Key Insights

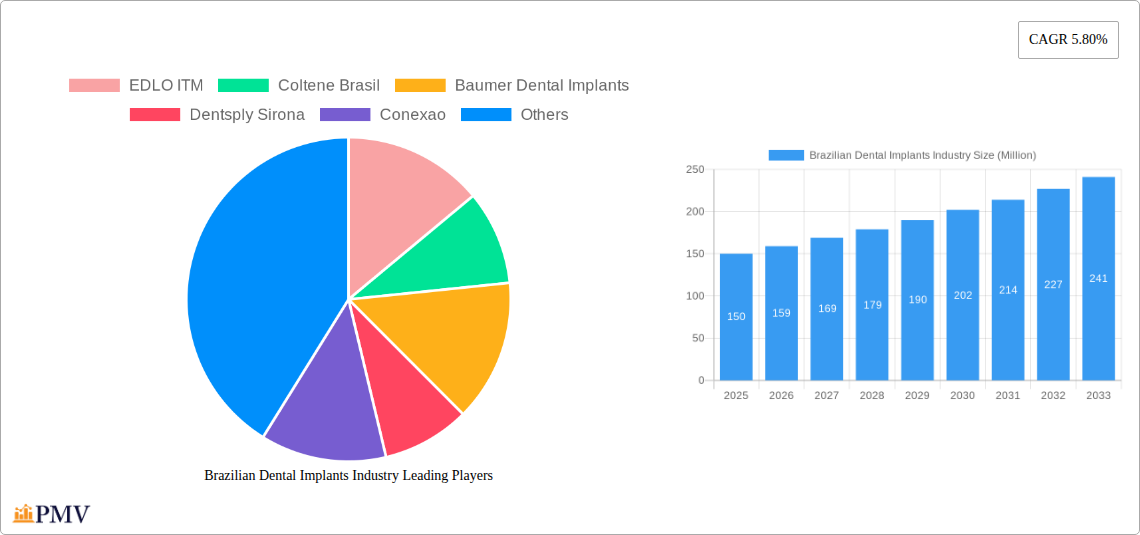

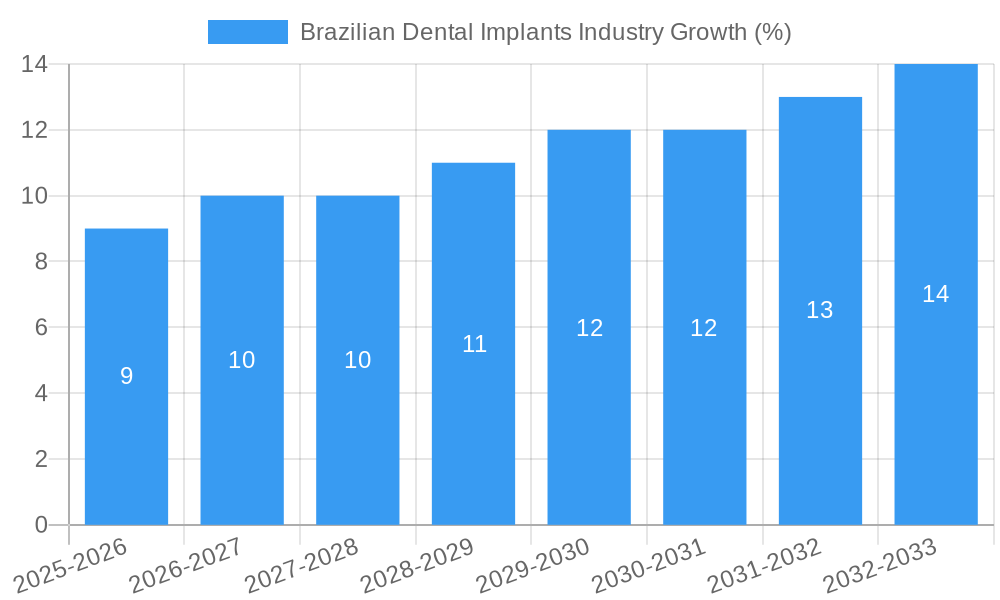

The Brazilian dental implants market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This growth is fueled by several key factors. Firstly, rising disposable incomes and increased health awareness among the Brazilian population are driving greater demand for aesthetic and functional dental solutions. Secondly, advancements in implant technology, leading to improved biocompatibility, shorter treatment times, and better patient outcomes, are further boosting market expansion. The increasing prevalence of periodontal diseases and tooth loss, particularly amongst the aging population, also significantly contributes to the market's growth trajectory. Furthermore, the expanding network of dental clinics and hospitals across Brazil offers improved access to dental implant procedures, supporting market penetration. The market is segmented by treatment type (Orthodontic, Endodontic, Periodontic, Prosthodontic), end-user (Hospitals, Clinics, Other End-Users), and product type (General and Diagnostic Equipment, Other Dental Consumables, Other General and Diagnostic Equipment). The presence of established international players like Dentsply Sirona and Straumann, alongside prominent domestic companies like Angelus Dental and Derig Implantes do Brasil, creates a competitive landscape fostering innovation and accessibility.

Despite these positive drivers, challenges remain. High treatment costs can restrict access for a segment of the population, potentially limiting market expansion. Furthermore, the regulatory landscape and reimbursement policies can influence the market dynamics. Nevertheless, the overall outlook for the Brazilian dental implants market remains positive, driven by a confluence of factors pointing towards sustained growth and an increase in market share for key players. The market's dynamic nature necessitates continuous adaptation and innovation from market participants to capitalize on emerging opportunities and address existing challenges. Further market segmentation analyses, considering factors such as geographic location and socioeconomic factors, would provide a more granular understanding of the market's potential.

Brazilian Dental Implants Industry: Market Analysis and Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Brazilian dental implants industry, covering market structure, competitive dynamics, growth drivers, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025), projecting the market’s trajectory until 2033. The report offers crucial insights for industry stakeholders, investors, and market entrants seeking to navigate this dynamic sector. The total market value is projected to reach xx Million by 2033.

Brazilian Dental Implants Industry Market Structure & Competitive Dynamics

The Brazilian dental implants market exhibits a moderately concentrated structure, with key players like Dentsply Sirona, Straumann Group (Neodent), and other international and domestic companies vying for market share. The industry is characterized by a dynamic innovation ecosystem, driven by advancements in materials science, digital dentistry, and minimally invasive techniques. Regulatory frameworks, while generally supportive of industry growth, necessitate compliance with stringent quality and safety standards. Product substitutes, such as dentures and bridges, continue to compete, although the growing preference for aesthetically pleasing and long-lasting solutions fuels demand for implants. End-user trends reveal a shift toward advanced treatment procedures and greater emphasis on personalized care.

M&A activities have played a role in shaping the competitive landscape, with notable transactions involving xx Million in deal values over the past few years. This activity signifies the strategic importance of the Brazilian market and the consolidation trend within the sector. Key metrics like market share, calculated for each major player, reveal a dynamic competitive landscape with shifting positions based on product innovation and marketing strategies.

- Market Concentration: Moderately Concentrated

- Innovation Ecosystem: High, driven by material science and digital dentistry.

- Regulatory Framework: Stringent, focusing on quality and safety.

- M&A Activity: Significant, with deal values totaling xx Million in recent years.

Brazilian Dental Implants Industry Industry Trends & Insights

The Brazilian dental implants market is experiencing robust growth, driven by factors such as increasing prevalence of dental diseases, rising disposable incomes, and growing awareness of aesthetic dentistry. The CAGR during the forecast period (2025-2033) is estimated at xx%, reflecting the market’s sustained expansion. Technological disruptions, particularly in digital dentistry (CAD/CAM technology, guided surgery), are transforming treatment protocols and improving outcomes. Consumer preferences increasingly favor minimally invasive procedures, faster healing times, and superior aesthetics. Competitive dynamics are intense, with companies vying for market share through product innovation, strategic partnerships, and aggressive marketing. Market penetration of dental implants is steadily rising, particularly in urban areas, with projections indicating a significant expansion into less-penetrated regions.

Dominant Markets & Segments in Brazilian Dental Implants Industry

The Brazilian dental implants market demonstrates strong growth across various segments. The Prosthodontic segment is currently dominant due to higher treatment complexity and associated value. Clinics represent the largest end-user segment, driven by their accessibility and widespread presence. Growth drivers vary across segments:

- Prosthodontic Segment: High demand for aesthetically pleasing and functional restorations.

- Clinics Segment: Wide availability and affordability compared to hospitals.

- Geographic Dominance: Major metropolitan areas (São Paulo, Rio de Janeiro) exhibit the highest market share due to concentrated wealth and better access to advanced healthcare services.

Key Drivers:

- Economic Growth: Rising disposable incomes enhance affordability.

- Healthcare Infrastructure: Improvement in dental clinics and hospitals expands access.

- Government Initiatives: Public health programs promoting oral health.

Brazilian Dental Implants Industry Product Innovations

Recent product innovations focus on enhancing implant longevity, improving osseointegration, and simplifying surgical procedures. Zirconia implants, like Neodent's Zi system, showcase superior strength and aesthetics. Digital dentistry technologies streamline workflows and improve treatment precision. These advancements offer competitive advantages by improving treatment outcomes and patient experience. The market is witnessing a shift toward more patient-centric products and solutions.

Report Segmentation & Scope

The report segments the Brazilian dental implants market across various dimensions:

Treatment: Orthodontic, Endodontic, Periodontic, Prosthodontic (each segment shows growth projections and competitive dynamics). The Prosthodontic segment is anticipated to exhibit the highest growth due to increasing demand for advanced restorative options.

End-User: Hospitals, Clinics, Other End-Users (market size and competitive landscape detailed for each). Clinics comprise the largest end-user segment due to increased accessibility and affordability.

Product: General and Diagnostic Equipment, Other Dental Consumables (Other Dental Devices), Other General and Diagnostic equipment (Dental Consumables) (growth forecasts and competitive analyses provided for each). The General and Diagnostic Equipment segment is likely to see growth driven by the adoption of advanced technologies.

Key Drivers of Brazilian Dental Implants Industry Growth

Several factors fuel the Brazilian dental implants market's expansion. Technological advancements such as CAD/CAM technology and guided surgery improve implant placement accuracy and reduce procedure time. Rising disposable incomes and increased health awareness enhance patient access to advanced dental care. Government initiatives aimed at improving oral healthcare infrastructure further support market growth.

Challenges in the Brazilian Dental Implants Industry Sector

Despite significant growth potential, challenges remain. Regulatory hurdles related to product approvals can create delays in market entry. Supply chain disruptions and fluctuations in raw material prices impact profitability. Intense competition, especially from established international players, requires strong marketing and differentiation strategies. These factors collectively influence the industry's expansion trajectory.

Leading Players in the Brazilian Dental Implants Industry Market

- EDLO ITM

- Coltene Brasil

- Baumer Dental Implants

- Dentsply Sirona

- Conexao

- Bicon LLC

- SDI Limited

- Derig Implantes do Brasil

- Angelus Dental

- Institut Straumann AG

- SIN Implant System

- ZimVie Inc

Key Developments in Brazilian Dental Implants Industry Sector

- September 2022: DENTSPLY SIRONA Inc. announced new digital dentistry products at Dentsply Sirona World 2022, signifying ongoing innovation in the sector.

- March 2022: Neodent (Straumann Group) launched the Zi zirconia implant system, highlighting material advancements and influencing market competition.

Strategic Brazilian Dental Implants Industry Market Outlook

The Brazilian dental implants market presents significant growth opportunities over the forecast period. Continued technological advancements, increasing disposable incomes, and expansion into less-penetrated regions will drive market expansion. Strategic partnerships, product diversification, and focus on delivering high-quality, patient-centric solutions will be crucial for success in this competitive landscape. The market is poised for considerable expansion, driven by strong fundamentals and ongoing industry innovation.

Brazilian Dental Implants Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

- 1.1.1. Dental Laser

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic equipment

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Periodontic

- 2.4. Prosthodontic

-

3. End-User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End-Users

Brazilian Dental Implants Industry Segmentation By Geography

- 1. Brazil

Brazilian Dental Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Government Initiatives; High Number of Dentists and Growing Cosmetic Dentistry; Technological Advancements in Dentistry

- 3.3. Market Restrains

- 3.3.1. High Cost of Device

- 3.4. Market Trends

- 3.4.1. Periodontics Segment is Expected to Witness Considerable Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Laser

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic equipment

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Periodontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EDLO ITM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coltene Brasil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baumer Dental Implants

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dentsply Sirona

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Conexao

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bicon LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SDI Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Derig Implantes do Brasil

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Angelus Dental

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Institut Straumann AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SIN Implant System

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ZimVie Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 EDLO ITM

List of Figures

- Figure 1: Brazilian Dental Implants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian Dental Implants Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazilian Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Brazilian Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 4: Brazilian Dental Implants Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Brazilian Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazilian Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazilian Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 8: Brazilian Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 9: Brazilian Dental Implants Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Brazilian Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Dental Implants Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Brazilian Dental Implants Industry?

Key companies in the market include EDLO ITM, Coltene Brasil, Baumer Dental Implants, Dentsply Sirona, Conexao, Bicon LLC, SDI Limited, Derig Implantes do Brasil, Angelus Dental, Institut Straumann AG, SIN Implant System, ZimVie Inc.

3. What are the main segments of the Brazilian Dental Implants Industry?

The market segments include Product, Treatment, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Initiatives; High Number of Dentists and Growing Cosmetic Dentistry; Technological Advancements in Dentistry.

6. What are the notable trends driving market growth?

Periodontics Segment is Expected to Witness Considerable Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Device.

8. Can you provide examples of recent developments in the market?

September 2022- DENTSPLY SIRONA Inc. announced that at Dentsply Sirona World 2022, it would be launching new products and solutions as part of its digital universe, which are designed to bring innovation in dentistry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Dental Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Dental Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Dental Implants Industry?

To stay informed about further developments, trends, and reports in the Brazilian Dental Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence