industry is bright, with continued growth driven by technological advancements, increasing defense spending, and the expansion of the aerospace industry. Strategic opportunities exist for companies that can innovate and develop high-performance, reliable components that meet the stringent requirements of this demanding sector. Focusing on miniaturization, improved energy efficiency, and enhanced reliability will be key for success in this market. The market offers substantial potential for companies that can effectively address the challenges of supply chain management and certification requirements.

Passive Electronic Components Market In Aerospace & Defense Industry Segmentation

-

1. Type

- 1.1. Capacitors

- 1.2. Inductors

- 1.3. Resistors

Passive Electronic Components Market In Aerospace & Defense Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

Passive Electronic Components Market In Aerospace & Defense Industry Regional Market Share

Geographic Coverage of Passive Electronic Components Market In Aerospace & Defense Industry

Passive Electronic Components Market In Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Advanced Electronic Devices in Aerospace & Defense Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Price of Critical Metals Used in Manufacturing of Passive Electronic Components

- 3.4. Market Trends

- 3.4.1. Increase in Defense Spending is Expected to Propel the Industry's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Capacitors

- 5.1.2. Inductors

- 5.1.3. Resistors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Capacitors

- 6.1.2. Inductors

- 6.1.3. Resistors

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Capacitors

- 7.1.2. Inductors

- 7.1.3. Resistors

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Capacitors

- 8.1.2. Inductors

- 8.1.3. Resistors

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Capacitors

- 9.1.2. Inductors

- 9.1.3. Resistors

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Vishay Intertechnology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AVX Corporation (Kyocera Corporation)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 KEMET Corporation (Yageo Company)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 WIMA GmbH & Co KG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 TT Electronics PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 TE Connectivity

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cornell Dubilier Electronics Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 API Delevan ( Fortive Corporation)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Taiyo Yuden Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bourns Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 TDK Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Ohmite Manufacturing Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Panasonic Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Honeywell International Inc *List Not Exhaustive

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Eaton Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passive Electronic Components Market In Aerospace & Defense Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Passive Electronic Components Market In Aerospace & Defense Industry?

Key companies in the market include Vishay Intertechnology Inc, AVX Corporation (Kyocera Corporation), KEMET Corporation (Yageo Company), WIMA GmbH & Co KG, TT Electronics PLC, TE Connectivity, Cornell Dubilier Electronics Inc, API Delevan ( Fortive Corporation), Taiyo Yuden Co Ltd, Bourns Inc, TDK Corporation, Ohmite Manufacturing Company, Panasonic Corporation, Honeywell International Inc *List Not Exhaustive, Eaton Corporation.

3. What are the main segments of the Passive Electronic Components Market In Aerospace & Defense Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Advanced Electronic Devices in Aerospace & Defense Industry.

6. What are the notable trends driving market growth?

Increase in Defense Spending is Expected to Propel the Industry's Growth.

7. Are there any restraints impacting market growth?

Increasing Price of Critical Metals Used in Manufacturing of Passive Electronic Components.

8. Can you provide examples of recent developments in the market?

April 2023: Cornell Dubilier Electronics Inc. announced a new line of standard supercapacitor modules. The DSM series addresses the need for supercapacitor storage capability at higher voltages than individual devices can provide. The new modules come in packs of 6, 3, or 10 cells in series for 18V, 9V, and 30V outputs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passive Electronic Components Market In Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passive Electronic Components Market In Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passive Electronic Components Market In Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Passive Electronic Components Market In Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence