Key Insights

The Latin America Biaxially Oriented Polypropylene (BOPP) Film Market is projected for substantial growth, expected to reach $7.18 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 7.28%. This expansion is largely driven by the robust demand from the flexible packaging sector, a primary market contributor. Growth within flexible packaging spans both food and non-food applications, influenced by changing consumer lifestyles, a rising middle class, and the increasing need for convenient and sustainable packaging solutions across the region. The industrial segment also presents significant opportunities, particularly in lamination, adhesives, and capacitor manufacturing, where BOPP films offer superior barrier resistance, printability, and mechanical strength. Mexico and Brazil are anticipated to lead market adoption due to their strong economies and developing industrial sectors, with Argentina and the rest of Latin America also expected to play a vital role in the market's overall trajectory.

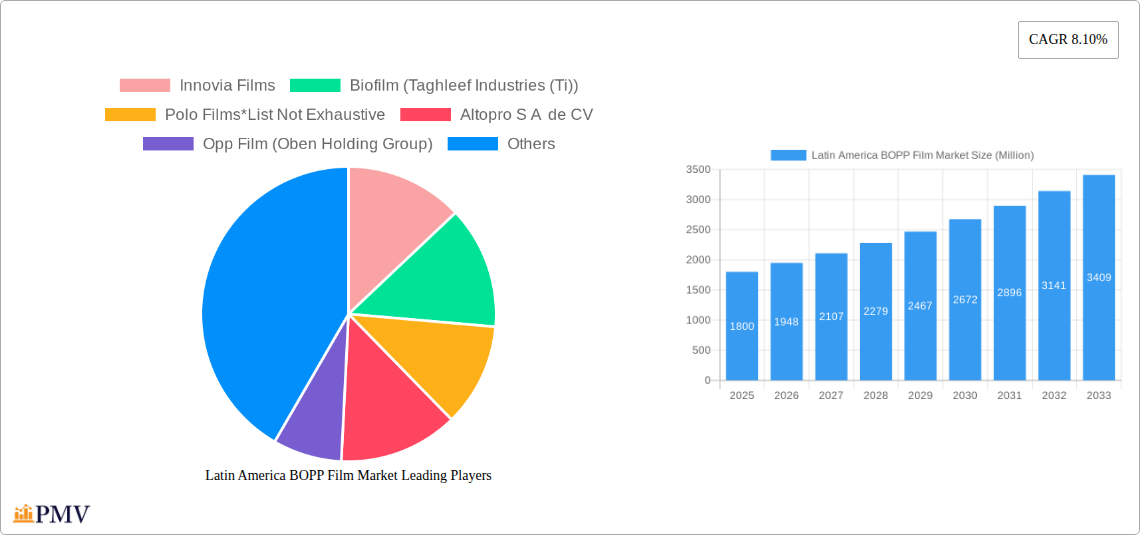

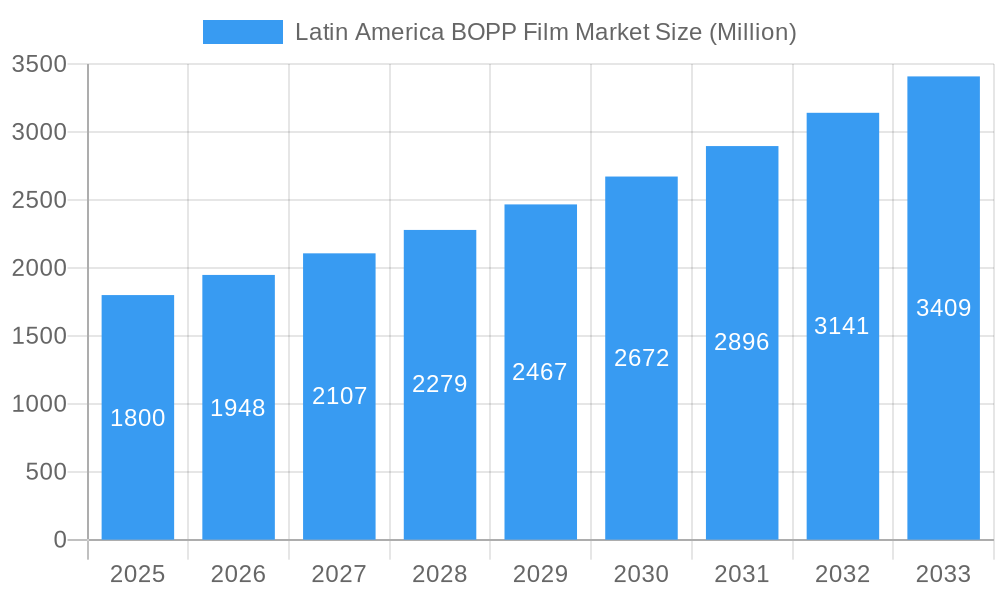

Latin America BOPP Film Market Market Size (In Billion)

Key trends and drivers are shaping the Latin America BOPP Film Market. The increasing adoption of sustainable packaging, including the development of thinner, lighter, and recyclable BOPP films, is a significant growth catalyst. Technological advancements in film properties, such as enhanced barrier performance for extended food shelf life and improved heat sealability, are also driving market penetration. Furthermore, the expanding e-commerce sector in Latin America requires efficient and durable packaging for logistics, further stimulating BOPP film demand. However, market restraints include volatile raw material prices, particularly for polypropylene, which can affect manufacturer profitability. Stringent environmental regulations concerning plastic waste management in certain countries may present challenges, though they simultaneously encourage innovation in recyclable BOPP solutions. Intensifying competition among key players such as Innovia Films, Biofilm (Taghleef Industries), and Polo Films is driving a focus on product differentiation and cost optimization.

Latin America BOPP Film Market Company Market Share

Unlocking Growth: Latin America BOPP Film Market Report (2019-2033)

This comprehensive report delves into the dynamic Latin America BOPP Film Market, providing in-depth analysis and actionable insights for stakeholders. Examining market size, growth trends, and competitive landscapes from 2019 to 2033, with a base year of 2025, this study is an indispensable resource for understanding the future trajectory of biaxially oriented polypropylene films across the region. We forecast the market to reach US$ XXX Million by 2033, exhibiting a robust CAGR of XX% during the forecast period (2025-2033). The historical period (2019-2024) laid the groundwork for current trends, and our estimated year of 2025 provides a crucial benchmark.

Latin America BOPP Film Market Market Structure & Competitive Dynamics

The Latin America BOPP Film Market exhibits a moderately concentrated structure, with key players like Innovia Films and Biofilm (Taghleef Industries (Ti)) holding significant market shares. Innovation plays a pivotal role, with companies continuously investing in developing specialized BOPP films with enhanced properties. The regulatory landscape, while evolving, generally supports the growth of the packaging industry. Product substitutes, such as PET and CPP films, are present but often come with higher costs or different performance characteristics, giving BOPP a competitive edge in many applications. End-user trends indicate a strong preference for flexible packaging solutions, driven by evolving consumer demands for convenience and sustainability. Mergers and acquisitions (M&A) are sporadic but significant, as seen with the acquisition of Poligal by Oben Group, indicating strategic consolidation and expansion efforts. M&A deal values, while not publicly disclosed for all transactions, underscore the strategic importance of market presence and technological capabilities. Understanding these dynamics is crucial for navigating the competitive terrain.

- Market Concentration: Moderate, dominated by a few key international and regional players.

- Innovation Ecosystem: Driven by demand for specialized properties like barrier enhancement, printability, and sustainability.

- Regulatory Frameworks: Evolving environmental regulations and food safety standards influence film development.

- Product Substitutes: PET, CPP, and other flexible film types, with BOPP offering a cost-effective balance of properties.

- End-User Trends: Growing demand for high-performance flexible packaging, particularly in the food and beverage sector.

- M&A Activities: Strategic acquisitions aimed at expanding market reach, product portfolios, and manufacturing capabilities.

Latin America BOPP Film Market Industry Trends & Insights

The Latin America BOPP Film Market is experiencing significant growth, propelled by several key trends. The burgeoning middle class across the region, particularly in countries like Brazil, Mexico, and Argentina, is driving increased consumption of packaged goods, directly translating to higher demand for BOPP films for flexible packaging. The convenience and extended shelf-life offered by BOPP-based packaging solutions are highly valued by consumers. Furthermore, the growing e-commerce sector is creating new avenues for BOPP film applications, demanding durable and aesthetically pleasing packaging. Technological advancements in BOPP film manufacturing are continuously improving product performance, including enhanced barrier properties against moisture and oxygen, improved printability for enhanced branding, and the development of thinner yet stronger films, contributing to material cost savings and sustainability efforts. Consumer preferences are shifting towards more sustainable packaging options, prompting manufacturers to explore and invest in recyclable and compostable BOPP film variants. This shift is a significant driver for innovation and market penetration of eco-friendly solutions. The competitive dynamics are characterized by a blend of global leaders and agile regional players, all vying for market share through product differentiation, strategic partnerships, and efficient supply chain management. The Latin America BOPP Film Market is projected to witness a market penetration of XX% by 2033, indicating substantial room for growth. The average market size of BOPP film is estimated to be around US$ XXX Million in the base year 2025.

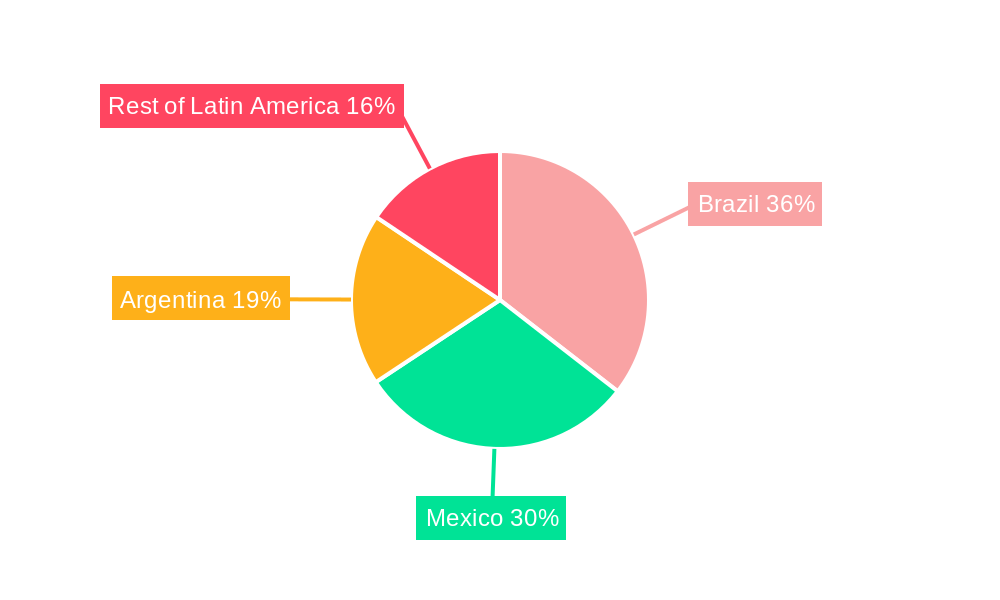

Dominant Markets & Segments in Latin America BOPP Film Market

Brazil stands out as the dominant market within the Latin America BOPP Film Market, driven by its large population, diversified industrial base, and robust agricultural sector. The country's economic policies, aimed at promoting manufacturing and exports, further bolster the demand for flexible packaging solutions. Its well-developed infrastructure facilitates efficient distribution and logistics, crucial for the widespread adoption of BOPP films. Within the end-user verticals, Flexible Packaging is the undisputed leader, encompassing both Food and Non-Food applications. The surging demand for convenience foods, snacks, beverages, and processed goods in Brazil fuels the need for high-quality, cost-effective BOPP packaging that ensures product safety and extends shelf life. The Industrial segment also contributes significantly, with Lamination applications being particularly strong, used in the production of high-performance packaging materials.

Dominant Geography: Brazil

- Key Drivers: Large consumer base, strong food & beverage industry, growing middle class, favorable economic policies, and e-commerce growth.

- Detailed Dominance Analysis: Brazil's extensive retail network and a significant percentage of its population relying on packaged goods make it a prime market. The "Rest of Latin America" segment, while fragmented, collectively represents a substantial market, with countries like Colombia and Chile showing promising growth. Mexico also holds a significant position due to its manufacturing prowess and proximity to the North American market. Argentina's market, while subject to economic volatility, remains a key player in the region.

Dominant End-User Vertical: Flexible Packaging

- Sub-segment: Food Packaging

- Key Drivers: Increasing demand for processed and convenience foods, growing packaged snack market, and the need for extended shelf-life solutions. BOPP films offer excellent printability for branding and barrier properties to preserve freshness.

- Sub-segment: Non-Food Packaging

- Key Drivers: Growth in personal care products, household goods, and pharmaceuticals, all requiring reliable and visually appealing packaging.

- Sub-segment: Industrial Applications

- Lamination: Crucial for creating multi-layer packaging structures with enhanced barrier properties and strength.

- Adhesives: Used as release liners and in various adhesive tape applications.

- Capacitors: Specialized BOPP films are essential dielectric materials in the manufacturing of capacitors.

- Other End-User Verticals: Includes niche applications in the textile and stationery industries, contributing a smaller but steady demand.

- Sub-segment: Food Packaging

Latin America BOPP Film Market Product Innovations

Recent product innovations in the Latin America BOPP Film Market are centered around enhancing sustainability and performance. Innovia Films’ May 2021 launch of a new Propafilm range exemplifies this trend, offering superior thermal resistance and shrinkage properties for specialty packaging. This development enables substitution of conventional films in pouches and lidding, catering to the diverse needs of food markets. These advancements provide competitive advantages by meeting evolving regulatory demands and consumer preferences for environmentally conscious packaging solutions without compromising product integrity.

Report Segmentation & Scope

The Latin America BOPP Film Market is meticulously segmented to provide granular insights. The End-user Vertical segmentation includes Flexible Packaging (Food, Non-Food), which is expected to dominate with a projected market size of US$ XXX Million by 2033. The Industrial segment, encompassing Lamination, Adhesives, and Capacitors, is forecast to reach US$ XXX Million by 2033, driven by manufacturing growth. Other End-user Verticals represent niche applications. Geographically, the market is divided into Brazil, projected at US$ XXX Million, Argentina (US$ XXX Million), Mexico (US$ XXX Million), and the Rest of Latin America (US$ XXX Million). Each segment's growth is influenced by specific economic, demographic, and industrial factors, offering a comprehensive view of market opportunities and challenges.

Key Drivers of Latin America BOPP Film Market Growth

Several factors are propelling the Latin America BOPP Film Market forward. The escalating demand for convenient and durable flexible packaging, particularly within the burgeoning food and beverage sector, is a primary driver. An expanding middle class with increased disposable income fuels consumption of packaged goods. Technological advancements enabling the production of high-performance, cost-effective BOPP films, such as those with enhanced barrier properties and improved printability, are crucial. Furthermore, evolving consumer preferences for sustainable packaging solutions are encouraging innovation in recyclable and biodegradable BOPP films. Favorable government initiatives promoting manufacturing and packaging industries in key economies like Brazil and Mexico also contribute significantly.

- Growing demand for flexible packaging in food & beverage.

- Increasing consumer spending power and preference for convenience.

- Technological advancements in BOPP film manufacturing.

- Shift towards sustainable and eco-friendly packaging alternatives.

- Supportive government policies and industrial development initiatives.

Challenges in the Latin America BOPP Film Market Sector

Despite robust growth, the Latin America BOPP Film Market faces several challenges. Economic volatility and currency fluctuations in some countries can impact investment and consumer spending. The availability and cost of raw materials, primarily polypropylene resin, can be subject to global price swings. Intense competition from established players and emerging regional manufacturers, along with the presence of substitute materials like PET and CPP films, exerts pressure on profit margins. Navigating diverse and sometimes stringent regulatory landscapes across different Latin American countries adds complexity for manufacturers. Supply chain disruptions, exacerbated by logistical challenges and infrastructure limitations in certain regions, can also impede market growth.

- Economic instability and currency fluctuations.

- Volatility in raw material prices (polypropylene resin).

- Intense competition and threat of substitute materials.

- Complex and varying regulatory frameworks across countries.

- Supply chain and logistical challenges.

Leading Players in the Latin America BOPP Film Market Market

- Innovia Films

- Biofilm (Taghleef Industries (Ti))

- Polo Films

- Altopro S A de CV

- Opp Film (Oben Holding Group)

- Premix Brazil

- Vitopel

Key Developments in Latin America BOPP Film Market Sector

- May 2021: Innovia Films launched a new BOPP film in its Propafilm range of transparent specialty packaging films. This film offers improved thermal resistance and shrinkage properties compared to conventional polypropylene films and is designed to substitute traditional outer web films in laminates for applications such as pouches and lidding in various food markets.

- March 2021: Poligal, a manufacturer of biaxially oriented polypropylene (BOPP) and cast PP films, was sold by its parent company, family-owned Group Peralada, to Peru-based film manufacturer Oben Group. Operations under Poligal's group subsidiaries include BOPP and CPP production plants in Portugal and Poland and sales offices in Germany, indicating strategic consolidation in the global BOPP market.

Strategic Latin America BOPP Film Market Market Outlook

The Latin America BOPP Film Market is poised for significant strategic growth, driven by increasing demand for high-value packaging solutions and a growing emphasis on sustainability. Key growth accelerators include investments in advanced manufacturing technologies to produce films with superior barrier properties, enhanced printability for brand differentiation, and improved recyclability. The expansion of the processed food and beverage industry, coupled with the burgeoning e-commerce sector, presents substantial opportunities. Strategic partnerships and collaborations between film manufacturers and end-users will be crucial for developing tailored solutions that meet specific market needs. Furthermore, companies that successfully leverage innovation to offer eco-friendly BOPP alternatives will gain a competitive advantage and capitalize on the shifting consumer and regulatory landscape, ensuring sustained market leadership.

Latin America BOPP Film Market Segmentation

-

1. End-user Vertical

-

1.1. Flexible Packaging

- 1.1.1. Food

- 1.1.2. Non-Food

-

1.2. Industrial

- 1.2.1. Lamination

- 1.2.2. Adhesives

- 1.2.3. Capacitors

- 1.3. Other End-user Verticals

-

1.1. Flexible Packaging

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Mexico

- 2.4. Rest of Latin America

Latin America BOPP Film Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Mexico

- 4. Rest of Latin America

Latin America BOPP Film Market Regional Market Share

Geographic Coverage of Latin America BOPP Film Market

Latin America BOPP Film Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Stringent Government Regulations against the Use of Conventional Plastics; Increased Usage of Green Products

- 3.2.2 Sustainability

- 3.2.3 and Inclination toward Environment Protection

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Growing Demand of Flexible Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America BOPP Film Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Flexible Packaging

- 5.1.1.1. Food

- 5.1.1.2. Non-Food

- 5.1.2. Industrial

- 5.1.2.1. Lamination

- 5.1.2.2. Adhesives

- 5.1.2.3. Capacitors

- 5.1.3. Other End-user Verticals

- 5.1.1. Flexible Packaging

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Mexico

- 5.2.4. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Mexico

- 5.3.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. Brazil Latin America BOPP Film Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.1.1. Flexible Packaging

- 6.1.1.1. Food

- 6.1.1.2. Non-Food

- 6.1.2. Industrial

- 6.1.2.1. Lamination

- 6.1.2.2. Adhesives

- 6.1.2.3. Capacitors

- 6.1.3. Other End-user Verticals

- 6.1.1. Flexible Packaging

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Mexico

- 6.2.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7. Argentina Latin America BOPP Film Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.1.1. Flexible Packaging

- 7.1.1.1. Food

- 7.1.1.2. Non-Food

- 7.1.2. Industrial

- 7.1.2.1. Lamination

- 7.1.2.2. Adhesives

- 7.1.2.3. Capacitors

- 7.1.3. Other End-user Verticals

- 7.1.1. Flexible Packaging

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Mexico

- 7.2.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8. Mexico Latin America BOPP Film Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.1.1. Flexible Packaging

- 8.1.1.1. Food

- 8.1.1.2. Non-Food

- 8.1.2. Industrial

- 8.1.2.1. Lamination

- 8.1.2.2. Adhesives

- 8.1.2.3. Capacitors

- 8.1.3. Other End-user Verticals

- 8.1.1. Flexible Packaging

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Mexico

- 8.2.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9. Rest of Latin America Latin America BOPP Film Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.1.1. Flexible Packaging

- 9.1.1.1. Food

- 9.1.1.2. Non-Food

- 9.1.2. Industrial

- 9.1.2.1. Lamination

- 9.1.2.2. Adhesives

- 9.1.2.3. Capacitors

- 9.1.3. Other End-user Verticals

- 9.1.1. Flexible Packaging

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Mexico

- 9.2.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Innovia Films

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Biofilm (Taghleef Industries (Ti))

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Polo Films*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Altopro S A de CV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Opp Film (Oben Holding Group)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Premix Brazil

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Vitopel

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Innovia Films

List of Figures

- Figure 1: Latin America BOPP Film Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America BOPP Film Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America BOPP Film Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 2: Latin America BOPP Film Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Latin America BOPP Film Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America BOPP Film Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Latin America BOPP Film Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Latin America BOPP Film Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Latin America BOPP Film Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Latin America BOPP Film Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Latin America BOPP Film Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Latin America BOPP Film Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 11: Latin America BOPP Film Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Latin America BOPP Film Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Latin America BOPP Film Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 14: Latin America BOPP Film Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America BOPP Film Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America BOPP Film Market?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the Latin America BOPP Film Market?

Key companies in the market include Innovia Films, Biofilm (Taghleef Industries (Ti)), Polo Films*List Not Exhaustive, Altopro S A de CV, Opp Film (Oben Holding Group), Premix Brazil, Vitopel.

3. What are the main segments of the Latin America BOPP Film Market?

The market segments include End-user Vertical, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.18 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations against the Use of Conventional Plastics; Increased Usage of Green Products. Sustainability. and Inclination toward Environment Protection.

6. What are the notable trends driving market growth?

Growing Demand of Flexible Packaging.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

May 2021 - Innovia Films launched a new BOPP film in its Propafilm range of transparent specialty packaging films. It offers improved thermal resistance and shrinkage properties compared to conventional polypropylene films. It has been designed to substitute traditional outer web films in laminates for applications such as pouches and lidding in various food markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America BOPP Film Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America BOPP Film Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America BOPP Film Market?

To stay informed about further developments, trends, and reports in the Latin America BOPP Film Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence