Key Insights

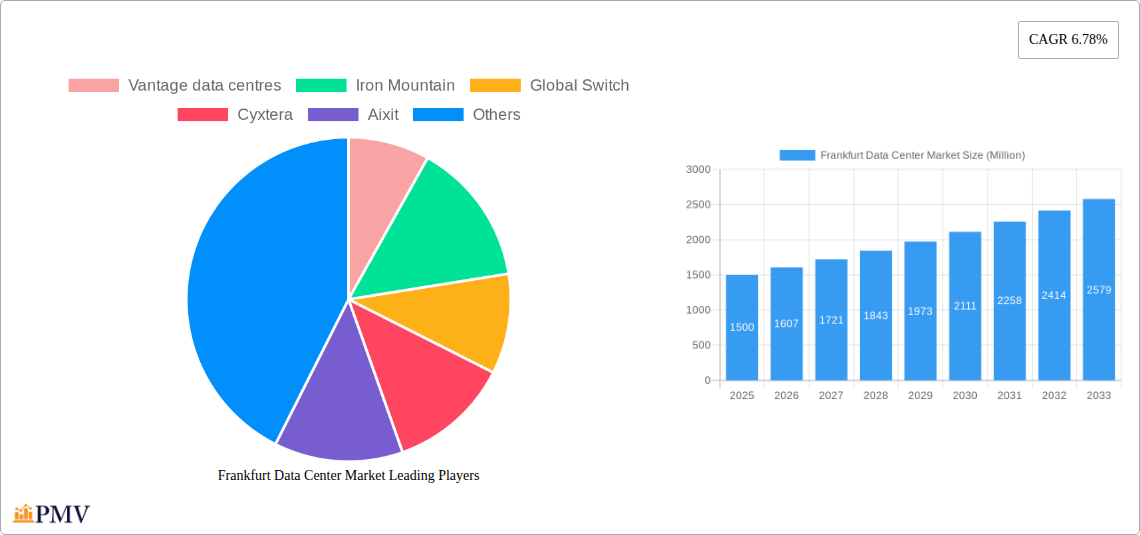

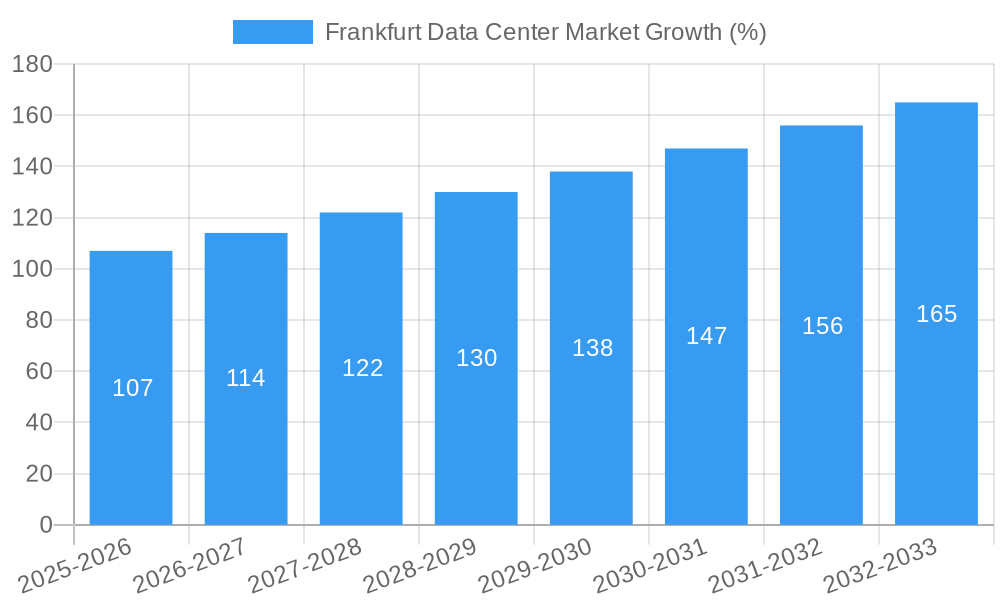

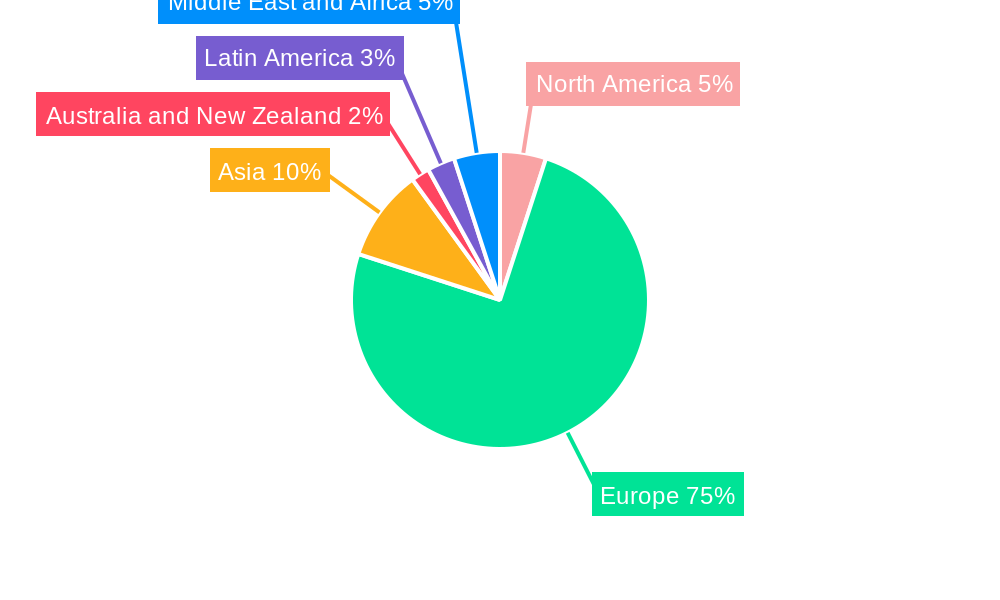

The Frankfurt data center market, a crucial hub for European digital infrastructure, is experiencing robust growth, fueled by increasing digitalization across various sectors and the region's strategic location. The market's 6.78% CAGR indicates a sustained expansion, projected to continue throughout the forecast period (2025-2033). Key drivers include the burgeoning cloud computing sector, the expanding presence of hyperscale operators seeking low-latency connectivity, and the growing demand for colocation services from businesses across diverse industries like finance (BFSI), e-commerce, and media & entertainment. The trend towards edge computing is further stimulating demand for smaller, geographically distributed data centers to reduce latency and improve performance. While a lack of skilled labor and rising energy costs could act as restraints, the overall positive market outlook persists. Frankfurt's established digital ecosystem, robust connectivity, and favorable regulatory environment continue to attract significant investments, making it a highly competitive yet lucrative market for data center operators. Segmentation analysis reveals that hyperscale colocation and large-scale data center facilities are driving substantial revenue, although the retail and wholesale segments continue to play significant roles. The utilized capacity is likely to increase steadily, indicating robust uptake, while the non-utilized portion represents opportunities for future expansion. North America might hold a lower share compared to Europe, given Frankfurt's central location within Europe. However, Asia and other regions are expected to register growth, driven by increasing digital adoption.

The competitive landscape features both global giants like Equinix, Digital Realty, and NTT, alongside regional players and specialized providers. This competitive environment ensures innovation and drives down prices, benefiting businesses. The forecast for the Frankfurt data center market suggests sustained, albeit potentially fluctuating, growth due to cyclical economic factors and investment trends. The continuing demand for digital infrastructure across industries is expected to consistently outweigh the restraining factors, driving continued expansion and consolidation within the market. The ongoing focus on sustainability and energy efficiency will become an increasingly important factor influencing future development and investment decisions within the Frankfurt data center market.

Frankfurt Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Frankfurt data center market, encompassing market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages a robust methodology incorporating primary and secondary research, offering valuable insights for investors, data center operators, technology providers, and industry stakeholders. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Frankfurt Data Center Market Market Structure & Competitive Dynamics

The Frankfurt data center market exhibits a moderately concentrated structure, with a few major players controlling a significant market share. Key players include Vantage Data Centers, Iron Mountain, Global Switch, Cyxtera, Aixit, Equinix, Telehouse, Leaseweb, CyrusOne, Lumen Technologies Inc, Digital Realty, Zenlayer, NTT, Deft, and DARZ. These companies compete based on factors such as infrastructure capacity, connectivity, security, pricing, and sustainability initiatives.

The market is characterized by a dynamic innovation ecosystem, with ongoing investments in advanced technologies like AI-optimized facilities (as exemplified by Alibaba Cloud's recent Frankfurt facility) and sustainable energy solutions. Regulatory frameworks, including data privacy regulations (GDPR), play a crucial role, influencing operational practices and investment decisions. Product substitutes, such as cloud-based services, exert competitive pressure. M&A activity remains significant, with deal values fluctuating year to year, reflecting consolidation and expansion strategies within the sector. For example, in 2024, mergers and acquisitions totaled approximately xx Million. The market share distribution amongst the top 5 players is approximately:

- Equinix: xx%

- Global Switch: xx%

- Vantage Data Centers: xx%

- Digital Realty: xx%

- Iron Mountain: xx%

End-user trends are shifting towards hyperscale deployments and colocation services, driven by the increasing adoption of cloud computing and big data analytics. The overall competitive landscape is intensely competitive, characterized by ongoing technological advancements, strategic partnerships, and capacity expansions.

Frankfurt Data Center Market Industry Trends & Insights

The Frankfurt data center market is experiencing robust growth, fueled by several key factors. The strong presence of financial institutions and the thriving digital economy in Frankfurt necessitate significant data center capacity. The increasing demand for cloud computing services, the growing adoption of big data analytics, and the rise of the Internet of Things (IoT) contribute to this expansion. Technological advancements, such as the deployment of AI-optimized data centers and the increasing use of renewable energy sources, are shaping the market landscape. The market is witnessing increasing consolidation, with major players expanding their presence through mergers, acquisitions, and greenfield developments. The CAGR for the period 2025-2033 is projected to be xx%, indicating substantial market growth driven by the factors mentioned above. Market penetration of hyperscale facilities is steadily increasing, currently at xx% and projected to reach xx% by 2033. Consumer preferences are shifting towards environmentally sustainable data centers, pushing for increased use of renewable energy and reduced carbon footprints. This preference is driving investments in sustainable infrastructure and technologies by market players.

Dominant Markets & Segments in Frankfurt Data Center Market

The Frankfurt data center market is dominated by the following segments:

Tier Type: Tier III and Tier IV data centers command the largest share, driven by their high reliability and redundancy features. Key drivers include stringent regulatory compliance requirements and the need for continuous business operations for critical applications.

Absorption: The utilized capacity segment dominates, reflecting strong demand for data center services. Growth is projected to continue, driven by expansion in the cloud and IT sector. Non-utilized capacity remains relatively low, indicating an efficient market.

Colocation Type: Wholesale and hyperscale colocation segments are witnessing the most significant growth, driven by large cloud providers and enterprises requiring large-scale infrastructure. Retail colocation remains a sizable market, meeting the demands of smaller businesses and organizations.

End User: The Cloud & IT sector constitutes the largest end-user segment, driven by the exponential growth of cloud computing and the increasing demand for data storage and processing capabilities. The BFSI sector also represents a significant segment, due to the concentration of financial institutions in Frankfurt.

Frankfurt Data Center Market Product Innovations

The Frankfurt data center market is witnessing significant product innovations, including AI-optimized data centers that leverage AI and machine learning for enhanced efficiency and resource optimization; sustainable data centers incorporating renewable energy sources and efficient cooling systems to minimize environmental impact. These innovations reflect a market trend toward improved operational efficiency, enhanced security, and reduced environmental footprint. This also helps data center providers to gain a competitive advantage.

Report Segmentation & Scope

This report segments the Frankfurt data center market by Tier Type (Tier I, Tier II, Tier III, Tier IV); Absorption (Utilized, Non-Utilized); Colocation Type (Retail, Wholesale, Hyperscale); End User (Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, Other); and DC Size (Small, Medium, Large, Massive, Mega). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. For instance, the hyperscale segment is projected to experience the highest growth due to the increasing demand for large-scale infrastructure from major cloud providers.

Key Drivers of Frankfurt Data Center Market Growth

Several factors drive the Frankfurt data center market's growth:

- Strong Economic Growth: Frankfurt's thriving economy, particularly its financial sector, fuels high demand for data center services.

- Digital Transformation: The increasing digitalization across various sectors increases the need for robust data infrastructure.

- Government Initiatives: Supportive government policies and investments in digital infrastructure further stimulate market growth.

- Technological Advancements: Innovations such as AI-optimized data centers and sustainable solutions enhance market attractiveness.

Challenges in the Frankfurt Data Center Market Sector

The Frankfurt data center market faces several challenges:

- Energy Costs and Sustainability: Balancing energy consumption with sustainability goals presents a significant challenge.

- Land Availability: Limited availability of suitable land for data center construction restricts expansion.

- Competition: Intense competition among existing players and new entrants creates pricing pressures.

- Regulatory Compliance: Adhering to stringent data privacy regulations adds to operational complexities.

Leading Players in the Frankfurt Data Center Market Market

- Vantage Data Centers

- Iron Mountain

- Global Switch

- Cyxtera

- Aixit

- Equinix

- Telehouse

- Leaseweb

- CyrusOne

- Lumen Technologies Inc

- Digital Realty

- Zenlayer

- NTT

- Deft

- DARZ

Key Developments in Frankfurt Data Center Market Sector

- April 2023: Green Mountain and KMW launched a joint venture to build a 54MW data center campus near Mainz, signifying a significant investment in sustainable data center infrastructure.

- May 2022: Alibaba Cloud opened an AI-focused data center in Frankfurt, highlighting the growing importance of AI in the data center market.

Strategic Frankfurt Data Center Market Market Outlook

The Frankfurt data center market is poised for continued growth, driven by robust economic conditions, technological innovation, and increasing digitalization across various sectors. Strategic opportunities exist in developing sustainable and AI-optimized data center solutions, expanding capacity to meet growing demand, and leveraging strategic partnerships to enhance market reach and competitiveness. The focus on sustainability and the increasing demand for AI-powered solutions will shape the future of the Frankfurt data center market.

Frankfurt Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Frankfurt Data Center Market Segmentation By Geography

- 1. Germany

Frankfurt Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness Among Internet Users About Secure Web Access; Managing Strict Regulations and Compliance

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About the Importance of Security Certificates; Using of Self-Signed Certificates

- 3.4. Market Trends

- 3.4.1. Tier 3 Segment is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Frankfurt Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Vantage data centres

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Iron Mountain

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Global Switch

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cyxtera

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aixit

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Equinix

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Telehouse

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Leaseweb

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cyrusone

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Lumen Technologies Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Digital Realty

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Zenlayer

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 NTT

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Deft

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 DARZ

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Vantage data centres

List of Figures

- Figure 1: Frankfurt Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Frankfurt Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Frankfurt Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Frankfurt Data Center Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 3: Frankfurt Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 4: Frankfurt Data Center Market Volume Thousand Forecast, by DC Size 2019 & 2032

- Table 5: Frankfurt Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 6: Frankfurt Data Center Market Volume Thousand Forecast, by Tier Type 2019 & 2032

- Table 7: Frankfurt Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 8: Frankfurt Data Center Market Volume Thousand Forecast, by Absorption 2019 & 2032

- Table 9: Frankfurt Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Frankfurt Data Center Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 11: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 13: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 15: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 17: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 19: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 21: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 23: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 25: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 27: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 29: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 31: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 33: Frankfurt Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Frankfurt Data Center Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 35: Frankfurt Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 36: Frankfurt Data Center Market Volume Thousand Forecast, by DC Size 2019 & 2032

- Table 37: Frankfurt Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 38: Frankfurt Data Center Market Volume Thousand Forecast, by Tier Type 2019 & 2032

- Table 39: Frankfurt Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 40: Frankfurt Data Center Market Volume Thousand Forecast, by Absorption 2019 & 2032

- Table 41: Frankfurt Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Frankfurt Data Center Market Volume Thousand Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Frankfurt Data Center Market?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the Frankfurt Data Center Market?

Key companies in the market include Vantage data centres, Iron Mountain, Global Switch, Cyxtera, Aixit, Equinix, Telehouse, Leaseweb, Cyrusone, Lumen Technologies Inc, Digital Realty, Zenlayer, NTT, Deft, DARZ.

3. What are the main segments of the Frankfurt Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness Among Internet Users About Secure Web Access; Managing Strict Regulations and Compliance.

6. What are the notable trends driving market growth?

Tier 3 Segment is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness About the Importance of Security Certificates; Using of Self-Signed Certificates.

8. Can you provide examples of recent developments in the market?

April 2023 : Green Mountain, a Norwegian data centre firm, has launched a joint venture with energy firm KMW to build a new campus south of Frankfurt, Germany. The two corporations have created a 50:50 partnership to build a 54MW data center near Mainz. Three structures are proposed for the 25,000 sqm (269,100 sq ft) FRA1-Main site, which will be next to KMW's power plants. According to the firms, the buildings can handle both multi-tenant contracts and dedicated buildings. Power will be supplied by KMW's renewable portfolio, with backup power supplied by the local KMW gas plant rather than backup generators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Frankfurt Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Frankfurt Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Frankfurt Data Center Market?

To stay informed about further developments, trends, and reports in the Frankfurt Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence