Key Insights

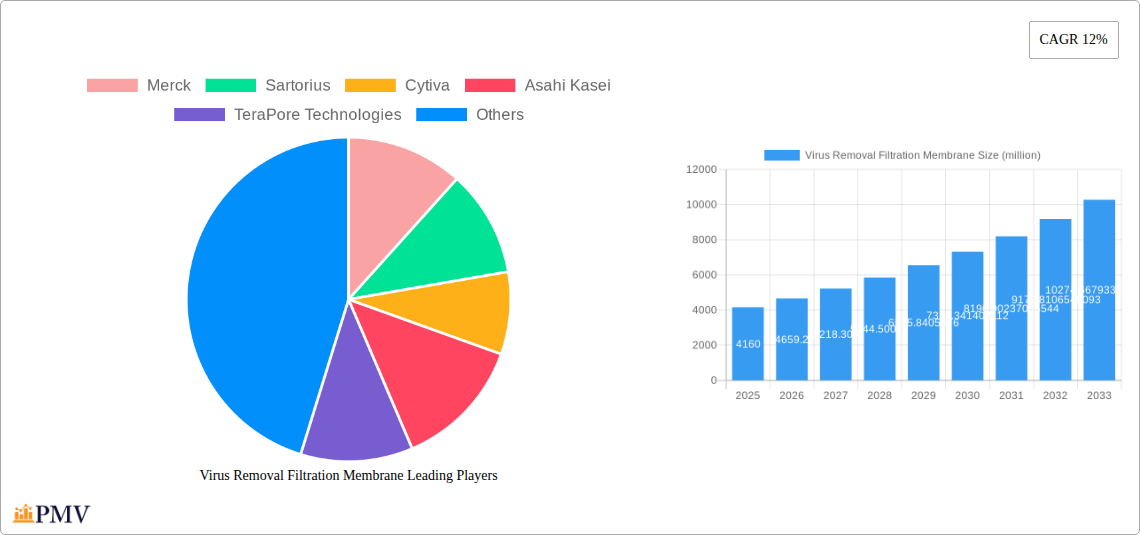

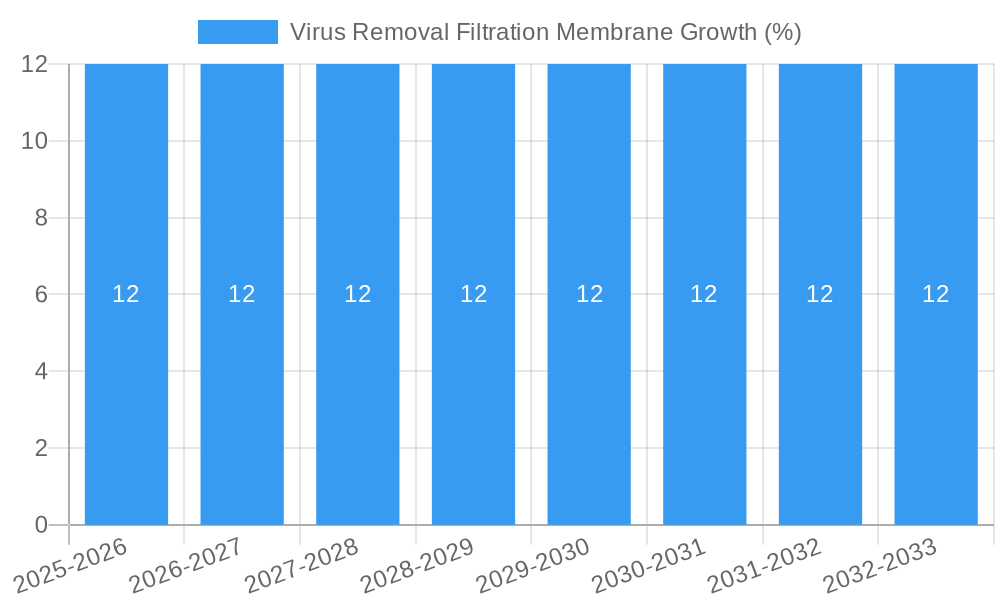

The global Virus Removal Filtration Membrane market is poised for robust expansion, with a current market size estimated at approximately $4,160 million. This impressive growth trajectory is underpinned by a substantial Compound Annual Growth Rate (CAGR) of 12% projected throughout the forecast period of 2025-2033. This elevated CAGR signifies a rapidly increasing demand for advanced filtration solutions, driven by critical applications in biopharmaceuticals and laboratory research. The biopharmaceutical sector, in particular, is a significant contributor, owing to the stringent regulatory requirements for viral clearance in the production of biologics, vaccines, and therapeutic proteins. As the development of novel biotherapeutics accelerates and the focus on patient safety intensifies, the need for highly effective virus removal filtration membranes becomes paramount. Furthermore, advancements in laboratory research, including the development of new cell culture techniques and the increasing prevalence of virology studies, are also fueling market growth. Emerging economies, with their expanding healthcare infrastructure and growing biopharmaceutical manufacturing capabilities, are anticipated to present significant opportunities for market players.

The market's dynamism is further shaped by a series of interconnected drivers and trends. Key growth drivers include the escalating global burden of infectious diseases, necessitating advanced diagnostic and therapeutic approaches that rely on effective viral filtration. The continuous innovation in membrane technology, leading to enhanced filtration efficiency, capacity, and reduced product loss, also acts as a significant catalyst. Trends such as the increasing adoption of single-use filtration systems, driven by their benefits in reducing cross-contamination risks and streamlining bioprocessing, are shaping market demand. Moreover, the growing emphasis on process intensification and miniaturization in biomanufacturing is encouraging the development of more compact and efficient filtration solutions. While the market presents a promising outlook, certain restraints, such as the high initial investment costs associated with advanced filtration systems and the complexity of regulatory approvals in some regions, may pose challenges. However, the persistent drive for improved healthcare outcomes and the continuous technological evolution are expected to largely outweigh these constraints, ensuring sustained market expansion.

This in-depth market research report offers a definitive analysis of the global Virus Removal Filtration Membrane market, providing critical insights into its structure, competitive landscape, evolving trends, and future trajectory. Leveraging a rigorous research methodology, the report covers the historical period from 2019 to 2024, presents a detailed analysis of the base year 2025, and offers robust forecasts for the period 2025–2033. This report is an indispensable resource for stakeholders seeking to understand the biopharmaceutical filtration, laboratory research filtration, and medical device filtration markets, identifying strategic opportunities and navigating inherent challenges within this crucial sector. The report provides granular data on Polyethersulfone (PES) membranes, Regenerated Cellulose (RC) membranes, and Polyvinylidene Fluoride (PVDF) membranes, alongside comprehensive coverage of key industry developments and leading market participants. The total market size is projected to reach over one million million by the end of the forecast period.

Virus Removal Filtration Membrane Market Structure & Competitive Dynamics

The global Virus Removal Filtration Membrane market exhibits a moderately concentrated structure, driven by a select number of established global players and a growing cohort of specialized manufacturers. Innovation ecosystems are robust, fueled by continuous research and development in advanced filtration technologies to meet stringent regulatory demands and evolving application needs, particularly in biopharmaceutical manufacturing. Regulatory frameworks, such as those established by the FDA and EMA, play a pivotal role in shaping market entry and product development, prioritizing safety and efficacy. Product substitutes, while existing in broader filtration categories, face significant challenges in replicating the specific virus removal efficacy of dedicated membranes. End-user trends are increasingly leaning towards single-use filtration solutions for enhanced flexibility and reduced contamination risk, a trend evident across both biopharmaceutical production and diagnostic laboratories. Merger and acquisition (M&A) activities are moderate, characterized by strategic acquisitions aimed at expanding product portfolios and market reach, with several deals valued in the tens of millions. Key competitive dynamics revolve around product performance, cost-effectiveness, regulatory compliance, and the ability to offer customized filtration solutions.

- Market Share Distribution: Analysis of market share will reveal the dominance of key players, with top companies holding significant portions of the market, estimated to be in the hundreds of millions for leading entities.

- Innovation Ecosystems: The report details the collaborative efforts between research institutions and manufacturers, driving advancements in pore size optimization and material science.

- Regulatory Impact: Emphasis will be placed on how evolving GMP standards and international pharmacopeia requirements influence membrane selection and validation processes.

- Product Substitutes: While broad filtration exists, the specificity required for virus removal creates a unique market space for advanced membranes.

- End-User Preferences: Shift towards disposable systems and demand for higher throughput solutions are key indicators of evolving user needs.

- M&A Activities: The report identifies strategic acquisitions and partnerships that have reshaped the competitive landscape, with an estimated total M&A deal value in the hundreds of millions over the historical period.

Virus Removal Filtration Membrane Industry Trends & Insights

The Virus Removal Filtration Membrane industry is experiencing dynamic growth, propelled by a confluence of technological advancements, expanding applications, and increasing global demand for safe and effective biopharmaceuticals and diagnostics. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% over the forecast period. Key growth drivers include the escalating prevalence of chronic diseases, necessitating greater production of monoclonal antibodies and recombinant proteins, all of which rely heavily on robust viral clearance. Furthermore, the burgeoning field of cell and gene therapy, with its inherent viral vector risks, presents a significant new avenue for virus removal membrane adoption, estimated to contribute millions in new market opportunities. Technological disruptions are primarily centered on enhancing membrane performance, including improved flux rates, increased binding capacity, and reduced protein adsorption, alongside the development of novel materials that offer superior viral retention. The adoption of advanced manufacturing techniques, such as hollow fiber membranes and optimized tangential flow filtration systems, is also reshaping the competitive landscape. Consumer preferences, particularly within the biopharmaceutical sector, are increasingly dictating a demand for validated, high-purity filtration solutions that minimize batch-to-batch variability and ensure patient safety. The laboratory research segment, crucial for preclinical and diagnostic development, is witnessing a surge in demand for smaller-scale, high-efficiency membranes for research and development purposes, representing a market segment valued in the hundreds of millions. The competitive dynamics are characterized by intense innovation, strategic collaborations, and a focus on providing comprehensive validation support to end-users. The increasing investment in novel biotherapeutics and the growing emphasis on biosafety in pharmaceutical production are strong indicators of sustained market expansion, with the overall market size projected to exceed one million million by 2033. The market penetration of advanced virus removal membranes is anticipated to rise significantly as regulatory scrutiny and patient safety expectations continue to intensify.

Dominant Markets & Segments in Virus Removal Filtration Membrane

The Biopharmaceuticals application segment stands as the dominant force within the global Virus Removal Filtration Membrane market. This dominance is underpinned by the ever-increasing production of biologics, including therapeutic proteins, vaccines, and monoclonal antibodies, which require stringent viral clearance to ensure patient safety. The sheer scale of production in this sector, with numerous manufacturing facilities globally, drives substantial demand for high-performance virus removal membranes. Within this segment, the Polyethersulfone (PES) membrane type emerges as a leading choice due to its excellent chemical resistance, high flux, and broad pH compatibility, making it suitable for a wide range of biopharmaceutical processes. The Polyvinylidene Fluoride (PVDF) membrane also commands a significant share, particularly for applications requiring sterilizing grade filtration and high protein recovery.

Key Drivers for Dominance in Biopharmaceuticals:

- Growing Biologics Pipeline: A robust pipeline of novel biopharmaceutical drugs, including advanced therapies and vaccines, necessitates large-scale, high-purity manufacturing processes that rely on effective virus removal.

- Stringent Regulatory Requirements: Global regulatory bodies like the FDA and EMA mandate rigorous viral clearance steps in biopharmaceutical production, driving the adoption of validated virus removal membranes.

- Increasing Investment in Biomanufacturing: Significant investments in new manufacturing facilities and expansion of existing ones globally are directly fueling the demand for filtration solutions.

- Therapeutic Protein Production: The continued growth in the production of therapeutic proteins, such as insulin, growth hormones, and enzymes, relies heavily on advanced filtration technologies for viral safety.

The Laboratory Research segment, while smaller in overall market size compared to biopharmaceuticals, represents a critical and rapidly expanding niche. This segment is characterized by the need for precise and reliable filtration for a variety of research applications, including cell culture, molecular biology, and diagnostic assay development. The demand here is for membranes that offer high specificity and minimize sample loss.

Key Drivers for Dominance in Laboratory Research:

- Advancements in Life Sciences Research: The rapid pace of discovery in areas like genomics, proteomics, and cell biology requires researchers to use highly effective filtration for sample preparation and purification.

- Development of Diagnostic Kits: The increasing demand for accurate and reliable diagnostic kits for various diseases drives the need for specialized filtration membranes in their manufacturing processes.

- Emergence of Novel Research Modalities: The growth of areas like personalized medicine and organoid research necessitates advanced filtration for maintaining cell viability and purity.

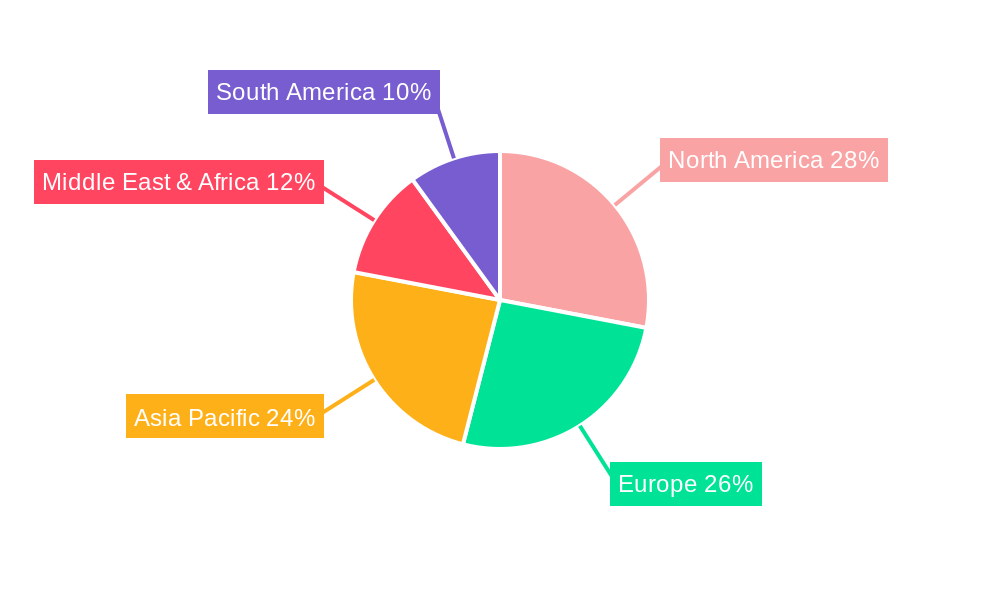

Geographically, North America and Europe currently represent the largest markets for virus removal filtration membranes, driven by their well-established biopharmaceutical industries, significant R&D investments, and stringent regulatory environments. However, the Asia-Pacific region is emerging as a high-growth market, fueled by the expanding biomanufacturing capabilities, increasing healthcare expenditure, and a growing focus on biosafety in countries like China and India.

Virus Removal Filtration Membrane Product Innovations

Product innovations in the Virus Removal Filtration Membrane market are focused on enhancing efficiency, yield, and ease of use. Manufacturers are developing membranes with optimized pore structures for superior viral clearance while minimizing protein adsorption, leading to improved product recovery. Advancements in material science have led to the introduction of novel PES and PVDF formulations offering enhanced chemical compatibility and higher throughput. Innovations also include the integration of these membranes into single-use systems and the development of pre-validated filter capsules, catering to the demand for convenience and reduced validation burden in biopharmaceutical manufacturing. These developments offer competitive advantages by improving process economics and ensuring regulatory compliance.

Report Segmentation & Scope

This report segments the Virus Removal Filtration Membrane market by Application and Type. The key application segments include Biopharmaceuticals, crucial for the production of therapeutics and vaccines; Laboratory Research, supporting drug discovery, diagnostics, and academic studies; and Others, encompassing applications in medical devices and diagnostics manufacturing. The market is also segmented by membrane type, with significant focus on Polyethersulfone (PES), known for its broad chemical compatibility; Regenerated Cellulose (RC), often used in protein-sensitive applications; and Polyvinylidene Fluoride (PVDF), recognized for its robustness and sterilizing capabilities. Each segment's growth projections, market sizes, and competitive dynamics have been thoroughly analyzed within the report's scope.

Key Drivers of Virus Removal Filtration Membrane Growth

The Virus Removal Filtration Membrane market is propelled by several critical growth drivers. Firstly, the expanding global biopharmaceutical industry, with its increasing demand for biologics and complex therapies, necessitates robust viral clearance. Secondly, stringent regulatory requirements across major health authorities mandate the use of validated virus removal solutions, driving adoption. Thirdly, technological advancements in membrane materials and manufacturing processes are leading to improved performance, higher yields, and cost-effectiveness. The growing focus on patient safety and the increasing incidence of viral contamination concerns further underpin market expansion. The emergence of new therapeutic modalities like cell and gene therapy, which inherently involve viral vectors, also presents significant growth opportunities.

Challenges in the Virus Removal Filtration Membrane Sector

Despite its robust growth, the Virus Removal Filtration Membrane sector faces several challenges. High development and validation costs for new membrane technologies and applications represent a significant barrier to entry. Stringent and evolving regulatory landscapes can create complexities and delays in market approval. Supply chain vulnerabilities, particularly for specialized raw materials, can impact production timelines and costs. Furthermore, competition from alternative filtration methods and the need for continuous innovation to stay ahead of technological advancements pose ongoing pressures. The cost-effectiveness of advanced virus removal membranes remains a consideration for some applications, particularly in resource-constrained settings.

Leading Players in the Virus Removal Filtration Membrane Market

- Merck

- Sartorius

- Cytiva

- Asahi Kasei

- TeraPore Technologies

- Agilitech

- Meissner

- Masterfilter

- Cobetter

- LePure Biotech

- S&P Filtration

Key Developments in Virus Removal Filtration Membrane Sector

- 2023/10: Sartorius launches new generation of PES membranes with enhanced flux and improved virus retention for biopharmaceutical manufacturing.

- 2023/08: Cytiva announces expansion of its filter production capacity to meet growing global demand for bioprocessing solutions.

- 2023/05: Merck introduces a novel PVDF membrane with superior chemical resistance for challenging biopharmaceutical applications.

- 2022/11: TeraPore Technologies receives FDA 510(k) clearance for its new line of viral filters for diagnostic applications.

- 2022/07: Asahi Kasei announces a strategic partnership to develop advanced filtration materials for emerging cell and gene therapies.

Strategic Virus Removal Filtration Membrane Market Outlook

The Virus Removal Filtration Membrane market presents a highly promising outlook, driven by sustained innovation and expanding applications in life sciences. Growth accelerators include the continued advancements in biologics, the rising demand for advanced therapies, and the increasing global focus on biosafety. Strategic opportunities lie in developing membranes with higher throughput, improved selectivity, and enhanced sustainability features. The integration of digital technologies for process monitoring and control within filtration systems will also shape future market dynamics. As regulatory stringency continues to evolve, the demand for validated, high-performance virus removal solutions is expected to remain robust, ensuring significant growth potential for market players. The market is poised for continued expansion, with significant investment in research and development expected to unlock new applications and further solidify its critical role in global health.

Virus Removal Filtration Membrane Segmentation

-

1. Application

- 1.1. Biopharmaceuticals

- 1.2. Laboratory Research

- 1.3. Others

-

2. Type

- 2.1. Polyethersulfone (PES)

- 2.2. Regenerated Cellulose (RC)

- 2.3. Polyvinylidene Fluoride (PVDF)

Virus Removal Filtration Membrane Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Virus Removal Filtration Membrane REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virus Removal Filtration Membrane Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Biopharmaceuticals

- 5.1.2. Laboratory Research

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Polyethersulfone (PES)

- 5.2.2. Regenerated Cellulose (RC)

- 5.2.3. Polyvinylidene Fluoride (PVDF)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Virus Removal Filtration Membrane Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Biopharmaceuticals

- 6.1.2. Laboratory Research

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Polyethersulfone (PES)

- 6.2.2. Regenerated Cellulose (RC)

- 6.2.3. Polyvinylidene Fluoride (PVDF)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Virus Removal Filtration Membrane Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Biopharmaceuticals

- 7.1.2. Laboratory Research

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Polyethersulfone (PES)

- 7.2.2. Regenerated Cellulose (RC)

- 7.2.3. Polyvinylidene Fluoride (PVDF)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Virus Removal Filtration Membrane Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Biopharmaceuticals

- 8.1.2. Laboratory Research

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Polyethersulfone (PES)

- 8.2.2. Regenerated Cellulose (RC)

- 8.2.3. Polyvinylidene Fluoride (PVDF)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Virus Removal Filtration Membrane Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Biopharmaceuticals

- 9.1.2. Laboratory Research

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Polyethersulfone (PES)

- 9.2.2. Regenerated Cellulose (RC)

- 9.2.3. Polyvinylidene Fluoride (PVDF)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Virus Removal Filtration Membrane Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Biopharmaceuticals

- 10.1.2. Laboratory Research

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Polyethersulfone (PES)

- 10.2.2. Regenerated Cellulose (RC)

- 10.2.3. Polyvinylidene Fluoride (PVDF)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Merck

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sartorius

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cytiva

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Asahi Kasei

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TeraPore Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Agilitech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Meissner

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Masterfilter

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cobetter

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LePure Biotech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 S&P Filtration

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Merck

List of Figures

- Figure 1: Global Virus Removal Filtration Membrane Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Virus Removal Filtration Membrane Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Virus Removal Filtration Membrane Revenue (million), by Application 2024 & 2032

- Figure 4: North America Virus Removal Filtration Membrane Volume (K), by Application 2024 & 2032

- Figure 5: North America Virus Removal Filtration Membrane Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Virus Removal Filtration Membrane Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Virus Removal Filtration Membrane Revenue (million), by Type 2024 & 2032

- Figure 8: North America Virus Removal Filtration Membrane Volume (K), by Type 2024 & 2032

- Figure 9: North America Virus Removal Filtration Membrane Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Virus Removal Filtration Membrane Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Virus Removal Filtration Membrane Revenue (million), by Country 2024 & 2032

- Figure 12: North America Virus Removal Filtration Membrane Volume (K), by Country 2024 & 2032

- Figure 13: North America Virus Removal Filtration Membrane Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Virus Removal Filtration Membrane Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Virus Removal Filtration Membrane Revenue (million), by Application 2024 & 2032

- Figure 16: South America Virus Removal Filtration Membrane Volume (K), by Application 2024 & 2032

- Figure 17: South America Virus Removal Filtration Membrane Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Virus Removal Filtration Membrane Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Virus Removal Filtration Membrane Revenue (million), by Type 2024 & 2032

- Figure 20: South America Virus Removal Filtration Membrane Volume (K), by Type 2024 & 2032

- Figure 21: South America Virus Removal Filtration Membrane Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Virus Removal Filtration Membrane Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Virus Removal Filtration Membrane Revenue (million), by Country 2024 & 2032

- Figure 24: South America Virus Removal Filtration Membrane Volume (K), by Country 2024 & 2032

- Figure 25: South America Virus Removal Filtration Membrane Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Virus Removal Filtration Membrane Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Virus Removal Filtration Membrane Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Virus Removal Filtration Membrane Volume (K), by Application 2024 & 2032

- Figure 29: Europe Virus Removal Filtration Membrane Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Virus Removal Filtration Membrane Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Virus Removal Filtration Membrane Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Virus Removal Filtration Membrane Volume (K), by Type 2024 & 2032

- Figure 33: Europe Virus Removal Filtration Membrane Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Virus Removal Filtration Membrane Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Virus Removal Filtration Membrane Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Virus Removal Filtration Membrane Volume (K), by Country 2024 & 2032

- Figure 37: Europe Virus Removal Filtration Membrane Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Virus Removal Filtration Membrane Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Virus Removal Filtration Membrane Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Virus Removal Filtration Membrane Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Virus Removal Filtration Membrane Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Virus Removal Filtration Membrane Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Virus Removal Filtration Membrane Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Virus Removal Filtration Membrane Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Virus Removal Filtration Membrane Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Virus Removal Filtration Membrane Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Virus Removal Filtration Membrane Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Virus Removal Filtration Membrane Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Virus Removal Filtration Membrane Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Virus Removal Filtration Membrane Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Virus Removal Filtration Membrane Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Virus Removal Filtration Membrane Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Virus Removal Filtration Membrane Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Virus Removal Filtration Membrane Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Virus Removal Filtration Membrane Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Virus Removal Filtration Membrane Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Virus Removal Filtration Membrane Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Virus Removal Filtration Membrane Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Virus Removal Filtration Membrane Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Virus Removal Filtration Membrane Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Virus Removal Filtration Membrane Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Virus Removal Filtration Membrane Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Virus Removal Filtration Membrane Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Virus Removal Filtration Membrane Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Virus Removal Filtration Membrane Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Virus Removal Filtration Membrane Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Virus Removal Filtration Membrane Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Virus Removal Filtration Membrane Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Virus Removal Filtration Membrane Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Virus Removal Filtration Membrane Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Virus Removal Filtration Membrane Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Virus Removal Filtration Membrane Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Virus Removal Filtration Membrane Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Virus Removal Filtration Membrane Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Virus Removal Filtration Membrane Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Virus Removal Filtration Membrane Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Virus Removal Filtration Membrane Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Virus Removal Filtration Membrane Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Virus Removal Filtration Membrane Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Virus Removal Filtration Membrane Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Virus Removal Filtration Membrane Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Virus Removal Filtration Membrane Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Virus Removal Filtration Membrane Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Virus Removal Filtration Membrane Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Virus Removal Filtration Membrane Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Virus Removal Filtration Membrane Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Virus Removal Filtration Membrane Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Virus Removal Filtration Membrane Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Virus Removal Filtration Membrane Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Virus Removal Filtration Membrane Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Virus Removal Filtration Membrane Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Virus Removal Filtration Membrane Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Virus Removal Filtration Membrane Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Virus Removal Filtration Membrane Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Virus Removal Filtration Membrane Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Virus Removal Filtration Membrane Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Virus Removal Filtration Membrane Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Virus Removal Filtration Membrane Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Virus Removal Filtration Membrane Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Virus Removal Filtration Membrane Volume K Forecast, by Country 2019 & 2032

- Table 81: China Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Virus Removal Filtration Membrane Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Virus Removal Filtration Membrane Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virus Removal Filtration Membrane?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Virus Removal Filtration Membrane?

Key companies in the market include Merck, Sartorius, Cytiva, Asahi Kasei, TeraPore Technologies, Agilitech, Meissner, Masterfilter, Cobetter, LePure Biotech, S&P Filtration.

3. What are the main segments of the Virus Removal Filtration Membrane?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4160 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virus Removal Filtration Membrane," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virus Removal Filtration Membrane report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virus Removal Filtration Membrane?

To stay informed about further developments, trends, and reports in the Virus Removal Filtration Membrane, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence