Key Insights

The United States Ampoules Packaging Market is projected to reach approximately $5.49 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.6%. This growth is primarily driven by the pharmaceutical industry's increasing demand for sterile and secure packaging for injectables and sensitive medications, further propelled by advancements in drug delivery systems and the rising prevalence of chronic diseases. The personal care and cosmetic sectors also contribute significantly through the use of ampoules for premium, single-dose formulations. Innovations in both glass and plastic ampoule designs, focusing on enhanced safety, portability, and inertness, are shaping the material landscape.

United States Ampoules Packaging Market Market Size (In Billion)

Future market expansion will be influenced by innovations in tamper-evident sealing, sustainable packaging materials, and smart packaging features for traceability. Key growth drivers include advancements in drug delivery and the increasing need for specialized packaging. However, the market faces challenges such as fluctuating raw material costs and stringent regulatory compliance. Leading companies are actively enhancing production capabilities and developing novel solutions, sustaining the market's upward trajectory. The market is segmented by material (Glass, Plastics) and end-user (Pharmaceutical, Personal Care & Cosmetic), reflecting diverse applications and specific demands.

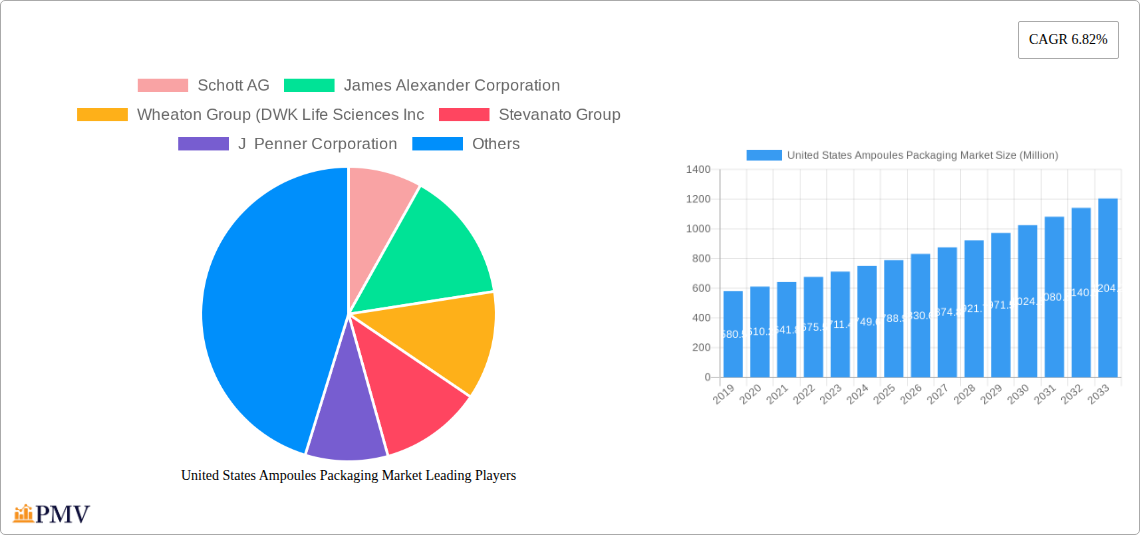

United States Ampoules Packaging Market Company Market Share

This report offers a granular analysis of the United States Ampoules Packaging Market, including market structure, competitive landscape, industry trends, segment dominance, product innovations, and key growth drivers and challenges. The study covers the historical period from 2019 to 2024, with a base year of 2025 and forecasts extending to 2033, providing critical insights into market size, share, CAGR projections, and strategic developments by leading players.

United States Ampoules Packaging Market Market Structure & Competitive Dynamics

The United States ampoules packaging market is characterized by a moderately consolidated structure, with a few dominant players holding significant market share, estimated to be over 60% by the base year 2025. Innovation ecosystems are robust, driven by the pharmaceutical industry's stringent quality requirements and the increasing demand for specialized drug delivery systems. Regulatory frameworks, governed by entities like the FDA, play a crucial role in shaping market entry and product development, emphasizing sterile packaging and tamper-evident features. Product substitutes, while present in broader pharmaceutical packaging, are limited for the specific sterile, single-dose applications where ampoules excel. End-user trends indicate a growing preference for smaller, single-dose formats for improved patient compliance and reduced drug waste. Mergers and acquisitions (M&A) activities are strategic, focused on consolidating market presence and expanding technological capabilities. For instance, recent M&A deals in the broader pharmaceutical packaging sector have seen valuations in the tens to hundreds of Millions, indicating a healthy appetite for strategic growth.

- Market Concentration: Moderate to high, driven by established players with significant R&D and manufacturing capabilities.

- Innovation Ecosystems: Fueled by pharmaceutical R&D, demanding advanced sterilization and material science.

- Regulatory Frameworks: FDA oversight is paramount, dictating stringent quality and safety standards.

- Product Substitutes: Limited for sterile, single-dose primary packaging applications.

- End-User Trends: Shift towards single-dose vials and pre-filled syringes in some therapeutic areas, but ampoules retain a strong niche.

- M&A Activities: Strategic acquisitions aimed at expanding product portfolios and geographical reach.

United States Ampoules Packaging Market Industry Trends & Insights

The United States ampoules packaging market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is primarily fueled by the escalating demand for sterile, single-dose packaging solutions within the pharmaceutical industry, driven by the development of biologics, vaccines, and specialized injectable drugs. Technological advancements in glass manufacturing and plastic molding are enabling the production of more sophisticated and cost-effective ampoules, offering enhanced product protection and ease of use. Consumer preferences are increasingly leaning towards convenience and patient safety, making pre-filled and single-use packaging formats highly desirable. The personalized medicine trend is also a significant growth driver, as it often necessitates the packaging of small, precise dosages, a role ampoules are ideally suited to fulfill. Competitive dynamics are intensifying, with manufacturers investing heavily in research and development to enhance barrier properties, introduce novel designs, and ensure compliance with evolving regulatory standards. The market penetration of specialized ampoule designs, such as those with enhanced breakability and tamper-evidence, is on the rise. Furthermore, the growing awareness and implementation of Good Manufacturing Practices (GMP) across the supply chain are reinforcing the demand for high-quality, reliable ampoule packaging solutions. The increasing prevalence of chronic diseases and the subsequent rise in pharmaceutical production are creating sustained demand for reliable drug containment systems like ampoules. The U.S. market’s robust healthcare infrastructure and its position as a global leader in pharmaceutical innovation provide a fertile ground for continued expansion. The focus on preventing drug counterfeiting and ensuring product integrity further bolsters the importance of secure ampoule packaging. The pharmaceutical sector's continuous pipeline of new drug formulations, particularly injectable biologics, directly translates into a steady requirement for sterile and inert packaging solutions, with glass ampoules often being the preferred choice due to their superior chemical inertness. The personalized healthcare revolution, which involves smaller, more targeted doses, also favors the use of ampoules for precise drug delivery.

Dominant Markets & Segments in United States Ampoules Packaging Market

The Pharmaceutical segment stands as the dominant end-user in the United States ampoules packaging market, accounting for an estimated 85% of the total market value in 2025. This dominance is directly attributable to the critical need for sterile, inert, and precisely dosed packaging for a vast array of injectable drugs, vaccines, and biopharmaceuticals. The stringent regulatory requirements imposed by the FDA for pharmaceutical packaging, emphasizing product integrity, sterility assurance, and patient safety, further solidify the position of ampoules, particularly glass ampoules, in this sector. Economic policies supporting pharmaceutical research and development, coupled with substantial government investment in healthcare infrastructure, create a perpetually high demand for drug packaging.

Within the material segmentation, Glass ampoules are the most prominent, projected to hold over 75% of the market share in 2025. This preference for glass stems from its unparalleled chemical inertness, excellent barrier properties against moisture and gases, and its ability to withstand sterilization processes without degradation. Glass ampoules are ideal for sensitive drug formulations, including biologics and highly reactive compounds, ensuring product stability and efficacy. The historical preference and established manufacturing processes for glass ampoules in the U.S. pharmaceutical industry contribute to its sustained dominance.

Pharmaceutical End-User Dominance:

- Key Drivers: Stringent FDA regulations, high demand for sterile injectables, growth in biologics and vaccines, focus on patient safety and drug efficacy.

- Detailed Analysis: The pharmaceutical industry’s continuous innovation pipeline, including novel drug discoveries and the expansion of therapeutic areas requiring injectable administration, directly translates to sustained demand for ampoules. The need for precise dosing in specialized treatments and the prevention of cross-contamination are critical factors driving the adoption of ampoules.

Glass Material Dominance:

- Key Drivers: Superior chemical inertness, excellent barrier properties, resistance to high temperatures during sterilization, established trust and reliability in pharmaceutical applications.

- Detailed Analysis: Glass ampoules offer a proven track record of protecting sensitive pharmaceutical products from external contaminants and degradation. Their non-reactive nature ensures that no leachable impurities are introduced into the drug formulation, a critical concern for injectable medications. The visual inspection of glass ampoules for particulate matter is also a significant advantage for quality control.

United States Ampoules Packaging Market Product Innovations

Recent product innovations in the United States ampoules packaging market focus on enhancing user safety, improving drug stability, and offering greater convenience. Developments include specialized break-point designs for easier and safer opening, minimizing glass shard contamination. Innovations in barrier coatings and tamper-evident closures are also gaining traction, providing an additional layer of product security and integrity. The increasing adoption of pre-filled ampoules streamlines the drug administration process for healthcare professionals and patients alike.

Report Segmentation & Scope

This report segments the United States Ampoules Packaging Market by material and end-user. The material segments include Glass and Plastics. The end-user segments are Pharmaceutical and Personal Care and Cosmetic. The Pharmaceutical segment is projected to dominate the market with a significant share due to stringent requirements for sterile packaging and a growing pipeline of injectable drugs. The Personal Care and Cosmetic segment, while smaller, shows potential for growth driven by premium product formulations requiring precise, single-dose delivery.

Key Drivers of United States Ampoules Packaging Market Growth

The United States ampoules packaging market is propelled by several key drivers. The robust growth of the pharmaceutical sector, particularly in biologics, vaccines, and specialized injectable drugs, creates a consistent demand for sterile and inert packaging. Increasingly stringent regulatory requirements from bodies like the FDA mandate high-quality packaging solutions that ensure drug integrity and patient safety. Technological advancements in glass and plastic manufacturing are leading to more efficient and cost-effective production of ampoules, with improved features. Furthermore, the rising trend towards personalized medicine necessitates precise, single-dose packaging, a role that ampoules are well-suited to fulfill.

Challenges in the United States Ampoules Packaging Market Sector

Despite the positive growth trajectory, the United States ampoules packaging market faces several challenges. The cost of glass manufacturing and the energy-intensive processes involved can impact overall pricing. Supply chain disruptions, particularly for specialized raw materials, can lead to production delays and increased costs. Stringent regulatory compliance, while a driver for quality, also presents a hurdle, requiring significant investment in quality control and validation processes. Moreover, the emergence of alternative sterile single-dose packaging formats, such as pre-filled syringes and vials, poses a competitive threat in certain therapeutic areas.

Leading Players in the United States Ampoules Packaging Market Market

- Schott AG

- James Alexander Corporation

- Wheaton Group (DWK Life Sciences Inc)

- Stevanato Group

- J Penner Corporation

- Nipro Pharma Packaging International NV

- Gerresheimer AG

- Accu-Glass LLC

Key Developments in United States Ampoules Packaging Market Sector

- July 2022: Vichy Laboratoires recalled LiftActiv Peptide-C Ampoules due to a laceration hazard. This recall involved Liftactiv Peptide-C Ampoules 1.8 ml (10 pack) and Liftactiv Peptide-C Ampoules 1.8 ml (30 pack), which are facial serums.

- June 2022: American Regent Inc. and Provepharm Life Solutions announced the availability of ProvayBlue (methylene blue) Injection, USP, in a 10 ml single-dose vial. Pediatric and adult patients with acquired methemoglobinemia can be treated with ProvayBlue.

Strategic United States Ampoules Packaging Market Market Outlook

The strategic outlook for the United States ampoules packaging market remains optimistic, driven by innovation and the unwavering demand from the pharmaceutical industry. Future growth will likely be accelerated by the continued development of advanced sterile packaging technologies, including novel materials and tamper-evident features. Manufacturers focusing on sustainable packaging solutions and those with strong regulatory compliance expertise will be well-positioned for success. The increasing global demand for injectable drugs, coupled with the U.S. market’s role as a hub for pharmaceutical research and development, presents significant strategic opportunities for market players to expand their offerings and capture a larger market share.

United States Ampoules Packaging Market Segmentation

-

1. Material

- 1.1. Glass

- 1.2. Plastics

-

2. End-user

- 2.1. Pharmaceutical

- 2.2. Personal Care and Cosmetic

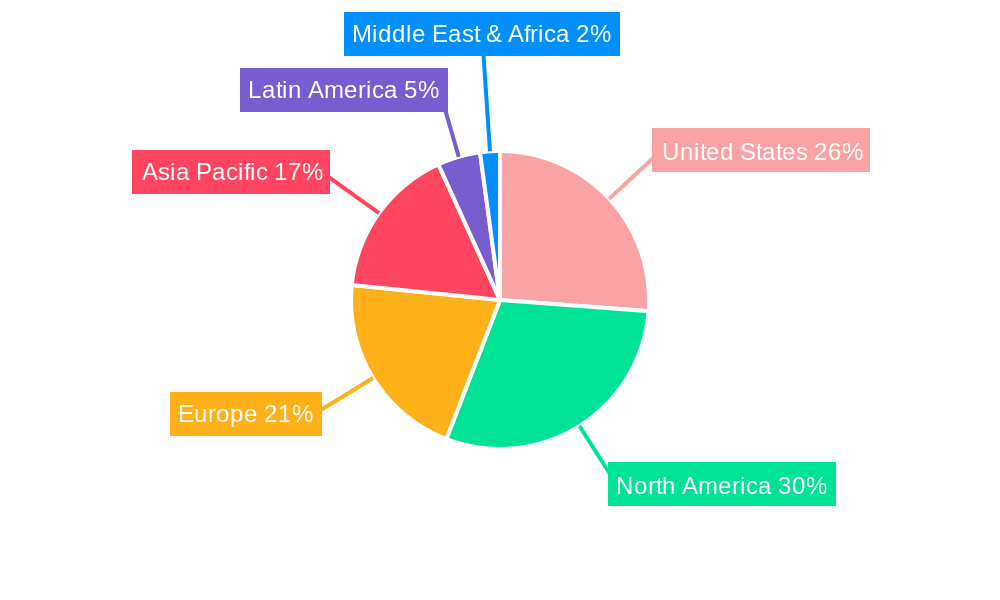

United States Ampoules Packaging Market Segmentation By Geography

- 1. United States

United States Ampoules Packaging Market Regional Market Share

Geographic Coverage of United States Ampoules Packaging Market

United States Ampoules Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Tamper-proof Pharmaceutical Product Packaging; Commodity Value of Glass Increased with Recyclability

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Dumping of Used Ampoules

- 3.4. Market Trends

- 3.4.1. High Commodity Value of Glass Resulting in High Recyclability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ampoules Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Glass

- 5.1.2. Plastics

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Pharmaceutical

- 5.2.2. Personal Care and Cosmetic

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Schott AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 James Alexander Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wheaton Group (DWK Life Sciences Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stevanato Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J Penner Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nipro Pharma Packaging International NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerresheimer AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accu-Glass LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Schott AG

List of Figures

- Figure 1: United States Ampoules Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Ampoules Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ampoules Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: United States Ampoules Packaging Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: United States Ampoules Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Ampoules Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 5: United States Ampoules Packaging Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: United States Ampoules Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ampoules Packaging Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the United States Ampoules Packaging Market?

Key companies in the market include Schott AG, James Alexander Corporation, Wheaton Group (DWK Life Sciences Inc, Stevanato Group, J Penner Corporation, Nipro Pharma Packaging International NV, Gerresheimer AG, Accu-Glass LLC.

3. What are the main segments of the United States Ampoules Packaging Market?

The market segments include Material, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Tamper-proof Pharmaceutical Product Packaging; Commodity Value of Glass Increased with Recyclability.

6. What are the notable trends driving market growth?

High Commodity Value of Glass Resulting in High Recyclability.

7. Are there any restraints impacting market growth?

Concerns Regarding Dumping of Used Ampoules.

8. Can you provide examples of recent developments in the market?

July 2022: Vichy Laboratoires recalled LiftActiv Peptide-C Ampoules due to a laceration hazard. This recall involved Liftactiv Peptide-C Ampoules 1.8 ml (10 pack) and Liftactiv Peptide-C Ampoules 1.8 ml (30 pack), which are facial serums.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ampoules Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ampoules Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ampoules Packaging Market?

To stay informed about further developments, trends, and reports in the United States Ampoules Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence