Key Insights

The African folding carton market is projected for robust expansion, with an estimated market size of 2.5 billion in 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.1% from 2025 to 2033. This growth is driven by increasing demand for packaged foods and beverages in rapidly urbanizing regions like Nigeria, Egypt, and South Africa. The expanding pharmaceutical and cosmetics sectors, along with rising e-commerce activities, further contribute to market momentum. Key market drivers include a growing middle class, increased disposable incomes, and a shift towards modern retail. While challenges such as raw material price volatility exist, the market outlook remains positive. The food and beverage segment dominates, followed by pharmaceuticals and personal care. Nigeria, South Africa, and Egypt are the leading national markets. Key industry players are strategically positioned to capitalize on these trends, though competitive intensity is expected to rise. Future expansion will be shaped by economic development, evolving consumer preferences, infrastructural advancements, and the adoption of sustainable packaging solutions.

Africa Folding Carton Market Market Size (In Billion)

Africa Folding Carton Market: A Comprehensive Market Analysis Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa Folding Carton Market, offering invaluable insights for businesses operating within or seeking to enter this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver actionable intelligence. The report utilizes the most up-to-date data available and provides detailed segmentation across various key aspects of the market. Expect detailed analysis of market size (in Million USD) for each segment.

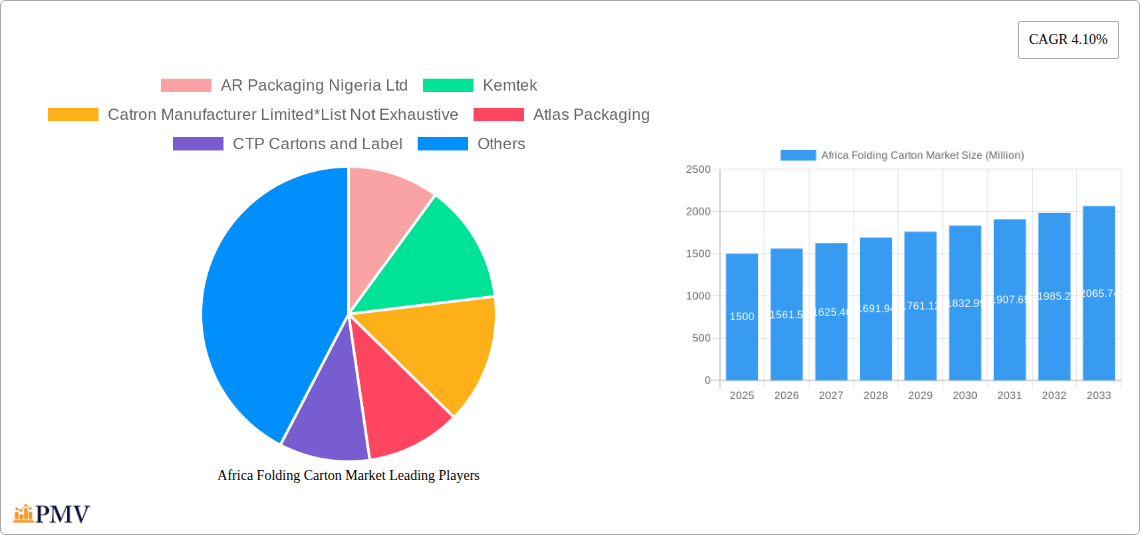

Africa Folding Carton Market Company Market Share

Africa Folding Carton Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the African folding carton market, analyzing market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a mix of multinational corporations and local players, with varying degrees of market share. While precise market share figures for individual companies are commercially sensitive and require primary research, analysis suggests a moderately fragmented market. The market concentration ratio (CR4 or CR8) is estimated at xx%, indicating a balance between larger established players and smaller niche businesses.

The innovation ecosystem is developing, with companies investing in new technologies and materials to improve product quality and efficiency. Regulatory frameworks vary across African nations, impacting production costs and market access. Substitute products, such as flexible packaging materials, present competitive pressure. End-user trends are shifting towards sustainability, demanding environmentally friendly packaging solutions. M&A activity has been moderate, with deal values averaging xx Million USD over the past five years. Examples include [mention specific examples if available, otherwise omit this sentence]. This section offers a detailed breakdown of the market dynamics, supported by quantitative data where available.

Africa Folding Carton Market Industry Trends & Insights

The Africa Folding Carton Market exhibits a robust growth trajectory, driven by factors like the rising population, increasing urbanization, and a surge in demand from various end-user sectors. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is fueled by increasing consumer spending, particularly in the food and beverage, pharmaceutical, and cosmetics/personal care sectors. Technological advancements, such as advancements in printing techniques and automation, are enhancing production efficiency and product quality. Market penetration of folding cartons is increasing steadily, particularly in regions with developing manufacturing and retail infrastructure. However, challenges such as fluctuating raw material prices and logistical constraints continue to influence market growth. The competitive landscape is witnessing increased competition, with both established players and new entrants vying for market share. Further analysis delves into specific consumer preferences influencing purchasing decisions and the strategic approaches taken by leading players to maintain their market positions.

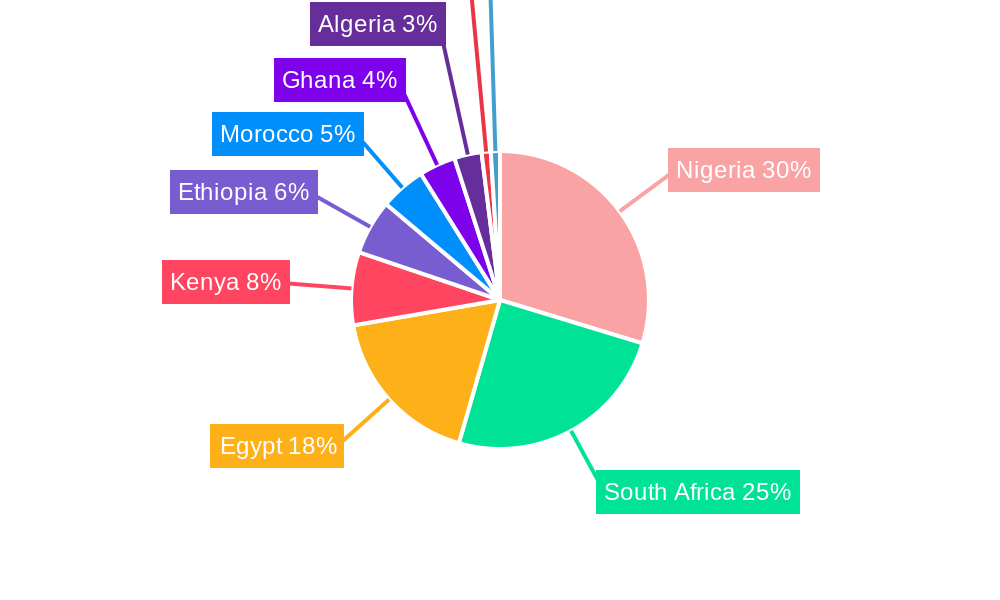

Dominant Markets & Segments in Africa Folding Carton Market

The dominant markets and segments within the Africa Folding Carton Market are analyzed extensively. This section identifies the leading region, country, or segment across all categories: Food, Beverage, Pharmaceutical, Cosmetics/Personal Care, Tobacco, and Other End-user Industries, and across geographical divisions: Egypt, Nigeria, South Africa, and the Rest of Africa. The South Africa region currently holds the largest market share, driven by its advanced manufacturing sector and higher consumer spending power.

- Key Drivers of South Africa's Dominance:

- Well-established infrastructure and logistics networks

- Relatively strong regulatory environment

- Higher per capita income compared to other African countries

- A robust manufacturing base and significant presence of multinational corporations

- Developed retail sector with large organized retail chains

Nigeria and Egypt also represent significant market opportunities, though their growth trajectory may differ based on their specific economic and infrastructural developments. The food and beverage segment is the largest end-use sector, with increasing demand from packaged food and beverage companies.

Africa Folding Carton Market Product Innovations

The Africa folding carton market witnesses continuous innovation in product design, materials, and printing technologies. Companies are introducing sustainable packaging solutions, including those made from recycled materials and biodegradable alternatives. Advanced printing techniques like digital printing are gaining traction, allowing for personalized packaging and shorter production runs. The market is also seeing an increased adoption of functional barriers to extend shelf life and enhance product protection. These innovations help improve product appeal, enhance branding opportunities and meet the growing demand for sustainable packaging options. This results in a competitive advantage for companies adopting these technological advancements and tailoring products to specific consumer needs.

Report Segmentation & Scope

This report provides a granular segmentation of the Africa folding carton market across various parameters:

- By End-User Industry: Food (including xx Million USD in 2025), Beverage (xx Million USD in 2025), Pharmaceutical (xx Million USD in 2025), Cosmetics/Personal Care (xx Million USD in 2025), Tobacco (xx Million USD in 2025), Other End-user Industries (xx Million USD in 2025)

- By Geography: Egypt (xx Million USD in 2025), Nigeria (xx Million USD in 2025), South Africa (xx Million USD in 2025), Rest of Africa (xx Million USD in 2025)

Each segment is analyzed in detail, including growth projections, market size, and competitive dynamics. Detailed forecasts for each segment through 2033 are provided, giving stakeholders a comprehensive understanding of future market potential.

Key Drivers of Africa Folding Carton Market Growth

Several factors contribute to the growth of the African folding carton market. These include:

- Rising disposable incomes: Increased consumer spending power fuels demand for packaged goods.

- Growing urbanization: Urban populations drive demand for convenience and pre-packaged products.

- Expanding retail sector: Modern trade formats are driving demand for attractive and functional packaging.

- Government initiatives: Support for local manufacturing and packaging industries stimulates growth.

These trends create significant opportunities for folding carton manufacturers to expand their market presence.

Challenges in the Africa Folding Carton Market Sector

The Africa folding carton market faces certain challenges:

- Fluctuating raw material prices: Price volatility impacts production costs.

- Infrastructure limitations: Inadequate infrastructure can disrupt supply chains and increase transportation costs.

- Competition from alternative packaging: Flexible packaging poses a competitive threat.

- Regulatory variations across countries: Navigating varying regulations complicates market entry and operations.

Addressing these challenges is vital for sustainable growth within the sector.

Leading Players in the Africa Folding Carton Market

- AR Packaging Nigeria Ltd

- Kemtek

- Catron Manufacturer Limited

- Atlas Packaging

- CTP Cartons and Label

- Britepak

- Masterpack Cape

- Shave & Gibson

Key Developments in Africa Folding Carton Market Sector

- [Year/Month]: [Specific development, e.g., Launch of a new sustainable packaging solution by a major player.] Impact: [Explain the impact of the development on the market.]

- [Year/Month]: [Specific development, e.g., Acquisition of a smaller packaging company by a multinational.] Impact: [Explain the impact of the development on the market.]

- [Continue adding bullet points for other key developments]:

Strategic Africa Folding Carton Market Outlook

The Africa folding carton market presents substantial growth potential driven by continued economic expansion, increasing consumerism, and the growing need for sophisticated and sustainable packaging solutions. Strategic opportunities lie in adopting innovative technologies, focusing on sustainable materials, and catering to the specific needs of diverse end-user industries across the continent. Companies prioritizing localization strategies and investing in local infrastructure will be well-positioned to capitalize on future market expansion. The market's trajectory indicates significant long-term growth, rewarding businesses that proactively adapt to the region's dynamic trends.

Africa Folding Carton Market Segmentation

- 1. Food (in

- 2. Beverage

- 3. Pharmaceutical

- 4. Cosmetics/Personal Care

- 5. Tobacco

- 6. Other End-user Industries

- 7. Egypt

- 8. Nigeria

- 9. South Africa

- 10. Rest of Africa

Africa Folding Carton Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Folding Carton Market Regional Market Share

Geographic Coverage of Africa Folding Carton Market

Africa Folding Carton Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Ready-to-Consume Packaged Food Products; Growing demand for flavor retaining packaging

- 3.3. Market Restrains

- 3.3.1. Rising Concerns About the Environment and Stringent Government Regulations Regarding the Use of Plastic

- 3.4. Market Trends

- 3.4.1. Food and Beverages to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Folding Carton Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food (in

- 5.2. Market Analysis, Insights and Forecast - by Beverage

- 5.3. Market Analysis, Insights and Forecast - by Pharmaceutical

- 5.4. Market Analysis, Insights and Forecast - by Cosmetics/Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Tobacco

- 5.6. Market Analysis, Insights and Forecast - by Other End-user Industries

- 5.7. Market Analysis, Insights and Forecast - by Egypt

- 5.8. Market Analysis, Insights and Forecast - by Nigeria

- 5.9. Market Analysis, Insights and Forecast - by South Africa

- 5.10. Market Analysis, Insights and Forecast - by Rest of Africa

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Food (in

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AR Packaging Nigeria Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kemtek

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Catron Manufacturer Limited*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atlas Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CTP Cartons and Label

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Britepak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Masterpack Cape

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shave & Gibson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 AR Packaging Nigeria Ltd

List of Figures

- Figure 1: Africa Folding Carton Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Folding Carton Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Folding Carton Market Revenue billion Forecast, by Food (in 2020 & 2033

- Table 2: Africa Folding Carton Market Revenue billion Forecast, by Beverage 2020 & 2033

- Table 3: Africa Folding Carton Market Revenue billion Forecast, by Pharmaceutical 2020 & 2033

- Table 4: Africa Folding Carton Market Revenue billion Forecast, by Cosmetics/Personal Care 2020 & 2033

- Table 5: Africa Folding Carton Market Revenue billion Forecast, by Tobacco 2020 & 2033

- Table 6: Africa Folding Carton Market Revenue billion Forecast, by Other End-user Industries 2020 & 2033

- Table 7: Africa Folding Carton Market Revenue billion Forecast, by Egypt 2020 & 2033

- Table 8: Africa Folding Carton Market Revenue billion Forecast, by Nigeria 2020 & 2033

- Table 9: Africa Folding Carton Market Revenue billion Forecast, by South Africa 2020 & 2033

- Table 10: Africa Folding Carton Market Revenue billion Forecast, by Rest of Africa 2020 & 2033

- Table 11: Africa Folding Carton Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Africa Folding Carton Market Revenue billion Forecast, by Food (in 2020 & 2033

- Table 13: Africa Folding Carton Market Revenue billion Forecast, by Beverage 2020 & 2033

- Table 14: Africa Folding Carton Market Revenue billion Forecast, by Pharmaceutical 2020 & 2033

- Table 15: Africa Folding Carton Market Revenue billion Forecast, by Cosmetics/Personal Care 2020 & 2033

- Table 16: Africa Folding Carton Market Revenue billion Forecast, by Tobacco 2020 & 2033

- Table 17: Africa Folding Carton Market Revenue billion Forecast, by Other End-user Industries 2020 & 2033

- Table 18: Africa Folding Carton Market Revenue billion Forecast, by Egypt 2020 & 2033

- Table 19: Africa Folding Carton Market Revenue billion Forecast, by Nigeria 2020 & 2033

- Table 20: Africa Folding Carton Market Revenue billion Forecast, by South Africa 2020 & 2033

- Table 21: Africa Folding Carton Market Revenue billion Forecast, by Rest of Africa 2020 & 2033

- Table 22: Africa Folding Carton Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: Nigeria Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Africa Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Egypt Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Kenya Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Ethiopia Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Morocco Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Ghana Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Algeria Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Tanzania Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Ivory Coast Africa Folding Carton Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Folding Carton Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Africa Folding Carton Market?

Key companies in the market include AR Packaging Nigeria Ltd, Kemtek, Catron Manufacturer Limited*List Not Exhaustive, Atlas Packaging, CTP Cartons and Label, Britepak, Masterpack Cape, Shave & Gibson.

3. What are the main segments of the Africa Folding Carton Market?

The market segments include Food (in, Beverage, Pharmaceutical, Cosmetics/Personal Care, Tobacco, Other End-user Industries, Egypt, Nigeria, South Africa, Rest of Africa.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Ready-to-Consume Packaged Food Products; Growing demand for flavor retaining packaging.

6. What are the notable trends driving market growth?

Food and Beverages to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Rising Concerns About the Environment and Stringent Government Regulations Regarding the Use of Plastic.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Folding Carton Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Folding Carton Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Folding Carton Market?

To stay informed about further developments, trends, and reports in the Africa Folding Carton Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence