Key Insights

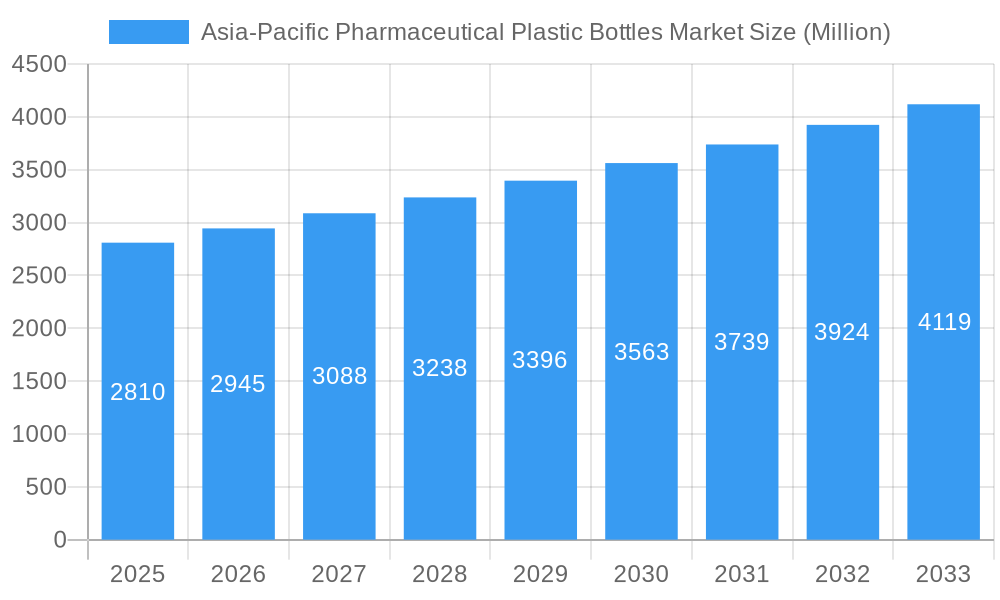

The Asia-Pacific pharmaceutical plastic bottles market is poised for robust expansion, projected to reach approximately USD 2.81 million by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 4.85% throughout the forecast period of 2025-2033. A primary driver for this upward trajectory is the burgeoning pharmaceutical industry across the region, fueled by an increasing population, rising healthcare expenditure, and a growing demand for accessible and affordable medications. Furthermore, the inherent advantages of plastic bottles, such as their lightweight nature, durability, cost-effectiveness, and versatility in design and functionality, make them a preferred choice for packaging a wide array of pharmaceutical products. Key segments like dropper bottles and nasal spray bottles are witnessing significant demand due to their specialized applications in delivering precise dosages for various treatments. The increasing adoption of advanced manufacturing technologies and the development of innovative packaging solutions are also contributing to market dynamism.

Asia-Pacific Pharmaceutical Plastic Bottles Market Market Size (In Billion)

The market landscape is characterized by a strong focus on sustainable and recyclable packaging materials, with Polyethylene Terephthalate (PET) and Polypropylene (PP) emerging as dominant raw materials. However, the market also faces certain restraints, including stringent regulatory compliances for pharmaceutical packaging and the potential volatility in raw material prices. Despite these challenges, the continuous innovation in polymer science and the strategic collaborations between packaging manufacturers and pharmaceutical companies are expected to foster market resilience. Leading players such as Amcor Group GmbH, Gerresheimer AG, and Berry Global Inc. are actively investing in research and development and expanding their manufacturing capacities to cater to the escalating demand. The Asia-Pacific region, with its diverse economies and expanding healthcare infrastructure, presents a significant opportunity for sustained growth in the pharmaceutical plastic bottles market.

Asia-Pacific Pharmaceutical Plastic Bottles Market Company Market Share

Asia-Pacific Pharmaceutical Plastic Bottles Market: Comprehensive Growth Analysis & Forecast (2019–2033)

This in-depth market research report delivers a critical analysis of the Asia-Pacific Pharmaceutical Plastic Bottles Market. Spanning the historical period of 2019–2024, base year 2025, and a robust forecast period from 2025–2033, this study offers unparalleled insights into market dynamics, growth drivers, and future opportunities. We meticulously examine key segments, dominant regions, and influential players shaping the pharmaceutical packaging solutions landscape across the Asia-Pacific region. With an estimated market size of $XX Billion in 2025 and a projected CAGR of X.XX% during the forecast period, this report is essential for stakeholders seeking to understand and capitalize on the burgeoning demand for innovative and sustainable plastic bottles for pharmaceutical applications.

Asia-Pacific Pharmaceutical Plastic Bottles Market Market Structure & Competitive Dynamics

The Asia-Pacific Pharmaceutical Plastic Bottles Market exhibits a moderately concentrated structure, characterized by the presence of established global players and a growing number of regional manufacturers. Key competitors are actively vying for market share through strategic alliances, product innovation, and capacity expansions. The innovation ecosystem is robust, driven by increasing demand for specialized pharmaceutical packaging, including dropper bottles, nasal spray bottles, and liquid bottles, that offer enhanced product protection, user convenience, and regulatory compliance. Regulatory frameworks across diverse Asia-Pacific nations, while presenting some harmonization challenges, are generally evolving to support higher standards for pharmaceutical plastic packaging. Product substitutes, primarily glass bottles and flexible packaging solutions, are present but face limitations in terms of cost-effectiveness, breakability, and specific application suitability for many pharmaceutical formulations. End-user trends are strongly influenced by the growing pharmaceutical industry, rising healthcare expenditure, and an increasing preference for convenient and safe drug delivery systems. Merger and acquisition (M&A) activities are prevalent as companies aim to consolidate market presence, expand product portfolios, and gain access to new technologies and geographical markets. For instance, significant M&A deals valued in the hundreds of millions of dollars are expected to continue shaping the competitive landscape, with companies like Amcor Group GmbH and Berry Global Inc. being key participants. Market share analysis reveals a dynamic interplay between multinational corporations and agile local manufacturers, with the leading players holding substantial portions of the PET pharmaceutical bottles market and PP pharmaceutical bottles market.

Asia-Pacific Pharmaceutical Plastic Bottles Market Industry Trends & Insights

The Asia-Pacific Pharmaceutical Plastic Bottles Market is experiencing significant growth, propelled by a confluence of robust industry trends and evolving consumer preferences. A primary growth driver is the escalating pharmaceutical production across the region, fueled by an expanding population, increasing prevalence of chronic diseases, and rising disposable incomes that enhance healthcare access. The growing demand for child-resistant pharmaceutical bottles and tamper-evident packaging solutions further bolsters market expansion, as patient safety and regulatory compliance remain paramount for pharmaceutical manufacturers.

Technological disruptions are playing a pivotal role, with advancements in polymer science leading to the development of lighter, more durable, and chemically inert plastic bottles for pharmaceuticals. The increasing adoption of sophisticated manufacturing techniques, such as injection molding and blow molding, contributes to higher production efficiency and improved product quality. Furthermore, the push towards sustainable packaging solutions is gaining significant traction. Companies are actively investing in recycled PET (rPET) and exploring bio-based materials to reduce the environmental footprint of pharmaceutical packaging, aligning with global sustainability initiatives and growing consumer consciousness.

Consumer preferences are shifting towards convenience and ease of use. This translates into a higher demand for innovative dosage delivery systems integrated within plastic bottles, such as oral syringes, dropper bottles with precise dispensing mechanisms, and nasal spray bottles designed for optimal patient compliance. The growth of the e-commerce pharmaceutical sector also necessitates robust and secure packaging that can withstand transit challenges, further driving the demand for high-quality plastic pharmaceutical containers.

The competitive landscape is characterized by intense innovation and strategic partnerships. Companies are focusing on developing specialized packaging for sensitive drugs, temperature-controlled formulations, and biologics, requiring advanced barrier properties and material science expertise. The penetration of advanced pharmaceutical plastic packaging solutions is projected to witness a significant surge, with the market expected to reach over $XX Billion by 2033. The overall market penetration of plastic bottles in pharmaceutical applications is already high, estimated at over XX%, and continues to grow as a cost-effective and versatile alternative to traditional packaging materials. The CAGR of the Asia-Pacific Pharmaceutical Plastic Bottles Market is anticipated to remain strong, estimated between 6% and 8% during the forecast period, underscoring the sustained growth trajectory of this vital sector.

Dominant Markets & Segments in Asia-Pacific Pharmaceutical Plastic Bottles Market

The Asia-Pacific Pharmaceutical Plastic Bottles Market is a dynamic landscape where specific regions, countries, and material segments exhibit pronounced dominance, driven by a complex interplay of economic, demographic, and regulatory factors.

Dominant Regions and Countries

- China stands as the undisputed leader within the Asia-Pacific region, owing to its vast manufacturing capabilities, expanding domestic pharmaceutical market, and significant export of pharmaceutical products. Government initiatives supporting the growth of the healthcare and pharmaceutical industries, coupled with substantial investments in packaging technology, contribute to China's dominant position. The country's robust supply chain infrastructure and competitive manufacturing costs make it a hub for pharmaceutical plastic bottle production.

- India follows closely, driven by its position as the "pharmacy of the world" and its burgeoning domestic demand for affordable and accessible medicines. The Indian government's strong focus on enhancing healthcare infrastructure and promoting local manufacturing under initiatives like "Make in India" further fuels the demand for pharmaceutical packaging solutions.

- Southeast Asian nations, including Indonesia, Vietnam, and the Philippines, are emerging as significant growth pockets. These countries benefit from growing populations, increasing urbanization, and a rising middle class that is driving demand for pharmaceuticals. Favorable economic policies and expanding healthcare access are key drivers in these markets.

Dominant Segments: Raw Material

- Polyethylene Terephthalate (PET): This is the dominant raw material segment, particularly for liquid bottles and oral care applications. PET offers excellent clarity, good barrier properties against moisture and gases, and recyclability, making it a preferred choice for a wide range of pharmaceutical products. The increasing demand for sustainable packaging is further propelling the use of recycled PET (rPET), contributing to PET's market leadership. Key drivers include its cost-effectiveness, high strength-to-weight ratio, and compliance with food and drug contact regulations. The PET segment is estimated to hold over XX% of the market share in 2025.

- Polypropylene (PP): PP is a strong contender, especially for applications requiring higher temperature resistance and chemical inertness, such as in certain dropper bottles and oral care products. Its rigidity and good barrier properties make it suitable for a variety of pharmaceutical packaging needs.

- High-density Polyethylene (HDPE): HDPE is widely used for liquid bottles, particularly those containing opaque or light-sensitive medications, due to its excellent chemical resistance and opaque nature. It is also a preferred material for dispensing closures and some oral care packaging.

- Low-density Polyethylene (LDPE): While less dominant than PET or HDPE, LDPE finds applications in specialized packaging requiring flexibility and squeezability, such as certain types of dropper bottles and caps.

Dominant Segments: Type

- Liquid Bottles: This segment represents the largest share within the Asia-Pacific Pharmaceutical Plastic Bottles Market, driven by the widespread use of liquid medications across various therapeutic areas, including antibiotics, analgesics, and cough and cold remedies. The increasing demand for over-the-counter (OTC) and prescription liquid formulations contributes significantly to this dominance.

- Dropper Bottles: The demand for dropper bottles is rapidly growing, fueled by the increasing use of ophthalmic solutions, ear drops, and specialized oral liquid medications requiring precise dosing. Advancements in dropper tip technology and material compatibility are key growth accelerators.

- Nasal Spray Bottles: This segment is experiencing robust growth due to the rising prevalence of respiratory conditions and the increasing preference for non-invasive drug delivery methods. Innovations in pump mechanisms and spray patterns are enhancing user experience and therapeutic efficacy.

- Oral Care: While a distinct segment, oral care products often utilize specialized plastic bottles for mouthwash, dental rinses, and gels, contributing to the overall market volume.

Asia-Pacific Pharmaceutical Plastic Bottles Market Product Innovations

Product innovation in the Asia-Pacific Pharmaceutical Plastic Bottles Market is primarily driven by the pursuit of enhanced patient safety, improved drug stability, and increased sustainability. Manufacturers are focusing on developing bottles with advanced barrier properties to protect sensitive pharmaceutical formulations from degradation caused by oxygen, moisture, and light. Innovations in dispensing mechanisms, such as integrated child-resistant closures, tamper-evident seals, and precise dosing systems for dropper bottles and nasal spray bottles, are key areas of development. Furthermore, the industry is witnessing a surge in the adoption of recycled and bio-based plastics, aligning with global environmental concerns. The introduction of bottles made from 100% recycled PET, offering virgin-quality standards, is a significant technological trend, signaling a shift towards a circular economy in pharmaceutical packaging. These advancements not only address regulatory requirements but also cater to evolving consumer preferences for eco-friendly and user-centric packaging solutions, providing a competitive edge to manufacturers prioritizing these innovations.

Report Segmentation & Scope

This comprehensive report segments the Asia-Pacific Pharmaceutical Plastic Bottles Market by Raw Material and Type to provide granular insights into market dynamics and growth opportunities.

- Raw Material Segmentation: The market is analyzed across Polyethylene Terephthalate (PET), Polypropylene (PP), Low-density Polyethylene (LDPE), and High-density Polyethylene (HDPE). PET is projected to maintain its dominance due to its versatility and increasing adoption of recycled content, with an estimated market share of XX% in 2025. PP and HDPE will cater to specific applications requiring enhanced chemical resistance and rigidity. LDPE will serve niche markets demanding flexibility.

- Type Segmentation: The analysis covers Dropper Bottles, Nasal Spray Bottles, Liquid Bottles, Oral Care, and Other Types. Liquid Bottles are expected to lead the market in terms of volume and value, driven by widespread pharmaceutical applications. Dropper Bottles and Nasal Spray Bottles are identified as high-growth segments due to the increasing demand for specialized drug delivery systems. The "Other Types" category will encompass various specialized bottles for vials, capsules, and other pharmaceutical formulations. Each segment's growth is projected to be influenced by evolving therapeutic needs and advancements in packaging technology.

Key Drivers of Asia-Pacific Pharmaceutical Plastic Bottles Market Growth

The Asia-Pacific Pharmaceutical Plastic Bottles Market is propelled by several key drivers. A fundamental driver is the expanding pharmaceutical industry across the region, fueled by a growing population and increasing healthcare expenditure. This leads to higher demand for essential medications, consequently driving the need for reliable plastic packaging solutions. The increasing prevalence of chronic diseases necessitates a consistent supply of pharmaceuticals, further boosting market growth.

Technological advancements in plastic manufacturing and material science are crucial, enabling the production of lighter, more durable, and safer pharmaceutical plastic bottles. The growing emphasis on patient convenience and safety is driving the demand for specialized packaging like child-resistant bottles and precisely dosed dispensing systems.

Furthermore, the increasing global focus on sustainability is a significant driver, promoting the adoption of recycled PET (rPET) and eco-friendly materials in pharmaceutical packaging. Favorable government policies supporting domestic manufacturing and healthcare infrastructure development in countries like China and India also contribute to the market's upward trajectory.

Challenges in the Asia-Pacific Pharmaceutical Plastic Bottles Market Sector

Despite robust growth, the Asia-Pacific Pharmaceutical Plastic Bottles Market faces several challenges. Stringent regulatory requirements across different countries regarding material safety, leachables, and extractables can pose significant hurdles, requiring substantial investment in compliance and testing. The fluctuating raw material prices, particularly for petroleum-based polymers, can impact manufacturing costs and profit margins.

Supply chain disruptions, as witnessed in recent years, can affect the availability and timely delivery of raw materials and finished products, impacting production schedules. Intense market competition among numerous domestic and international players often leads to price pressures, requiring manufacturers to focus on cost optimization without compromising quality.

The perception and increasing preference for sustainable packaging also present a challenge for manufacturers heavily reliant on traditional plastics. Adapting to these demands requires significant investment in R&D for alternative materials and advanced recycling technologies. Moreover, the growing concern over plastic waste management in the region necessitates innovative end-of-life solutions for pharmaceutical plastic bottles.

Leading Players in the Asia-Pacific Pharmaceutical Plastic Bottles Market Market

- Amcor Group GmbH

- Gerresheimer AG

- Berry Global Inc

- AptarGroup Inc

- Alpha Packaging Pvt Ltd

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Silgan Holdings Inc

- Chemco Group

- Supple Pack (India) Private Limited

- LOG Pharma Packaging

- Dongguan Fukang Plastic Products Co Lt

Key Developments in Asia-Pacific Pharmaceutical Plastic Bottles Market Sector

- January 2024: Bormioli Pharma, a significant player in pharmaceutical packaging and medical devices in China, collaborated with Loop Industries Inc., a pioneer in clean technology. This partnership led to the introduction of a novel pharmaceutical packaging bottle crafted entirely from 100% recycled, virgin-quality Loop PET resin. This development represents a substantial stride towards establishing a circular plastics economy within the pharmaceutical packaging sector.

- July 2023: Otsuka Pharmaceutical Co. Ltd, in collaboration with Governor Masazumi Gotoda of Tokushima Prefecture, finalized a strategic partnership. The primary objective of this collaboration is to advance the concept of horizontal "bottle-to-bottle" recycling for PET bottles, thereby contributing to the creation of a more sustainable society.

Strategic Asia-Pacific Pharmaceutical Plastic Bottles Market Market Outlook

The strategic outlook for the Asia-Pacific Pharmaceutical Plastic Bottles Market is highly positive, driven by persistent growth in the pharmaceutical sector and a strong emphasis on technological innovation and sustainability. The increasing demand for specialized packaging solutions, such as dropper bottles and nasal spray bottles with enhanced functionalities, presents a significant growth accelerator. Manufacturers that invest in advanced barrier technologies and integrate smart features into their packaging will gain a competitive advantage.

The widespread adoption of recycled PET (rPET) and the exploration of bio-based alternatives will be crucial for market participants aiming to align with global environmental mandates and consumer preferences for eco-friendly products. Strategic partnerships and collaborations, akin to those observed in recent developments, will be instrumental in driving innovation and expanding market reach. Moreover, focusing on emerging markets within Southeast Asia and leveraging digital technologies for improved supply chain efficiency will unlock substantial future potential. The market is poised for continued expansion, offering lucrative opportunities for companies that can adapt to evolving regulatory landscapes and embrace sustainable manufacturing practices.

Asia-Pacific Pharmaceutical Plastic Bottles Market Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate (PET)

- 1.2. Polypropylene (PP)

- 1.3. Low-density Polyethylene (LDPE)

- 1.4. High-density Polyethylene (HDPE)

-

2. Type

- 2.1. Dropper Bottles

- 2.2. Nasal Spray Bottles

- 2.3. Liquid Bottles

- 2.4. Oral Care

- 2.5. Other Types

Asia-Pacific Pharmaceutical Plastic Bottles Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Pharmaceutical Plastic Bottles Market Regional Market Share

Geographic Coverage of Asia-Pacific Pharmaceutical Plastic Bottles Market

Asia-Pacific Pharmaceutical Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Pharmaceutical Packaging Adoption Fuels Growth of the Market; Rising Demand for Child-Resistant Packaging

- 3.3. Market Restrains

- 3.3.1. Expanding Pharmaceutical Packaging Adoption Fuels Growth of the Market; Rising Demand for Child-Resistant Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate (PET)

- 5.1.2. Polypropylene (PP)

- 5.1.3. Low-density Polyethylene (LDPE)

- 5.1.4. High-density Polyethylene (HDPE)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Dropper Bottles

- 5.2.2. Nasal Spray Bottles

- 5.2.3. Liquid Bottles

- 5.2.4. Oral Care

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Group GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gerresheimer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AptarGroup Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alpha Packaging Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chemco Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supple Pack (India) Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LOG Pharma Packaging

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dongguan Fukang Plastic Products Co Lt

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amcor Group GmbH

List of Figures

- Figure 1: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Pharmaceutical Plastic Bottles Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 3: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 8: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 9: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Pharmaceutical Plastic Bottles Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Asia-Pacific Pharmaceutical Plastic Bottles Market?

Key companies in the market include Amcor Group GmbH, Gerresheimer AG, Berry Global Inc, AptarGroup Inc, Alpha Packaging Pvt Ltd, ALPLA Werke Alwin Lehner GmbH & Co KG, Silgan Holdings Inc, Chemco Group, Supple Pack (India) Private Limited, LOG Pharma Packaging, Dongguan Fukang Plastic Products Co Lt.

3. What are the main segments of the Asia-Pacific Pharmaceutical Plastic Bottles Market?

The market segments include Raw Material, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Pharmaceutical Packaging Adoption Fuels Growth of the Market; Rising Demand for Child-Resistant Packaging.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Expanding Pharmaceutical Packaging Adoption Fuels Growth of the Market; Rising Demand for Child-Resistant Packaging.

8. Can you provide examples of recent developments in the market?

January 2024: Bormioli Pharma, a player in pharmaceutical packaging and medical devices in China, and Loop Industries Inc., a pioneer in clean technology, introduced a pharmaceutical packaging bottle. This bottle is crafted entirely from 100% recycled, virgin-quality Loop PET resin, marking a significant step toward a circular plastics economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Pharmaceutical Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Pharmaceutical Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Pharmaceutical Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Pharmaceutical Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence