Key Insights

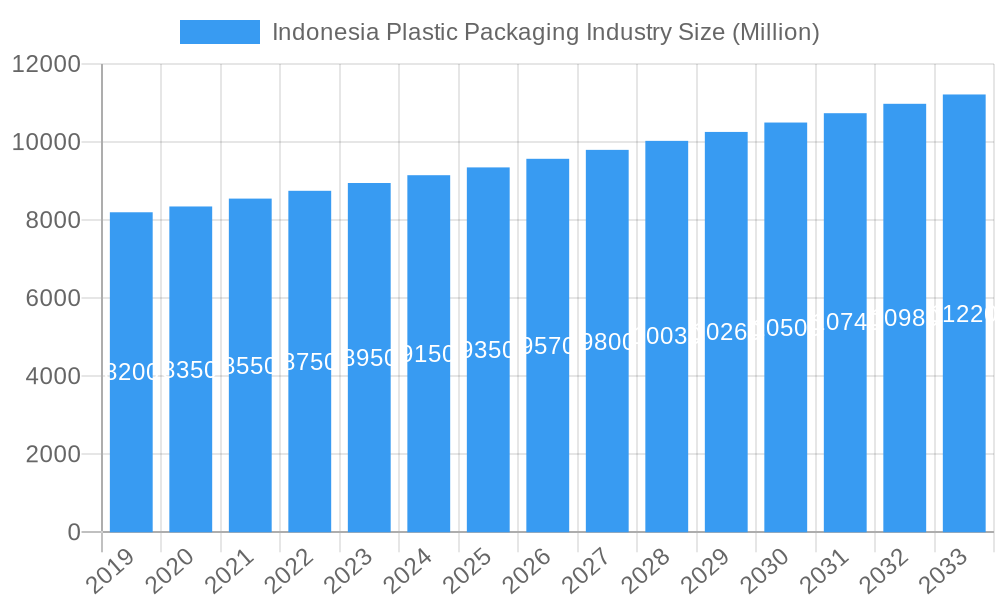

The Indonesian plastic packaging market is projected for robust growth, expected to reach $10.47 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 6.65% through 2033. This expansion is fueled by escalating demand across key sectors, including food & beverage and consumer goods, which depend on versatile and cost-effective plastic packaging for product protection, safety, and market appeal. A growing middle class, increased urbanization, and evolving consumer lifestyles in Indonesia are further stimulating demand for packaged products, directly benefiting the plastic packaging industry. Government support for industrial development and consumer spending also bolsters the positive market outlook.

Indonesia Plastic Packaging Industry Market Size (In Billion)

Key growth catalysts for the Indonesian plastic packaging sector include a burgeoning population, rising disposable incomes, and the rapid expansion of e-commerce, which requires efficient and protective packaging solutions. The increasing adoption of sustainable packaging, such as recycled plastics and bioplastics, represents a significant emerging trend. However, the market faces challenges from stringent environmental regulations on plastic waste management and volatile raw material prices, primarily linked to petrochemicals. Despite these hurdles, opportunities are abundant in flexible packaging, rigid containers, and innovative packaging designs that cater to specific product needs and consumer preferences. Industry players are prioritizing technological advancements, supply chain efficiency, and the development of eco-friendly alternatives to secure a competitive advantage.

Indonesia Plastic Packaging Industry Company Market Share

This detailed report provides a comprehensive analysis of the Indonesia Plastic Packaging Industry, offering critical insights into market dynamics, emerging trends, and future growth prospects. Covering a study period from 2019 to 2033, with a base year of 2025, this report utilizes historical data (2019-2024) and robust forecast projections (2025-2033) to deliver actionable intelligence for stakeholders. We meticulously examine key segments, including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis, equipping you with the essential knowledge to navigate this dynamic market.

Indonesia Plastic Packaging Industry Market Structure & Competitive Dynamics

The Indonesia Plastic Packaging Market Structure is characterized by a moderate level of concentration, with a few dominant players alongside a significant number of smaller enterprises. Innovation plays a crucial role, driven by the demand for sustainable and advanced packaging solutions. Regulatory frameworks, including those aimed at promoting recycling and reducing plastic waste, are increasingly shaping market strategies. The report analyzes the influence of product substitutes, such as paper and bioplastics, on market share. End-user trends, particularly within the rapidly growing food & beverage and e-commerce sectors, are meticulously examined. Mergers and acquisitions (M&A) activities are assessed, providing insights into consolidation patterns and strategic alliances. Historical data indicates M&A deal values in the millions of US dollars, reflecting significant strategic investments. Market share analysis for key players reveals an estimated collective share of over 70% held by the top five companies.

Indonesia Plastic Packaging Industry Industry Trends & Insights

The Indonesia Plastic Packaging Industry Trends are shaped by a confluence of powerful growth drivers. A burgeoning middle class, coupled with increasing urbanization, fuels demand for packaged goods, consequently driving the need for innovative and efficient plastic packaging solutions. The food and beverage sector, a cornerstone of the Indonesian economy, represents a significant consumer of plastic packaging for preservation and convenience. E-commerce expansion further bolsters demand for robust and protective packaging. Technological disruptions, including advancements in material science, automation in manufacturing, and the development of smart packaging, are transforming production capabilities and product offerings. Consumer preferences are shifting towards sustainable options, with a growing demand for recyclable, compostable, and biodegradable packaging materials. This trend is prompting manufacturers to invest in R&D for eco-friendly alternatives. Competitive dynamics are intensifying, with both domestic and international players vying for market share through product differentiation, cost optimization, and strategic partnerships. The Compound Annual Growth Rate (CAGR) for the Indonesian plastic packaging market is projected to be approximately 5.5% during the forecast period. Market penetration of advanced packaging technologies is estimated to reach 45% by 2033, up from 28% in 2024.

Dominant Markets & Segments in Indonesia Plastic Packaging Industry

Production Analysis: The primary production hubs for plastic packaging are concentrated in Java, particularly in regions with established industrial infrastructure and proximity to major consumption centers. Economic policies promoting manufacturing and investment in new facilities are key drivers. Infrastructure development, including improved logistics and transportation networks, further supports production efficiency.

Consumption Analysis: The Indonesia Plastic Packaging Consumption is dominated by the food and beverage segment, accounting for an estimated 60% of the total market volume. This is driven by the vast population, changing dietary habits, and the need for product safety and extended shelf life. The pharmaceutical and personal care sectors also represent significant consumers, driven by increased healthcare awareness and demand for hygiene products.

Import Market Analysis (Value & Volume): While Indonesia has substantial domestic production, imports play a role in supplying specialized or high-performance plastic packaging materials and machinery not readily available domestically. The import market value is estimated to reach USD 850 Million in 2025, with key import categories including specialized films, resins, and advanced packaging machinery. Volume is largely driven by demand for specific grades of polymers and components.

Export Market Analysis (Value & Volume): Indonesia's export market for plastic packaging is growing, driven by competitive pricing and the increasing adoption of international quality standards. Key export destinations include neighboring Southeast Asian countries and some African nations. The export market value is projected to reach USD 520 Million by 2025. Volume growth is influenced by trade agreements and the demand for flexible packaging solutions.

Price Trend Analysis: Price trends are influenced by raw material costs (primarily crude oil derivatives), global supply-demand dynamics, and government policies on imports and exports. Fluctuations in resin prices significantly impact the cost of plastic packaging. The report provides detailed analysis of historical price volatility and future projections, indicating an average price increase of 2-3% annually due to inflation and raw material costs.

Indonesia Plastic Packaging Industry Product Innovations

Product innovations in the Indonesia Plastic Packaging Industry are increasingly focused on sustainability, functionality, and convenience. Developments include advanced barrier films for enhanced food preservation, lightweight yet durable containers for reduced material usage, and smart packaging solutions incorporating features like tamper-evident seals and freshness indicators. The competitive advantage lies in offering eco-friendly alternatives that meet stringent regulatory requirements and evolving consumer demand. This includes the introduction of post-consumer recycled (PCR) content in various packaging formats and the development of novel biodegradable polymers.

Report Segmentation & Scope

This report segments the Indonesia Plastic Packaging Market across Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. The Production Analysis segment offers insights into manufacturing capacities and regional distribution. Consumption Analysis delves into the demand patterns across various end-use industries, with projected growth in the food & beverage segment to reach USD 4,500 Million by 2025. Import Market Analysis provides data on the value and volume of plastic packaging imported into Indonesia. Export Market Analysis details the outbound trade of Indonesian plastic packaging. The Price Trend Analysis offers historical and forecasted price movements, crucial for cost management and strategic planning. Each segment includes detailed market size estimations and competitive dynamics.

Key Drivers of Indonesia Plastic Packaging Industry Growth

The Indonesia Plastic Packaging Industry Growth is propelled by several key factors. A rapidly expanding population and a growing middle class are increasing disposable incomes, leading to higher consumption of packaged goods, particularly food and beverages. The burgeoning e-commerce sector necessitates robust and protective packaging solutions. Government initiatives promoting domestic manufacturing and foreign investment, coupled with a focus on infrastructure development, create a favorable environment for industry expansion. Furthermore, increasing consumer awareness regarding hygiene and product safety is driving demand for sealed and tamper-evident plastic packaging.

Challenges in the Indonesia Plastic Packaging Industry Sector

Despite significant growth, the Indonesia Plastic Packaging Industry Sector faces several challenges. Stringent environmental regulations and growing public concern over plastic waste necessitate increased investment in sustainable packaging solutions and waste management infrastructure. Fluctuations in raw material prices, particularly crude oil derivatives, can impact production costs and profitability. Intense competition from both domestic and international players, as well as the availability of alternative packaging materials, puts pressure on pricing and market share. Supply chain disruptions, including logistics challenges and the availability of skilled labor, can also hinder operational efficiency and growth.

Leading Players in the Indonesia Plastic Packaging Industry Market

- Sonoco Products Company

- Wipak Ltd

- Coveris Holding

- Amcor PLC

- National Flexible Ltd

- Constantia Flexibles Group

- Silgan Holdings

- Berry Global Inc

- Sealed Air Corporation

- Tetra Laval Group

Key Developments in Indonesia Plastic Packaging Industry Sector

- November 2022: The CMA CGM Group launched EASY RECYCLING, an innovative recycling solution for paper and plastic packaging for its customers shipping to Jakarta, Indonesia. This pilot program aims to expand to other Asian nations, enhancing waste disposal options.

- July 2022: Coca-Cola Euro-Pacific Partners (CCEP) established the first food-grade PET plastic recycling facility in Indonesia, the Amandina Bumi Nusantara plant. This joint venture with Dynapack Asia and the non-profit Mahija Parahita Nusantara aims to strengthen collection infrastructure and support micro businesses.

Strategic Indonesia Plastic Packaging Industry Market Outlook

The Strategic Indonesia Plastic Packaging Industry Market Outlook is exceptionally positive, driven by a confluence of demographic shifts, economic growth, and evolving consumer preferences. The increasing demand for convenience, hygiene, and sustainable packaging solutions presents significant opportunities for innovation and market expansion. Investments in advanced manufacturing technologies and the development of eco-friendly materials will be critical for companies aiming to capture market share. Strategic partnerships and collaborations will also play a vital role in navigating the evolving regulatory landscape and meeting the growing demand for circular economy solutions within the plastic packaging sector. The market is poised for sustained growth, with an estimated market size exceeding USD 10 Billion by 2033.

Indonesia Plastic Packaging Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Plastic Packaging Industry Segmentation By Geography

- 1. Indonesia

Indonesia Plastic Packaging Industry Regional Market Share

Geographic Coverage of Indonesia Plastic Packaging Industry

Indonesia Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Increased Eco-friendly Packaging and Recycled Plastic

- 3.3. Market Restrains

- 3.3.1. Shift from Conventional Materials to New Recyclable Materials

- 3.4. Market Trends

- 3.4.1. Skincare Segment is Observing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipak Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coveris Holding

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 National Flexible Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constantia Flexibles Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan Holdings*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Global Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tetra Laval Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: Indonesia Plastic Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Plastic Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Plastic Packaging Industry?

The projected CAGR is approximately 6.65%.

2. Which companies are prominent players in the Indonesia Plastic Packaging Industry?

Key companies in the market include Sonoco Products Company, Wipak Ltd, Coveris Holding, Amcor PLC, National Flexible Ltd, Constantia Flexibles Group, Silgan Holdings*List Not Exhaustive, Berry Global Inc, Sealed Air Corporation, Tetra Laval Group.

3. What are the main segments of the Indonesia Plastic Packaging Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.47 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Increased Eco-friendly Packaging and Recycled Plastic.

6. What are the notable trends driving market growth?

Skincare Segment is Observing Significant Growth.

7. Are there any restraints impacting market growth?

Shift from Conventional Materials to New Recyclable Materials.

8. Can you provide examples of recent developments in the market?

November 2022: The CMA CGM Group, a global player in sea, land, and air logistics, introduced EASY RECYCLING, an innovative recycling solution, to enable its customers with shipments to Jakarta, Indonesia, to dispose of used paper and plastic packaging. In Jakarta, only CMA CGM customers will have access to EASY RECYCLING as part of a pilot that aims to eventually bring the service to other Asian nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the Indonesia Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence