Key Insights

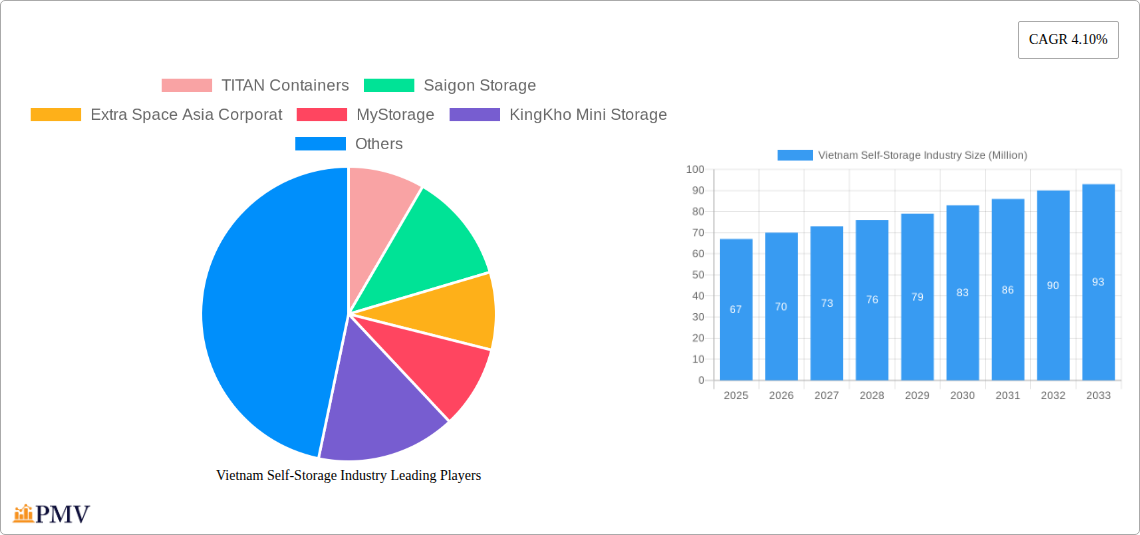

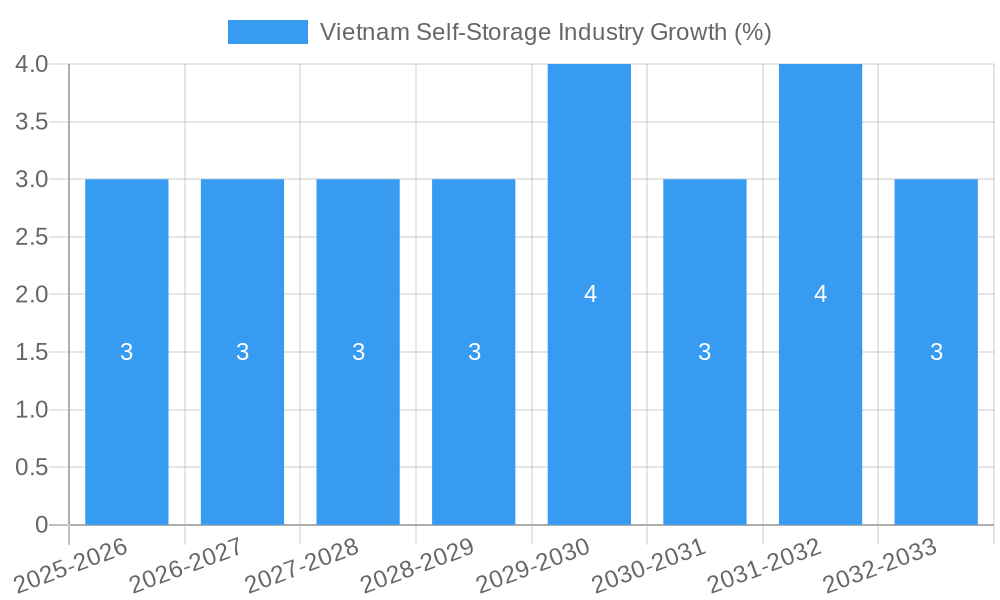

The Vietnam self-storage market, currently experiencing robust growth, presents a compelling investment opportunity. With a Compound Annual Growth Rate (CAGR) of 4.10% from 2019 to 2024, the market demonstrates sustained expansion. While the exact 2025 market size isn't specified, projecting from a plausible base year of 2019 (estimating a market size of $50 million based on regional comparisons and industry averages for developing economies with similar growth trajectories), and applying the 4.10% CAGR yields an estimated market value of approximately $67 million in 2025. This growth is driven by several factors, including a burgeoning e-commerce sector, increasing urbanization leading to smaller living spaces, and the rise of small and medium-sized enterprises (SMEs) requiring flexible storage solutions. The market is segmented into consumer and business self-storage, with both segments anticipated to contribute significantly to future growth. Key players like Titan Containers, Saigon Storage, Extra Space Asia Corporation, MyStorage, and KingKho Mini Storage are competing to capture market share, indicating a competitive but expanding landscape.

Looking forward to 2033, continued expansion is projected, driven by sustained economic growth and evolving consumer preferences. However, potential restraints include regulatory hurdles and the availability of suitable land for new facility development. Strategic investments in technology, improved logistics, and a focus on diverse customer segments will be crucial for market players seeking sustained success in this dynamic market. The dominance of consumer or business self-storage will likely depend on macroeconomic indicators and the rate of SME growth. Understanding these nuances is critical to developing a successful business strategy within the burgeoning Vietnamese self-storage sector.

Vietnam Self-Storage Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Vietnam self-storage industry, offering invaluable insights for investors, businesses, and industry stakeholders. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The analysis leverages extensive data from the historical period (2019-2024) to paint a vivid picture of market trends, competitive dynamics, and future growth potential. This report utilizes data that may include projections for missing figures. All values are expressed in millions.

Vietnam Self-Storage Industry Market Structure & Competitive Dynamics

The Vietnam self-storage market is characterized by a moderately concentrated structure, with key players such as TITAN Containers, Saigon Storage, Extra Space Asia Corporation, MyStorage, and KingKho Mini Storage vying for market share. While precise market share figures for each company are unavailable and require further investigation (xx%), the industry exhibits signs of increasing competition, driven by both established players expanding their footprints and new entrants capitalizing on market growth. Innovation within the sector is presently focused on enhancing storage technology and improving customer experience through online platforms and streamlined booking processes. The regulatory framework is currently relatively nascent, with ongoing developments impacting licensing and operational standards. Product substitutes, such as traditional warehousing solutions, continue to exist, but the convenience and flexibility of self-storage are attracting a growing segment of the market. End-user trends point towards increasing demand from both consumers and businesses, driven by factors such as urbanization, e-commerce growth, and the increasing need for flexible workspace solutions. M&A activity in the sector is expected to continue with further data needed to analyze deal values (xx Million) in recent years; however, strategic acquisitions are likely as larger companies aim to consolidate their market presence.

Vietnam Self-Storage Industry Industry Trends & Insights

The Vietnam self-storage market is witnessing significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is fueled by several key factors. Rapid urbanization in major cities like Ho Chi Minh City and Hanoi is driving demand for efficient storage solutions, particularly amongst younger demographics. The burgeoning e-commerce sector is also contributing significantly, with businesses requiring warehousing space to manage inventory and fulfill orders. Technological disruptions, such as the adoption of smart storage solutions and online booking systems, are enhancing convenience and customer experience, further stimulating market growth. Consumer preferences are shifting towards secure, easily accessible, and technologically advanced storage facilities. Market penetration is expected to increase substantially over the forecast period, reflecting rising awareness and adoption of self-storage as a viable solution for both personal and business needs. The competitive landscape is evolving, with players focusing on differentiation through enhanced services, technology, and strategic location optimization.

Dominant Markets & Segments in Vietnam Self-Storage Industry

The self-storage market in Vietnam is experiencing robust growth across both consumer and business segments. While precise data on regional dominance is not available (xx), the major urban centers of Ho Chi Minh City and Hanoi are expected to represent the largest share of the market.

Key Drivers for Consumer Segment Dominance:

- Rising disposable incomes and changing lifestyles.

- Increased mobility and frequent relocation amongst younger populations.

- Growing preference for decluttered living spaces.

Key Drivers for Business Segment Dominance:

- Expansion of e-commerce and related logistics needs.

- Growth in small and medium-sized enterprises (SMEs).

- Demand for flexible and scalable warehousing solutions.

The dominance of these segments is primarily driven by the rapid economic growth and urbanization taking place in Vietnam, leading to increased demand for convenient and flexible storage options. Government policies promoting infrastructure development and supporting the growth of SMEs also contributes to the market's expansion.

Vietnam Self-Storage Industry Product Innovations

Recent innovations in the Vietnamese self-storage market center around enhanced security features, such as improved surveillance systems and access control measures. The integration of technology, including online booking platforms and mobile applications, is also prominent, aiming to streamline the customer experience. Climate-controlled units are gaining popularity, particularly for businesses needing to store sensitive materials. These innovations provide significant competitive advantages by offering superior security, convenience, and enhanced value propositions.

Report Segmentation & Scope

This report segments the Vietnam self-storage market into two primary categories based on self-storage type: consumer and business.

Consumer Segment: This segment encompasses individual customers utilizing self-storage for personal belongings, encompassing various storage unit sizes and potentially including additional services like packing supplies. The growth of this segment is anticipated to remain robust driven by urbanization and changing lifestyles. Market size projections suggest xx Million in revenue by 2033.

Business Segment: This segment focuses on commercial users, such as SMEs, e-commerce companies, and businesses needing flexible warehousing solutions. Market growth is anticipated to be substantial due to the booming e-commerce sector and the growing number of SMEs. Revenue projections for this segment indicate xx Million by 2033.

Key Drivers of Vietnam Self-Storage Industry Growth

Several key factors propel the growth of Vietnam's self-storage industry. Rapid urbanization leads to increased demand for space-saving solutions, while the rise of e-commerce fuels the need for efficient warehousing and inventory management. Government initiatives promoting infrastructure development and supporting SMEs also contribute positively. Technological advancements, such as smart storage solutions and online booking platforms, improve accessibility and user experience. Finally, evolving consumer preferences toward flexible, convenient, and secure storage options further boost market expansion.

Challenges in the Vietnam Self-Storage Industry Sector

The Vietnam self-storage industry faces several challenges. Land acquisition costs can be substantial in urban areas, hindering expansion. Competition is growing increasingly intense, necessitating strategic differentiation. Regulatory uncertainties around licensing and operational standards also pose risks. Furthermore, supply chain disruptions in procuring building materials and managing operations can affect service delivery. These combined challenges negatively impact profitability and long-term growth.

Leading Players in the Vietnam Self-Storage Industry Market

- TITAN Containers

- Saigon Storage

- Extra Space Asia Corporation

- MyStorage

- KingKho Mini Storage

Key Developments in Vietnam Self-Storage Industry Sector

- 2022 Q4: Saigon Storage launched a new online booking platform.

- 2023 Q1: TITAN Containers announced a significant expansion of its facilities in Hanoi.

- 2023 Q3: Extra Space Asia Corporation acquired a smaller local competitor. (Further details on acquisition value and company name unavailable, xx Million).

Strategic Vietnam Self-Storage Industry Market Outlook

The Vietnam self-storage industry holds significant future potential. Sustained economic growth, urbanization, and the continued expansion of e-commerce are key growth accelerators. Strategic opportunities exist for companies to capitalize on these trends through innovation, strategic acquisitions, and expansion into underserved markets. Investing in technology, optimizing operational efficiency, and building strong customer relationships will be crucial for long-term success in this dynamic market.

Vietnam Self-Storage Industry Segmentation

-

1. Self-storage Type

- 1.1. Consumer

- 1.2. Business

Vietnam Self-Storage Industry Segmentation By Geography

- 1. Vietnam

Vietnam Self-Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Favorable Demographic Trends Such as High-income Population

- 3.2.2 Demand in Urban Areas and Growing Market Concentration

- 3.3. Market Restrains

- 3.3.1. High Raw Materials and Manufacturing Cost; Complicated and Variable Regulations of Cleanroom

- 3.4. Market Trends

- 3.4.1 Increased Urbanization

- 3.4.2 Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in Vietnam

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Self-Storage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 5.1.1. Consumer

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TITAN Containers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saigon Storage

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Extra Space Asia Corporat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MyStorage

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KingKho Mini Storage

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 TITAN Containers

List of Figures

- Figure 1: Vietnam Self-Storage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Self-Storage Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Self-Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Self-Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 3: Vietnam Self-Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Vietnam Self-Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Vietnam Self-Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 6: Vietnam Self-Storage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Self-Storage Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Vietnam Self-Storage Industry?

Key companies in the market include TITAN Containers, Saigon Storage, Extra Space Asia Corporat, MyStorage, KingKho Mini Storage.

3. What are the main segments of the Vietnam Self-Storage Industry?

The market segments include Self-storage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Favorable Demographic Trends Such as High-income Population. Demand in Urban Areas and Growing Market Concentration.

6. What are the notable trends driving market growth?

Increased Urbanization. Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in Vietnam.

7. Are there any restraints impacting market growth?

High Raw Materials and Manufacturing Cost; Complicated and Variable Regulations of Cleanroom.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Self-Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Self-Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Self-Storage Industry?

To stay informed about further developments, trends, and reports in the Vietnam Self-Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence