Key Insights

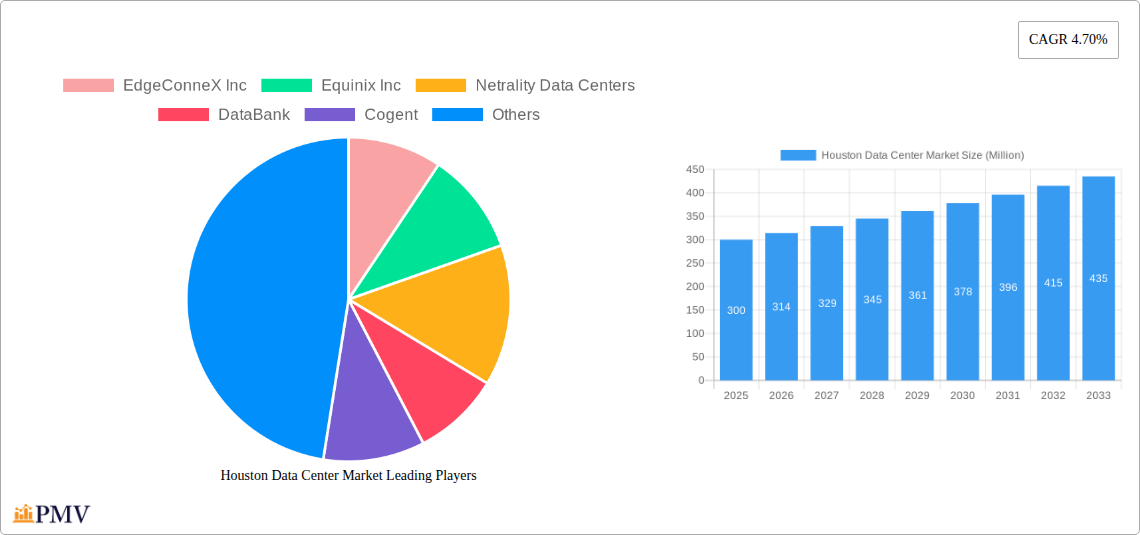

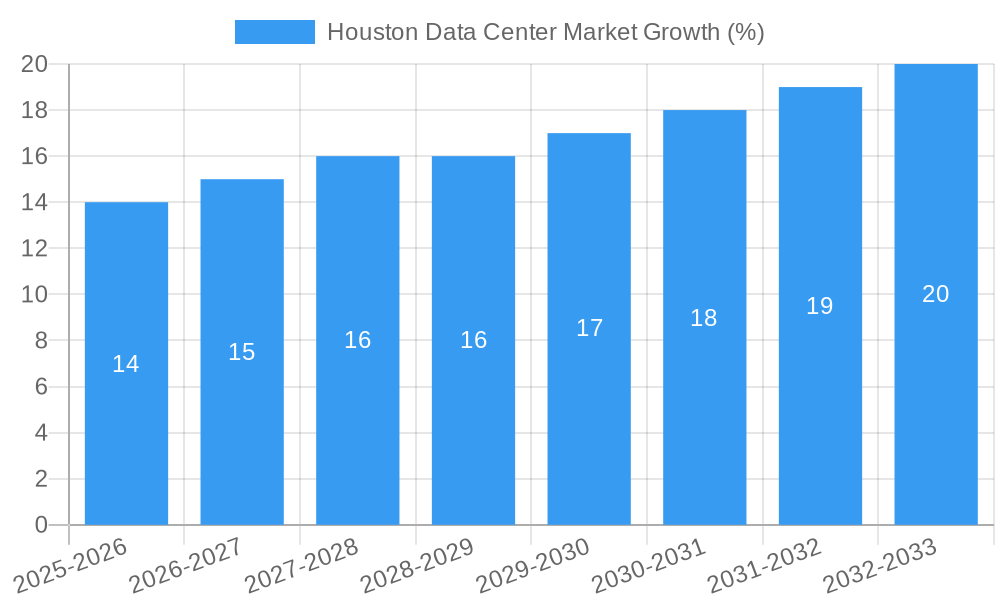

The Houston data center market is experiencing robust growth, driven by the city's burgeoning energy sector, expanding technology footprint, and strategic location within the U.S. The market's CAGR of 4.70% indicates a steady and significant increase in demand for colocation services, particularly from hyperscale providers and cloud & IT companies. This growth is fueled by the increasing need for low-latency connectivity, high-capacity infrastructure, and robust disaster recovery solutions. The diverse range of end-users, including Telecom, Media & Entertainment, BFSI, and Manufacturing, further contributes to the market's dynamism. While specific market size data for Houston is missing, considering the national CAGR and the city's economic strengths, a reasonable estimate for the 2025 market size could be in the range of $250-350 million, with projected growth exceeding $400 million by 2030. This growth, however, might face some restraints such as energy costs and the availability of skilled labor, necessitating strategic investments in infrastructure and workforce development. The market segmentation reflects this diversity, with a significant portion likely attributable to hyperscale colocation and large-scale data centers. Competition among established players like Equinix, Digital Realty Trust, and others is likely fierce, driving innovation and pushing pricing strategies.

The competitive landscape in Houston is characterized by a blend of national and regional players. Established global providers like Equinix and Digital Realty compete with regional specialists offering tailored services. The increasing focus on edge computing, driven by the need for reduced latency and faster data processing, could significantly impact the market in the near future. Future growth will depend on factors such as successful infrastructure development, attracting additional tech investments to the Houston region, and effectively managing potential challenges like energy costs and the demand for skilled professionals. The retail colocation segment might see less growth compared to the hyperscale segment due to the increasing preference for larger scale deployments by major cloud providers. Furthermore, the market's response to evolving technologies like AI and IoT will play a crucial role in shaping its long-term trajectory.

Houston Data Center Market: 2019-2033 Forecast - A Comprehensive Report

This comprehensive report provides an in-depth analysis of the Houston data center market, offering crucial insights into market dynamics, competitive landscape, and future growth prospects from 2019 to 2033. The study covers key segments, including by absorption, colocation type, end-user, data center size, and tier type, providing detailed market sizing and forecasting. This report is essential for data center operators, investors, technology providers, and anyone seeking to understand this rapidly evolving market.

Houston Data Center Market Structure & Competitive Dynamics

The Houston data center market exhibits a moderately concentrated structure, with several key players vying for market share. Leading companies like Equinix Inc, Digital Realty Trust Inc, EdgeConneX Inc, Netrality Data Centers, DataBank, Cogent, and Stream Data Centers are driving innovation and shaping the competitive landscape. Market share analysis reveals Equinix and Digital Realty holding significant positions, with xx% and xx% respectively in 2024, while others compete for the remaining market.

The market is characterized by a robust innovation ecosystem, with companies investing heavily in advanced technologies such as AI-powered management systems and sustainable infrastructure solutions. The regulatory framework, while generally supportive of data center development, involves navigating local ordinances and permitting processes. Product substitutes, including cloud computing services, exert pressure on traditional colocation offerings. End-user trends reflect a growing demand for scalable, secure, and energy-efficient data center solutions. M&A activity in the Houston market has been moderate in recent years, with a total deal value of approximately $xx Million in the period 2019-2024, reflecting consolidation among existing players and strategic acquisitions to expand market reach. This consolidation is expected to continue with the increasing demand for data center services.

Houston Data Center Market Industry Trends & Insights

The Houston data center market is experiencing robust growth, driven by several key factors. The region's strong economic activity, burgeoning energy sector, and strategic geographical location contribute significantly to the demand for data center services. Technological advancements, such as the adoption of 5G and edge computing, further fuel market expansion. Consumer preferences are shifting towards cloud-based solutions, necessitating robust data center infrastructure. The market is witnessing an increasing focus on sustainability and energy efficiency, with data centers adopting renewable energy sources and implementing eco-friendly cooling systems. The competitive landscape is dynamic, with companies investing in expansion and modernization to maintain their market share. The Compound Annual Growth Rate (CAGR) for the Houston data center market is projected to be xx% during the forecast period (2025-2033), resulting in a market size of approximately $xx Million by 2033. Market penetration of hyperscale data centers is expected to increase from xx% in 2024 to xx% by 2033, driven by the growing needs of large cloud providers and enterprises.

Dominant Markets & Segments in Houston Data Center Market

The Houston data center market is dominated by the Utilized segment in terms of absorption, indicating a high level of occupancy and demand.

- Key Drivers of Utilized Segment Dominance:

- Strong economic growth in Houston

- Increasing demand from cloud and IT sectors

- Robust energy infrastructure supporting data centers

Within colocation types, Retail colocation leads, catering to a wide range of businesses, while Hyperscale facilities are gaining traction due to the presence of major cloud providers. The Cloud & IT end-user segment is the largest, reflecting the region’s robust technology ecosystem. Large and Mega data centers are the most prevalent, owing to the scalability requirements of large enterprises and cloud providers. The Tier III segment holds the largest market share within tier types because of their high level of redundancy and reliability.

The non-utilized segment is expected to remain relatively small, considering the high demand and consistent growth of the Houston market.

Houston Data Center Market Product Innovations

Recent product innovations focus on enhanced security features, AI-powered management systems, and sustainable cooling technologies. These advancements aim to improve efficiency, reduce operational costs, and increase the overall appeal of data center solutions. The market is witnessing the increased adoption of modular data centers for faster deployment and scalability. These developments cater to the rising demands for high-performance computing and edge computing applications, positioning the Houston market for continuous growth.

Report Segmentation & Scope

This report segments the Houston data center market by:

- Absorption: Utilized and Non-Utilized, with growth projections for each segment.

- Colocation Type: Retail, Wholesale, and Hyperscale, analyzing competitive dynamics within each type.

- End User: Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, and Other End-User, identifying dominant sectors.

- Data Center Size: Small, Medium, Large, Massive, and Mega, assessing market share and future trends.

- Tier Type: Tier I, Tier II, and Tier III, evaluating the distribution across different tiers.

Each segment includes market size estimations, growth projections, and competitive analysis for the study period (2019-2033).

Key Drivers of Houston Data Center Market Growth

Several factors drive Houston's data center market growth. The city's robust energy infrastructure provides a reliable and cost-effective power source. Strong economic performance and population growth create high demand for data center capacity. Government initiatives supporting technological advancement and infrastructure development also play a vital role. Furthermore, strategic location and access to fiber optic networks further enhance the market's attractiveness.

Challenges in the Houston Data Center Market Sector

Challenges include securing sufficient land for large-scale data center development, navigating permitting processes, and addressing potential power outages. Competition among established players and new entrants poses challenges in terms of securing clients and maintaining market share. Supply chain disruptions, particularly for critical components, can impact project timelines and costs. These challenges need to be effectively addressed to ensure sustainable market growth.

Leading Players in the Houston Data Center Market Market

- EdgeConneX Inc

- Equinix Inc

- Netrality Data Centers

- DataBank

- Cogent

- Digital Realty Trust Inc

- Stream Data Centers

Key Developments in Houston Data Center Market Sector

- May 2022: Element Critical completes the Houston One Data Centre expansion, adding significant capacity to the market and enhancing its Tier III infrastructure with a premium rollover power service. This development reflects the increasing demand for reliable and scalable data center solutions in the Texas region.

Strategic Houston Data Center Market Outlook

The Houston data center market presents significant growth potential over the next decade, fueled by the city’s dynamic economy, technological advancements, and favorable business environment. Strategic opportunities exist for companies to capitalize on the expanding demand for cloud services, edge computing, and other emerging technologies. Investment in sustainable infrastructure and innovative technologies will be key to maintaining a competitive edge in this evolving market. The focus on expanding hyperscale facilities and enhancing connectivity will further shape the market’s future trajectory.

Houston Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Houston Data Center Market Segmentation By Geography

- 1. Houston

Houston Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. High Adoption Of Hyperscale Data Center

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Houston Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Houston

- 5.1. Market Analysis, Insights and Forecast - by DC Size

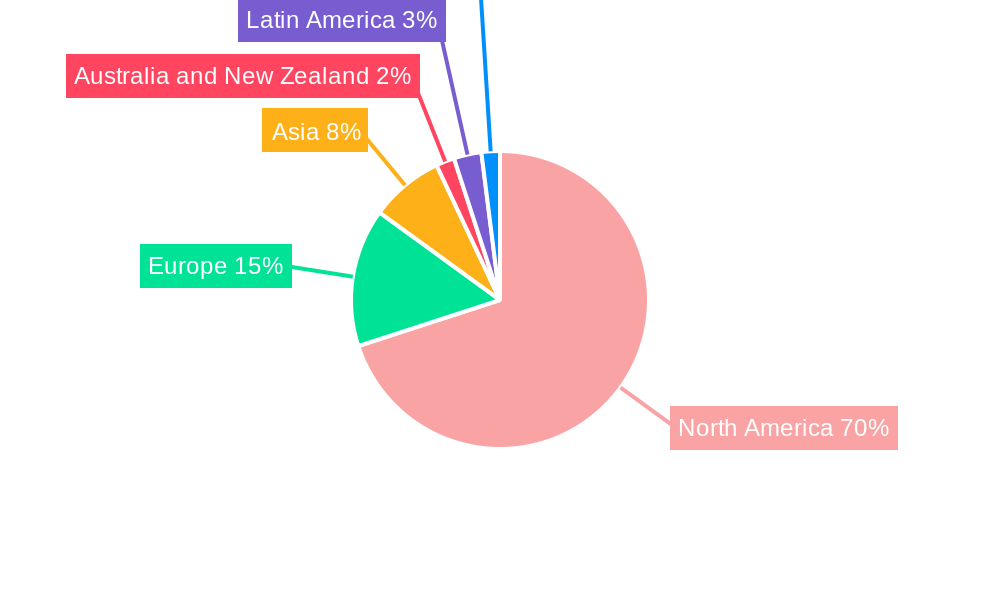

- 6. North America Houston Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Houston Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Houston Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Houston Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Houston Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Houston Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 EdgeConneX Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Equinix Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Netrality Data Centers

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DataBank

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cogent

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Digital Realty Trust Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Stream Data Centers

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 EdgeConneX Inc

List of Figures

- Figure 1: Houston Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Houston Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Houston Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Houston Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Houston Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Houston Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Houston Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Houston Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Houston Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Houston Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Houston Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Houston Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Houston Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Houston Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Houston Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Houston Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Houston Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Houston Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Houston Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Houston Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Houston Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Houston Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Houston Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Houston Data Center Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Houston Data Center Market?

Key companies in the market include EdgeConneX Inc, Equinix Inc, Netrality Data Centers, DataBank, Cogent, Digital Realty Trust Inc, Stream Data Centers.

3. What are the main segments of the Houston Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

High Adoption Of Hyperscale Data Center.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

May 2022: Element Critical Completes Houston One Data Centre expansion to meet increasing demand for Texas Customizable Data Centre Space. The Tier III data center is next to a 300 MW loop-fed substation. It offers a premium rollover service that automatically transfers power from two redundant substation transformers for optimal reliability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Houston Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Houston Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Houston Data Center Market?

To stay informed about further developments, trends, and reports in the Houston Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence