Key Insights

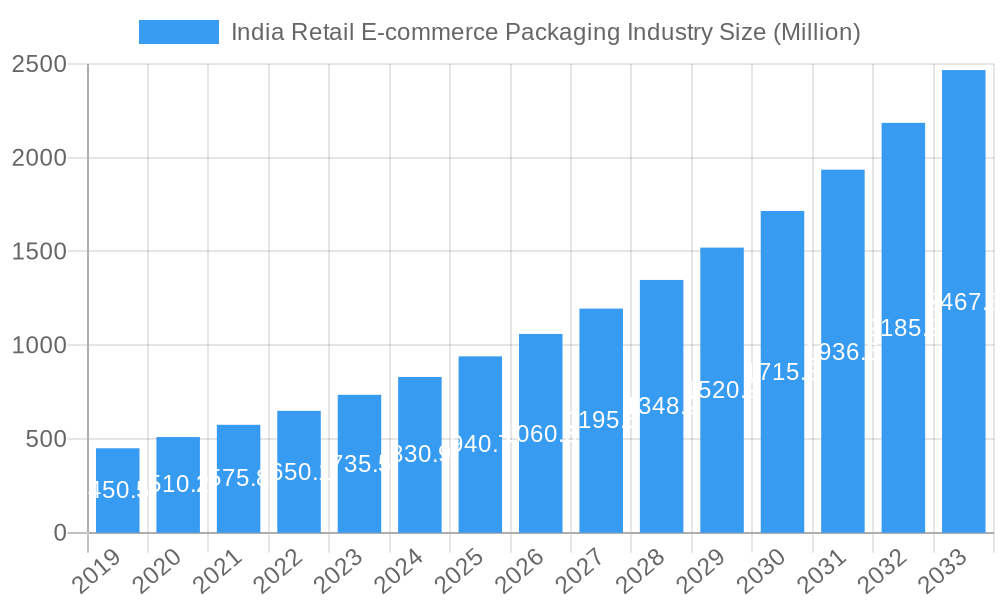

The Indian Retail E-commerce Packaging market is experiencing robust growth, projected to reach an estimated XX Million by 2025, driven by a compelling CAGR of 12.97%. This expansion is fundamentally fueled by the burgeoning e-commerce sector, which has witnessed unprecedented adoption across India, particularly in the wake of changing consumer behaviors and increased internet penetration. Key drivers include the rising disposable incomes, a growing preference for online shopping for convenience and wider product selection, and the significant investments made by e-commerce giants in logistics and supply chain infrastructure. The demand for innovative and sustainable packaging solutions is paramount, reflecting a broader consumer consciousness towards environmental impact. This trend is further amplified by government initiatives promoting plastic alternatives and a circular economy. The market is seeing increased adoption of specialized packaging types like protective packaging for fragile goods, alongside a surge in demand for efficient and aesthetically pleasing solutions within the fashion and apparel, consumer electronics, and food and beverage segments.

India Retail E-commerce Packaging Industry Market Size (In Million)

The competitive landscape is characterized by a mix of established players and emerging companies, all vying to capture market share by offering advanced packaging materials, customized solutions, and a commitment to sustainability. Trends such as the adoption of recyclable, biodegradable, and compostable materials are reshaping product offerings. Innovations in smart packaging, including features for product authentication and tracking, are also gaining traction, particularly in high-value segments like electronics and personal care. However, the market is not without its restraints. Fluctuations in raw material prices, particularly for paper and plastics, can impact profitability. Furthermore, the logistical challenges in reaching remote areas and the need for specialized packaging for certain product categories, like perishable goods requiring temperature-controlled environments, present ongoing hurdles. Despite these challenges, the overwhelming growth trajectory of e-commerce in India ensures a sustained and dynamic expansion for its packaging industry.

India Retail E-commerce Packaging Industry Company Market Share

Report Description:

Dive deep into the burgeoning India Retail E-commerce Packaging Industry with this comprehensive market research report. Covering the period from 2019 to 2033, with a base year of 2025, this study provides granular insights into the market dynamics, growth drivers, challenges, and key players shaping the future of packaging solutions for India's rapidly expanding online retail sector. Explore the dominance of segments like Boxes and Protective Packaging, the immense potential within Fashion and Apparel and Consumer Electronics end-user industries, and critical industry developments. This report is essential for stakeholders seeking to understand and capitalize on the e-commerce packaging market growth in India, offering actionable intelligence on sustainable packaging solutions, innovative packaging designs, and supply chain optimization.

India Retail E-commerce Packaging Industry Market Structure & Competitive Dynamics

The India retail e-commerce packaging industry exhibits a moderately concentrated market structure, with a mix of large established players and agile smaller enterprises vying for market share. Innovation ecosystems are flourishing, driven by the demand for sustainable, cost-effective, and protective packaging solutions. Regulatory frameworks, while evolving, are increasingly focusing on environmental impact and material recyclability, influencing material choices and manufacturing processes. Product substitutes are abundant, ranging from traditional cardboard boxes to advanced cushioning materials and smart packaging technologies. End-user trends strongly favor lightweight, durable, and aesthetically pleasing packaging that enhances the unboxing experience for consumers. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to expand their geographical reach, technological capabilities, and product portfolios. The market share of leading players like Kapco Packaging and Packman Packaging is significant, though specific figures fluctuate. M&A deal values are projected to rise as consolidation becomes a strategic imperative.

- Market Concentration: Moderately concentrated, with key players holding substantial market share.

- Innovation Ecosystems: Thriving, with a focus on sustainability, functionality, and cost-efficiency.

- Regulatory Frameworks: Evolving, with increasing emphasis on environmental compliance and recyclability.

- Product Substitutes: Abundant, offering diverse solutions for varying needs.

- End-User Trends: Demand for attractive, protective, and sustainable packaging.

- M&A Activities: Expected to increase for strategic expansion and consolidation.

India Retail E-commerce Packaging Industry Industry Trends & Insights

The India retail e-commerce packaging industry is poised for remarkable growth, fueled by a confluence of powerful trends. The escalating adoption of online shopping across Tier 1, Tier 2, and Tier 3 cities is a primary market growth driver, leading to an exponential rise in order volumes. This surge directly translates into a higher demand for robust and efficient e-commerce packaging solutions. Technological disruptions are rapidly reshaping the landscape, with advancements in material science leading to the development of lighter, stronger, and more sustainable packaging options. The integration of smart packaging technologies, such as RFID tags and QR codes, is also gaining traction, offering enhanced traceability and consumer engagement. Consumer preferences are increasingly shifting towards eco-friendly packaging, with a growing awareness of environmental issues. Brands are responding by adopting recyclable, biodegradable, and reusable packaging materials, thereby enhancing their brand image and appealing to environmentally conscious shoppers. This has also led to a significant rise in demand for custom e-commerce packaging. The competitive dynamics within the industry are intense, characterized by product differentiation, price competition, and strategic partnerships. Companies are investing in R&D to develop innovative packaging designs that not only protect products but also enhance the customer unboxing experience, a critical touchpoint in the online retail journey. The CAGR for the India retail e-commerce packaging industry is estimated to be robust, projected to exceed xx% during the forecast period. Market penetration of advanced packaging solutions is expected to deepen as e-commerce adoption becomes ubiquitous across various consumer segments. The increasing penetration of smartphones and affordable internet access further fuels this growth trajectory. The rise of the gig economy also contributes indirectly by supporting last-mile delivery networks, which rely heavily on efficient and reliable packaging. Furthermore, government initiatives promoting digital India and manufacturing excellence indirectly support the growth of the packaging sector. The demand for food and beverage e-commerce packaging and personal care product packaging is particularly strong due to category growth. The integration of sustainable materials and practices is no longer a niche but a mainstream expectation.

Dominant Markets & Segments in India Retail E-commerce Packaging Industry

The India retail e-commerce packaging industry is characterized by distinct dominant markets and segments, each contributing significantly to overall market expansion. Boxes, particularly corrugated boxes, remain the most dominant segment by type, owing to their versatility, durability, and cost-effectiveness in handling a wide array of products. Their ability to be customized in various sizes and strengths makes them indispensable for shipping diverse items. Protective Packaging, encompassing cushioning materials like bubble wrap, air pillows, and foam inserts, is another critical segment, gaining prominence as e-commerce retailers strive to minimize transit damage for fragile goods such as Consumer Electronics. The Fashion and Apparel end-user industry is a leading driver of demand, with a continuous flow of garments requiring specialized, often branded, packaging that enhances the perceived value and customer experience. The Consumer Electronics segment also exhibits strong growth, necessitating highly protective packaging to safeguard sensitive and high-value items. Within the geographical landscape, North India and West India are emerging as dominant regions, driven by the concentration of major e-commerce fulfillment centers, established manufacturing hubs, and a higher propensity for online purchasing. Economic policies supporting manufacturing and trade, coupled with robust infrastructure development including advanced logistics networks and warehousing facilities, further bolster the dominance of these regions. Government initiatives aimed at boosting digital adoption and e-commerce penetration are also critical economic policies fostering this growth. The increasing disposable income of the Indian population, particularly in urban and semi-urban areas, directly translates into higher consumer spending online, thus amplifying the demand for all types of e-commerce packaging. The growing preference for premium and branded products in categories like Personal Care Products also contributes to the demand for sophisticated and aesthetically appealing packaging solutions. The Other End-user Industries, including home goods, books, and FMCG, collectively represent a substantial portion of the market, showcasing the broad applicability of e-commerce packaging.

- Dominant Type Segment: Boxes (especially corrugated) – essential for a wide range of products due to versatility and cost-effectiveness.

- Key Growth Type Segment: Protective Packaging – crucial for minimizing transit damage, particularly for fragile items.

- Leading End-User Industry: Fashion and Apparel – drives demand for branded and experiential packaging.

- High-Growth End-User Industry: Consumer Electronics – requires robust protection for high-value, sensitive goods.

- Dominant Geographic Regions: North India and West India – driven by logistics infrastructure and consumer demand.

- Key Drivers for Regional Dominance:

- Concentration of e-commerce fulfillment centers.

- Established manufacturing bases.

- High online purchasing propensity.

- Supportive economic policies and infrastructure.

India Retail E-commerce Packaging Industry Product Innovations

Product innovations in the India retail e-commerce packaging industry are increasingly focused on sustainability, enhanced protection, and improved user experience. Manufacturers are developing lightweight yet strong corrugated boxes using recycled content and innovative designs that reduce material usage. The development of biodegradable and compostable cushioning materials, such as those derived from cornstarch or mushroom mycelium, offers eco-friendly alternatives to traditional plastics. Smart packaging solutions, incorporating features like tamper-evident seals, temperature indicators, and QR codes for product authentication and traceability, are gaining traction, especially for sensitive products like food and pharmaceuticals. Furthermore, there's a growing emphasis on aesthetically pleasing packaging that contributes to the "unboxing experience," with custom printing, embossing, and unique structural designs becoming competitive advantages for brands. These innovations are driven by consumer demand for sustainability and the need for brands to differentiate themselves in a crowded online marketplace.

Report Segmentation & Scope

This report segments the India Retail E-commerce Packaging Industry by Type and End-user Industry.

Type Segmentation: The report meticulously analyzes the market for Boxes, which includes various forms of corrugated and paperboard packaging designed for shipping. It also delves into Protective Packaging, encompassing cushioning materials like bubble wrap, air pillows, foam, and void fill. Finally, Other Types of Packaging, covering mailer bags, envelopes, and specialized packaging solutions, are also comprehensively covered. Growth projections and competitive dynamics are detailed for each of these sub-segments.

End-user Industry Segmentation: The report provides in-depth analysis for key end-user industries, including Fashion and Apparel, which demands attractive and often branded packaging. Consumer Electronics segment focuses on protective packaging needs for delicate devices. The Food and Beverage segment examines packaging for shelf-stable and perishable goods, with a focus on safety and freshness. Personal Care Products segment highlights the demand for premium and appealing packaging. Other End-user Industries, encompassing a broad spectrum of products like books, home décor, and FMCG, are also analyzed to provide a holistic market view. Market sizes and growth forecasts are provided for each end-user segment.

Key Drivers of India Retail E-commerce Packaging Industry Growth

The India retail e-commerce packaging industry's growth is propelled by several key factors. The rapid digitalization of India and the widespread adoption of smartphones and affordable internet access are fundamental drivers, significantly expanding the online consumer base. The ensuing surge in e-commerce sales volumes directly translates into a higher demand for packaging materials to facilitate order fulfillment. Furthermore, a growing consumer consciousness towards sustainability and eco-friendly practices is pushing manufacturers to develop and adopt recyclable, biodegradable, and reusable packaging solutions. Government initiatives promoting Make in India and supporting manufacturing, alongside investments in logistics and supply chain infrastructure, are also crucial economic factors fostering industry expansion.

- Rapid digitalization and smartphone penetration.

- Exponential growth in e-commerce sales volumes.

- Increasing consumer demand for sustainable packaging.

- Government initiatives and infrastructure development.

Challenges in the India Retail E-commerce Packaging Industry Sector

Despite robust growth, the India retail e-commerce packaging industry faces several challenges. Navigating complex and evolving regulatory landscapes, particularly concerning plastic waste management and environmental compliance, can be a significant hurdle. Supply chain disruptions, including fluctuating raw material prices (e.g., paper pulp) and logistics bottlenecks, can impact production costs and delivery timelines. Intense competitive pressures from both domestic and international players lead to price sensitivity and a constant need for innovation and cost optimization. Ensuring the effective and affordable implementation of sustainable packaging solutions on a large scale remains a challenge, requiring significant investment in new technologies and infrastructure.

- Navigating evolving environmental regulations.

- Supply chain volatility and raw material price fluctuations.

- Intense price competition among players.

- Scaling sustainable packaging solutions cost-effectively.

Leading Players in the India Retail E-commerce Packaging Industry Market

- Kapco Packaging

- Avon Pacfo Services LLP

- B&B Triplewall Containers Limited

- U-Pack

- Storopack Ind Pvt Ltd

- Oji India Packaging Pvt Ltd

- TGI Packaging Pvt Ltd

- Packman Packaging

- Ecom Packaging

- Astron Packaging Ltd

- Total Pack

Key Developments in India Retail E-commerce Packaging Industry Sector

- April 2022: SIG, a Swiss provider of aseptic carton packaging systems, plans to invest in a new facility in India. This move is advantageous for SIG's operations in the country, which is one of its fastest-growing markets. An aseptic carton is a multilayered packaging solution created by combining layers of paperboard and plastic for the packing of liquid meals and drinks. Other firms in this industry include Tetra and UFlex.

- March 2022: Noida-based AdwayPrint Concept, a manufacturer of mono cartons, relocated its manufacturing plant from Delhi to Noida for the expansion of its production capacities.

Strategic India Retail E-commerce Packaging Industry Market Outlook

The strategic outlook for the India retail e-commerce packaging industry is exceptionally promising. Future market potential is driven by the continued expansion of online retail penetration across all consumer segments and geographies. Companies that invest in innovative and sustainable packaging solutions will gain a significant competitive advantage. Key growth accelerators include the increasing adoption of custom e-commerce packaging that enhances brand identity and customer experience, the integration of smart packaging for improved logistics and consumer engagement, and a strong focus on circular economy principles and material recyclability. Strategic opportunities lie in catering to the growing demand for specialized packaging for segments like fresh produce, pharmaceuticals, and personalized goods, as well as in exploring partnerships to build robust and efficient supply chains.

India Retail E-commerce Packaging Industry Segmentation

-

1. Type

- 1.1. Boxes

- 1.2. Protective Packaging

- 1.3. Other Types of Packaging

-

2. End-user Industry

- 2.1. Fashion and Apparel

- 2.2. Consumer Electronics

- 2.3. Food and Beverage

- 2.4. Personal Care Products

- 2.5. Other End-user Industries

India Retail E-commerce Packaging Industry Segmentation By Geography

- 1. India

India Retail E-commerce Packaging Industry Regional Market Share

Geographic Coverage of India Retail E-commerce Packaging Industry

India Retail E-commerce Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence

- 3.3. Market Restrains

- 3.3.1. Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices

- 3.4. Market Trends

- 3.4.1. Protective Packaging to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Retail E-commerce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Boxes

- 5.1.2. Protective Packaging

- 5.1.3. Other Types of Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Fashion and Apparel

- 5.2.2. Consumer Electronics

- 5.2.3. Food and Beverage

- 5.2.4. Personal Care Products

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kapco Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Avon Pacfo Services LLP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 B&B Triplewall Containers Limited*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 U-Pack

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Storopack Ind Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oji India Packaging Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TGI Packaging Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Packman Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ecom Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Astron Packaging Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Total Pack

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kapco Packaging

List of Figures

- Figure 1: India Retail E-commerce Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Retail E-commerce Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Retail E-commerce Packaging Industry?

The projected CAGR is approximately 12.66%.

2. Which companies are prominent players in the India Retail E-commerce Packaging Industry?

Key companies in the market include Kapco Packaging, Avon Pacfo Services LLP, B&B Triplewall Containers Limited*List Not Exhaustive, U-Pack, Storopack Ind Pvt Ltd, Oji India Packaging Pvt Ltd, TGI Packaging Pvt Ltd, Packman Packaging, Ecom Packaging, Astron Packaging Ltd, Total Pack.

3. What are the main segments of the India Retail E-commerce Packaging Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence.

6. What are the notable trends driving market growth?

Protective Packaging to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices.

8. Can you provide examples of recent developments in the market?

April 2022 - SIG, a Swiss provider of aseptic carton packaging systems, plans to invest in a new facility in India. The move will be advantageous for SIG's operations in the country, which is one of its fastest-growing markets. An aseptic carton is a multilayered packaging solution created by combining layers of paperboard and plastic for the packing of liquid meals and drinks. Other firms in this industry include Tetra and UFlex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Retail E-commerce Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Retail E-commerce Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Retail E-commerce Packaging Industry?

To stay informed about further developments, trends, and reports in the India Retail E-commerce Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence