Key Insights

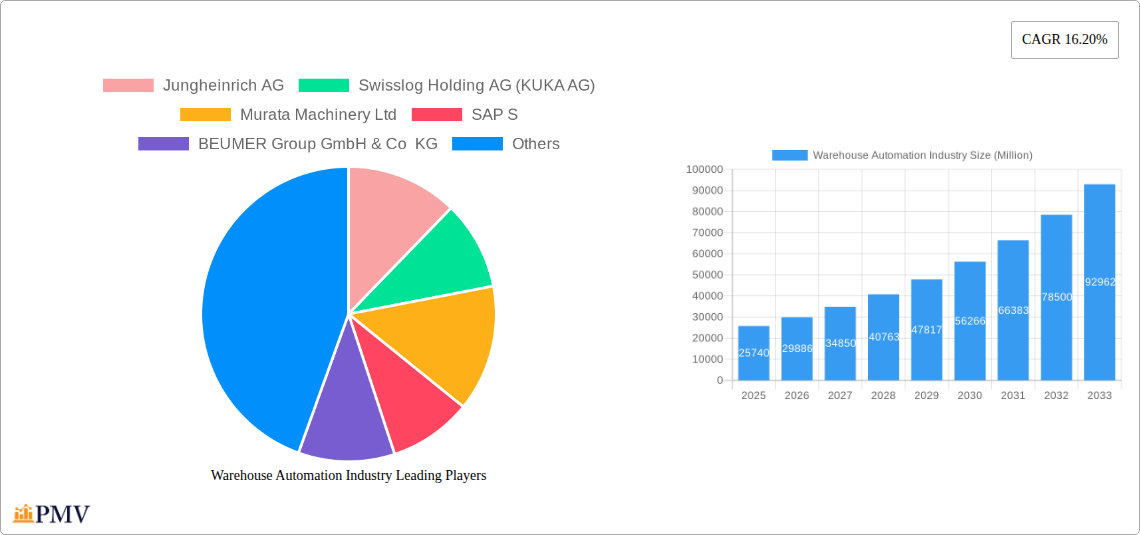

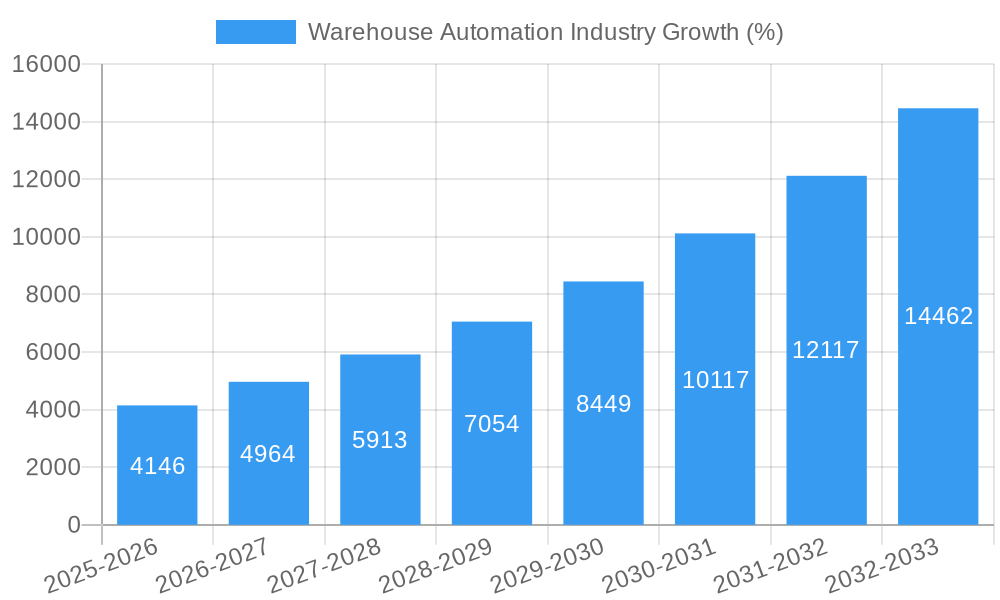

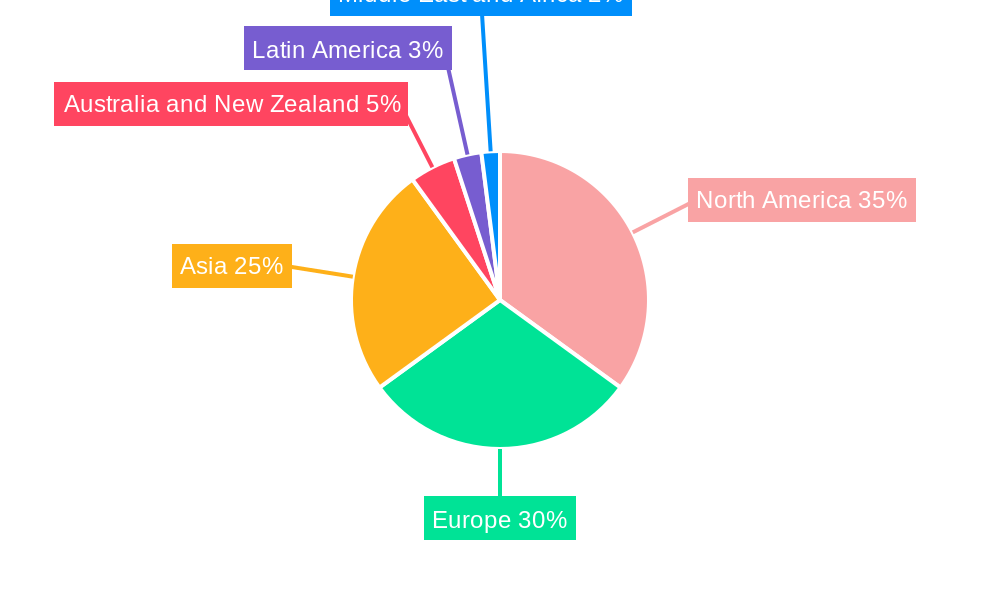

The warehouse automation market, valued at $25.74 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 16.20% from 2025 to 2033. This surge is driven by the increasing demand for efficient order fulfillment, rising labor costs, and the growing adoption of e-commerce. Key drivers include the integration of advanced technologies like Artificial Intelligence (AI), machine learning (ML), and the Internet of Things (IoT) for improved inventory management, optimized workflows, and enhanced operational visibility. Furthermore, the expansion of automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and sophisticated warehouse management systems (WMS) are streamlining warehouse operations and boosting productivity. The market is segmented by component (hardware, software, services) and end-user (food & beverage, post & parcel, retail, apparel, manufacturing, and others). The hardware segment, encompassing robots and automated storage and retrieval systems (AS/RS), constitutes a significant portion of the market share, closely followed by the software segment, which includes WMS and WES solutions vital for seamless integration and data analysis. The services segment provides essential support through value-added services, maintenance, and technical expertise. Geographically, North America and Europe currently hold substantial market shares due to early adoption and strong technological advancements, but the Asia-Pacific region is anticipated to witness significant growth in the coming years, fueled by rapid industrialization and e-commerce expansion.

The competitive landscape is characterized by a mix of established players and emerging technology providers. Leading companies like Jungheinrich AG, Swisslog, and Dematic are leveraging their extensive experience and comprehensive product portfolios to maintain market leadership. However, innovative start-ups and specialized solution providers are challenging the status quo with niche offerings and disruptive technologies. Continued investment in research and development across the industry is crucial for enhancing automation capabilities, driving down costs, and improving the overall efficiency and scalability of warehouse automation solutions. The future of warehouse automation points towards a more integrated, intelligent, and adaptable ecosystem, meeting the evolving needs of a dynamic and increasingly demanding global supply chain. The integration of advanced analytics and predictive capabilities will further enhance operational efficiency, reduce waste, and optimize overall warehouse performance.

Warehouse Automation Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global warehouse automation industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for stakeholders across the value chain, from hardware and software providers to end-user industries. The total market value is projected to reach xx Million by 2033.

Warehouse Automation Industry Market Structure & Competitive Dynamics

The warehouse automation market is characterized by a moderately concentrated structure, with several major players holding significant market share. Key competitors such as Jungheinrich AG, Swisslog Holding AG (KUKA AG), and Daifuku Co Limited compete fiercely through technological innovation, strategic partnerships, and mergers and acquisitions (M&A). The market concentration ratio (CR5) is estimated at xx%, reflecting the influence of leading companies. Innovation ecosystems are dynamic, with constant developments in robotics, AI, and software solutions driving market expansion. Regulatory frameworks vary across regions, impacting deployment and adoption rates. Product substitutes, such as manual labor, are gradually losing relevance due to increasing labor costs and efficiency demands. End-user trends show a growing preference for automated solutions to optimize supply chain operations and enhance agility.

M&A activities have significantly shaped the market landscape. For instance, the March 2024 acquisition of One Network Enterprises by Blue Yonder for approximately USD 839 Million illustrates the strategic importance of expanding capabilities in warehouse management and supply chain optimization. Other significant M&A deals, including (but not limited to) xx deals valued at xx Million in total, demonstrate a consolidation trend in the industry. These deals have increased market concentration and created synergies for the involved companies.

Warehouse Automation Industry Industry Trends & Insights

The warehouse automation market is experiencing robust growth, driven by factors such as the rise of e-commerce, increasing labor costs, and the need for greater supply chain efficiency. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Technological advancements, particularly in robotics, AI, and cloud-based software, are revolutionizing warehouse operations. The market penetration of automated guided vehicles (AGVs), automated storage and retrieval systems (AS/RS), and warehouse management systems (WMS) continues to rise, driven by increasing demand for faster order fulfillment and reduced operational costs. Consumer preferences for fast and reliable deliveries are also fueling the adoption of automation technologies. Competitive dynamics are intense, with companies continually innovating and seeking to differentiate their offerings through unique features, enhanced capabilities, and superior customer support. The industry is seeing increased adoption of autonomous mobile robots (AMRs), collaborative robots (cobots), and advanced analytics solutions to optimize warehouse processes. The integration of these technologies is enhancing warehouse productivity, increasing throughput, and improving overall efficiency.

Dominant Markets & Segments in Warehouse Automation Industry

Dominant Regions/Countries: North America and Europe currently hold the largest market shares, driven by robust e-commerce growth, established logistics infrastructure, and high adoption rates of automation technologies. However, Asia-Pacific is poised for significant growth due to rapid economic expansion and increasing investments in logistics infrastructure.

Dominant Segments:

By Component: Hardware (including AS/RS, conveyors, and AGVs) constitutes the largest segment by market value, owing to high initial investment costs. However, the software segment (WMS and WES) is experiencing rapid growth due to the rising demand for sophisticated warehouse management and control solutions.

By End-User: The food and beverage industry is a major adopter of warehouse automation due to stringent quality control requirements and the need for efficient temperature-controlled storage. Other large end-users include retail, manufacturing, and post and parcel, each experiencing significant automation implementation.

Key Drivers:

- Economic Policies: Government incentives and support for automation adoption are boosting market growth in several regions.

- Infrastructure: Development of modern warehousing facilities and improved logistics networks facilitate the implementation of automated systems.

- Technological Advancements: Continuous innovations in robotics, AI, and software are enhancing the efficiency and capabilities of warehouse automation solutions.

Warehouse Automation Industry Product Innovations

Recent product innovations focus on advanced robotics, particularly AMRs and piece-picking robots, designed for seamless integration and flexible deployment in various warehouse environments. The industry is witnessing a growing trend towards modular and scalable solutions to accommodate diverse needs. This adaptability, combined with advanced software solutions such as WMS and WES, enables companies to improve efficiency and reduce operational costs while optimizing their supply chain. The introduction of cloud-based solutions is further enhancing scalability, data analytics, and remote management capabilities, providing a clear competitive edge.

Report Segmentation & Scope

The report segments the warehouse automation market by component (hardware, software, and services) and by end-user (food and beverage, post and parcel, retail, apparel, manufacturing, and others). Each segment includes detailed analysis of market size, growth projections, and competitive dynamics. The hardware segment includes growth projections based on increasing demand for robotics and material handling systems. The software segment analysis covers both WMS and WES, with projections based on growing adoption of cloud-based solutions and integration with other technologies. The services segment considers aspects like value-added services, maintenance, and support, which are essential for the sustained operation and optimization of automated systems. End-user segments are analyzed based on industry-specific needs, adoption rates, and anticipated growth based on factors like e-commerce expansion and industry-specific regulations.

Key Drivers of Warehouse Automation Industry Growth

Several factors are driving the growth of the warehouse automation industry. Technological advancements, such as the development of sophisticated robotics and AI-powered software, are increasing efficiency and reducing labor costs. E-commerce expansion is creating a surge in demand for faster and more efficient order fulfillment. Furthermore, government regulations and incentives promoting automation are creating a favorable environment for adoption. The need for enhanced supply chain resilience and flexibility in the face of global uncertainties also adds to the momentum of the warehouse automation market.

Challenges in the Warehouse Automation Industry Sector

Despite significant growth potential, the warehouse automation industry faces challenges. High initial investment costs can hinder adoption, particularly for small and medium-sized enterprises. Integration complexities between different systems and the need for skilled labor are significant barriers. Moreover, concerns about job displacement due to automation and the cybersecurity risks associated with interconnected systems need to be addressed. Supply chain disruptions and the volatility of raw material prices also impact the cost and availability of automation solutions. The combined effect of these challenges could reduce the industry's growth rate by an estimated xx% in the short-term.

Leading Players in the Warehouse Automation Industry Market

- Jungheinrich AG

- Swisslog Holding AG (KUKA AG)

- Murata Machinery Ltd

- SAP S

- BEUMER Group GmbH & Co KG

- Daifuku Co Limited

- Honeywell Intelligrated (Honeywell International Inc)

- SSI Schaefer AG

- WITRON Logistik + Informatik GmbH

- TGW Logistics Group GmbH

- Kardex Group

- Oracle Corporation

- One Network Enterprises Inc

- Vanderlande Industries BV

- Knapp AG

- Mecalux SA

- Dematic Group (Kion Group AG)

Key Developments in Warehouse Automation Industry Sector

- July 2023: Jungheinrich premiered its latest mobile robot solution at LogiMAT 2023, showcasing advancements in adaptable and easily integrable warehouse automation. This launch signifies a focus on enhancing flexibility and efficiency within existing warehouse environments.

- March 2024: Blue Yonder's acquisition of One Network Enterprises for approximately USD 839 Million highlights the strategic consolidation occurring within the industry and positions Blue Yonder as a significant force in integrated supply chain solutions.

Strategic Warehouse Automation Industry Market Outlook

The warehouse automation market is poised for continued strong growth, driven by sustained e-commerce expansion and increasing adoption across diverse industries. The focus on enhancing supply chain resilience, operational efficiency, and data-driven decision-making will further fuel demand for advanced automation solutions. Strategic opportunities exist for companies to invest in innovative technologies, expand into new markets, and foster strategic partnerships to capitalize on the growth potential of this dynamic sector. The integration of AI and machine learning will further shape the future, creating intelligent and adaptive warehouse systems that are able to learn and respond to changing conditions.

Warehouse Automation Industry Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Mobile Robots (AGV, AMR)

- 1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 1.1.3. Automated Conveyor & Sorting Systems

- 1.1.4. De-palletizing/Palletizing Systems

- 1.1.5. Automati

- 1.1.6. Piece Picking Robots

- 1.2. Software

- 1.3. Services (Value Added Services, Maintenance, etc.)

-

1.1. Hardware

-

2. End-User

- 2.1. Food and

- 2.2. Post and Parcel

- 2.3. Retail

- 2.4. Apparel

- 2.5. Manufacturing (Durable and Non-Durable)

- 2.6. Other End-user Industries

Warehouse Automation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Warehouse Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability

- 3.3. Market Restrains

- 3.3.1. Optimizing Battery Life of Hearable Device

- 3.4. Market Trends

- 3.4.1. Retail to Have a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Mobile Robots (AGV, AMR)

- 5.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.1.3. Automated Conveyor & Sorting Systems

- 5.1.1.4. De-palletizing/Palletizing Systems

- 5.1.1.5. Automati

- 5.1.1.6. Piece Picking Robots

- 5.1.2. Software

- 5.1.3. Services (Value Added Services, Maintenance, etc.)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Food and

- 5.2.2. Post and Parcel

- 5.2.3. Retail

- 5.2.4. Apparel

- 5.2.5. Manufacturing (Durable and Non-Durable)

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.1.1. Mobile Robots (AGV, AMR)

- 6.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.3. Automated Conveyor & Sorting Systems

- 6.1.1.4. De-palletizing/Palletizing Systems

- 6.1.1.5. Automati

- 6.1.1.6. Piece Picking Robots

- 6.1.2. Software

- 6.1.3. Services (Value Added Services, Maintenance, etc.)

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Food and

- 6.2.2. Post and Parcel

- 6.2.3. Retail

- 6.2.4. Apparel

- 6.2.5. Manufacturing (Durable and Non-Durable)

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.1.1. Mobile Robots (AGV, AMR)

- 7.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.1.3. Automated Conveyor & Sorting Systems

- 7.1.1.4. De-palletizing/Palletizing Systems

- 7.1.1.5. Automati

- 7.1.1.6. Piece Picking Robots

- 7.1.2. Software

- 7.1.3. Services (Value Added Services, Maintenance, etc.)

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Food and

- 7.2.2. Post and Parcel

- 7.2.3. Retail

- 7.2.4. Apparel

- 7.2.5. Manufacturing (Durable and Non-Durable)

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.1.1. Mobile Robots (AGV, AMR)

- 8.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.1.3. Automated Conveyor & Sorting Systems

- 8.1.1.4. De-palletizing/Palletizing Systems

- 8.1.1.5. Automati

- 8.1.1.6. Piece Picking Robots

- 8.1.2. Software

- 8.1.3. Services (Value Added Services, Maintenance, etc.)

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Food and

- 8.2.2. Post and Parcel

- 8.2.3. Retail

- 8.2.4. Apparel

- 8.2.5. Manufacturing (Durable and Non-Durable)

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.1.1. Mobile Robots (AGV, AMR)

- 9.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.1.3. Automated Conveyor & Sorting Systems

- 9.1.1.4. De-palletizing/Palletizing Systems

- 9.1.1.5. Automati

- 9.1.1.6. Piece Picking Robots

- 9.1.2. Software

- 9.1.3. Services (Value Added Services, Maintenance, etc.)

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Food and

- 9.2.2. Post and Parcel

- 9.2.3. Retail

- 9.2.4. Apparel

- 9.2.5. Manufacturing (Durable and Non-Durable)

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.1.1. Mobile Robots (AGV, AMR)

- 10.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 10.1.1.3. Automated Conveyor & Sorting Systems

- 10.1.1.4. De-palletizing/Palletizing Systems

- 10.1.1.5. Automati

- 10.1.1.6. Piece Picking Robots

- 10.1.2. Software

- 10.1.3. Services (Value Added Services, Maintenance, etc.)

- 10.1.1. Hardware

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Food and

- 10.2.2. Post and Parcel

- 10.2.3. Retail

- 10.2.4. Apparel

- 10.2.5. Manufacturing (Durable and Non-Durable)

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.1.1. Mobile Robots (AGV, AMR)

- 11.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 11.1.1.3. Automated Conveyor & Sorting Systems

- 11.1.1.4. De-palletizing/Palletizing Systems

- 11.1.1.5. Automati

- 11.1.1.6. Piece Picking Robots

- 11.1.2. Software

- 11.1.3. Services (Value Added Services, Maintenance, etc.)

- 11.1.1. Hardware

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Food and

- 11.2.2. Post and Parcel

- 11.2.3. Retail

- 11.2.4. Apparel

- 11.2.5. Manufacturing (Durable and Non-Durable)

- 11.2.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Jungheinrich AG

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Swisslog Holding AG (KUKA AG)

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Murata Machinery Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 SAP S

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 BEUMER Group GmbH & Co KG

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Daifuku Co Limited

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Honeywell Intelligrated (Honeywell International Inc )

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 SSI Schaefer AG

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 WITRON Logistik + Informatik GmbH

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 TGW Logistics Group GmbH

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Kardex Group

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Oracle Corporation

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 One Network Enterprises Inc

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Vanderlande Industries BV

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Knapp AG

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 Mecalux SA

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.17 Dematic Group (Kion Group AG)

- 18.2.17.1. Overview

- 18.2.17.2. Products

- 18.2.17.3. SWOT Analysis

- 18.2.17.4. Recent Developments

- 18.2.17.5. Financials (Based on Availability)

- 18.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global Warehouse Automation Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Warehouse Automation Industry Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Warehouse Automation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Warehouse Automation Industry Revenue (Million), by End-User 2024 & 2032

- Figure 17: North America Warehouse Automation Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 18: North America Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Warehouse Automation Industry Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Warehouse Automation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Warehouse Automation Industry Revenue (Million), by End-User 2024 & 2032

- Figure 23: Europe Warehouse Automation Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 24: Europe Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Warehouse Automation Industry Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Warehouse Automation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Warehouse Automation Industry Revenue (Million), by End-User 2024 & 2032

- Figure 29: Asia Warehouse Automation Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 30: Asia Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Warehouse Automation Industry Revenue (Million), by Component 2024 & 2032

- Figure 33: Australia and New Zealand Warehouse Automation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 34: Australia and New Zealand Warehouse Automation Industry Revenue (Million), by End-User 2024 & 2032

- Figure 35: Australia and New Zealand Warehouse Automation Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 36: Australia and New Zealand Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Warehouse Automation Industry Revenue (Million), by Component 2024 & 2032

- Figure 39: Latin America Warehouse Automation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 40: Latin America Warehouse Automation Industry Revenue (Million), by End-User 2024 & 2032

- Figure 41: Latin America Warehouse Automation Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 42: Latin America Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Warehouse Automation Industry Revenue (Million), by Component 2024 & 2032

- Figure 45: Middle East and Africa Warehouse Automation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 46: Middle East and Africa Warehouse Automation Industry Revenue (Million), by End-User 2024 & 2032

- Figure 47: Middle East and Africa Warehouse Automation Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 48: Middle East and Africa Warehouse Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Warehouse Automation Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Warehouse Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global Warehouse Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 18: Global Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 19: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 21: Global Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 25: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 27: Global Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 28: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Global Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 31: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global Warehouse Automation Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 34: Global Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Warehouse Automation Industry?

The projected CAGR is approximately 16.20%.

2. Which companies are prominent players in the Warehouse Automation Industry?

Key companies in the market include Jungheinrich AG, Swisslog Holding AG (KUKA AG), Murata Machinery Ltd, SAP S, BEUMER Group GmbH & Co KG, Daifuku Co Limited, Honeywell Intelligrated (Honeywell International Inc ), SSI Schaefer AG, WITRON Logistik + Informatik GmbH, TGW Logistics Group GmbH, Kardex Group, Oracle Corporation, One Network Enterprises Inc, Vanderlande Industries BV, Knapp AG, Mecalux SA, Dematic Group (Kion Group AG).

3. What are the main segments of the Warehouse Automation Industry?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability.

6. What are the notable trends driving market growth?

Retail to Have a Significant Growth.

7. Are there any restraints impacting market growth?

Optimizing Battery Life of Hearable Device.

8. Can you provide examples of recent developments in the market?

July 2023 - Jungheinrich, premiered its latest mobile robot solution at Stuttgart's LogiMAT 2023, the international trade fair for intralogistics solutions. It's a robot that can be easily integrated into any warehouse, which finds its own solutions, and which adapts to changing warehouse needs, increasing performance and efficiency. Its newly developed control system and toolchain enable smooth, simple integration with any existing warehouse environment and guarantee impressive flexibility from planning stage to day-to-day operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Warehouse Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Warehouse Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Warehouse Automation Industry?

To stay informed about further developments, trends, and reports in the Warehouse Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence